⬇️ My Thoughts ⬇️

QE also removes safe collateral from the market, mainly US Treasury bills, notes and bonds. this safe collateral is the backbone of wholesale debt markets, where financial institutions, including commercial and central banks finance and re-finance their positions

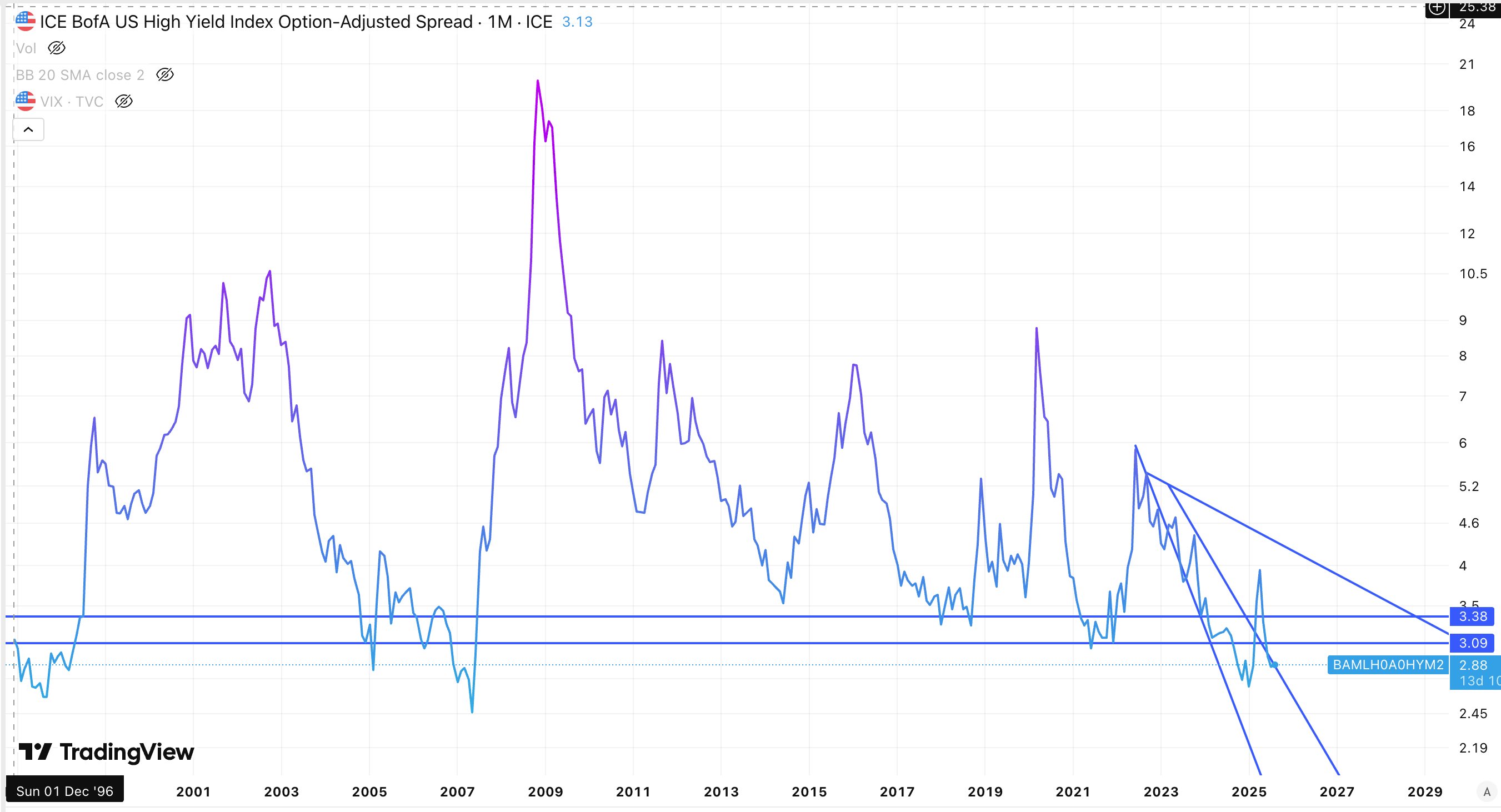

however, eventually yield spreads will raise with high velocity. this is the larger financial crisis part of the cycle. there you will also see lower rates and more QE

however, eventually yield spreads will raise with high velocity. this is the larger financial crisis part of the cycle. there you will also see lower rates and more QE

in the short-term, lower rates and/or QE means easier funding conditions, so more positions will get to be refinanced

in the short-term, lower rates and/or QE means easier funding conditions, so more positions will get to be refinanced

the yield spreads may also start an almost vertical uptrend on a monthly timescale - this usually means a financial crisis to some degree

that's probably not happening in the next 3 months though, as you can expect Federal Reserve to decrease interest rates and/or employ QE

the yield spreads may also start an almost vertical uptrend on a monthly timescale - this usually means a financial crisis to some degree

that's probably not happening in the next 3 months though, as you can expect Federal Reserve to decrease interest rates and/or employ QE

here's what yield spreads are saying about Bitcoin

≈3-3.40 is an important historical band which served as support bottom several times, including during COVID, and partly during the 2008 GFC

so far it looks like a trend-reversal in the short-term, with the spreads heading up

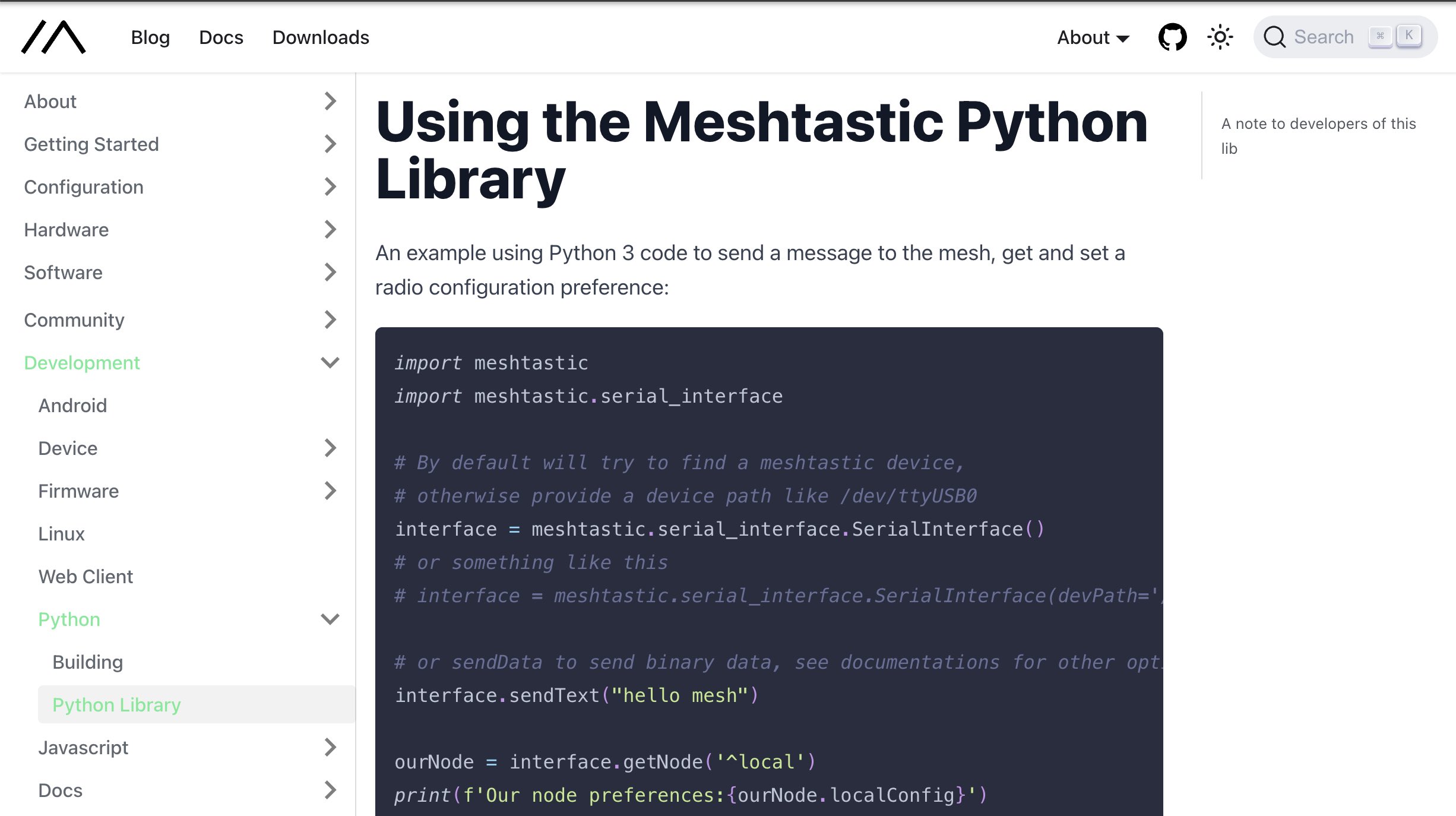

i just ran across meshtastic now, so cannot attest to the feasibility of implementing LoRA networks with it - but from the documentation it looks straightforward

you can even write your code in Python! 🐍

electromagnetic waves propagate at a ≈constant speed (speed of light), which means that you can estimate the distance between two communicating end nodes, or between a node and a relay

similar approaches are used mitigate against range extender attacks for remote car unlocking

electromagnetic waves propagate at a ≈constant speed (speed of light), which means that you can estimate the distance between two communicating end nodes, or between a node and a relay

similar approaches are used mitigate against range extender attacks for remote car unlocking

you can use something like meshtastic to easily setup a network of end nodes and relays

this also enables additional use-cases, like verifiable geolocation/proximity, and locale-restricted access

you can use something like meshtastic to easily setup a network of end nodes and relays

this also enables additional use-cases, like verifiable geolocation/proximity, and locale-restricted access

there should be more blockchains running over mesh technologies like LoRA

this way you can keep the consensus and payments running even when internet is down

polynomial commitments (ZK) can be used to store-and-forward transactions

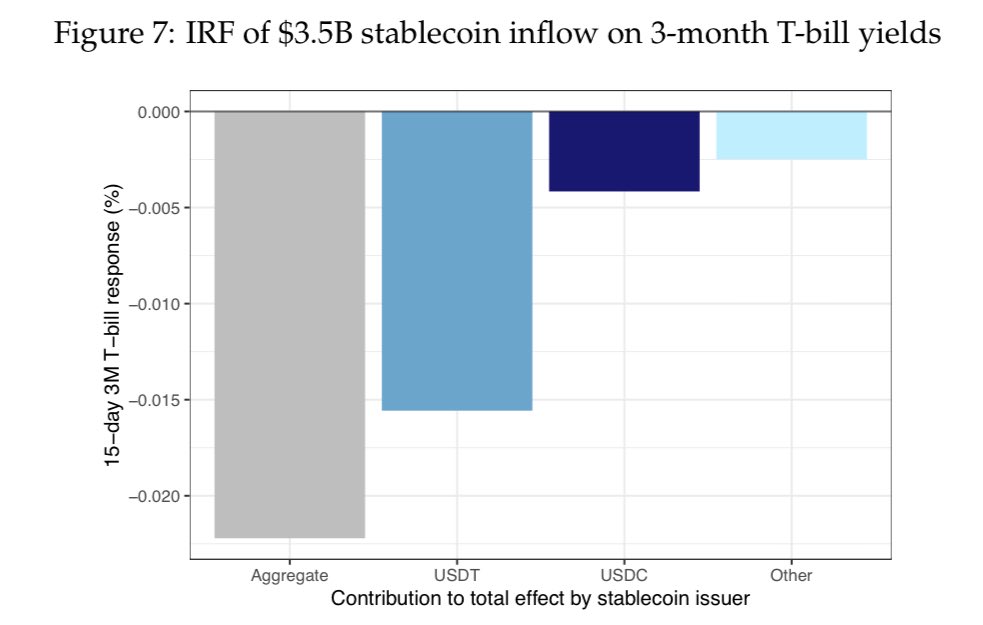

stablecoins are good for short-term interest rates

i wrote a thread explaining why

📖 read it here: https://illya.sh/threads/@1755378840-1.html

so when market signals a higher risk appetite - Bitcoin tends to see inflows

when market is more risk-averse - bitcoin tends to see outflows, alongside other risk assets

you can use the US Treasury/riskier bonds yield spreads to understand BTC's trend direction. it's an alpha

if you overlay Bitcoin's price history over those yield spreads, you will notice a significant level of correlation

⬆️ Bitcoin appreciates when spreads are lowering and/or low

⬇️ Bitcoin depreciates when spreads are increasing and/or high

makes sense - Bitcoin is a risk asset

if you overlay Bitcoin's price history over those yield spreads, you will notice a significant level of correlation

⬆️ Bitcoin appreciates when spreads are lowering and/or low

⬇️ Bitcoin depreciates when spreads are increasing and/or high

makes sense - Bitcoin is a risk asset

thus, you interpret yield spreads between US Treasuries and riskier bonds as:

📈 increasing/high yield spread = risk-off

📉 lowering/low yield spread = risk-on

thus, you interpret yield spreads between US Treasuries and riskier bonds as:

📈 increasing/high yield spread = risk-off

📉 lowering/low yield spread = risk-on

a lower yield spread means that the market requires less return per unit of risk

lower yield spreads means that US Treasuries have a small premium over riskier bonds, thus the market is attributing a smaller premium to safe assets - a "risk-on" signal

a lower yield spread means that the market requires less return per unit of risk

lower yield spreads means that US Treasuries have a small premium over riskier bonds, thus the market is attributing a smaller premium to safe assets - a "risk-on" signal

yield spread between a safe asset and a riskier one is an expression of the required return per unit of risk

higher yield spreads, means risker bonds are significantly cheaper than US Treasury bonds, thus the market is valuing safe assets with a premium - a "risk-off" signal

yield spread between a safe asset and a riskier one is an expression of the required return per unit of risk

higher yield spreads, means risker bonds are significantly cheaper than US Treasury bonds, thus the market is valuing safe assets with a premium - a "risk-off" signal

yield spreads between US Treasuries and riskier bonds mirror the price of Bitcoin

in practice, there is a correlation between them:

📈 yield spreads up = ⬇️ BTC down

📉 yield spreads down = ⬆️ BTC up

why? because those spreads are proxy for market's risk appetite

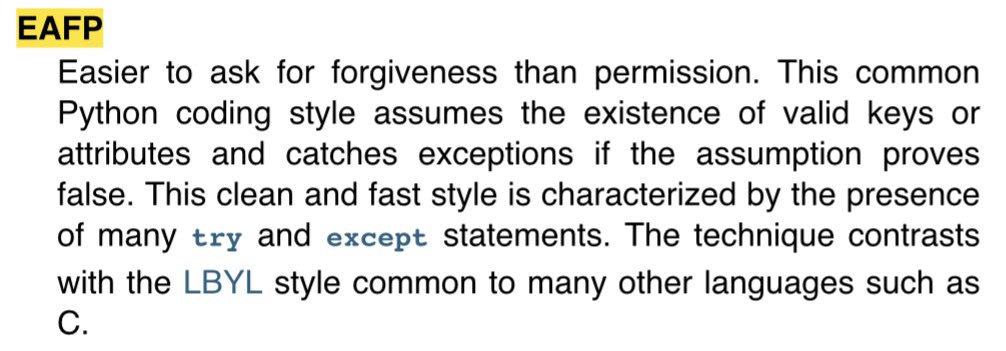

it's totally okay to use exceptions for error handling

it depends on how you're using abstractions. e.g. EAFP in Python

there are very few dogmas in software engineering - as the best architecture always depends on the operating context, environment and constraints

these regulatory constraints are synchronized to a significant degree across all jurisdictions

this means that the financial regulations in EU & USA will have an analogous functional effect (although not the same!). so you can expect similar frameworks across several countries

since all dealers are subject to functionally similar regulatory constraints, they're also subject to functionally similar set of balance sheet constraints

this is important to remember in the context of global liquidity, especially in terms of pro-cyclical effects

since all dealers are subject to functionally similar regulatory constraints, they're also subject to functionally similar set of balance sheet constraints

this is important to remember in the context of global liquidity, especially in terms of pro-cyclical effects

bank dealers are subject to Basel III, non-bank dealers to other similar regulations

non-bank dealers don't have HQLA or leverage ratio (Basel), but they have net capital haircuts and other leverage/margin requirements

so all dealers are subject to a similar set of regulations

bank dealers are subject to Basel III, non-bank dealers to other similar regulations

non-bank dealers don't have HQLA or leverage ratio (Basel), but they have net capital haircuts and other leverage/margin requirements

so all dealers are subject to a similar set of regulations

market makers and other dealers are also subject to regulatory balance sheet constraints

many of them are banks, so frameworks like Basel III apply. non-bank dealers have similar regulations

this means dealers are also subject to HQLA, haircuts, leverage limits and alike

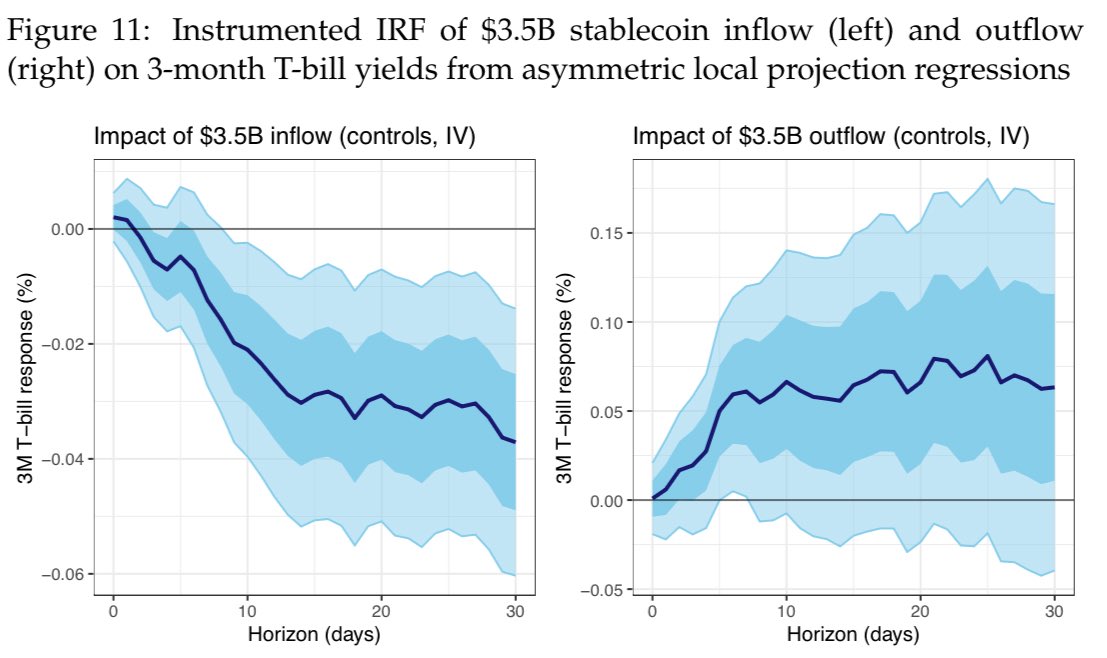

essentially many T-bill sales flood the market at once, so their price falls, thus causing a yield increase

selling T-bills is more urgent than buying - the stablecoin issuer cannot split it across auctions & dealers as easily, so the market yield change is larger on outflows

stablecoin outflows proxy T-bill sales or reduced rolling

redemption/burn requires the stablecoin issuer to sell NOW, so large volumes means dealers/market makers will require a yield concession to warehouse those T-bills, as they are subject to balance sheet constraints

this is because a stablecoin mint/creation on-chain is the proxy for a T-bill purchase by the company issuing that stablecoin (e.g. Circle, Tether)

so stablecoin inflows proxy T-bill purchases, which raises their price and lowers the yield

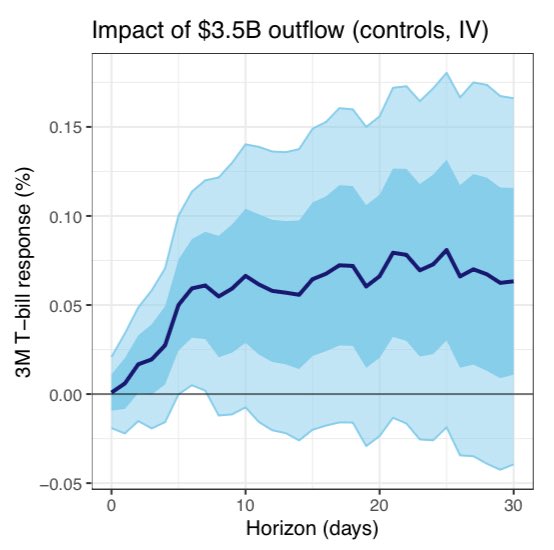

stablecoin inflows lower 3M Treasury bill yields, while outflows raise yields by a larger amount

LP-IV estimates:

⏩ $3.5B inflows lower yields by ≈3 bp

⏪ $3.5B outflows raise the yields by ≈8 bp

inflow = mint

outflow = redemption/burn