Bitcoin market, cycles & ETF flows

Timeline of BTC price action, halving-cycle milestones, ETF flows and correlations with macro liquidity.

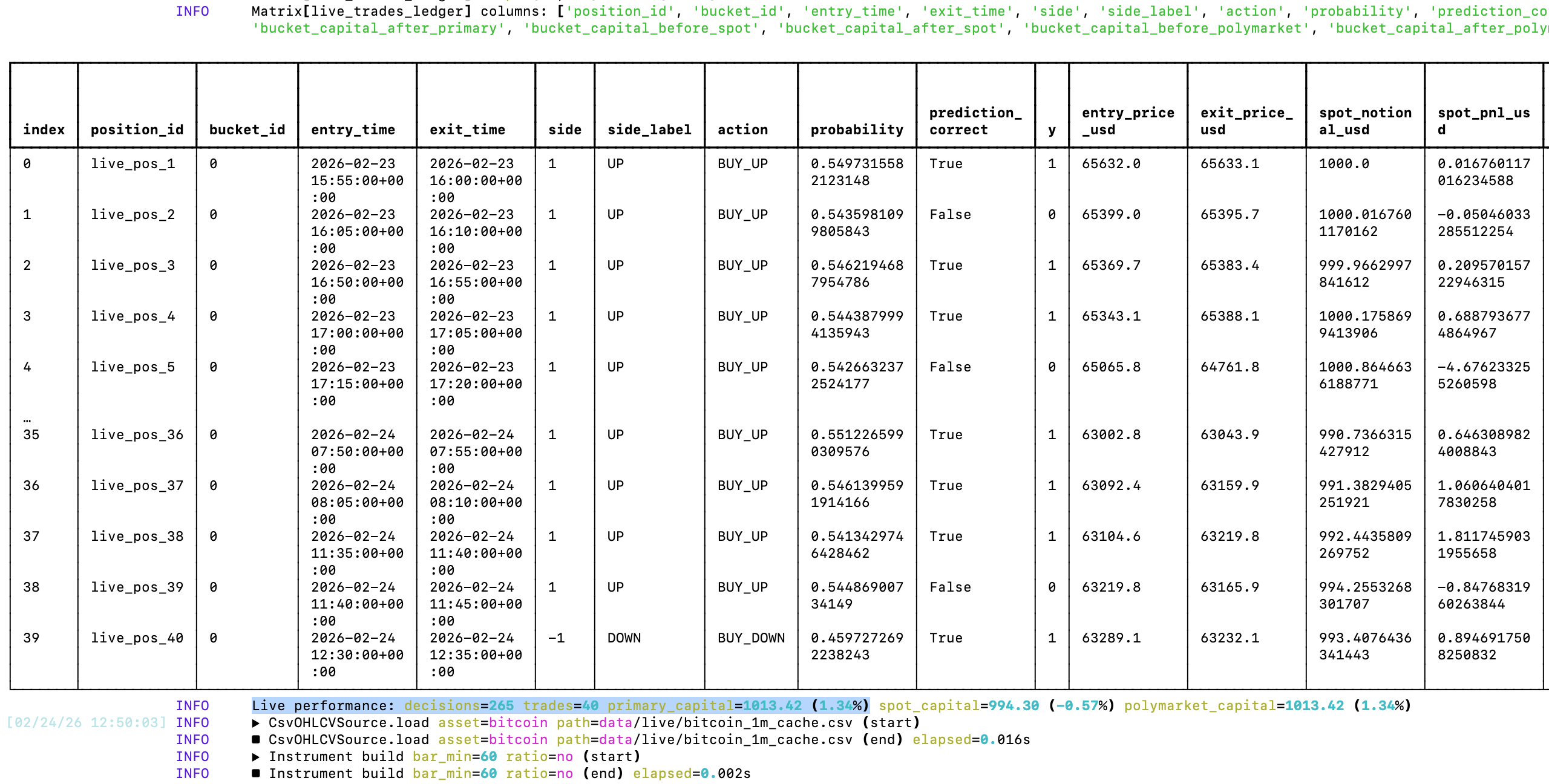

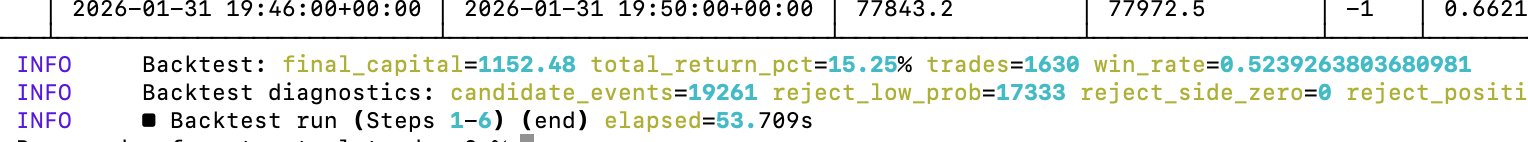

I've been running live a tuned model designed to predict Bitcoin's price moves in Polymarket's BTC's 5 minute up or down markets

Backtests had a quite remarkable perfomance, with PnL over 70% across >500 trades

As expected, real world performance is not as impressive, but it's managing to be slightly profitable 😁 LOB data integration should improve the model's accuracy further.

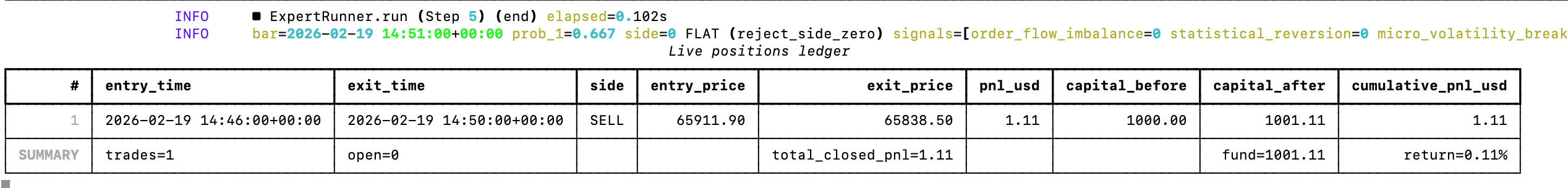

The model's first live data trade was a successful Bitcoin short! The position was open for 4 minutes, for a 0.11% return

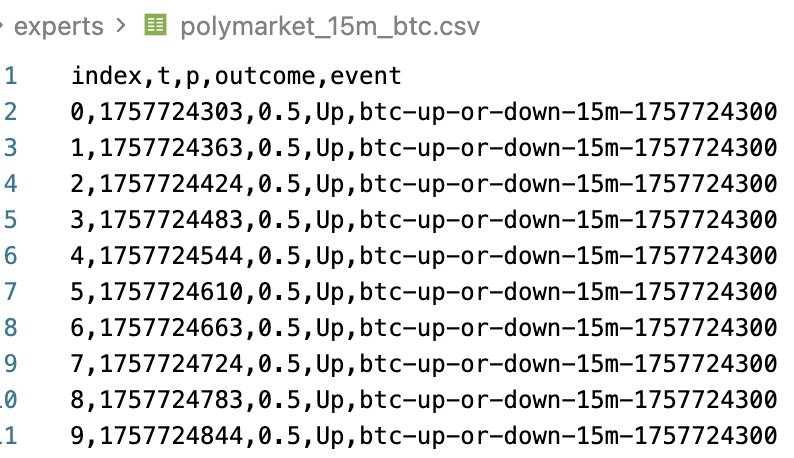

Proxy Model From Polymarket's 15 Minute Bitcoin Price

I found historical datasets for Polymarket's 15 minute up or down Bitcoin price and I think I can use this data to obtain useful signals via a proxy model. I'll start with linear regression to build a prediction model, to see if this transfer learning approach works here.

Yes, it will be overfitting, but for this signal generator it would be by design. The end goal is to find features that improve the random forest's split rules, thus further improving the win rate.

Expert optimization is going well, and I'm starting to move towards the alpha in 5-minute Bitcoin price markets

I'm not claiming that the model that I currently have is meaningful (it's NOT!), but it's getting closer to interesting win rate ratios (>55%)

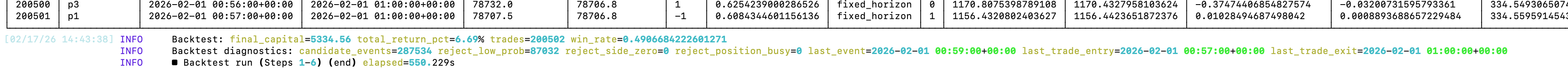

My ML model factory produced this amazing model that trades Bitcoin on 5-minute intervals, cut off at each 5th minute (very similar to Polymarket's 5 minute BTC markets) and it made over 200K trades in ≈7 months

Stats:

- 200K trades

- 6.69% profit

- 49% win rate

So I've pretty much discovered a coin flip 🤣

Gold Outperformed Bitcoin In The Last 8 Years

Let's go back in time. It's December 2017. You have $1000 to invest, and you have 2 options: gold or Bitcoin. Which one would you choose?

If you bought $1000 worth of BTC at ≈$20K/BTC in December 2017, you'd now have ≈$3500, or roughly a $2500 net profit.

If you instead bought $1000 worth of gold at ≈$1260/oz, you'd now have ≈$4000, or roughly $3000 net profit.

And throughout those 8 years of holding, gold's price never crashed by ≈50%, like it's more or less the norm with Bitcoin & rest of the crypto.

Bitcoin can be a great idea for your portfolio, but if you're so determined to HODL long-term, you may be much better off with gold.

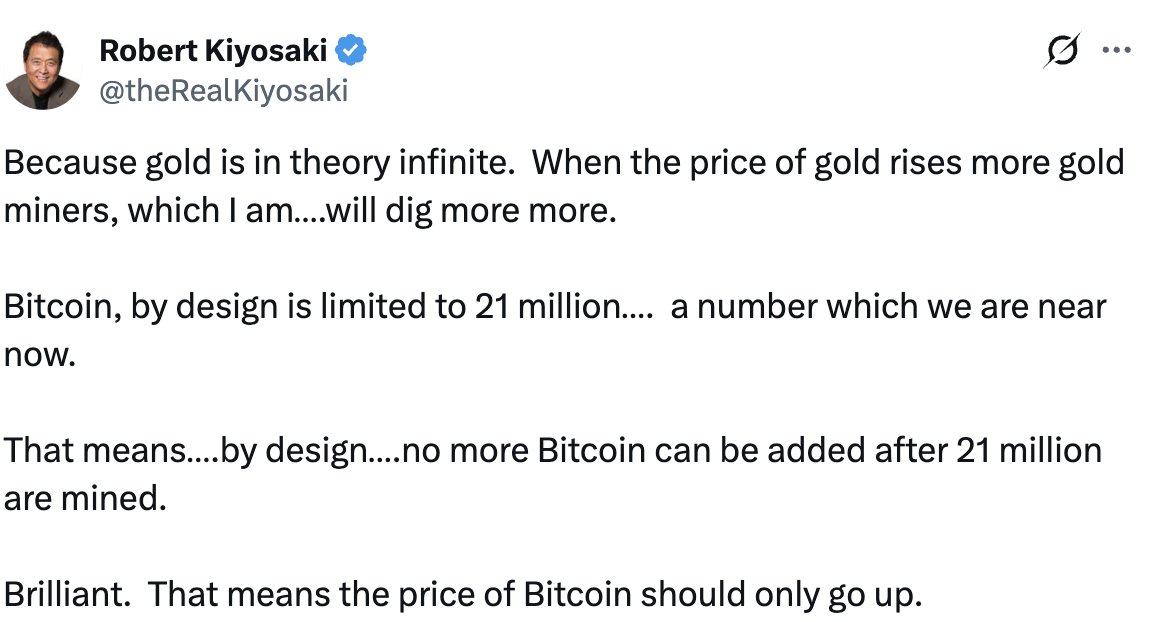

Scarcity Doesn't Make Bitcoin Better Than Gold

Just because something is more scarce, doesn't mean it's more valuable. The number of existing Picasso paintings is much more scarce than Bitcoin - and that number won't increase.

Would you rather have all of Picasso's paintings or all of the Bitcoin? Or maybe that's a bad example. If you own all of the Bitcoin, it's a big question what will the other market participants value it at -- definitely much below the current prices though.

There's a lot more than you can do with gold than with Bitcoin. In fact, the nodes supporting Bitcoin network use gold in their connectors. Not to mention that you can take down Bitcoin, but you can't take down gold (just cut electricity and/or node subnets).

Moreover, saying that gold is "infinite" is wrong technically and practically. There is a big distinction in the amount of gold existent in the universe and Planet Earth, and the amount of gold that's economically viable to obtain.

If your argument on why Bitcoin is better than gold relies heavily on the scarcity aspect - it's probably a weak argument.

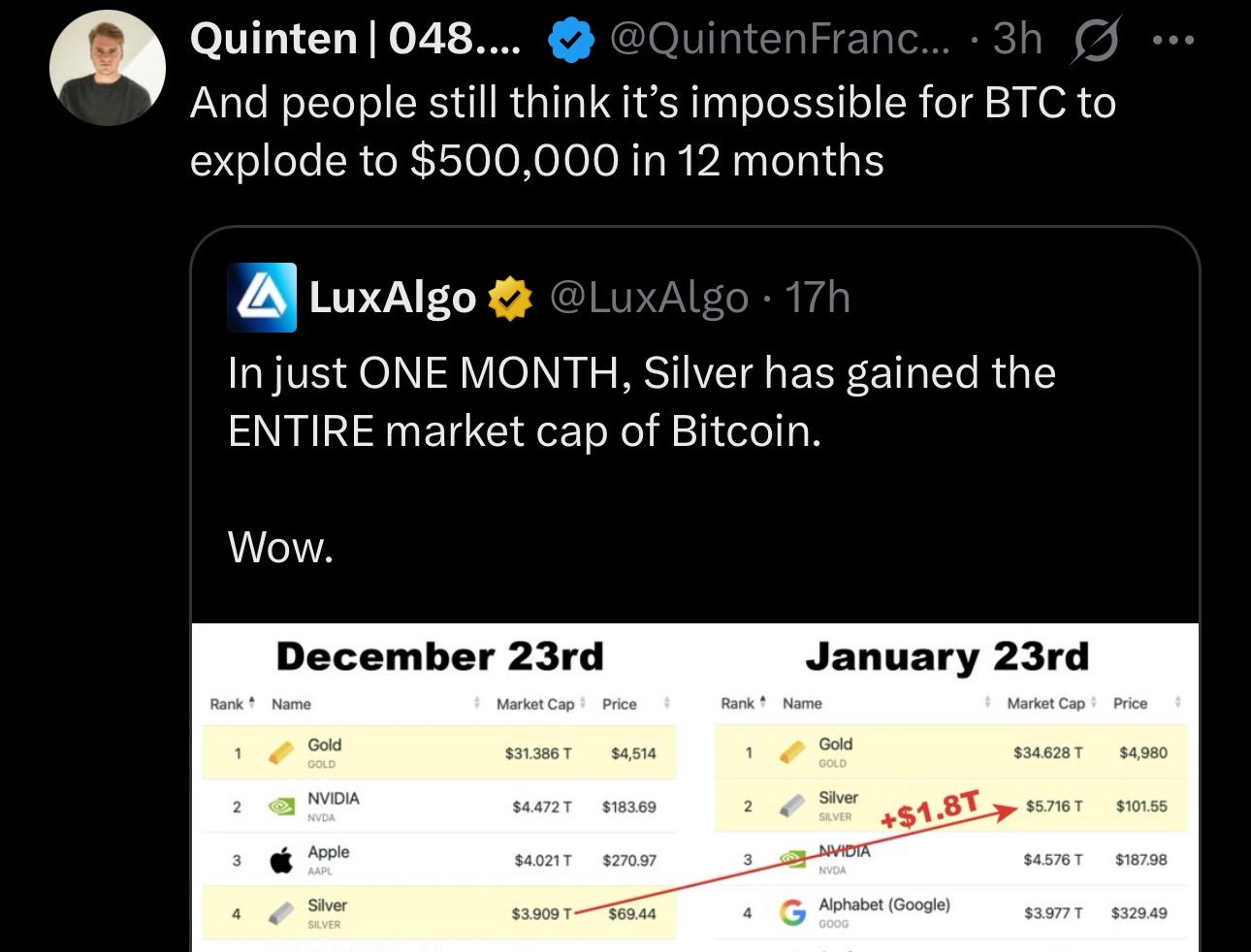

And people still think that silver and Bitcoin are within the same category of assets

(hint: they're not)

The same X accounts that were telling you to buy the Bitcoin dip on October 1st 2025, are now telling you to sell Silver on December 31st 2025

Since October 1st:

➖Bitcoin down ≈40%

➖Silver up ≈80%

Their silver top calls will age as well, as the Bitcoin dip calls earlier this year 😄

The markets gave you an early 2026 present in the form of a systemic commodity price correction - and it's up to you to take it or not

Happy 2026 🥳

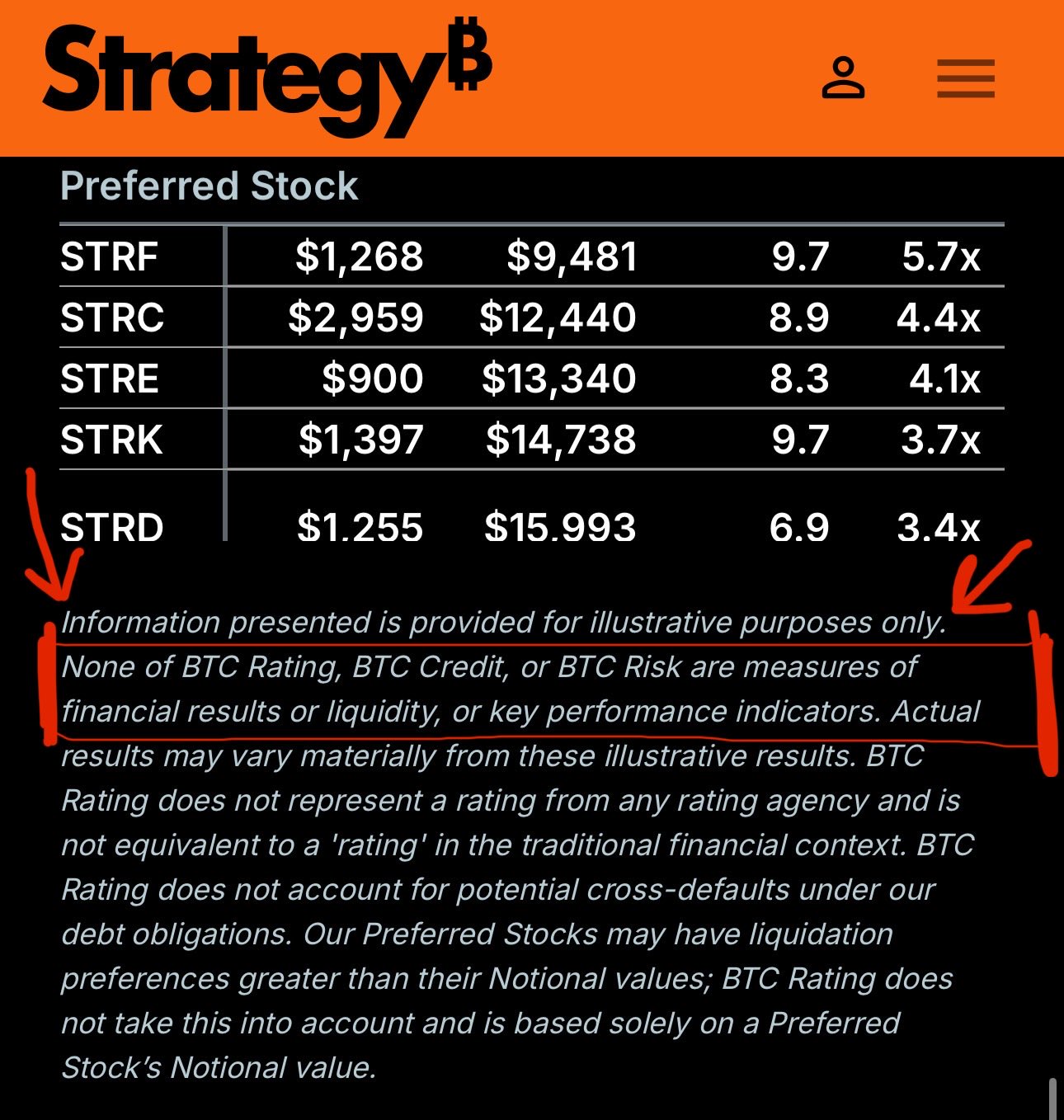

Strategy Invents Financial Metrics And Everybody Applauds 👏

MSTR's own website states that their reports do not reflect the financial reality:

"None of BTC Rating, BTC Credit, or BTC Risk are measures of financial results or liquidity, or key performance indicators."

Strategy's software business also operates at a ≈$60M loss, but on their website and socials they decide to ignore a part of expenses and market it as profit. So they create their own non-standard accounting and credit metrics and advertise those.

Strategy has a consistent pattern of misrepresenting their financials to look more favorable in their public marketing campaigns. A lot of it is in the form of Michael Saylor's videos, podcast appearances and posts on X. A lot seem to think that just because someone says something in a video or a social media post it must be true.

Words can be deceiving, numbers not so much.

In Net Terms, Bitcoin is a Geopolitical Liability, Not an Asset

This is because Bitcoin is vulnerable to attacks targeting its consensus and network availability. A sufficiently resourceful adversary can yield the Bitcoin network inoperable and/or untrustable

A nation state adversary can take the Bitcoin network down, at least a significant portion of it. And it doesn't require them having access to quantum computers or compromising the underlying cryptographic primitives in other manner.

This is why sovereign strategic Bitcoin reserves, including BTC as a Central Bank reserve asset is not a good idea, at least in the current state and design of the Bitcoin protocol.

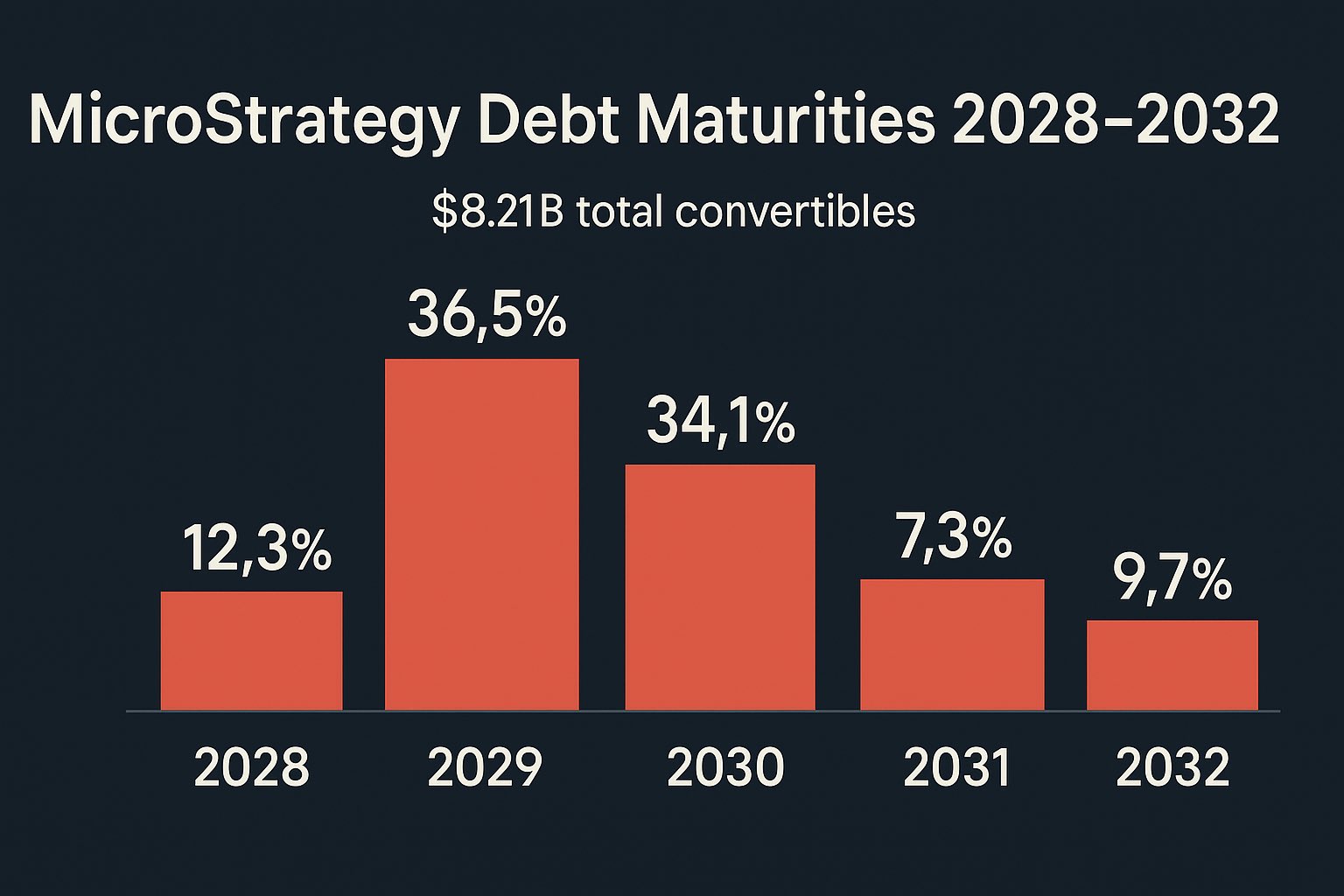

MicroStrategy Is Dependent On Refinancing Capacity, Not Bitcoin Price

MSTR won't have to sell Bitcoin if BTC price goes down, they'll have to sell Bitcoin if they're unable to acquire funding along the maturity of their debt wall.

MicroStrategy is essentially a leveraged trade on Bitcoin, based on the following cycle:

1️⃣ Acquire funding via debt or equity

2️⃣ Buy Bitcoin

3️⃣ Repeat

This cycle works for as long as MSTR is able to obtain funding. Once funding becomes unavailable (i.e. market isn't willing to lend at favorable interest rates), funding must come from asset liquidation (i.e. the sale of Bitcoin).

The availability of funding is mostly dependent on Bitcoin's price. As long as Bitcoin price and trend is favorable around the dates when the debt wall matures - MSTR should be able to continue their leveraged trade. MSTR share price vs Bitcoin NAV is also important. If MSTR trades a premium over Bitcoin's NAV it allows Microstrategy to short their own equity and long Bitcoin.

However, an unfavorable Bitcoin price action environment (e.g. during a bear market) that coincides with debt repayment obligations may trigger the unwinding of this leveraged position, forcing MSTR to sell Bitcoin, thus putting further downwards price pressure on Bitcoin, which lowers Microstrategy's equity even more, which makes lender even less likely to lend. The end result is an even more degraded funding capacity, which at the limit leads to bankruptcy.

Debt starts maturing from 2028 (≈$1B), but the most significant portion of ≈70%/$5.8B matures in 2029-2030. This is where the price of Bitcoin is of great importance for Microstrategy's solvency.

So don't expect Microstrategy to have pressure to sell significant amounts of Bitcoin before at least 2027, even if the Bitcoin price stays low.

Just wait until Bitcoin hype accounts find out that Czechia has not adapted the Euro, so it's not a part of the Eurozone.

Thus, the Czech National Bank (CNB) is a part of European System of Central Banks (ESCB), but not a full Eurosystem central bank, so it's not represented in and not bound by the ECB Governing Council's monetary policy decisions.

No Eurozone National Central Bank (NCB) is holding Bitcoin in their reserves, and ECB's current policy rejects the idea of BTC as a reserve asset.

Watch what they do, not what Bitcoin hype media says.

Bitcoin is not just for speculative gambling

Nation state-linked companies are already settling their transactions in Bitcoin. Sure, they're using Bitcoin only as an intermediary, not as the end settlement unit of account, but this takes Bitcoin's utility far beyond gambling.

Just because Bitcoin isn't replacing gold as money, doesn't mean that it's a failure. Just because Bitcoin bitcoin collapsed below 100K, doesn't mean it won't come back higher (liquidity cycles suggest it will).

Extremes are better for engagement, but reality is very inclusive.

My article on Gold vs Bitcoin, and how Bitcoin needs Gold, but Gold doesn't need Bitcoin: https://illya.sh/threads/bitcoin-needs-gold-gold-doesnt-need-bitcoin.html

Gold is within the fabric of money, not just Central Banks

A lot of posts on X frame Central Banks as malevolent institutions, and by some form of conspiracy they hold gold in their reserve accounts. And apparently not holding gold is a step towards monetary freedom - even more if you forego an atomic element (Au) for a cryptographic computer algorithm (Bitcoin).

A more productive approach is asking why do Central Banks chose gold over all other commodities and assets. Every single world reserve currency, without exception, started on a gold and/or silver standard. Gold has been used as money for over 5000 years.

I've written several articles on what makes gold so special and how Bitcoin is not a replacement for gold. I'll leave them linked below

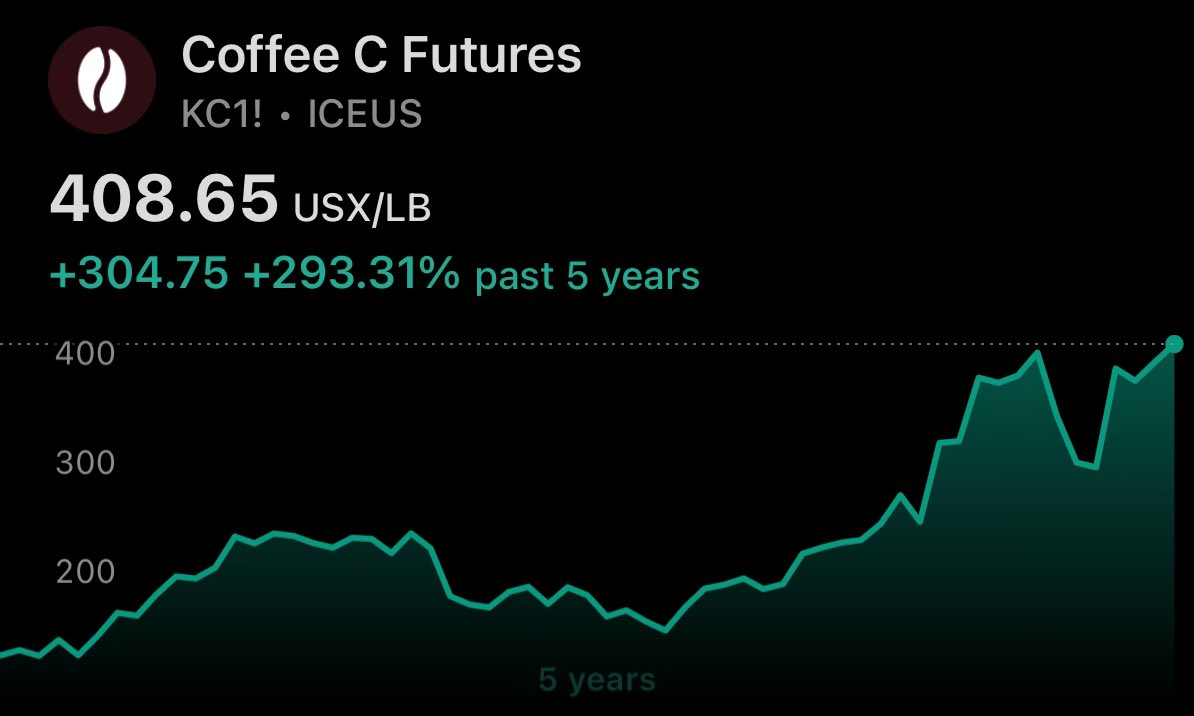

Coffee outperformed Gold in the last 5 years

Would it be sound to conclude that coffee beans are better money and investment than gold, and that Central Banks should hold coffee & its derivatives in reserve assets?

Bitcoin has less than 20 years of price action, and it started trading at a negligent price. Gold has been money for over 5000 years and its earliest recorded price per ounce is of ≈100 days of labor

A better question is whether Bitcoin will continue to consistently outperform gold over the next 20 years. *Consistency* is key - it must be at least a store of value, including shorter-term. If you get caught in the typical >50% price drops - you may pay a high opportunity cost.

It's not just whether Bitcoin will increase more in price than gold in the next 20 years, but also how severe and long-lasting Bitcoin's corrections are.

Imagine you buy Bitcoin today and it goes into a bear market with a significant value loss in the next 4 years. In those 4 years - many investment opportunities may arise, such as in real estate, equities, commodities or bonds. If your capital is locked in Bitcoin throughout that period - that's an opportunity cost.

Gold doesn't come with those shortcomings. There is a reason why all world reserve currencies started on a gold and/or silver standards.

There is no free lunch in the markets. Higher return is almost unanimously correlated with higher risk. Quantitatively Bitcoin is high risk- it's not a matter of opinion.

This doesn't mean that Bitcoin is a bad idea, but it also doesn't mean that Bitcoin is a better idea than gold. It does, however mean, that Bitcoin isn't a replacement for gold.

And now you understand what makes gold so special. You don't have to believe me - believe centuries of price action and human history.

More Bitcoin has been seized than Gold

If you think that Bitcoin is harder to seize than gold, you are probably wrong. At least according to the data.

In the history of Bitcoin's existence, much much more Bitcoin has been seized than Gold. You don't need to compromise cryptographic primitives to seize Bitcoin.

Apparently this isn't a very well known fact in the Bitcoin Maxi world 😄

Why would a Central Bank hold Bitcoin in reserves?

1. Even assuming that Bitcoin is an inflation hedge - it still doesn't mean that Central Banks should hold it. What would be the purpose of that? Central Banks are not commercial institutions - they hold assets for very specific reasons (e.g. FX rate stabilization).

2. You may have misunderstood me. I said that Bitcoin isn't money - but that by itself doesn't mean that Central Banks shouldn't hold it. FIAT currencies aren't money either. Neither are government bonds. BUT - those bonds or currencies generally don't crash >50% on cycle tops. So it's the fact that it's not money, combined with the other points I mentioned here and in the article that i linked

3. Kaspa isn't money. It certainly hasn't been long enough to be classified as money, nor it has enough intrinsic value. It carries the same set of technology risks as other cryptocurrencies- and even without looking at the chart - I can tell you that it's correlated to the rest of the crypto market.

I am a big fan of crypto, but we need to keep it real 😄

Thousands of accounts on X with large following shill Bitcoin/Crypto non-stop, with little reasoning behind it. They either do it for pay, engagement or a mix of both.

You don't have to look far - usually just search for "gold" on their profile and you'll find something like this (see screenshot).

If you want to understand how Bitcoin is not gold, it will never be gold, and it will never replace gold - read this article: https://illya.sh/threads/bitcoin-needs-gold-gold-doesnt-need-bitcoin.html

Is the rotation from Gold to Bitcoin in the room with us? 😉

Over the past 2 weeks hundreds of X accounts with large following have been posting about an imminent rotation from gold to Bitcoin, once gold reaches a correction level.

Their main argument seemed to be based on Bitcoin's historic price correlation - essentially "here are some select occurrences from the past where this happened, so it will happen now". Many of them went as far as claiming that gold has topped in this cycle (it hasn't).

Local top for gold was reached, but rotation didn't happen. As I've been alluding to over this same timeframe - the reality in financial market is seldom this simplistic.

In general, you should be very wary of market thesis that are too abstract, or fail to consider the macro picture.

How exactly does Bitcoin break U.S. dollar control, when >90% of Bitcoin's buying volume is USD-derived (including stablecoins)?

All reserve currencies achieved reserve status under gold or silver standards

And some still think that Bitcoin will be the next reserve currency. Judging by the actions of the sovereigns positioning their local monetary units for reserve currency position that is highly unlikely 😁

More specifically, China & BRICS are heavily buying gold, and they have openly discussed partly gold-backed currencies several times. In the EU, the ECB is very clear on their stance against adding Bitcoin to their reserves.

Bitcoin doesn't exhibit the characteristics necessary for a reserve currency. If you believe that it does, then you need to start by explaining how it would integrate into the current financial system. Do not forget to consider Central Banks, wholesale debt markets and refinancing cycles. A potential role that Bitcoin may take is as collateral, for example in money markets. The problem is, that you will be inadvertently running into very large haircuts and low LTVs. So unless Bitcoin concisely keeps yielding higher highs, you'd be better off by using higher-quality collateral, such as government bonds or even equities.

Another point comes down to risk. The more Bitcoin is used the more risky it becomes. Sure, you can say that the network also growth with usage, but in case Central Banks start holding Bitcoin - it becomes a geopolitical liability. It will become a matter of time before disruptive attack and compromise of private keys. Also, >90% of the buy volume of Bitcoin is in USD or its derivatives, such as USD-pegged stablecoins. So it's USD that's mostly invested there, not euros, renminbi or others. This makes Bitcoin extremely exposed to USD currency risk.

Gold and silver have a much more modest exposure to the risks above. You don’t have to believe me - just look at the history. Since 500 BCE it's mostly been gold and/or silver - and Bitcoin doesn't change that.

Accounts on X that relentlessly promote the idea of Bitcoin being money, and better money than gold fail to address these points.

but Bitcoin is also taxed and surveilled - the ledger is public and attributable 😄

most of Bitcoin's trading volume is in central-bank issued currencies. actually, it's mostly the USD - so Bitcoin is highly susceptible to U.S. currency risk

so yes, bitcoin is risky. that's the premise of no free lunch in financial markets 😄

if AI will want something it would be gold, not Bitcoin

AI can create another Bitcoin protocol and program the node logic, but AI won't be able to create gold

AI will also need to gold for the signal connectors in the electronics that the AI runs on

It's chemistry/physics vs computer code. You can write new code, but you can't create new Au (without it being very, very expensive)

Bitcoin needs gold. Gold doesn't need Bitcoin

TL;DR: Bitcoin is a protocol that runs on computers. Computers rely heavily on electronics. Gold is widely used in electronics. Bitcoin depends on gold.

Bitcoin quite literally runs on gold. ≈99% of physical machines hosting Bitcoin nodes contain at least trace amounts of gold. The same is true for the overall electric grid infrastructure that delivers electricity to Bitcoin nodes.

While gold isn't strictly required for electronics, it's widely used to due to organic demand. Gold's ROI in signal connectors is very strong, because you need little gold to mitigate a large amount of failure risk. All of this is due to the unique chemical nature of gold, which alongside its scarcity is at the base of gold's intrinsic value.

Gold is a chemical element in the periodic table - its atomic symbol is Au. Physical gold is essentially Au atoms connected to other Au atoms in a cubic pattern. This structure is very stable, and at the same time soft/malleable. Gold is used in electronics because it provides stable, low and predictable contact resistance and corrosion immunity at low currents/voltages, including under vibration.

Electronics is of course just one of the use-cases of gold. Among others, it has been used as money for more than 5000 years. Even if Bitcoin does become money in the future, it won't be the only form of money (plus, you can always tokenize gold!). And especially not for the near long-term future.

Digital currencies are at their infancy, and they almost always depend on stable electrical grid and network connection to function properly. This includes Bitcoin. Gold doesn't have this risk. It was used as money before electricity and networks existed, and it can continue to be used alongside them

This is not to say that Bitcoin is a bad idea, but gold has a higher intrinsic value by definition