Commodities, metals & energy market updates

Short updates on commodities and commodity markets, including precious metals, industrial metals (e.g. copper), energy (oil/crude, nuclear/uranium, power/electricity themes) and agriculture — plus miners, producers and supply/demand dynamics.

As expected - 3 months was all that crude oil needed to spike back up

Other commodities like gold, silver & others are up since as well

CME publishes daily data on physical settlement on gold futures

The problem is that it's PDFs with numbers

Some interesting alpha factors can be extracted from this 💡

Maybe making a website to visualize, interpret & combine that data would be useful 👀

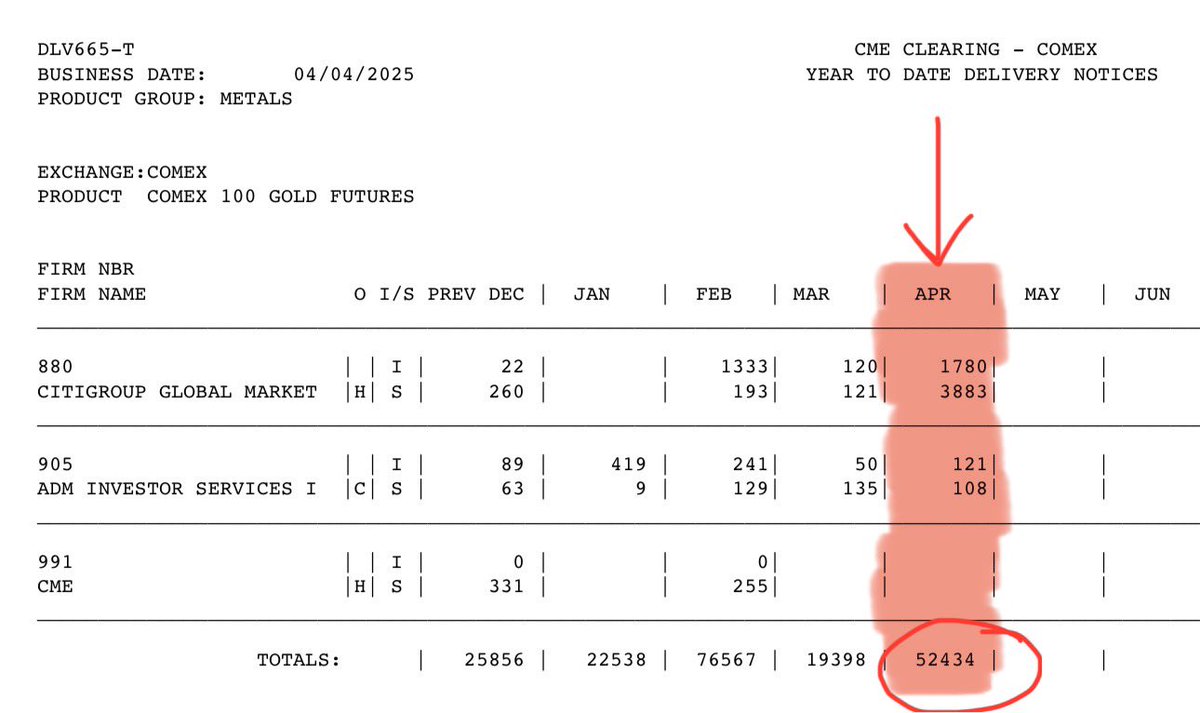

PHYSICAL GOLD RUSH

It's not just Central Banks anymore

In the first 4 days of April 2025, over 52K COMEX 100 Gold Futures contracts have been requested for physical delivery

Only 4 days in & it's already x2 of January interest

Physical gold in high demand

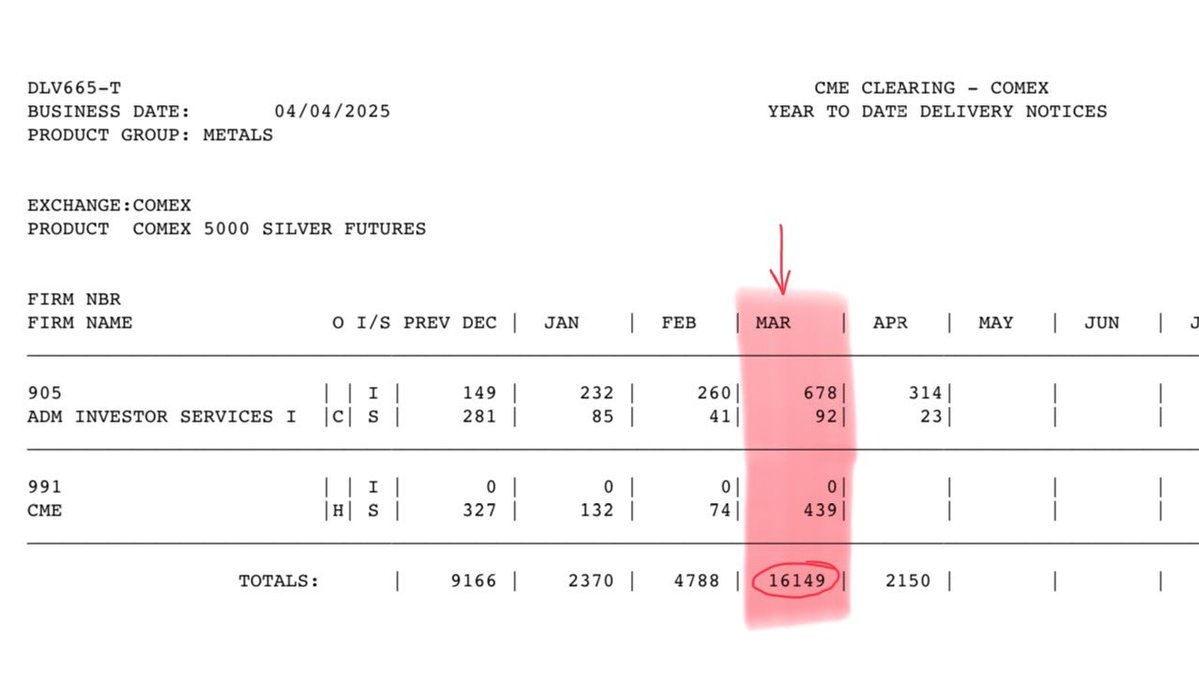

Silver Physcial Delivery Demand HIGH

CME's COMEX & NYMEX Metal Delivery Notices show a MASSIVE demand for physical silver

16.1K futures contract for delivery/physical settlement, up x3 from a year ago

A.K.A. tariffs effect on silver

Investors are HOARDING silver