Gold: macro, inflation, miners and price

Ongoing updates on gold price action, central-bank demand, miners and macro drivers in the precious-metals market.

I'll be using PAXG prices as a proxy for gold prices. The great thing about PAXG is that Binance provides for historical 1-minute OCHLV data dating back more than 5 years

My plan is to use this data to derive more signals and/or features for the meta forest

A script is in the process of downloading and preparing the data 😄

If you invested just $100 in Gold in 4000 BCE, today it would be worth $100

This is because USD didn't exist 6000 years ago, so it wouldn't be accepted as means of settlement in Ancient Egypt, thus you wouldn't find a counterparty willing to sell you gold in exchange for US currency.

6000 years is also for how long gold has been used as money. Yet, some still believe that Bitcoin is the new gold and that it will replace gold as money 😄

Gold Outperformed Bitcoin In The Last 8 Years

Let's go back in time. It's December 2017. You have $1000 to invest, and you have 2 options: gold or Bitcoin. Which one would you choose?

If you bought $1000 worth of BTC at ≈$20K/BTC in December 2017, you'd now have ≈$3500, or roughly a $2500 net profit.

If you instead bought $1000 worth of gold at ≈$1260/oz, you'd now have ≈$4000, or roughly $3000 net profit.

And throughout those 8 years of holding, gold's price never crashed by ≈50%, like it's more or less the norm with Bitcoin & rest of the crypto.

Bitcoin can be a great idea for your portfolio, but if you're so determined to HODL long-term, you may be much better off with gold.

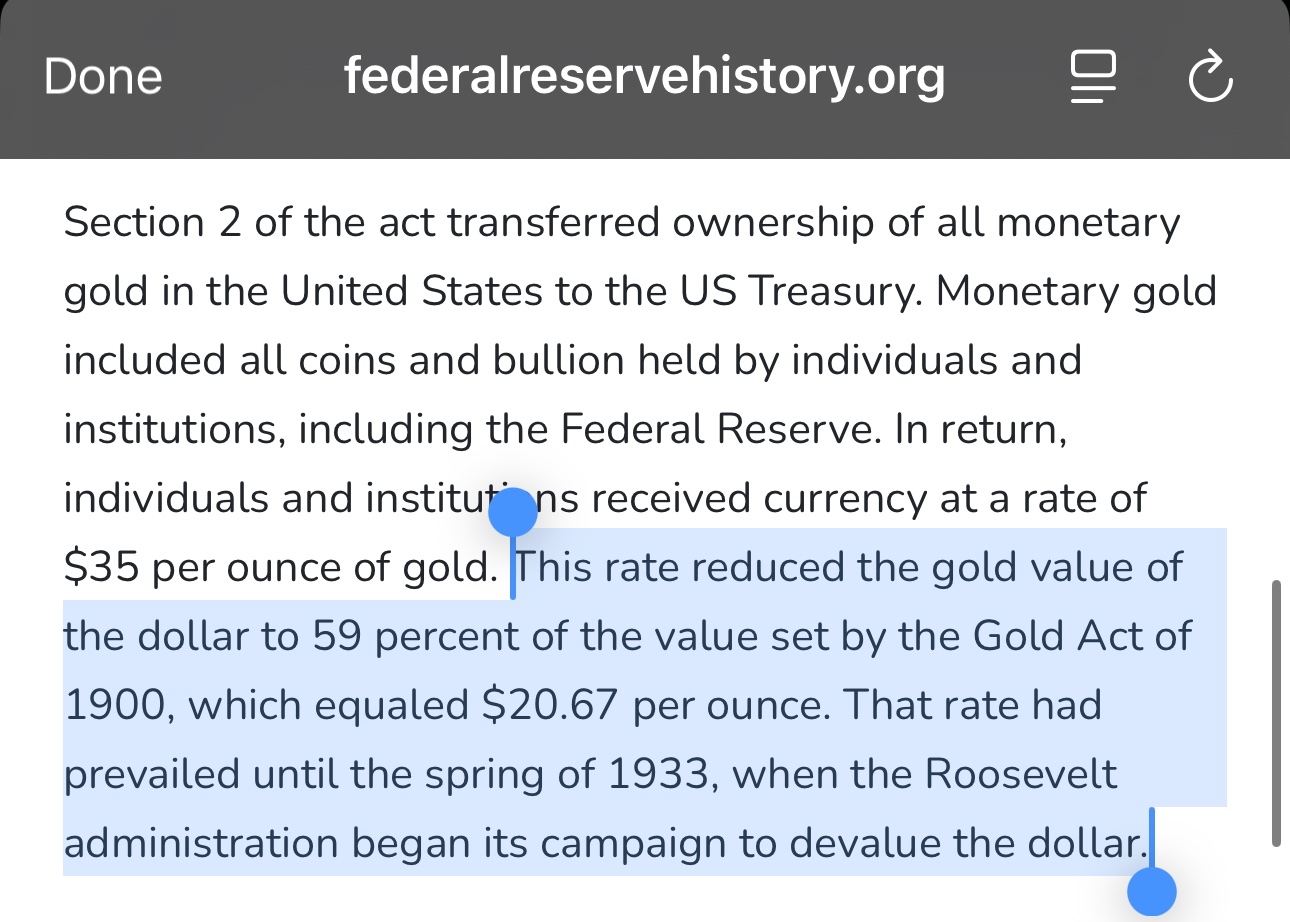

In 1934, the U.S. government had to legally raise the price of gold to make a ≈70% profit on it in ≈1 year

Today, gold goes up by more than 70%/year just by market forces 😄

I've been spamming you to buy gold since it was ≈$1800/oz

How USA Profited 70% On Gold In 1 Year

In 1933, the U.S. government purchased gold at $20.67/oz. In 1934, gold was valued at $35/oz, or ≈70% higher!

How did they do it? Easy:

1️⃣ Force public to liquidate gold at $20.67/oz

2️⃣ Raise the official gold price to $35/oz

3️⃣ Instant 70% profit 😄

Had the United States citizens not surrendered their gold in 1933 (which would be illegal to do!), they would be 70% richer just a year later. Instead, that wealth was forcefully transferred to the government, and the people who surrendered their gold became 40% poorer just a year later.

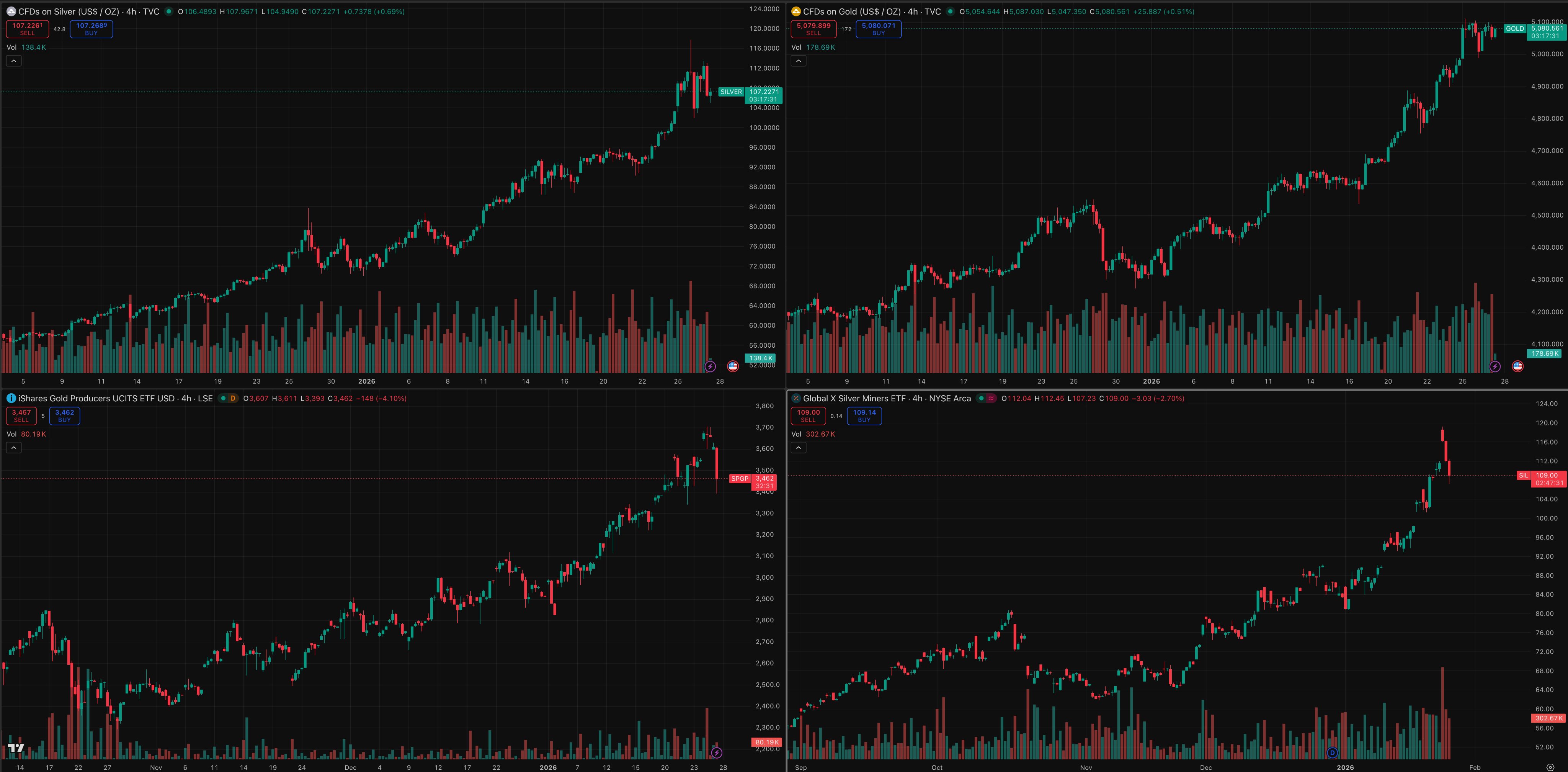

As I've explained in my prior posts: the commodities rally isn't over

Gold is back above $5000

Silver is back above $80

Copper is back above $6

Prices below the above remain a buying opportunity

Enjoy!

My Target For Gold Is At Least ≈7500 USD Per Ounce

I would like to clarify that this is my *minimum*, medium-to-longterm target for this commodity cycle.

Gold reaching $7500 wouldn't be anything out of the ordinary. It may happen faster than you think.

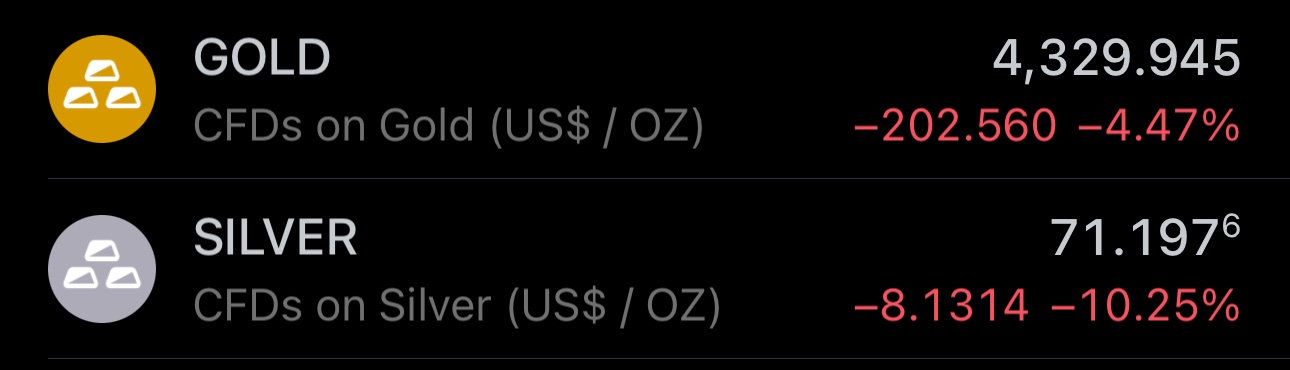

Today's Commodity Miners Sell-Off Is A Buying Opportunity

I've made numerous such calls in the past, and they were correct 100% of the time. Today, I'm making one of such calls again.

Gold, silver and copper miners are down today, with indices and individual large caps falling by as much as ≈8%, despite the underlying metals remaining in the green. This is exactly the situation where you can leverage the increased volatility in the mining sector to increase your exposure to the underlying metals during an uptrend.

I expect the prices of gold and silver miners indices to increase by ≈30% from current levels within roughly 10 trading weeks from now. It may happen sooner than though - pay close attention to the price action.

It's also possible for the price to dip lower than the current levels before the upwards move described above materializes. This mainly depends on the price action of the precious and industrial metals in the next few weeks, but I don't believe that either one of them has topped for the cycle, thus uptrend resumption is imminent.

I've written several articles explaining why commodities and commodity miners are a great investment for 2026. I suggest you to read them if you haven't done so yet.

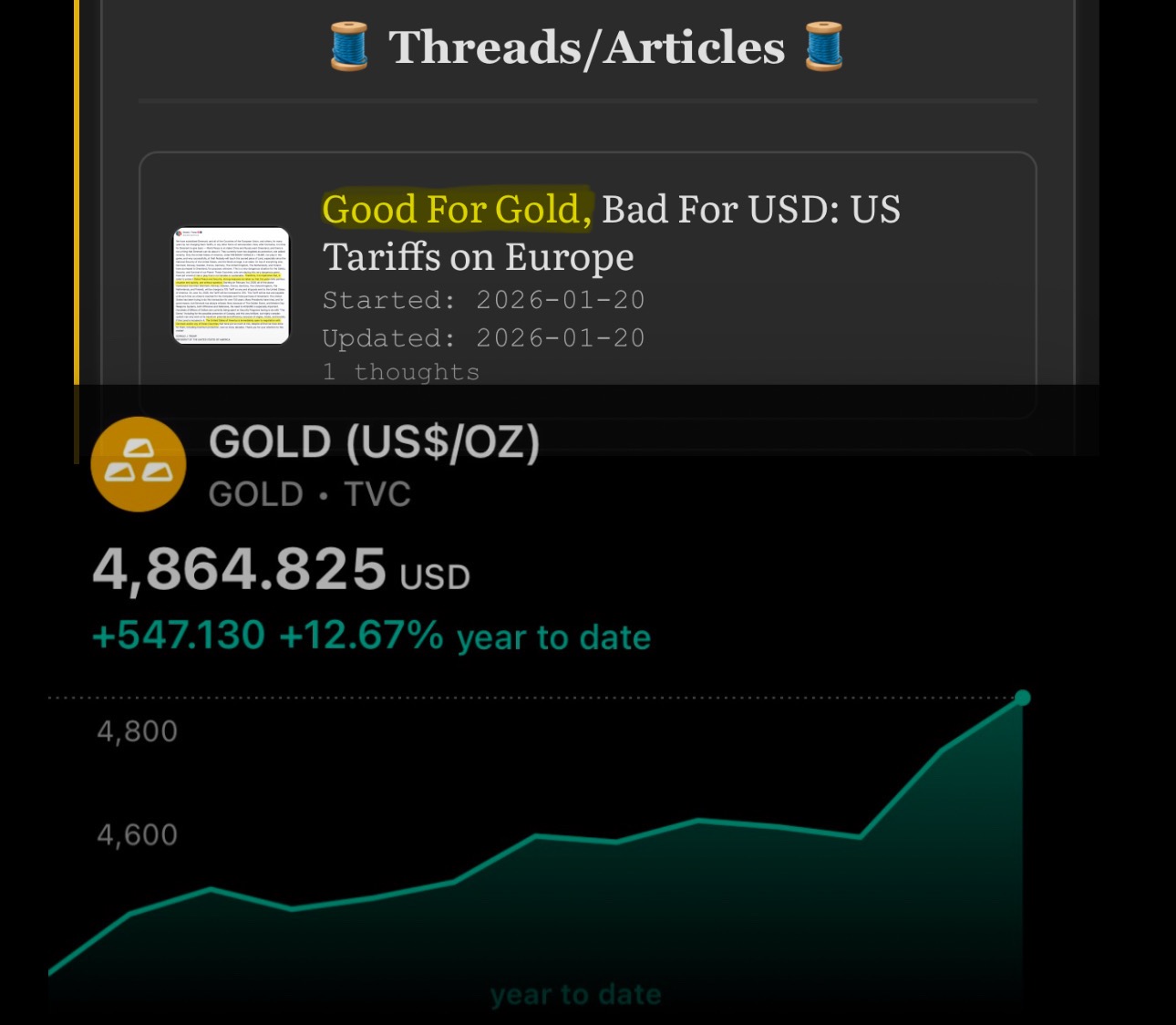

Yesterday I wrote an article explaining why US tariffs on Europe mean more expensive gold and cheaper US dollar

Today, gold hit a new all time high & you should expect this trend to continue

If you haven't read the article yet, you can do it here: https://illya.sh/threads/good-for-gold-bad-for-usd-us-tariffs-on-europe

Good For Gold, Bad For USD: US Tariffs on Europe

The tariffs imposed by the U.S. on the European countries are detrimental to USD's position as a reserve currency. A capital outflow out of the U.S. dollar creates positive price pressure on gold via increased demand.

This is true regardless of the U.S. Supreme Court's decision on whether President Trump can lawfully impose unilateral broad tariffs via executive order using the the International Emergency Economic Powers Act (IEEAP).

At the high level, there's two moves for gold here:

➖ If the tariffs are deemed illegal and the collected tariff revenue must to refunded - which would lead to an increase of USD supply accessible to the wider economy. The refund would come either from existing reserves, thus directly increasing broad money or from newly issued debt, which may reduce broad money in the short-term, but the newly issued bonds will eventually be rehypothecated, thus effectively increasing USD credit/effective supply. This is positive price pressure on gold, at the very least due to the increase in liquidity. This is negative price pressure on USD, due to increased supply & public debt of the issuer.

➖If the tariffs are deemed legal, and/or do not need to be refunded, the geopolitical and liquidity risk remains, which materializes in a lower incencitve to own USD. After all, why would you want to hold a currency, whose purchasing power/liqudity may be reduced every other week after the markets close on a Friday? Gold is the natural outflow path from USD, especially at sovereign/central bank level.

If the Eurozone wants to reduce their USD exposure in the next 5 years, what can they do? The European countries may not want to start significantly increasing the share of renminbi in their FX reserves just yet. Additionally, EU could position Euro as an alternative to USD for settlements, as EUR is already the second most used currency for international trade & FX turnover, second only to USD. Gold presents itself as an attractive alternative to USD, even if the focus on increasing its tonnage in the reserves is transitory. At the very least, increasing the share of gold relative to the balance sheet size in the Eurozone, would increase foreign exchange rate value of Euro and/or would provide basis for monetary expansion in the future.

Many forget that the "gold and foreign exchange reserves" are a single asset-side item in central banks balance sheets. "Gold" is explicitly discriminated among all other assets/commodities, while all currencies and their derivatives (e.g. sovereign bonds) are clustered under the generic "FX reserves" name. Across all currencies, renminbi is best positioned to increase its share in reserve assets and international settlement. Unlike renminbi, gold is nobody's liability and has no counterparty risk (assuming no jurisdiction risk, which can be greatly mitigated by storing the gold bullion domestically).

Given this, I expect the European countries to increase their gold holdings, via a combination of swaps from USD-denominated assets for gold and other FX currencies like the Chinese Yen.

Even As Central Banks Bought Gold, The Market Analysts Remained Bearish

* This goes to the list of "things that are obvious in hindsight"

In 2014 Forbes published an opinion saying that increased gold buying by Central Bank of Russia (CBR) isn't an indicator of positive price pressures for gold.

Gold's price has more than quadrupled since then, going from ≈$1600/oz in November 2014 to ≈$4600/oz as of January 19th 2026.

The article frames the purchase as "forced", when commenting the fact that CBR decided to increase the share of gold in the "gold and foreign exchange reserve assets" item in their balance sheet. It is not by chance that this central bank accounting item explicitly includes "gold" in its name.

The Forbes article also seems to assume that miner profit margins don't spread cross-border.

Another thing that the article omits is that a central bank can buy gold without expanding the base monetary base (i.e. "printing" new currency), for example by swapping FX reserves for gold via a single or multi-leg sale.

Gold miners are about to breakout

It looks like gold miners are about to appreciate relative to gold, as you can see on the multi-year ascending triangle on the chart. Given that I don't expect gold to have any significant medium-to-longterm pullbacks, this means that gold mining stocks are setup to appreciate more than gold.

The next significant medium to long-term resistance zone is ≈60% higher, meaning that miners have room to appreciate significantly more relative to the price of gold.

The chart is on a monthly level and it shows the ratio between the price of gold miners index and gold futures.

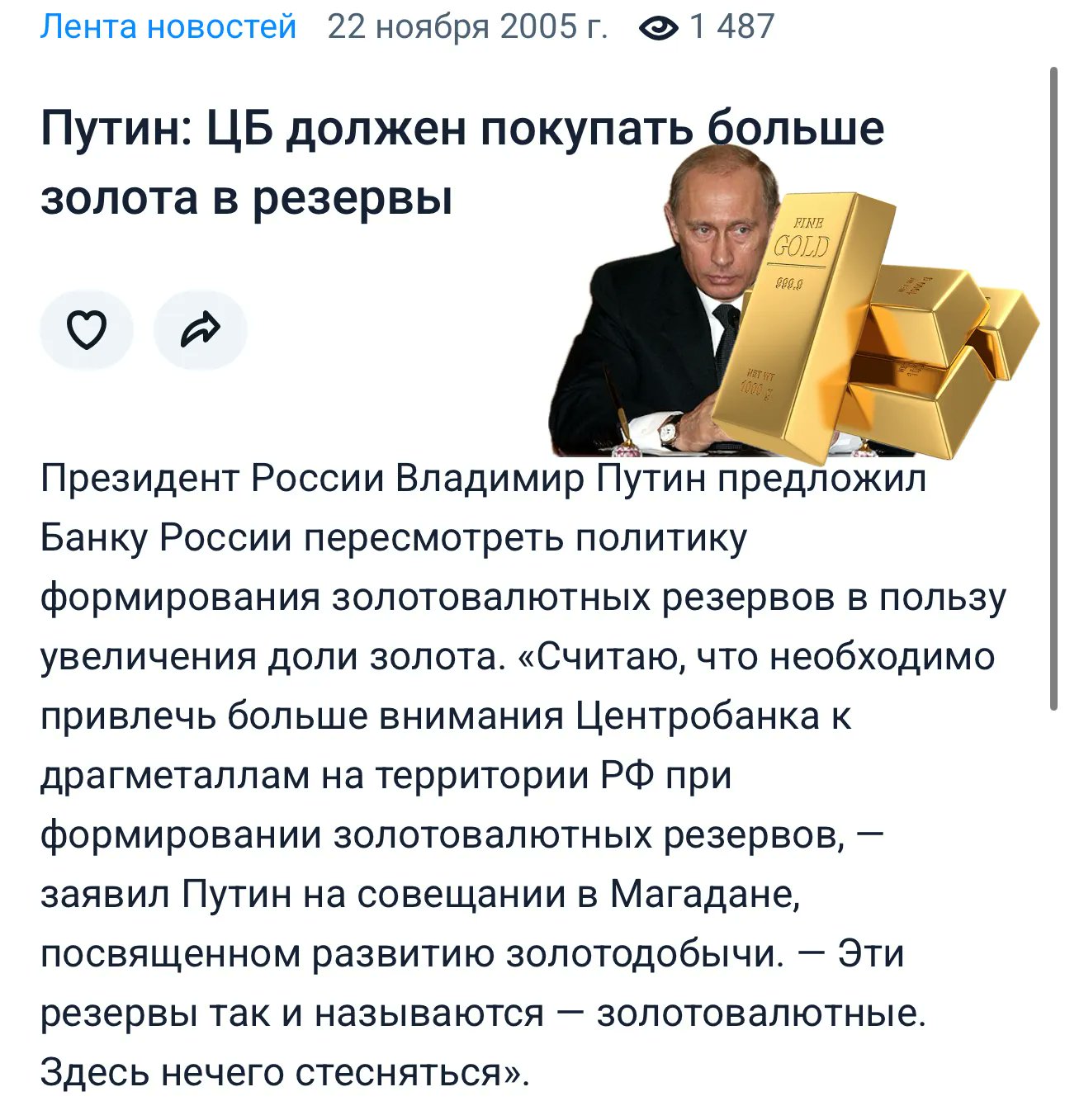

Putin Instructed Central Bank of Russia To Buy Gold In 2005

In 20 years, Russia's share of gold in their central bank's international reserves account increased by a factor of ≈12.1 times.

At the start of 2026, gold represents ≈43% of Bank of Russia's (BoR) international reserves. Back in 2005, gold accounted for a mere ≈3.5% of the same reserves account.

The move to gold was mainly motivated by the desire to diversify away from the U.S. Dollar and the explicit goal of increasing BoR's holdings of gold relative to foreign exchange assets. On November 22nd 2005 Putin stated:

➖ "I believe it's necessary for the Central Bank to pay more attention to precious metals within the territory of the Russian Federation when forming gold and foreign-currency reserves. Those reserves are even called 'gold and foreign-currency' reserves. There's nothing to be shy about here."

Since Vladimir Putin instructed Bank of Russia to start buying more gold, gold is up ≈840%, i.e. almost 10 times. In the same period, S&P 500 TR increased ≈726%, or almost 9 times. This means that Putin's strategy outperformed the U.S. stock market index by ≈14%. Perhaps the president of Russia should start his own investment fund?

You can read the full article on gold revaluation, its low-level mechanics and impact on the U.S. here ⬇️

https://illya.sh/threads/gold-revaluation-will-not-solve-the-us-debt-problem

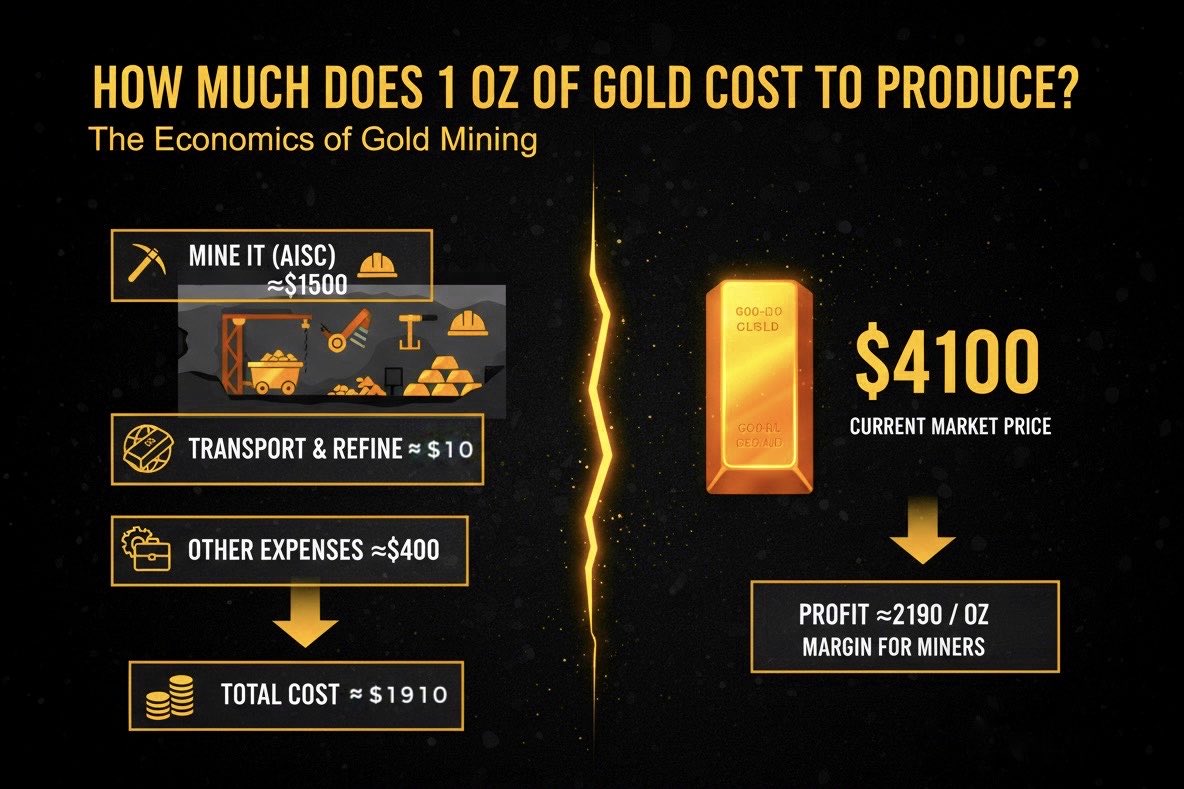

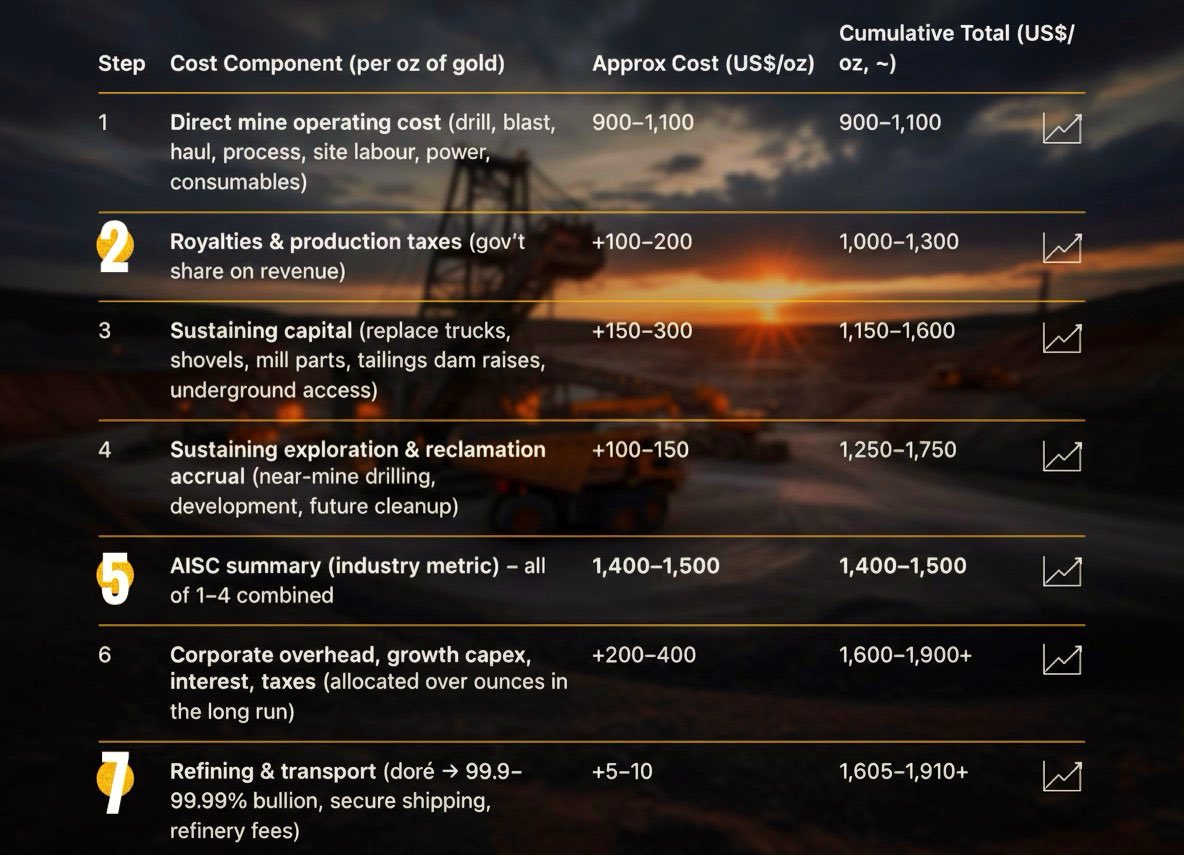

The big play on precious metals mining stocks is that production costs remain (much) smaller than the metal's spot price

For gold - the cost to produce/mine 1 oz is roughly $2000. Then, those same miners sell it for more than $4000. Instant >$2000 profit per ounce (again, rough numbers) 😄

So from the current levels, assuming production costs increase less than the spot price of the metal - miners win big. I believe this will be the case.

I wrote a more detailed article explains gold mining costs and miner profits here: https://illya.sh/threads/1-oz-of-gold-production-cost-and-miner-profit

Gold hasn't even touched its daily level uptrend support and finance accounts on X are already calling for a top

I have been writing my price thesis on gold for 2 years now, and since my call in December 2023 gold's price is up ≈125%. In the last day or 2025 my call is that this uptrend will continue.

Regarding local tops, it's worth noting that gold has been in one for over 2 months now.

Additionally, closes below a seemingly arbitrary 4H support line drawn on a chart does not imply any significant top or trend reversal. Gold can go down to $3900 and still be in an uptrend!

TA & charting is supportive, as it gives you hints about what the market is doing, but on its own it can't provide you with a high-confidence prediction of the future.

If you lack the foundation on the basis of the price action of an asset, you'll find it much more challenging to distinguish a dip from a longer-term trend reversal. I've written several articles explaining why gold's price will keep going up, in terms of currency debasement, refinancing cycles, global liquidity and geopolitical pressures. You can access those threads/articles on my website free or cost. They'll provide you with a solid basis for understanding gold, where its price headed and why.

Gold hasn't even touched its daily support line from October 2025

In fact, gold price could fall under $4300 and still be above that support (green line on the chart).

This discounts all theories suggesting a long-term top at current price levels. Gold's price action clearly suggests the continuation of the uptrend into 2026.

This dip is a buying opportunity

Today's gold, silver and their miners sell-off is a buying opportunity

Treat it as an early new year's gift for 2026 🥳

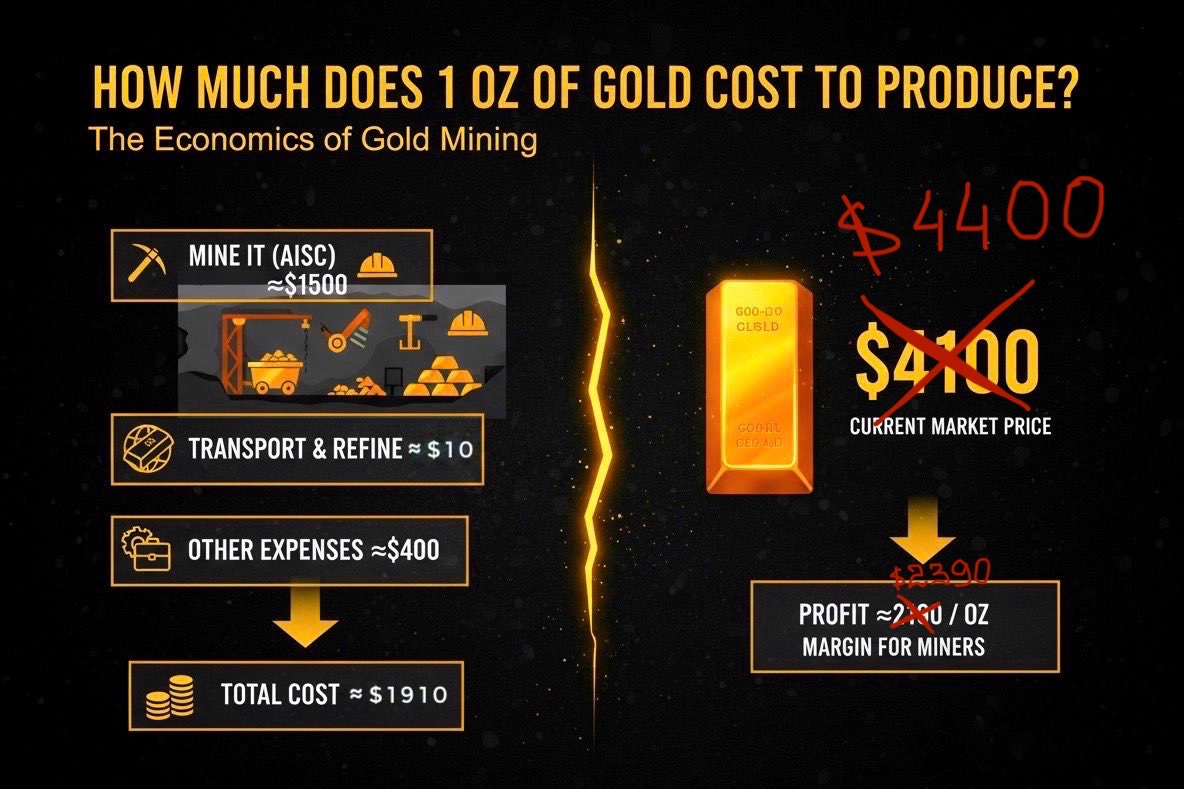

1 oz of Gold: Production Cost and Miner Profit

1 oz of gold costs ≈$1500 to mine (AISC), ≈10$ to transport and refine and another ≈$400 in various other expenses.

In total, that sums to about ≈$1910 to get 1 ounce of gold from the ground to bullion gold bar.

Currently, gold trades at ≈$4100/oz (when you're reading this it's probably much higher 😄). This means there is about $4100-$1910=$2190 of margin on each ounce of refined gold. Almost all of this margin on the sale of an ounce of gold is pocketed by gold miners.

Let's compute the profit per ounce of gold from the perspective of a miner. Gold miners generally sell gold to refineries at a fixed haircut over the spot price. This haircut is generally very small, ≈$10 which accounts mainly for refining and treatment costs. So with the numbers above (also see attached image), gold miners are making a profit of $4100-$(1500+400+10)=$2190 (the same number we computed above).

The larger the premium/gap of gold's spot price over its production costs, the larger is the profit for the miners. As the cost of labor and industrial production increases due to global monetary debasement, so will gold production costs. The same monetary debasement, combined with strong demand for gold will push its price further up.

In the next 2-3 years, I expect gold price to increase by a larger proportion than gold mining costs, as gold is under several positive price pressure points (central banks, USD alternatives, monetary debasement, etc). Thus, the margin over mining costs should remain high, leading to a sustained high profit per ounce of gold for miners.

This is why gold mining stocks are currently a great investment. The same is true for other miners, such as silver.

1 oz of Bullion Gold Costs ≈$1910 to Produce

Gold's current spot price is ≈$4100. There's a ≈$2190 price gap between what gold costs to buy and what it costs to mine & refine.

The majority of that $2190 profit per 1 ounce of gold goes to the miners. Gold refiners earn just a few dollars per ounce in profit.

This is why mining stocks are currently such a good investment idea.

Europe's Gold Imports and Exports Explained

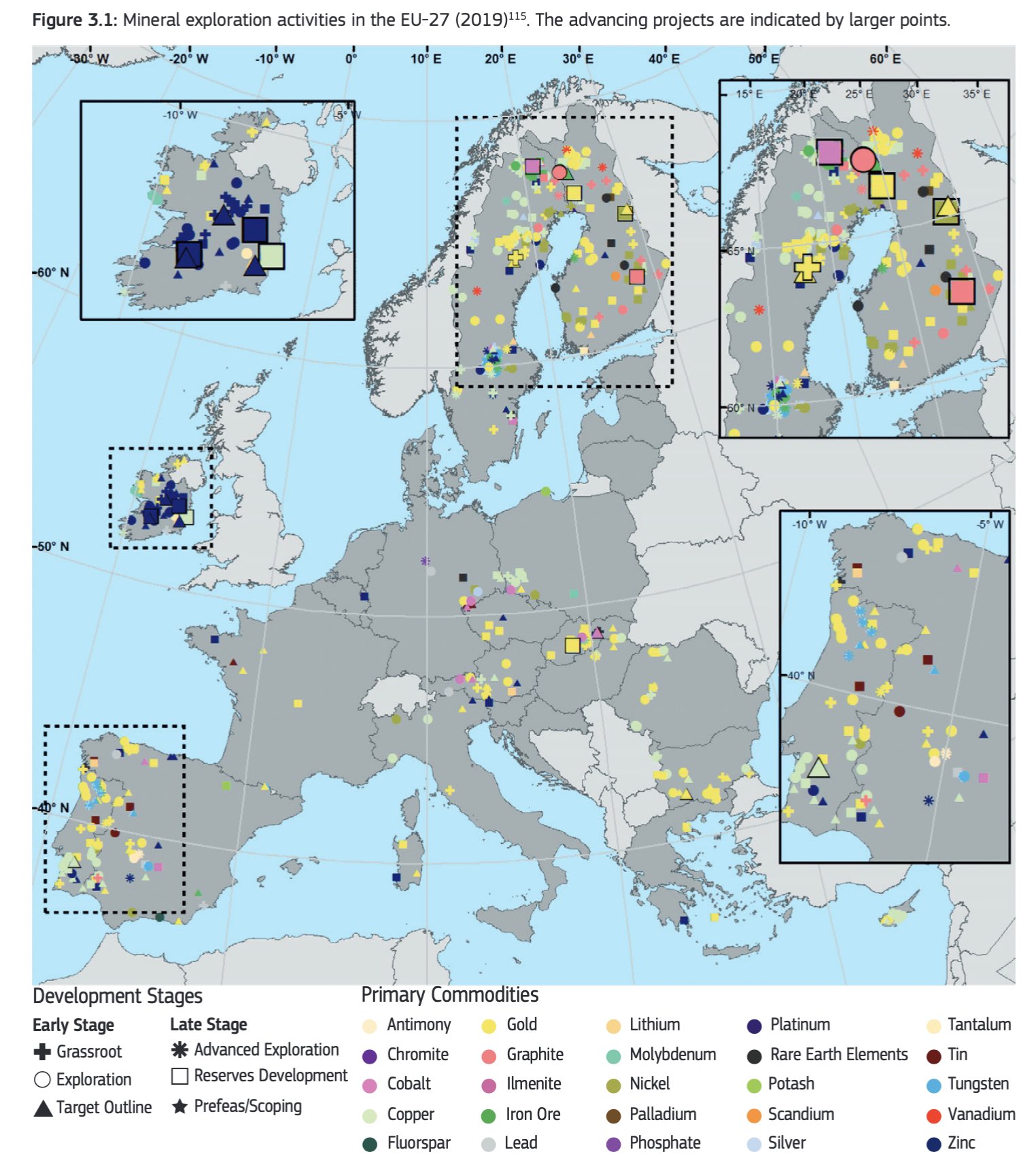

Europe has gold mines in Finland, Sweden, Türkiye and Romania among others.

Together they account for <2% of world output (≈70 tones of gold/year). Europe is heavily dependent on gold imports, with >90% of the gold for its needs being imported.

Switzerland is the world's largest gold refining and transit hub, with at least ≈50% of all of the newly minted gold passing through Swiss refineries. Refining and re-exporting is by far the largest driver of European gold imports.

Europe imports ≈3900 tones of gold per year, but only keeps 10% of it.

My prediction on gold's bottom was correct: ≈$3900 ✅

You can direct anyone who is saying that gold and silver have topped to my posts.

If you think that gold and silver have topped - I'm really curious to hear your thesis. I've laid mine out extensively in prior writings.

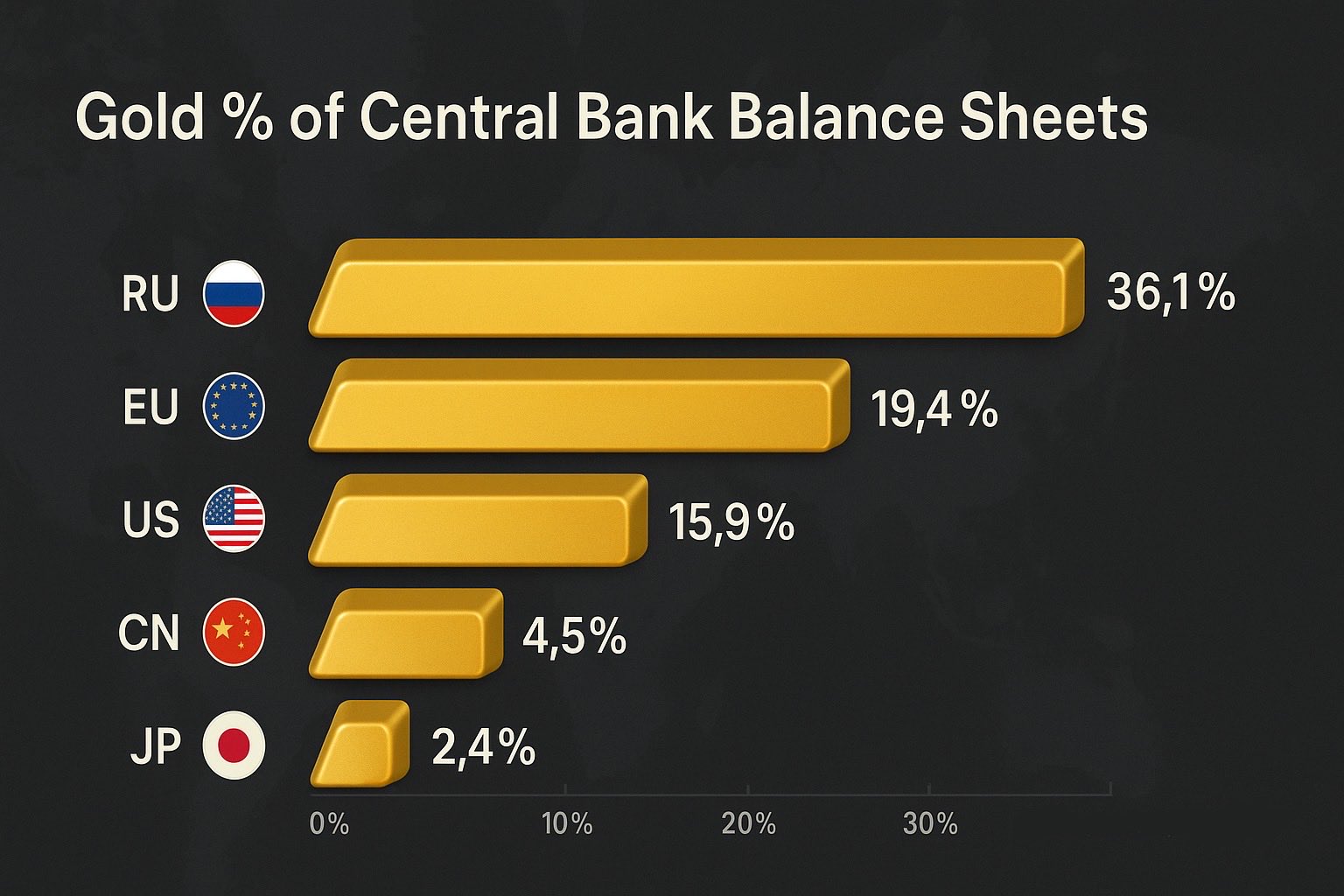

Gold as a percentage of balance sheet size in Central Banks (ranked):

🇯🇵 Japan (MoF + BoJ): ≈2.4%

🇨🇳 China (PBoC): ≈4.5%

🇺🇸 U.S. (Fed gold certificates): ≈15.9%

🇪🇺 European Union (ECB + Eurosystem): ≈19.4%

🇷🇺 Russia (BoR): ≈36.1%

All of the above will expand their balance sheets, but it's mostly China & Russia actively buying more gold.

Conclusions you can take from here:

➖ China's gold holdings are relatively small when compared to their Central Bank's balance sheet size, and given their efforts to promote renminbi as the invoice currency worldwide, you can expect PBoC to continue their gold purchases for the medium-long term. The gold share must at least double to come close to the current reserve currency - the U.S. dollar. All reserve currencies started on a gold and/or silver standard - and the pressure towards this direction won't be different for renminbi/yuan. When the USD became the world reserve currency with the Bretton-Woods agreement - gold certificates accounted for ≈40% of the Fed's balance sheet.

➖ Russia has built up a massive balance sheet capacity for the future. Once the international trade markets with Russia re-open, there will be a plenty of reserves to back-up a massive wave of Ruble credit. Expect Russian capital markets to rally then.

➖ European Union has a healthy relative position. Given that the Euro is currently the closest alternative to the U.S. Dollar - it's a good idea to both, expand gold reserves and promote capital markets. The latter is an explicit goal via the Capital Markets Union (CMU). Given that EU will further expand the balance sheet, it's necessary to increase the gold reserves - repricing won't be enough. Gold will make Euro more attractive, and with it the FX holdings of Euro by sovereigns.

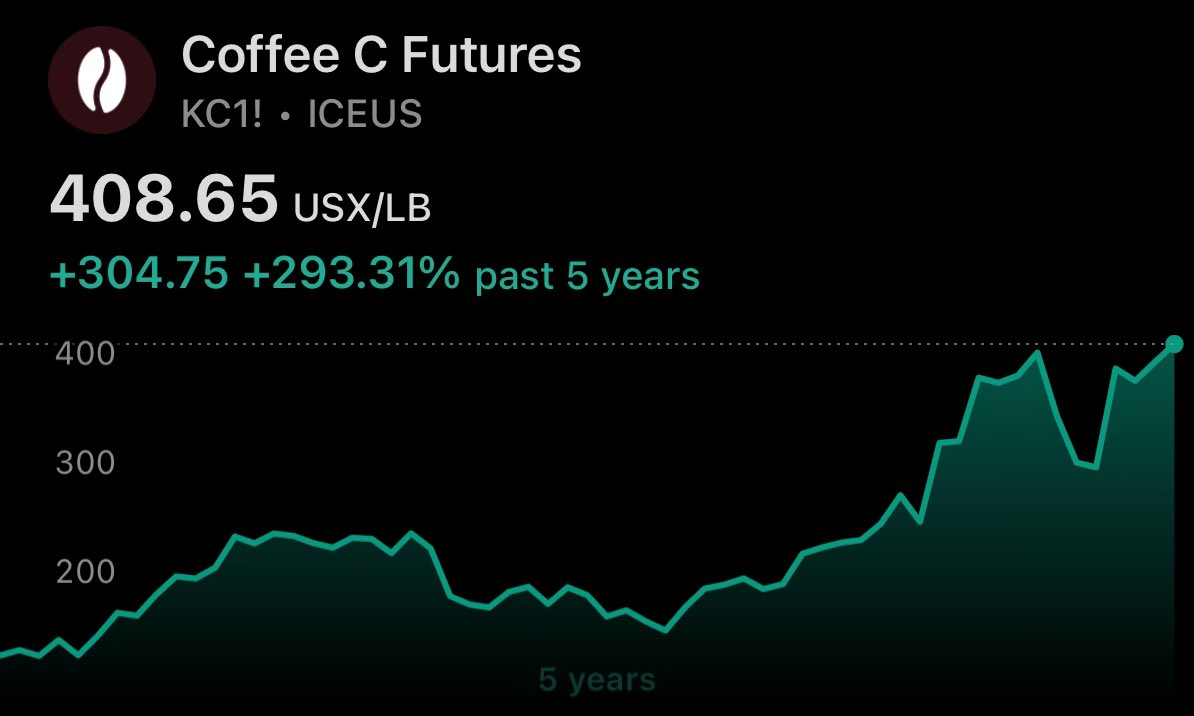

Coffee outperformed Gold in the last 5 years

Would it be sound to conclude that coffee beans are better money and investment than gold, and that Central Banks should hold coffee & its derivatives in reserve assets?

Bitcoin has less than 20 years of price action, and it started trading at a negligent price. Gold has been money for over 5000 years and its earliest recorded price per ounce is of ≈100 days of labor

A better question is whether Bitcoin will continue to consistently outperform gold over the next 20 years. *Consistency* is key - it must be at least a store of value, including shorter-term. If you get caught in the typical >50% price drops - you may pay a high opportunity cost.

It's not just whether Bitcoin will increase more in price than gold in the next 20 years, but also how severe and long-lasting Bitcoin's corrections are.

Imagine you buy Bitcoin today and it goes into a bear market with a significant value loss in the next 4 years. In those 4 years - many investment opportunities may arise, such as in real estate, equities, commodities or bonds. If your capital is locked in Bitcoin throughout that period - that's an opportunity cost.

Gold doesn't come with those shortcomings. There is a reason why all world reserve currencies started on a gold and/or silver standards.

There is no free lunch in the markets. Higher return is almost unanimously correlated with higher risk. Quantitatively Bitcoin is high risk- it's not a matter of opinion.

This doesn't mean that Bitcoin is a bad idea, but it also doesn't mean that Bitcoin is a better idea than gold. It does, however mean, that Bitcoin isn't a replacement for gold.

And now you understand what makes gold so special. You don't have to believe me - believe centuries of price action and human history.