Stablecoin reserves, flows & market structure

Ongoing analysis of USDC, USDT and other stablecoins across reserves, yield allocation, depeg risk and macro linkages.

How exactly does Bitcoin break U.S. dollar control, when >90% of Bitcoin's buying volume is USD-derived (including stablecoins)?

central banks have rejected holding Bitcoin in their reserves including Fed, ECB, PBoC and many others

what would even be the purpose of a central bank holding BTC on their balance sheet? so that they can stabilize the value of the currency against Bitcoin? what would be the practical benefit from it now?

cross-border crypto trade in non-stablecoins is negligible. Bitcoin is extremely volatile, which would make central-bank issued currency more volatile - this goes exactly against the direct mandate of most central banks - price stability.

a more volatile currency will also lead to a more volatile bond market, which will make government funding more volatile, and thus a high risk/uncertain economy

and i'm not even going to touch on the security risks. okay, maybe briefly 😄:

➖ governments are one of the only entities that can realistically perform a successful 51% attack on Bitcoin. well, with central banks owning BTC will make such attacks much more attractive - including at the geopolitical level. the same goes for denial of service family of attacks

➖ what if the central bank's wallets get hacked/compromised? i'm not talking about quantum computers breaking RSA, but operational level mistake or compromise

so for the next 10 years, I view central banks holding Bitcoin on their balance sheet as a negative sign for their currency. of course, the protocol and the bitcoin network will evolve/change over time, and with so may my stance

i believe cryptocurrencies, and more specifically distributed layer technologies/blockchain architectures can bring immense value to our financial system as a whole, but that doesn't mean that we should have central banks speculating on that today. it makes much more sense to increase gold reserves instead

stablecoins are good for short-term interest rates

i wrote a thread explaining why

📖 read it here: https://illya.sh/threads/@1755378840-1.html

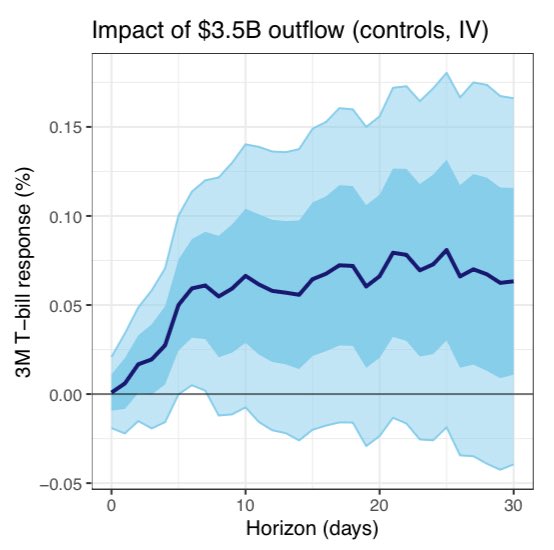

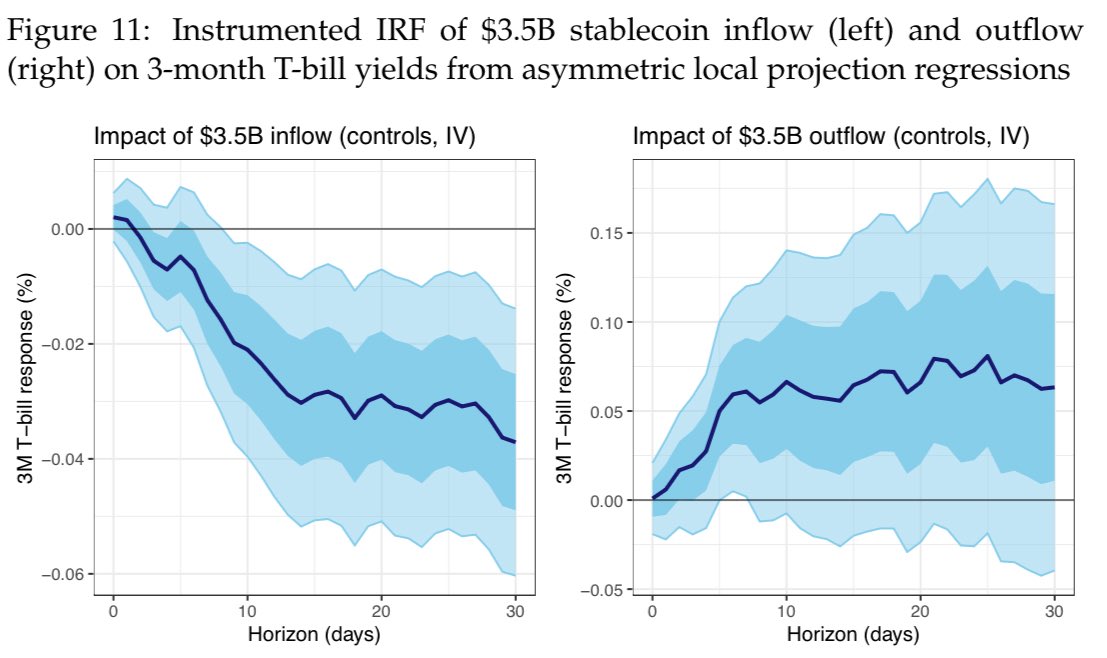

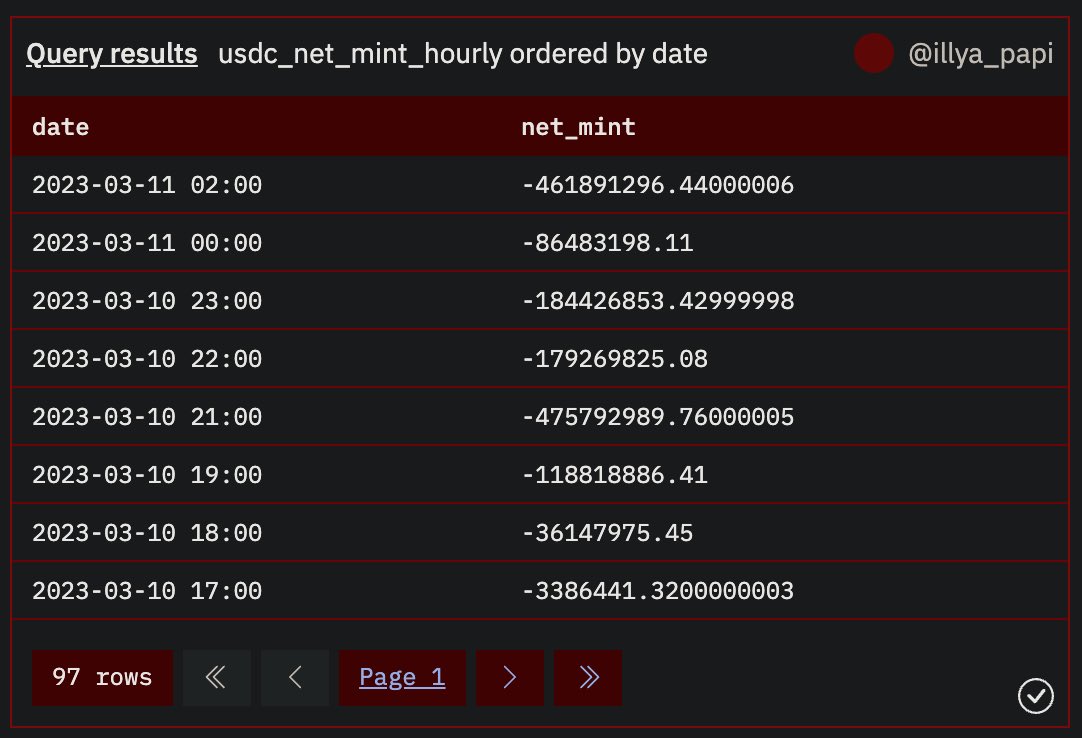

stablecoin outflows proxy T-bill sales or reduced rolling

redemption/burn requires the stablecoin issuer to sell NOW, so large volumes means dealers/market makers will require a yield concession to warehouse those T-bills, as they are subject to balance sheet constraints

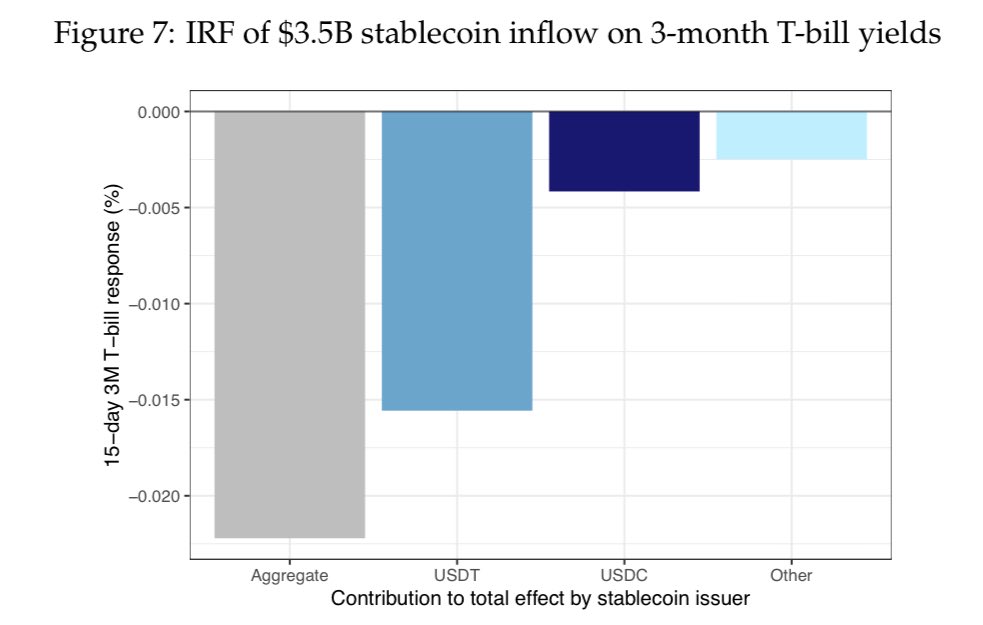

this is because a stablecoin mint/creation on-chain is the proxy for a T-bill purchase by the company issuing that stablecoin (e.g. Circle, Tether)

so stablecoin inflows proxy T-bill purchases, which raises their price and lowers the yield

stablecoin issuers would get this new credit, purchase treasury bonds and increase the supply of their stablecoin

a new direct line from newly issued credit into treasuries 😄

stablecoin issuers could intermediate the issuance process, so you don't need to get all credit institutions on-chain from the start

non-algorithmic stablecoin issuance already happens off-chain and presumes trust in a third party

this would just be faster. more liquidity

stablecoin issuers could intermediate the issuance process, so you don't need to get all credit institutions on-chain from the start

non-algorithmic stablecoin issuance already happens off-chain and presumes trust in a third party

this would just be faster. more liquidity

now imagine when credit institutions can tokenize new credit and allow automated stablecoin issuance backed by that credit

in practice it's code in smart contract that wraps one token with another

i created a similar project on an Ethereum hackathon ⬇️

https://github.com/iluxonchik/eth-lisbon-hackathon-23

now imagine when credit institutions can tokenize new credit and allow automated stablecoin issuance backed by that credit

in practice it's code in smart contract that wraps one token with another

i created a similar project on an Ethereum hackathon ⬇️

https://github.com/iluxonchik/eth-lisbon-hackathon-23

further deprecation of USD against Ruble

now back to July 4th 2025 levels

this will also further fuel the asset bubble & devaluate USD

so it doesn't mean that stock & crypto will go up perpetually - it's a cycle

of course, at some point the debt bubble will pop - but it's unlikely to happen tomorrow 😄

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

this means inflation & gold up

at least short-term: equities up, crypto up

🚨🇺🇸 USD M2 Money Supply is almost back at pre-interest rate increase levels

That QT didn't last after all 🤷♀️

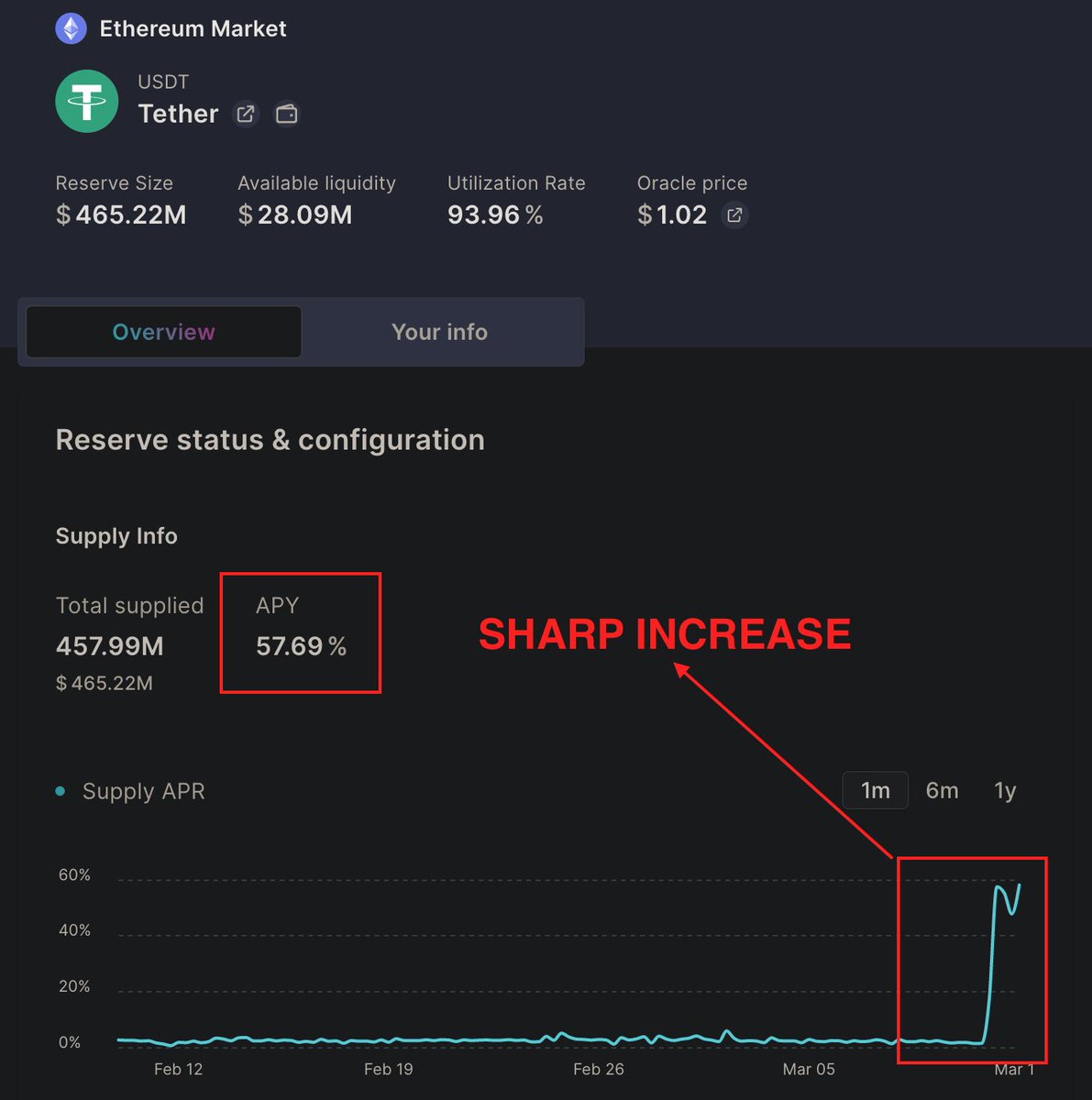

🚨📈 $USDT APY on #AAVE is 60%

This means that people are shorting $USDT. The market sentiment is that $USDT is overpriced.

How to profit:

1. Short $USDT

2. Lend $USDT for a high APR. Should last until Monday

3. Do both

This happened because of the depeg of $USDC

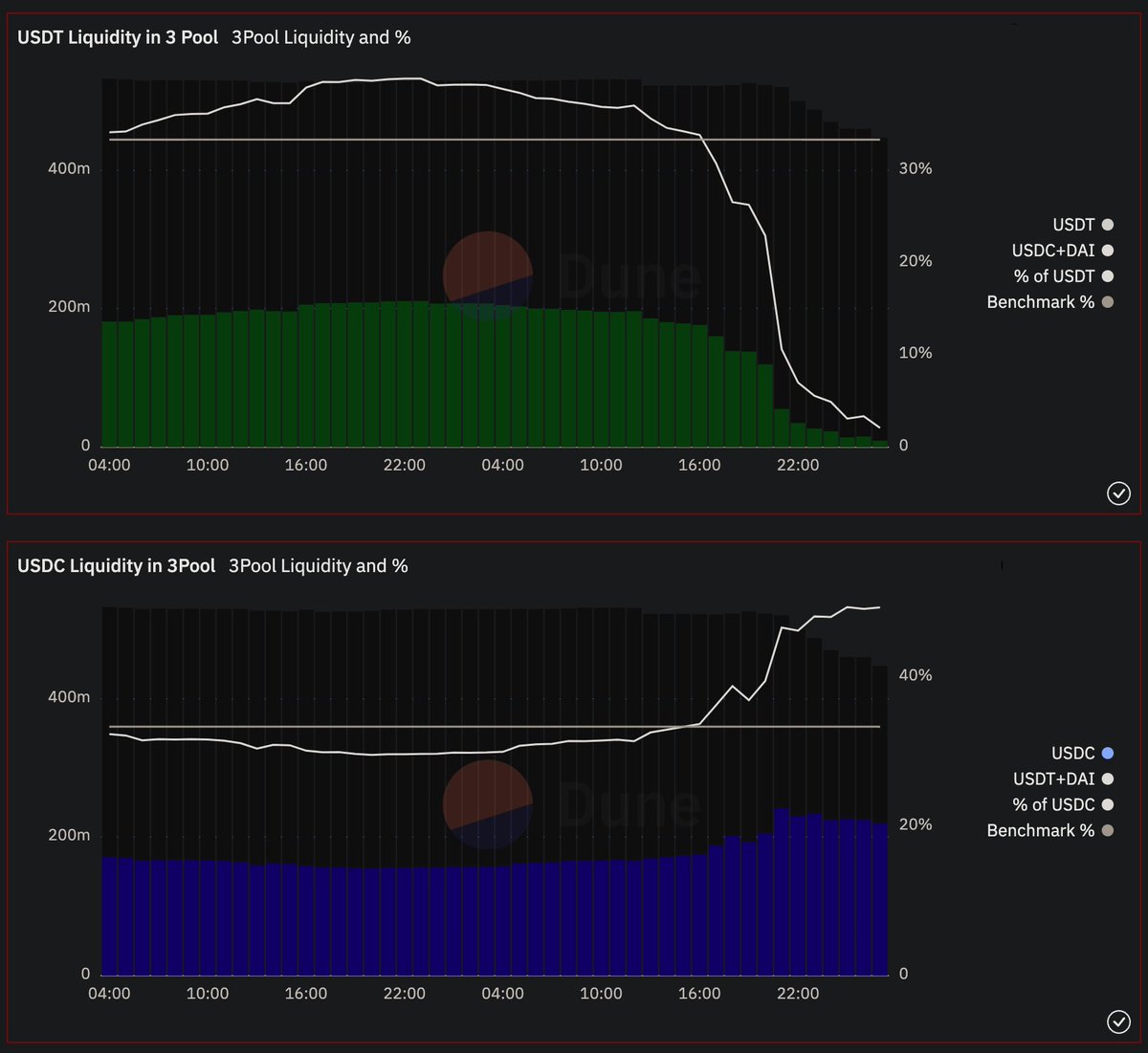

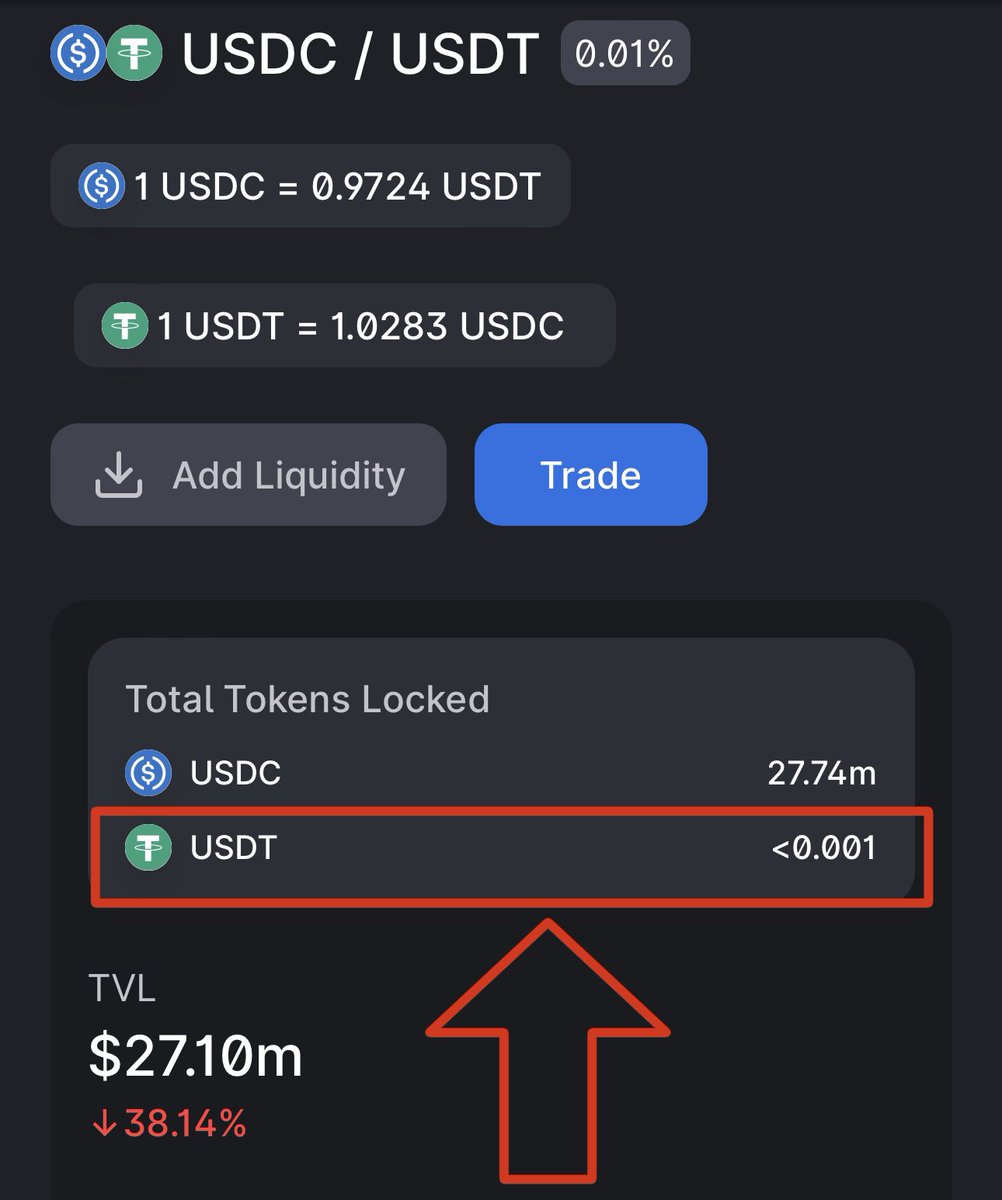

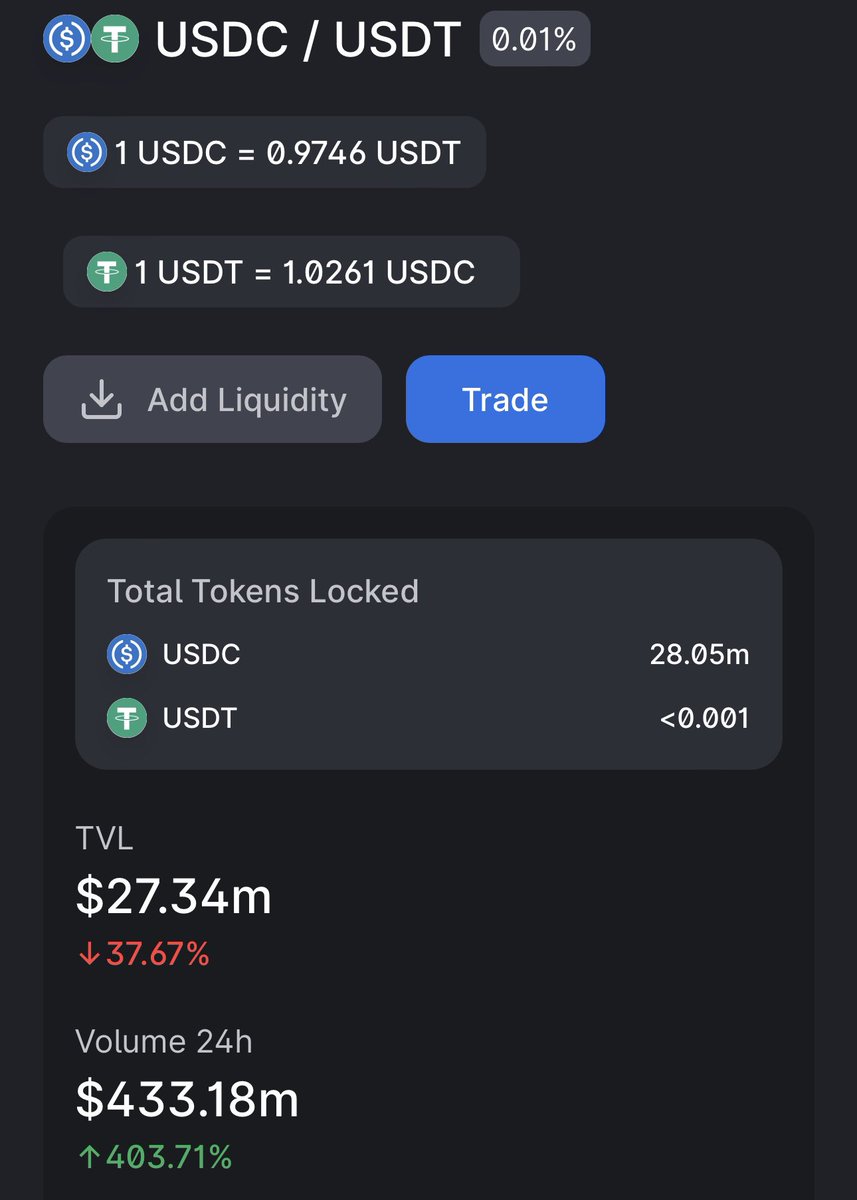

🚨📈 $USDT liquidity on #DEX pools decreased to almost ZERO, while $USDC liquidity almost doubled

This is a result of mass swapping of $USDC for $USDT

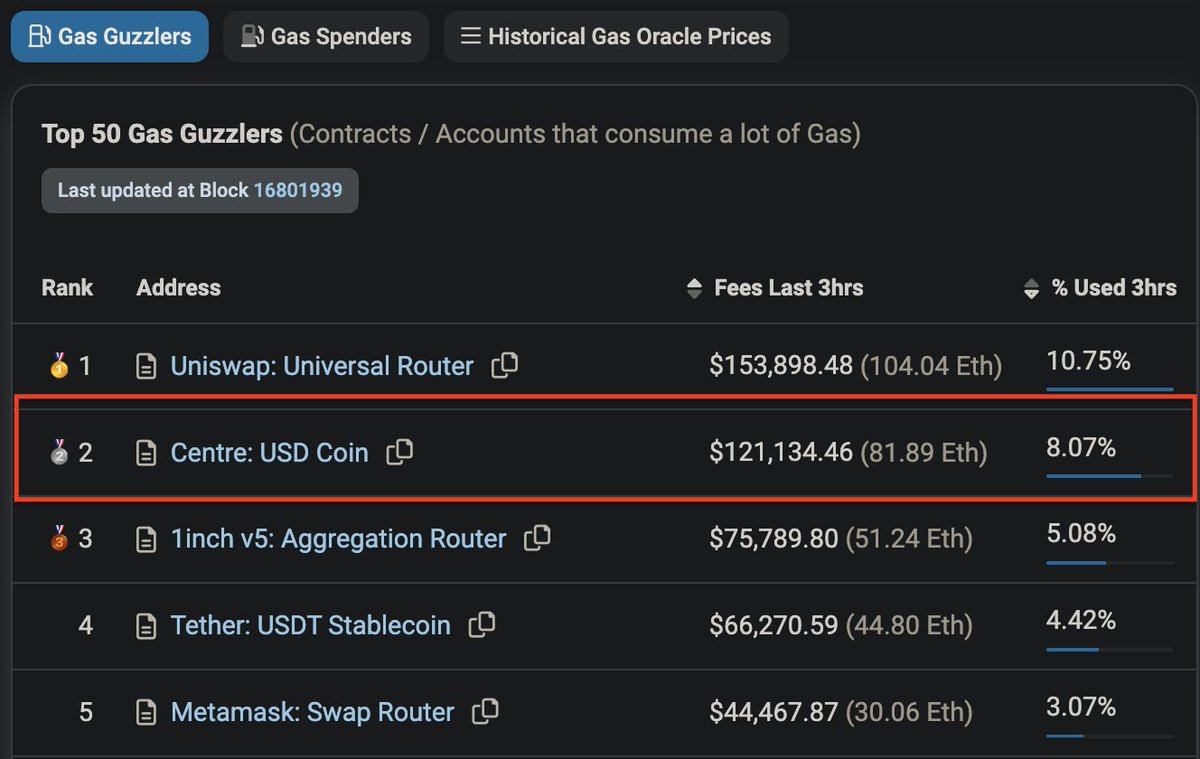

🚨📈 $USDC is the 2nd smart contract with the most gas usage on #Ethereum, second only to #Uniswap

$USDT is 4th, since massive swapping from $USDC to $USDT is taking across all pools in #DEX

Depegging of $USDC can lead to the collapse of other #stablecoins and #crypto prices

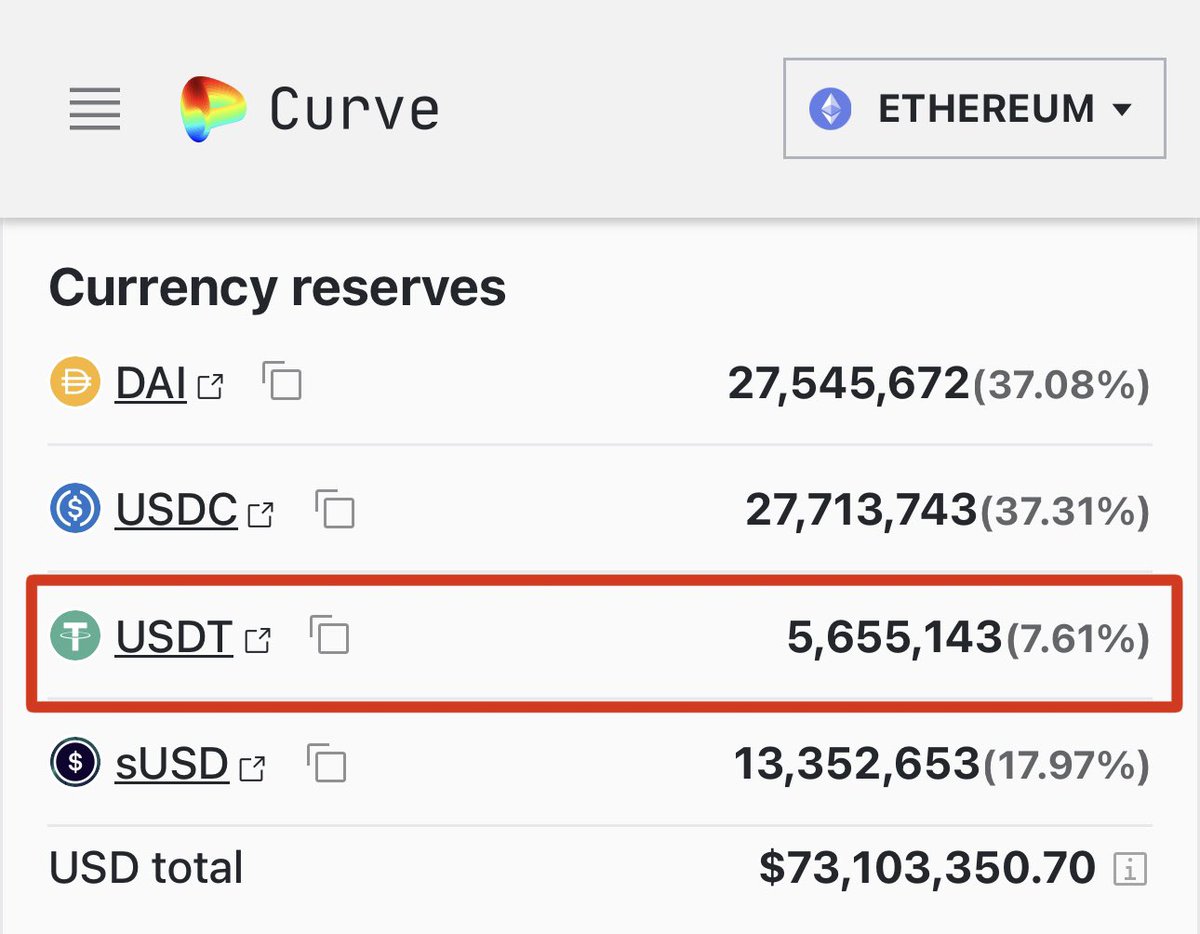

🚨📈 $USDT reserves are depleting across all #DEX pools that have $USDC.

It's not just the #3pool on #Curve, #SUSD pool is in the same situation.

This is a result of massive liquidation of $USDC, due to SVB's collapse.

The depegging seems to be more likely by the minute 😳

🚨📈 $USDT reserves at the $USDC / $USDT 0.01% pool on #Uniswap are depleted 😳

This indicates a massive $USDC liquidation.

A lot of news saying that $USDC is safe despite #SVB collapse, but the market seems be saying otherwise…

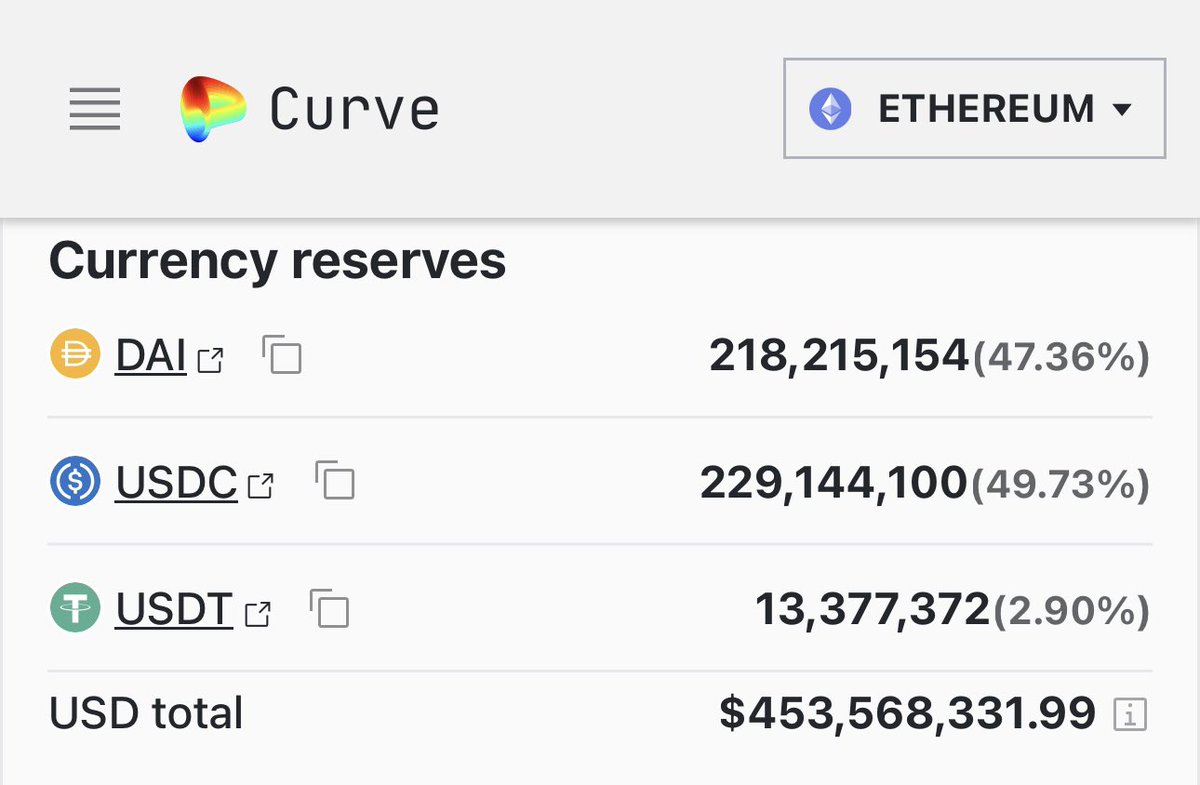

🚨📈 $USDT reserves at #Curve's #3pool dropped below 3%!!

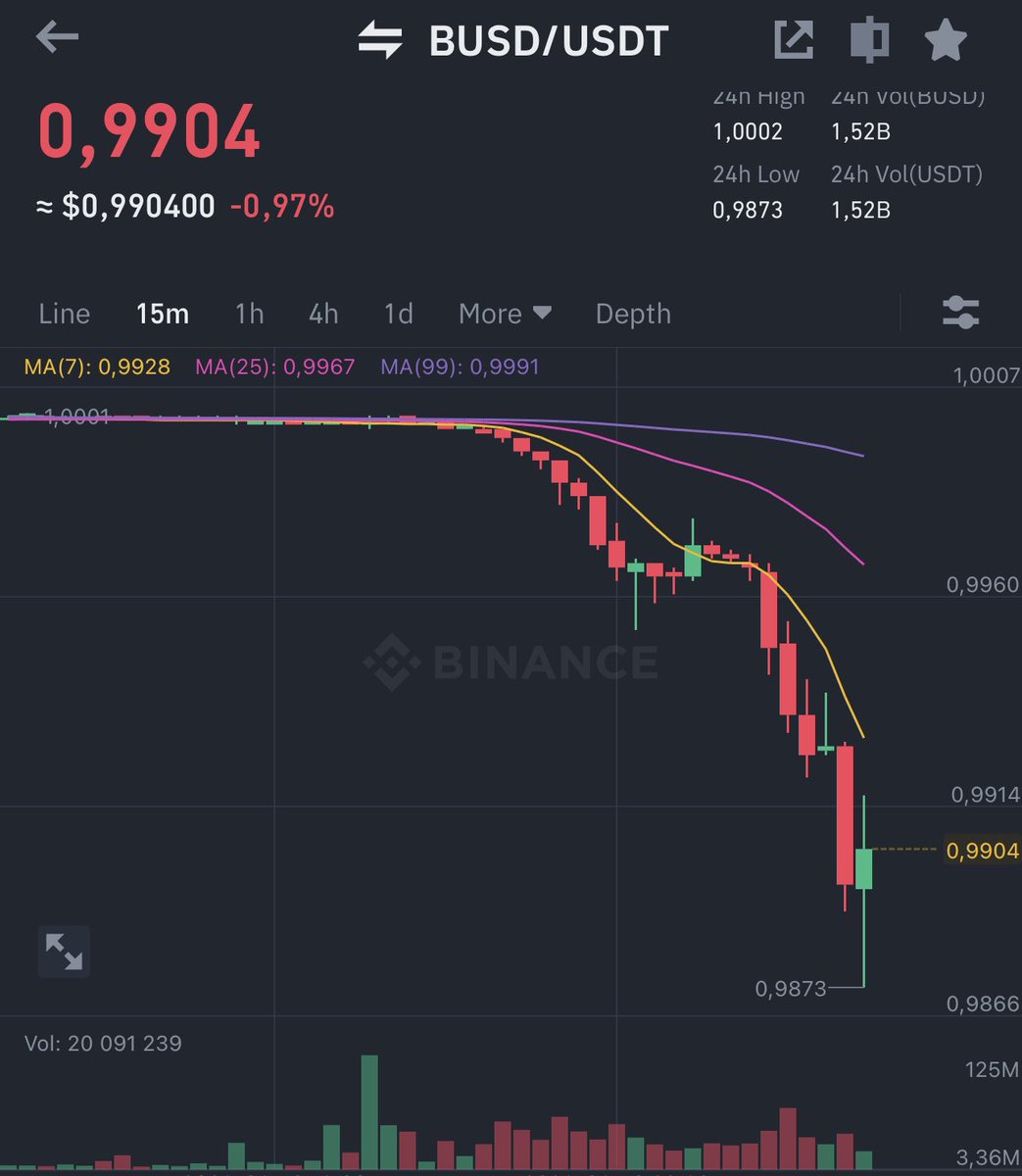

This is the reason why $BUSD is trading below $USDT at #Binance

It's caused by mass swap of $USDC to $USDT across the DEXes. Same happening on #Uniswap

🚨📈 Mass $USDC to $USDT swapping has caused $BUSD to fall below $USDT by more than 1%

As $USDT reserves across #DEX are depleting, it's also affecting #CEX like #Binance

This is a result of the collapse of the Silicon Valley Bank, where $USDC has reserves

🚨 $USDT reserves at #Curve are almost depleted, with less than 4% of it remaining in the #3pool

This is another sign of massive swapping of $USDC for $USDT, due to the collapse of #SVB

$USDC depegging is on the horizon!

🚨 $USDC trading below $USD and $USDT above $USD

Looks like everyone is swapping $USDC for $USDT because of #SVB collapse

Saying that Silvergate represents crypto is like saying that you represent the US Dollar, because you have them in your wallet.

Not a single DEX collapsed for the same reasons. DeFi is building the best financial system in history.

#bitcoin #crypto #defi #dex