Tariffs, trade policy & market impact

Updates on tariff announcements, trade negotiations and their effects on FX, commodities and risk assets.

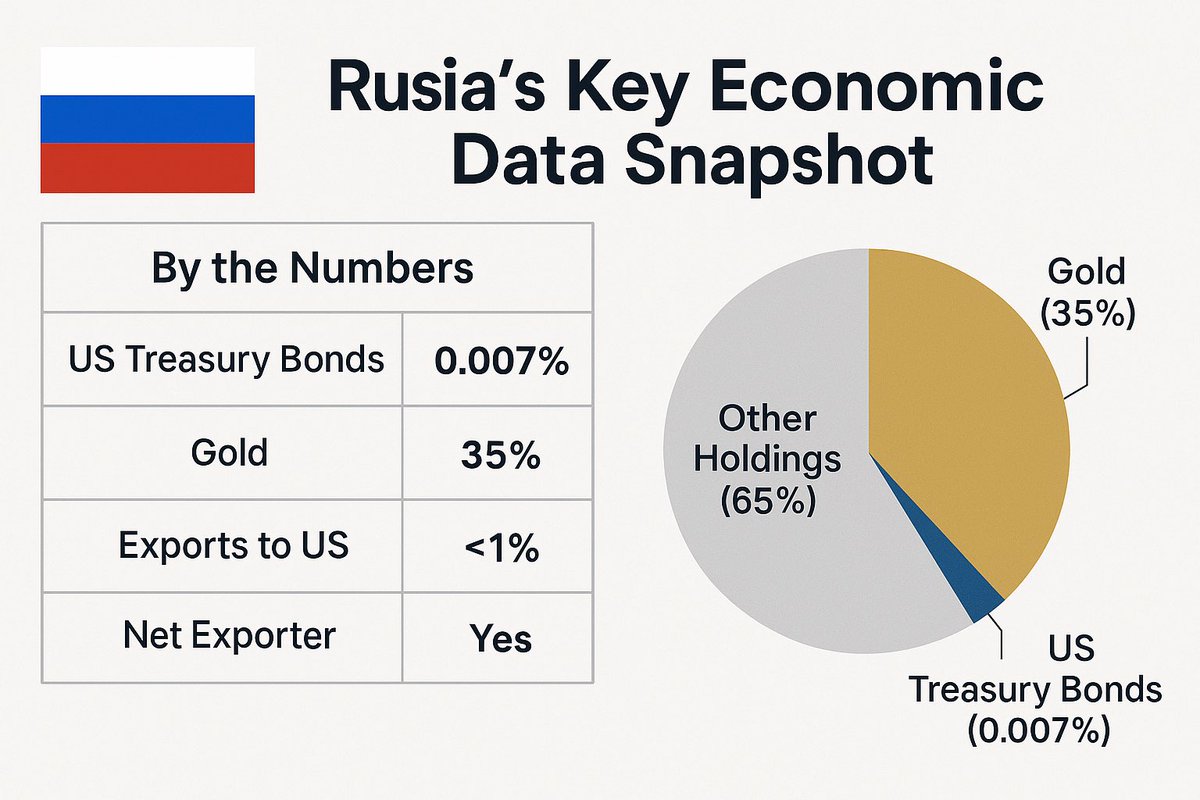

🇷🇺 Russia is immune to US tariffs

Russia's international reserves are as follows:

- 0.007% US Treasury bonds

- 35% Gold

Russia exports <1% to the US. Russia is a net exporter

This makes them protected from US sovereign risk (USD devaluation) & trade risk

Sure, if you:

Put tariffs

Lower interest rates

Remove tariffs

the maket will skyrocket

But that also means increased:

Asset bubble

Inflation

Public debt/deficit

Tariff income won't offset it

Monitor the hedge fund's shorts on risky assets, and when the

One of the core ideas behind the tariffs is to solve US's the trade deficit by incentivizing other countries to import from the US - I'm deriving this from the 'tariff' formula

So by importing more from US - you get lower/no tariffs

That won't work. Over the medium term the

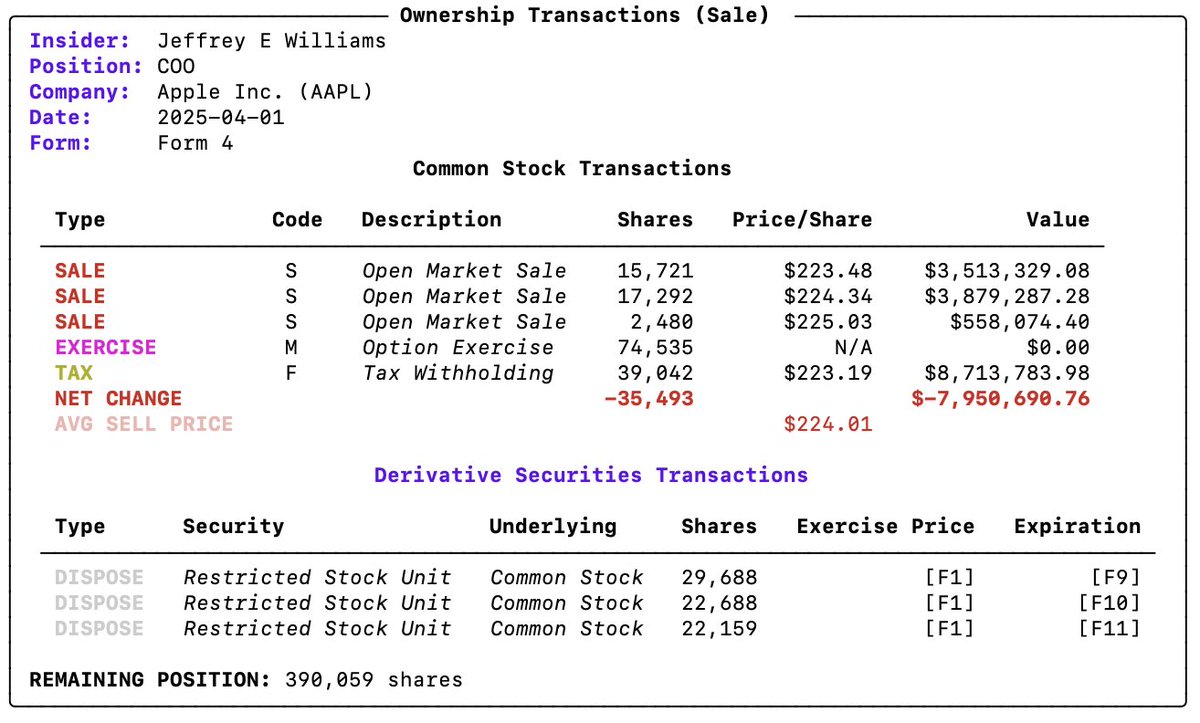

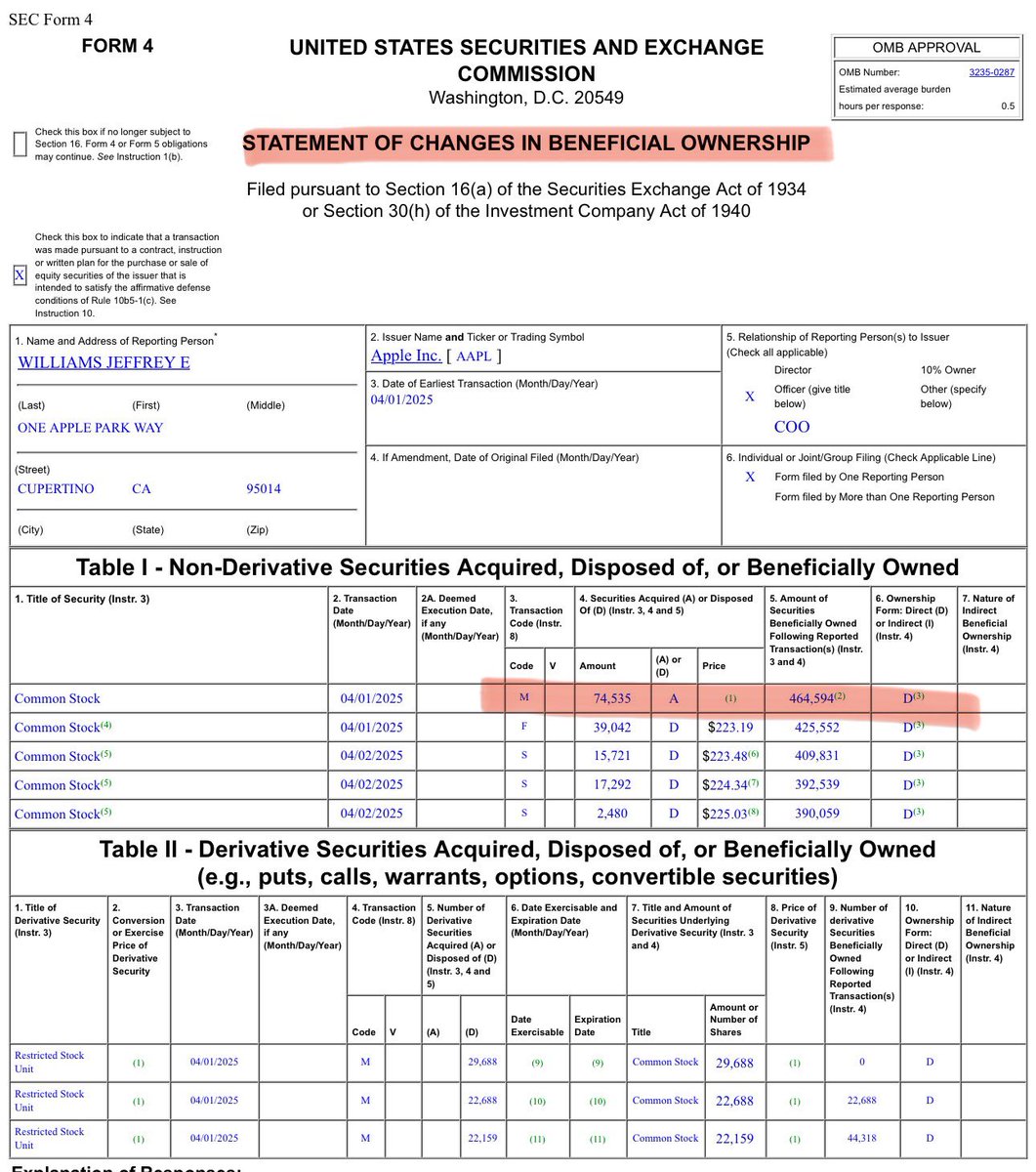

Do not browse insider trading SEC filings on EDGAR directly

There's a Python library called edgartools - much better, cleaner & you can directly extract the data

Now go find alpha factors that you can use next time worldwide tariffs are set

Insider Trading Before Tariffs

If you're curious about how insiders were buying/selling their equity positions, head over to @SECGov's EDGAR & check for Form 4 & 3 filings

Here's the latest one from $AAPL

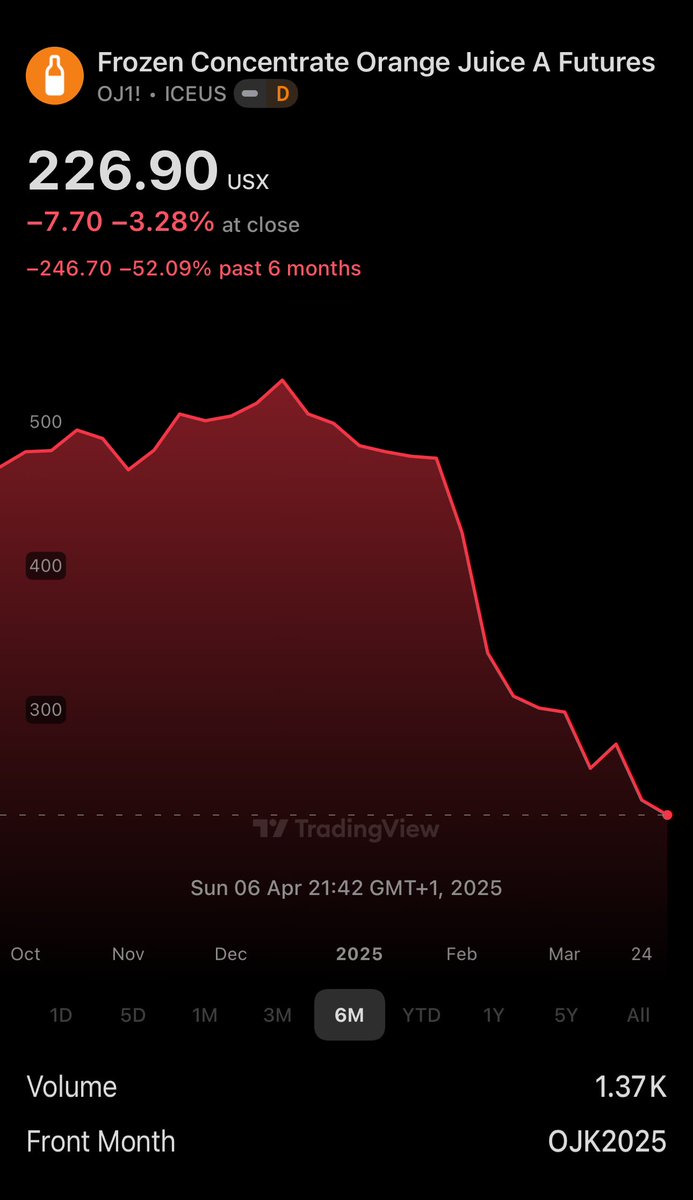

This tariffs-induced volatility is the dream of every trader

Clearing houses are banking from fees & comissions

Finally, risky-assets/DeFi/crypto volatility coming to your favorite regulated exchange

What's even the point of all the regulations in TradFi?

🇧🇷🇷🇺🇮🇳🇨🇳🇿🇦 BRICS & Tariffs

Amid the collective chaos there is a group of nations set to benefit from President Trump's tariffs

HINT: it's not the USA ❌🇺🇸

BRICS got geopolitical justification for their existence

Tariff-free zone + local currency trade acts as insurance http

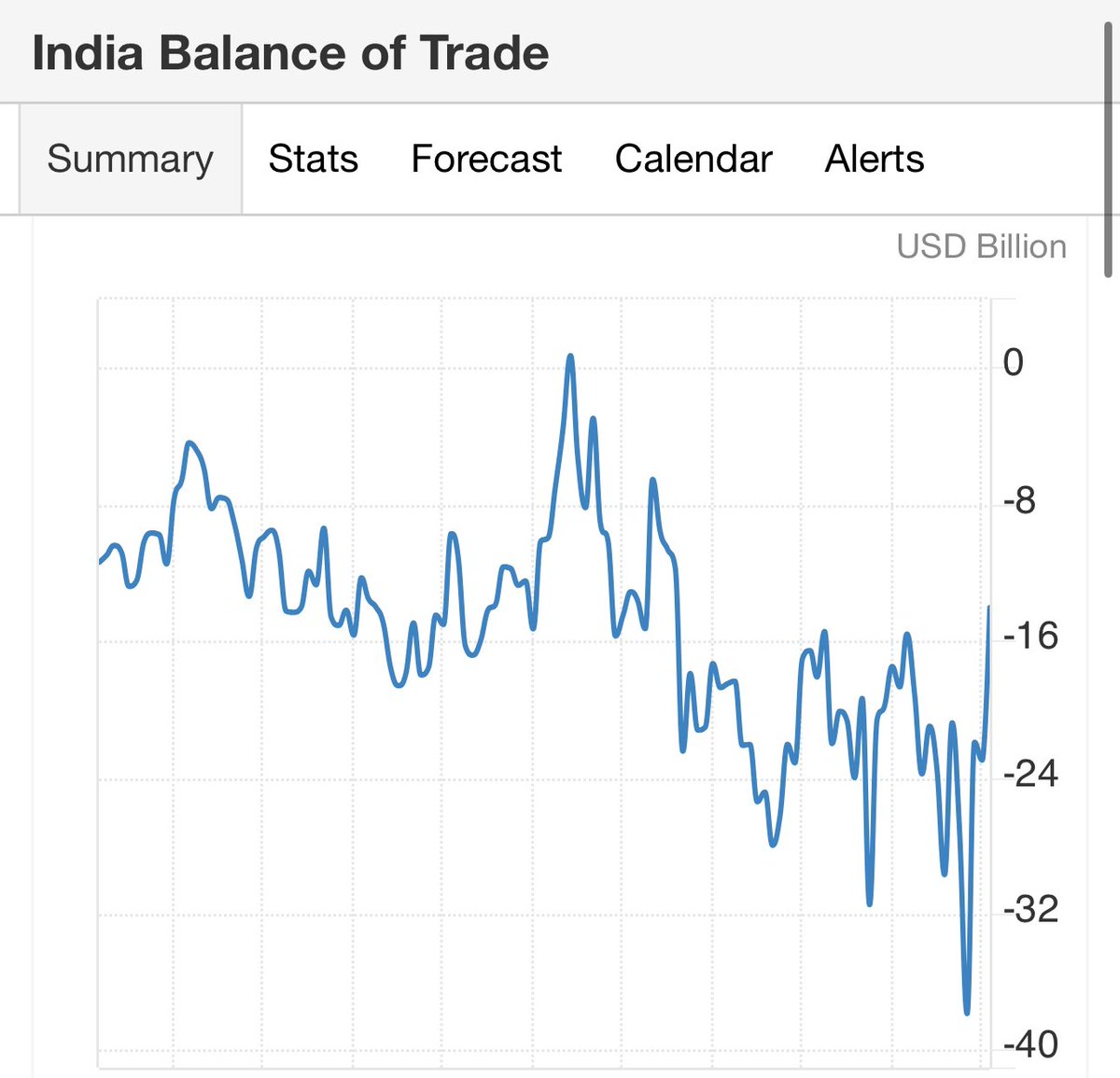

🇮🇳 India has accumulated a massive trade deficit

India imports from China, Russia & then exports to USA & UAE. The imports are also similar to exports & a lot of it is re-exports

This deficit isn't sustainable of course https://t.co

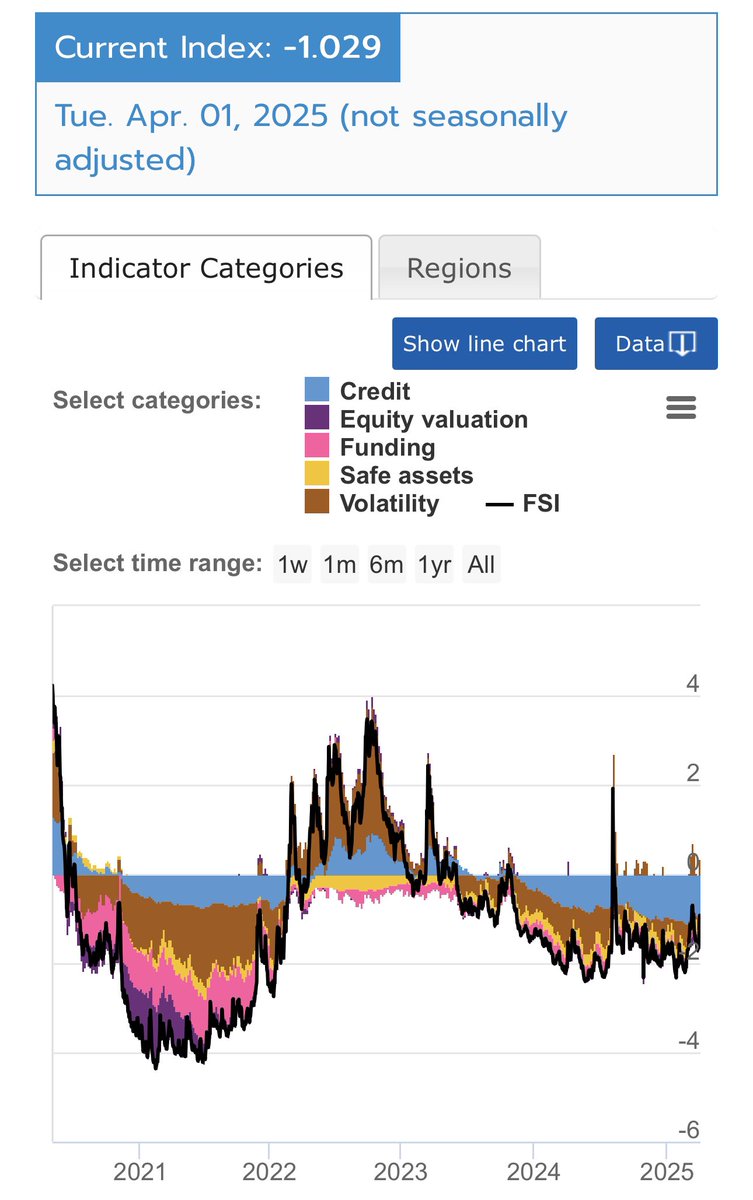

🚨 Financial Stress Index Tariffs Update

Trump/US tariffs so far:

⬇️ Equity valuation down

⬆️ Volatility up

⬆️ Safe assets up

⬆️ Credit spread up

📈 A perfect setup for the increase of OFR's Financial Stress Index

Let's see - it's updated with a 2 day delay

🤯 USD/EUR down 3 cents overnight

🇺🇸 An immediate response to Trump/USA import tariffs

This is Bitcoin-level volatility in FOREX

Volatility is a measure of risk. What does this mean for the US Dollar?

🚨 Bitcoin Reacts To US Tariffs:

As expected, a massive BTC sell-off post Trump's tariffs announcement

The price peaked during the speech, and then dumped down more than 6% so far + US dollar index is down

A move away from riskier assets & USD into Gold & foreign currencies https://

🚨 🇷🇺🇨🇳🇪🇺🇯🇵 reacting to US tariffs

The initial FOREX response to tariffs is a net outflow from #USD

US dollar fell against major currencies. The Euro fell against both the Chinese Yuan/renminbi & the Russian Ruble

Interesting, but expected having #RUB & #Yuan gain from this https://

🔴 $BTC, $DXY & $XAU during Trump's tariffs speech

Interesting to observe the negative correlation between Bitcoin & US Dollar Index

Gold wasn't clearly correlated with either. This makes sense - the tariffs lead to uncertainty regarding the reserve currency & central bank… https://t.co

🚨Trump's Tariffs Update - 🇨🇳, 🇯🇵, 🇰🇷

Not only tariffs are tanking the US economy, but their strongest partners are looking elsewhere

Unsurprisingly, Asia will find other buyers for their products - they have the upper hand, not 🇺🇸 or 🇪🇺 - a result of perpetual import deficits…

Bad news for #USD 👎

The value of a currency is a direct reflection of the organic demand for it. Sanctions will decrease the demand for US Dollar, via disincentives

Plus, it's the US consumer that will be paying for the tariffs, not the BRICS countries 🤷♀️