⬇️ My Thoughts ⬇️

ex: in the 1980's US fought high inflation by raising interest rates towards ≈20%

if the FED did that today - the global financial markets, alongside the US would be destroyed. there wouldn't be enough liquidity to refinance the debt

using historical behavior can be a great alpha - but you should probably focus on the patterns from this century

perpetually low ≈0% interest rates have been a norm only post ≈2009 (but the bubble started before)

so you want to look at the behavior in that environment

using historical behavior can be a great alpha - but you should probably focus on the patterns from this century

perpetually low ≈0% interest rates have been a norm only post ≈2009 (but the bubble started before)

so you want to look at the behavior in that environment

this is the general model, and think of these events as adding pressure towards the described outcome, rather than an axiom

there are other events than can steer the pressure towards a different outcome, and the final outcome is a combination of all 😄

this is the general model, and think of these events as adding pressure towards the described outcome, rather than an axiom

there are other events than can steer the pressure towards a different outcome, and the final outcome is a combination of all 😄

this new liquidity will reach financial markets first, before reaching the "real economy"

equity, cryptocurrencies all go up in prices. bubble further fueled. you know what (eventually) happens to all bubbles

Gold & Co. is a great hedge

this new liquidity will reach financial markets first, before reaching the "real economy"

equity, cryptocurrencies all go up in prices. bubble further fueled. you know what (eventually) happens to all bubbles

Gold & Co. is a great hedge

once FED lowers interest rates, it's likely to put downward pressure on yields - assuming term premia doesn't increase by more

in the end, the yields will be higher than in the last 20 years, for the same FED funds rate

QE/liquidity injections will further devalue USD

liquidity abundance leads to the narrowing of spread between riskier and safe assets (mostly government bonds)

safe assets fall in price, with their yields increasing towards the riskier ones

US bond yields are high under tighter monetary conditions - liquidity is pro cyclical

the higher use of lower quality collateral has pro-cyclical effects

if the price of collateral falls during economic downturn - you'll get a lot of margin calls & insolvencies. this will further put pressure on short-term funding mechanisms, which already lack HQ collateral

the 14 year old dormant bitcoin wallet transactions are likely OTC operations

if you want to buy/sell >$1B worth of bitcoin, you're not going to do it through coinbase 😄

i've encountered numerous alternative explanations - some very creative

🪒 remember: occam's razor

the higher use of lower quality collateral has pro-cyclical effects

if the price of collateral falls during economic downturn - you'll get a lot of margin calls & insolvencies. this will further put pressure on short-term funding mechanisms, which already lack HQ collateral

US Treasuries are by far the most popular collateral type in secured short-term funding markets (e.g. the repo market)

outstanding volume of these markets is larger than M2

notice the increase in usage of less safe assets as a collateral

not enough UST for its demand ⬇️

📡 quoted thoughts are neatly rendered

visually it's like the quote block that you find in e-mail

🏞️ quoted post images are also rendered

and you can click on the hyperlink which will take you directly to the quoted thought

RSS is indeed a useful standard 😄

📡🌇 images are also included in the RSS feed

so if a thought/post has an attached image - it will also be displayed in the RSS entry

the image is included in 2 different ways - so should be compatible with your favorite RSS reader

here's how it looks like ⬇️

📡 so if you open the though's feed in an RSS reader you can see all the posts

without a need for centralized services. the RSS can be served via various mediums

everything is static so very SEO/LLM friendly

+ as a bonus you'll probably have integrated search as well 😄

🚀📡 added an RSS feed to my thoughts

so now you can follow the RSS feed, instead of reading the content from X or HTML webpage. any RSS reader should work

implemented statically generated RSS feed of all the content posted under the microblogging platform

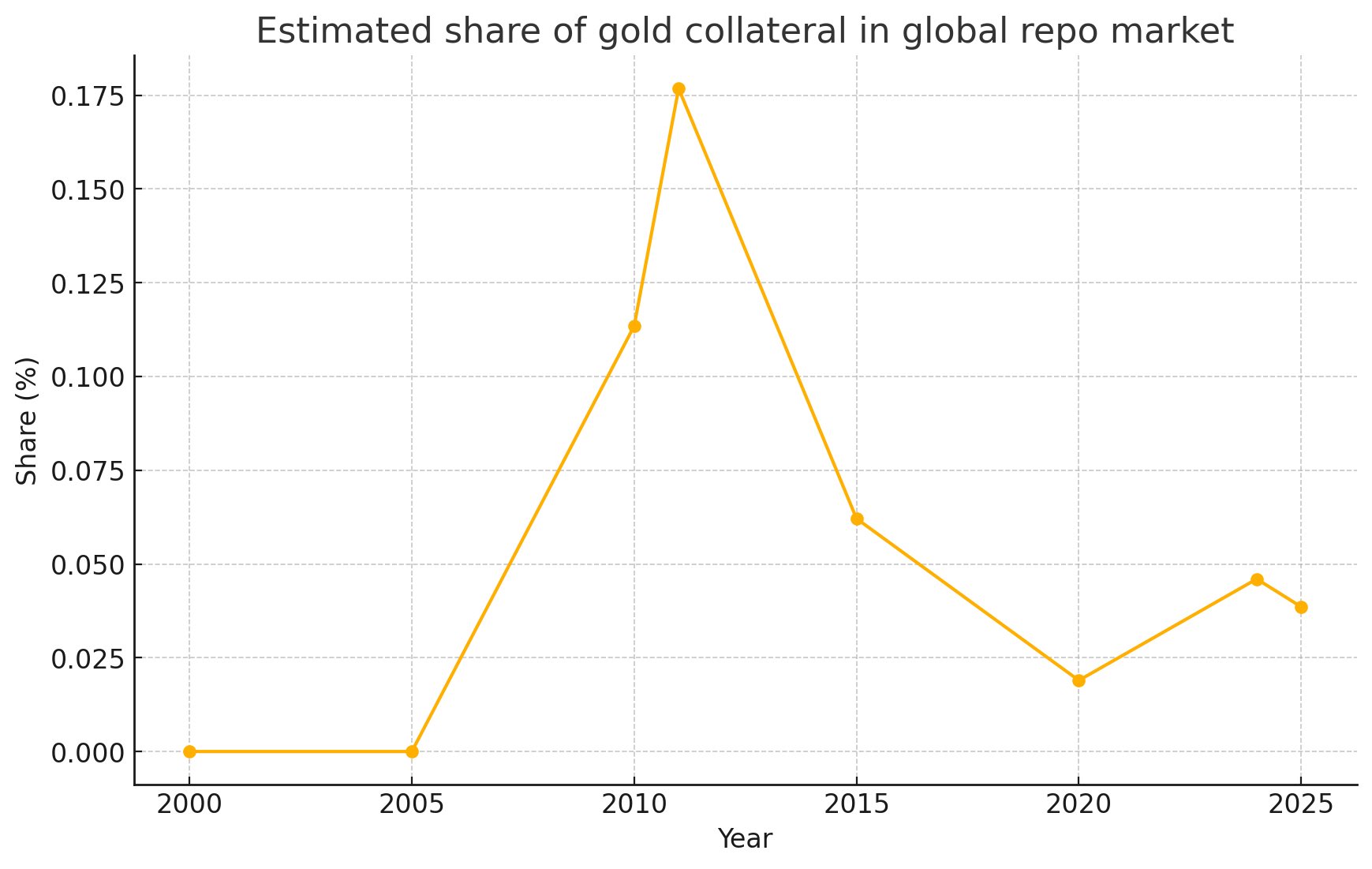

gold did exactly this during the 2008 GFC

its share in collateral usage in global repo markets increased

and in 2025 we're seeing the same trend, with gold share in repo market collateral increasing

as more markets develop over gold - so will its usage as collateral in short-term/repo credit markets

it will likely become a more frequent choice for collateral/hedge during the multipolar transition. specially if bond yields continue to exhibit increased volatility

as more markets develop over gold - so will its usage as collateral in short-term/repo credit markets

it will likely become a more frequent choice for collateral/hedge during the multipolar transition. specially if bond yields continue to exhibit increased volatility

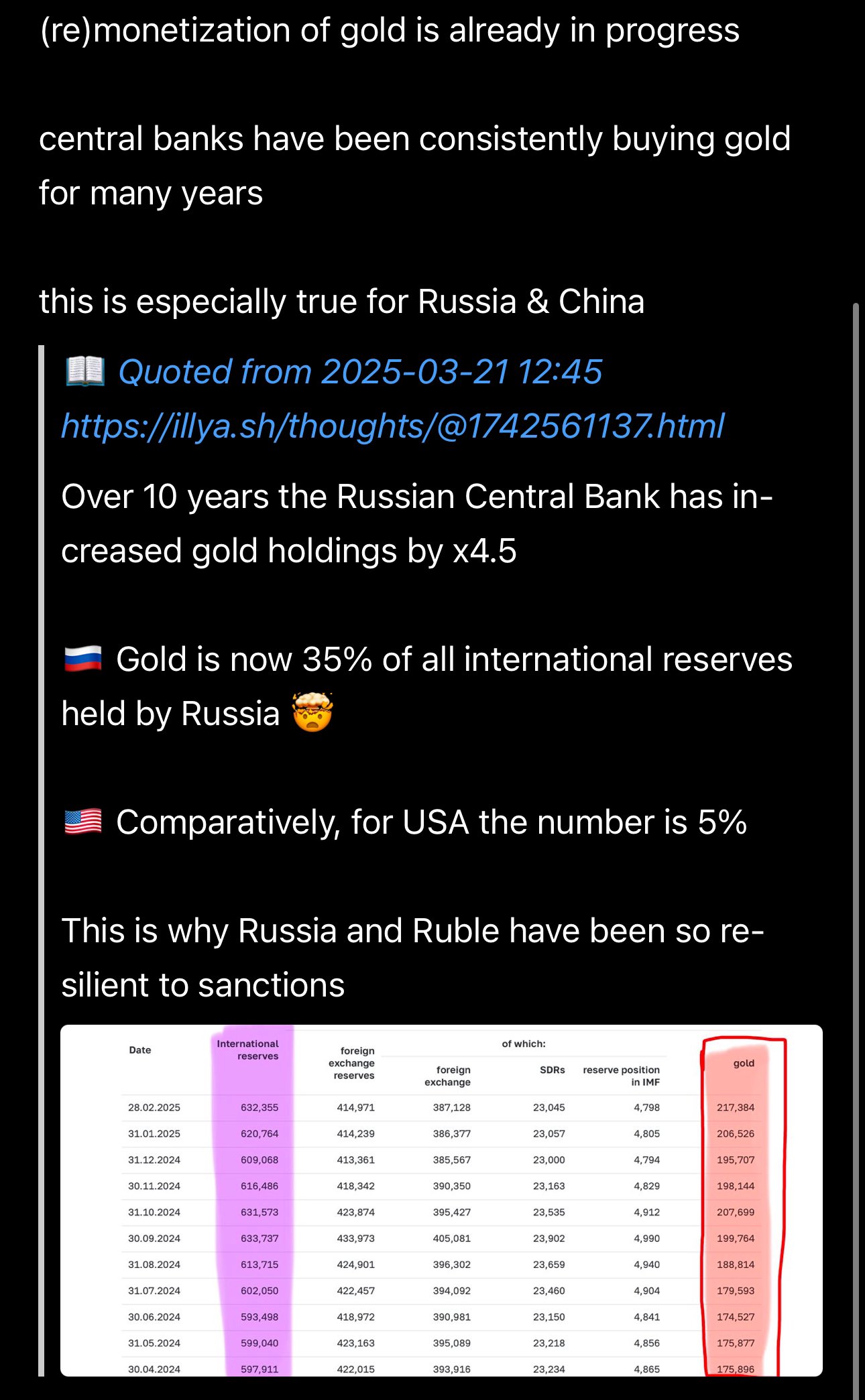

(re)monetization of gold is already in progress

central banks have been consistently buying gold for many years

this is especially true for Russia & China

(re)monetization of gold is already in progress

central banks have been consistently buying gold for many years

this is especially true for Russia & China

transition into multipolarity brings risks & volatility into financial markets

some FX currencies & bonds go up - others down

the demand for safe assets is not going away anywhere

the debt still needs to be refinanced 🤷♀️

now you might think that gold would be a perfect collateral for repos, but currently:

it's too volatile - price may drop > 10% on systemic risks

there is no lender of last resort (you can't print gold or have swap lines for it 😀)

most of debt is issued for re-financing of existing debt, not for new debt

repo markets are the backbone of that. and since they're collateralized loans - there is a huge demand for collateral/safe assets

most of debt is issued for re-financing of existing debt, not for new debt

repo markets are the backbone of that. and since they're collateralized loans - there is a huge demand for collateral/safe assets

remember those HUGE repo markets that I talked about?

US bonds/treasuries are the favorite collateral for those transactions

and that's why they're not going away anytime soon

but of course, the financial system is slowly diversifying

repo markets are HUGE - about the size of USD M2!

they underpin the global financial system

however, there's not many DeFi protocols addressing this part of the market

i may pick it up in the near future

if you're working on something similar - hit me up!

overall blockchain DeFi lacks development for short-term lending markets

short-term market volumes are larger than M2 & Co.

yes, you can lend on AAVE, but rates vary greatly

repo markets are HUGE - about the size of USD M2!

they underpin the global financial system

however, there's not many DeFi protocols addressing this part of the market

i may pick it up in the near future

if you're working on something similar - hit me up!

repo markets are HUGE - about the size of USD M2!

they underpin the global financial system

however, there's not many DeFi protocols addressing this part of the market

i may pick it up in the near future

if you're working on something similar - hit me up!

in the end, you get your UST bond back

and it makes sense for you to repurchase the bond (collateral) even if the price falls

as long as the price fall is < ≈haircut (2% in our case)

in the end, you get your UST bond back

and it makes sense for you to repurchase the bond (collateral) even if the price falls

as long as the price fall is < ≈haircut (2% in our case)

so if you have a UST bond worth $100:

lender applies a haircut (e.g. 2%) - 100*(1-0.02)=$98

lender sets a repurchase price (e.g. $98.013)

so you use your $100 bond to get a $98 loan, for which you must repay with a fee (interest) $98.013

so if you have a UST bond worth $100:

lender applies a haircut (e.g. 2%) - 100*(1-0.02)=$98

lender sets a repurchase price (e.g. $98.013)

so you use your $100 bond to get a $98 loan, for which you must repay with a fee (interest) $98.013

repurchase agreements are almost always over-collateralized

the borrower undervalues the collateral by a percentage (haircut) - this is a buffer against price volatility

the purchase and repurchase price are computed over the post-haircut value

repurchase agreements are almost always over-collateralized

the borrower undervalues the collateral by a percentage (haircut) - this is a buffer against price volatility

the purchase and repurchase price are computed over the post-haircut value