⬇️ My Thoughts ⬇️

♾️ The recursive nature of zkSNARKs & zkSTARKs enables INFINITE SCALABILITY

🌿 Imagine compressing 1000s of computations into a SINGLE proof

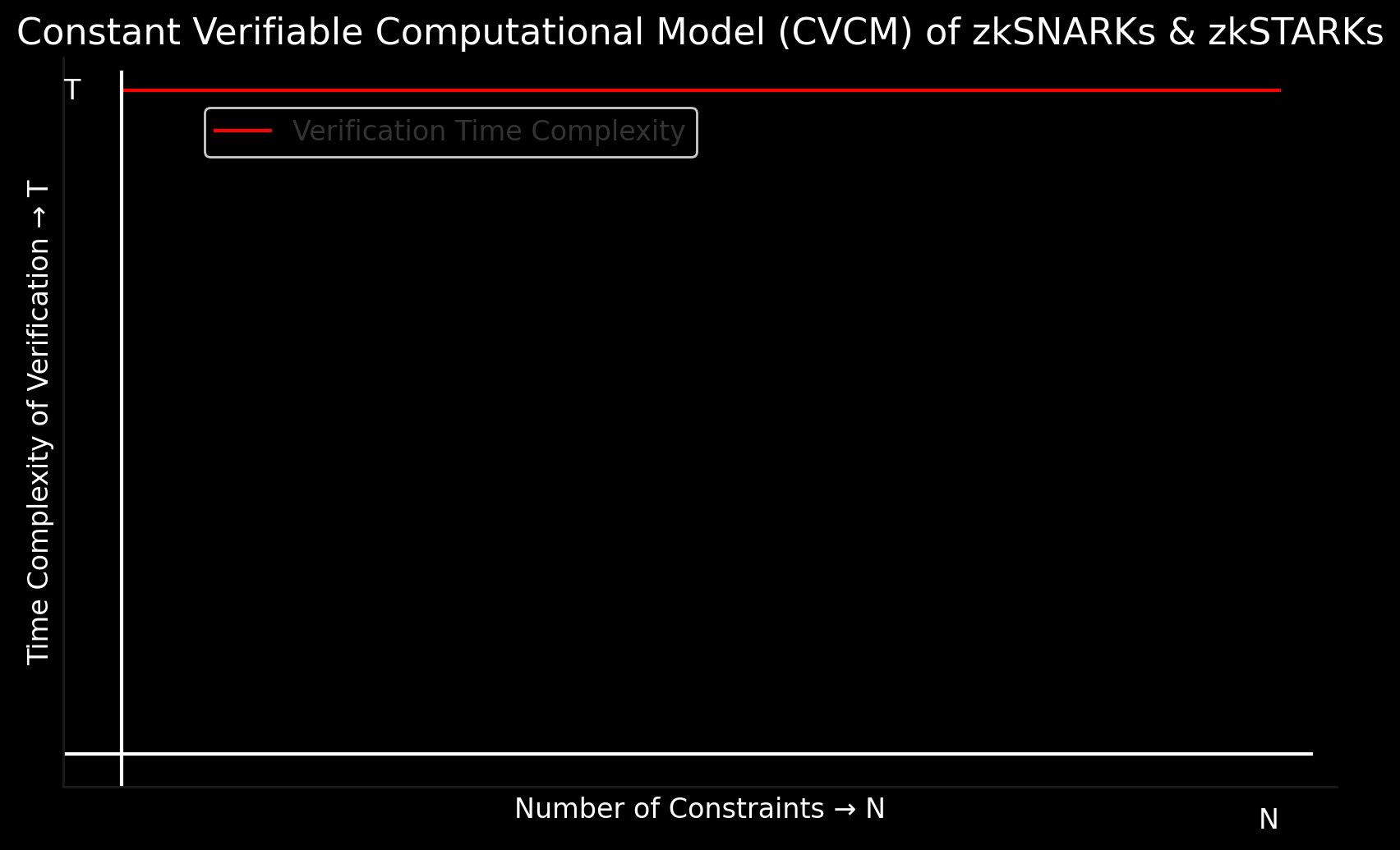

⏰ Verification time remains ~CONSTANT

💰 Gas costs are DRASTICALLY reduced

🔥 This is the power of ZKP! 🔥

Mina Protocol blockchain aces it 💪

🤯 The implications are MASSIVE!

🧪 Mina Protocol blockchain and it's native token $MINA operate on this architecture

📍zkLocus leverages this technology to turn geolocation into a RWA, by enabling private, verifiable and programmable geolocation sharing

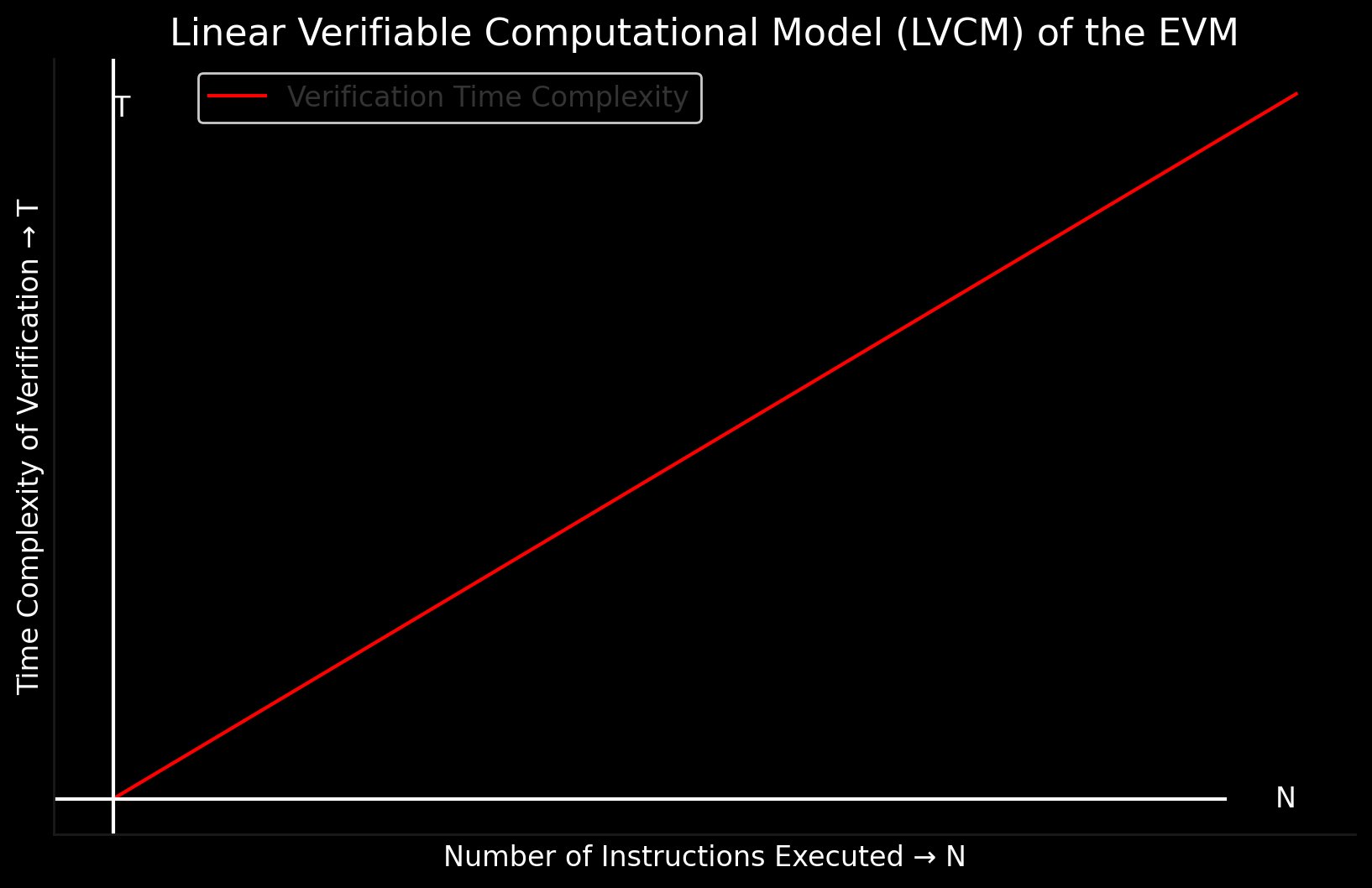

🚀 zkSNARKs & zkSTARKs offer a Constant Verifiable Computational Model (CVCM)

⚡ Verification time is CONSTANT - O(1), regardless of computation complexity

💡 Contrast this with the EVM's Linear VCM (LVCM), where verification grows LINEARLY with instructions - O(n)

🤔 What makes a computation VERIFIABLE?

✅ In zkSNARKs & zkSTARKs, provers generate proofs of computations, while verifiers check their correctness

🔒 This model supports PRIVATE inputs, unlike the EVM

🌍 It's not limited to blockchain - zkLocus showcases off-chain use cases

🤔 What makes a computation VERIFIABLE?

✅ In zkSNARKs & zkSTARKs, provers generate proofs of computations, while verifiers check their correctness

🔒 This model supports PRIVATE inputs, unlike the EVM

🌍 It's not limited to blockchain - zkLocus showcases off-chain use cases

zkSNARKs & zkSTARKs: Disrupting Verifiable Computation

Explore how these #ZeroKnowledge protocols SURPASS the #EVM's model, opening a world of possibilities for #Web3 applications

Deep dive ARTICLE

Let's unravel the key insights

zkSNARKs & zkSTARKs: Disrupting Verifiable Computation

Explore how these #ZeroKnowledge protocols SURPASS the #EVM's model, opening a world of possibilities for #Web3 applications

Deep dive ARTICLE

Let's unravel the key insights

Great idea! A use-case leveraging one of the unique value-propositions of the verifiable computational model offered by Zero-Knowledge Proofs and recursive zkSNARKs

It's easy to blame it on the devs or the ecosystem. A fair assessment compares solutions within the ecosystem. Good, innovate and disruptive solutions? Likely a dev issue. If not - the ecosystem. Remember to take the critical mass into consideration

Individuality isn't about opposing the majority. It's about thinking for yourself

In product, it's not about doing something or avoiding something. It's about doing what increases value, and not doing what diminishes value

Very interesting to see the #BitcoinEFT used as a liquidity exit

And only a few days ago the supply APY on most FIAT stable coins was over 20% on #AAVE You could mistake this for a bullish sign, in an apparent short of FIAT for #crypto

Always analyze the big picture

A good software engineer follows the best practices. A great software engineer follows the best practices which are compatible with the goal, the mission, and the vision. In practice this makes suboptimal architecture acceptable in exchange for flexibility.

The point of software is to be able to iterate fast. 100% of software can be replaced with hardware, but nobody wants to hardcode circuits (except for the #ZK crowd 😄). Iteration is its value proposition

This is why software products that take years to deliver don't make sense

A little trip into circular dependencies in TypeScript will make you appreciate Python's local imports even more

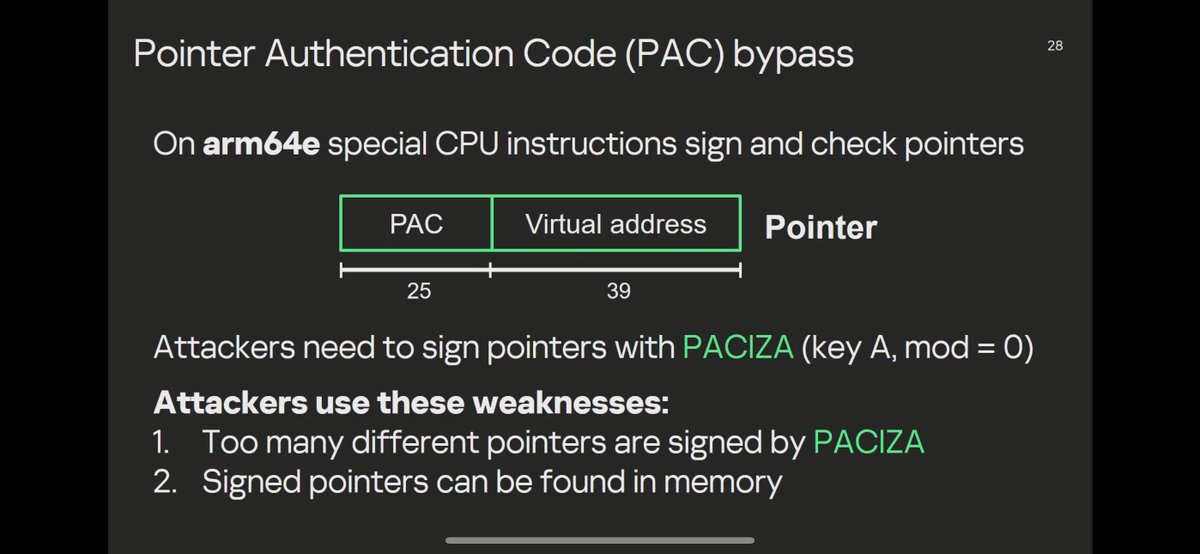

Just to re-iterate on this further: the iPhone's 0-click exploit broke the ARM processor's authentication mechanism for pointers, thus allowing the malware to perform arbitrary signatures of arbitrary pointers, thus breaking their authentication & integrity guarantees http

A small insight into the meticulous care that is necessary in designing #DeFi tokens with sound economic value principles ⬇️

🟢 The first battery of tests has just been launched!

🔵 Authenticated metadata commitments are coming too. This will allow for a cryptographic association between metadata and the geolocation

🟣 Such features are infeasible without the recursive zkSNARK architecture of $MINA

#DeFi only makes sense with private data. This is infeasible on Ethereum, but trivial on $MINA.

Zero-Knowledge will lead to mass adoption of #DeFi, enabling its Cambrian explosion.

Of course, you can also bridge $MINA to Ethereum. This is by design.

Big things are coming.

The negative connotation associated with 'weirdness' is a product of insecurity and fragile ego.

Always remember: your ego can be trained and developed through deliberate mental and physical effort.

I'm not fanboying. Once you think deeply about it will all make sense

#ZKP #Web3

If you only understood how cheap gold is now. To put it in perspective, its current FIAT price only reflects inflation prior to 2011 🤯

Any direct or indirect inflation following that time period has not yet been accounted for

You don't have to trust me. Trust the price action

🤯 Zero-Knowledge cryptography is how the blockchain will connect to the outside world. As the ZK field matures, so will the blockchain use cases. Two computation models that were meant for each other.

#zk #blockchain #evm #crypto #mina #Bitcoin #smartcontracts

Unlock the secret to predicting any asset's price! The 30-day federal funds rate futures contract on the Chicago Mercantile Exchange is the key. Learn how to use this unique indicator for profitable trading in this video. #Trading #Investing #Cryptocurrency #Futures