⬇️ My Thoughts ⬇️

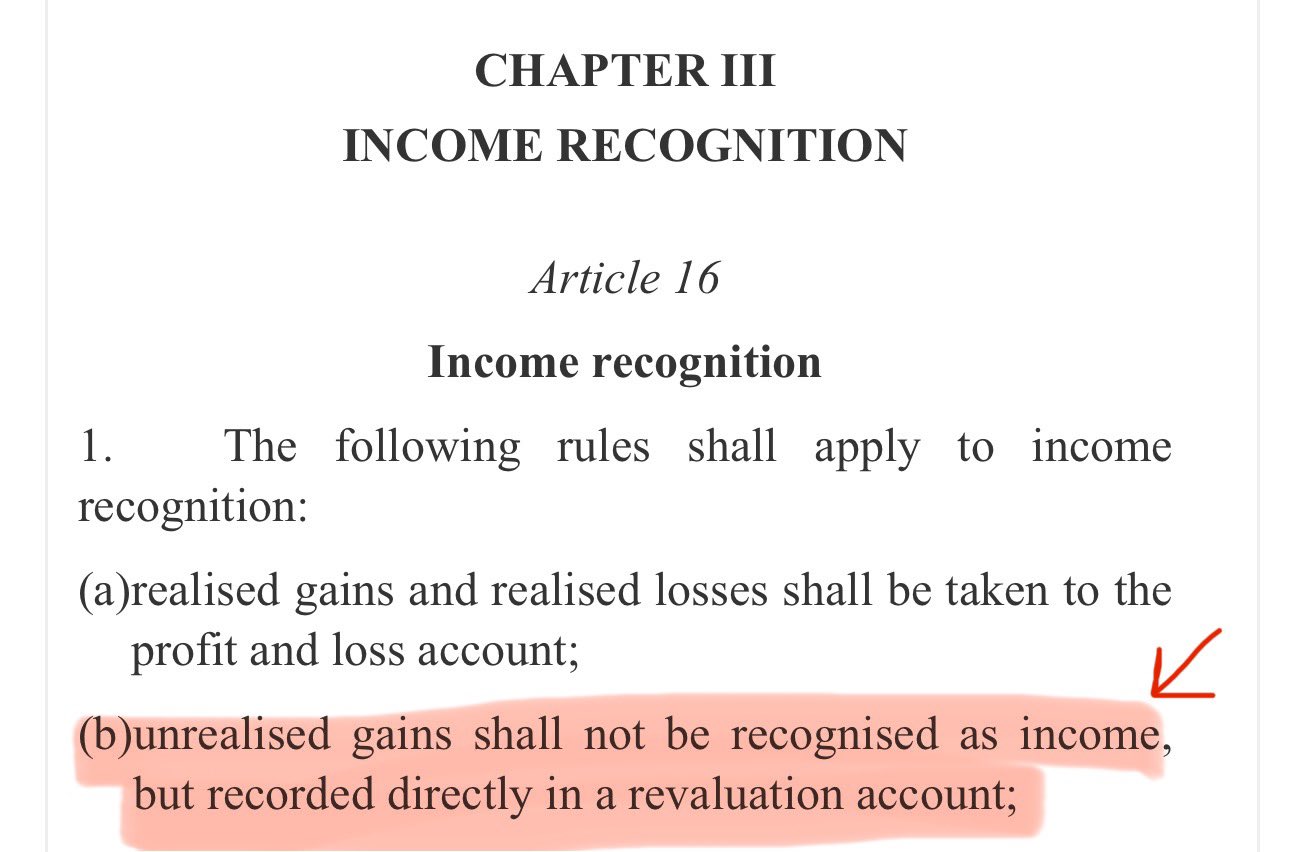

ECB's legal framework forbids the use of gold revaluation proceeds to pay expenses or operating losses

unrealized gains are not recognized as income and are instead credited to the revaluation account

revaluation account is under liability/equity on the ECB's balance sheet

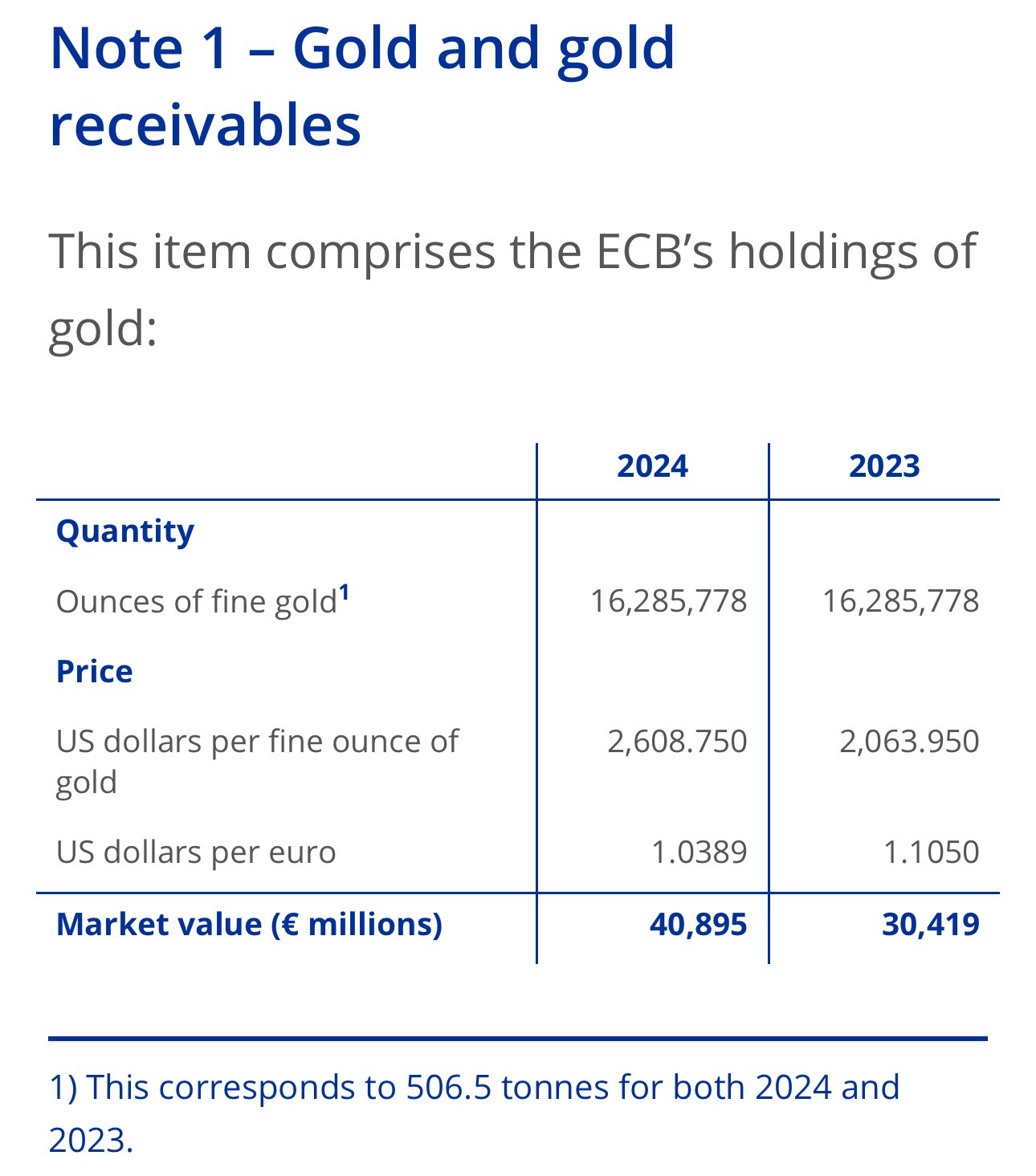

to clarify: European Central Bank didn't increase its gold holdings, but the gold that ECB already owns (≈506 tonnes) increased in value, since gold's market price increased

ECB reevaluates gold at the end of every year and credits or debits the revelation account accordingly

🇪🇺 ECB gained €10.5B on gold from 2023 to 2024

2025 YTD running gains add another net positive ≈€10B & likely to be higher by the year end's gold revaluation

that's an implied ≈8% yield on gold appreciation - much more than the ECB earned from other asset buckets

leverage and the carry trades eventually unwind

at some point there isn't enough on-demand liquidity and mass defaults, losses and insolvency occur

this is when the cycle tops/bubble pops

the financial system is heavily dependent on refinancing

this is true for both, governments and the public sector - especially the financial institutions

≈70% of all new credit is used for refinancing/repaying of existing maturing debt rather than novel financing

the financial system is heavily dependent on refinancing

this is true for both, governments and the public sector - especially the financial institutions

≈70% of all new credit is used for refinancing/repaying of existing maturing debt rather than novel financing

in addition to being a store of value, gold is also acting as an investment

it's up ≈40% YTD

this is gold catching up to inflation and accumulated leverage

in addition to being a store of value, gold is also acting as an investment

it's up ≈40% YTD

this is gold catching up to inflation and accumulated leverage

the financial system infrastructure, including monetary policies of the central banks are correlated

they're heavily exposed to the same set of assets - a lot of which are USD-denominated

this is of course extremely pro-cyclical

the financial system infrastructure, including monetary policies of the central banks are correlated

they're heavily exposed to the same set of assets - a lot of which are USD-denominated

this is of course extremely pro-cyclical

gold is a great asset to hold for the next 5 years

it's a hedge against the credit & refinancing bubble of the US equity markets + government debt

but not only against USD - all FIAT & risk assets including crypto

gold is a great asset to hold for the next 5 years

it's a hedge against the credit & refinancing bubble of the US equity markets + government debt

but not only against USD - all FIAT & risk assets including crypto

since i've written this, gold is up ≈16%

≈25% if you count from the tariffs announcements on April 7th

i will re-iterate that in order to protect the EUR the ECB should increase their onshore gold holdings

🇪🇺 The best countermeasure that EU can take is swapping US securities for Gold

Gold is inversely correlated with USD. Such a decision can be done today and it will:

1️⃣be a response to the US

2️⃣increase value of EUR

3️⃣minimize consumer impact

Anything else will hurt the economy

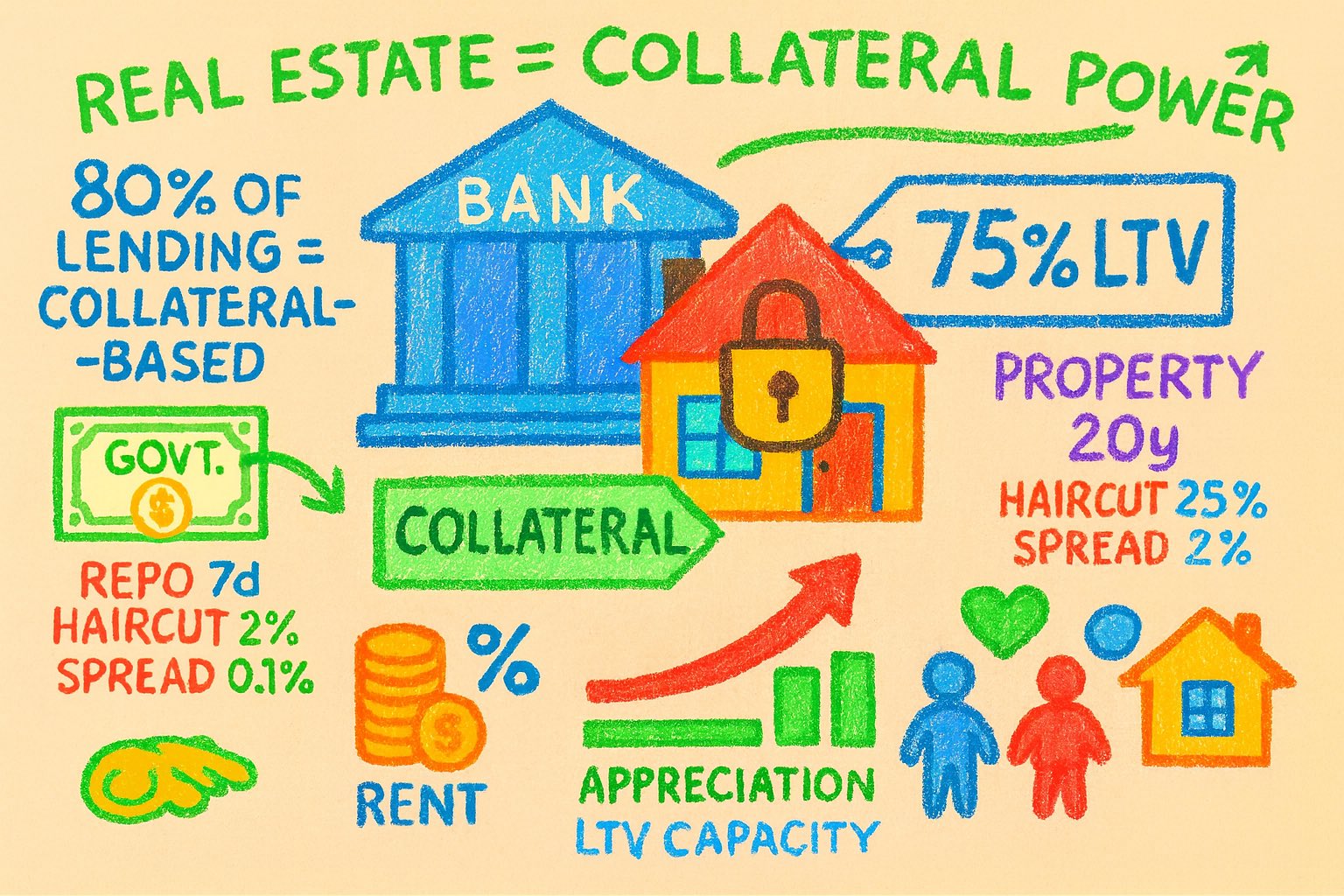

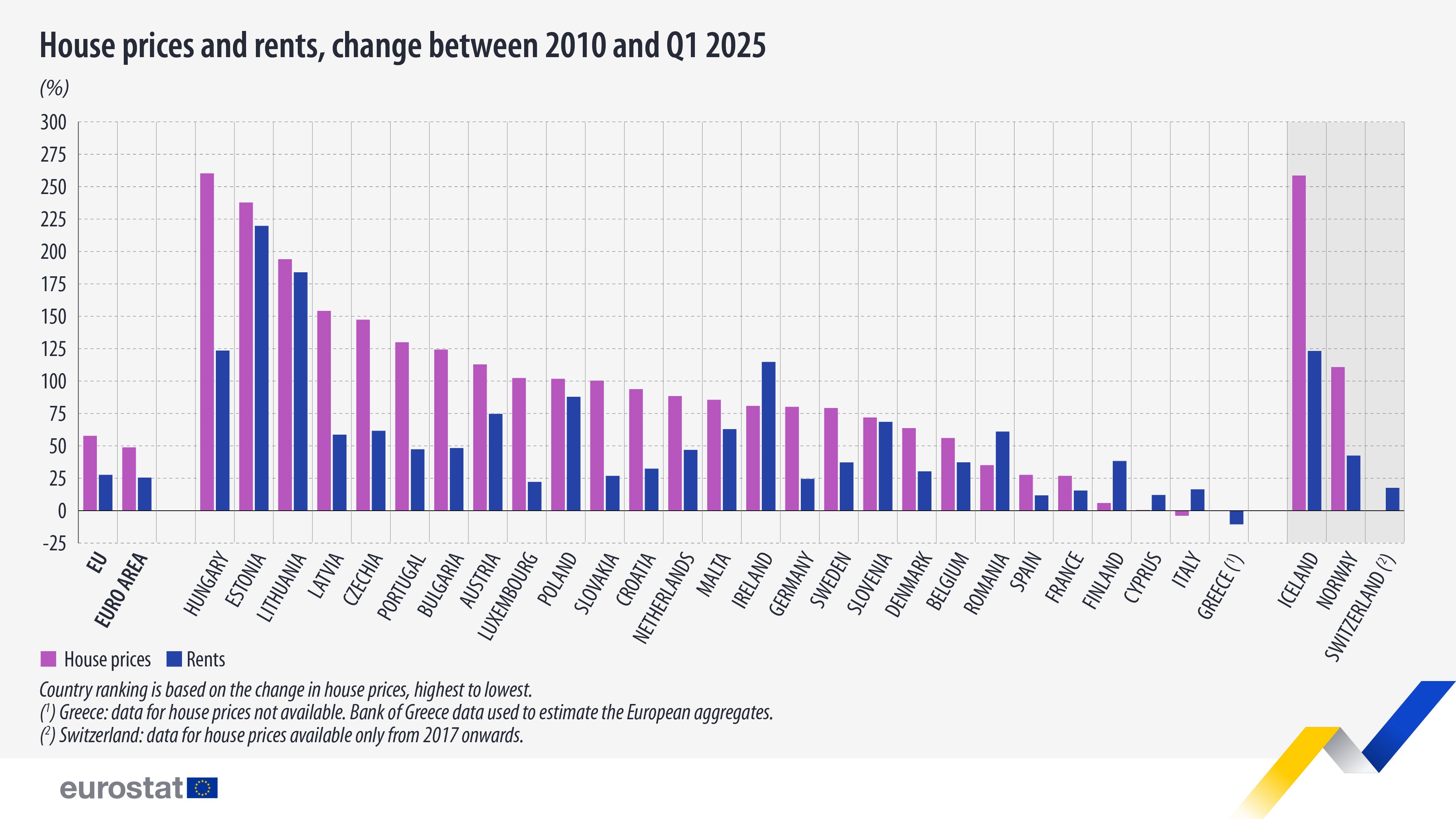

this makes immovable property a good hedge against inflation and economic downturn

price adjusts to value & while the composition of demand may change (e.g. shift towards smaller/cheaper units) - the demand for property will inherently remain high

given that housing is a core necessity for most combined with the willingness of banks to finance against immovable property creates a high persistent demand for real estate

given that housing is a core necessity for most combined with the willingness of banks to finance against immovable property creates a high persistent demand for real estate

as the immovable property appreciates, so do your assets and financing capacity. with a more valuable collateral asset - the bank will give a larger loan

increasing real estate purchase prices push rent prices up as well. so may increased interest rates, since it's harder to buy

as the immovable property appreciates, so do your assets and financing capacity. with a more valuable collateral asset - the bank will give a larger loan

increasing real estate purchase prices push rent prices up as well. so may increased interest rates, since it's harder to buy

so by using real estate as collateral you're just tapping into the existing low interest liquidity/credit line

at the same time the property earns a yield (e.g. via rents) and generally appreciates

so by using real estate as collateral you're just tapping into the existing low interest liquidity/credit line

at the same time the property earns a yield (e.g. via rents) and generally appreciates

this is why a 7 day Treasury bill-backed repo agreement may have 2% haircut and a 0.1% spread, while a 20 year immovable property collateralized loan a 25% haircut and a 2% spread

the T-bill is more liquid, less volatile and the loan term is much shorter

this is why a 7 day Treasury bill-backed repo agreement may have 2% haircut and a 0.1% spread, while a 20 year immovable property collateralized loan a 25% haircut and a 2% spread

the T-bill is more liquid, less volatile and the loan term is much shorter

collateralized lending comes with smaller interest rates/financing cost because it's low risk for the lender

if you default - the lender keeps your collateral

haircuts and spread are set sufficiently high to cover liquidity, term and market risks

collateralized lending comes with smaller interest rates/financing cost because it's low risk for the lender

if you default - the lender keeps your collateral

haircuts and spread are set sufficiently high to cover liquidity, term and market risks

≈80% of lending in financial markets is collateral-based

financial institutions use government bonds as collateral for short-term loans

you're using immovable property as collateral for a generally longer term-loan

≈80% of lending in financial markets is collateral-based

financial institutions use government bonds as collateral for short-term loans

you're using immovable property as collateral for a generally longer term-loan

real estate is a great asset because banks lend ≈75% of its value

so if your property is worth $100K, you can borrow $75K against it at a low rate

the immovable property is used as collateral

just as charted: with the yellow line resistance broken gold has risen over 6%

this thread covers the whole consolidation move, where i explained how it's a bullish precursor

the original goal of this thread was to follow gold until it breaks $3.5K, and now we're 0.15K above 😄

remember that real estate runs on credit - and in the most basic approach - the bank happily finances 75% of the value of the property. this is true even if you're just starting

as you accumulate collateral/properties it becomes easier and easier, as you can cross-collateralize

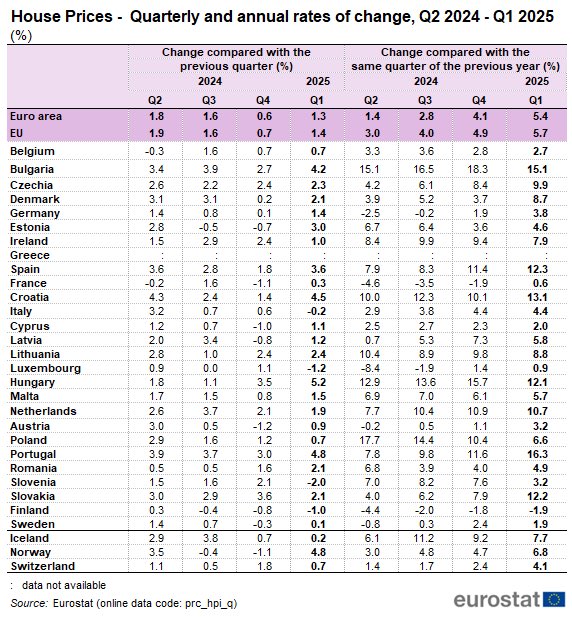

this increase will be more accentuated in lower per-capita GDP countries - as cross-border capital flows in to fill the price gap

lower GDP + highly desired location is the recipe for higher yields 😄

you can observe this in countries like Portugal in the table below

EU real estate prices will continue to increase

with investment capital moving away from US to the EU, a significant portion of it will will flow into housing, thus pushing sale and rent prices up

specially true for high-demand areas, like coastal & large cities

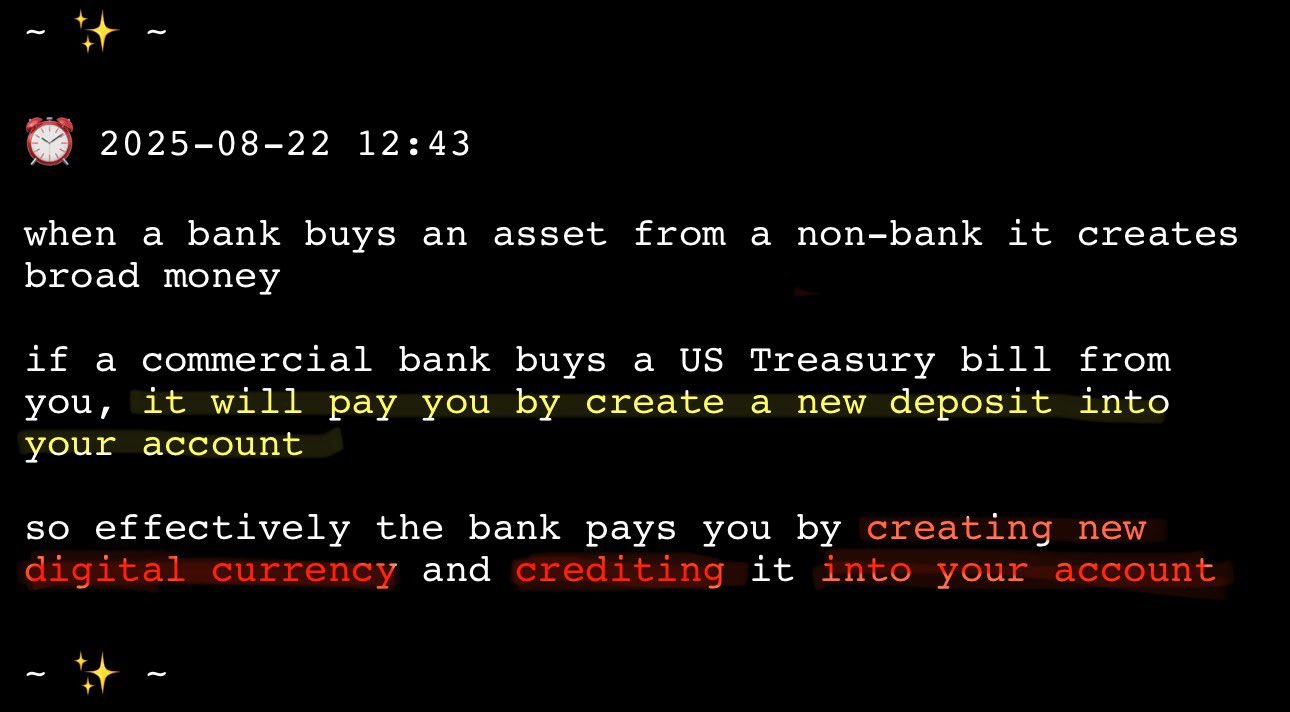

i wrote a thread explaining the business model of banks here: https://illya.sh/threads/@1755863018-1.html

the information in it is important to understand the balance sheet dynamics of gold reevaluation

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

so assuming no sanitization - an initial reduction of liquidity may occur