⬇️ My Thoughts ⬇️

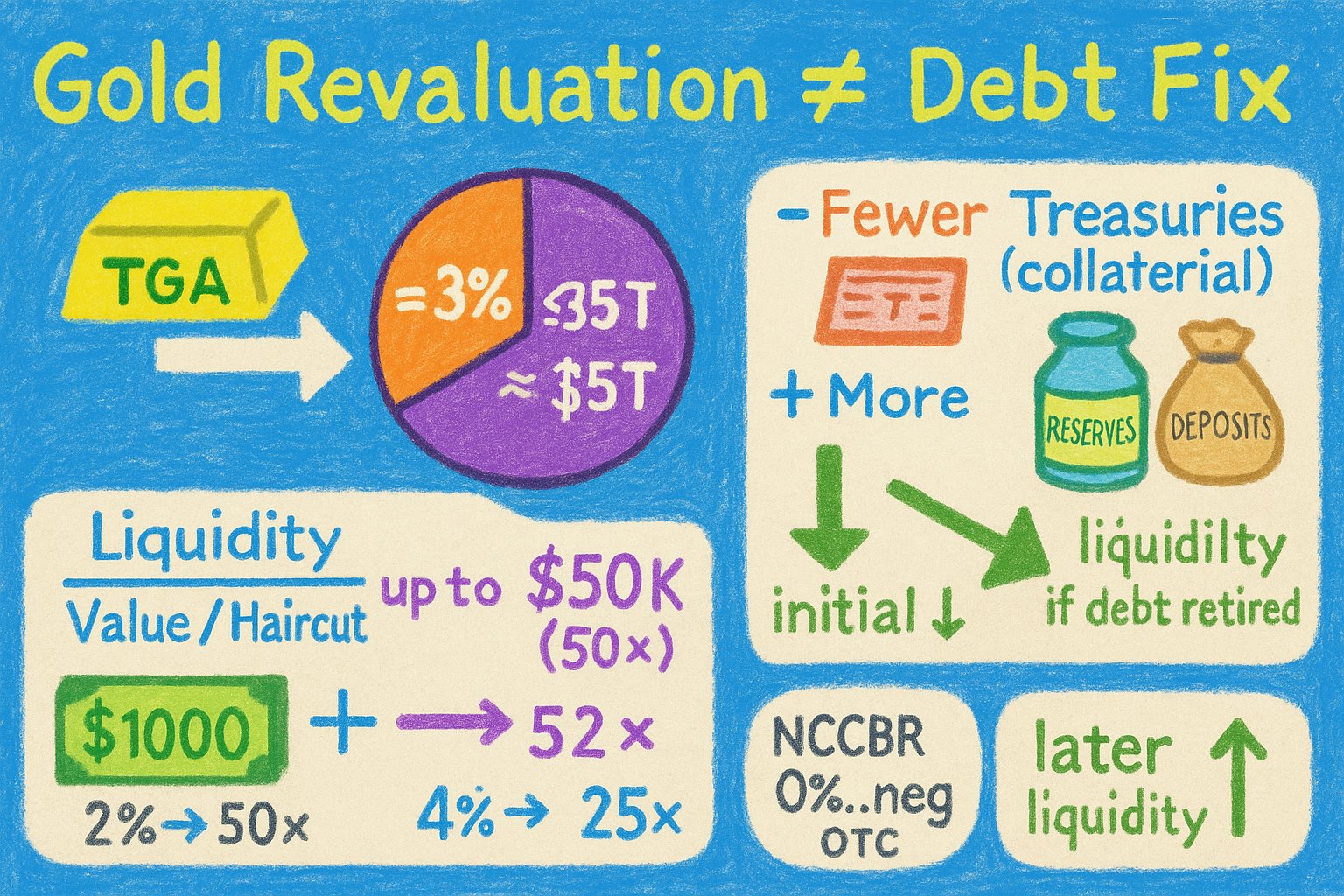

so assuming no sanitization - an initial reduction of liquidity may occur

while the haircut may also fall (upward pressure on liquidity), the volume reduction (downward pressure on liquidity) is likely to have more weight, due to global refinancing/liquidity needs

while the haircut may also fall (upward pressure on liquidity), the volume reduction (downward pressure on liquidity) is likely to have more weight, due to global refinancing/liquidity needs

so if the US Treasury revaluated gold and used all those proceeds to repurchase/retire debt it will likely have an initial negative effect on the liquidity, due to contraction in safe collateral

so if the US Treasury revaluated gold and used all those proceeds to repurchase/retire debt it will likely have an initial negative effect on the liquidity, due to contraction in safe collateral

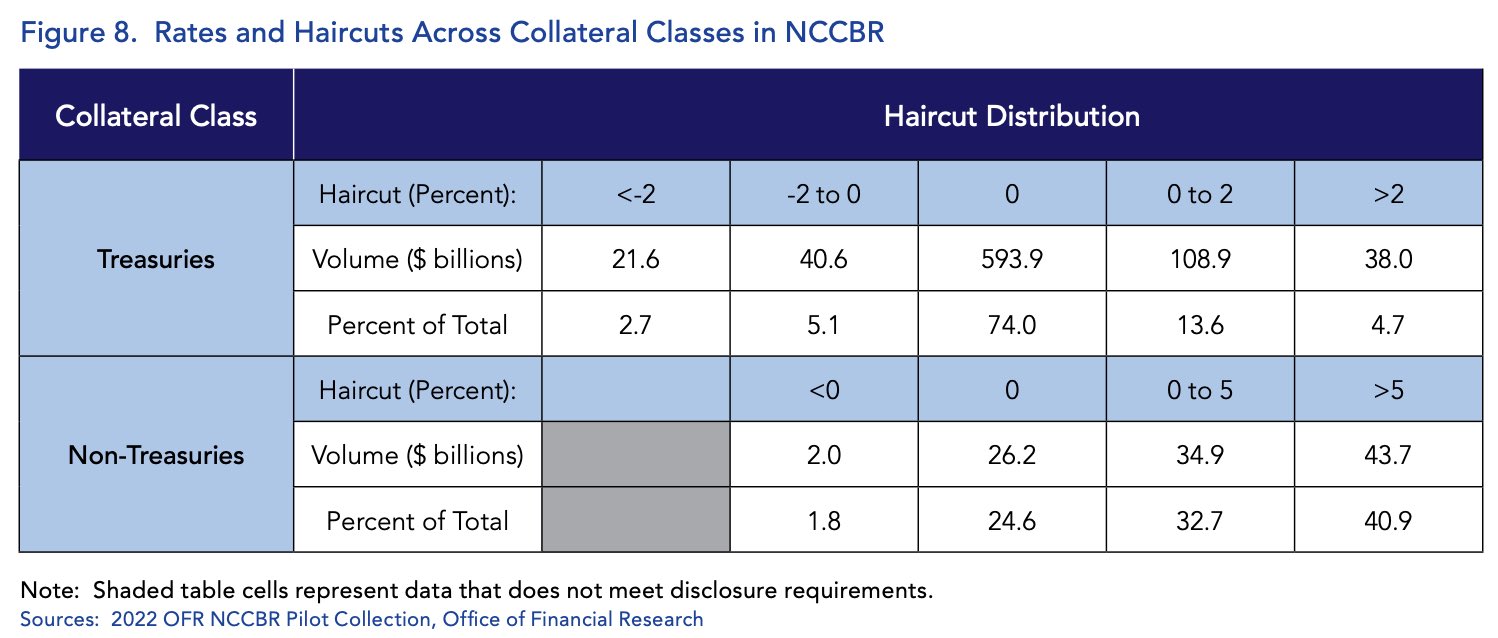

NCCBR participants are generally subject to regulations and balance sheet constraints - so don't think that null/negative haircuts means the collateral can be rehypothecated infinitely

these bilateral arrangements is where financial institutions manage their liquidity needs

NCCBR participants are generally subject to regulations and balance sheet constraints - so don't think that null/negative haircuts means the collateral can be rehypothecated infinitely

these bilateral arrangements is where financial institutions manage their liquidity needs

NCCBR users are mostly institutions part of the financial market infrastructure - such as dealers and hedge funds

they use NCCBR to manage their balance sheets and regulatory obligations. so a high need for Treasury collateral may drive the the haircuts negative

NCCBR users are mostly institutions part of the financial market infrastructure - such as dealers and hedge funds

they use NCCBR to manage their balance sheets and regulatory obligations. so a high need for Treasury collateral may drive the the haircuts negative

NCCBR are essentially bilateral OTC agreements - no central counterparty or tri-party custodian

NCCBR are essentially bilateral OTC agreements - no central counterparty or tri-party custodian

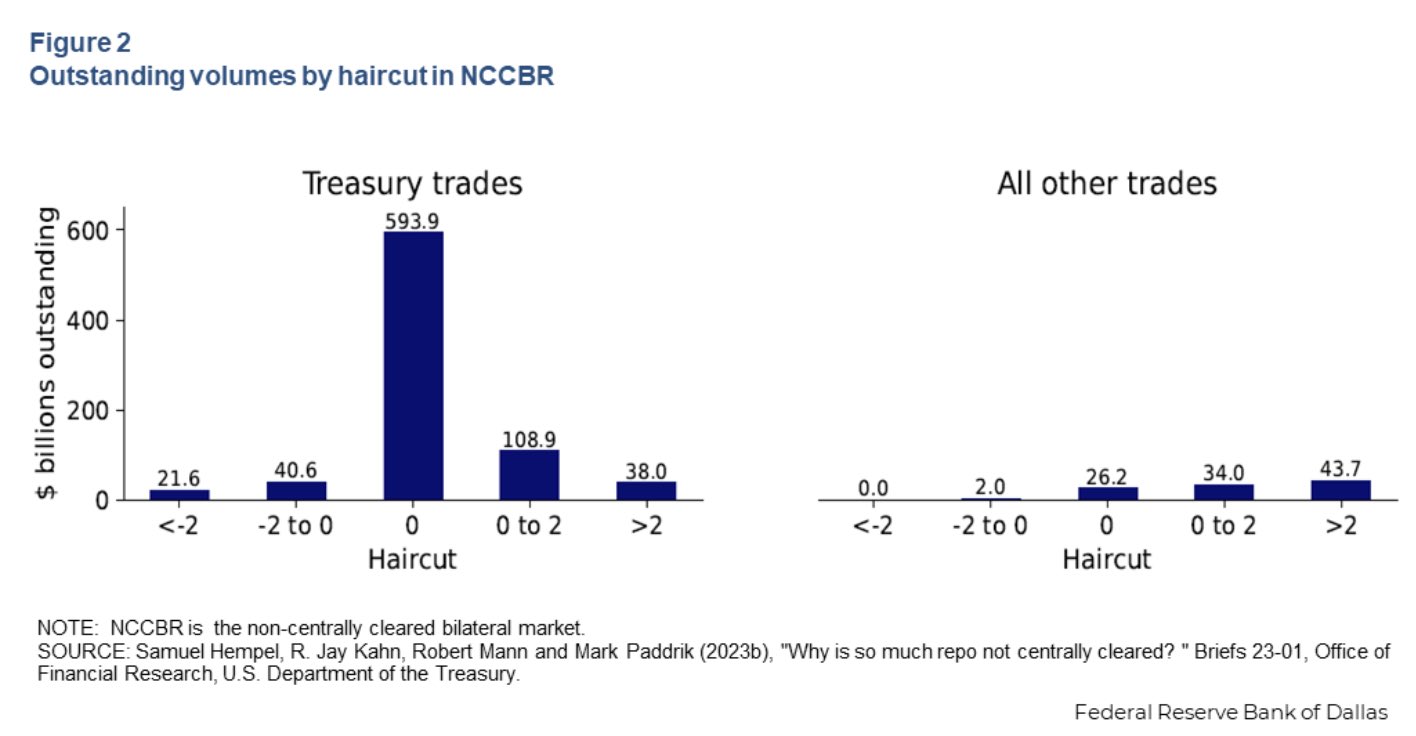

in non-centrally cleared bilateral repos (NCCBR) the Treasury haircut is mostly 0%, and a significant portion has negative haircuts - meaning that more money is lent in the repo that the market value of the Treasury collateral

current tri-party repo haircut average for Treasury collateral is 2%, supervisory is 4% (Capital Adequacy Requirements)

with a 2% haircut the collateral funding multiplier is 50x, with a 4% haircut - 25x

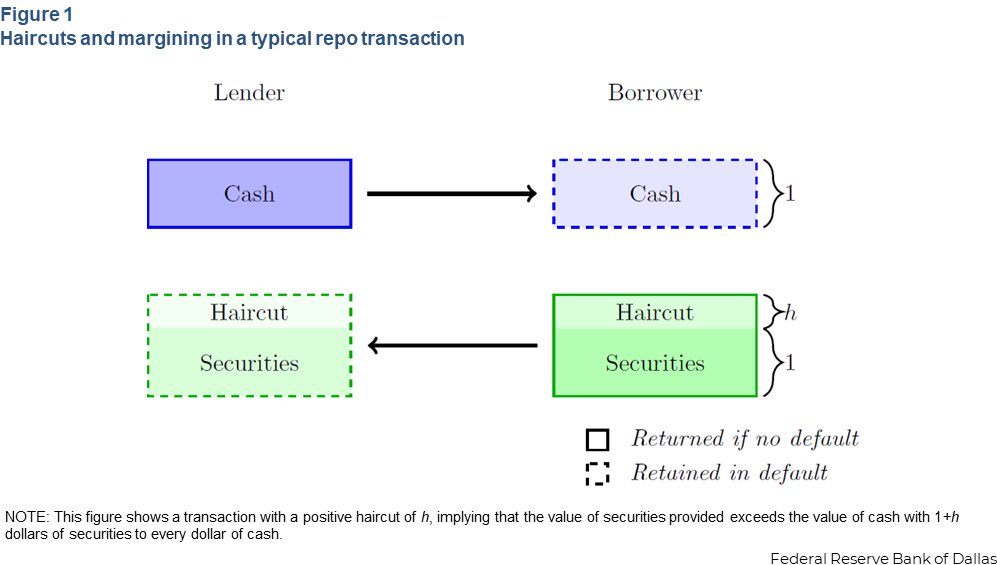

the smaller the haircut - the larger the maximum rehypothecated credit

thus, a 30 year Treasury bond trading at par (i.e. market value = face value = $1000) can create up to $50K of new liquidity/credit!

you cannot leverage as much with reserve money. so a $1000 bond can create more liquidity than $1000 cash/reserves

maximum liquidity added by bond = market value/haircut

so a Treasury security worth $1000 with a haircut of 2%, can create up to $50000 in new credit/liquidity

computed using the formula above: 1000/0.02=50000

maximum liquidity added by bond = market value/haircut

so a Treasury security worth $1000 with a haircut of 2%, can create up to $50000 in new credit/liquidity

computed using the formula above: 1000/0.02=50000

to estimate the maximum liquidity that can be added by a bond divide the market value by its haircut (e.g. effective repo haircut on that bond)

to estimate the maximum liquidity that can be added by a bond divide the market value by its haircut (e.g. effective repo haircut on that bond)

collateral gets reused/rehypothecated, reserves don't

dealers re-pledge/re-use Treasuries, e.g. through repo and reverse repo. thus, the financing capacity of Treasury bills, notes and bonds exceeds their market value

collateral gets reused/rehypothecated, reserves don't

dealers re-pledge/re-use Treasuries, e.g. through repo and reverse repo. thus, the financing capacity of Treasury bills, notes and bonds exceeds their market value

retiring debt with gold revaluation would change the composition of liquidity:

➖ less US government bonds (safe collateral)

➕ more base money (reserves) and/or broad money (deposits)

so the end result is more base and/or broad money, but less prime/repo-eligible collateral

retiring debt with gold revaluation would change the composition of liquidity:

➖ less US government bonds (safe collateral)

➕ more base money (reserves) and/or broad money (deposits)

so the end result is more base and/or broad money, but less prime/repo-eligible collateral

persistent deficits & refinancing needs will add $1 trillion of new debt in less than a year

so gold revaluation is insignificant for US federal government's debt problem

persistent deficits & refinancing needs will add $1 trillion of new debt in less than a year

so gold revaluation is insignificant for US federal government's debt problem

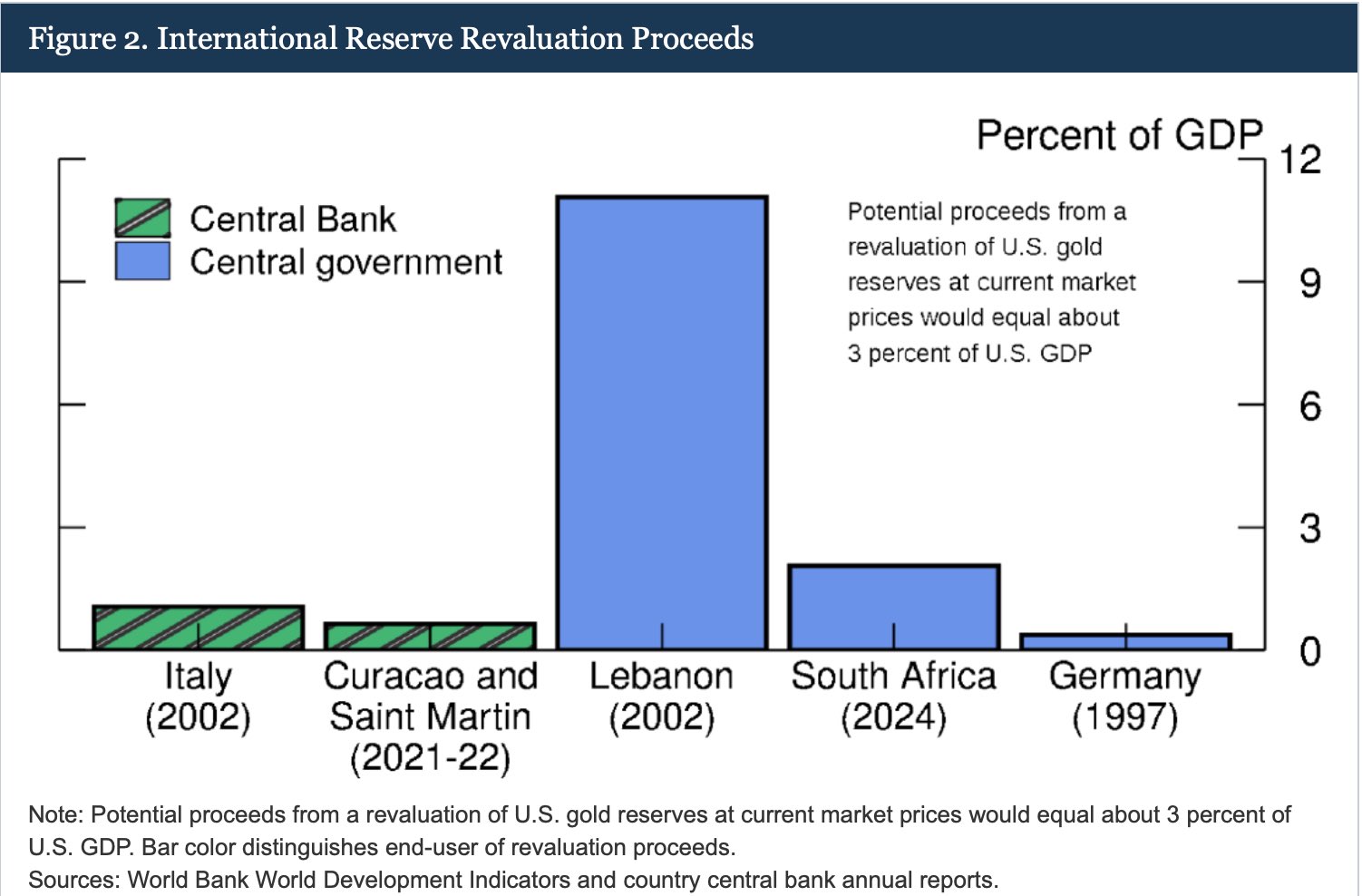

assuming all of the gold revaluation gains get credited to the Treasury's general account to retire government debt (e.g. by re-purchasing US Treasury bonds from the market) - that would cover a mere ≈3% of outstanding US government debt

assuming all of the gold revaluation gains get credited to the Treasury's general account to retire government debt (e.g. by re-purchasing US Treasury bonds from the market) - that would cover a mere ≈3% of outstanding US government debt

gold revaluation proceeds are not necessarily used to cover sovereign debt

central banks of Italy, Germany, Lebanon, South Africa & Curaçao and Sint Maarten reevaluated gold in the past, with some using the proceeds to finance the government, while others the central bank

gold revaluation will NOT solve the US debt problem

the gain would cover less than 3% (≈1 trillion USD) of the outstanding national debt

most recently it took ≈9 months for the US government to accumulate $1T in new debt

previously, $1T in new debt was added in ≈100 days

now everyone is talking about gold 😄

i've been writing about an imminent new all time high and uptrend continuation for 3 months now - you can check back up on this thread

every long call in this thread has been accurate

gold is a very special asset this cycle

gold reached $3500 new all time high 🥳

indeed once the yellow resistance trend line was broken - we saw a new all time high

the extended consolidation built up a strong future support

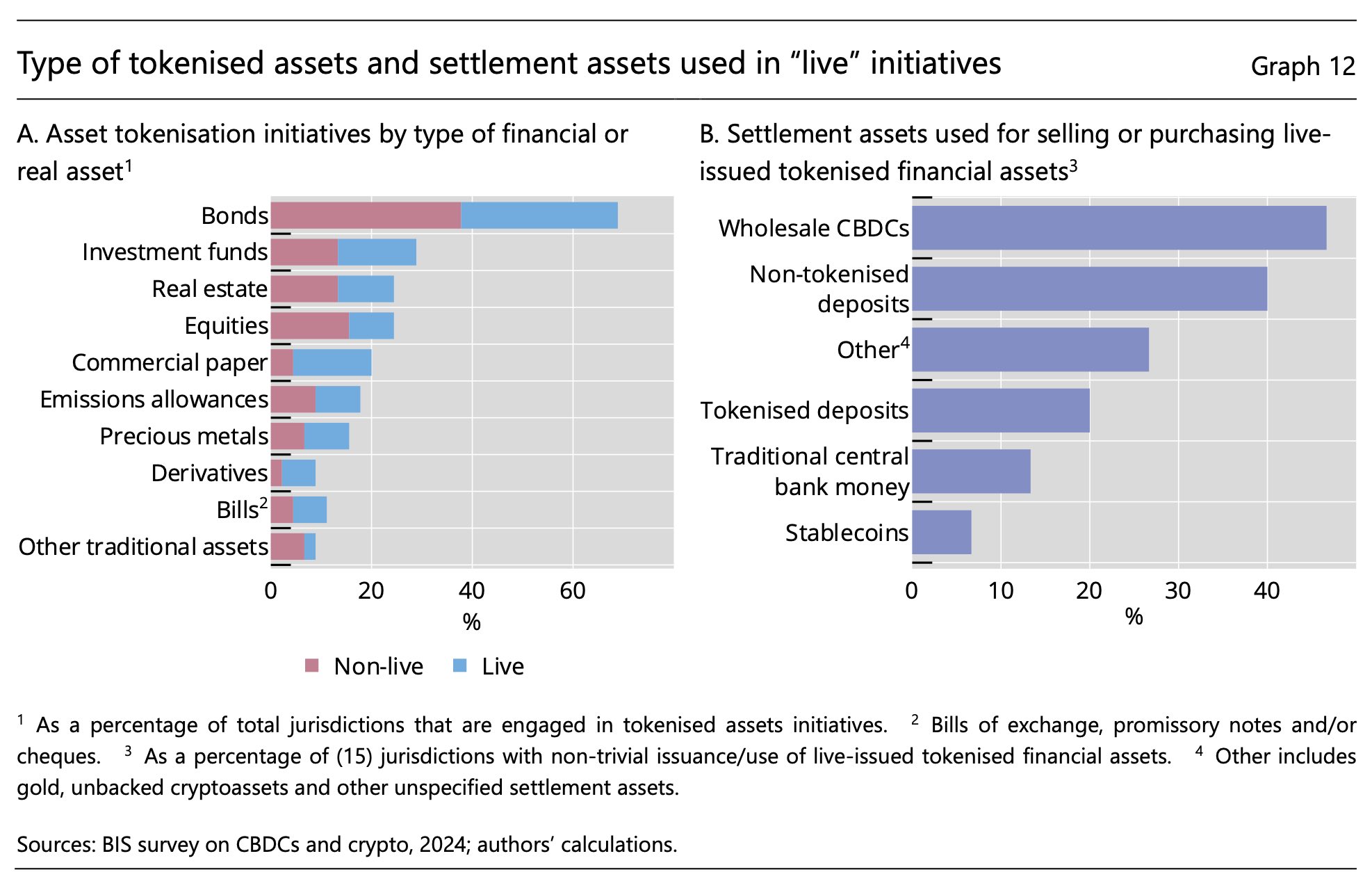

real world and financial asset tokenization is ongoing worldwide, with transactions mostly settled in CBDCs

government and corporate bonds are the most common RWA to be tokenized

gold continues its uptrend towards the new $3500 all time high

i've previously written how gold's price action suggests a consolidation before the next ATH

the last main resistance is the upper yellow trend line. once it's claimed as support expect gold to shoot to new highs

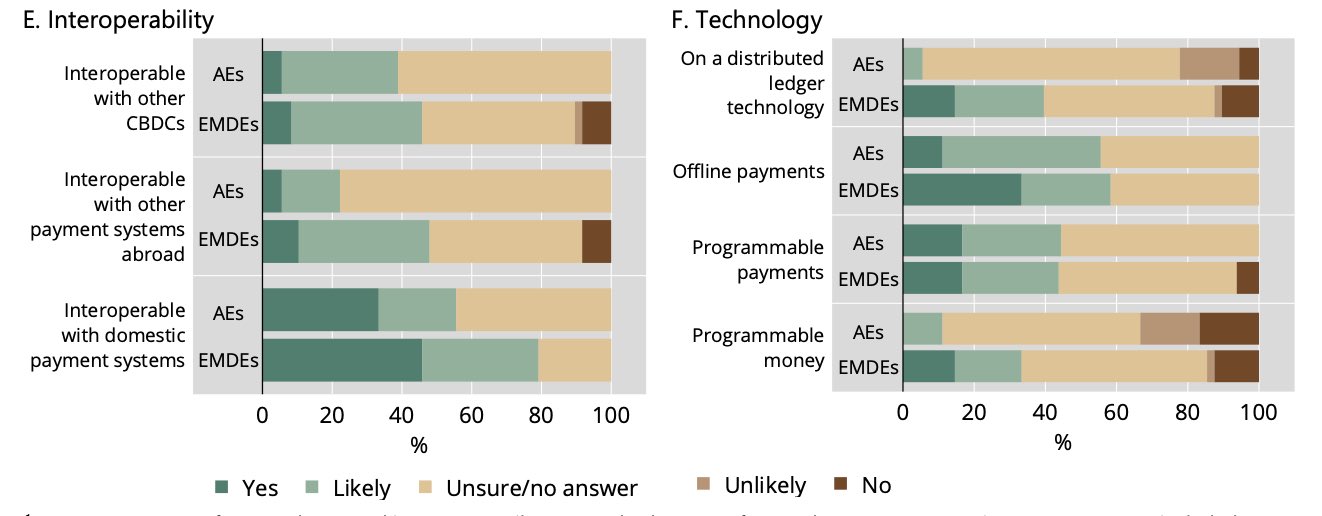

>80% of central banks plan to operate the DLT/blockchain for wholesale CBDCs themselves, hinting an in-house blockchain solution, and not a public and permissionless ledger

however, even if CBDCs are implemented using blockchain - it's unlikely to be a public, permissionless blockchain like Ethereum

however, even if CBDCs are implemented using blockchain - it's unlikely to be a public, permissionless blockchain like Ethereum

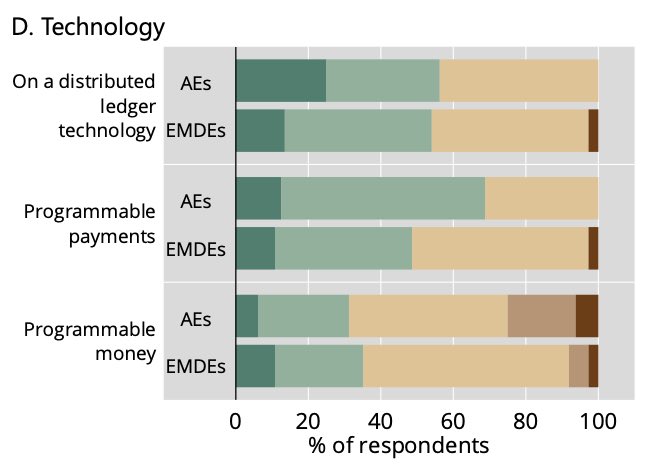

>50% of central banks in both, advanced and emerging economies are considering using DLT for wholesale CBDCs

this means that wholesale CBDC is likely to be implemented using some form of blockchain technology - much more likely than the retail CBDC

only 6% of advanced economies (AE) central banks and 40% of emerging economies (EM) central banks are considering distributed ledger technology (DLT) as an implementation layer for retail CBDCs

here, consider DLT = blockchain