⬇️ My Thoughts ⬇️

now crypto twitter seems to think that gold & silver have topped 😂

i don't think CT understands what gold & silver are

deep work in loud, distracting places is a skill that you can learn

and it's a very useful skill

FYI you can ask the bank to lend you ≈75%LTV of the future property before restoration works start

so assuming you have a real estate project for restoration - the bank estimates the future value (after the immovable property is restored) and lends ≈75% of that expected future value. if you lease the property instead of buying - banks can generally finance 100%

in restoration projects the bank may also agree for a lower installment payment schedule while the works are ongoing/the property business is being setup - e.g. for the first two years of the loan you're only paying interest installment portion without amortizing the outstanding principal amount

otherwise you'll need another way to finance the restoration costs, and I doubt the contracting company will agree to only receive payment once your loan gets approved

no, permissioned assets running on blockchains are NOT sheep in wolves' clothing

blockchains need to integrate with our existing legal systems - and the permissioned aspect is often required by law

i'm currently looking into implementing a real estate European Long Term Investment Fund (ELTIF) on-chain with smart contracts

the EU regulations governing such funds explicitly require a permissioned control. for example, an ELTIF must be managed by an Alternative Investment Fund Manager (AIFM), as per Directive 2011/61/EU (AIFMD). so there must always be an AIFM behind the token/smart contacts. it can't just be "ownerless" decentralized contracts. by design that someone also bears legal responsibility

you're also legally not allowed to allow retail investments into the fund without KYC, which is also a permissioned component

in order to be able to have the unit's funds tradable on-chain without qualifying as a trading venue under MiFID II (so you don't need additional licenses), you may want to use ELTIF RTS, which under certain conditions exempt your ELTIF smart contracts from being classified as a multilateral system. to qualify for this exception, the law requires the manager to operate windows, decide on execution prices, etc - i.e. the fund's units get traded in a permissioned manner

these are just some of practical examples. as you see, there are many reasons for using a permissioned design in your blockchain assets

permissionless is great, but practical value is more important. we need more solutions that work with the existing legal and financial system infrastructure

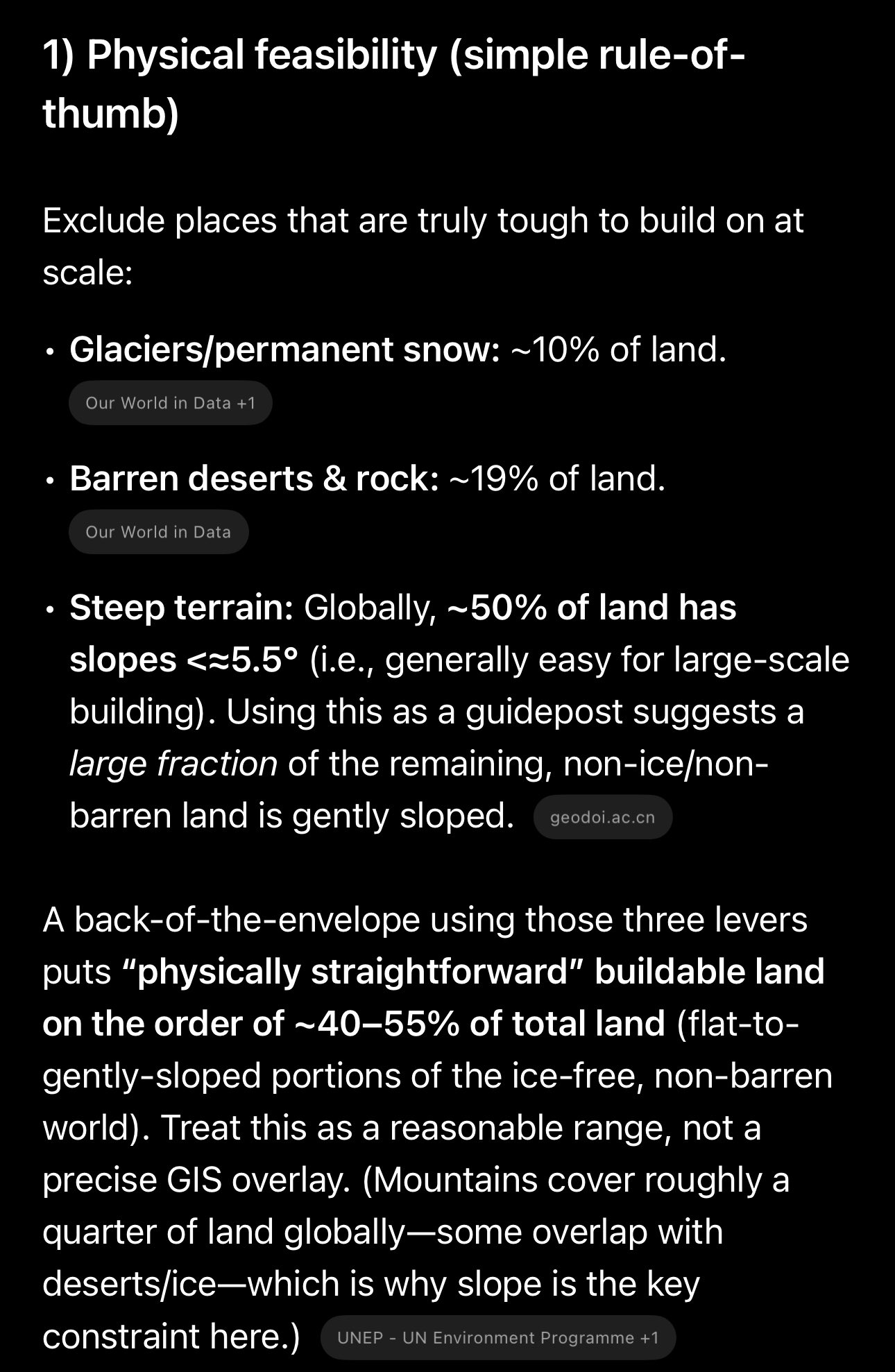

≈less than 50% of total land is buildable

this is if you want to be accurate for the near-long future

don't expect massive building in mountains, glaciers and deserts 😄

neither supply nor demand are static

if you renew a building in a high demand area you're removing an abandoned/old property from an area, which makes the area "nicer", thus it becomes more attractive = more demand

you're also probably will be renting more than the area average (it's a new construction now)

imagine doing this in an almost central part of a high demand city

so renting a building can actually bring prices in the area up instead of down

still - more building is better!! it does put downwards pressure on the real estate prices - but you're looking in the wrong place. you should be looking at credit instead. i wrote an article to get you started here: https://illya.sh/threads/@1757632740-1.html

people are calling Christine Lagarde ignorant on Bitcoin, but don't explain how

how exactly are her statements on Bitcoin ignorant? it's not nice to insult someone, and it certainly doesn't explain how Bitcoin has the same amount and class of intrinsic value as gold - a commodity that has been money for over 5K years

what is even the purpose of a central bank holding BTC in their balance sheet today? speculative investments are not a part of their mandates and moving in that direction would be contradictory to their legally established goals

commercial banking is not the same as central banking

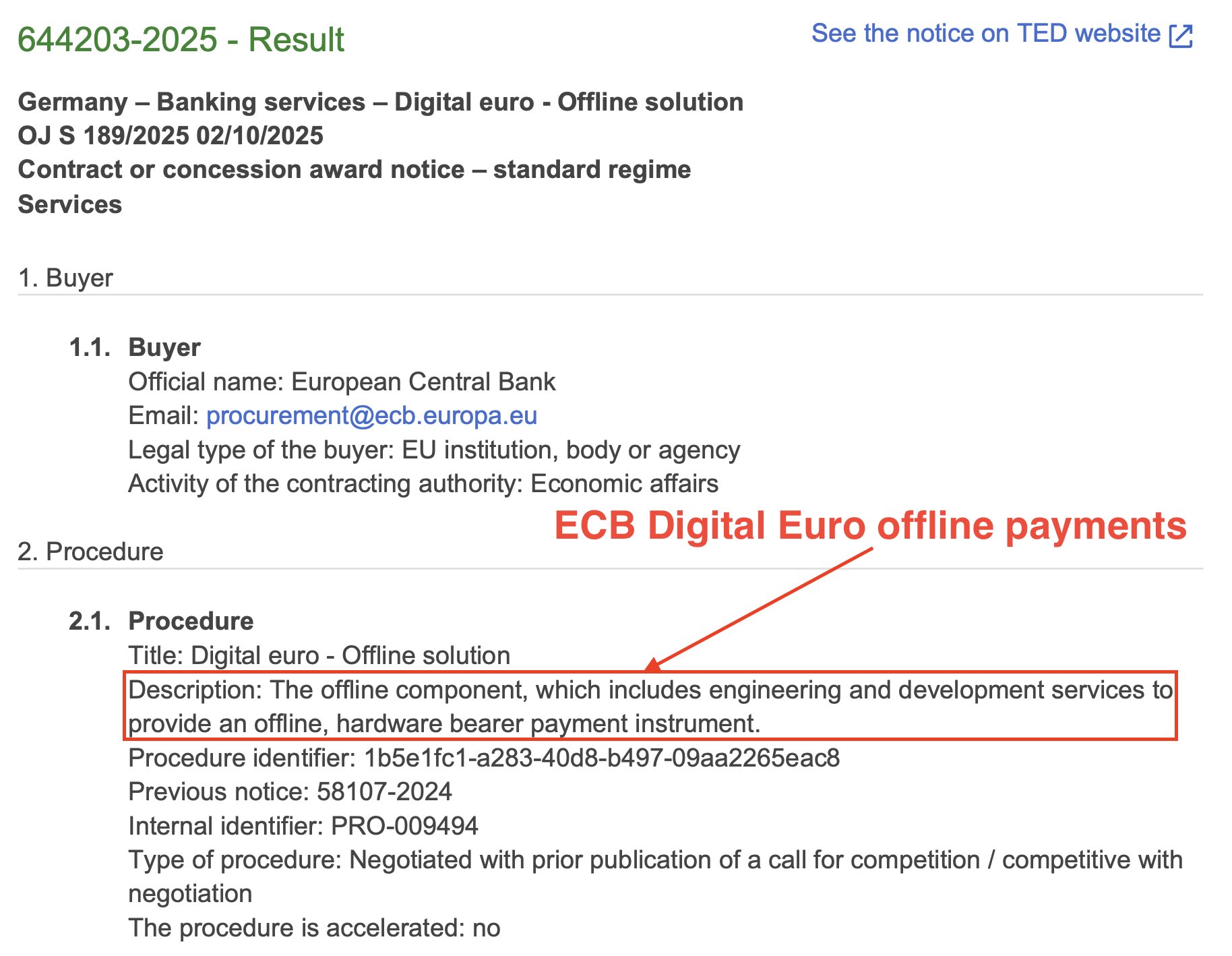

decentralized digital Euro will not work, because the ECB needs to have full control over it

retail CBDCs are direct central bank liabilities on the balance sheet. so "neutral market infrastructure" would not work, because the ECB needs to have full control over it. you can also imagine how many regulations need to be accounted for by the implementation

it most likely won't use a public blockchain for base implementation, and it's definitely not like stablecoins 😄

digital euro also needs to support offline payments, which isn't currently widely supported in DeFi. Zero Knowledge Proofs enable some potential solutions for this, but I don't believe that that's with what the ECB is going with now

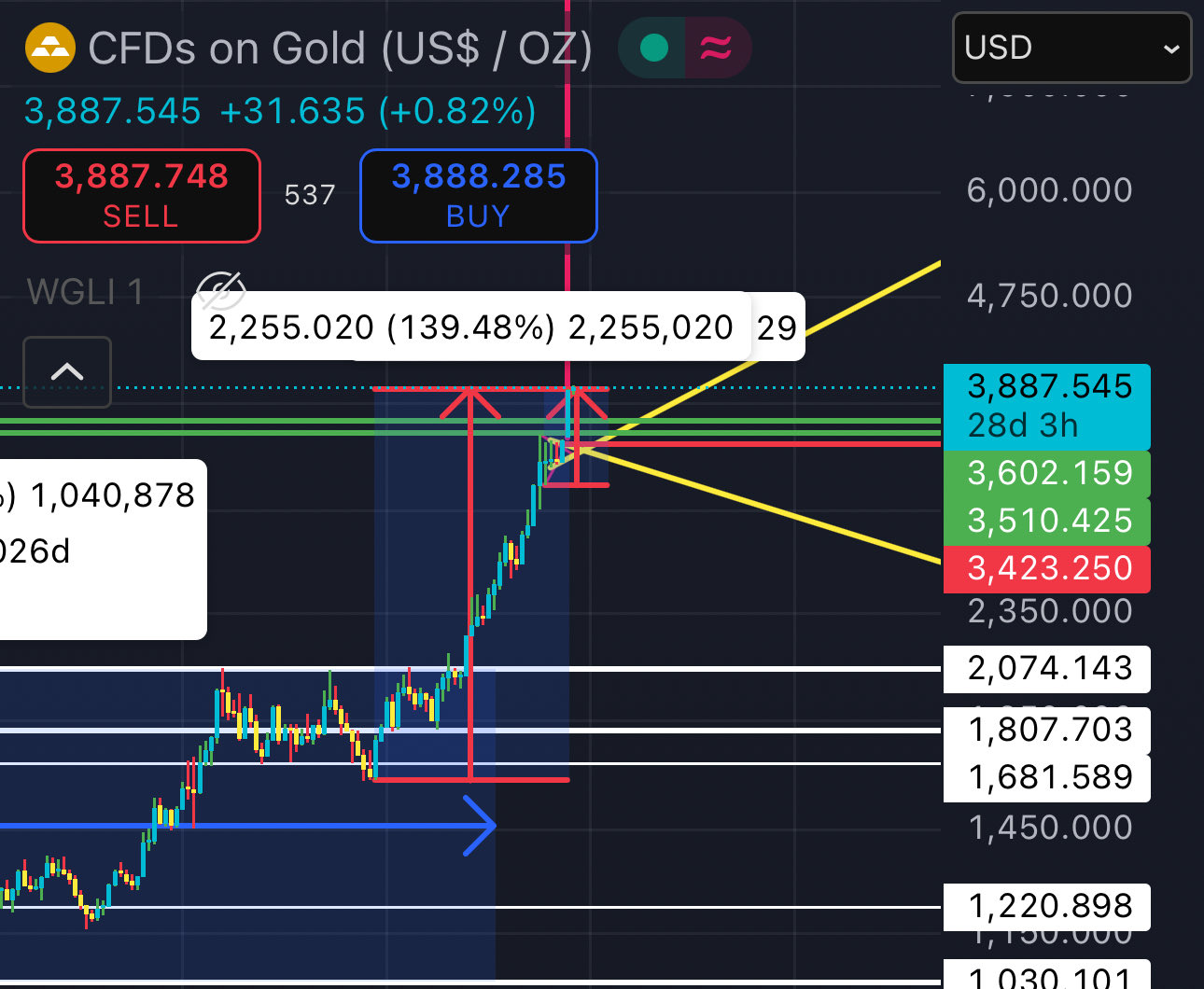

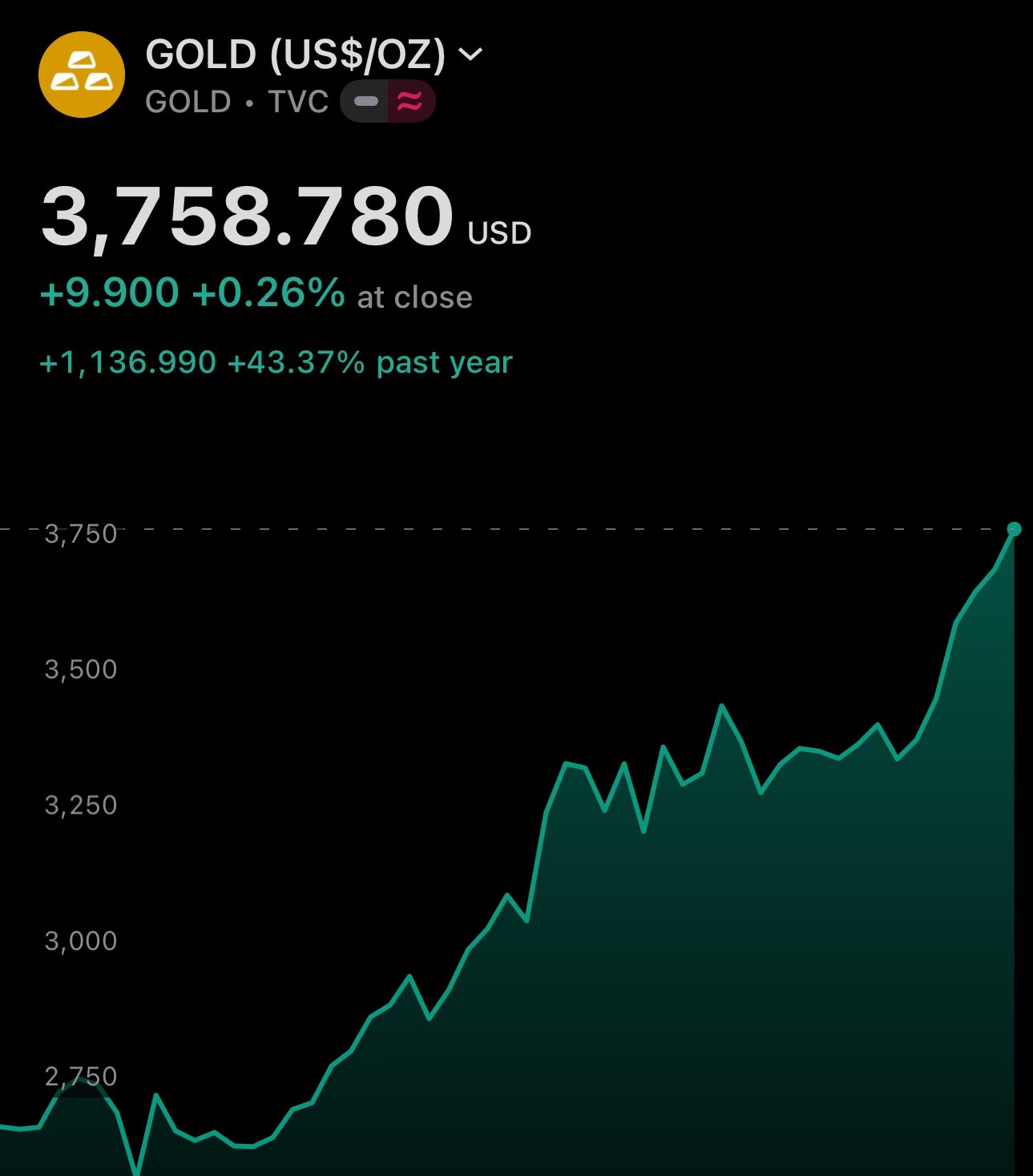

we are approaching a local top for silver and gold according to my market vibe meter

usually i'd write a longer post with an explanation & technicals, but today i'm writing of off vibes 😄

my twitter/x feed has been filled with so much euphoria regarding silver & gold that it starts to resemble those accounts which constantly promote Bitcoin

you also have to contextualize how extended gold and silver's moves have been. the graph shows monthly candles

this isn't a bearish post on gold though - still expecting $4000/oz in November 2025 😄

no, "The West" is not manipulating gold and silver prices

silver and gold had retracements many times before, but I guess when it falls on Chinese holidays it becomes "western manipulation"?

≈32% of global gold demand in 2025 comes from China (estimate for jewelry + bar & coin). China is a major buyer of gold - so a lot of demand there

a more reasonable explanation is a demand dip, due to the holiday in PRC. also the US government shutdown. although I agree the idea of a magic red button saying DUMP GOLD located somewhere in the west is more exciting 😄

it's also not clear what would be the purpose of manipulating the price of gold down, as that would be benefiting China - they can buy it cheaper!

PBoC has been buying gold for years, and they will continue to do so. PBoC doesn't announce targets publicly - and they're flexible on their purchases, so again, lowering the gold price would likely allow them to buy it at a cheaper price

Bitcoin is not a good collateral for a loan, here's why:

1️⃣ You can only get ≈50% LVT credit

2️⃣ You pay higher interest than on mortgages/real estate-backed loans

3️⃣ You get liquidated from ≈80% LVT

So if your strategy is to purchase assets and use them as collateral for loans, you may be better off with real estate:

1️⃣ You can get more than 75% LTV credit

2️⃣ You'll pay lower interest for a mortgage/real estate-collateralized loan than for a BTC collateralized loan

3️⃣ No liquidations when real estate is collateral. If property (collateral value) falls, you may be requested a cure, but forced sales must go though courts.

and there you go 😄

once the short-term suport line was broken, silver's price fell down to another support

the vast majority, if not all of tariffs set be the US will be removed in the next 4 years

latest - by the next US administration. it will be an easy way to mitigate price inflation a bit, and mobilize the overall US economy

tariffs are a net negative - i've said it from the very start. it's a lot more obvious now

the majority of real estate purchases in Portugal are done with credit. moreover, each property itself can be used as a collateral to get more credit - at least 75% of the property's value. so not only you can purchase the property, earn a yield via rents, but also get a credit/loan for 75% of value of the property

in Portugal, ≈90% of all credit/loans against real estate, go into investing into more real estate. so each collateraized property, can contribute ≈2x of its value as buying pressure for the real estate market as a whole (1x when the property is first purchased, and 0.75x-1x when the property is used as collateral to get a loan against it)

so effectively real estate itself is driving real estate prices up. banks happily finance real estate acquisitions, and lend against real estate collateral. then, most of that credit goes into purchasing more real estate, thus pushing the prices up

so the main drivers behind increasing real estate prices in Portugal are:

the real estate itself, i.e. the property itself

funding rate/cost of credit (highly influenced by ECB policy rates)

low relative transaction volume/market cap, making it easier to move the median

the first two points are generally universal across the globe. i've previously written an article about what makes real estate such a special asset from the point of view of financing. you can read it here: https://illya.sh/threads/@1757632740-1.html

the relatively low total transactional volume, which has increased almost x3 in the past decade - makes it "easier" for buying pressure to push the housing prices up

of course, other factors contribute as well. Portugal is highly demanded area for cultural and geographical reasons - i.e. locals are welcoming and Portugal has a huge coastal area. there is also high inflation, regulatory challenges and supply chain limitations

the bottom line is that real estate purchase and rent prices in Portugal will continue to increase over medium-long term

portugal golden visa real estate investments are less than 3% of total housing transactions

portuguese real estate market volume is ≈30B€/year, golden visa purchases accounted for ≈556M€/year

3% of total volume of the housing market is unlikely to be the primary driver of the national median prices increase

so next time someone tells you that one of the main drivers behind increasing Portuguese real estate prices are golden visa investments - their argument is likely to lack substance

if you buy a car with Bitcoin, you're still subject to capital gains tax

under the US law cryptocurrencies are property - so you're taxed on the USD value of the car at the time of purchase minus the cost of your original crypto purchase (so you're only taxed on the gain/profit)

so if the processing fee of a payment with Ethereum is larger than it would be by selling Ethereum for USD first (e.g. transfer ETH to an exchange --> sell --> transfer to your bank account), then you end up paying more with Ethereum than you would with USD. it make sense, because you'd be removing an intermediary (i.e. you sell ETH for USD yourself)

in either case, the seller receives USD for the car, not ETH or BTC. the intermediary most likely doesn't keep ETH/BTC on their balance sheet either, they just proxy your order to the market and charge a spread

central banks have rejected holding Bitcoin in their reserves including Fed, ECB, PBoC and many others

what would even be the purpose of a central bank holding BTC on their balance sheet? so that they can stabilize the value of the currency against Bitcoin? what would be the practical benefit from it now?

cross-border crypto trade in non-stablecoins is negligible. Bitcoin is extremely volatile, which would make central-bank issued currency more volatile - this goes exactly against the direct mandate of most central banks - price stability.

a more volatile currency will also lead to a more volatile bond market, which will make government funding more volatile, and thus a high risk/uncertain economy

and i'm not even going to touch on the security risks. okay, maybe briefly 😄:

➖ governments are one of the only entities that can realistically perform a successful 51% attack on Bitcoin. well, with central banks owning BTC will make such attacks much more attractive - including at the geopolitical level. the same goes for denial of service family of attacks

➖ what if the central bank's wallets get hacked/compromised? i'm not talking about quantum computers breaking RSA, but operational level mistake or compromise

so for the next 10 years, I view central banks holding Bitcoin on their balance sheet as a negative sign for their currency. of course, the protocol and the bitcoin network will evolve/change over time, and with so may my stance

i believe cryptocurrencies, and more specifically distributed layer technologies/blockchain architectures can bring immense value to our financial system as a whole, but that doesn't mean that we should have central banks speculating on that today. it makes much more sense to increase gold reserves instead

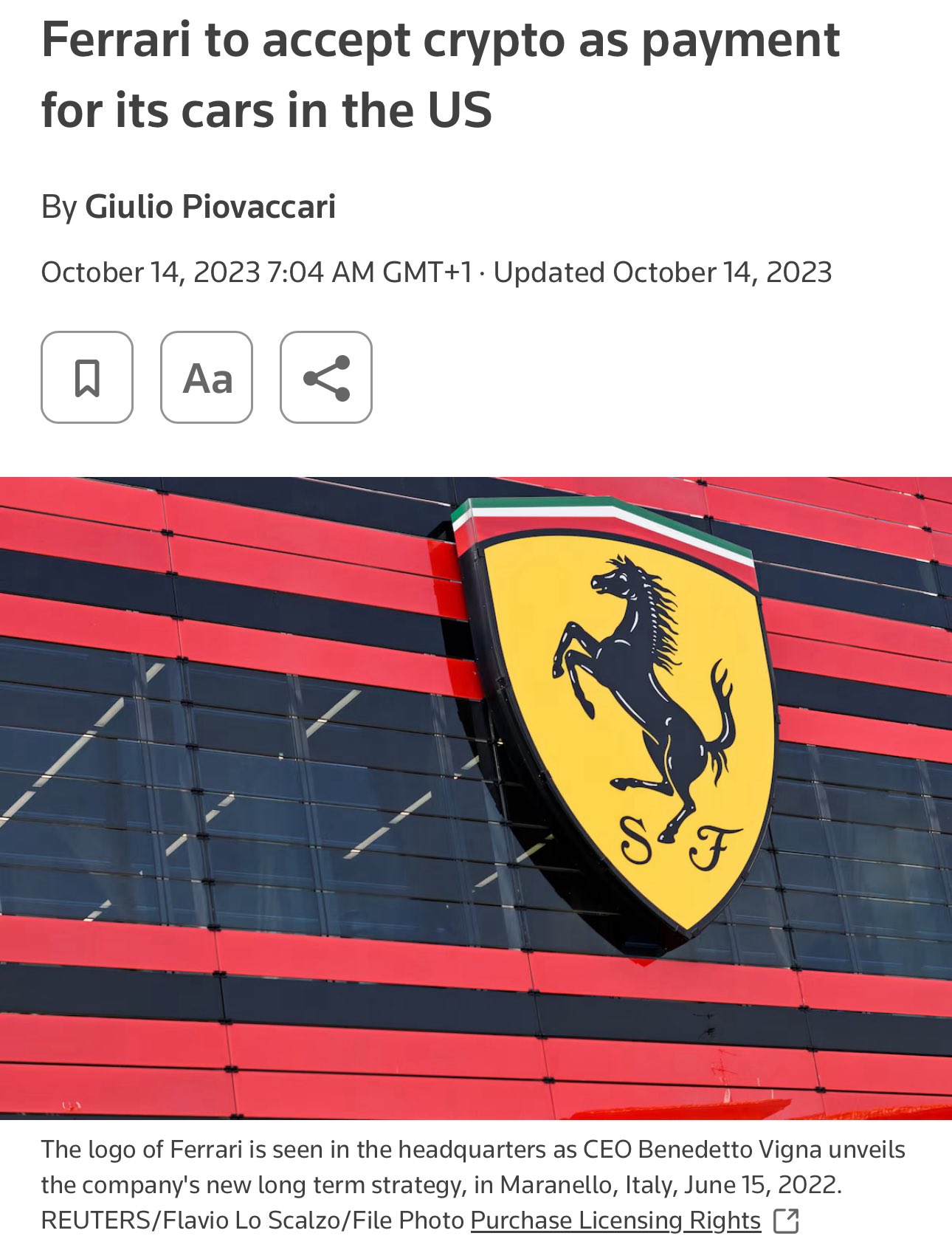

virtually every corporation that accepts Ethereum/Bitcoin for payments doesn't actually process the payment in crypto

they immediately covert it to USD or another FIAT, and not actually hold the BTC, ETH, etc

the convertion is generally done via an intermediary, so the company you're buying never even touch or care about the crypto asset. they want the same government-backed currencies that we use now

the intermediary will also generally charge a fee, around ≈1% of the transaction value. so buying directly with crypto is likely to be more expensive than directly with FIAT. if you just sell the crypto for FIAT and pay directly in USD, EUR, etc it will likely be cheaper. so what's the point of paying more?

don't be fooled by headlines or articles that suggest otherwise

portugal golden visa real estate investments are less than 3% of total housing transactions

portuguese real estate market volume is ≈30B€/year, golden visa purchases accounted for ≈556M€/year

3% of total volume of the housing market is unlikely to be the primary driver of the national median prices increase

so next time someone tells you that one of the main drivers behind increasing Portuguese real estate prices are golden visa investments - their argument is likely to lack substance

when mega caps like gold explode by ≈50% in a year and you don't think that that's a warning sign for US equities/risk asset - you probably should look back at history 😄

Bitcoin and Intel have do have one thing in common - direct monetary intervention from the US government

How Banks Create Money When Purchasing Assets

I have previously written about the unique legal powers given to commercial banks and credit institutions in general, that allow them to create new currency, thus increasing its supply. For banks, this also extends to their open market operations, such as when they buy securities and other assets from the open market. If the bank’s counterparty happens to be a non-bank, or more generally an entity without an account at the central bank, then the bank will create new currency to pay for that transaction. I described this in my thread/article titled "when a bank buys an asset from a non-bank it creates broad money":

https://illya.sh/threads/@1755863018-1.html

I received a question about it via e-mail, so I’m writing a follow-up with clarifications.

The flow that I was describing the thread linked above is what happens when a bank buys an asset from a non-bank. Let’s assume the bank ABC wants to buy an asset from you. Let’s forget about US government bonds for now, let’s say the bank wants to buy 100 shares of Tesla from you. The current market price for 1 Tesla share is ≈$450, so the ABC bank would pay you $45000 and you will give the bank the 100 shares. Let’s also assume you have an account in that bank (this is not mandatory!)

Let’s say that right before the bank makes a purchase from you (a microsecond before that transaction/sale happens) there is a total of $1 million ($1000000) of US dollars in circulation. The moment right after the transaction is made, and the bank crediting your account with $45000, the total money in circulation would become $1 000 000 + $45000 = $1 045 000. The main point here is that those $45000 didn’t exist in circulation before. They were not taken from someone else’s account, nor from internal bank reserves. Those $45000 were created “out of thin air”, and that money was credited into your account. I say “credited” because it’s from the point of view of the bank - your deposit account at the bank is a liability to the bank - it sits on the liabilities side of the balance sheet - a credit increases liabilities.

Now, I referred to “money in circulation”, but I actually meant Broad Money. There is another form of money - called Broad Money. There is a great paper from the Bank of England that describes them, alongside how commercial banks create money: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf . But in short, Broad Money is the money available for use by the larger economy (individuals, companies, etc), while Base Money is physical currency and currency held in reserve accounts at the central bank - the reserve accounts portion doesn’t touch the broader economy directly.

If instead a bank ABC purchases an asset from another bank DEF - then the total money does not change. The bank ABC would just debit their reserve account at the central bank and credit the reserve account of the bank DEF. So money moves accounts, but total quantity does not change.

In the same manner, when a commercial bank buys bonds directly from the government, there is no creation of “new money” - the money moves within the central bank’s reserve accounts. The general rule is: if the transacting entities have reserve accounts in the central bank the transaction is made within the central bank’s reserve accounts. Commercial banks, governments and sometimes select financial institutions (like in the US) have reserve accounts at the central bank, so transactions within them move Base Money

The following article on how commercial banks work will be very helpful to understand how they operate and create money: https://illya.sh/threads/@1754426330-1

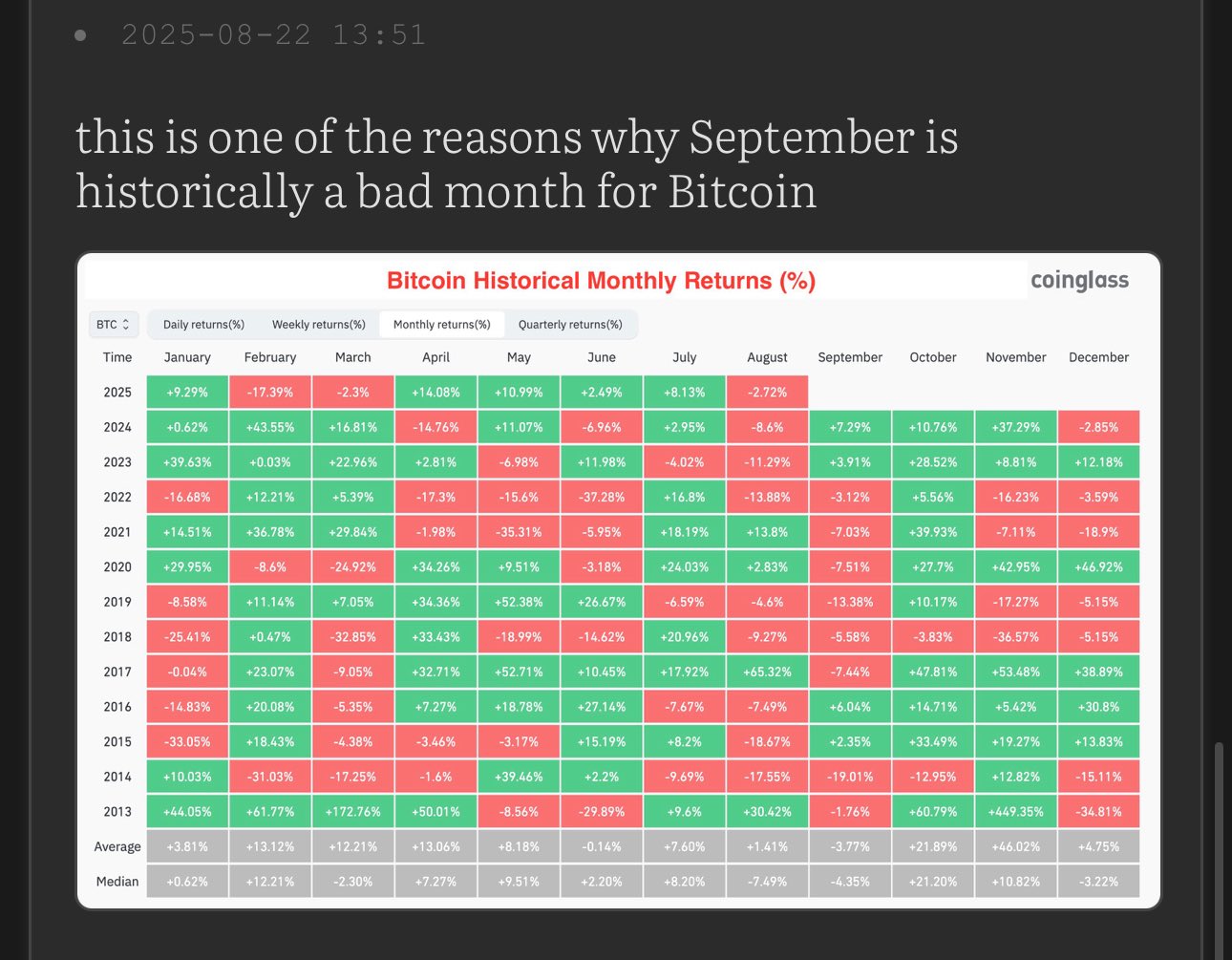

you can read the full article/thread explaining why September is generally a bad month for Bitcoin and other cryptocurrencies here: https://illya.sh/threads/@1755867104-1.html

my article on repo rates and BTC price was referenced on bitcoin.com

apparently it's been there for a month, but i only noticed now

it's a short read - and explains the negative price pressure that quarter-ends, and especially September bring on the price of liquidity sensitive assets like Bitcoin

it give you a concrete perspective on the current cryptocurrency price dump, even with decreasing funding rates

my article on repo rates and BTC price was referenced on bitcoin.com

apparently it's been there for a month, but i only noticed now

it's a short read - and explains the negative price pressure that quarter-ends, and especially September bring on the price of liquidity sensitive assets like Bitcoin

it give you a concrete perspective on the current cryptocurrency price dump, even with decreasing funding rates