⬇️ My Thoughts ⬇️

illya's threads & illya's thoughts are also on substack

i don't actively use substack, but i also import my thoughts & threads RSS feeds there

illya's threads on substack: https://illyathreads.substack.com/

illya's thoughts on substack: https://illyathoughts.substack.com/

previously, there was only a web version at https://illya.sh/threads/

now there is also RSS, just like for illya's thoughts

added RSS feed to illya's threads/articles: https://illya.sh/threads/feed.xml

so now you can subscribe my longer-form articles directly in your RSS reader

added RSS feed to illya's threads/articles: https://illya.sh/threads/feed.xml

so now you can subscribe my longer-form articles directly in your RSS reader

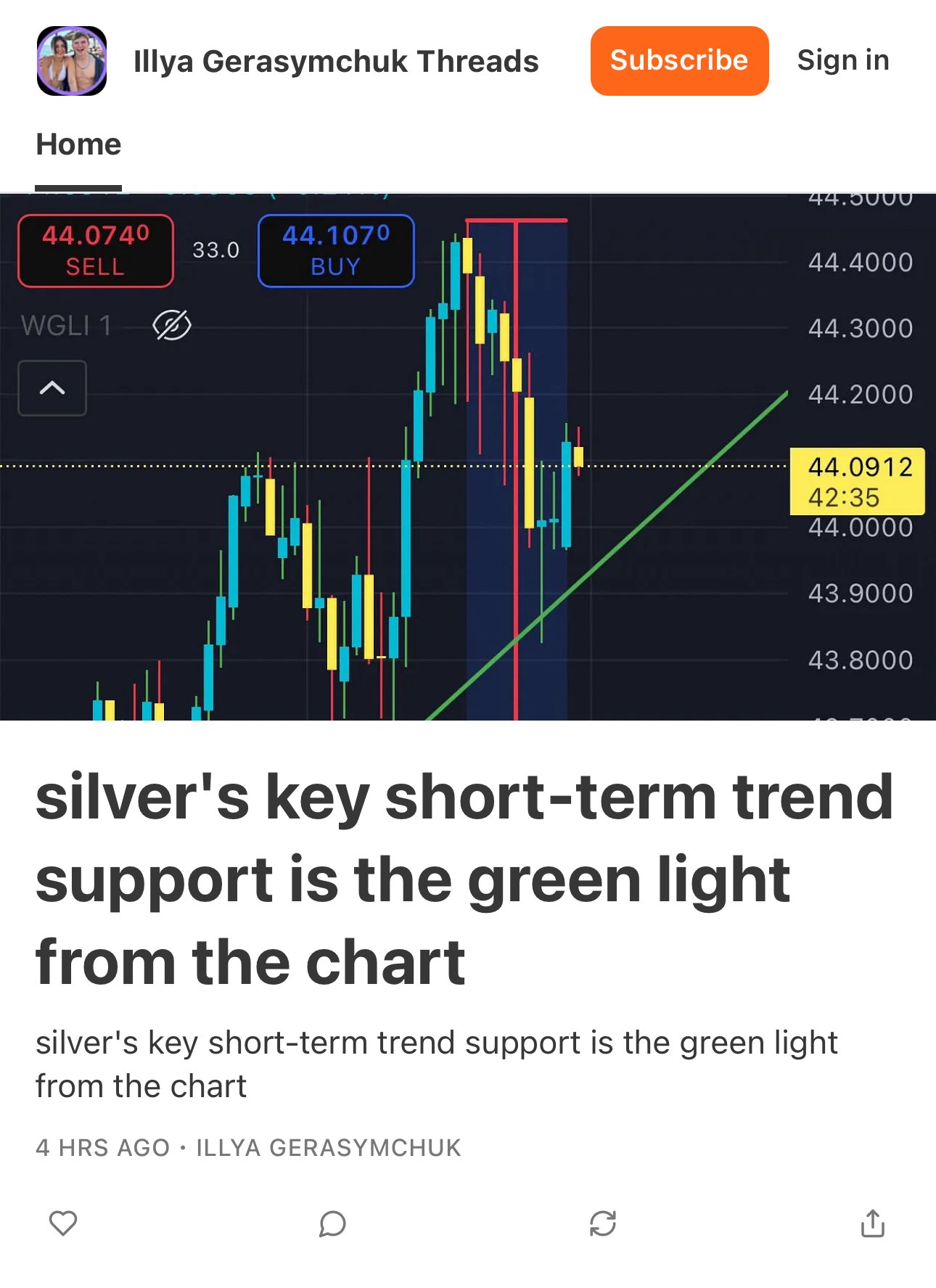

(silver) a breakdown below the bottom orange line will likely push the price further down, at least to ≈$43.35

so now, watch the orange trend line/triangle 👀

1h candles

silver and gold move differently, which why I generally refrain from referring to these commodities in conjunction, even though a lot of what I write about gold also applies to silver

both, gold and silver are currently great investments, but they exhibit a different risk profile

silver is a lot more volatile, meaning its moves are amplified in both directions

if you’re planning to hold in the treasury/balance sheet it can play a big difference, as you’ll generally be less liquid with your silver holdings - in the sense that you may find it in a significant pullback from a previous high if you try to liquidate it ad-hoc, especially short-term

So the US government funds & contracts OpenAI, buys 10% of Intel, gets a stake in NVIDIA and places Oracle to oversee TikTok

Then, these companies invest one into another

That’s a bubble within a bubble 🤯

silver's key short-term trend support is the green light from the chart

we can only talk about potential pullbacks or consolidations once it's broken

watch it closely 👀

expect silver to correct down by ≈18%

if the correction starts at the current level, that would bring the price down to ≈$36.22

but you may want to place orders above if you want to enter, somewhere from $37.5

gold moves up by ≈13% on breakouts, thus ≈$4000/oz gold in November 2025

this means that the current move would bring the gold price up to ≈$3978, which should happen at the start of November, around November 4th 2025

so far, gold has completed ≈6% of the current move - which means there's another ≈7% to move up from the current gold price of ≈$3715

this makes ≈$4000 the top of the next consolidation range. once that price is approached - expect a larger pullback, and potentially a longer consolidation phase, which could last ≈90 days. this means that after the top of the current move is hit (≈$4000) you may have to wait for another ≈3 months before a new all time high

it's important to note that the top of the target range is close to $4000, so gold may not cross $4K before the aforementioned pullback. this means that it may take gold another 4 months before gold firmly sits over $4000/oz

silver's current move is already up >25%. it's better to have a pullback somewhere around the current level

it can move up even further, extending the total move to ≈60%, but then you’ll get a larger and longer lasting pull back

when silver moves in smaller increments, it has shorter-lasting consolidations/pullbacks. so this is what i mean by "better"

real estate/land has been used as a store of value for as long as we have written records - at least 5000 years 😄

even 5K years ago lad had been owned, taxed, transferred, leased and used as collateral

physical space is limited and virtually everybody needs a house/shelter. this has been true for hundreds of thousands of years and it won't become a lie anytime soon

so yes, real estate/land will continue to be used as a store of value

US government's intervention into the private sector like with NVIDIA and Intel is negative for US equities long-term

it makes the stock market even more exposed to US government credit risk and the overall USD dominance

short-term the price goes up, but so does the leverage

lower interest rates means less attractive repo and deposit rates, thus expect more capital movement into assets, as the yields on MMF/deposits become less attractive

overall positive pressure on asset prices

for the next 3 years - gold, silver and real estate (real estate is more region specific) are great assets to hold

i'd be wary of US equities

while it's not the top yet and they'll still move higher - you need to be on the lookout the cycle top, which will manifest in some form in the medium long-term

in the next two years it's reasonable to expect a significant downturn in US equities, which may or may not be longer-lasting. it largely depends on the specific QE & other government policies taken to modulate liquidity and yields

so if you're heavily exposed to US equities, it's a good idea to monitor it closely, as there's a risk of a significant downturn

the biggest downside risk to US equities comes from FX, namely from the value and dominance of the US dollar:

➖ while a weaker USD is positive for cross-border USD credit/liquidity, it also makes imports more expensive for the US - and US is a net importer. increased import prices will put negative pressure on the whole economy, including publicly-traded companies

➖ less dominance/demand of USD will not only lead to less total USD abroad available to invest into the US equities, but also lead to the further development of non-USD financial markets because the capital that moves away from USD will need to get invested somewhere. China is the most obvious candidate to benefit from these developments, especially when it comes to equities and renminbi demand. i believe the EU is in a unique position to attract a lot of that USD-exiling demand, but that would require opening-up the markets and regulatory adaptations in that direction

$4000/oz gold by the end of 2025? yes, very much possible, but also beware of consolidation ranges which may extend for months

the remaining ≈50bps of rate cuts this year are very much in the process of being priced-in

moreover the USD isn't likely to strengthen significantly over the next 3 months

and additional liquidity will be injected from US, China, EU, Japan & others

all positive price pressure on gold

the question isn't wether gold will hit $4000 (it will!), but wether it will reach that price in the next 3 months. it could also settle in a consolidation range with the top just below $4K

remember that December is the tax year end pretty much worldwide, so balance sheets will be re-organized. US Treasury will also be running auctions on notes and bills every month until the end of 2025. and that collateral is needed by the wholesale debt markets/money market funds, so it will be bought up. these two could put downward pressure on the price of gold within the next 3 months

within the next 8 months gold will almost certainly reach $4000. so if it doesn't happen by December 31st 2025, it will be soon after

i'we written out my gold price thesis extensively in my previous posts, and closely followed the previous consolidation. you can read that to understand how to interpret data from price pressure, global liquidity and technical analysis standpoint

i will eventually cover these points in more detail, so stay tuned to future posts

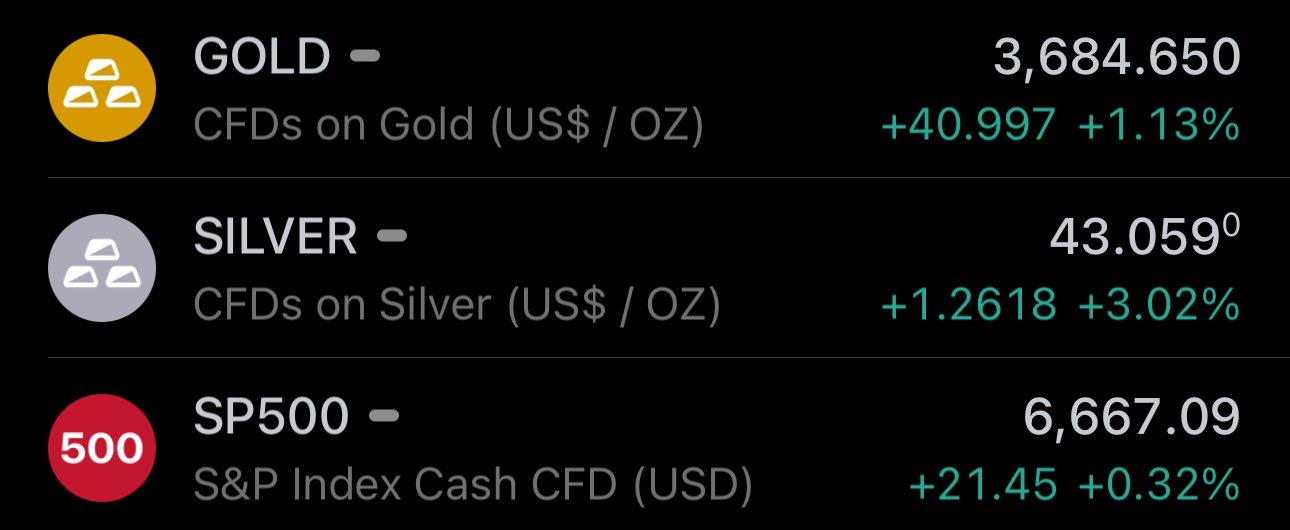

the market reacted exactly as I anticipated in a prior post

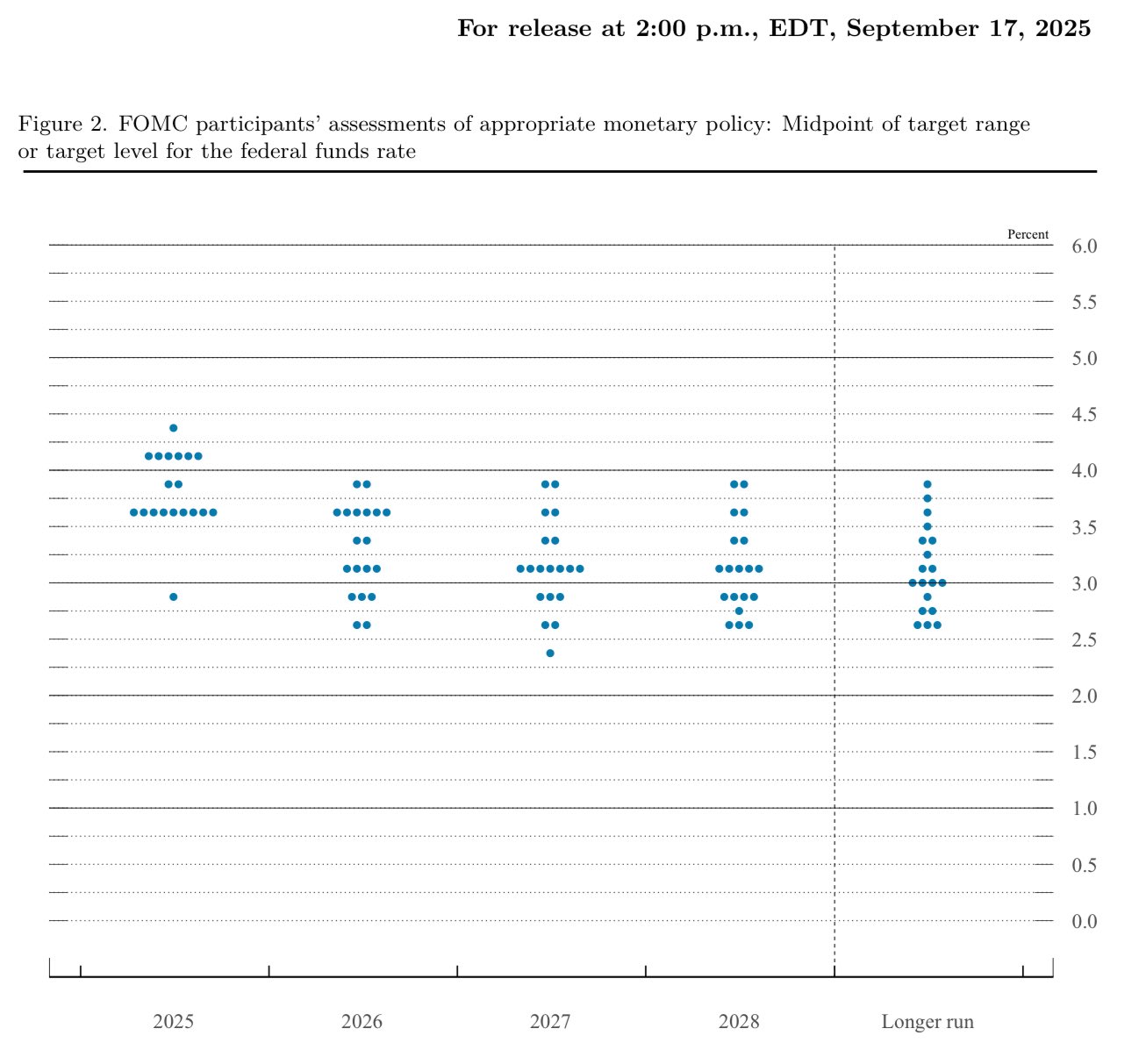

a lower median in the FOMC dot plot indeed pushed asset prices up. and you had plenty of time after the Fed's dot plot was published to enter into that leg

look at gold, silver and S&P500 😄

September 2025 FOMC dot plot suggests lower rates than in June 2025

the new implied median for end of 2025 is ≈3.6%, which is lower than the ≈3.9% June figure

this means you should expect the Fed to cut another 50 bps/0.5% in the next 3 months - likely in two 25bps iterations

but definitely expect volatility 😄

while the mortgage will eventually bubble pop/de-leverage to a significantly lower level, it's unlikely to happen within the next year or two, as many seem to suggest

as I've written here - there are still many tools that can push mortgage rates down shorter-term

while the mortgage will eventually bubble pop/de-leverage to a significantly lower level, it's unlikely to happen within the next year or two, as many seem to suggest

as I've written here - there are still many tools that can push mortgage rates down shorter-term

so as a takeaway: expect volatility within the mortgage rates in the US

➖ upwards pressure: financial downturns in other sectors, organic de-leveraging

➖ downwards pressure: QE, Fed facilities, government policies

so as a takeaway: expect volatility within the mortgage rates in the US

➖ upwards pressure: financial downturns in other sectors, organic de-leveraging

➖ downwards pressure: QE, Fed facilities, government policies

the US mortgage bubble will likely pop alongside other bubbles, due to a high degree of interdependence and correlation within the financial sector

the mortgage bubble can both, trigger and be triggered by burst of other bubbles

so you'll see a cross-border systemic downturn

the US mortgage bubble will likely pop alongside other bubbles, due to a high degree of interdependence and correlation within the financial sector

the mortgage bubble can both, trigger and be triggered by burst of other bubbles

so you'll see a cross-border systemic downturn

of course, that doesn't resolve the underlying supply/demand imbalance at the risk level implied by the leverage

so the bubble is still there, and eventually it will eventually pop

of course, that doesn't resolve the underlying supply/demand imbalance at the risk level implied by the leverage

so the bubble is still there, and eventually it will eventually pop

the same is true for government policies or programs - those are also likely to push mortgage rates lower short-term

at the very least, extended government guarantees synthetically reduce the risk - the US government is a more trusted backer than the issuer of the MBS

the same is true for government policies or programs - those are also likely to push mortgage rates lower short-term

at the very least, extended government guarantees synthetically reduce the risk - the US government is a more trusted backer than the issuer of the MBS

mortgage-rates targeted QE, such as the mass purchase of mortgage backed securities (MBS) by the Fed will drive the mortgage yields down short-term, but also further leverage that market sector in the process

mortgage-rates targeted QE, such as the mass purchase of mortgage backed securities (MBS) by the Fed will drive the mortgage yields down short-term, but also further leverage that market sector in the process

so expect a 2008 QE-1 style balance sheet expansion by the Fed targeting mortgage securities via OMO

there will also likely be additional government policies and programs, such as increasing the scope and volume of explicit government guarantees on mortgage securities

so expect a 2008 QE-1 style balance sheet expansion by the Fed targeting mortgage securities via OMO

there will also likely be additional government policies and programs, such as increasing the scope and volume of explicit government guarantees on mortgage securities

in the US, there's been a real estate bubble in the building since 1990's (pun intended). it was about to burst/de-leverage several times, but it was refueled via QE and government guarantees among others, thus delaying it