Illya Gerasymchuk

Entrepreneur / Engineer

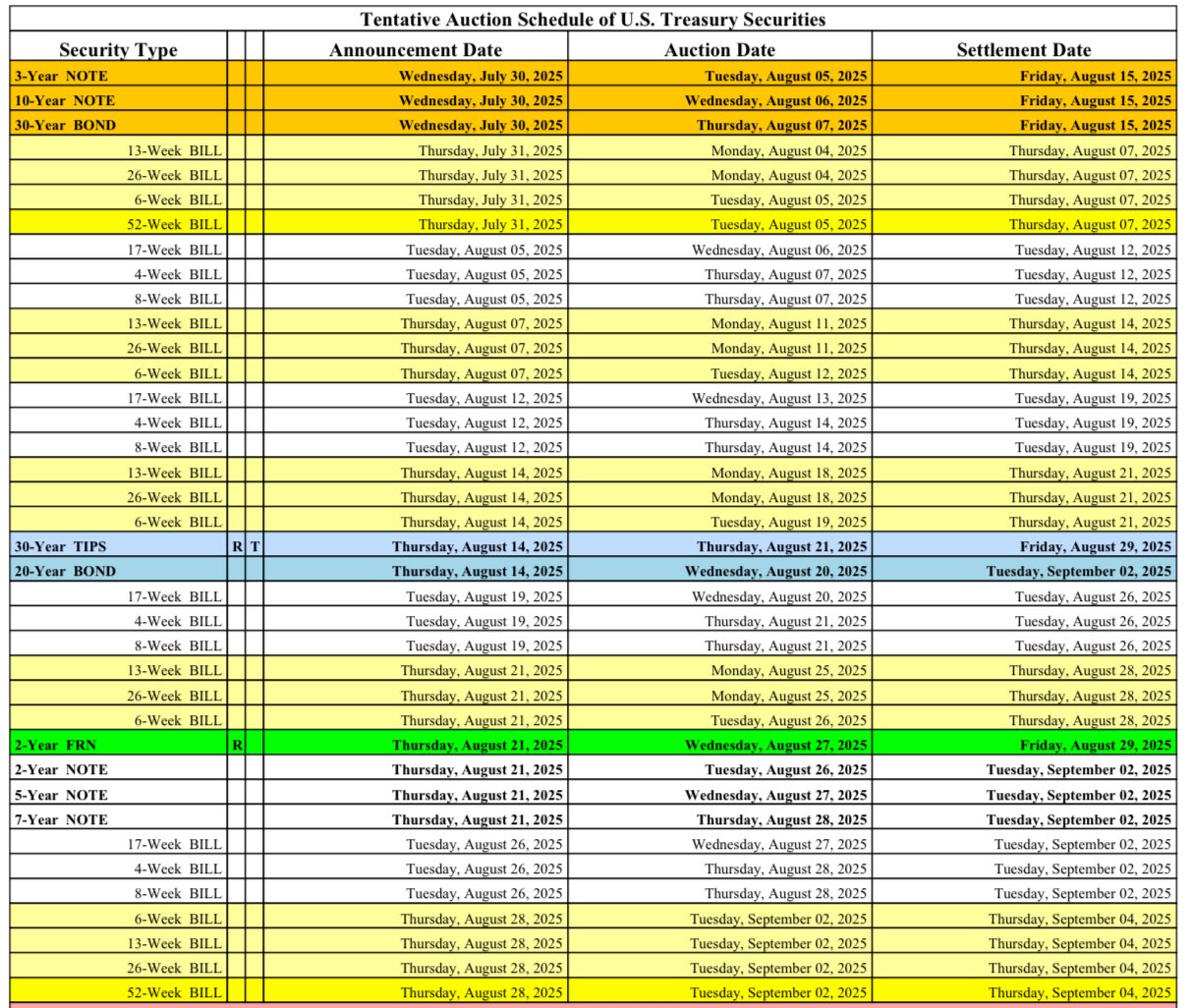

the US treasury is doing exactly that - issuing short-term debt to retire/repurchased long-term debt that's effectively refinancing longer-term debt with shorter-term debt. this shorter-term debt will also need to be refinanced, but now much sooner

this is why duration matching is key for financial institutions this is also the reason why it's generally not a good idea for governments to refinance long-term debt with short-term debt this shortens the duration of both - government liabilities and market's assets