Illya Gerasymchuk

Entrepreneur / Engineer

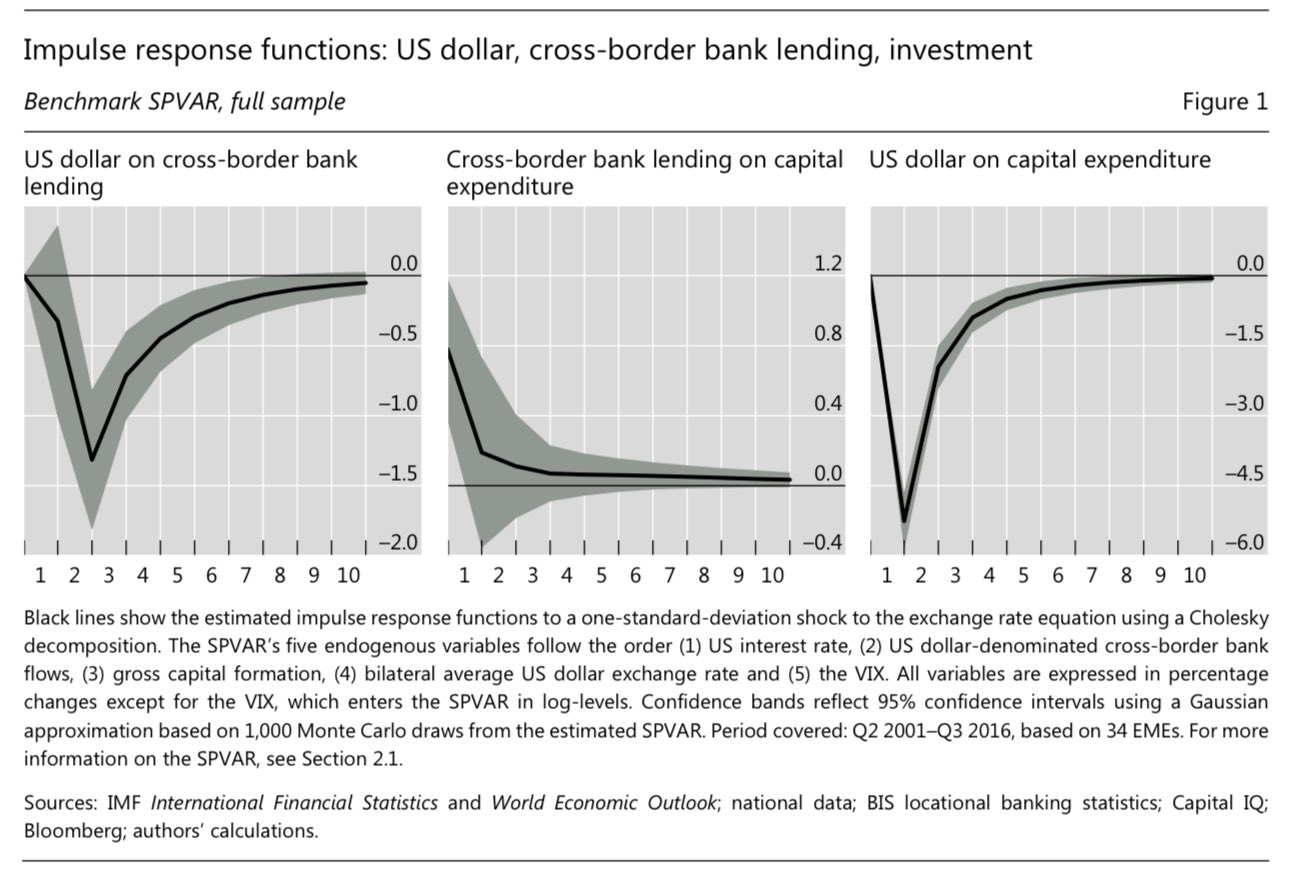

so a weaker US dollar tends to increase global USD liquidity in the SVAR, one standard deviation of US dollar's appreciation leads to a fall in cross-border USD lending. it reaches its bottom after 6 months and then eventually recovers after 2.5 years if no new shocks arrive

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD collateral here is the non-USD local currency, such as Yuan