China, yuan & PBoC macro analysis

Frequent insights on RMB policy, PBoC liquidity operations, capital controls and Chinese macro data.

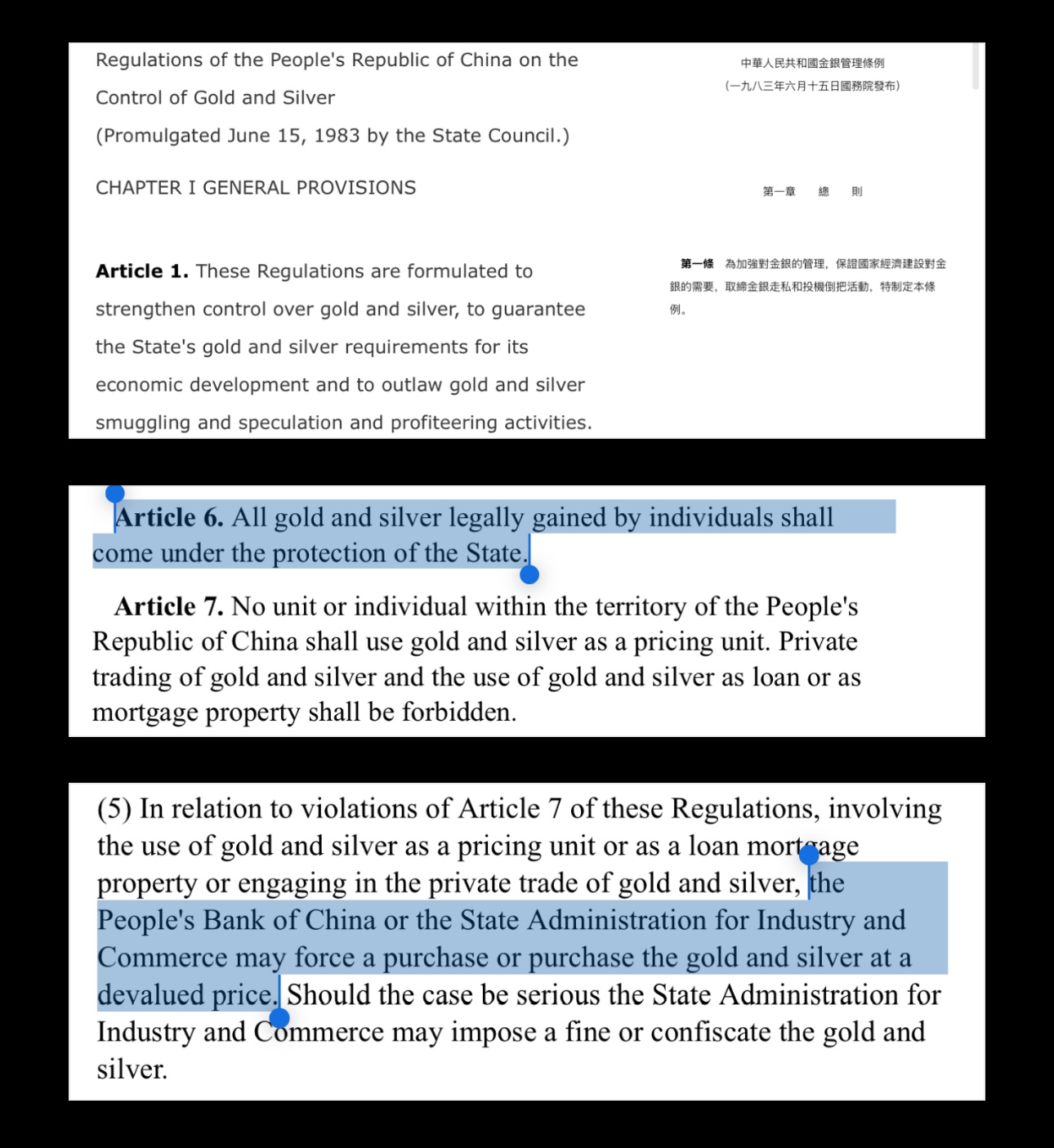

China Banned Gold & Silver As Money In 1983

While it remained legal to hold gold as an individual in PRC, you couldn't:

- Use gold/silver as money (unit of account/pricing)

- Trade gold/silver privately (you could only sell it to PBoC)

- Lend or pledge (use as collateral) gold/silver

- Act as a dealer of gold, unless authorized by PBoC

So effectively, as an individual in PRC, you could only sell your gold & silver through the PBoC system, but it was fully lawful to own those metals. Only if you violated the rules above, authorities could force you to liquidate your gold to PBoC at a discount over the spot price.

This is a big contrast with the gold ban in the United States via Executive Order 6102 in 1933, which required all persons to surrender/liquidate their gold coins, bullion and certificates to the state. Moreover, in 1933 the U.S. government credited you $20.67 per oz gold that you surrender. About a year later, the same government that forced people to liquidate their gold at $20.67, proceeded to raise the price of gold to $35 per oz (at that time the price of the gold was fixed by the government, not determined by market price action like today). So the U.S. government made an instant ≈70% profit on the public's gold.

China Also Banned Gold & Silver In 1983

But unlike in 1933 in the U.S., there was no global ban on the public owning gold & silver. The public was however not allowed to use it as money, collateral, lend it or trade it. Everything gold/silver related had to go through PBoC.

I'll cover this in more detail in a future post.

Maybe, just maybe the EU will start swapping their USD-denominated reserves for gold and (at least eventually) renminbi 😉

In my post ranking gold as a percentage of central bank balance sheet size I wrote renminbi/yen, when I meant renminbi/yuan

Yen is, of course, the Japanese, not PRC's local currency. I will correct this under threads & thoughts on my website, but it will remain with this typo on X (you can't update the post after 1 hour)

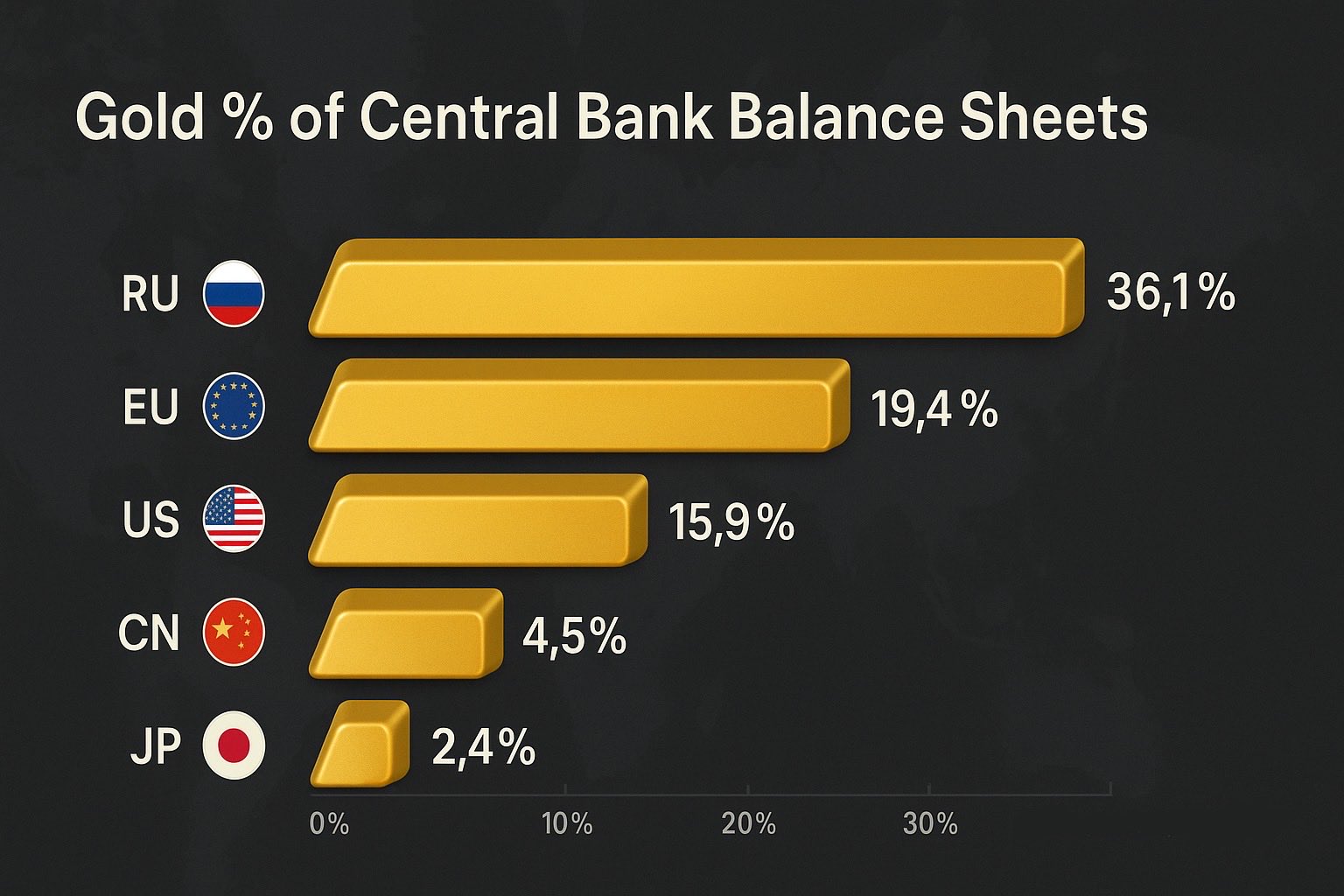

Gold as a percentage of balance sheet size in Central Banks (ranked):

🇯🇵 Japan (MoF + BoJ): ≈2.4%

🇨🇳 China (PBoC): ≈4.5%

🇺🇸 U.S. (Fed gold certificates): ≈15.9%

🇪🇺 European Union (ECB + Eurosystem): ≈19.4%

🇷🇺 Russia (BoR): ≈36.1%

All of the above will expand their balance sheets, but it's mostly China & Russia actively buying more gold.

Conclusions you can take from here:

➖ China's gold holdings are relatively small when compared to their Central Bank's balance sheet size, and given their efforts to promote renminbi as the invoice currency worldwide, you can expect PBoC to continue their gold purchases for the medium-long term. The gold share must at least double to come close to the current reserve currency - the U.S. dollar. All reserve currencies started on a gold and/or silver standard - and the pressure towards this direction won't be different for renminbi/yuan. When the USD became the world reserve currency with the Bretton-Woods agreement - gold certificates accounted for ≈40% of the Fed's balance sheet.

➖ Russia has built up a massive balance sheet capacity for the future. Once the international trade markets with Russia re-open, there will be a plenty of reserves to back-up a massive wave of Ruble credit. Expect Russian capital markets to rally then.

➖ European Union has a healthy relative position. Given that the Euro is currently the closest alternative to the U.S. Dollar - it's a good idea to both, expand gold reserves and promote capital markets. The latter is an explicit goal via the Capital Markets Union (CMU). Given that EU will further expand the balance sheet, it's necessary to increase the gold reserves - repricing won't be enough. Gold will make Euro more attractive, and with it the FX holdings of Euro by sovereigns.

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

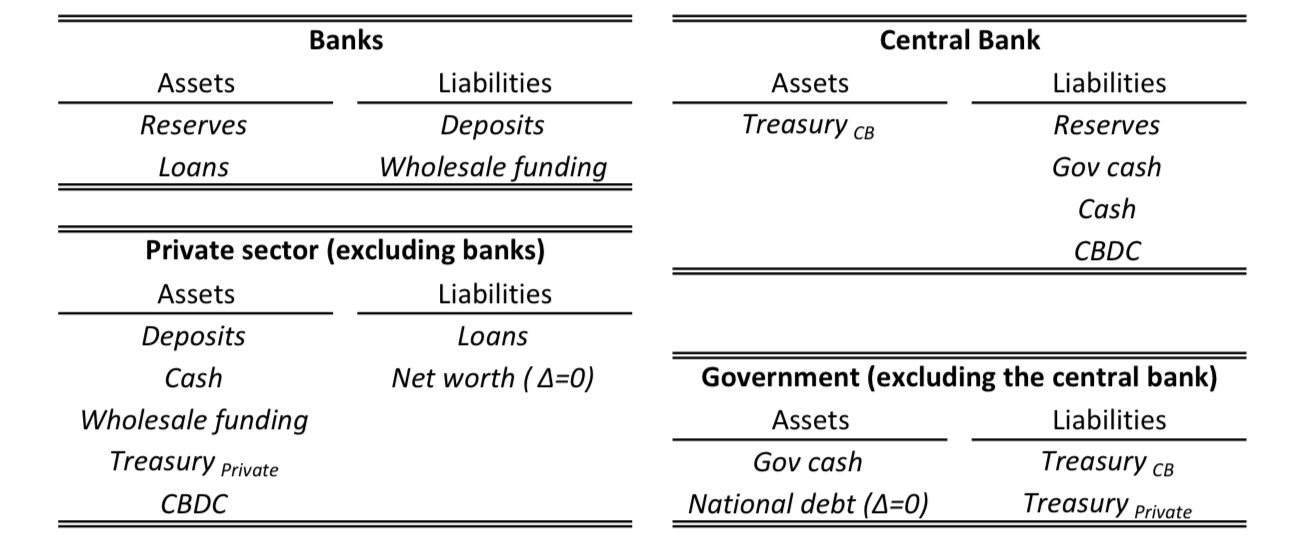

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

retail CBDC is the digital version of currency - a liability of the central bank in the balance sheet

retail CBDC will be used for day-to-day payments, similar to the ones you do with with a credit card. this is the type of CBDC you can use for business and consumer transactions, such as paying for a supermarket purchase

retail CBDC is central bank money, so converting bank deposits into digital Euro changes the composition of the monetary base - fewer commercial bank reserves at the central bank, more central bank CBDC liabilities

retail CBDC conversions settle in reserves

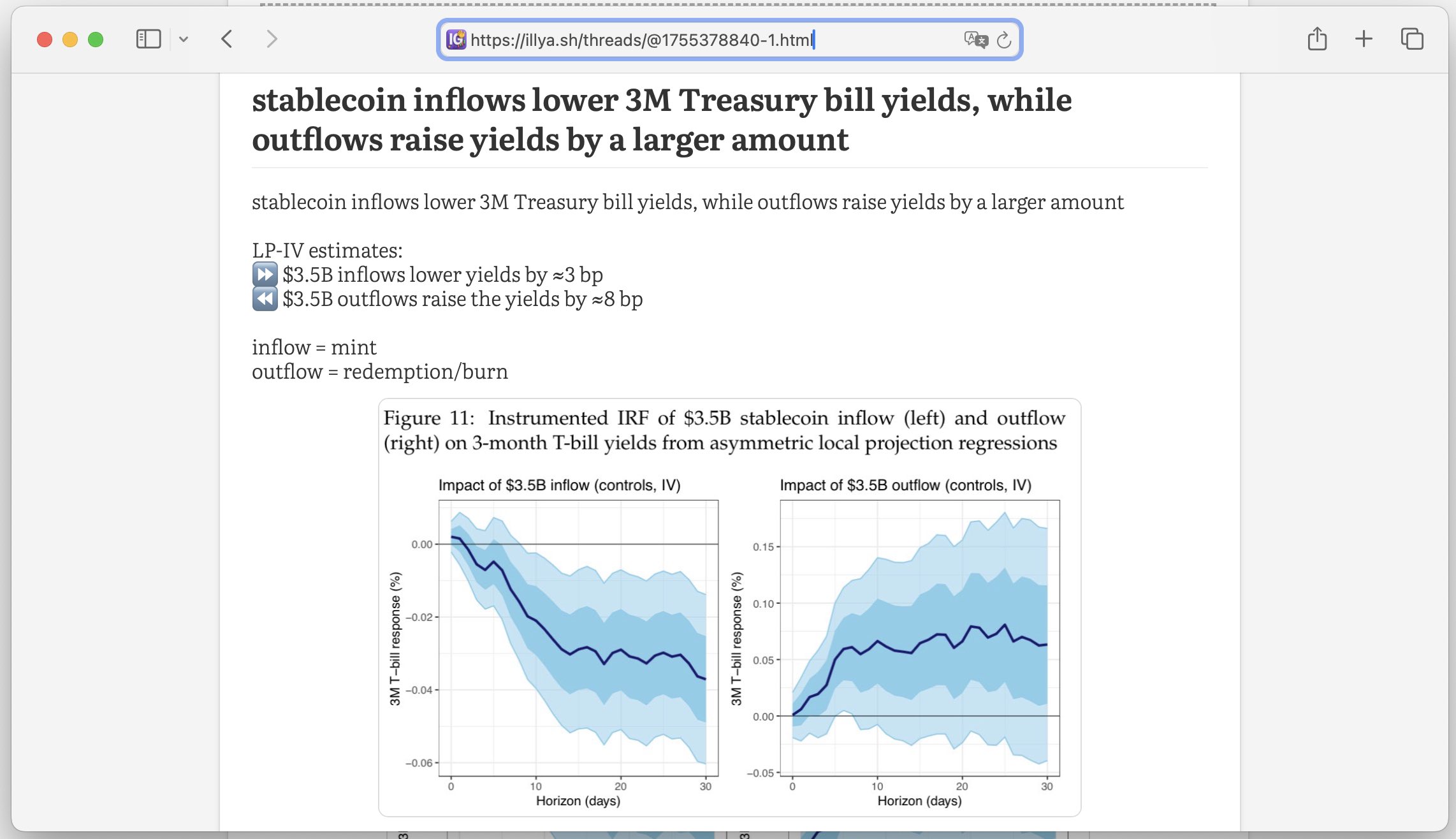

🇨🇳 China is considering Yuan-backed stablecoins, which will lower short-term CGB yields

that's assuming the stablecoin issuers will proxy short-term government bonds, like in the US

i wrote a thread explaining that. you can read it here: https://illya.sh/threads/@1755378840-1.html

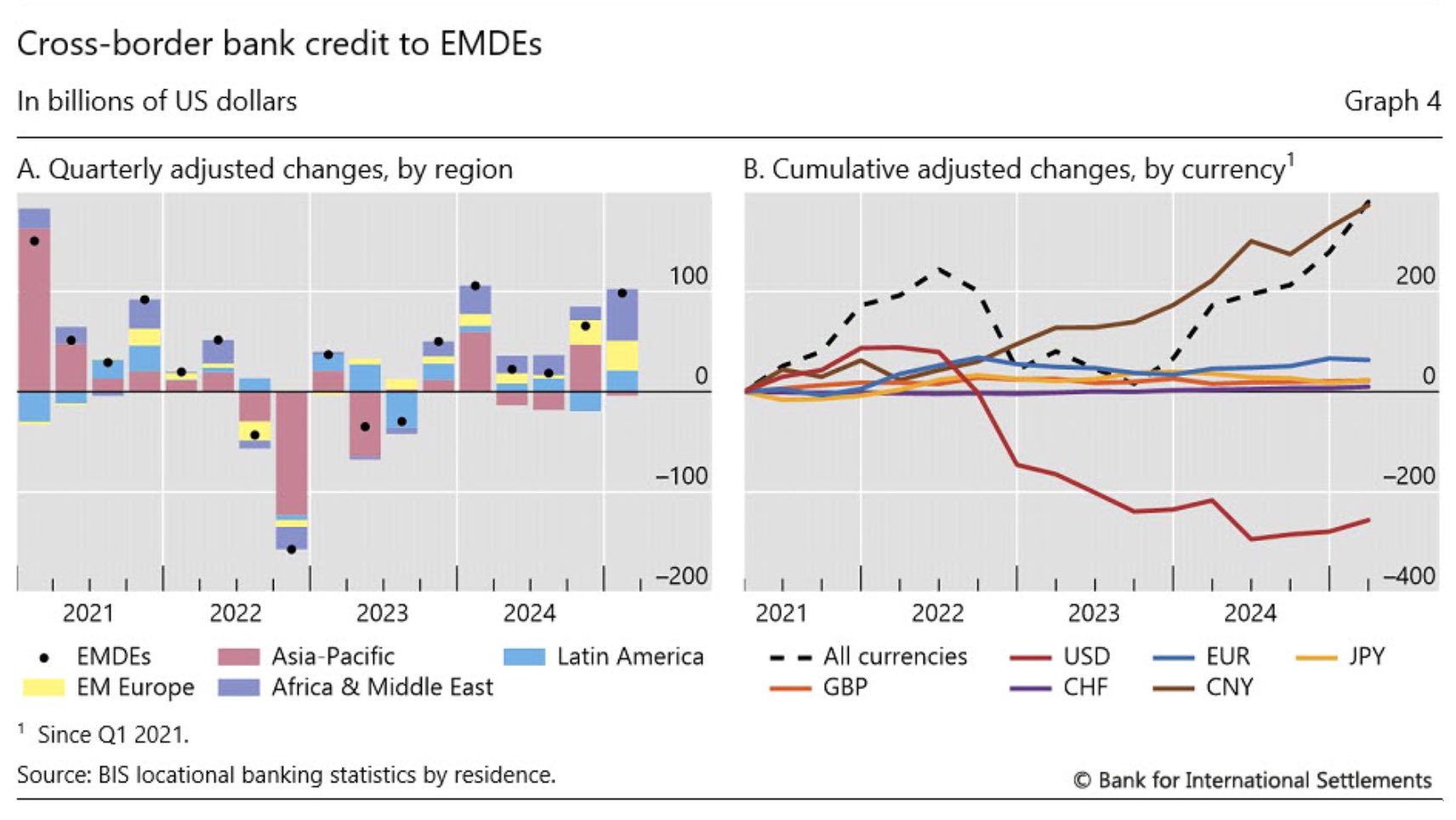

renminbi has become dominant in credit growth since 2022

a move from US dollar & Euro denominated credit to Chinese Yuan-denominated credit

in Russia, besides the Bank of Russia there's also the National Wealth Fund (NWF), which is operated by the Ministry of Finance

in China, there's policy banks, such as China Development Bank which are supported by PBoC's facilities

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

still, in the USA the Fed continues to dominate in importance

🇪🇺 ECB's "business model" is as follows:

➕ income: ECB creates money and invests it into financial assets (e.g.: FX, bonds, funds)

➖expenses, such as operational expanses (e.g. staff), facility and open market operation expenses (e.g. TARGET)

profit/loss = income - expenses

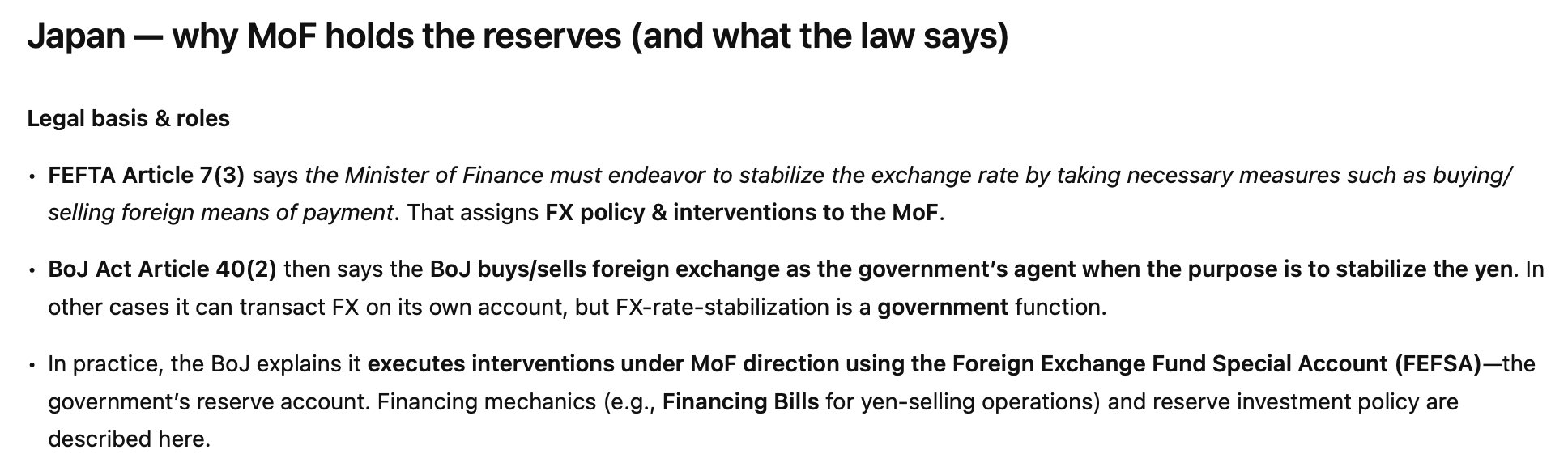

🇯🇵 Yen's exchange rate stabilization is a responsibility of the Minister of Finance (MoF)

MoF is also the holder of Japan's international reserves - not the Bank of Japan

so in Japan the government has significant responsibility for USD/JPY

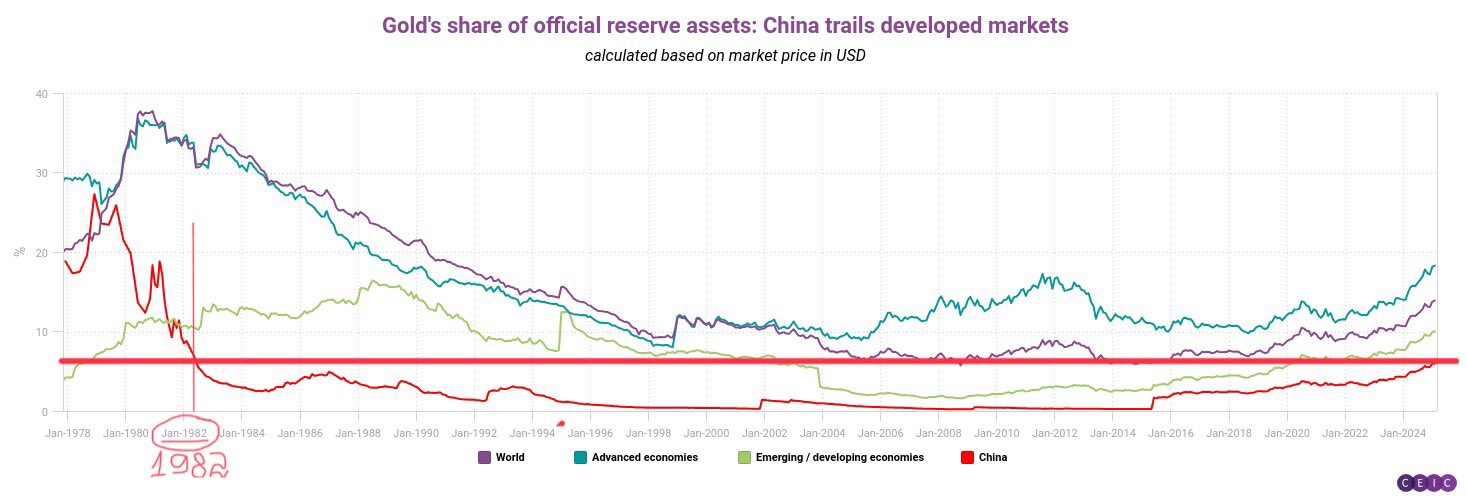

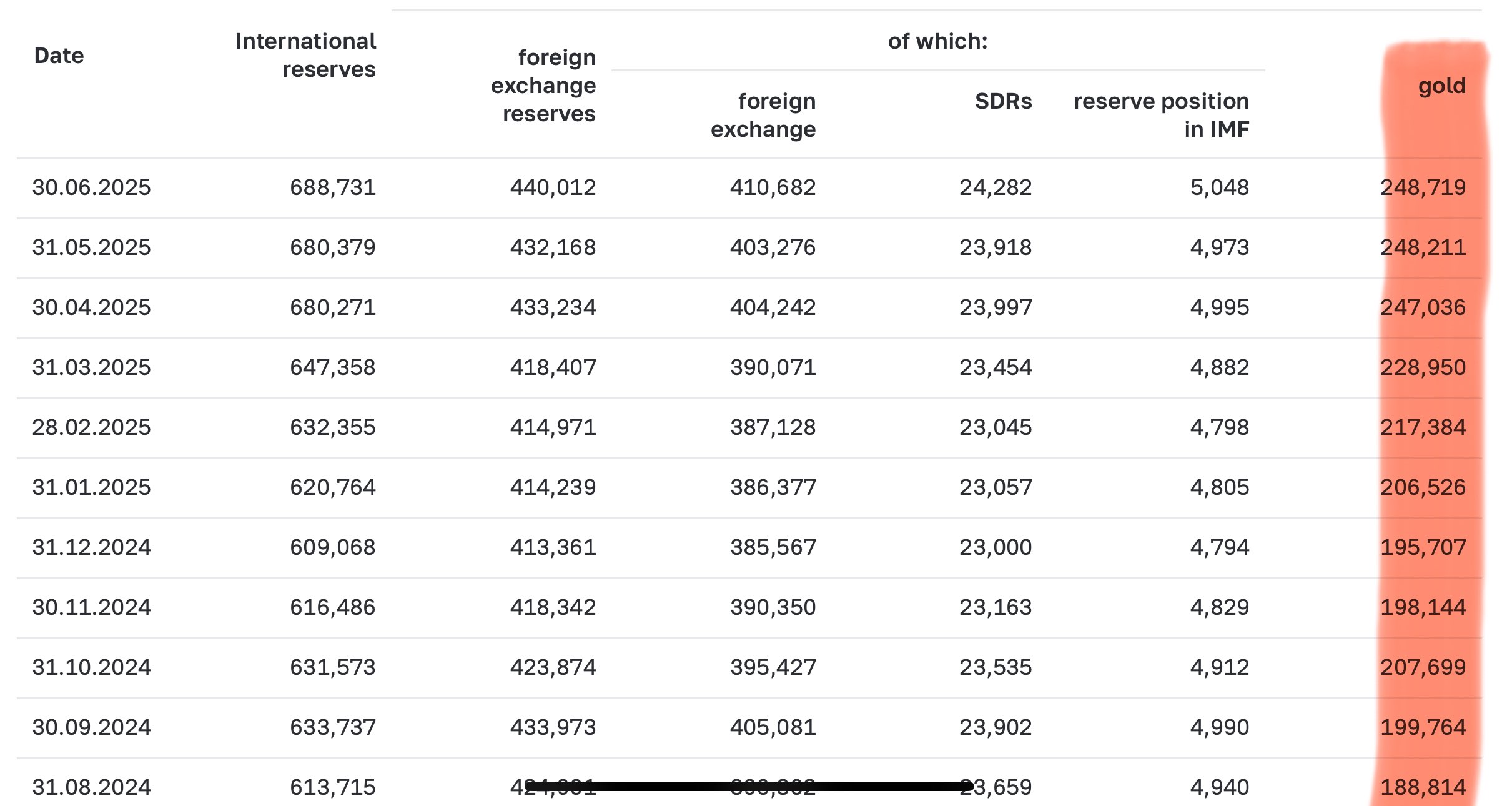

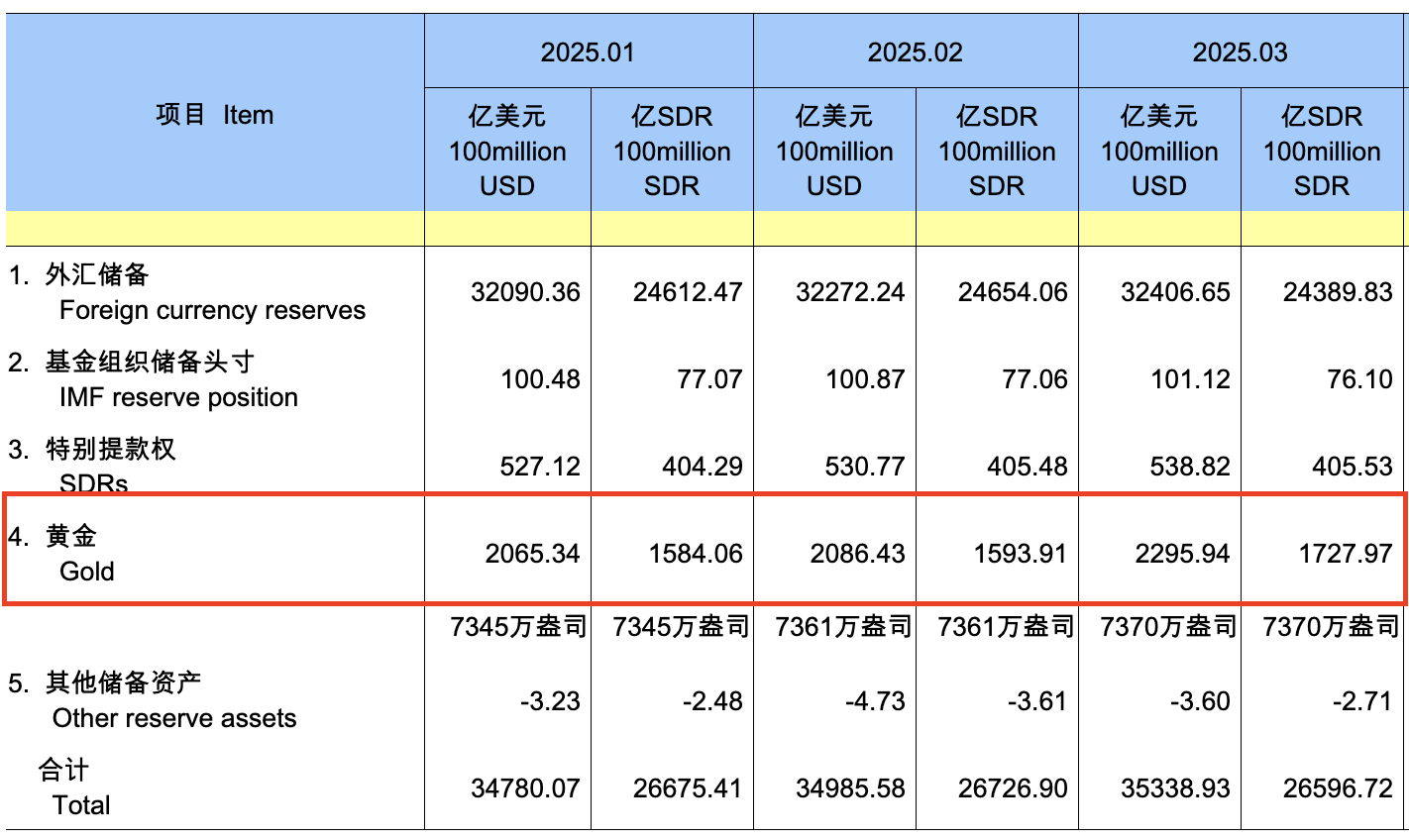

🇨🇳 China's gold holdings are at their highest level in 43 years

gold is now 6% of PBoC international reserves. but that's still below the world average of ≈14%. expect that gap to continue to shorten further

see my drawings on this nice chart spanning over 47 years i found

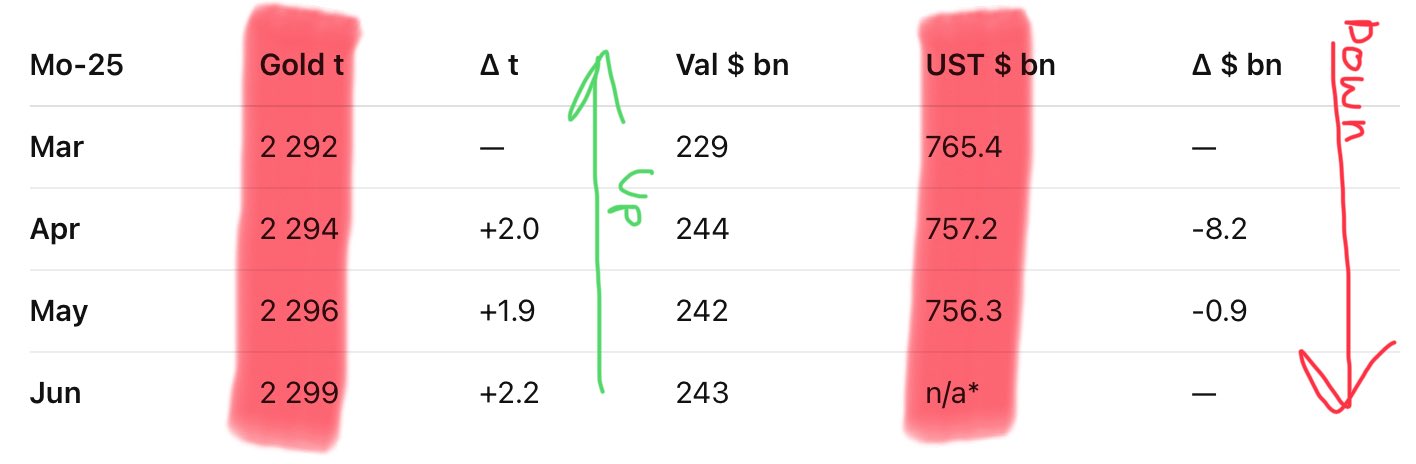

both Russia & China increased their gold holdings since I wrote this 😄

indeed - central banks are continuing to buy the gold dips

China sold US treasuries and bought gold - just like I wrote over 3 months ago

gold now accounts for ≈6% of PBoC international reserves, while US treasury holdings are ≈40% from their peak in 2013

off-ramp from USD debt to alternative assets continues its progress

👉 Digital Money ≠ E-Money 👈

🏦 Digital Money - claim on central bank money recorded on a public ledger. A form of public money. No credit risk. Think CBDC

💳 E-Money - claim on commercial bank money. A form of private money. Has credit risk. Think PayPal balance

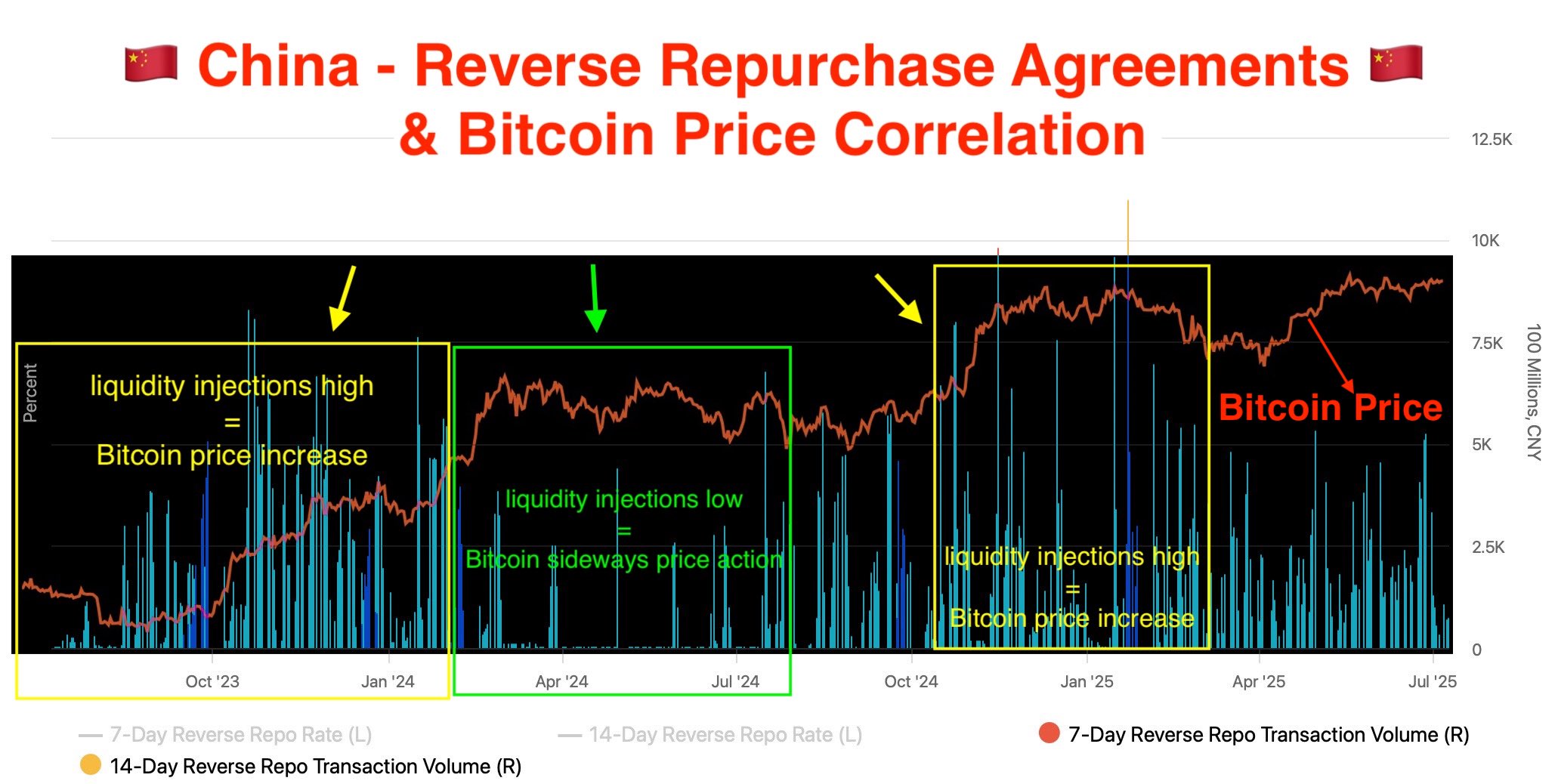

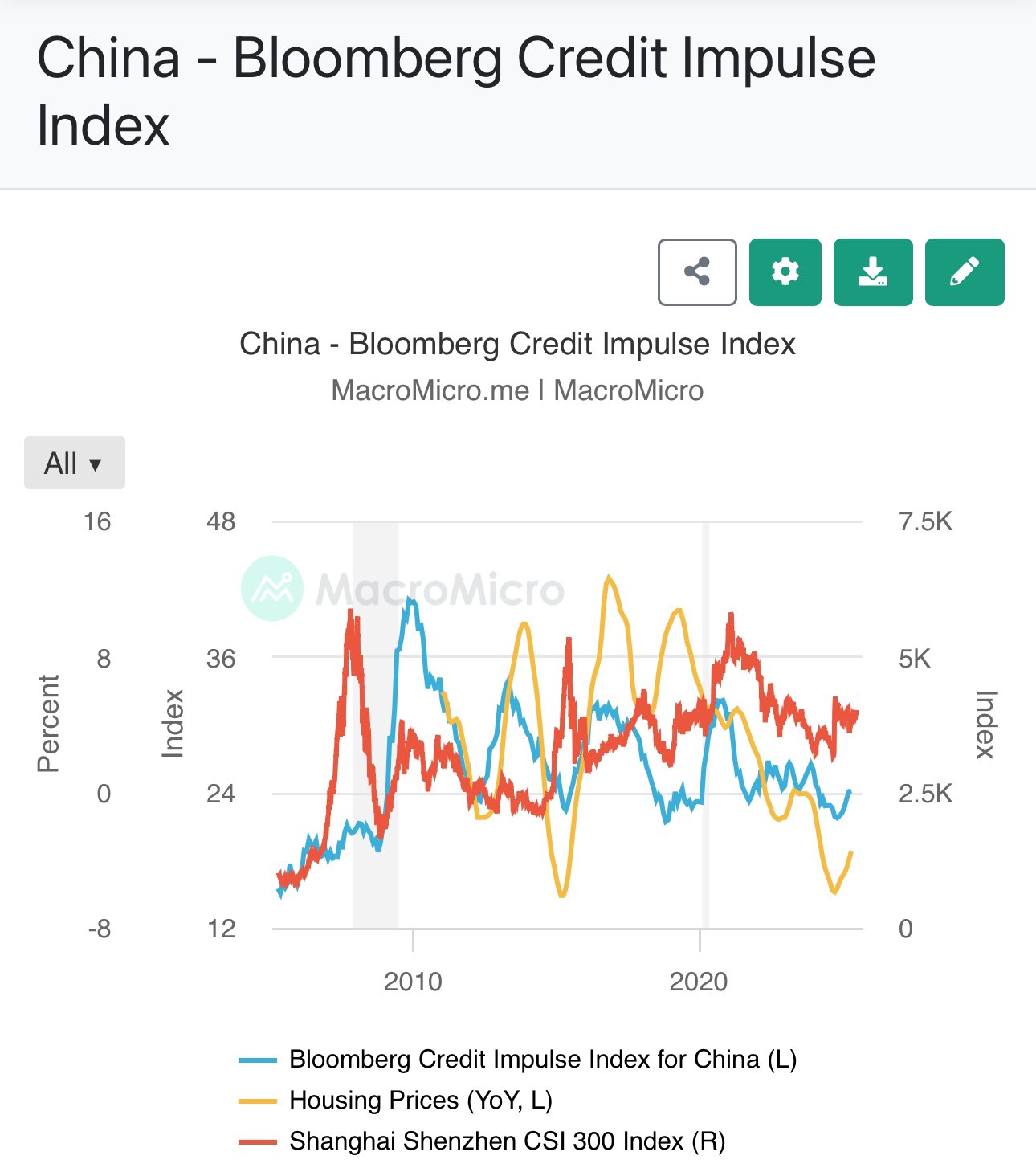

🇨🇳 China's reverse repo liquidity injections predict Bitcoin bullruns

it works like this:

📈 high PBoC injections = increasing bitcoin price

📉 low PBoC injections = sideways or decreasing

so every time China injects Yuan/reminbi, BTC price goes up 😁

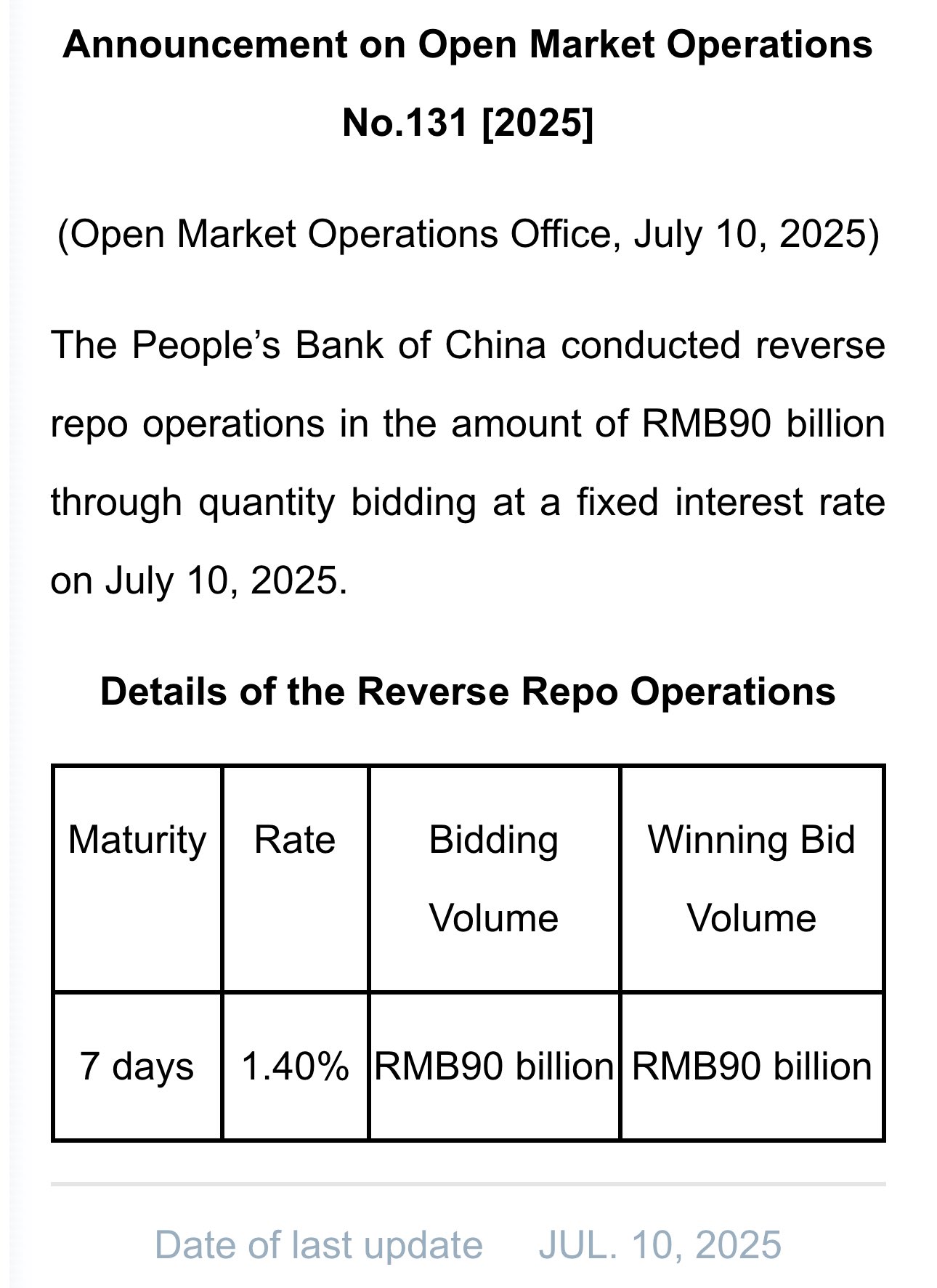

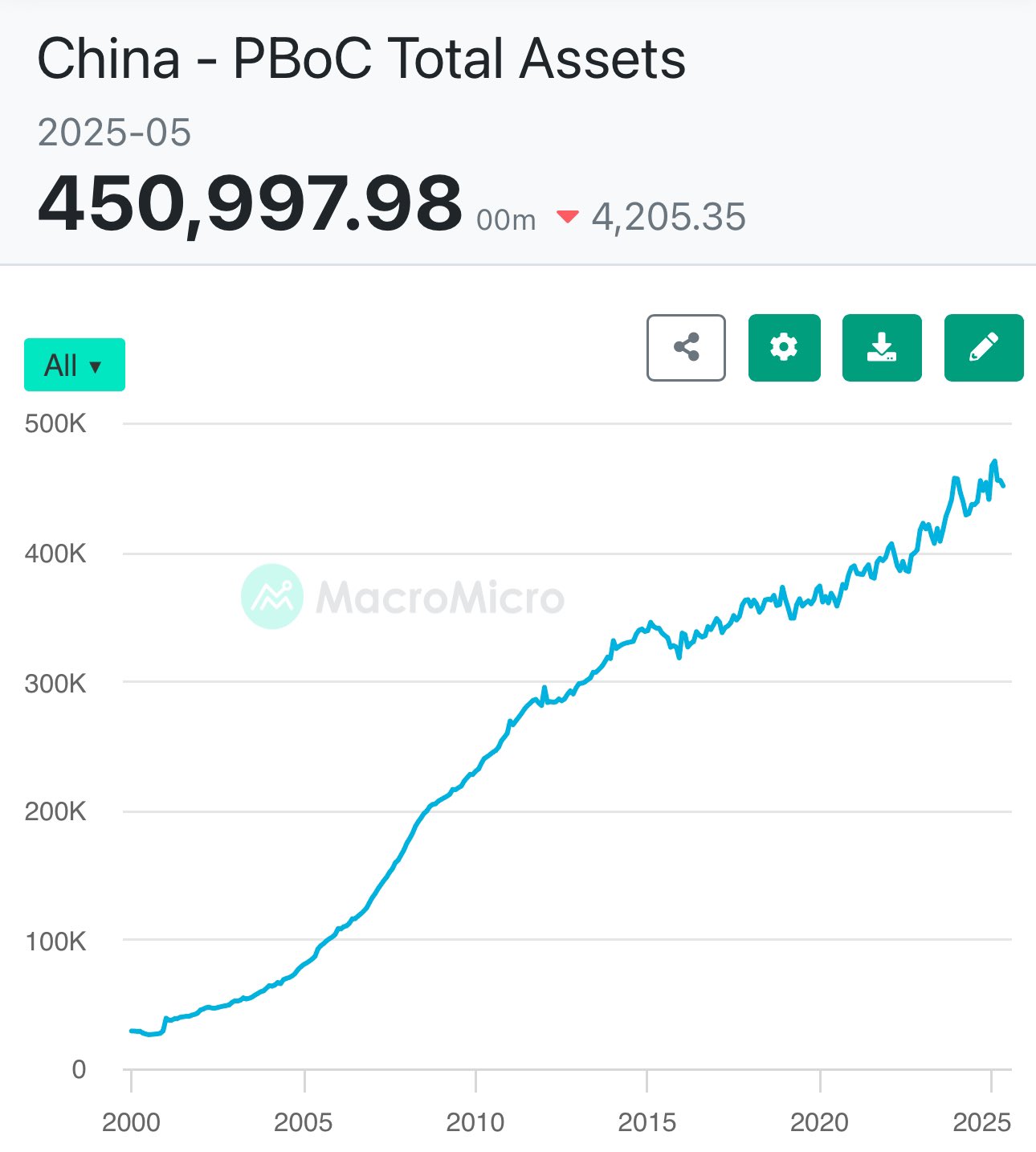

🇨🇳 PBoC provides commercial & policy banks with liquidity via reverse repo open market operations

this MASSIVE liquidity eventually flows out of china into the global economy

so it has a very direct effect on asset prices wherever your are 😄

🇨🇳 china injects liquidity mainly via reverse repurchase agreements

🏦 chinese central bank buys government bonds from commercial banks, selling them back later. this new cash is re-invested yielding a spread

💹 essentially, they allow banks to earn a yield on their bonds

🇺🇸🇨🇳 USA & China are the global liquidity drivers in financial markets

since 2000, each injected ≈$6 trillion of public money into markets. that's ≈40% of global liquidity 🤯

in 2025 - China is leading with injections

weaker USD + FED rate cuts & QE allow China to print Yuan/renminbi without a capital runoff

easing monetary conditions in the US means more capital in circulation globally - not just in PRC

thus, relative inflation is kept under more control

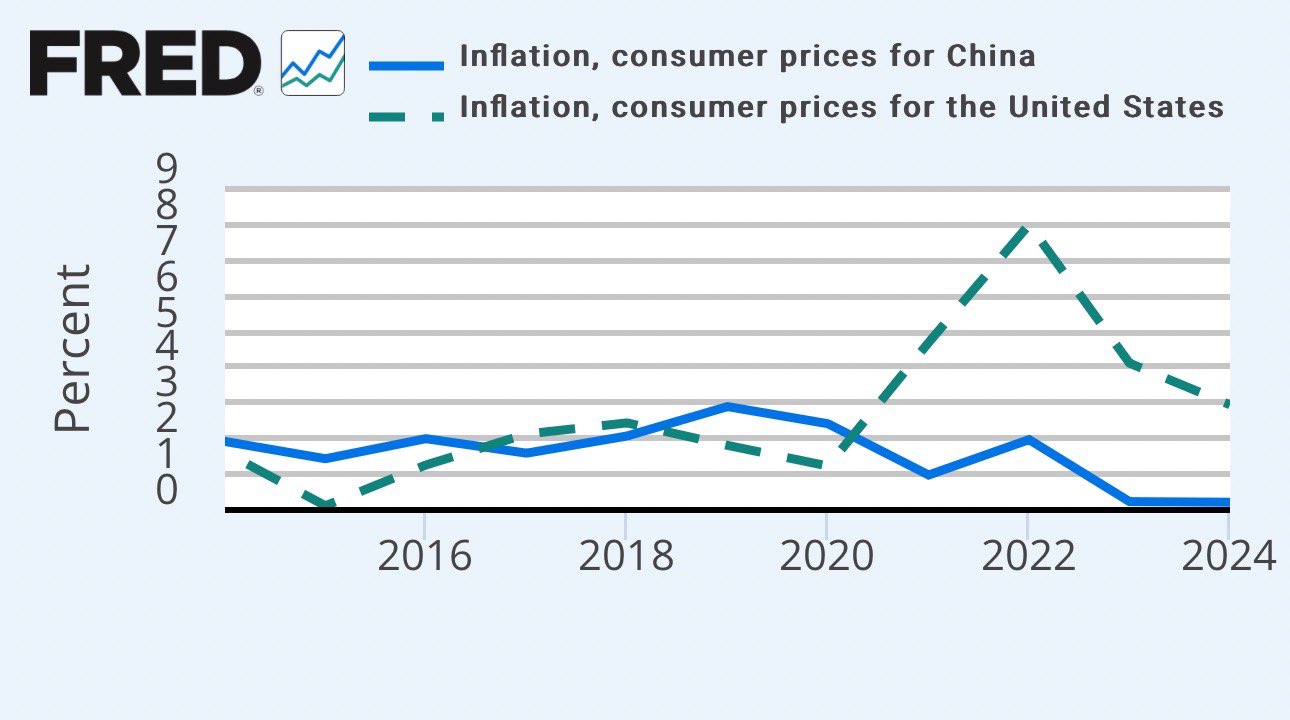

🇨🇳🇺🇸 china's CPI is below US's ⬇️

🇨🇳 china's central bank uses USD value as a key driver in economic policies

the monetary easing policy is adjusted by PBoC based on the dollar's trend - up or down

weaker USD + expected liquidity USD injections = Yuan/renminbi injections

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

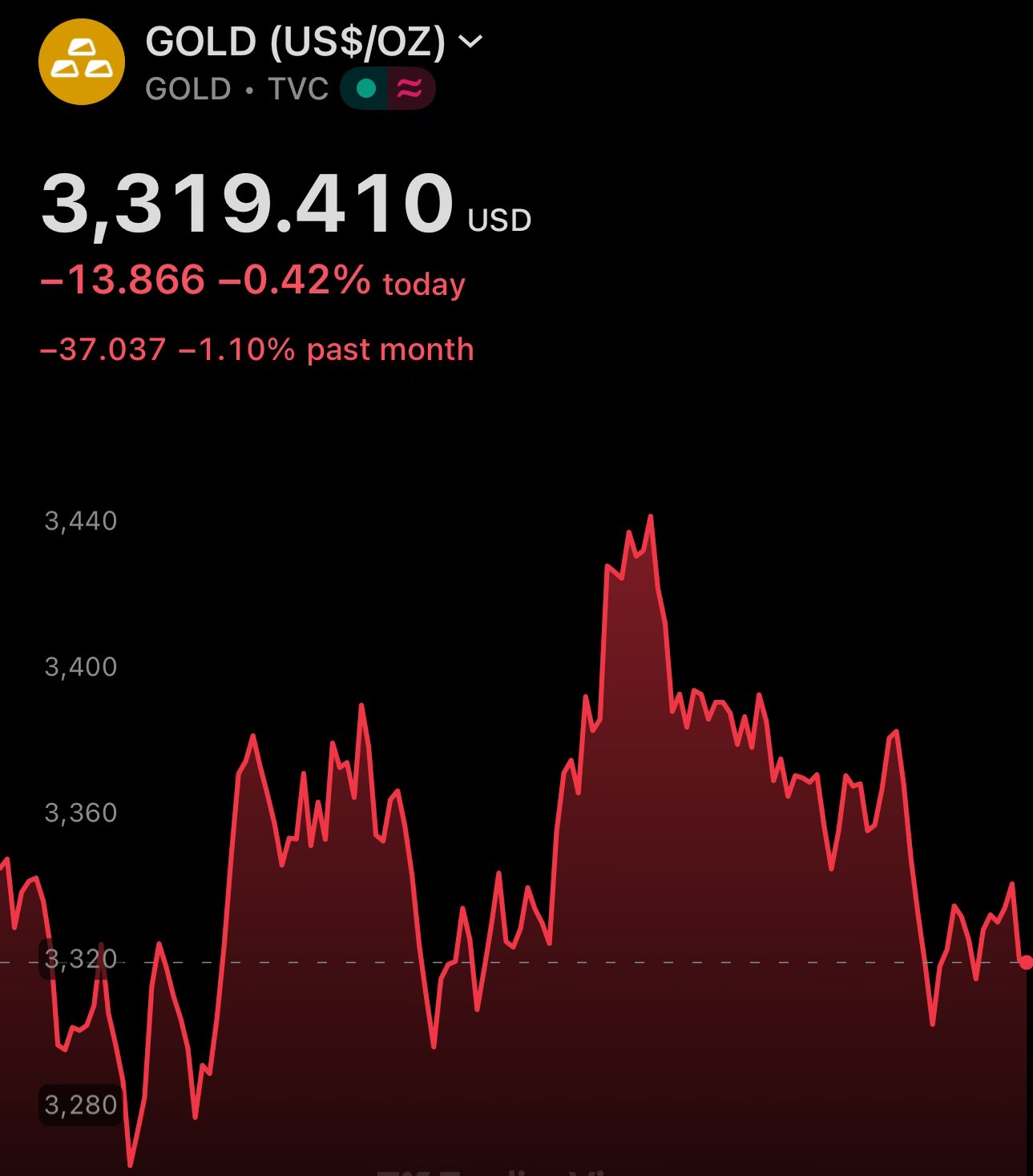

this means inflation & gold up

at least short-term: equities up, crypto up

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

(re)monetization of gold is already in progress

central banks have been consistently buying gold for many years

this is especially true for Russia & China