⬇️ My Thoughts ⬇️

🔑 The power of Ordinal Theory: Collecting, trading, and scheming!🤝 By assigning identities to satoshis, they become individually trackable and tradable for numismatic value. Plus, it enables inscriptions: a protocol to attach content to satoshis! 🎨🔐

🛠 Does Ordinal Theory require a side chain, separate token, or changes to Bitcoin? NO! It works right now with only bitcoin as the token, making it a seamless addition to the ecosystem.🌱🔄

🛠 Does Ordinal Theory require a side chain, separate token, or changes to Bitcoin? NO! It works right now with only bitcoin as the token, making it a seamless addition to the ecosystem.🌱🔄

🤔 What is Ordinal Theory? It's a protocol for assigning serial numbers to satoshis, the smallest unit of a bitcoin, and tracking their transactions. Imagine giving each satoshi a unique identity, like a collectible item! 💎🔗

🤔 What is Ordinal Theory? It's a protocol for assigning serial numbers to satoshis, the smallest unit of a bitcoin, and tracking their transactions. Imagine giving each satoshi a unique identity, like a collectible item! 💎🔗

🚀 The Bitcoin Ordinal Protocol Explained: an innovation which allows for tracking, trading, and collecting digital assets on the Bitcoin network!

⚡️Powers BRC20 & SBC20

💥 Let's dive into this fascinating protocol and explore its significance Blockchain Crypto

(a thread 🧵)

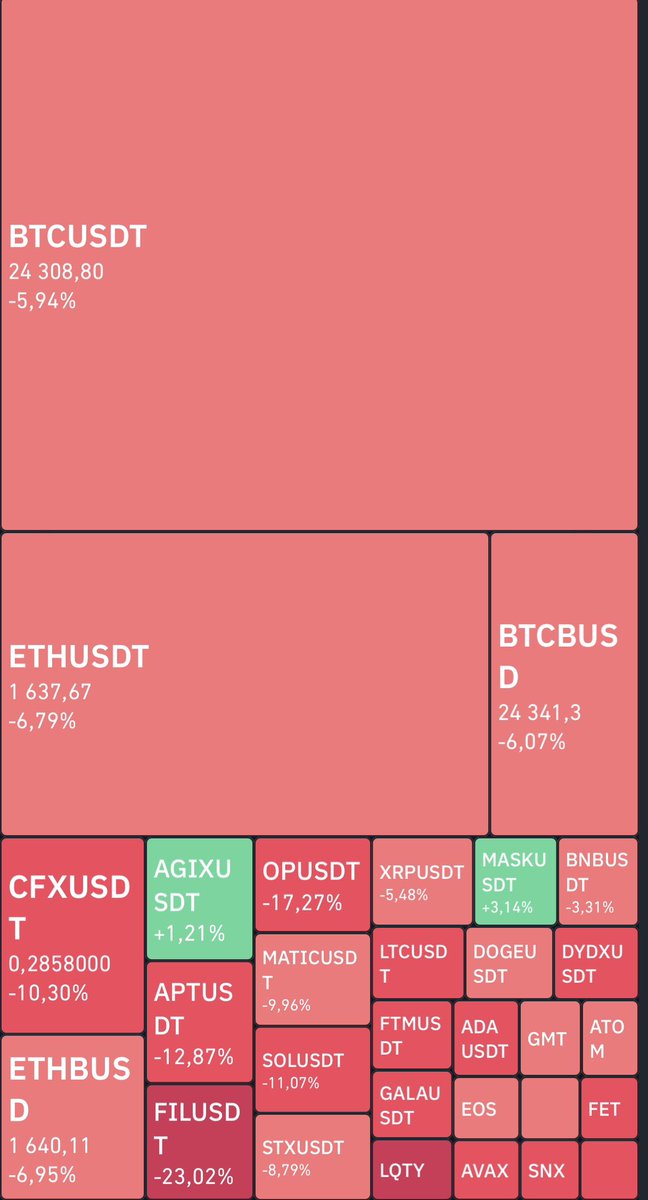

🚨📈 #Crypto DOWN‼️

Exactly as I pointed out yesterday

💡Markets are very easy to predict, you just have to listen at what they're saying

Always remember: #DeFi on-chain data is your friend

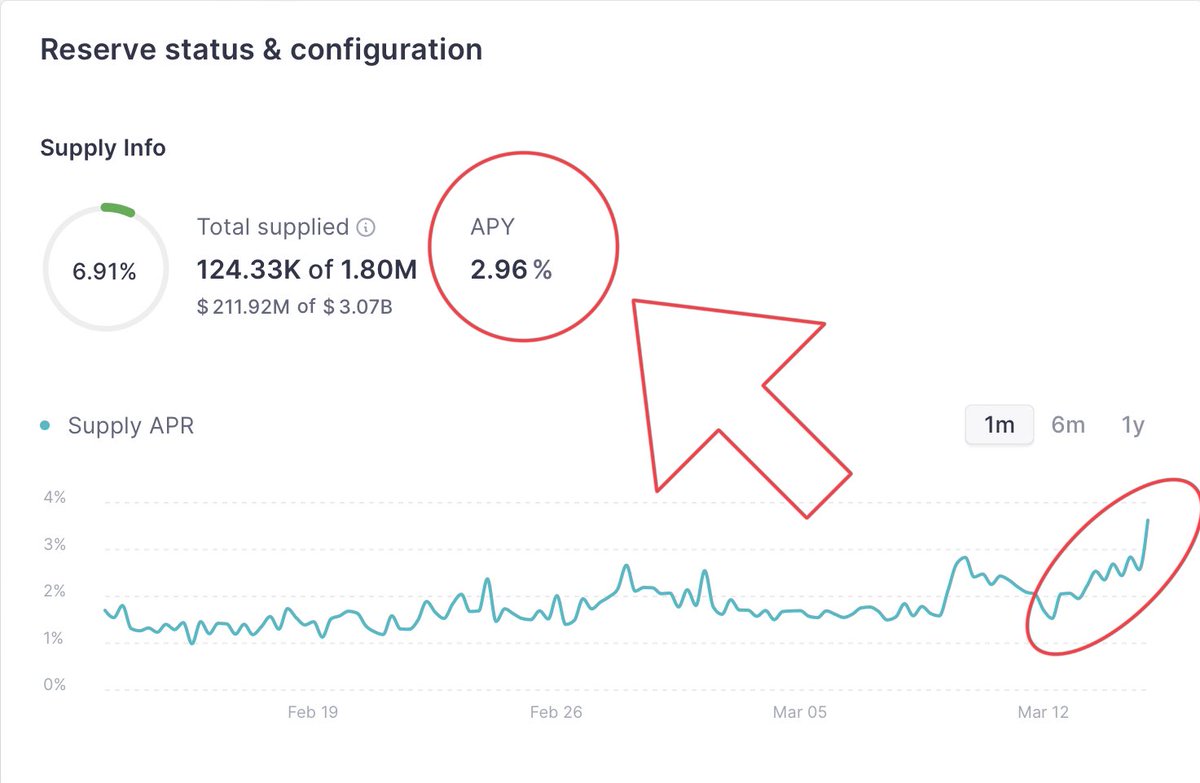

🚨📈 FIRST INDICATION OF #CRYPTO DOWNTREND

$ETH supply APY at 3% on #AAVE, the highest value this month

🩳The market is starting to short $ETH

💡REMINDER: Unfollow everyone saying that #Bitcoin is in a #BullMarket, as they have no idea what they are talking about

🚨📈A bounce back into the upper part of the previous weekly rectangle is NOT a #BulMarket signal

#Bitcoin will fall back down. So will the rest of the #crypto. Lower than previously

Prepare your #shorts

🚀 #Bitcoin #BullMarket CONFIRMED

🚨 You MUST unfollow every single person saying that Bitcoin and #crypto entered a bull market, because they have no idea what they are talking about

➡️I challenge anyone to show me a single sign of reversal. There is none #TA

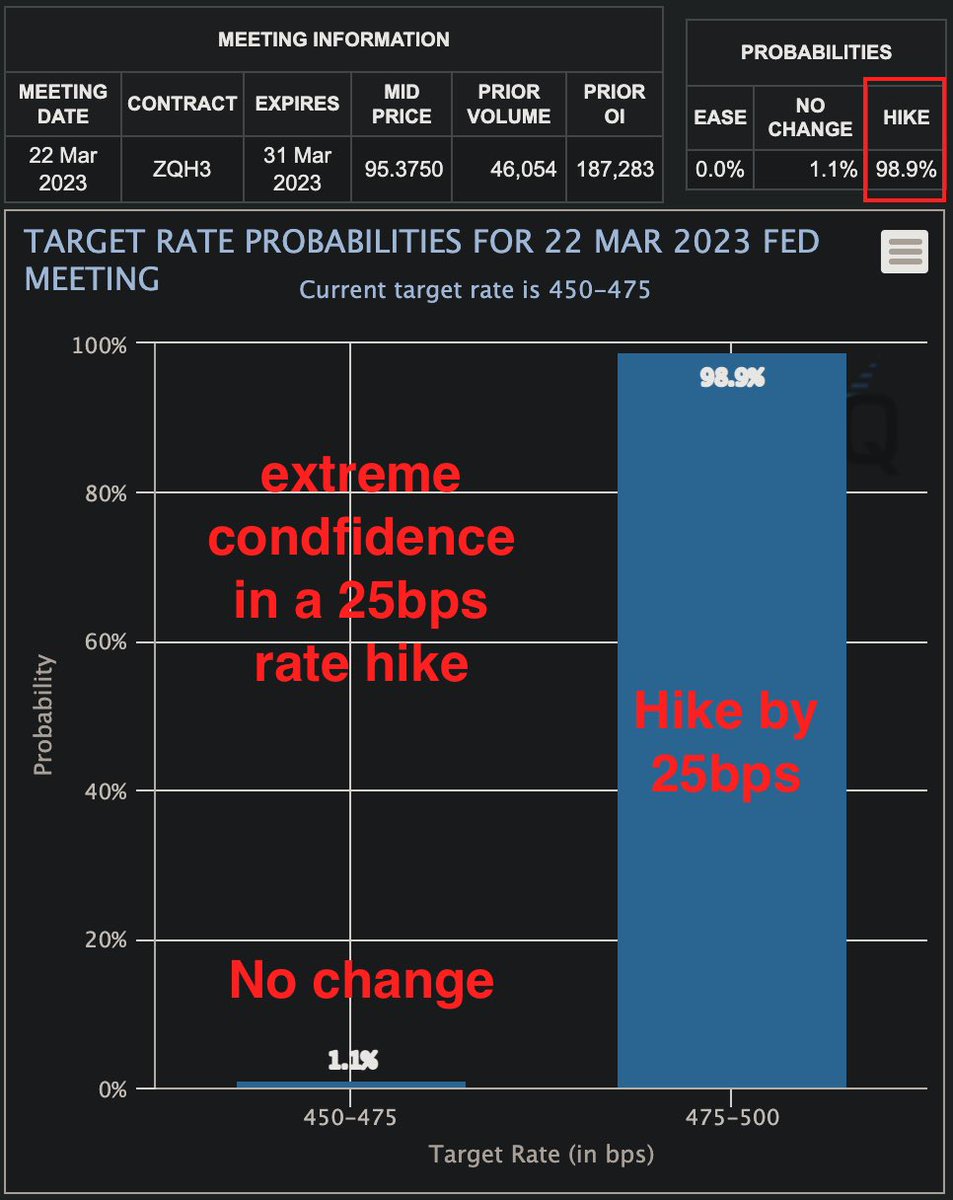

🚨📈 The failure and the bailout of $SVB and $SIVB has shifted the market's sentiment towards the #FED Funds Rate

A rate hike now seems less likely

🚨 Despite the Goldman Sachs's statement regarding rate hikes and bank bailouts, currently the market is fully expecting a rate hike by 25bps

Although things may change, specially with the Biden's speech

In either case, QE is not yet back, so no bull market for #Bitcoin

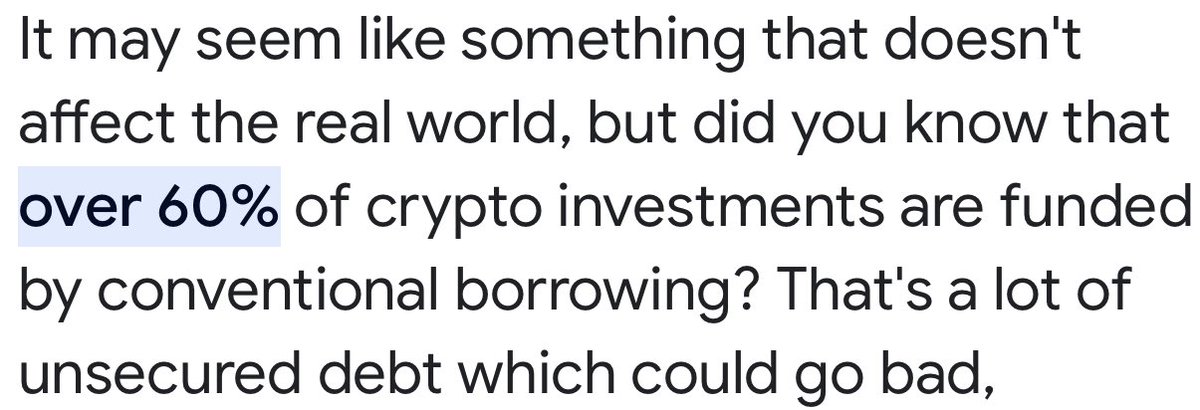

Failing banks will tank price of #Bitcoin down with them, because most of money in Bitcoin are loans from those same banks

🚨 $PAXG is trading at an $80 premium over gold

The market sentiment is clear: there is a run from #crypto into #gold

Selling your cryptocurrency for $PAXG is a good hedge against both, #Bitcoin and $USD

You can always buy it back for a profit after

🚨📈Bank failures will NOT drive $BTC price up

Most of crypto is financed by DEBT

As banks like SVB are failing, both the stock market and crypto prices will fall on Monday

How to profit:

1️⃣ Short #crypto

2️⃣ Buy #gold

3️⃣ Swap crypto for gold

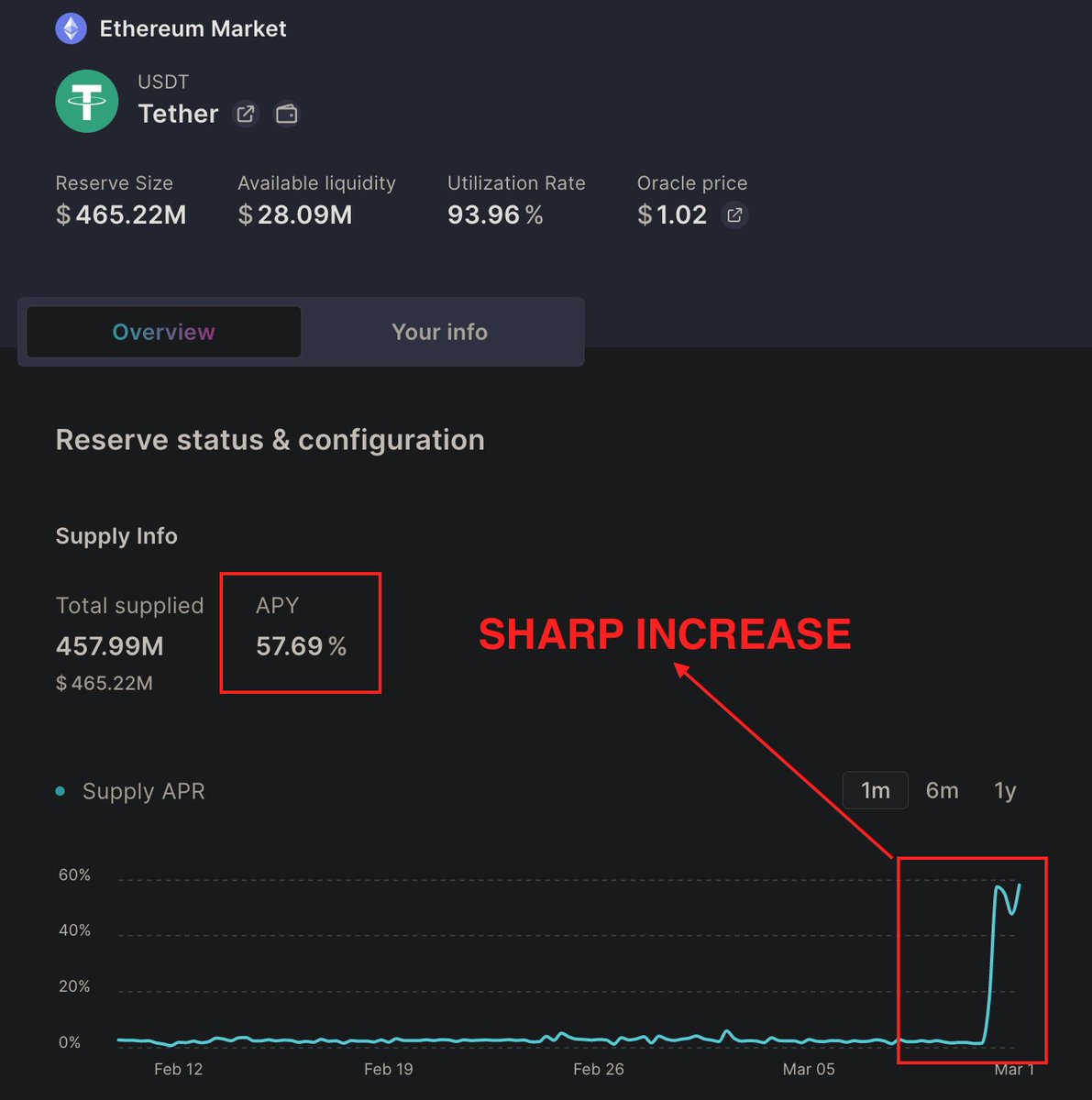

🚨📈 $USDT APY on #AAVE is 60%

This means that people are shorting $USDT. The market sentiment is that $USDT is overpriced.

How to profit:

1. Short $USDT

2. Lend $USDT for a high APR. Should last until Monday

3. Do both

This happened because of the depeg of $USDC

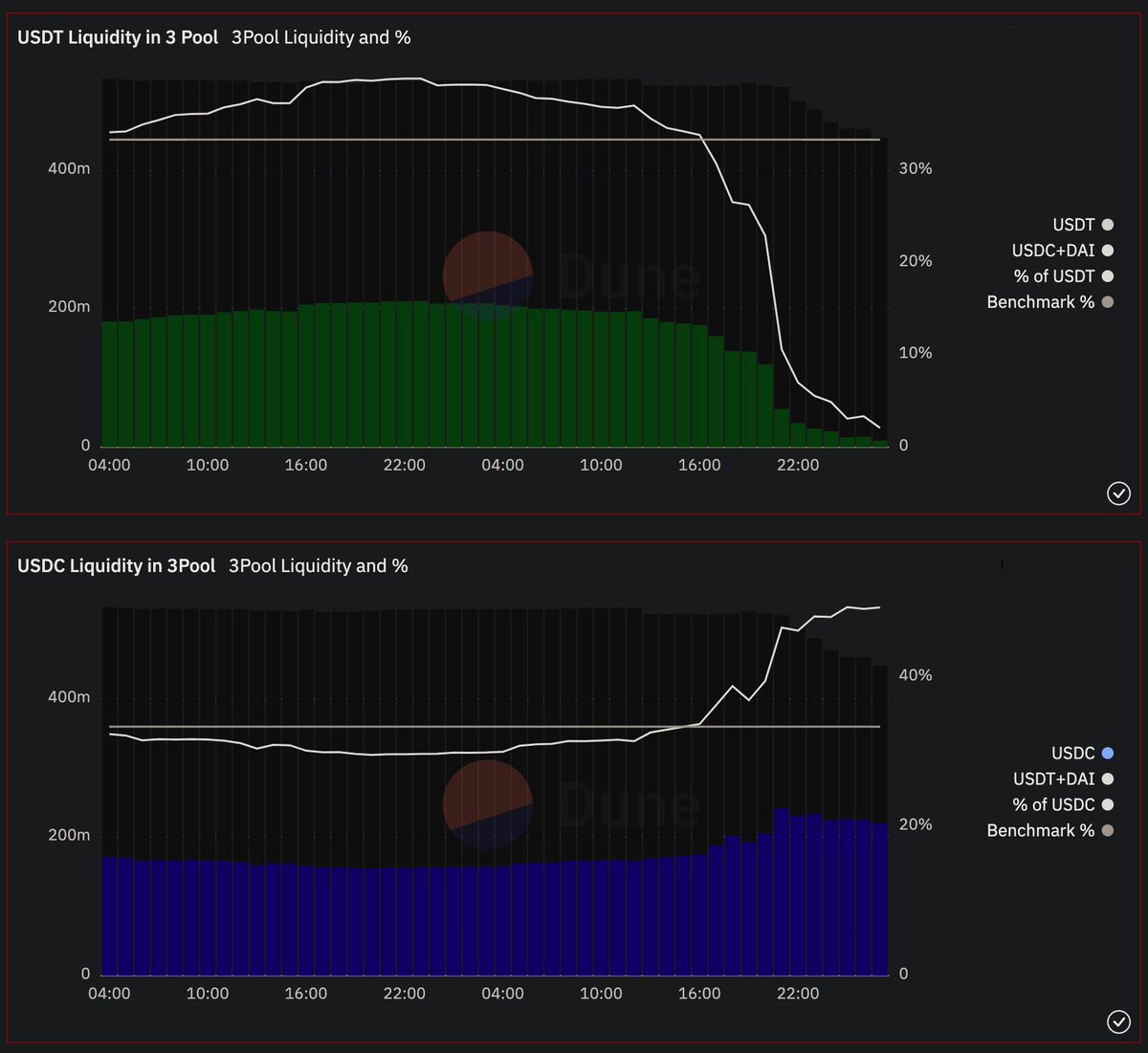

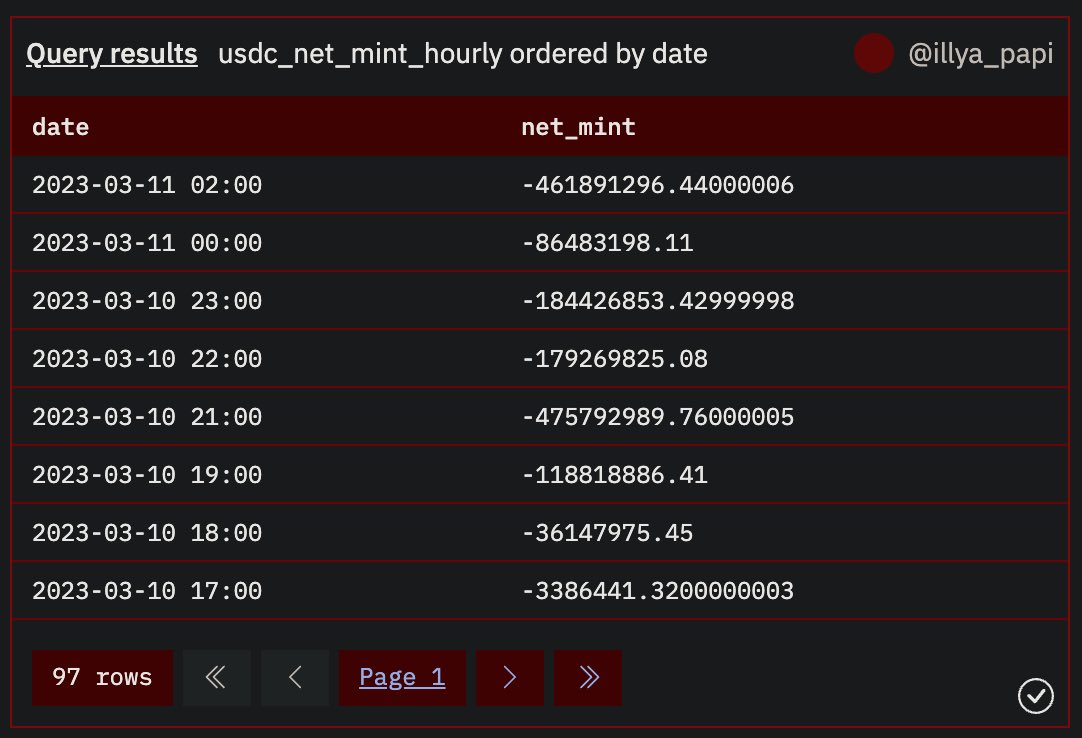

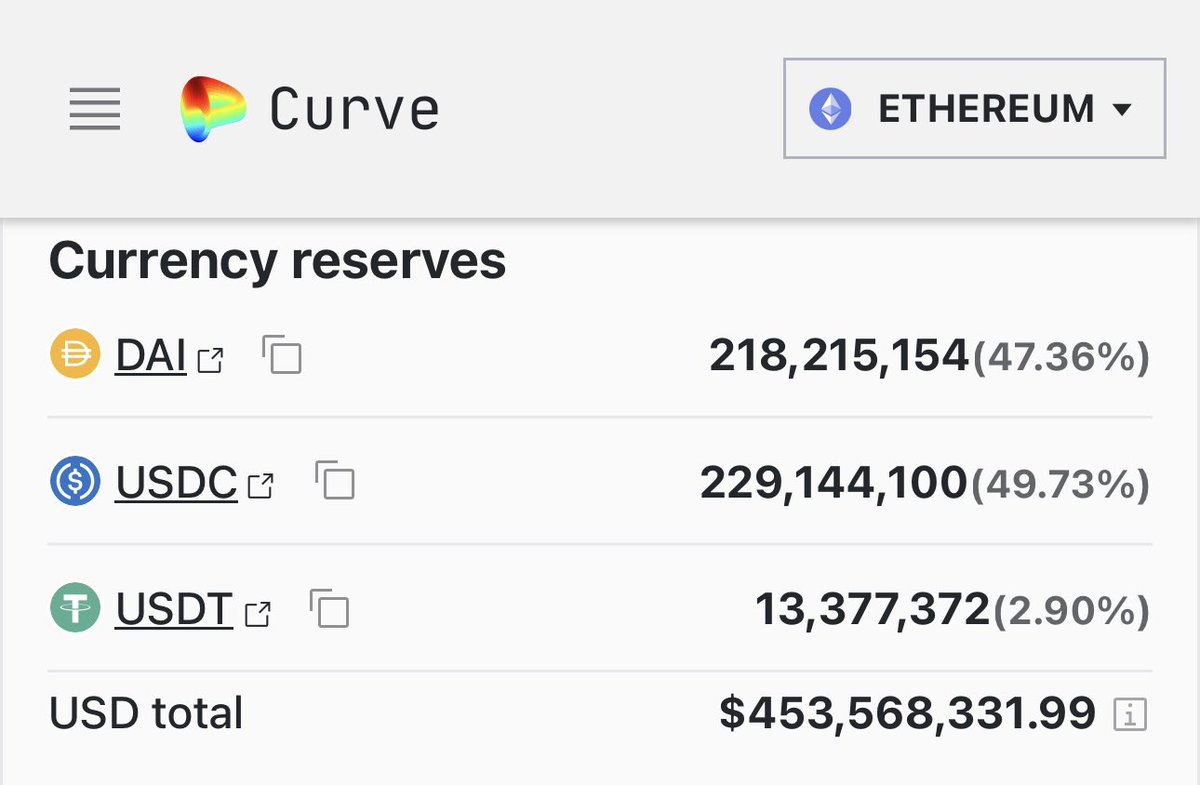

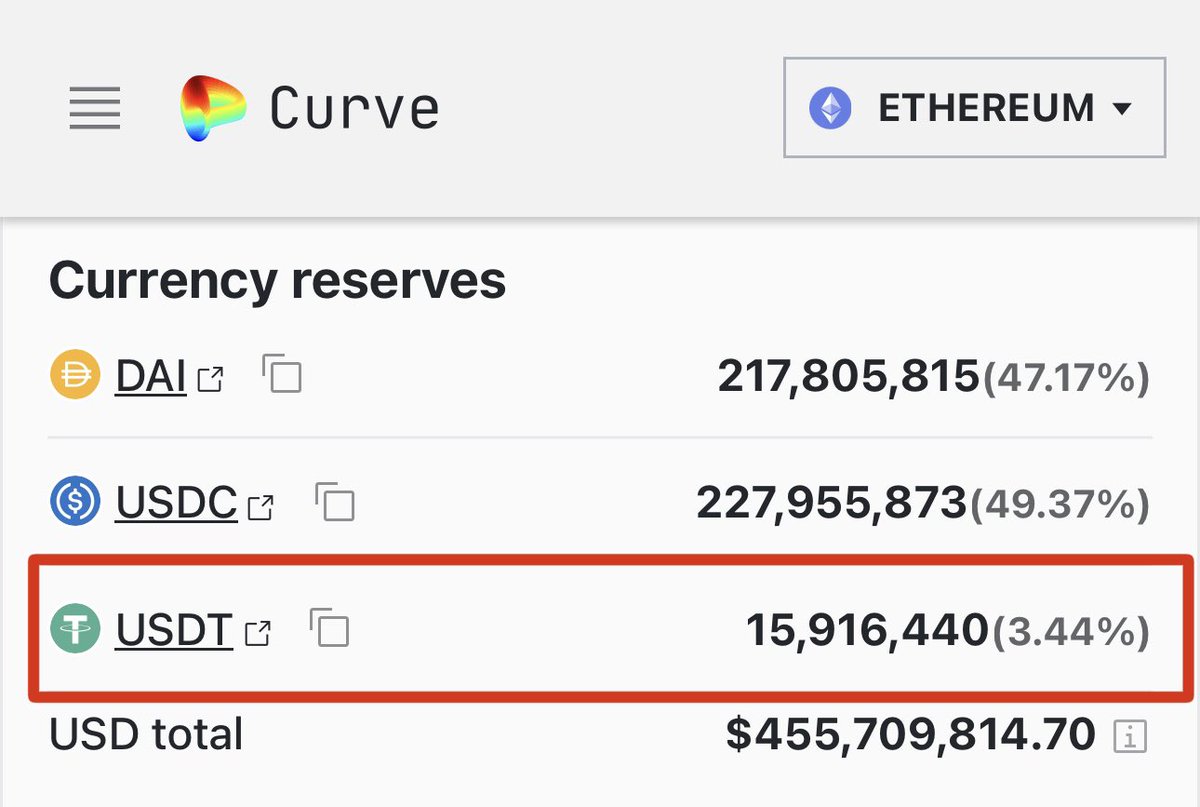

🚨📈 $USDT liquidity on #DEX pools decreased to almost ZERO, while $USDC liquidity almost doubled

This is a result of mass swapping of $USDC for $USDT

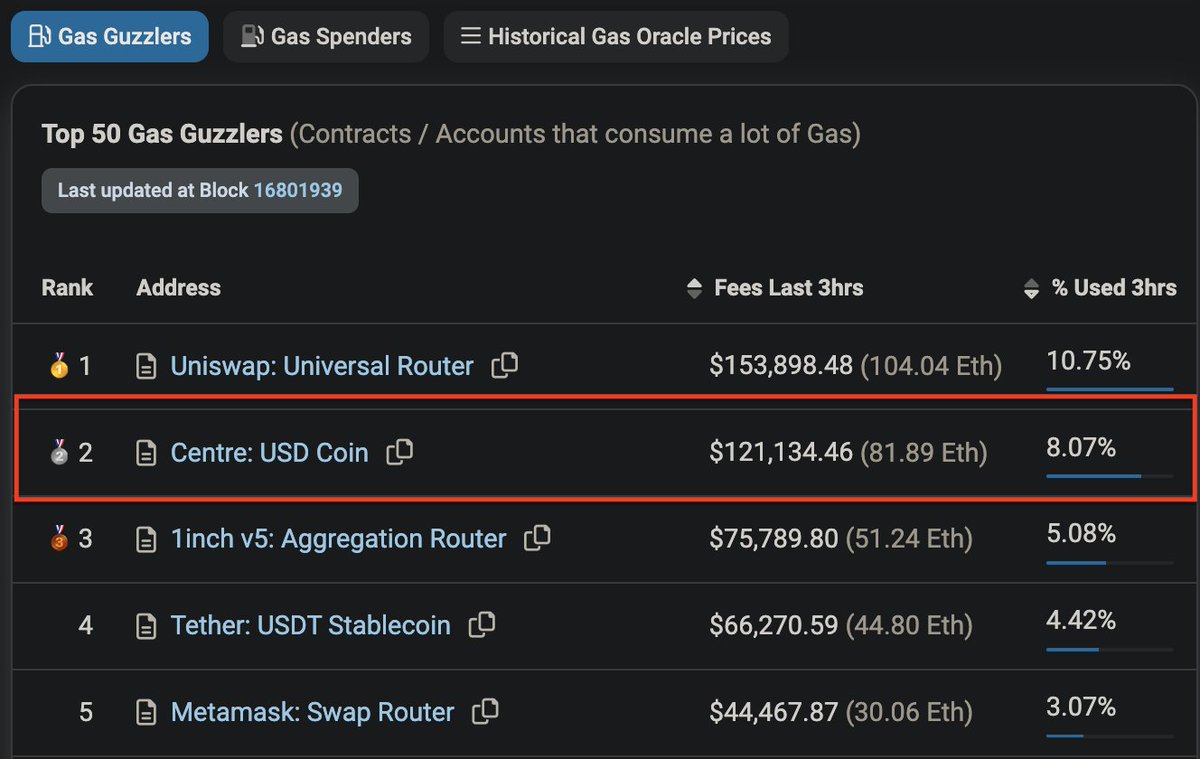

🚨📈 $USDC is the 2nd smart contract with the most gas usage on #Ethereum, second only to #Uniswap

$USDT is 4th, since massive swapping from $USDC to $USDT is taking across all pools in #DEX

Depegging of $USDC can lead to the collapse of other #stablecoins and #crypto prices

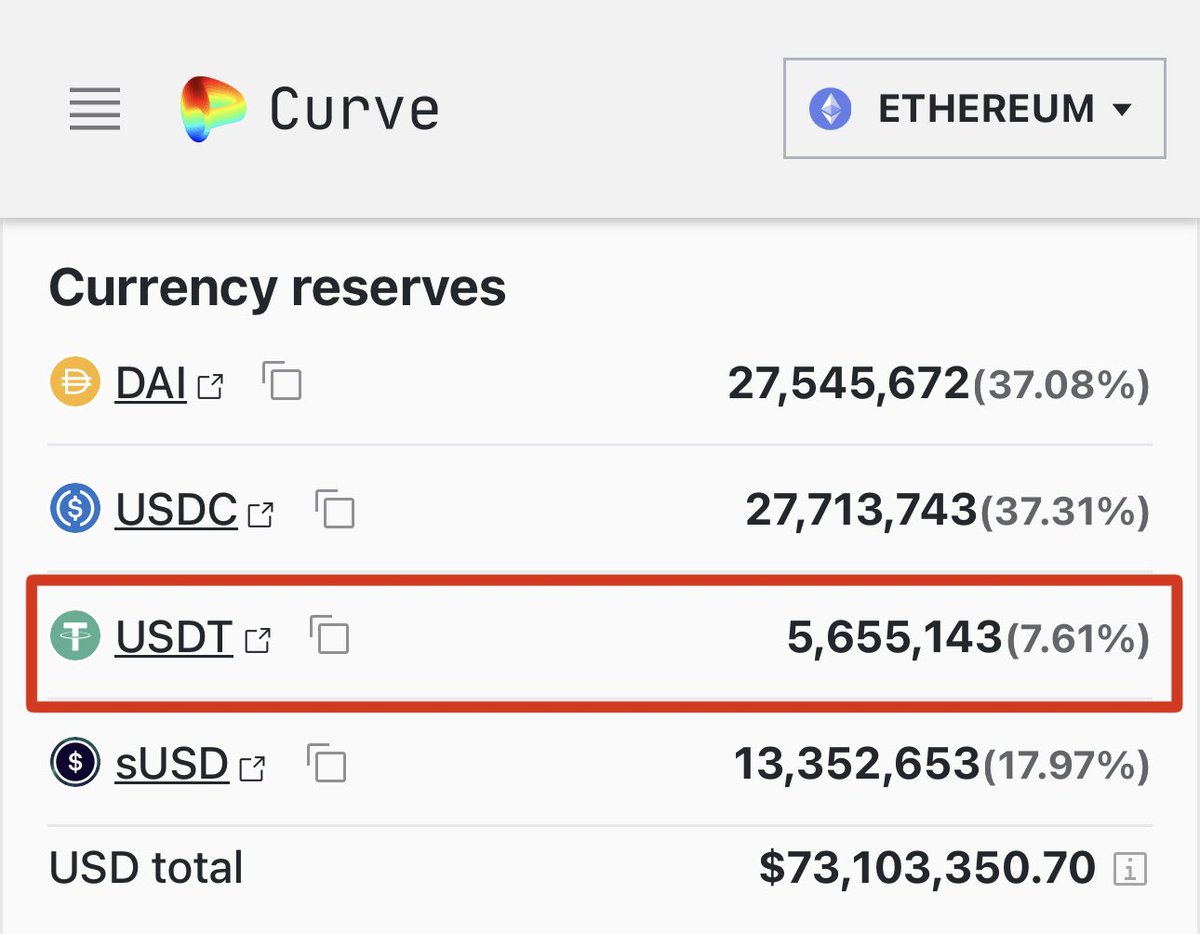

🚨📈 $USDT reserves are depleting across all #DEX pools that have $USDC.

It's not just the #3pool on #Curve, #SUSD pool is in the same situation.

This is a result of massive liquidation of $USDC, due to SVB's collapse.

The depegging seems to be more likely by the minute 😳

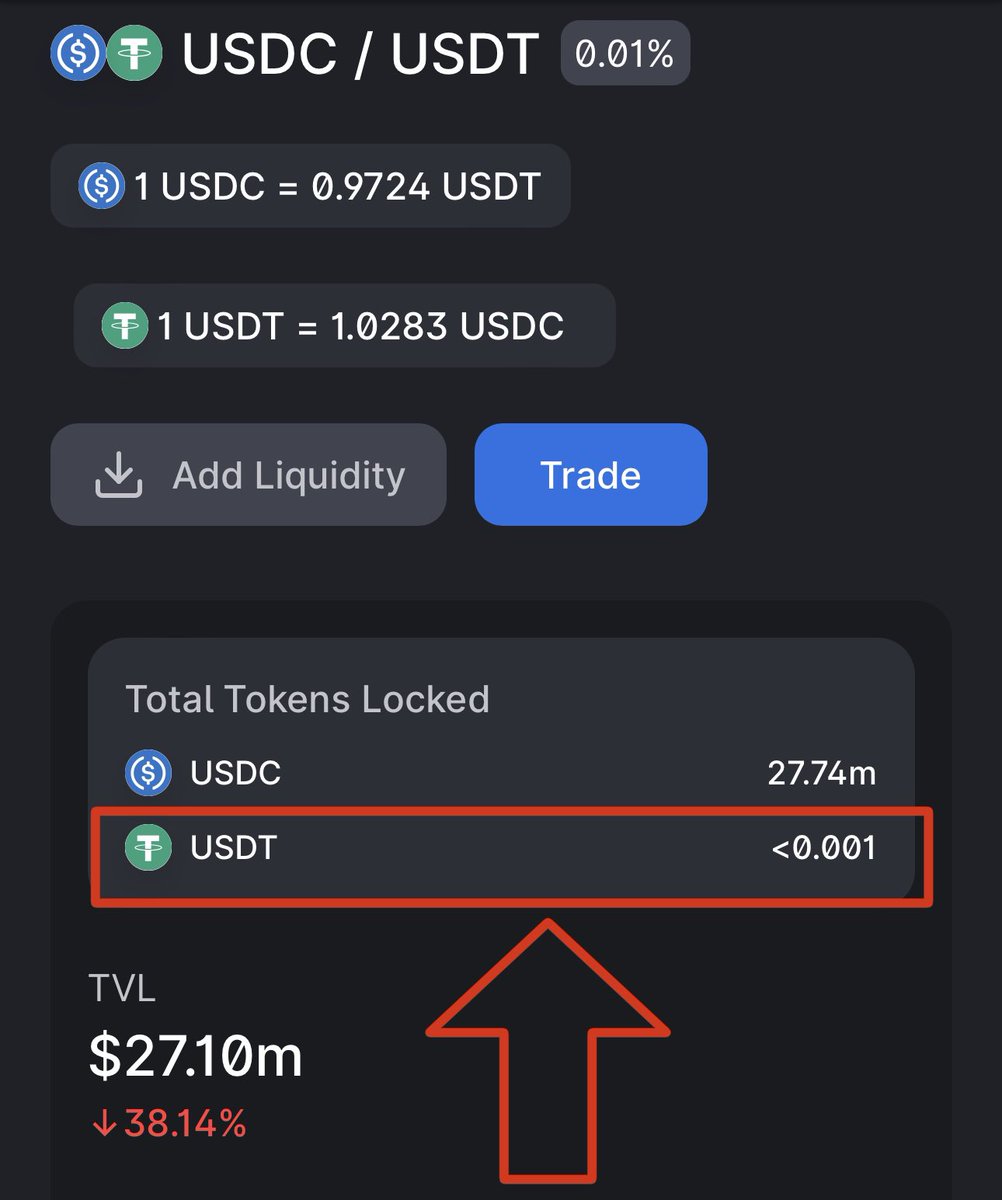

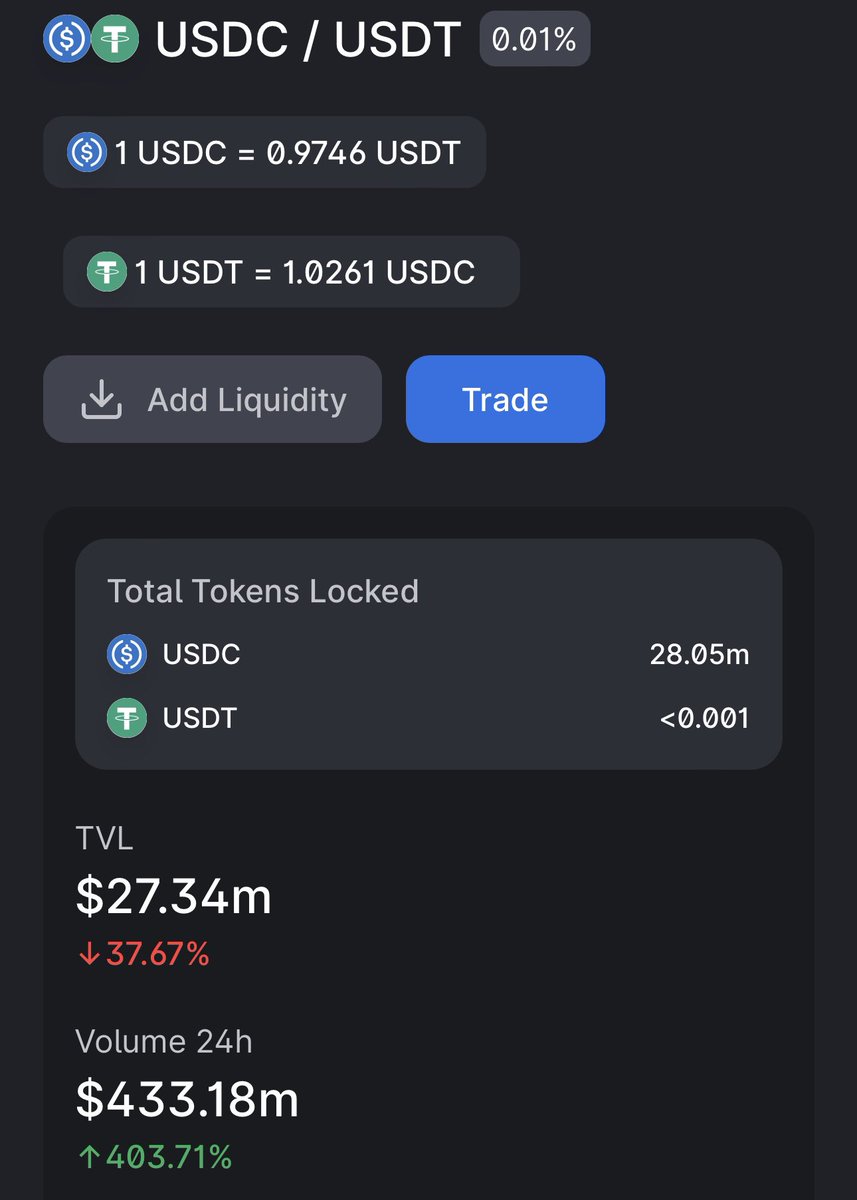

🚨📈 $USDT reserves at the $USDC / $USDT 0.01% pool on #Uniswap are depleted 😳

This indicates a massive $USDC liquidation.

A lot of news saying that $USDC is safe despite #SVB collapse, but the market seems be saying otherwise…

🚨📈 $USDT reserves at #Curve's #3pool dropped below 3%!!

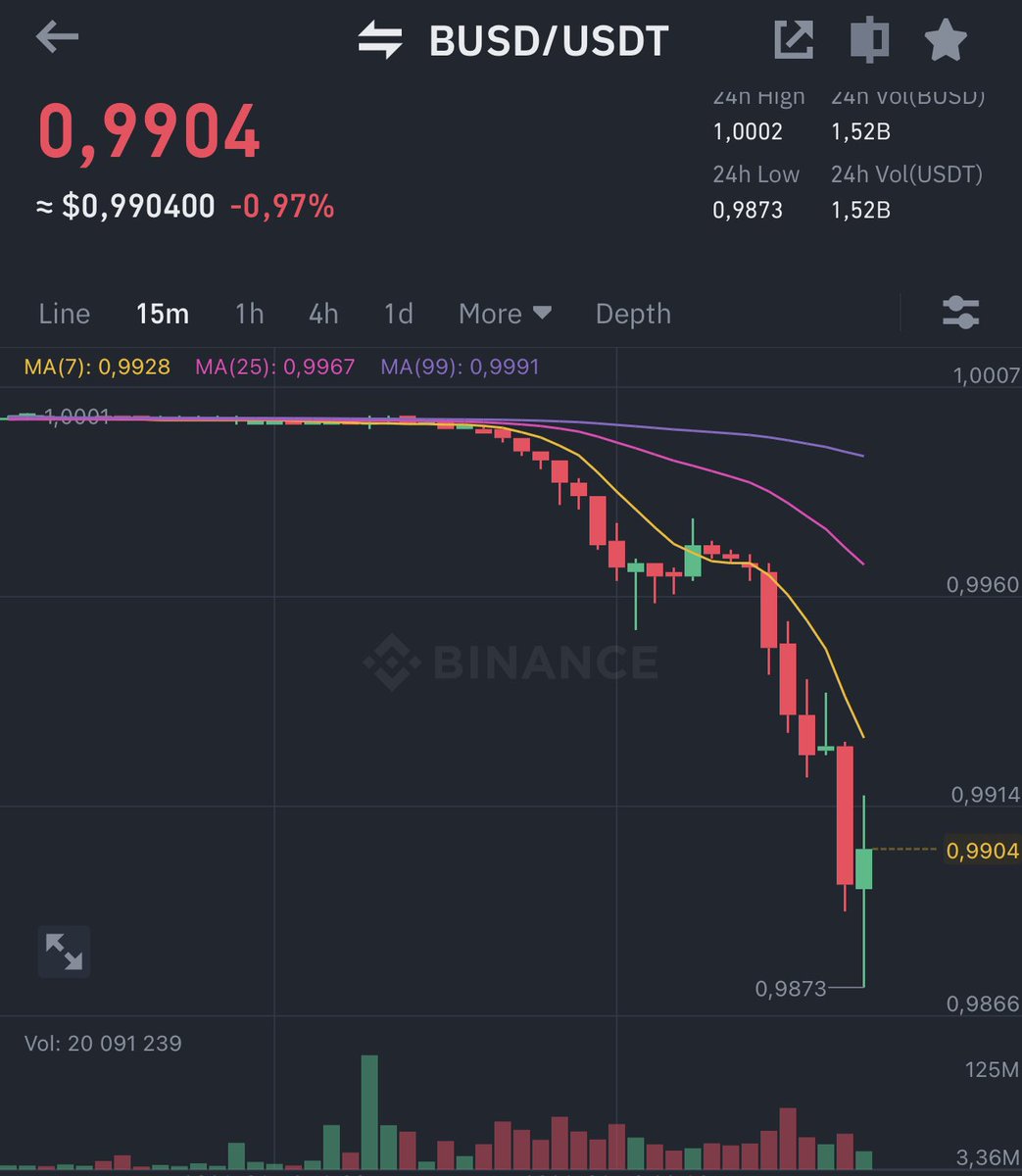

This is the reason why $BUSD is trading below $USDT at #Binance

It's caused by mass swap of $USDC to $USDT across the DEXes. Same happening on #Uniswap

🚨📈 Mass $USDC to $USDT swapping has caused $BUSD to fall below $USDT by more than 1%

As $USDT reserves across #DEX are depleting, it's also affecting #CEX like #Binance

This is a result of the collapse of the Silicon Valley Bank, where $USDC has reserves

🚨 $USDT reserves at #Curve are almost depleted, with less than 4% of it remaining in the #3pool

This is another sign of massive swapping of $USDC for $USDT, due to the collapse of #SVB

$USDC depegging is on the horizon!

🚨 $USDC trading below $USD and $USDT above $USD

Looks like everyone is swapping $USDC for $USDT because of #SVB collapse

Saying that Silvergate represents crypto is like saying that you represent the US Dollar, because you have them in your wallet.

Not a single DEX collapsed for the same reasons. DeFi is building the best financial system in history.

#bitcoin #crypto #defi #dex

Navigating the world of DeFi without a deep understanding of the economic and monetary theory is akin to navigating an unknown city without a map. Just because the buildings are made of the same material as in your hometown, doesn't mean you'll find your way through #DeFi #crypto