Financial regulation, securities & banking law

Brief analyses of Basel changes, securities rulings, CBDC law and cross-border tax and credit frameworks shaping markets.

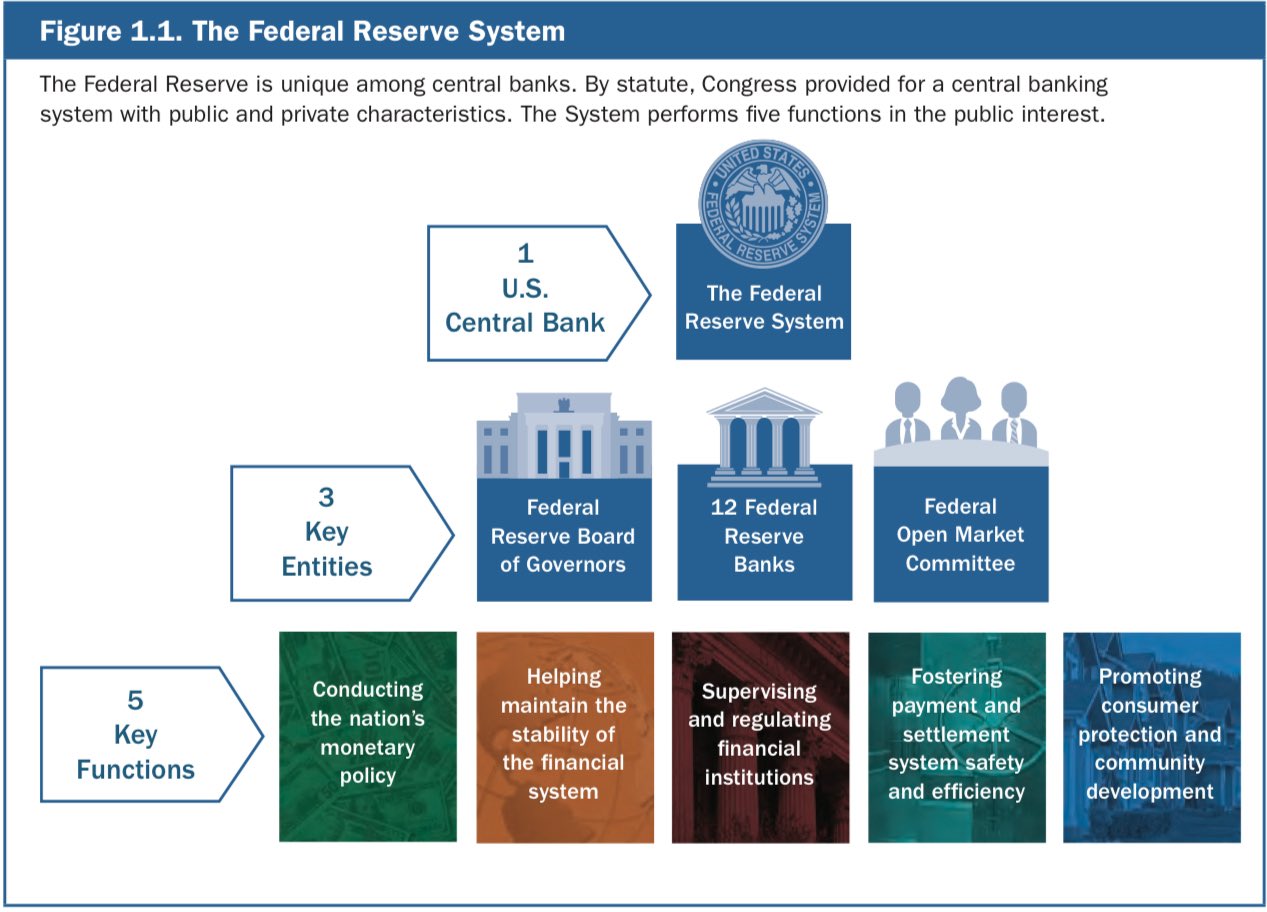

by "central bank" I'm frequently referring to the broader set of the legal framework behind the macro monetary policy

in most countries central banks plays a key role, but they frequently co-exist in a larger network of institutions

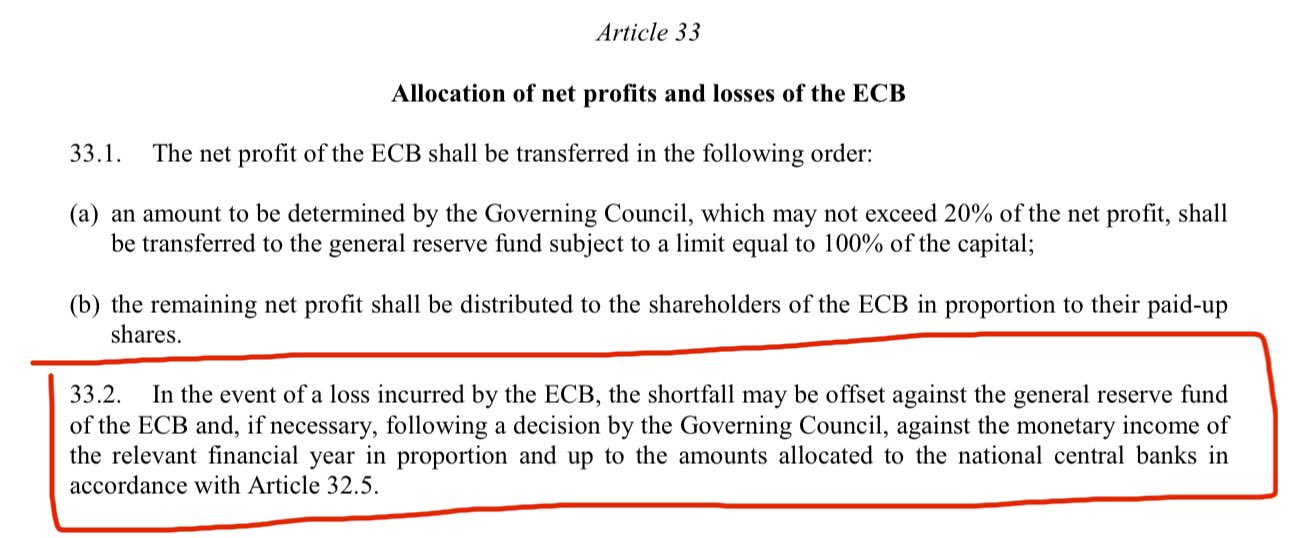

offsetting losses with future profits is explicitly allowed under Article 33 of Statute of ESCB & ECB

ESCB = ECB + EU National Central Banks (NCBs)

so this applies to both, the European Central Bank, and all EU National Central Banks

equity is the residual claim on assets after all liabilities are paid

equity = assets - liabilities

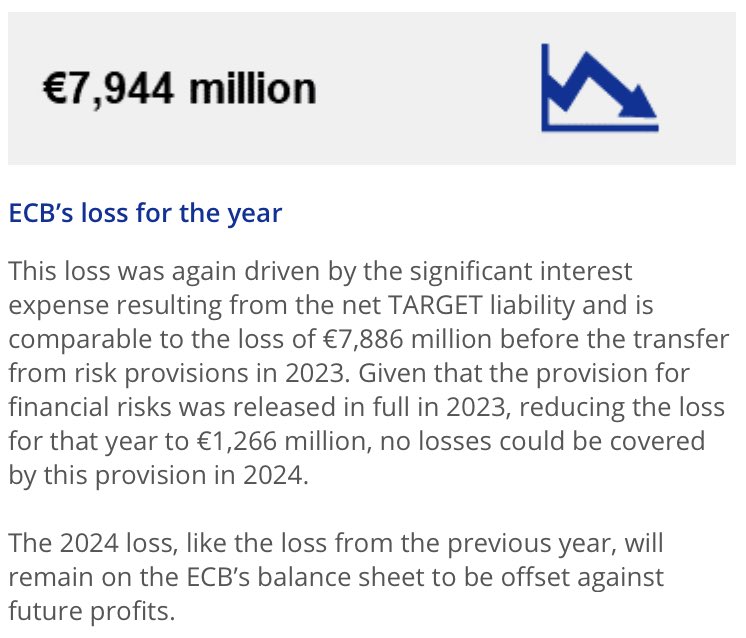

so the ECB just covers the loss with their equity. this equity reduction is carried forward to be offset by future profits

🇪🇺 ECB's "business model" is as follows:

➕ income: ECB creates money and invests it into financial assets (e.g.: FX, bonds, funds)

➖expenses, such as operational expanses (e.g. staff), facility and open market operation expenses (e.g. TARGET)

profit/loss = income - expenses