Financial regulation, securities & banking law

Brief analyses of Basel changes, securities rulings, CBDC law and cross-border tax and credit frameworks shaping markets.

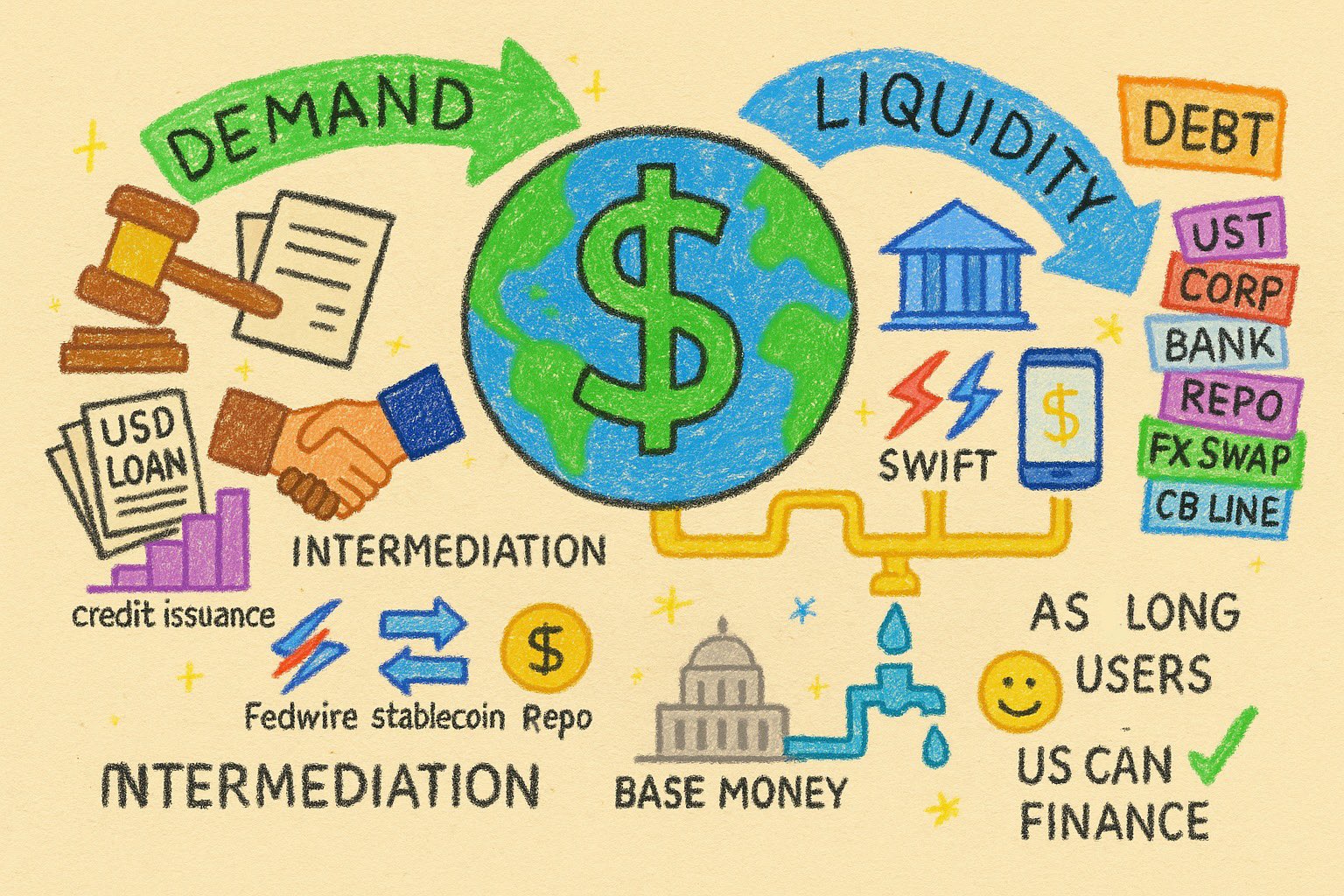

debt includes all form, tenor and issuers of USD-denominated debt are included, both public and private

examples: US Treasuries, corporate bonds, commercial bank credit, epos, FX swaps, central-bank lines

intermediation started with paper records, physical bank counters and now has mostly moved to technological - via computer systems

balance sheet capacity is heavily dependent on regulations (e.g. Basel III & local)

hybrid intermediation systems facilitate access to the payment and credit channels

SWIFT, FedWire and digital private USD claims like stablecoins & PayPal facilitate USD's movement and usage

liquidity means availability, thus it comes down to being able to:

1️⃣ access USD credit

2️⃣ settle payments in USD

this means balance sheet capacity and hybrid technological intermediation systems in place

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets

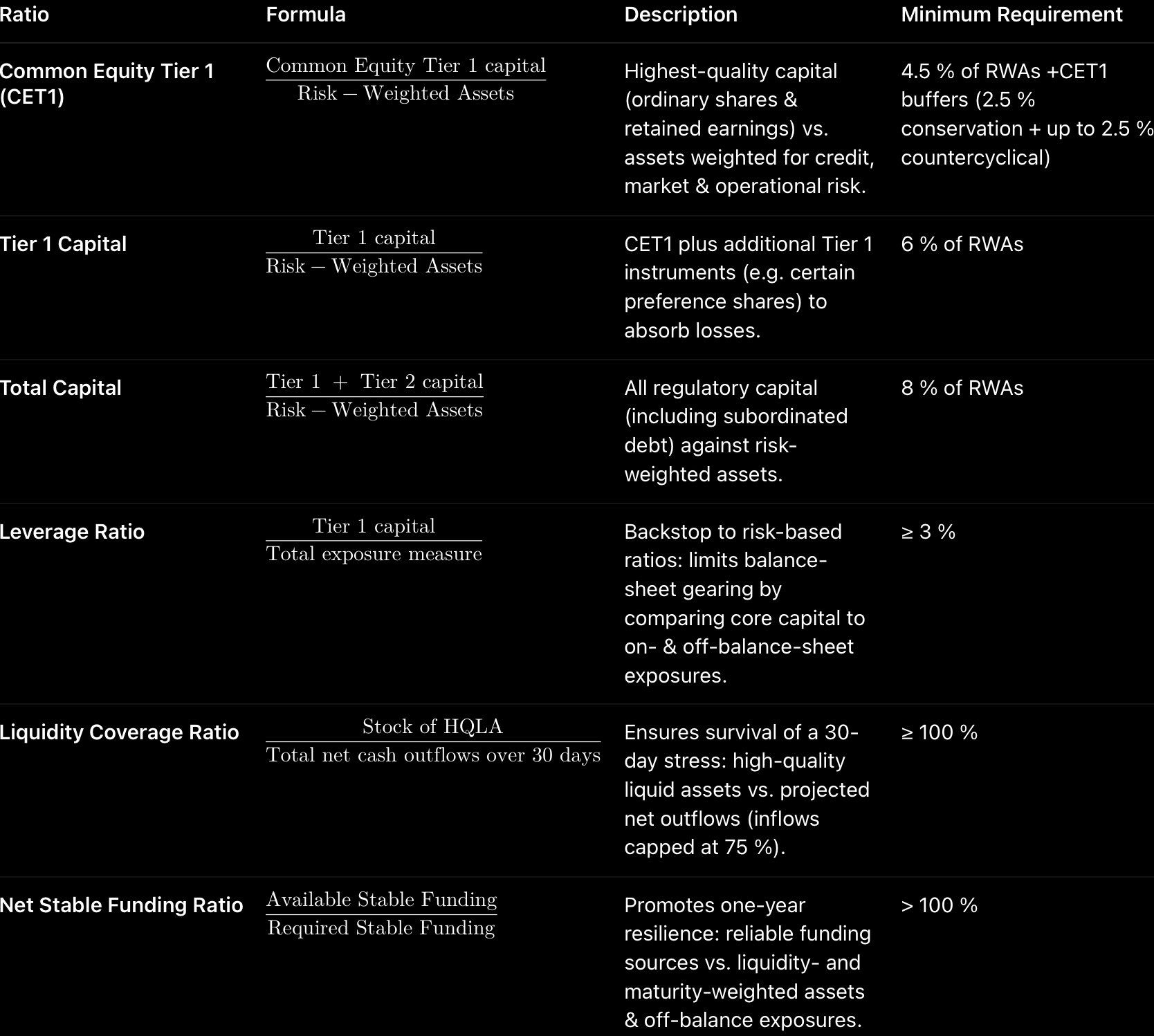

Basel III defines capital, leverage, liquidity and net stable funding ratios

they're in the form of formulas, and regulations require minimum thresholds to be met

I previously wrote about Basel III and its importance in financial markets here ⬇️

https://illya.sh/threads/@1753631798-1.html

banks are also subject to regulations when issuing loans

and no - it's not the fractional reserve system

in many sovereigns, like the USA the reserve requirements sit at 0%

there are other regulatory requirements limiting loan issuance

banks are also subject to regulations when issuing loans

and no - it's not the fractional reserve system

in many sovereigns, like the USA the reserve requirements sit at 0%

there are other regulatory requirements limiting loan issuance

the bank has the legal right to increase the money supply AKA 'print money'

so to give you a $100 loan the bank can just create those $100 and give give them to you

pretty neat arrangement, huh? 😁

current rates set by FED:

1️⃣ ON RRP - 4.25% (floor) - firms won't lend below

2️⃣ IORB - 4.40% (supplementary floor) - banks won't lend below

3️⃣ Discount Rate - 4.50% (ceiling) - banks won't borrow above

4️⃣ SRF - 4.50% (supplementary ceiling) - banks & firms won't borrow above

so how does the FED currently targets an interest rate range between 4.25%-4.50%?

let's consolidate everything with an example using current, real-world data

since banks can always deposit cash into their reserve account account at the FED and earn the IORB rate they have little incentive to lend at rates below IORB

effectively, this sets the floor (lower bound of the corridor) for interest rates for banks

Interest on Reserve Balances (IORB) is the rate FED pays banks on their excess reserves

commercial banks have reserve accounts at the FED. regulations define the minimum amounts - any excess earns the IORB interest rate set by the FED

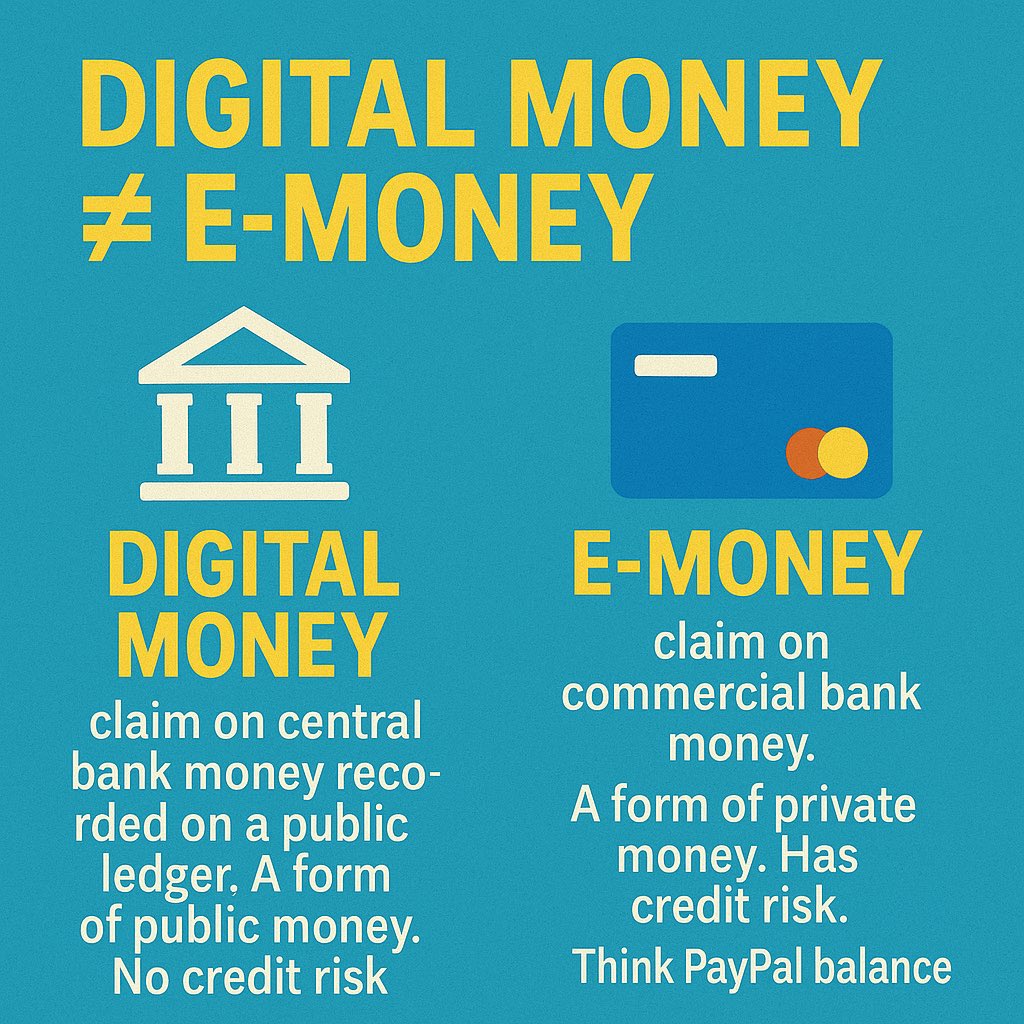

👉 Digital Money ≠ E-Money 👈

🏦 Digital Money - claim on central bank money recorded on a public ledger. A form of public money. No credit risk. Think CBDC

💳 E-Money - claim on commercial bank money. A form of private money. Has credit risk. Think PayPal balance

NOTE: Basel III is legally non-binding

so for a step 2 you'd want to look into the transposed legislations

🇪🇺 EU: Capital Requirements Regulation & Capital Requirements Directive

🇺🇸 USA: split throughout Code of Federal Regulations

(just ask ChatGPT/LLM & read from there 😄)

start by asking ChatGPT or another LLM with the Basel III PDF(s) attached

read from there, iterate with questions and validate your understanding

you'll probably need to come back to it a few times

don't overthink it, a basic prompt like this one is sufficient

👇

regulations may sound boring - but they're crucial to understand money, liquidity and financial system as a whole

they become fun once contextualized - and govern the rules of credit

i'd suggest starting with Basel III - namely liquidity coverage ratio & capital ratio

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

this means inflation & gold up

at least short-term: equities up, crypto up

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

so the market operations of dealers/market-markers is quite predictable

you just have to look at their business & regulatory model - from there it's almost plain math under regulatory constraints

dealers/market makers are legally limited in their balance sheet

there are ratios that they must respect, or face legal consequences (e.g. fines)

check Basel III & Leverage Ratios for more info - I also wrote about it in my past posts

committee recommendations develop into law

in a monthly maturity/tenor timescale - the repo funding rate has very direct effects

this makes sense - if your bond is maturing in ≈1 month, every day is significant

so you see more immediate effects from federal reserve's SRF operations / repo funding fee increases

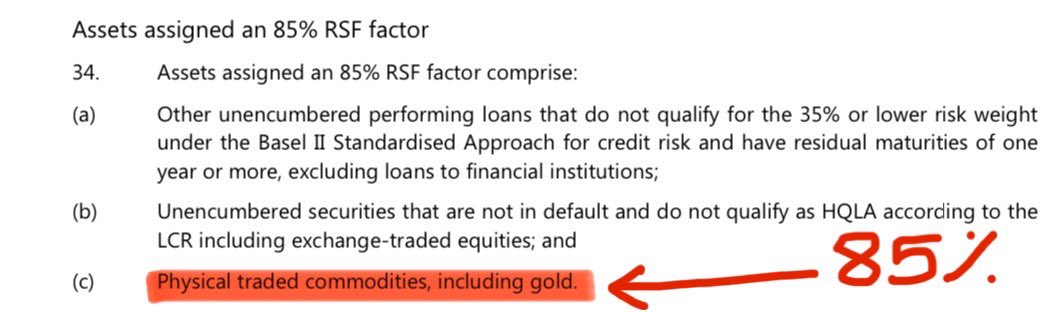

🏦 under Basel III gold is subject additional funding requirements

there's a 85% required stable funding (RSF) factor on gold under net stable funding ratio (NSFR)

so for every $1B of gold that a bank holds - $850M must be funded with longer term retail or wholesale funding

🚨🏦 claims that gold is a Tier 1 asset under Basel III are FALSE:

1. gold is NOT a Tier capital under Basel - it's on the liability, not asset side

2. gold had 0% risk weight since Basel I (no haircut)

3. gold is still NOT considered a high quality liquid asset (HQLA)

🇪🇺👩⚖️ EU Securitisation TL;DR

Securitisation of subprime loans was a key factor in 2007-11 financial crisis

EU Regulation 2017/2402 aims to address that by detailing how risk should be managed mathematically & how to distribute it among the parties in securitisation operations

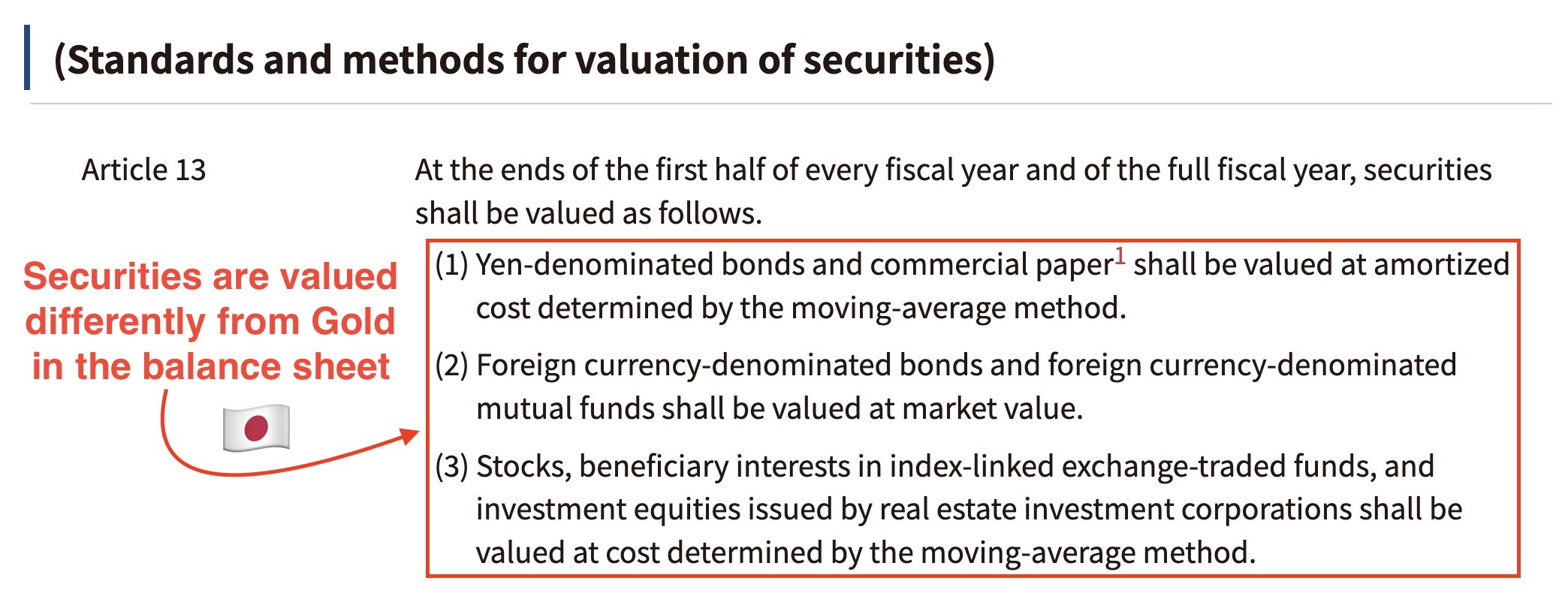

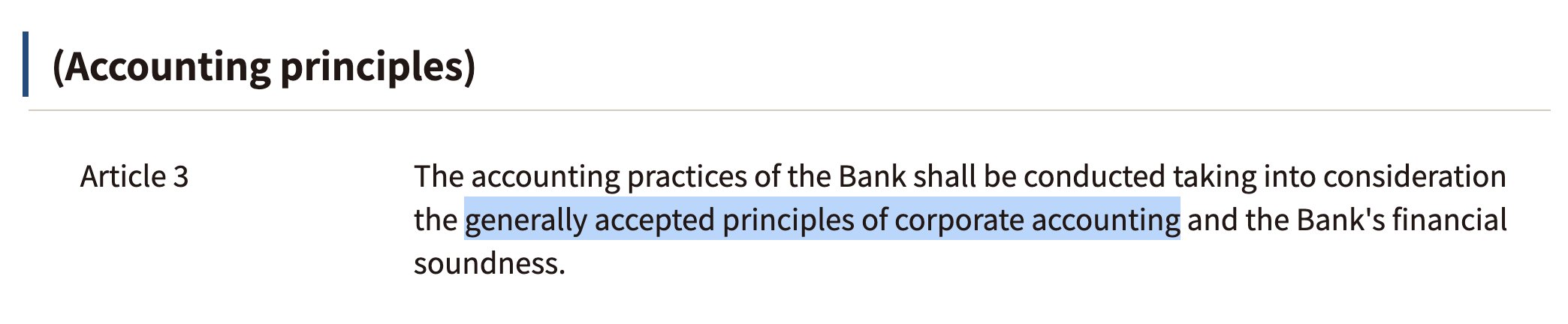

🇯🇵Article 13 of Accounting Rules of the BOJ defines special valuation rules for securities:

1️⃣ Yen bonds at amortized cost

2️⃣ Foreign currency bonds at market value

3️⃣ Stocks, ETFs, J-REITs at MA cost

Since gold is not a security, it falls under Article 3 - book value

🇯🇵Article 3 of Accounting Rules of the Bank of Japan states that "generally accepted principles of corporate accounting" shall be used for BOJ's accounting

This defines the framework of how assets and liabilities are values in the central bank's balance sheet

🇪🇺 The best countermeasure that EU can take is swapping US securities for Gold

Gold is inversely correlated with USD. Such a decision can be done today and it will:

1️⃣be a response to the US

2️⃣increase value of EUR

3️⃣minimize consumer impact

Anything else will hurt the economy

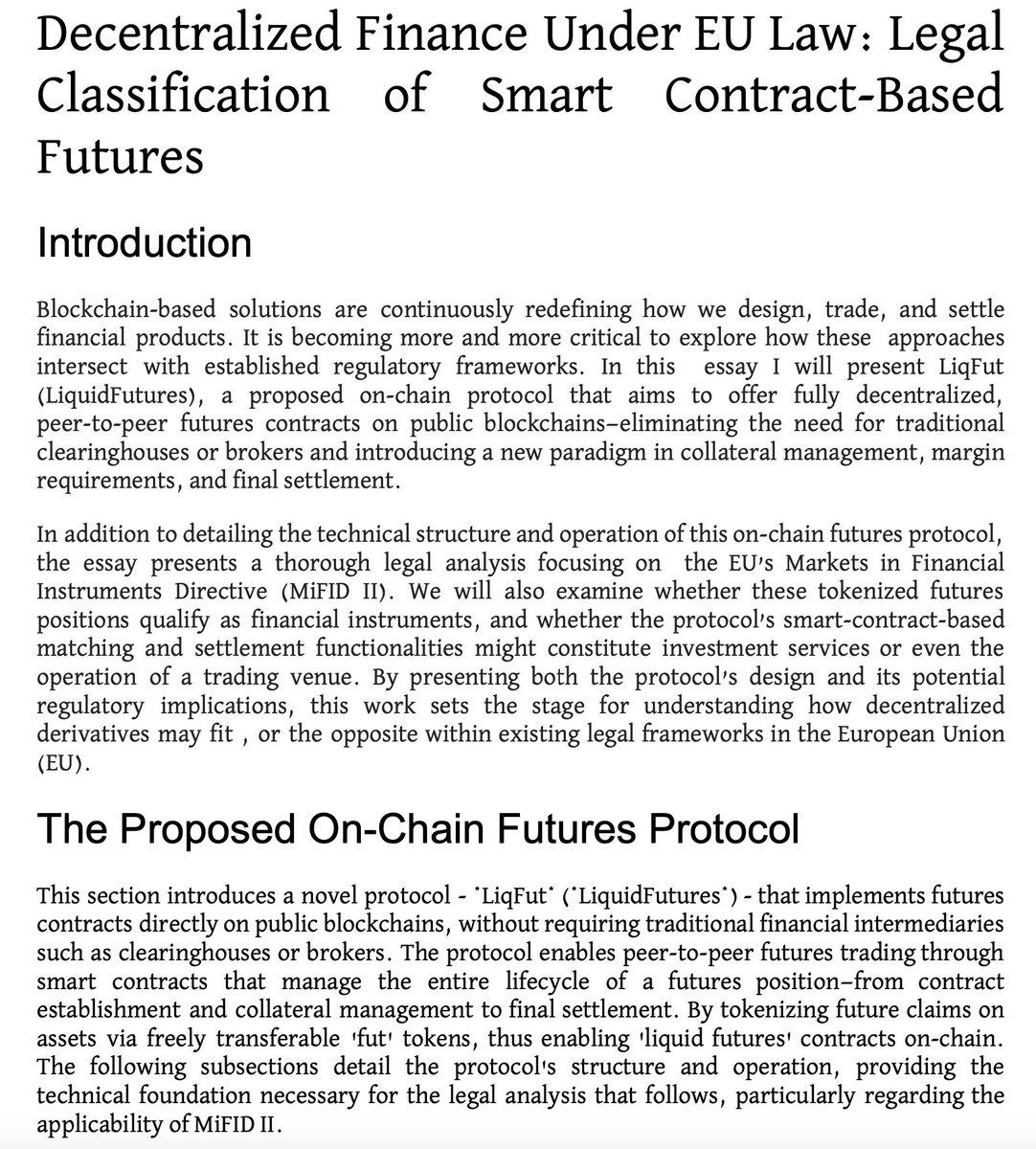

Are you building DeFi in the EU? Here's what you need to know ⬇️

At the time of conceptualizing this 'liquid futures protocol' I didn't even know where to start with regard to its legal compliance

A few days ago I finalized a paper exploring how one can legally launch on-chain…

🇪🇺 The future of Web3 & DeFi in the EU 🇪🇺

Legal compliance is fundamental for wide adoption of Web3 & DeFi. While security audits of DeFi protocols are a common practice, the same is not true for regulatory compliance audits

All investment services in the EU, including those… https://

🇯🇵🧠 For a deeper dive into Japan's deposit insurance system, read or listen my article at https://illya.sh/blog/posts/deposit-guarantee-scheme-japan-dia-dicj/

It covers Japan's deposit insurance's:

• Legal framework

• Historical cases

• Risk analysis

• EU comparison

Got questions? Ask me! 👇

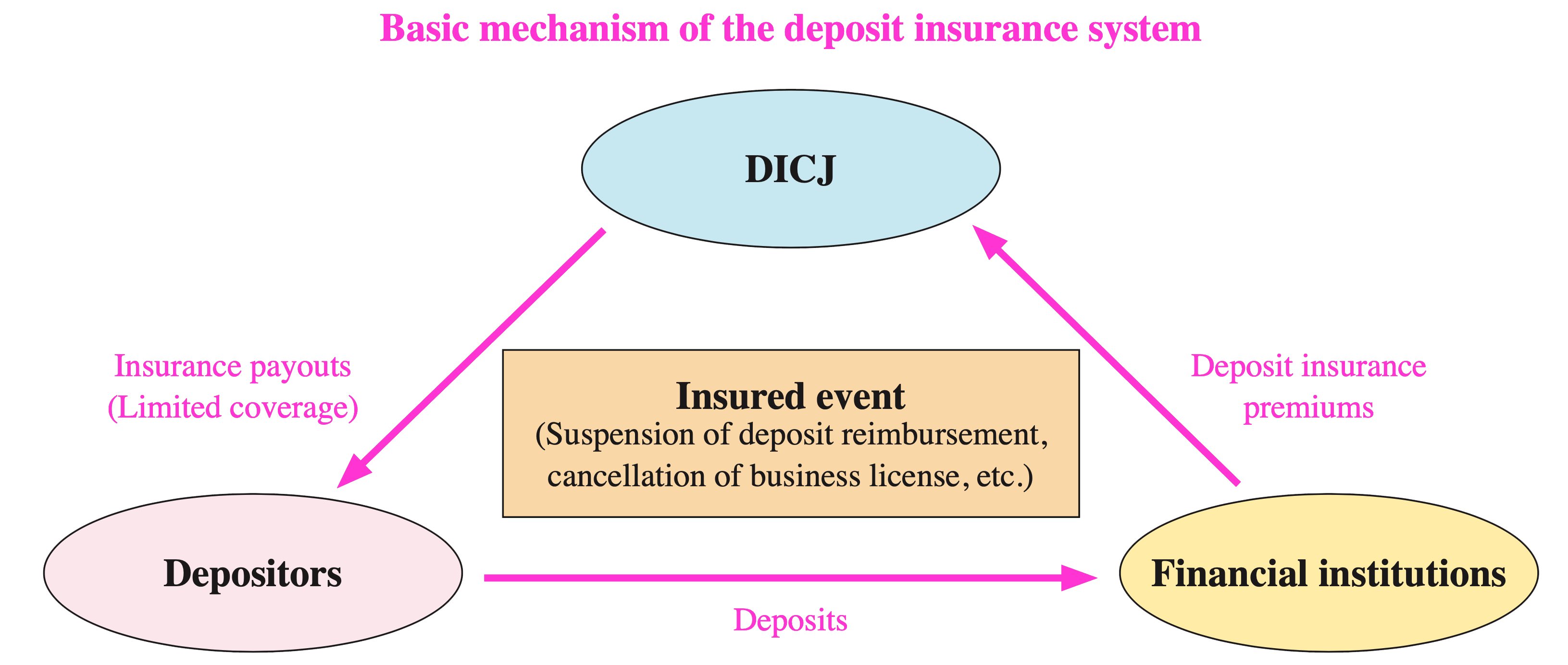

🇯🇵🆚🇪🇺

Japan's & EU's deposit guarantee schemes differ⬇️

🇯🇵 DICJ: Active crisis manager (Act 34 of 1971)

🇪🇺 DGS: Mainly deposit protection (Directive 2014/49/EU)

Japan's approach = more intervention power & broader mandate

EU's approach = more focused mandate

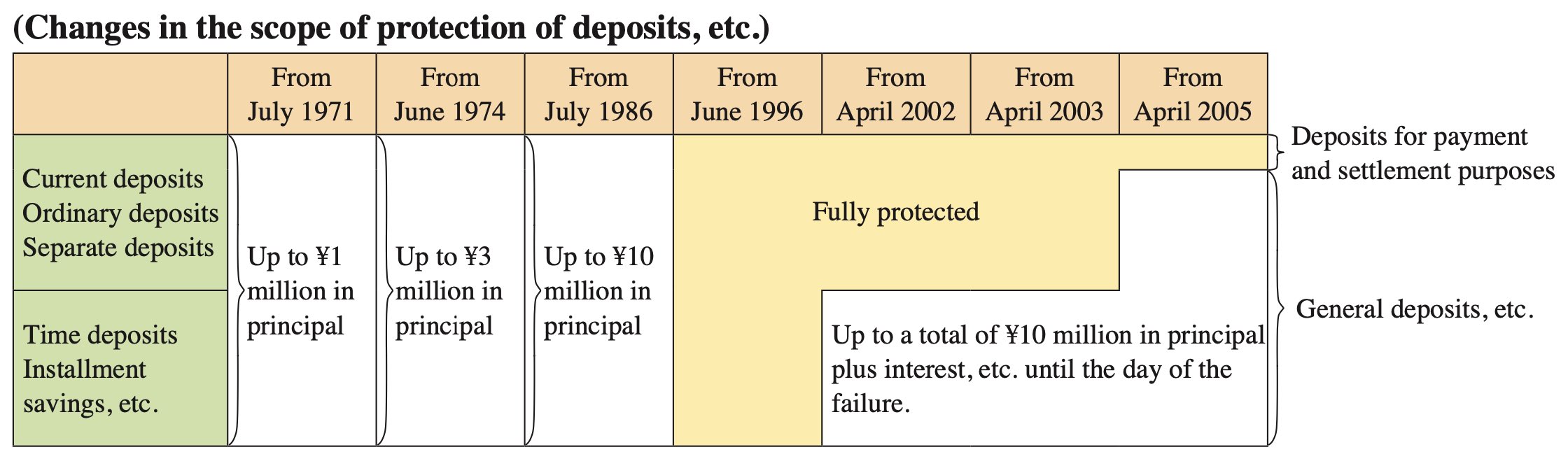

💴 Coverage limits:

• Regular deposits: Up to ¥10M (~$65k/€60k)

• Payment & settlement accounts: 100% covered

💡Fun fact: During the 90s crisis, ALL deposits were fully protected. Japan gradually reduced this to ¥10M by 2005

🇯🇵 How does Japan protect bank deposits when banks fail?

🤯 Their deposit insurance system handled 180+ financial institution failures, including the massive 90's banking crisis

👉 Here's how Japan's ¥10M deposit guarantee scheme works: https://illya.sh/blog/posts/deposit-guarantee-scheme-japan-dia-dicj/

🧵