Financial plumbing & market structure updates

Short updates on repo markets, collateral chains, clearing and settlement systems, and the core infrastructure that drives global liquidity.

Central Bank of Russia Denies Return to USD Payments

Just like I argued yesterday, claims by Bloomberg and other financial media suggesting that Russia is to return to USD settlement were misguided/wrong.

Not only those claims lacked factual basis, but also didn't make sense in terms of a macro picture.

Remember: just because a large-following news source claims something, it doesn't make it true. And do not discount for the existence of coordinated campaigns with ulterior motives. It doesn't have to be necessarily market manipulation -- just the engagement on its own can be a strong motivator.

Congratulations to Freddie Mac & Fannie Mae in their first steps at becoming a central bank

Looks like it's not just the Fed doing MBS-targeted QE now. Why control the Fed, when you can just move the Fed? 😆

Central Banks were more influenced by farming than you probably think

Historically interest, collateral, liquidity, inflation and monetary policies were shaped by the needs, risks and patterns of agricultural economies

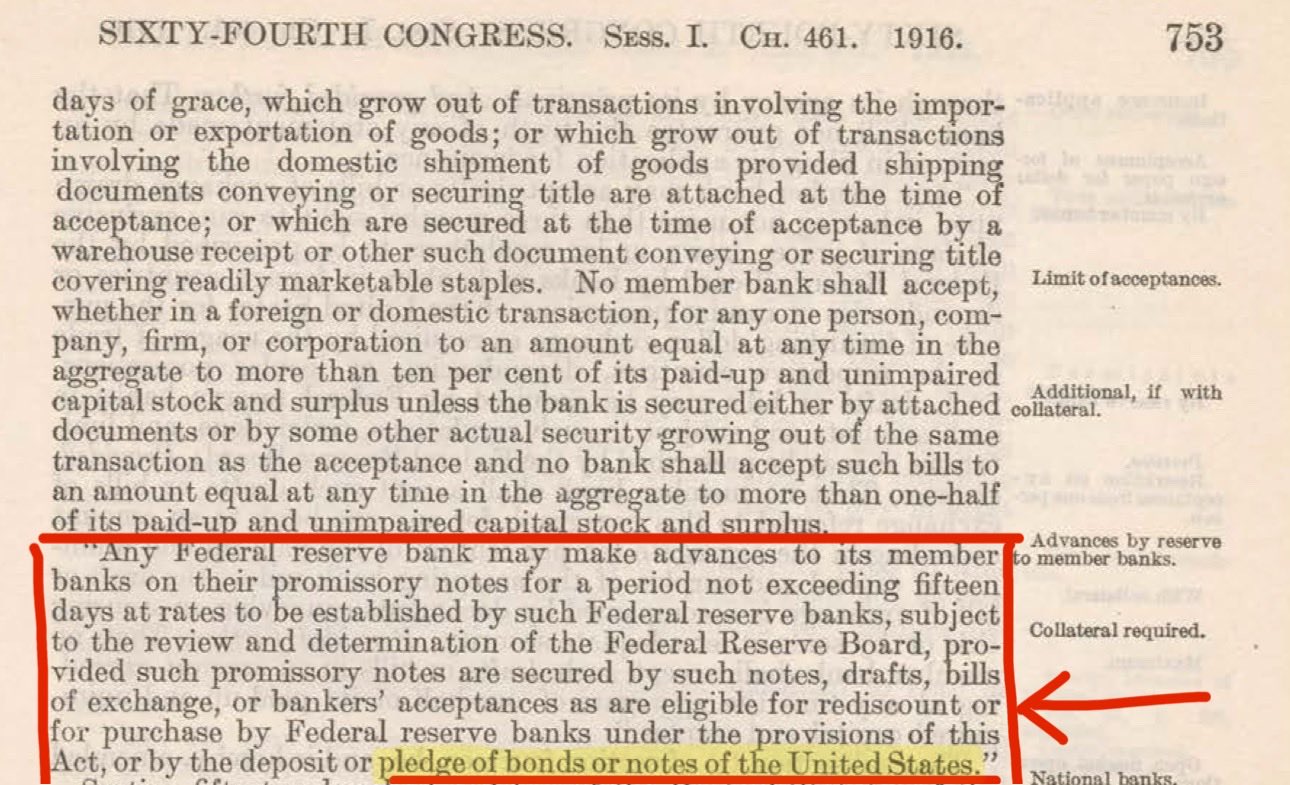

How the 1916 Fed Act Made Treasuries Prime Collateral

Before 1916, the Fed would only lend to banks against "eligible paper", which included self-liquidating commercial loans and agricultural loans.

The Federal Reserve Act 1916 amendment expanded the Fed's legal power to allow for lending to commercial banks against U.S. Treasuries (government bonds).

This effectively turned U.S. government debt into collateral backing Fed's liabilities. This paved the way for the U.S. Treasuries to become the most used form of collateral in short-term wholesale debt markets (e.g. repo/repurchase agreements) today.

You can read the article here: https://illya.sh/threads/how-does-the-federal-reserve-set-interest-rates

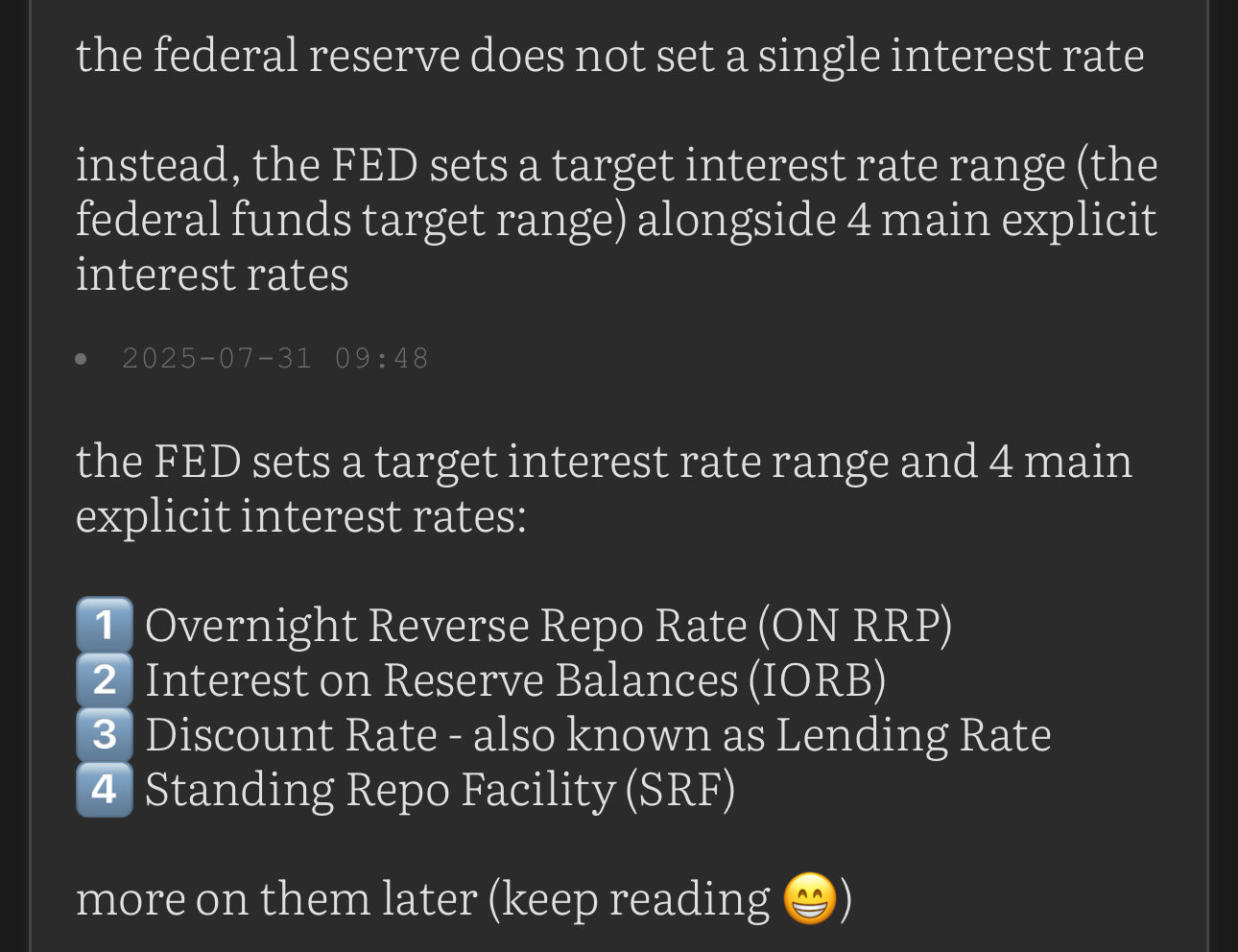

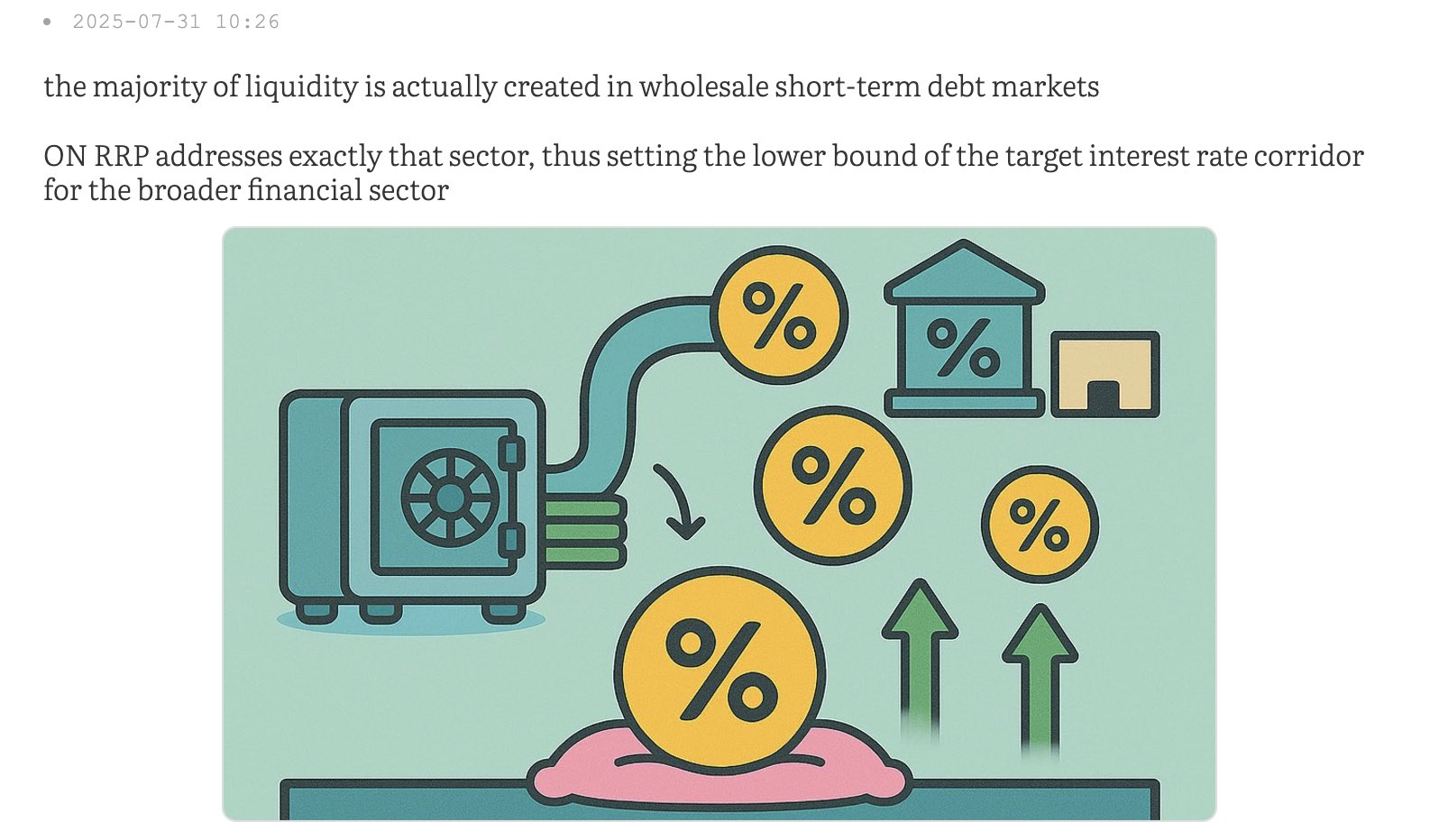

In July I wrote a primer on the mechanics by which the Fed steers the prevailing interest rates in the economy.

It covers the ON RRP, IORB, Discount Rate and SRF channels, explaining how together they set a corridor with upper and lower limits for the effective rate.

Prior to today the article reading experience was subpar, due to the amount of supporting images - the thread is composed of several shorter posts, and each one came with an image.

I've made it a lot more readable by removing most of the images

In July I wrote a primer on the mechanics by which the Fed steers the prevailing interest rates in the economy.

It covers the ON RRP, IORB, Discount Rate and SRF channels, explaining how together they set a corridor with upper and lower limits for the effective rate.

Prior to today the article reading experience was subpar, due to the amount of supporting images - the thread is composed of several shorter posts, and each one came with an image.

I've made it a lot more readable by removing most of the images

if you think they crypto will replace banks, you don't understand what banks are and how they work

banks are credit institutions. it doesn't matter if they process transactions in COBOL, Bitcoin or Solidity

DLTs can and will save on costs, but that will also open opportunities for banks to expand further

it's not about the underlying technology - the credit can be issued on-chain via tokens, but there will still be heavy regulations and authorization requirements

DLTs/blockchains won't magically replace banks

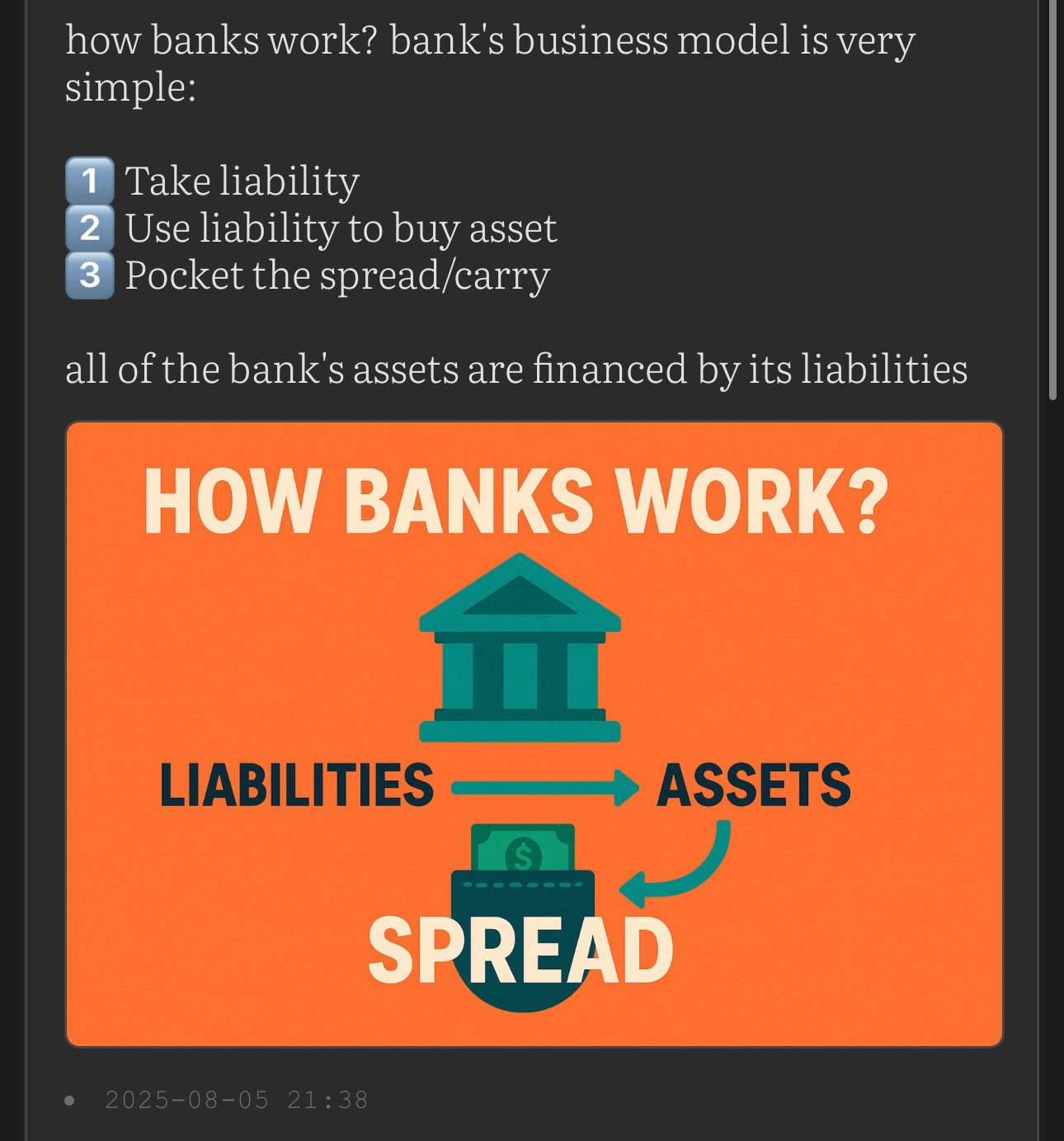

How Banks Create Money When Purchasing Assets

I have previously written about the unique legal powers given to commercial banks and credit institutions in general, that allow them to create new currency, thus increasing its supply. For banks, this also extends to their open market operations, such as when they buy securities and other assets from the open market. If the bank’s counterparty happens to be a non-bank, or more generally an entity without an account at the central bank, then the bank will create new currency to pay for that transaction. I described this in my thread/article titled "when a bank buys an asset from a non-bank it creates broad money":

https://illya.sh/threads/@1755863018-1.html

I received a question about it via e-mail, so I’m writing a follow-up with clarifications.

The flow that I was describing the thread linked above is what happens when a bank buys an asset from a non-bank. Let’s assume the bank ABC wants to buy an asset from you. Let’s forget about US government bonds for now, let’s say the bank wants to buy 100 shares of Tesla from you. The current market price for 1 Tesla share is ≈$450, so the ABC bank would pay you $45000 and you will give the bank the 100 shares. Let’s also assume you have an account in that bank (this is not mandatory!)

Let’s say that right before the bank makes a purchase from you (a microsecond before that transaction/sale happens) there is a total of $1 million ($1000000) of US dollars in circulation. The moment right after the transaction is made, and the bank crediting your account with $45000, the total money in circulation would become $1 000 000 + $45000 = $1 045 000. The main point here is that those $45000 didn’t exist in circulation before. They were not taken from someone else’s account, nor from internal bank reserves. Those $45000 were created “out of thin air”, and that money was credited into your account. I say “credited” because it’s from the point of view of the bank - your deposit account at the bank is a liability to the bank - it sits on the liabilities side of the balance sheet - a credit increases liabilities.

Now, I referred to “money in circulation”, but I actually meant Broad Money. There is another form of money - called Broad Money. There is a great paper from the Bank of England that describes them, alongside how commercial banks create money: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf . But in short, Broad Money is the money available for use by the larger economy (individuals, companies, etc), while Base Money is physical currency and currency held in reserve accounts at the central bank - the reserve accounts portion doesn’t touch the broader economy directly.

If instead a bank ABC purchases an asset from another bank DEF - then the total money does not change. The bank ABC would just debit their reserve account at the central bank and credit the reserve account of the bank DEF. So money moves accounts, but total quantity does not change.

In the same manner, when a commercial bank buys bonds directly from the government, there is no creation of “new money” - the money moves within the central bank’s reserve accounts. The general rule is: if the transacting entities have reserve accounts in the central bank the transaction is made within the central bank’s reserve accounts. Commercial banks, governments and sometimes select financial institutions (like in the US) have reserve accounts at the central bank, so transactions within them move Base Money

The following article on how commercial banks work will be very helpful to understand how they operate and create money: https://illya.sh/threads/@1754426330-1

my article on repo rates and BTC price was referenced on bitcoin.com

apparently it's been there for a month, but i only noticed now

it's a short read - and explains the negative price pressure that quarter-ends, and especially September bring on the price of liquidity sensitive assets like Bitcoin

it give you a concrete perspective on the current cryptocurrency price dump, even with decreasing funding rates

the financial system is heavily dependent on refinancing

this is true for both, governments and the public sector - especially the financial institutions

≈70% of all new credit is used for refinancing/repaying of existing maturing debt rather than novel financing

in addition to being a store of value, gold is also acting as an investment

it's up ≈40% YTD

this is gold catching up to inflation and accumulated leverage

the financial system infrastructure, including monetary policies of the central banks are correlated

they're heavily exposed to the same set of assets - a lot of which are USD-denominated

this is of course extremely pro-cyclical

gold is a great asset to hold for the next 5 years

it's a hedge against the credit & refinancing bubble of the US equity markets + government debt

but not only against USD - all FIAT & risk assets including crypto

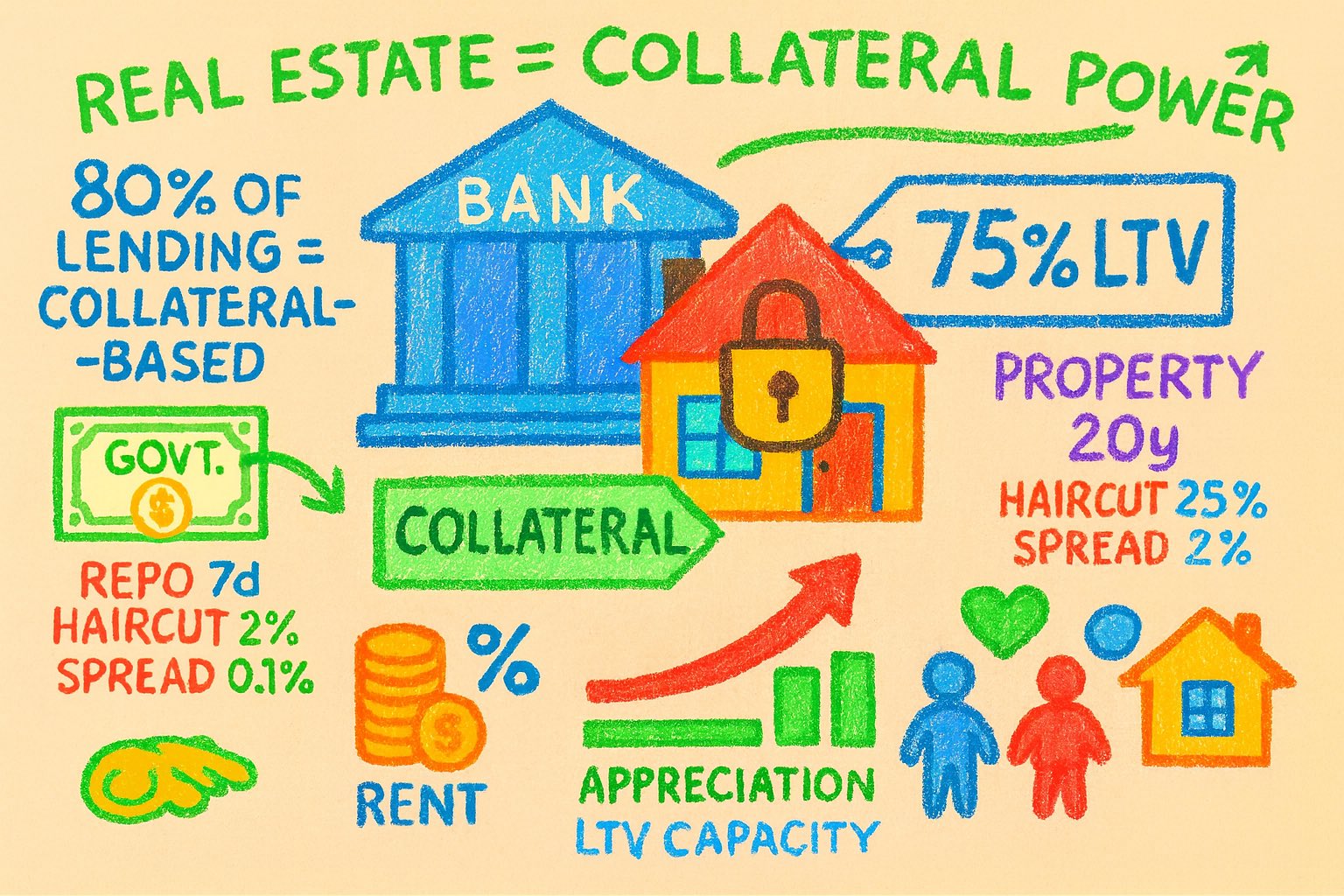

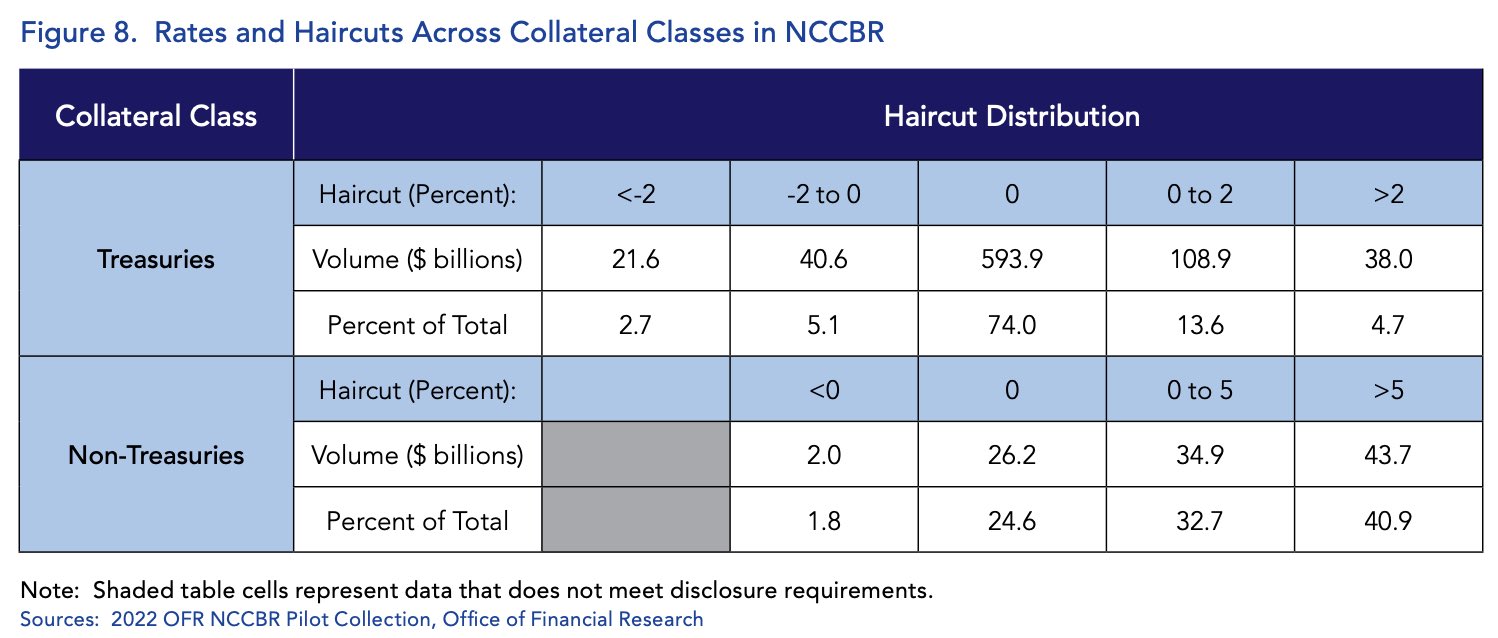

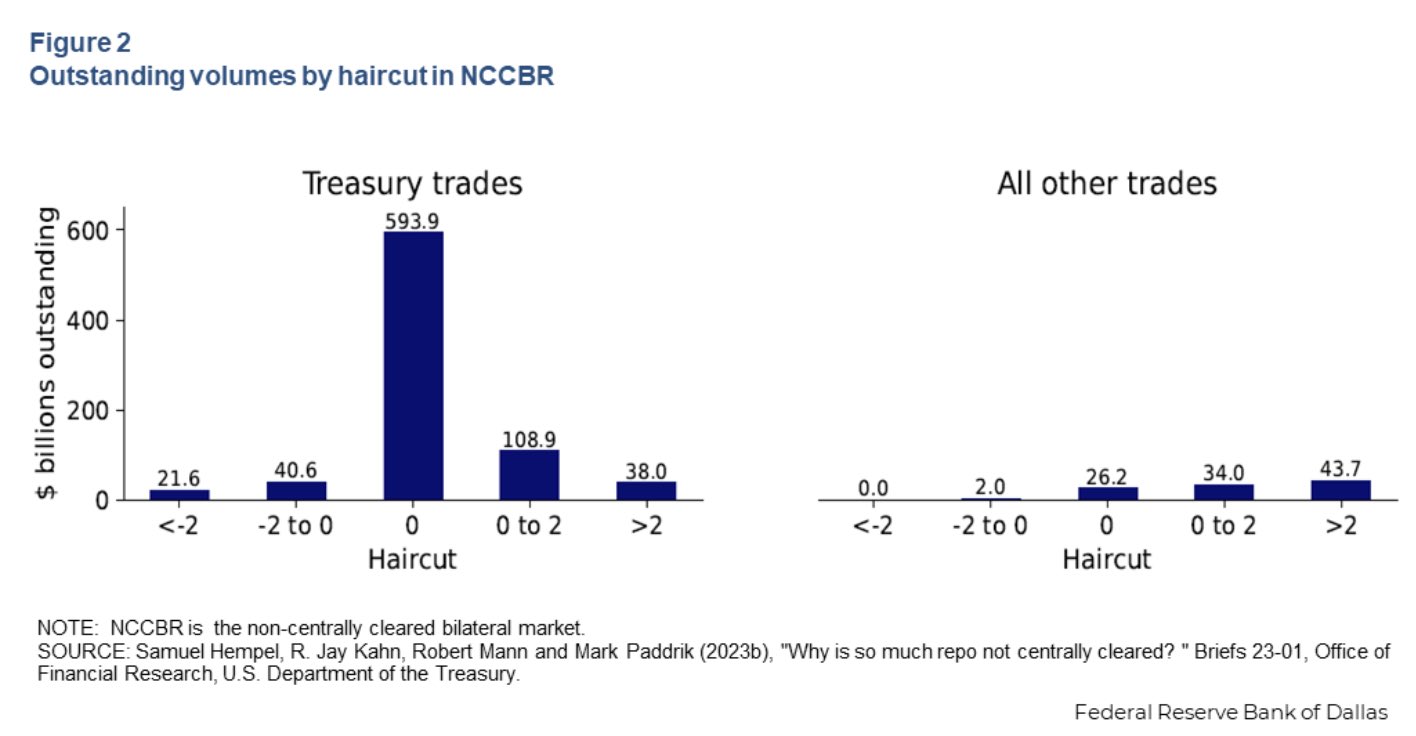

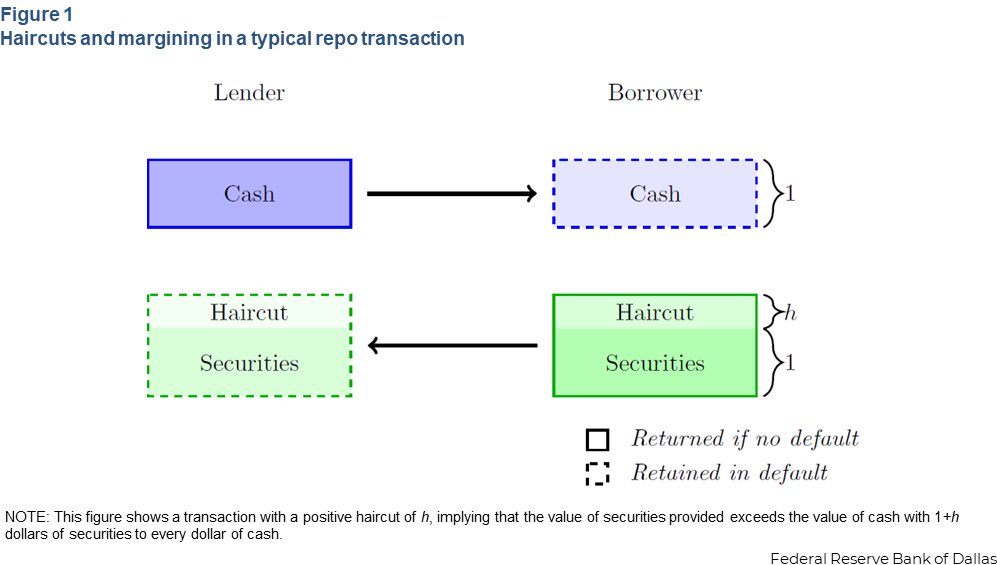

this is why a 7 day Treasury bill-backed repo agreement may have 2% haircut and a 0.1% spread, while a 20 year immovable property collateralized loan a 25% haircut and a 2% spread

the T-bill is more liquid, less volatile and the loan term is much shorter

collateralized lending comes with smaller interest rates/financing cost because it's low risk for the lender

if you default - the lender keeps your collateral

haircuts and spread are set sufficiently high to cover liquidity, term and market risks

collateralized lending comes with smaller interest rates/financing cost because it's low risk for the lender

if you default - the lender keeps your collateral

haircuts and spread are set sufficiently high to cover liquidity, term and market risks

≈80% of lending in financial markets is collateral-based

financial institutions use government bonds as collateral for short-term loans

you're using immovable property as collateral for a generally longer term-loan

≈80% of lending in financial markets is collateral-based

financial institutions use government bonds as collateral for short-term loans

you're using immovable property as collateral for a generally longer term-loan

i wrote a thread explaining the business model of banks here: https://illya.sh/threads/@1755863018-1.html

the information in it is important to understand the balance sheet dynamics of gold reevaluation

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

so assuming no sanitization - an initial reduction of liquidity may occur

so if the US Treasury revaluated gold and used all those proceeds to repurchase/retire debt it will likely have an initial negative effect on the liquidity, due to contraction in safe collateral

NCCBR participants are generally subject to regulations and balance sheet constraints - so don't think that null/negative haircuts means the collateral can be rehypothecated infinitely

these bilateral arrangements is where financial institutions manage their liquidity needs

NCCBR participants are generally subject to regulations and balance sheet constraints - so don't think that null/negative haircuts means the collateral can be rehypothecated infinitely

these bilateral arrangements is where financial institutions manage their liquidity needs

NCCBR users are mostly institutions part of the financial market infrastructure - such as dealers and hedge funds

they use NCCBR to manage their balance sheets and regulatory obligations. so a high need for Treasury collateral may drive the the haircuts negative

NCCBR users are mostly institutions part of the financial market infrastructure - such as dealers and hedge funds

they use NCCBR to manage their balance sheets and regulatory obligations. so a high need for Treasury collateral may drive the the haircuts negative

NCCBR are essentially bilateral OTC agreements - no central counterparty or tri-party custodian

in non-centrally cleared bilateral repos (NCCBR) the Treasury haircut is mostly 0%, and a significant portion has negative haircuts - meaning that more money is lent in the repo that the market value of the Treasury collateral

current tri-party repo haircut average for Treasury collateral is 2%, supervisory is 4% (Capital Adequacy Requirements)

with a 2% haircut the collateral funding multiplier is 50x, with a 4% haircut - 25x

the smaller the haircut - the larger the maximum rehypothecated credit

collateral gets reused/rehypothecated, reserves don't

dealers re-pledge/re-use Treasuries, e.g. through repo and reverse repo. thus, the financing capacity of Treasury bills, notes and bonds exceeds their market value

retiring debt with gold revaluation would change the composition of liquidity:

➖ less US government bonds (safe collateral)

➕ more base money (reserves) and/or broad money (deposits)

so the end result is more base and/or broad money, but less prime/repo-eligible collateral

retiring debt with gold revaluation would change the composition of liquidity:

➖ less US government bonds (safe collateral)

➕ more base money (reserves) and/or broad money (deposits)

so the end result is more base and/or broad money, but less prime/repo-eligible collateral

persistent deficits & refinancing needs will add $1 trillion of new debt in less than a year

so gold revaluation is insignificant for US federal government's debt problem