⬇️ My Thoughts ⬇️

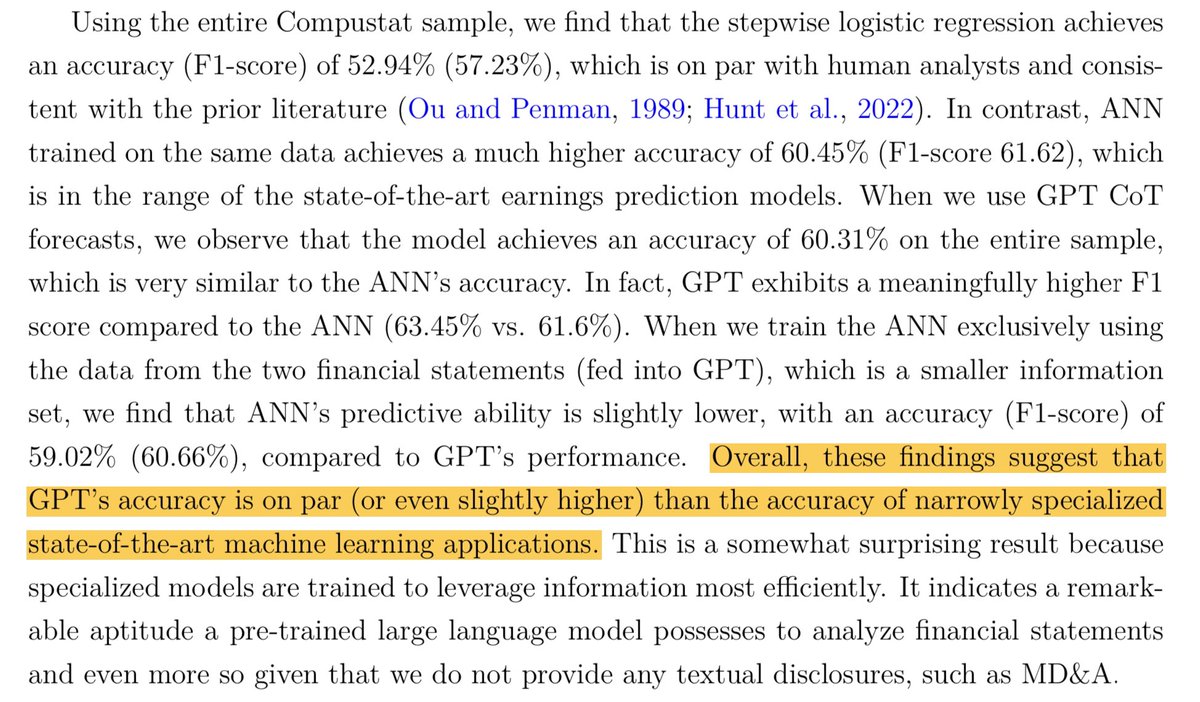

GPT-4 outperforms both, carbon-based financial analysts (humans) and purpose-specific ANNs

While the former is understandable, the latter is surprising. The broader context of an LLM appears to be more important than the specialized multi-dimensionality of an ANN

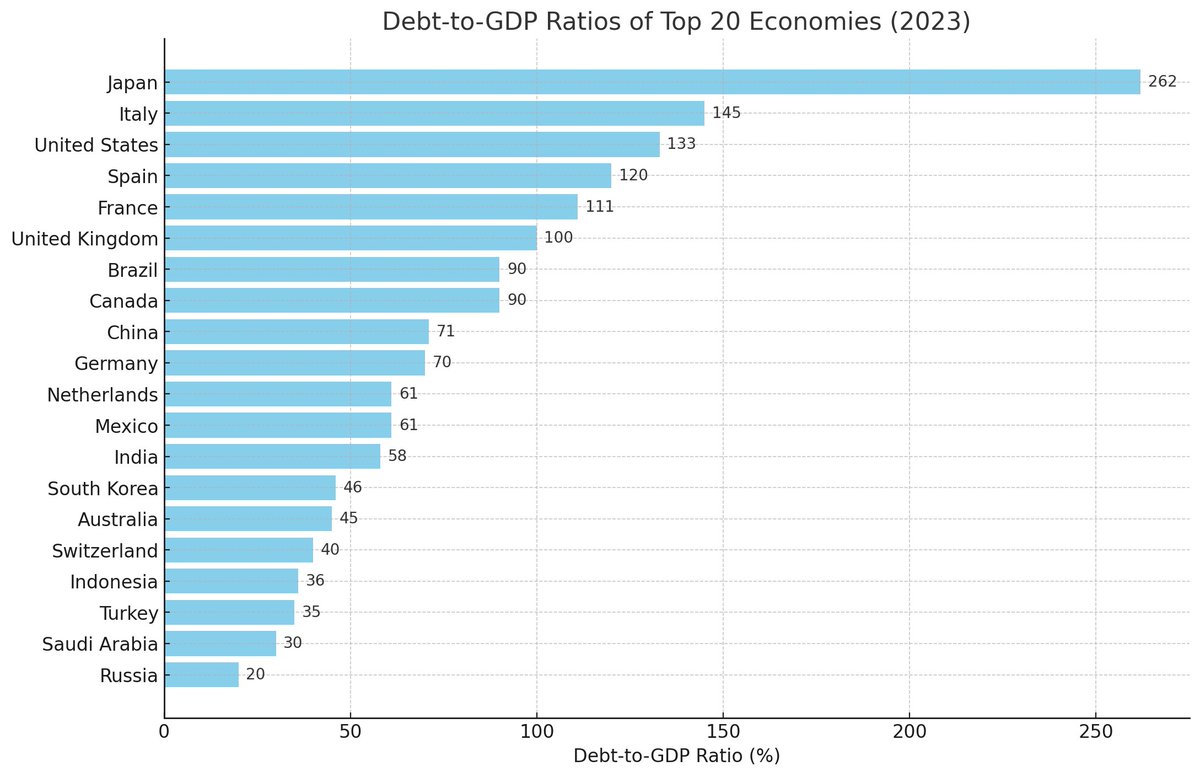

🔴 GDP is a useless metric 🔴

A country may resort to debt, inject that debt into the economy, and see nominal GDP figures raise, without producing value. This is a recipe for an economic bubble

Debt-to-GDP ratio presents a much clearer picture (smaller is better)👇

I invite you to check your country's net exports as a % of GDP and be surprised 😳

GDP comprises of numerous measures, some of which don't have any relation to the produced value

Net exports provide a more objective measure of self-sustainability and relative value

Additional insights from a practical perspective can be found here 👇

🔗

Read the full article to dive deeper into how the BRICS digital currency can be realized as a cryptocurrency on a public blockchain. 📖

🔗 https://illya.sh/blog/posts/brics-cryptocurrency-blockchain/

Let's discuss! Share your thoughts below🗣️

🌟 By embracing public blockchains and ZeroKnowledge technologies, the BRICS digital currency can pioneer a new era of finance🔮

A more efficient, interoperable, decentralized, and inclusive financial system aligned with Web3 principles 🌍

🌟 By embracing public blockchains and ZeroKnowledge technologies, the BRICS digital currency can pioneer a new era of finance🔮

A more efficient, interoperable, decentralized, and inclusive financial system aligned with Web3 principles 🌍

🧩 Implementing the BRICS currency on a public blockchain reduces cost & complexity

The dynamic supply is controlled by smart contracts, while ZKPs bridge data from arbitrary sources 🌉

Demand is driven by incentives for participating in the BRICS economic network 💰

🧩 Implementing the BRICS currency on a public blockchain reduces cost & complexity

The dynamic supply is controlled by smart contracts, while ZKPs bridge data from arbitrary sources 🌉

Demand is driven by incentives for participating in the BRICS economic network 💰

🌍 Integrating zkLocus allows associating geolocation data with each BRICS transaction while preserving user privacy 🔒

zkLocus turns geolocation into a programmable real-world asset (RWA), enabling location-based fees and taxation📍

✨ Native on MinaProtocol

🌍 Integrating zkLocus allows associating geolocation data with each BRICS transaction while preserving user privacy 🔒

zkLocus turns geolocation into a programmable real-world asset (RWA), enabling location-based fees and taxation📍

✨ Native on MinaProtocol

💸 The dynamic supply of the BRICS currency is defined by a formula:

M = ForT + FDI + PI + ForEx + G&EX + InterSec + Der + ForDeposit + EuroCurrency + MTransfer + Etc.

This can be automated using smart contracts on the blockchain 🤖

Like Algorithmic stablecoins and Uniswap

🔍 Let's explore how the BRICS currency can leverage these technologies:

✅ Dynamic supply mechanism via smart contracts

✅ Legal compliance on-chain using ZKPs

✅ Integration with DeFi and zkLocus for authenticated private geolocation

👉 A cryptocurrency for Web3

🔍 Let's explore how the BRICS currency can leverage these technologies:

✅ Dynamic supply mechanism via smart contracts

✅ Legal compliance on-chain using ZKPs

✅ Integration with DeFi and zkLocus for authenticated private geolocation

👉 A cryptocurrency for Web3

💡 While the original paper suggests the impossibility of realizing the BRICS currency as a cryptocurrency, we'll challenge it 🤔

A public blockchain with SmartContracts, combined with Zero-Knowledge Proofs (ZKP), provides a natural fit for the implementation 🧩

💡 While the original paper suggests the impossibility of realizing the BRICS currency as a cryptocurrency, we'll challenge it 🤔

A public blockchain with SmartContracts, combined with Zero-Knowledge Proofs (ZKP), provides a natural fit for the implementation 🧩

🌍 The BRICS digital currency aims to integrate with existing monetary systems, creating a unified economic area for member nations 🤝

Its value is algorithmically derived from various economic factors of the participating countries 📈

🌍 The BRICS digital currency aims to integrate with existing monetary systems, creating a unified economic area for member nations 🤝

Its value is algorithmically derived from various economic factors of the participating countries 📈

🚀 BRICS Digital Currency: Cryptocurrency on a Public Blockchain 🪙

In this article, we explore how the BRICS currency can be implemented on a public blockchain and challenge the claims made in "Digital Money Options for the BRICS" for Web3

🚀 BRICS Digital Currency: Cryptocurrency on a Public Blockchain 🪙

In this article, we explore how the BRICS currency can be implemented on a public blockchain and challenge the claims made in "Digital Money Options for the BRICS" for Web3

That's it for technical deep dive into RandoMina and its 01JS implementation on Mina Protocol blockchain ! 🤿

For more details, check out the source code and tests on GitHub. ⭐️

Feel free to ask any questions or share your thoughts! 💬

🔗 https://github.com/iluxonchik/randomina

1️⃣2️⃣ In summary, RandoMina leverages ZK proofs, $Mina's VRF `stakingEpochData.seed.value`, and a combination of network state, sender info, and local nonces to provide secure, verifiable, and infinite randomness for dAppss 🌟

1️⃣2️⃣ In summary, RandoMina leverages ZK proofs, $Mina's VRF `stakingEpochData.seed.value`, and a combination of network state, sender info, and local nonces to provide secure, verifiable, and infinite randomness for dAppss 🌟

1️⃣1️⃣ Generating a random number involves:

1. Preparing public (Network State, Sender) and private (Nonce) inputs

2. Generating a proof using `RandomNumberObservationCircuit`

3. Verifying the proof and network state with `RandoMinaContract`

Code & Tests: https://github.com/iluxonchik/randomina

1️⃣1️⃣ Generating a random number involves:

1. Preparing public (Network State, Sender) and private (Nonce) inputs

2. Generating a proof using `RandomNumberObservationCircuit`

3. Verifying the proof and network state with `RandoMinaContract`

Code & Tests: https://github.com/iluxonchik/randomina

🔟 Across different epochs, the same identity generates distinct random numbers:

🌐 Network State changes with each new epoch

🆕 Updated Network State is combined with Sender-Specific Nonce and Local Seed/Nonce

➡️ Guarantees diff numbers for the same identity across epochs! ⏰

🔟 Across different epochs, the same identity generates distinct random numbers:

🌐 Network State changes with each new epoch

🆕 Updated Network State is combined with Sender-Specific Nonce and Local Seed/Nonce

➡️ Guarantees diff numbers for the same identity across epochs! ⏰

9️⃣ For the same identity, using different Local Seed/Nonce values:

🔄 Varying the Local Seed/Nonce

🔗 While keeping the Sender-Specific Nonce and Network State constant

➡️ Produces unique random numbers for the same identity within an epoch! 🪄

9️⃣ For the same identity, using different Local Seed/Nonce values:

🔄 Varying the Local Seed/Nonce

🔗 While keeping the Sender-Specific Nonce and Network State constant

➡️ Produces unique random numbers for the same identity within an epoch! 🪄

8️⃣ When two identities generate random numbers using RandoMina:

✅ Sender-Specific Nonce is unique due to different public keys

✅ Combining unique Sender-Specific Nonce with Network State and Local Seed/Nonce

➡️ Always results in different random numbers for each identity! 🎉

8️⃣ When two identities generate random numbers using RandoMina:

✅ Sender-Specific Nonce is unique due to different public keys

✅ Combining unique Sender-Specific Nonce with Network State and Local Seed/Nonce

➡️ Always results in different random numbers for each identity! 🎉

7️⃣ Here's how RandoMina ensures unique random numbers! 🕵️

- Two identities (public keys) will always generate different random numbers 🔑

- Same identity with different local seeds produces unique numbers 🌱

- Same identity across different epochs generates distinct numbers 📅

7️⃣ Here's how RandoMina ensures unique random numbers! 🕵️

- Two identities (public keys) will always generate different random numbers 🔑

- Same identity with different local seeds produces unique numbers 🌱

- Same identity across different epochs generates distinct numbers 📅

6️⃣ RandoMina's smart contract, `RandoMinaContract`, verifies the computation and ensures the claimed network state matches the current epoch. ✅

It's designed to be used or integrated by other contracts needing secure randomness. 🧩

6️⃣ RandoMina's smart contract, `RandoMinaContract`, verifies the computation and ensures the claimed network state matches the current epoch. ✅

It's designed to be used or integrated by other contracts needing secure randomness. 🧩

5️⃣ The Local Seed/Nonce allows generating multiple random numbers per epoch for each sender. 🎲

By varying this private nonce, an infinite number of pseudo-random numbers can be generated within a single epoch. ♾️

5️⃣ The Local Seed/Nonce allows generating multiple random numbers per epoch for each sender. 🎲

By varying this private nonce, an infinite number of pseudo-random numbers can be generated within a single epoch. ♾️

4️⃣ The Sender-Specific Nonce is derived from the sender's public key, ensuring unique (pseudo)random numbers across the network. 🌍

It's computed by Poseidon-hashing the public key, adding a global uniqueness component. 🔑