⬇️ My Thoughts ⬇️

🔍 The challenge with e-commerce privacy lies in two main areas:

1️⃣ Keeping search queries private 🔒

2️⃣ Protecting personal info like name and address 🙅♂️

Traditional platforms require us to trust them with this data

🛒 E-commerce & Privacy - Myth or Reality? 🔐

💻 Online shopping without revealing your personal data?

🚀 Zero-Knowledge Proofs (ZKP), zkLocus and Mina Protocol blockchain enable just that

https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

Here's how 🧵👇

🛒 E-commerce & Privacy - Myth or Reality? 🔐

💻 Online shopping without revealing your personal data?

🚀 Zero-Knowledge Proofs (ZKP), zkLocus and Mina Protocol blockchain enable just that

https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

Here's how 🧵👇

😳 ZKP will redefine what you know about computation and privacy

📍 This is what we are doing at zkLocus, by turning geolocation into a RWA

🔗 To learn more, visit https://zklocus.dev/

🪄 This is just one example of what is possible with ZeroKnowledge Proofs

📚 It was taken from my article "Privacy Is A Myth. Unless You're Using Zero-Knowledge Proofs" 👇

https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

🪄 This is just one example of what is possible with ZeroKnowledge Proofs

📚 It was taken from my article "Privacy Is A Myth. Unless You're Using Zero-Knowledge Proofs" 👇

https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

🚨 By using Mina Protocol as a public layer for computation proofs, we create an auditable & transparent system 🕵️♀️

Anyone can verify that the cameras are operating as promised, without misusing the video data 🔍

🚨 By using Mina Protocol as a public layer for computation proofs, we create an auditable & transparent system 🕵️♀️

Anyone can verify that the cameras are operating as promised, without misusing the video data 🔍

📋 Here's how Mina Protocol blockchain fits into the picture:

1️⃣ zkSNARK circuits verifying camera code execution are stored on Mina

2️⃣ Commitments & ZKP circuits to the zkML model are also stored on the blockchain

3️⃣ All proofs from cameras are submitted & verified against them

📋 Here's how Mina Protocol blockchain fits into the picture:

1️⃣ zkSNARK circuits verifying camera code execution are stored on Mina

2️⃣ Commitments & ZKP circuits to the zkML model are also stored on the blockchain

3️⃣ All proofs from cameras are submitted & verified against them

🟣 Mina Protocol can implement the foundational layer 🚀

Verification keys that attest to the correct execution of the camera's code can be stored on $MINA 🔑

In practice, this involves commitments and ZKP circuits to the zkML model, thus ensuring the right one is used 🧠

🟣 Mina Protocol can implement the foundational layer 🚀

Verification keys that attest to the correct execution of the camera's code can be stored on $MINA 🔑

In practice, this involves commitments and ZKP circuits to the zkML model, thus ensuring the right one is used 🧠

🔐 zkSNARKs/zkSTARKs can be used to create ZK proofs that attest to the correct execution of the camera's code 📸

👮♀️ These proofs, representing an observation of a computation, ensure that non-suspicious video is discarded, thus preserving privacy

👉 Do not trust, verify 👈

🔐 zkSNARKs/zkSTARKs can be used to create ZK proofs that attest to the correct execution of the camera's code 📸

👮♀️ These proofs, representing an observation of a computation, ensure that non-suspicious video is discarded, thus preserving privacy

👉 Do not trust, verify 👈

🧩 Here's how a ZKP-powered surveillance system works:

1️⃣ Cameras feed live video into a zkML model

2️⃣ The model labels data as "suspicious" or "non-suspicious"

3️⃣ Only "suspicious" footage is stored & reported

4️⃣ The zkML model is public, ensuring transparency

🧩 Here's how a ZKP-powered surveillance system works:

1️⃣ Cameras feed live video into a zkML model

2️⃣ The model labels data as "suspicious" or "non-suspicious"

3️⃣ Only "suspicious" footage is stored & reported

4️⃣ The zkML model is public, ensuring transparency

🔍 The key lies in the verifiable computation model of Zero-Knowledge Proofs 🔑

Instead of trusting third-parties not to misuse data, we rely on cryptographic proofs to ensure privacy 💪

It's not about faith, but rather mathematical certainty 🧮

🔗 https://illya.sh/blog/posts/zksnark-zkstark-verifiable-computation-model-blockchain/

🔍 The key lies in the verifiable computation model of Zero-Knowledge Proofs 🔑

Instead of trusting third-parties not to misuse data, we rely on cryptographic proofs to ensure privacy 💪

It's not about faith, but rather mathematical certainty 🧮

🔗 https://illya.sh/blog/posts/zksnark-zkstark-verifiable-computation-model-blockchain/

📹 Imagine a global network of video cameras, monitoring every corner, every alley, even inside your home 🏠

Sounds like a privacy nightmare, right? 😨

Not necessarily! 😮

With ZKP, we can mathematically guarantee that private data is never stored or shared! 🔐

📹 Imagine a global network of video cameras, monitoring every corner, every alley, even inside your home 🏠

Sounds like a privacy nightmare, right? 😨

Not necessarily! 😮

With ZKP, we can mathematically guarantee that private data is never stored or shared! 🔐

🌍 Imagine 24/7 global video surveillance that doesn't compromise privacy

🤯 Sounds impossible?

😎 Zero-Knowledge Proofs disagree

Here's why 🧵👇

Linguistic vocal communication is such a wild concept 🤯

Like, I can take an abstract concept that I have in my mind, transform it into vibrations, transmit it wirelessly over air and have another individual parse it back into a similar abstract concept, now in their mind

👉 Learn more about ZKPs & privacy:

- zkLocus: https://zklocus.dev/

- zkSafeZones: https://zklocus.dev/zkSafeZones/

- Full article: https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

Let's make privacy the default, not an afterthought 🌟

🗣️ Privacy is a fundamental human right, and digital privacy is not an exception 📜

With Mina Protocol blockchain and ZKP solutions like zkLocus, we can build a future where privacy is the default 🙌

As the Web3 community, this is our mission & responsibility 💪

📹 Even 24/7 global video surveillance can be privacy-preserving with ZKP! 🌍

By combining zkML and verifiable computation, cameras can detect suspicious activity without storing private data 🕵️♀️

No, it's not magic. It's mathematics 🔐

📹 Even 24/7 global video surveillance can be privacy-preserving with ZKP! 🌍

By combining zkML and verifiable computation, cameras can detect suspicious activity without storing private data 🕵️♀️

No, it's not magic. It's mathematics 🔐

🔍 Imagine a search engine that never sees your raw queries, or a social network that keeps your connections hidden 😲

With ZKP, it's not just possible, but practical! 🎉

zkLocus, powered by Mina Protocol blockchain, is turning private geolocation into reality 📍

🌍 With ZKPs, we can build privacy-preserving: 🏗️

- Search engines 🔍

- Social networks 👥

- E-commerce platforms 🛒

- Even 24/7 global video surveillance! 📹

All without compromising functionality, business or individual privacy 💪

🌍 With ZKPs, we can build privacy-preserving: 🏗️

- Search engines 🔍

- Social networks 👥

- E-commerce platforms 🛒

- Even 24/7 global video surveillance! 📹

All without compromising functionality, business or individual privacy 💪

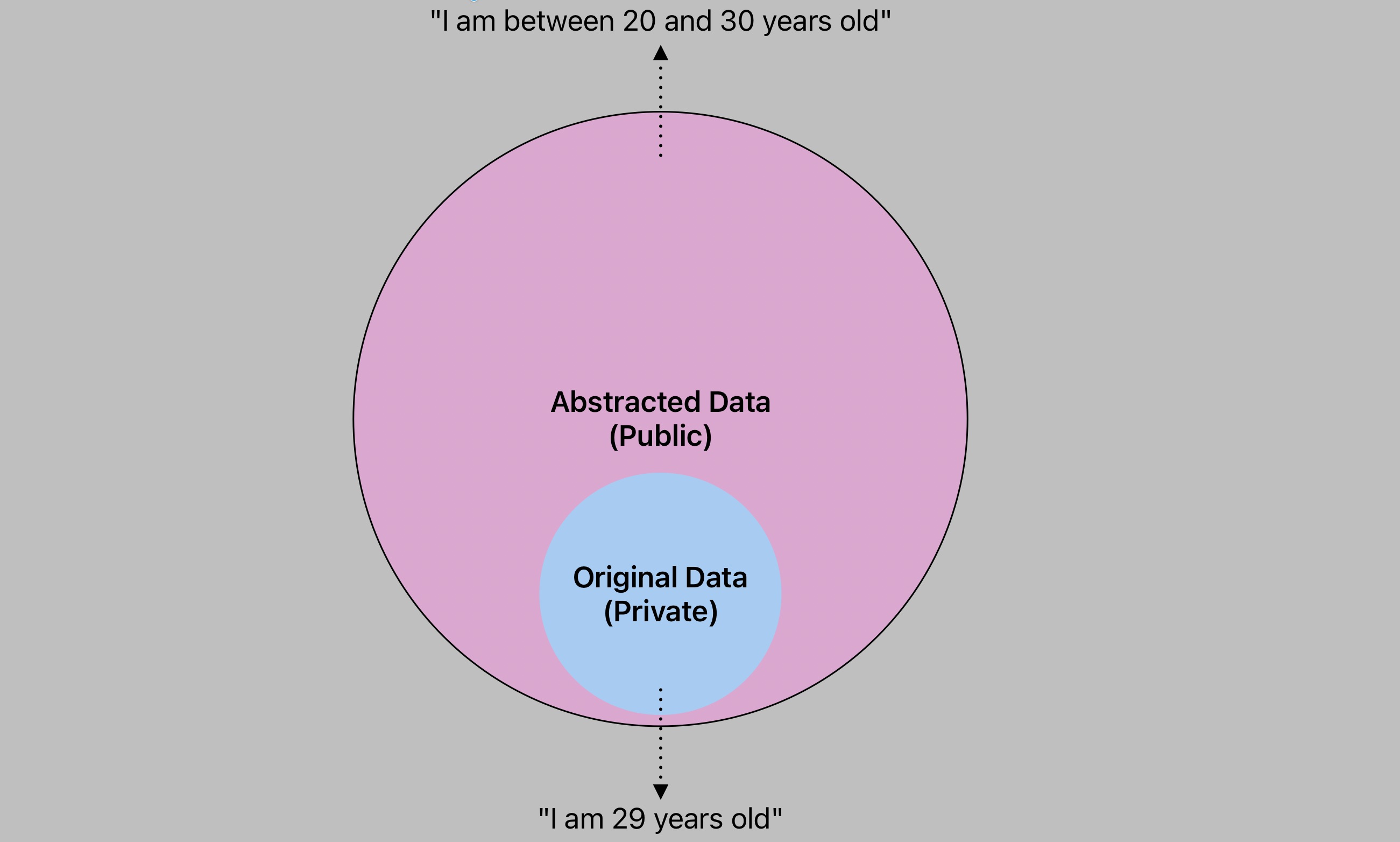

🔐 ZKPs remove the need to trust third parties for privacy. 🙅♂️

Instead, we rely on mathematical guarantees 🧮

This allows us to retain full custody & control over our data while enjoying digital services 😌

🔐 ZKPs remove the need to trust third parties for privacy. 🙅♂️

Instead, we rely on mathematical guarantees 🧮

This allows us to retain full custody & control over our data while enjoying digital services 😌

🌿 Merkle Trees, MPC, and homomorphic encryption complement ZKPs. 🍃

- Merkle Trees: Efficient & private data storage 📚

- MPC: Secure multi-party computation 🤝

- Homomorphic Encryption: Computation on encrypted data 🔒

🌿 Merkle Trees, MPC, and homomorphic encryption complement ZKPs. 🍃

- Merkle Trees: Efficient & private data storage 📚

- MPC: Secure multi-party computation 🤝

- Homomorphic Encryption: Computation on encrypted data 🔒

🔐 How does Mina Protocol blockchain fit into this? 🤔

$MINA serves as the foundation for ZKP apps, thanks to its programmable zkApps 🚀

It uses recursive zkSNARKs to create proofs of arbitrary computations, thus serving as the foundation of privacy solutions 💪

It's proof of everything

🔐 How does Mina Protocol blockchain fit into this? 🤔

$MINA serves as the foundation for ZKP apps, thanks to its programmable zkApps 🚀

It uses recursive zkSNARKs to create proofs of arbitrary computations, thus serving as the foundation of privacy solutions 💪

It's proof of everything

🔍 Solutions like zkLocus, zkSafeZones, zkML, and zkVM leverage ZKPs for privacy🛡️

- zkLocus: Private geolocation sharing on Mina Protocol blockchain 📍

- zkSafeZones: Civilian protection in warzones 🏥

- zkML: Private machine learning 🤖

- zkVM: Verifiable computation 💻

🔍 Solutions like zkLocus, zkSafeZones, zkML, and zkVM leverage ZKPs for privacy🛡️

- zkLocus: Private geolocation sharing on Mina Protocol blockchain 📍

- zkSafeZones: Civilian protection in warzones 🏥

- zkML: Private machine learning 🤖

- zkVM: Verifiable computation 💻

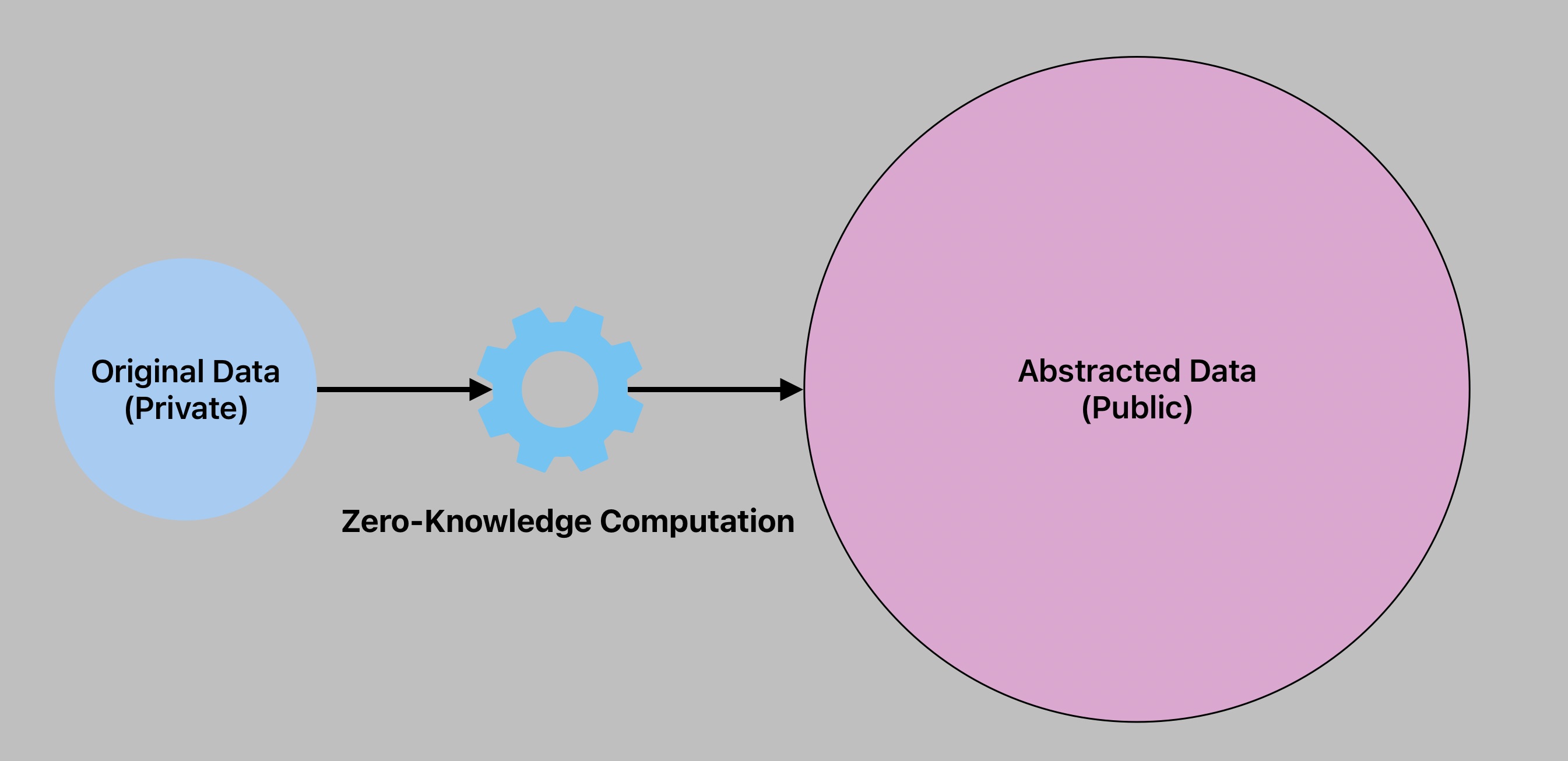

💡 Zero-Knowledge Proofs fix digital privacy 🌅

Instead of protecting sensitive data after sharing, ZKPs enable sharing data in an inherently private manner 🔐

By turning data into computation, ZKPs abstract it to preserve privacy 🧩

💡 The problem with digital privacy lies not in how data is stored & shared, but what data is shared 🤔

Even with encryption, once sensitive data leaves your device, it's compromised 😱

But what if we could share data in an inherently private manner? 🤯

🚨 PRIVACY IS A MYTH! 🕵️♂️

Digital privacy is fundamentally unfeasible, unless we rely on verifiable computation constructs like Zero-Knowledge Proofs (ZKP) 🔐

A thread 🧵 on why ZKPs are the key to true digital privacy 👇

https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

Privacy ZeroKnowledge Web3

🚨 PRIVACY IS A MYTH! 🕵️♂️

Digital privacy is fundamentally unfeasible, unless we rely on verifiable computation constructs like Zero-Knowledge Proofs (ZKP) 🔐

A thread 🧵 on why ZKPs are the key to true digital privacy 👇

https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

Privacy ZeroKnowledge Web3