⬇️ My Thoughts ⬇️

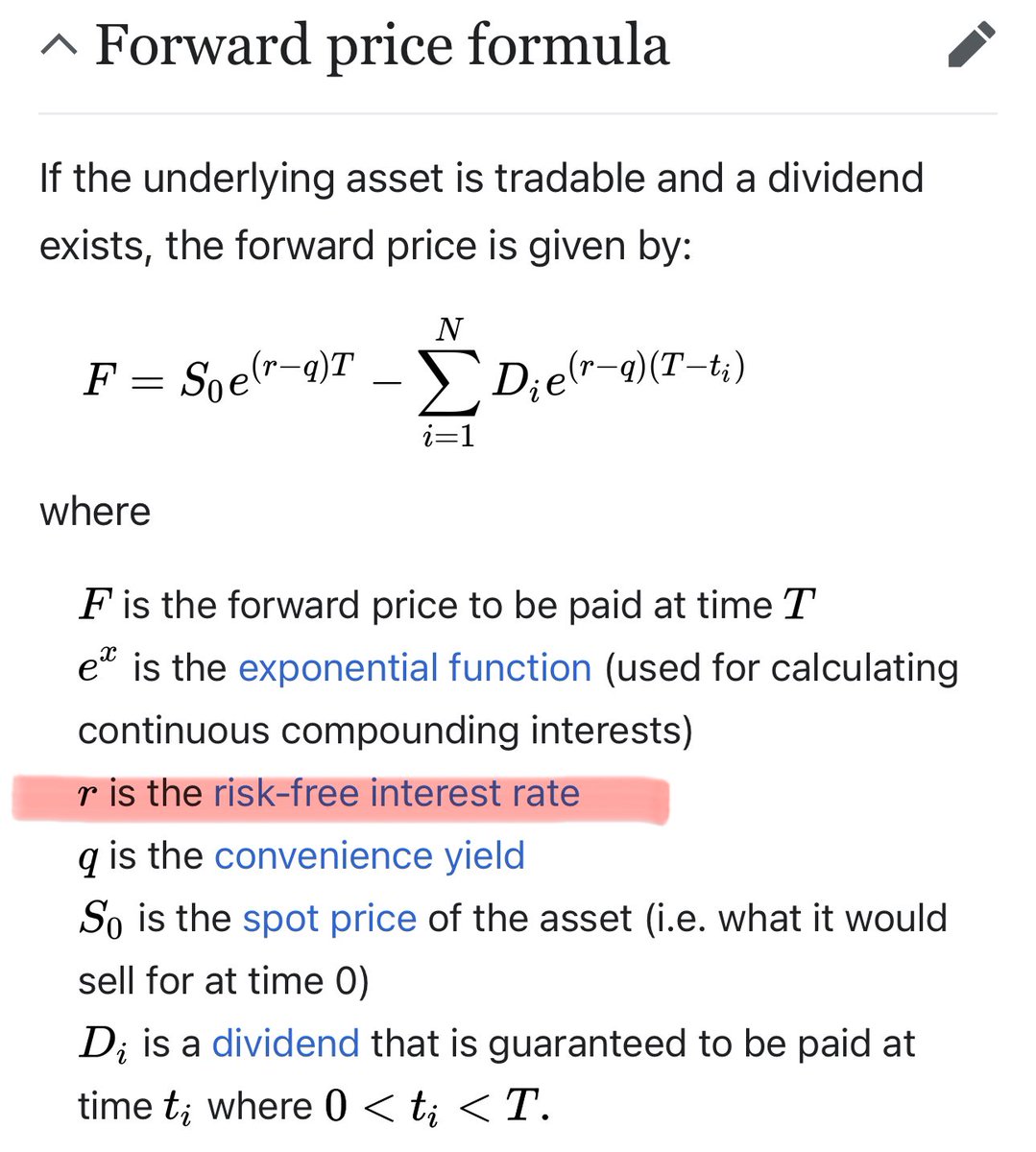

Futures pricing is deterministic, and its main goal is to prevent arbitrage:

💰 Futures Price = Spot Price * e^(rT)

- r: risk-free rate (e.g., $MINA staking yield)

- T: time to maturity

This formula approximates pricing at maturity in both TradFi and DeFi 🧮

🏦 Traditional futures require centralized clearing houses

On the blockchain, smart contracts eliminate intermediaries, enabling decentralized peer-to-peer agreements

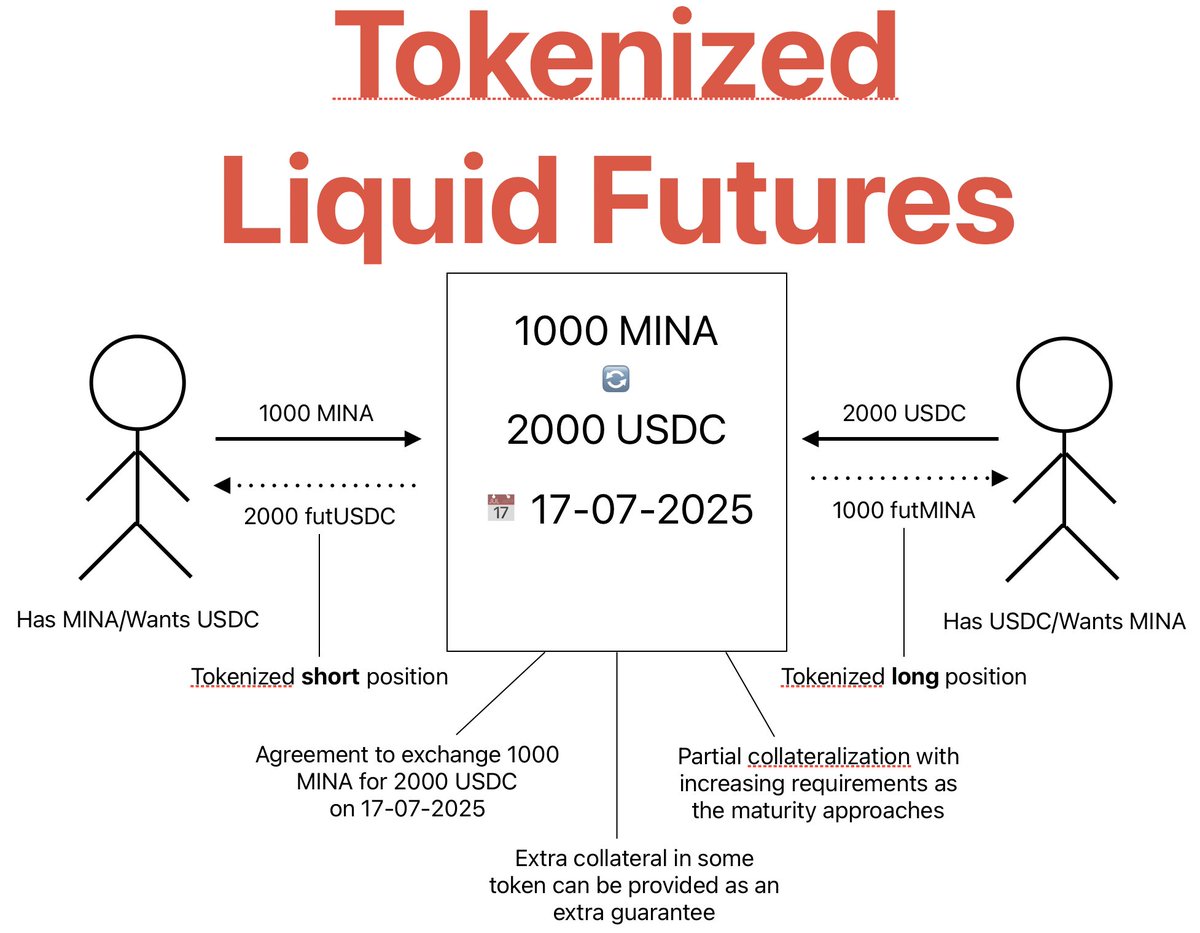

Example: A contract to trade 1000 $MINA for 2000 $USDC in 1 year, regardless of future $MINA price 📊

🏦 Traditional futures require centralized clearing houses

On the blockchain, smart contracts eliminate intermediaries, enabling decentralized peer-to-peer agreements

Example: A contract to trade 1000 $MINA for 2000 $USDC in 1 year, regardless of future $MINA price 📊

Futures contracts serve crucial roles in finance:

1️⃣ Hedging against price volatility

2️⃣ Speculation on future asset prices

3️⃣ Price discovery for underlying assets

Smart contracts on the blockchain will disrupt this $1T+ market. Here's how ⬇️

Futures contracts serve crucial roles in finance:

1️⃣ Hedging against price volatility

2️⃣ Speculation on future asset prices

3️⃣ Price discovery for underlying assets

Smart contracts on the blockchain will disrupt this $1T+ market. Here's how ⬇️

🚀 Exploring Tokenized Liquid Futures Contracts

A deep dive into how they can be implemented on Mina Protocol blockchain without oracles or trusted intermediaries

Covering technical aspects, use cases, and innovations of this DeFi derivative over TradFi solutions

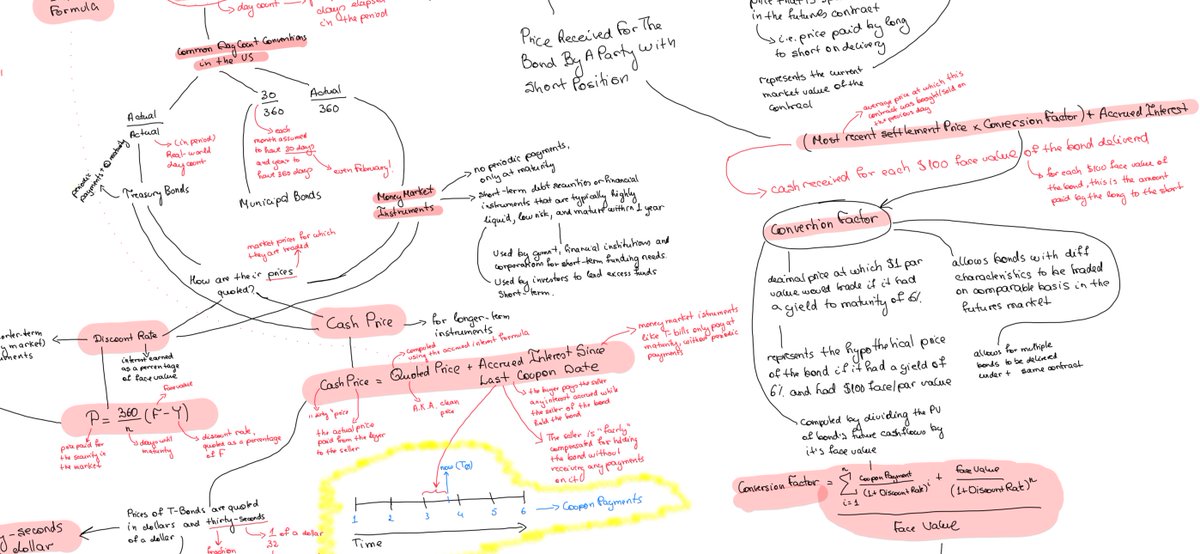

If you think you understand futures contracts, you must learn bond futures

Besides some differences, like dynamic settlement price, you will quickly realize how much #DeFi improves over #TradFi

The future of finance is on-chain

Simplicity, transparency & efficiency http

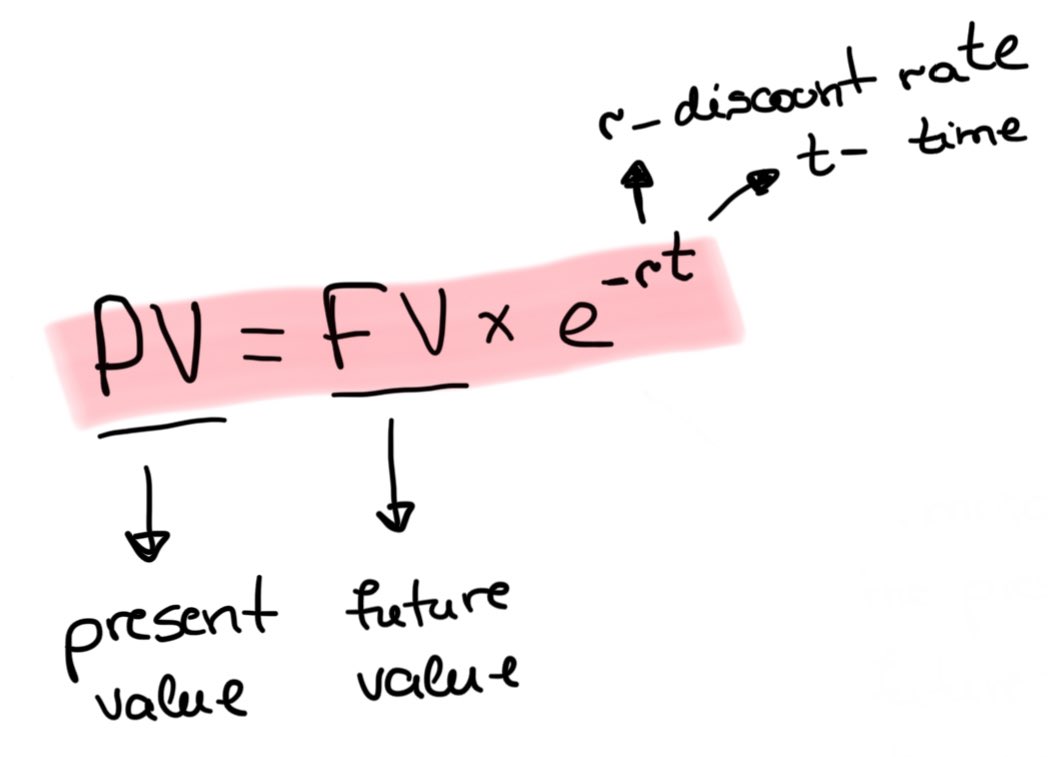

📚 Learning how derivatives are priced will make you realize that all the models are based on financing with an interest rate (IR). Future value of a derivative is discounted with an IR.

Where does this extra money come from?

🔎 Hint:

you may see it manifest as #inflation 😉

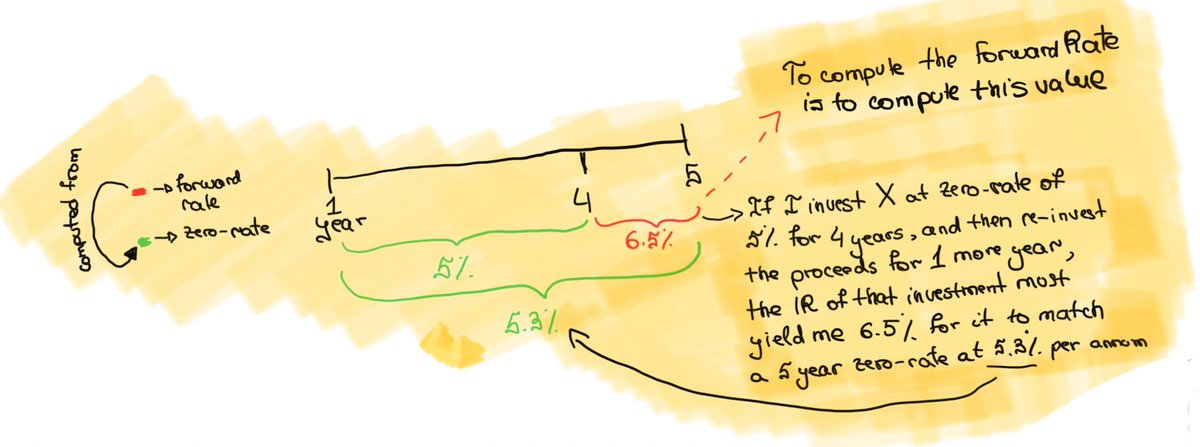

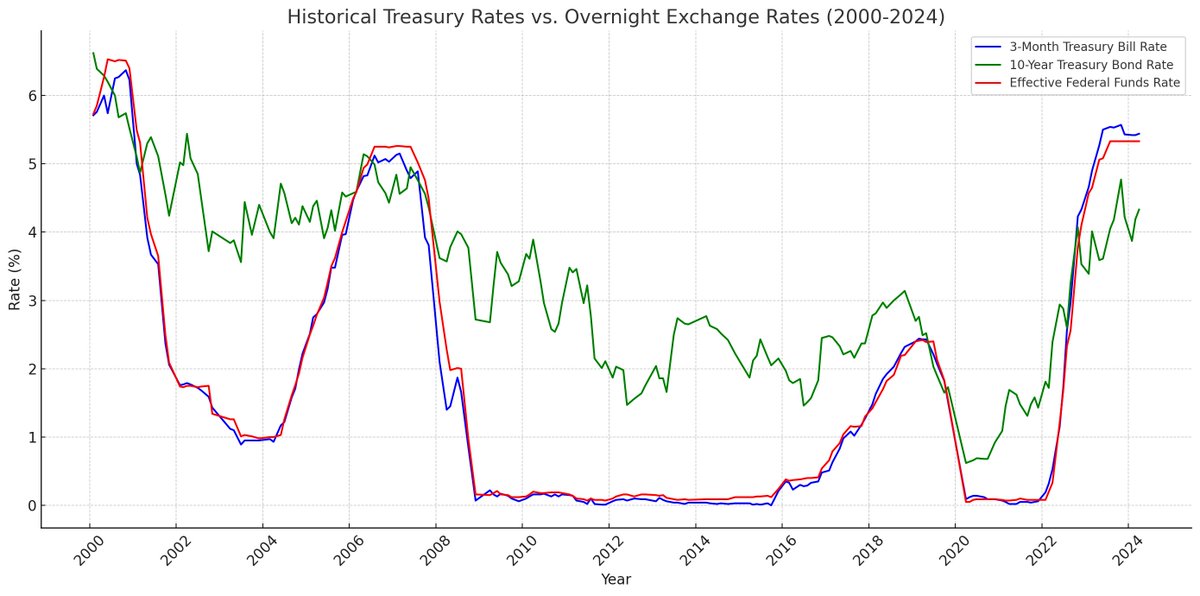

Forward rates compute the borrowing cost of money for a future period. They're derived from the existing interest rates in the market. Useful to compare investments, arbitrage on lend/borrow positions and even predict future inflation value

Here's the concept visualized 👇

And the first rate cut comes from the European Central Bank (#ECB)

Federal Reserve (#FED) coming up next

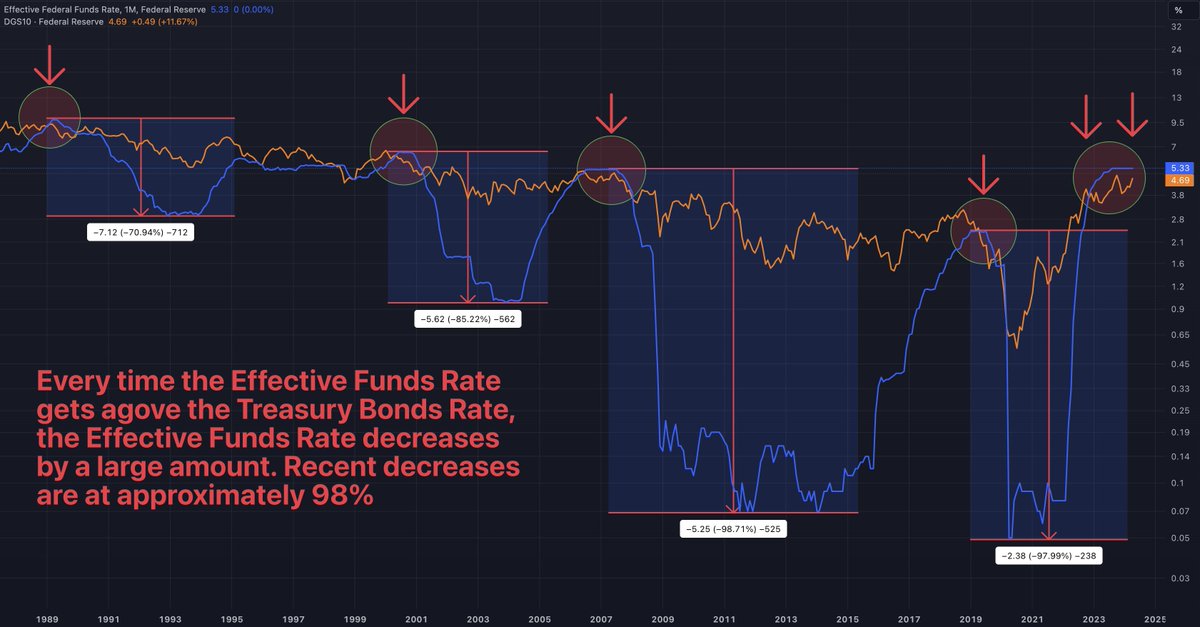

A few days ago I tweeted about how a rate cut is imminent, as suggested by the Treasury Bond rates falling below the overnight exchange rate👇

Besides inflation there is also discounting, which measures the time value of money

Discounting states that money today is worth more than tomorrow, since it can be invested to earn an interest

You can compute today's value of future money using the formula below 👇

🔴 Every time the Treasury Bond rate (#DGS10 / #US10Y) raises above the Fed Funds Rate (#FEDFUNDS / #EFFR), the Fed Funds Rate decreases dramatically

Historically, this has always been the case

and this is exactly what's happening now

Expect a rate cut from the #FED very soon

Treasury rates (Treasury Bills & Bonds) are risk-free, but they do not represent the risk-free rate, as they have artificial incentives. The risk-free rate must represent the true cost of borrowing money. Overnight exchange rates are a much better measure of the risk-free rate. http

👉 Learn more about Zero-Knowledge Proofs, their applications, and how they redefine privacy:

📍 zkLocus: https://zklocus.dev/

📖 Full article: https://illya.sh/blog/posts/privacy-is-a-myth-without-zero-knowledge-proofs/

💜 Let's build a Web3 future where privacy is the default, not an afterthought

🛡️ The result is an e-commerce platform that respects end-user privacy without sacrificing functionality 🎉

❌ There is no need to trade personal data for convenience

🙌 ZKP, Mina Protocol blockchain and zkLocus enable us to have both!

🛡️ The result is an e-commerce platform that respects end-user privacy without sacrificing functionality 🎉

❌ There is no need to trade personal data for convenience

🙌 ZKP, Mina Protocol blockchain and zkLocus enable us to have both!

🔗 The process leverages several ZKP building blocks:

⚙️ zkSNARKs for succinct, verifiable proofs

🌿 Merkle Trees for efficient data storage

🔐 Cyrptographic Commitments for data integrity

🔗 The process leverages several ZKP building blocks:

⚙️ zkSNARKs for succinct, verifiable proofs

🌿 Merkle Trees for efficient data storage

🔐 Cyrptographic Commitments for data integrity

🟣 This entire solution can be implemented on Mina Protocol blockchain! 💪

💻 $MINA's zkApps enable efficient, scalable and verifiable computation powered by zkSNARKs

📍 Combined with zkLocus for geolocation proofs, we have all of the necessary components

🟣 This entire solution can be implemented on Mina Protocol blockchain! 💪

💻 $MINA's zkApps enable efficient, scalable and verifiable computation powered by zkSNARKs

📍 Combined with zkLocus for geolocation proofs, we have all of the necessary components

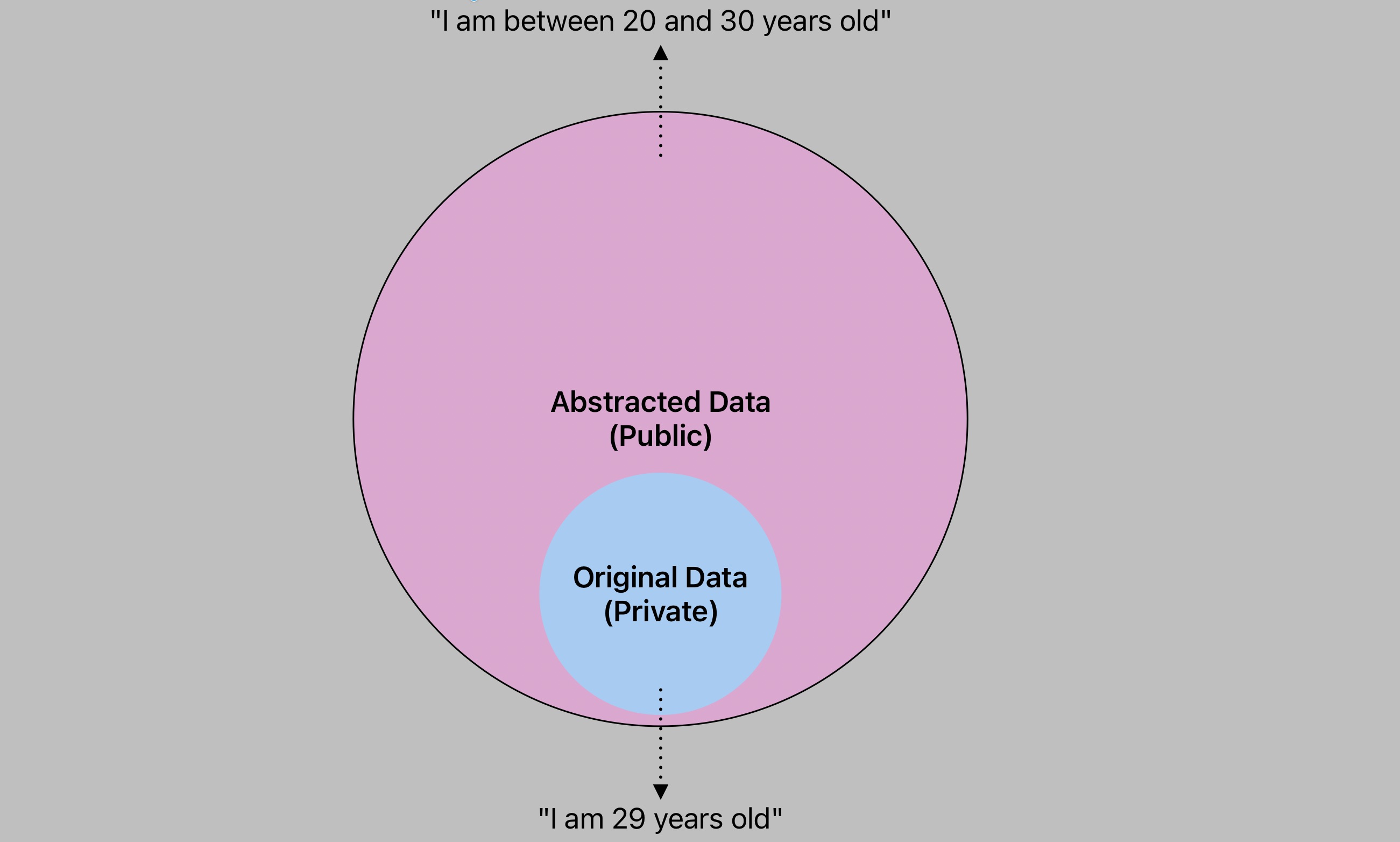

🔐 Throughout this process, your name and address remain hidden from the e-commerce platform. 😌

🌍 The platform only knows a broad area, not your specific location

🪪 The processing center only gets your exact info when you choose to reveal it

🔐 Throughout this process, your name and address remain hidden from the e-commerce platform. 😌

🌍 The platform only knows a broad area, not your specific location

🪪 The processing center only gets your exact info when you choose to reveal it

5️⃣ You provide the decryption key to the center to reveal address

📦 The package then gets shipped & delivered to the user

5️⃣ You provide the decryption key to the center to reveal address

📦 The package then gets shipped & delivered to the user

🎁 Here's how zkLocus enables private shipping:

1️⃣ You creates a zkLocus proof of their location

2️⃣ Proof is associated with encrypted name & address

3️⃣ E-commerce platform gets general area, but not exact info

4️⃣ Package is sent to a processing center in the general area

5️⃣👇

🎁 Here's how zkLocus enables private shipping:

1️⃣ You creates a zkLocus proof of their location

2️⃣ Proof is associated with encrypted name & address

3️⃣ E-commerce platform gets general area, but not exact info

4️⃣ Package is sent to a processing center in the general area

5️⃣👇

🔐 How can we conceal personal info like name and address?

📍This is where zkLocus comes in!

🌍 zkLocus allows users to prove they're in a certain area without revealing exact coordinates

🏠 It's like saying "I'm somewhere in New York" without revealing your exact address

🔐 How can we conceal personal info like name and address?

📍This is where zkLocus comes in!

🌍 zkLocus allows users to prove they're in a certain area without revealing exact coordinates

🏠 It's like saying "I'm somewhere in New York" without revealing your exact address

👀 Private search quries are great, but can we go a step further?

🪪 Is it possible to shop online without revealing any of your identity and shipping data to the e-commerce platform?

🤯 The answer is YES!

👀 Private search quries are great, but can we go a step further?

🪪 Is it possible to shop online without revealing any of your identity and shipping data to the e-commerce platform?

🤯 The answer is YES!

🕵️♀️ Such an approach allows us to search for data with a centralized provider without revealing our exact search queries

🔎 In the end, the provider has enough information to provide us with relevant results, without being able to track us

🕵️♀️ Such an approach allows us to search for data with a centralized provider without revealing our exact search queries

🔎 In the end, the provider has enough information to provide us with relevant results, without being able to track us

🧩 Here's how private search queries work:

1️⃣ User runs a zkML computation to abstract their query

2️⃣ The abstracted query is sent to the e-commerce platform

3️⃣ Platform returns relevant results, which are filtered locally by the user

🧩 Here's how private search queries work:

1️⃣ User runs a zkML computation to abstract their query

2️⃣ The abstracted query is sent to the e-commerce platform

3️⃣ Platform returns relevant results, which are filtered locally by the user

❗️Yes, and Zero-Knowledge Proofs are the answer❗️

📜 Instead of sharing raw data, ZKP allow us to share proofs about our data

🤯 Now, you can search for products to buy without revealing your exact queries!

💰 Wether you are online shopping on Amazon, eBay, AliExpress or any other e-commerce platform, you are sharing your personal data with them.

🤔 But does it have to be this way?

✨ Is a fully private online shopping experience possible?

💰 Wether you are online shopping on Amazon, eBay, AliExpress or any other e-commerce platform, you are sharing your personal data with them.

🤔 But does it have to be this way?

✨ Is a fully private online shopping experience possible?

🔍 The challenge with e-commerce privacy lies in two main areas:

1️⃣ Keeping search queries private 🔒

2️⃣ Protecting personal info like name and address 🙅♂️

Traditional platforms require us to trust them with this data