Financial plumbing & market structure updates

Short updates on repo markets, collateral chains, clearing and settlement systems, and the core infrastructure that drives global liquidity.

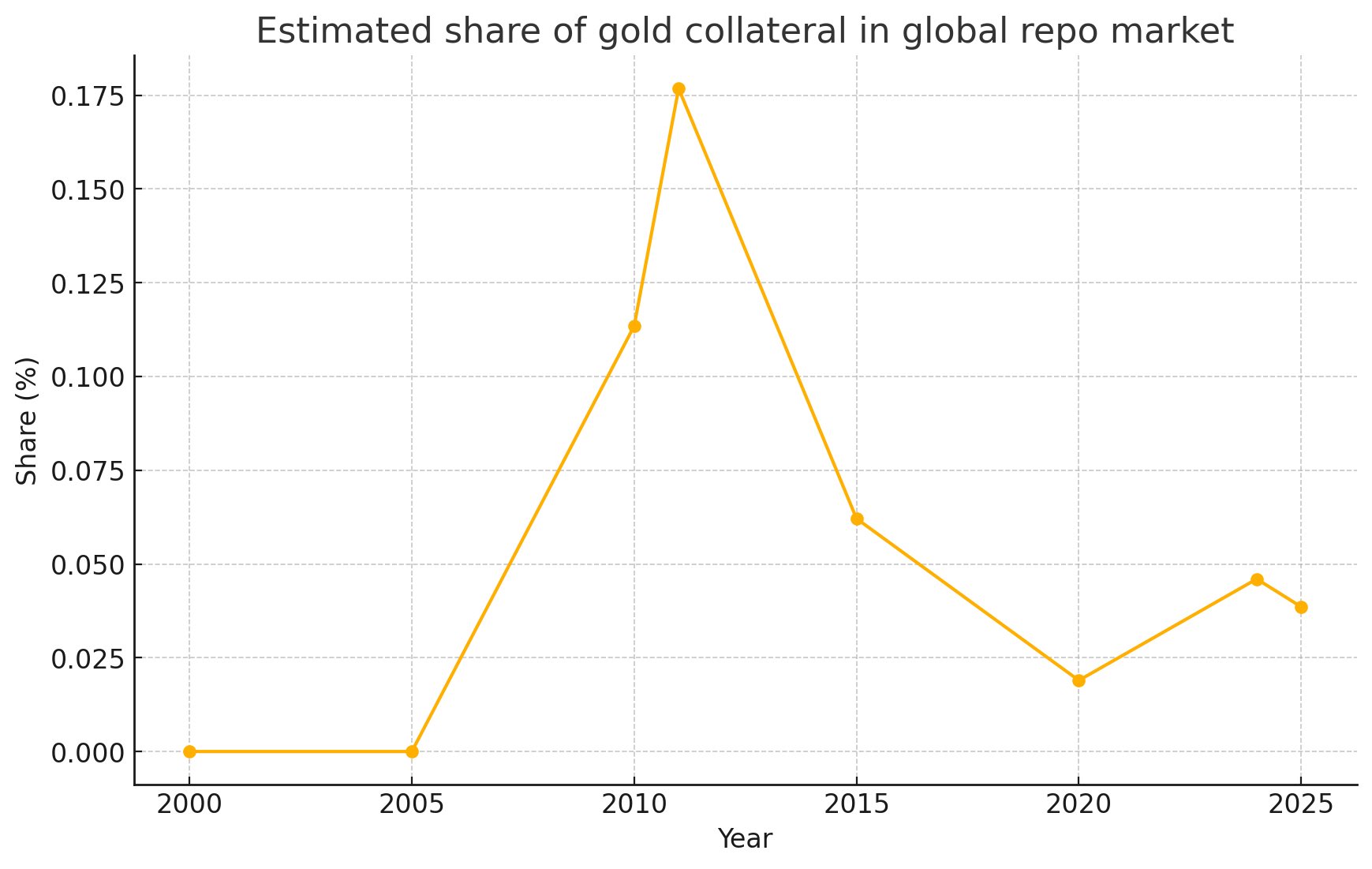

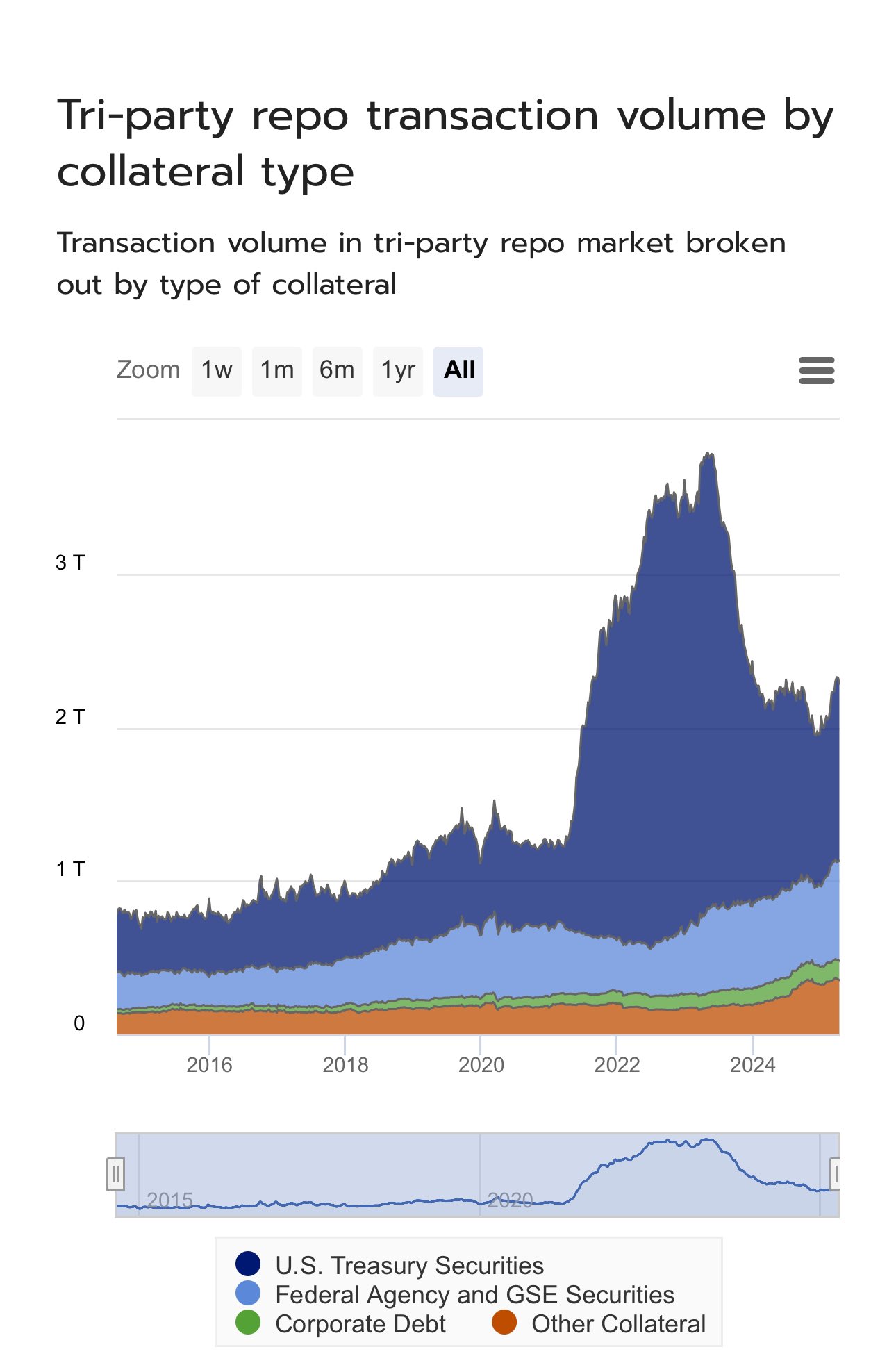

gold did exactly this during the 2008 GFC

its share in collateral usage in global repo markets increased

and in 2025 we're seeing the same trend, with gold share in repo market collateral increasing

as more markets develop over gold - so will its usage as collateral in short-term/repo credit markets

it will likely become a more frequent choice for collateral/hedge during the multipolar transition. specially if bond yields continue to exhibit increased volatility

as more markets develop over gold - so will its usage as collateral in short-term/repo credit markets

it will likely become a more frequent choice for collateral/hedge during the multipolar transition. specially if bond yields continue to exhibit increased volatility

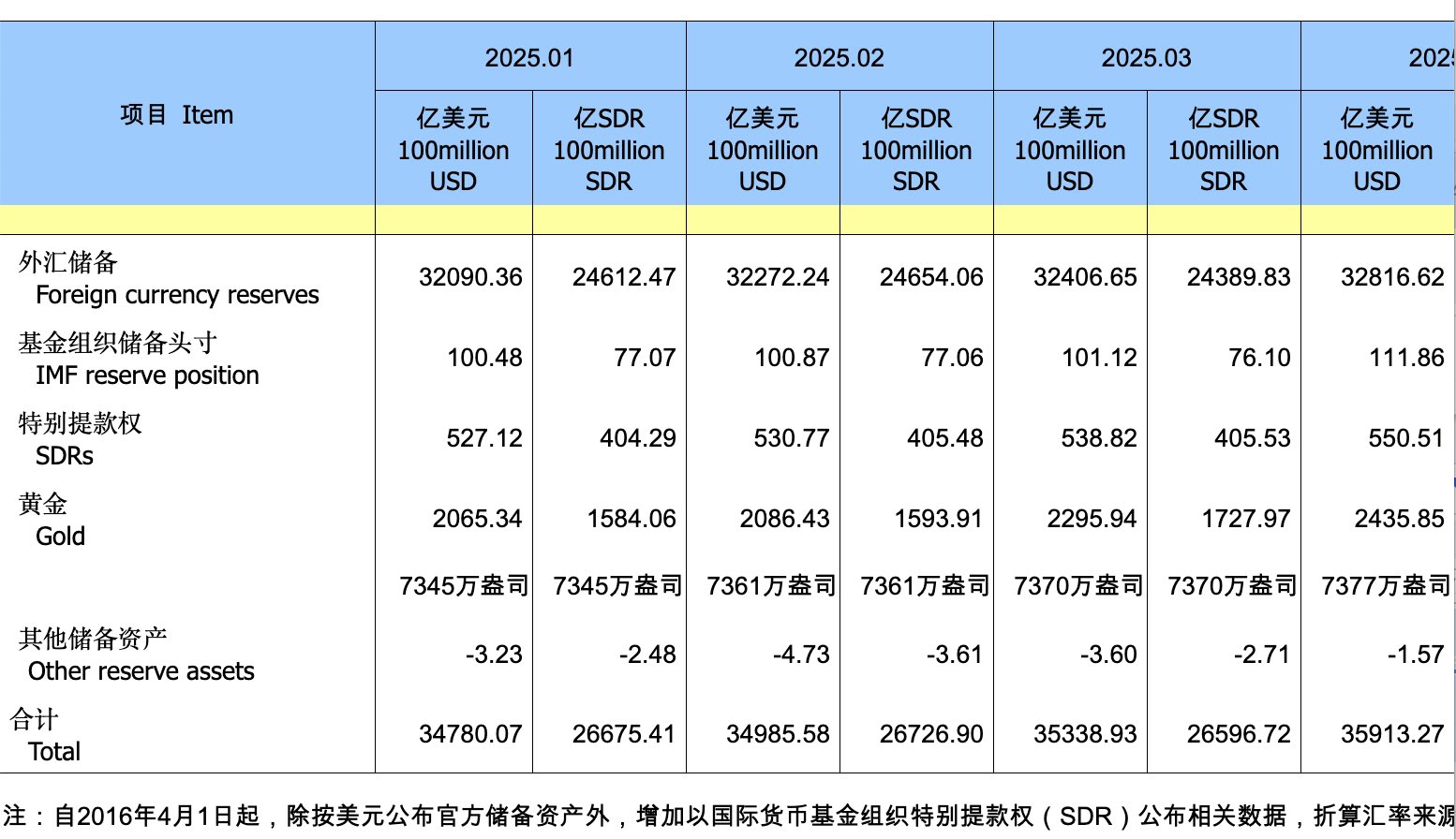

(re)monetization of gold is already in progress

central banks have been consistently buying gold for many years

this is especially true for Russia & China

now you might think that gold would be a perfect collateral for repos, but currently:

it's too volatile - price may drop > 10% on systemic risks

there is no lender of last resort (you can't print gold or have swap lines for it 😀)

most of debt is issued for re-financing of existing debt, not for new debt

repo markets are the backbone of that. and since they're collateralized loans - there is a huge demand for collateral/safe assets

most of debt is issued for re-financing of existing debt, not for new debt

repo markets are the backbone of that. and since they're collateralized loans - there is a huge demand for collateral/safe assets

remember those HUGE repo markets that I talked about?

US bonds/treasuries are the favorite collateral for those transactions

and that's why they're not going away anytime soon

but of course, the financial system is slowly diversifying

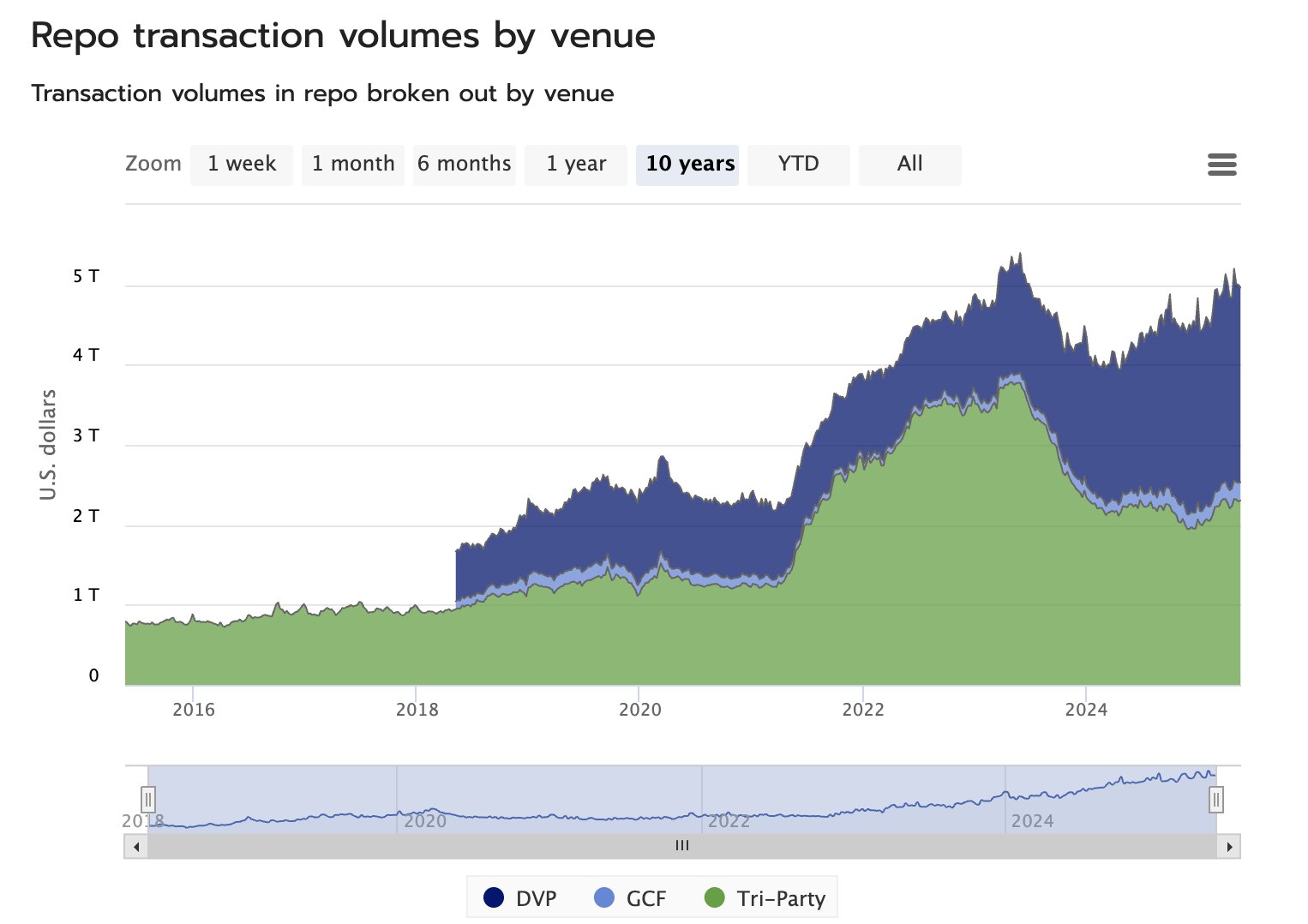

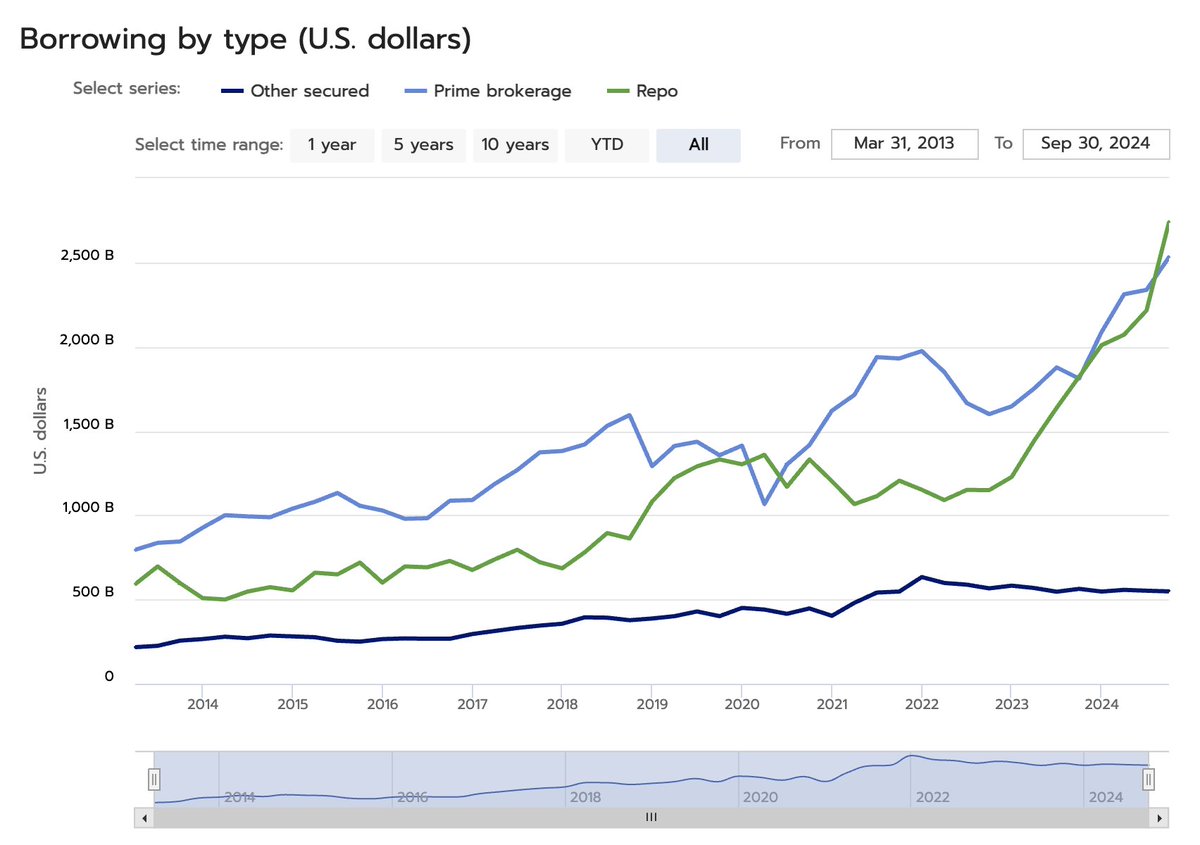

repo markets are HUGE - about the size of USD M2!

they underpin the global financial system

however, there's not many DeFi protocols addressing this part of the market

i may pick it up in the near future

if you're working on something similar - hit me up!

repo markets are HUGE - about the size of USD M2!

they underpin the global financial system

however, there's not many DeFi protocols addressing this part of the market

i may pick it up in the near future

if you're working on something similar - hit me up!

in the end, you get your UST bond back

and it makes sense for you to repurchase the bond (collateral) even if the price falls

as long as the price fall is < ≈haircut (2% in our case)

repurchase agreements are almost always over-collateralized

the borrower undervalues the collateral by a percentage (haircut) - this is a buffer against price volatility

the purchase and repurchase price are computed over the post-haircut value

new currency in circulation is just one of the side-effects

and that transition is neither direct, nor instant

before these funds effectively become new currency, they flow into financial markets - that's why you see the stock market going up first

the same for risky assets

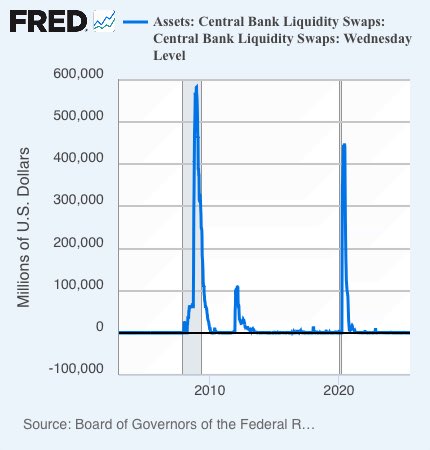

FED swap line operations reach ≈$600 bn

while the swaps are closed/repaid in less than a year, ≈80% of the repayment comes from newly issued wholesale debt

thus, ≈80% of the swap volume eventually becomes new currency in circulation

and then you wonder about inflation 😄

FED swap line operations reach ≈$600 bn

while the swaps are closed/repaid in less than a year, ≈80% of the repayment comes from newly issued wholesale debt

thus, ≈80% of the swap volume eventually becomes new currency in circulation

and then you wonder about inflation 😄

💧FED swap lines = infinite liquidity pool

👉 here's how:

1️⃣ central banks exchange their foreign currency for USD, 7-80 days later, they reverse the exchange at the same rate + fee

2️⃣ central banks then lend these new USD to commercial banks

thus, USD demand is met

central bank balance sheets are an underrated resource for understanding the global liquidity moves

if you're following my posts - you already know that

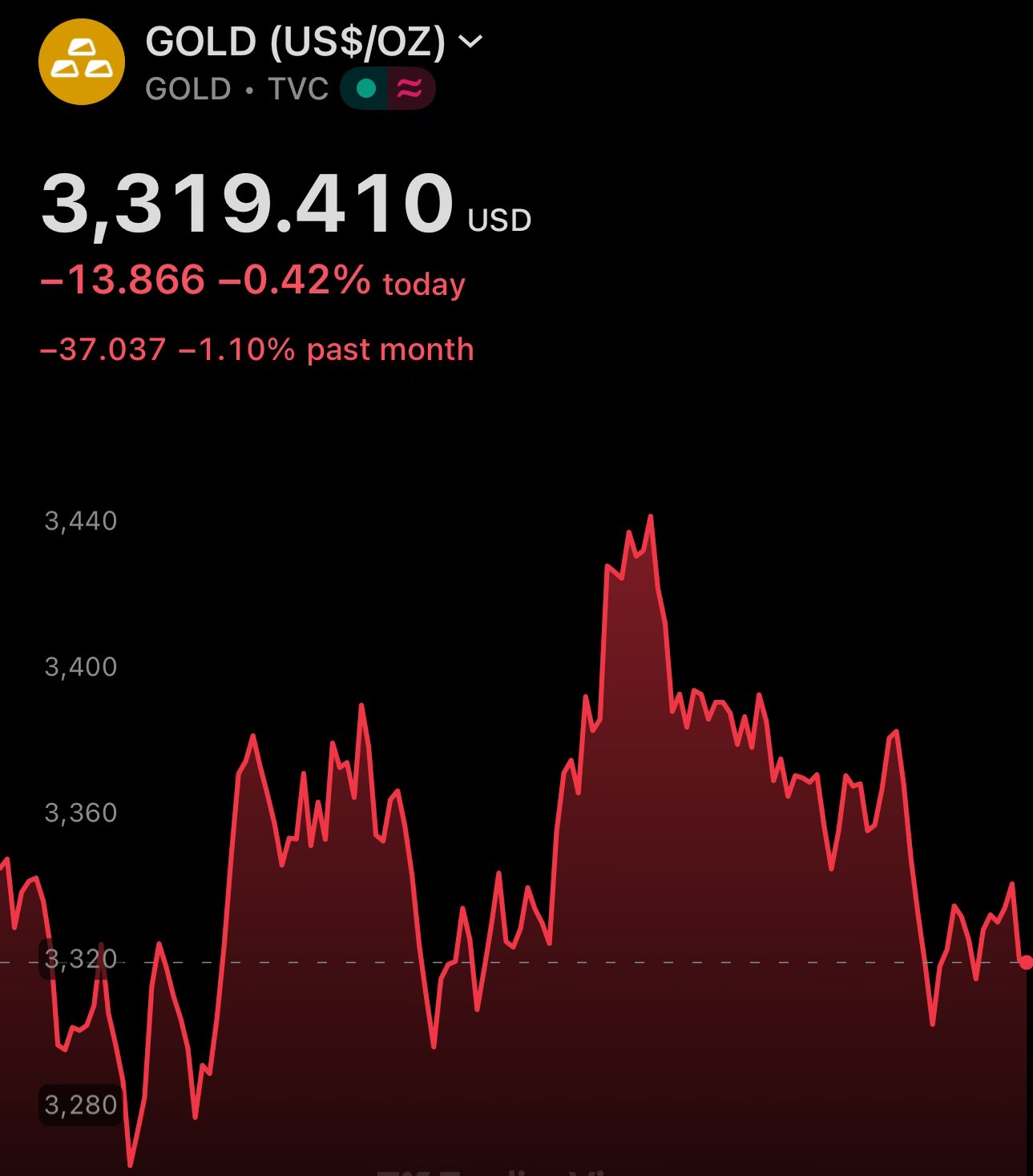

rising US bond yields, ruble & gold

falling USD

i've been warning about it for months

90's style data = massive alpha 😂⬇️

reverse repurchase agreement is just the other side (seller) side of a repurchase agreement (buyer)

repurchaser provides collateral and receives a loan

reverse repurchaser receives the collateral and issues a loan

at maturity the repurchaser repurchases the collateral

money market funds yield close to the risk free rate (think of FED funds rate in the US, or ECB deposit rate in the EU), while offering less risk due to shorter maturity

essentially, you provide a collateral (highly liquid - usually sovereign debt) and get a loan against it

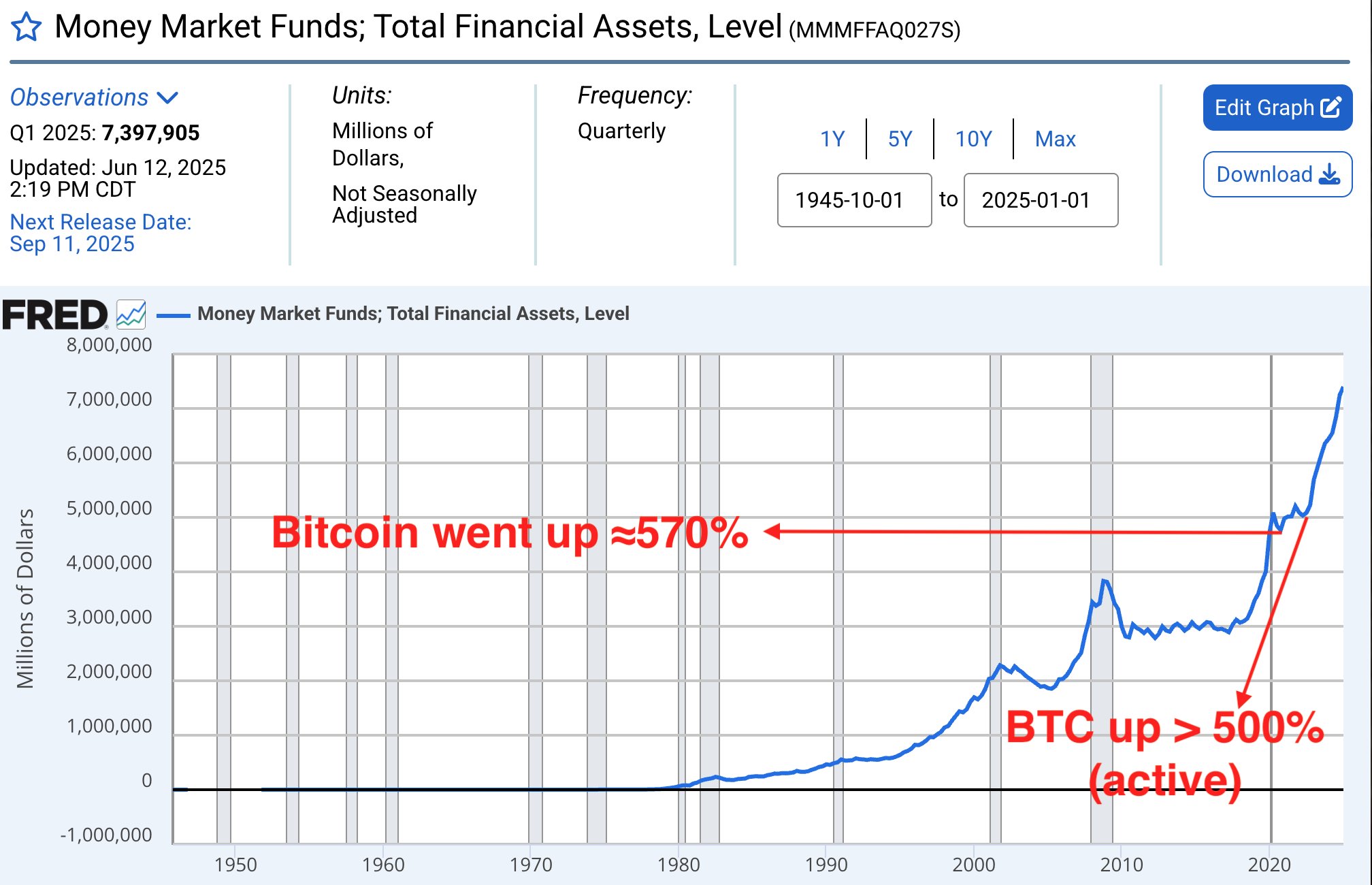

record $7 trillion USD in money market funds (mmf)

this risk-averse liquidity is bound to flow into into other financial assets at some point

mmf consists of short-term collateralized loans - credit that is NOT captured by M2

last two outflows coincided with bitcoin bullrun

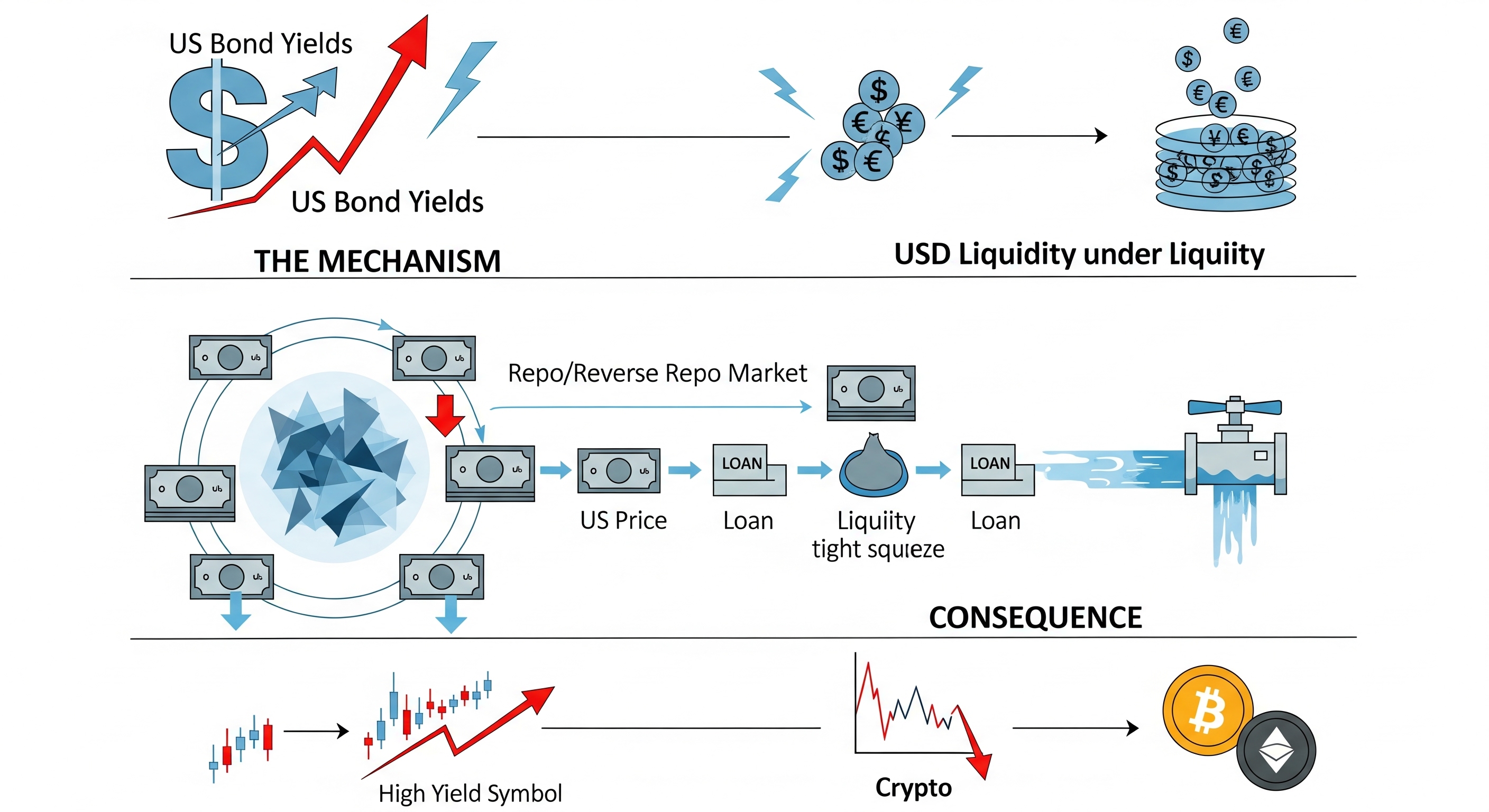

⚡️ US Bond yields directly affect USD liquidity

Here's how 👇

1️⃣ Repo + reverse repo market provides $5 trillion of liquidity

2️⃣ US bonds represent ≈70% of collateral

3️⃣ Lower bond prices means smaller loans, leading to a liquidity squeeze

🏦 Quantitative Easing (QE) by a Central Bank (CB) increase both - its assets & liabilities

👇

QE = CB buys securities from commercial banks

👆

This involves:

1️⃣ Transfer of securities to CB (asset UP)

2️⃣ Credit the bank's reserve account (liability UP)

👉 M2 Supply ≠ Liquidity 👈

M2 is only a part of the total liquidity

🔎 Here's an example:

Repurchase agreements market adds ≈$17T in the form of security-backed short-term credit, thus increasing available currency

M2 does not account for the repo market

Regarding the bond market collapse ⬇️

US Treasury Securities are the main collateral used in repurchase agreements. Given that these are short-term, the yield spike is unlikely to lead to defaults

However, the fall in bond prices will reduce credit, adding to liquidity crunch

Of course, this also gives China leverage - if The People Bank's of China (China's Central Bank) dumps their US Securities in the market, it will skyrocket bond yields, by reducing their prices

Who will lend to the US then, and at what premium? And at 125% debt to GDP 😬

📈 Institutional investors have increased their reverse purchase agreements exposure ever since the central bank interest rates spiked

Repos are shorter-term loans, meaning they present a shorter commitment, thus less risk

Another message is clear: institutions are expecting…

🚨 The system faced its biggest test during the 90s banking crisis:

• 110 financial institutions resolved

• Full deposit protection implemented

• Massive debt-based interventions

DICJ has met its insurance obligations, but at what cost? 🤔

🇯🇵 How does Japan protect bank deposits when banks fail?

🤯 Their deposit insurance system handled 180+ financial institution failures, including the massive 90's banking crisis

👉 Here's how Japan's ¥10M deposit guarantee scheme works: https://illya.sh/blog/posts/deposit-guarantee-scheme-japan-dia-dicj/

🧵

🛟 The liquidation logic makes the initial required margin a collateral for all of the parties

Failure to meet the obligations means a loss of the deposited margin/collateral, either in full or in part

If a party fails to meet margin requirements, the smart contract:

1️⃣ Terminates the agreement

2️⃣ Transfers deposited assets to the compliant party

3️⃣ Applies penalties to the defaulting party

This liquidation process is executed automatically on-chain 🤖

📈 The margin requirements increase algorithmically over the contract's lifespan

This ensurer both parties deposit their obligation in full by maturity, while allowing for partial collaterization

Thus leveraging the time value of money, without the need for a trusted party

The DeFi margin for futures contracts differs from TradFi margins, by:

1️⃣ Gradually increasing over time

2️⃣ Ensuring full collateralization by maturity

3️⃣ Delaying full payment

TradFi margin's main goal is to cover daily settlement gains/losses of the futures position

🏦 Traditional futures require centralized clearing houses

On the blockchain, smart contracts eliminate intermediaries, enabling decentralized peer-to-peer agreements

Example: A contract to trade 1000 $MINA for 2000 $USDC in 1 year, regardless of future $MINA price 📊

Futures contracts serve crucial roles in finance:

1️⃣ Hedging against price volatility

2️⃣ Speculation on future asset prices

3️⃣ Price discovery for underlying assets

Smart contracts on the blockchain will disrupt this $1T+ market. Here's how ⬇️