Financial plumbing & market structure updates

Short updates on repo markets, collateral chains, clearing and settlement systems, and the core infrastructure that drives global liquidity.

start by asking ChatGPT or another LLM with the Basel III PDF(s) attached

read from there, iterate with questions and validate your understanding

you'll probably need to come back to it a few times

don't overthink it, a basic prompt like this one is sufficient

👇

regulations may sound boring - but they're crucial to understand money, liquidity and financial system as a whole

they become fun once contextualized - and govern the rules of credit

i'd suggest starting with Basel III - namely liquidity coverage ratio & capital ratio

not all money (credit) is the same

there's a quality dimension to it as well

credit issued by a central bank is higher quality than the one issued by commercial banks - no credit risk

central bank money is an unambiguous means of settlement for debt - think of legal tender

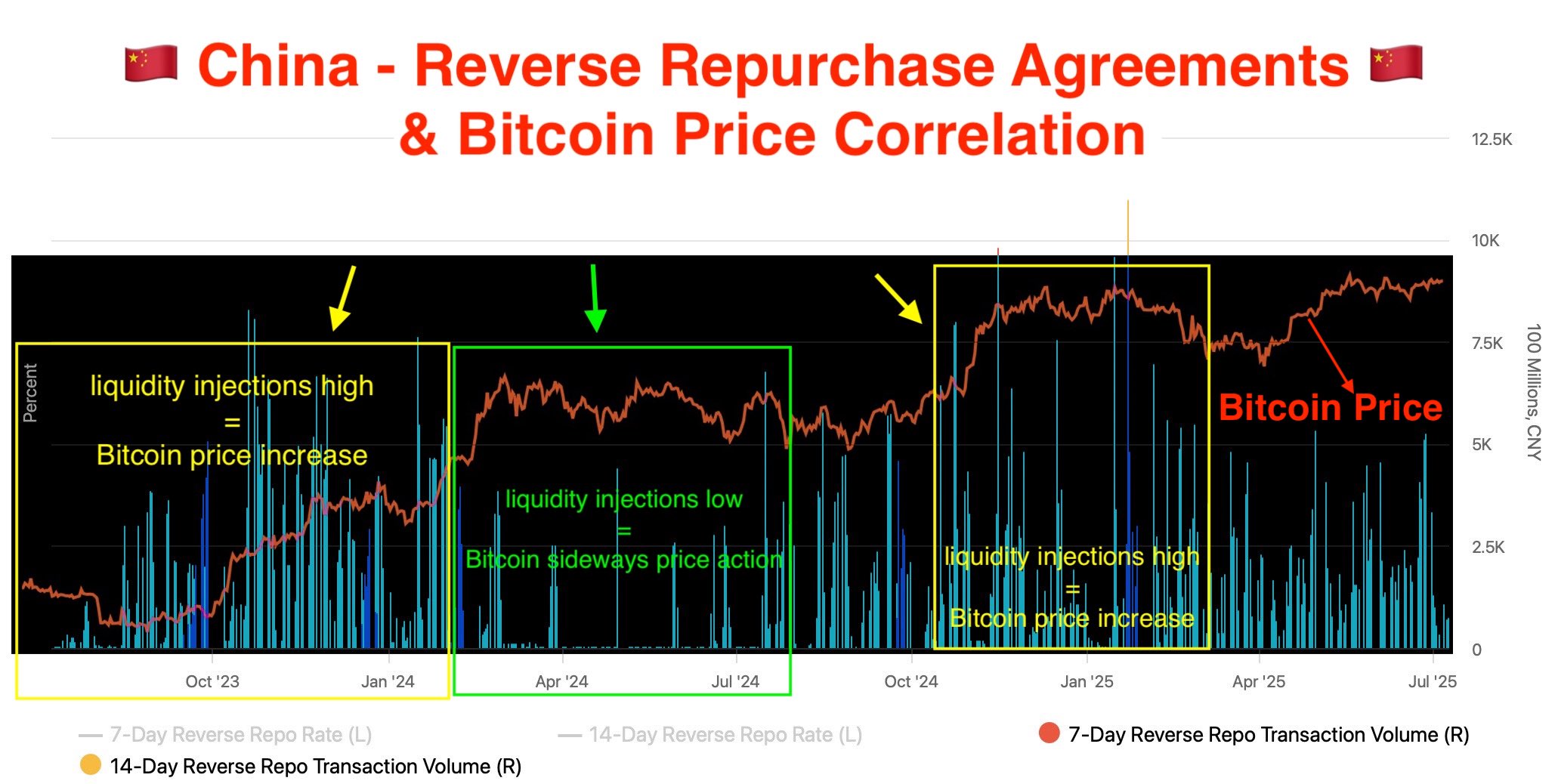

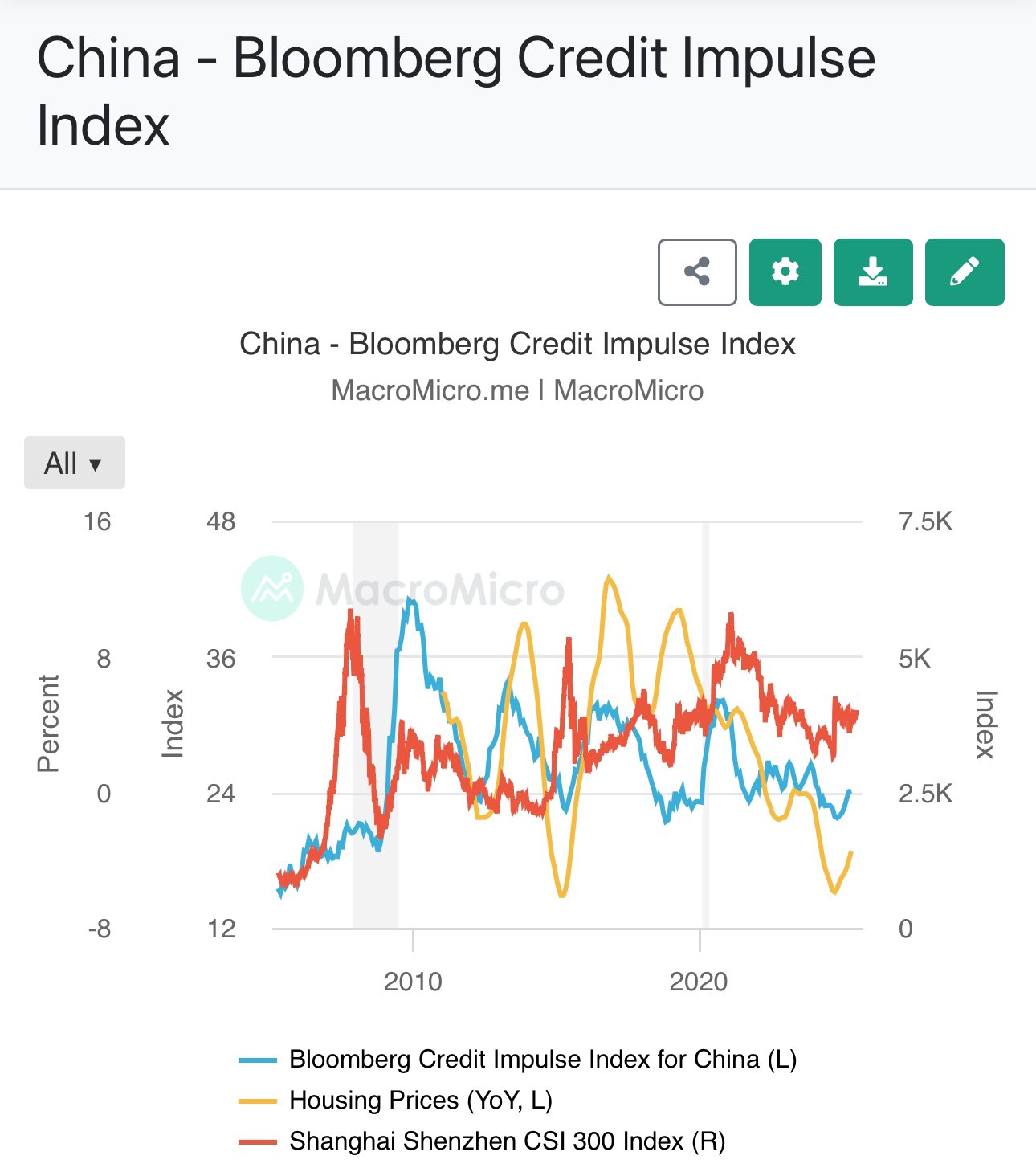

🇨🇳 China's reverse repo liquidity injections predict Bitcoin bullruns

it works like this:

📈 high PBoC injections = increasing bitcoin price

📉 low PBoC injections = sideways or decreasing

so every time China injects Yuan/reminbi, BTC price goes up 😁

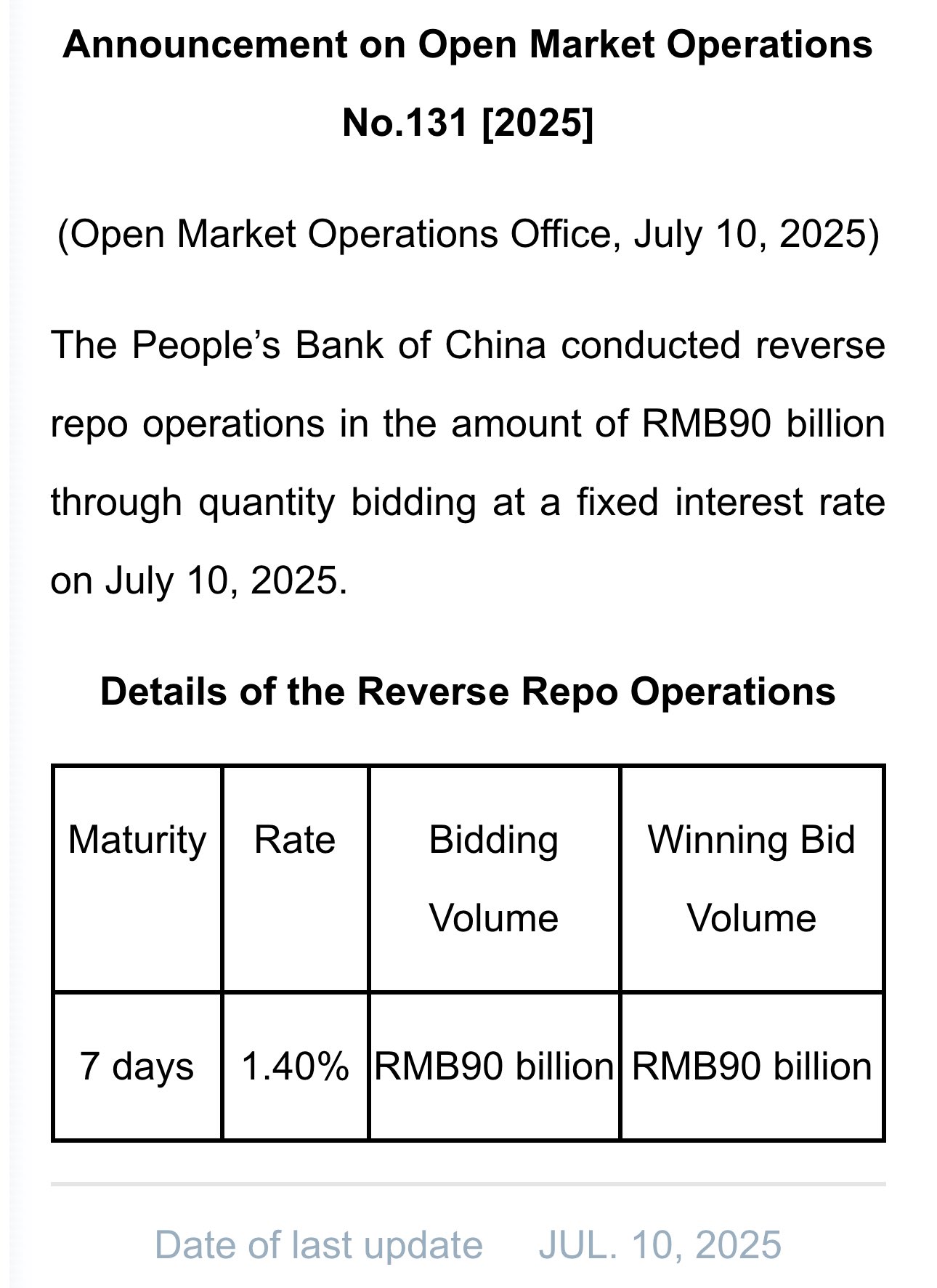

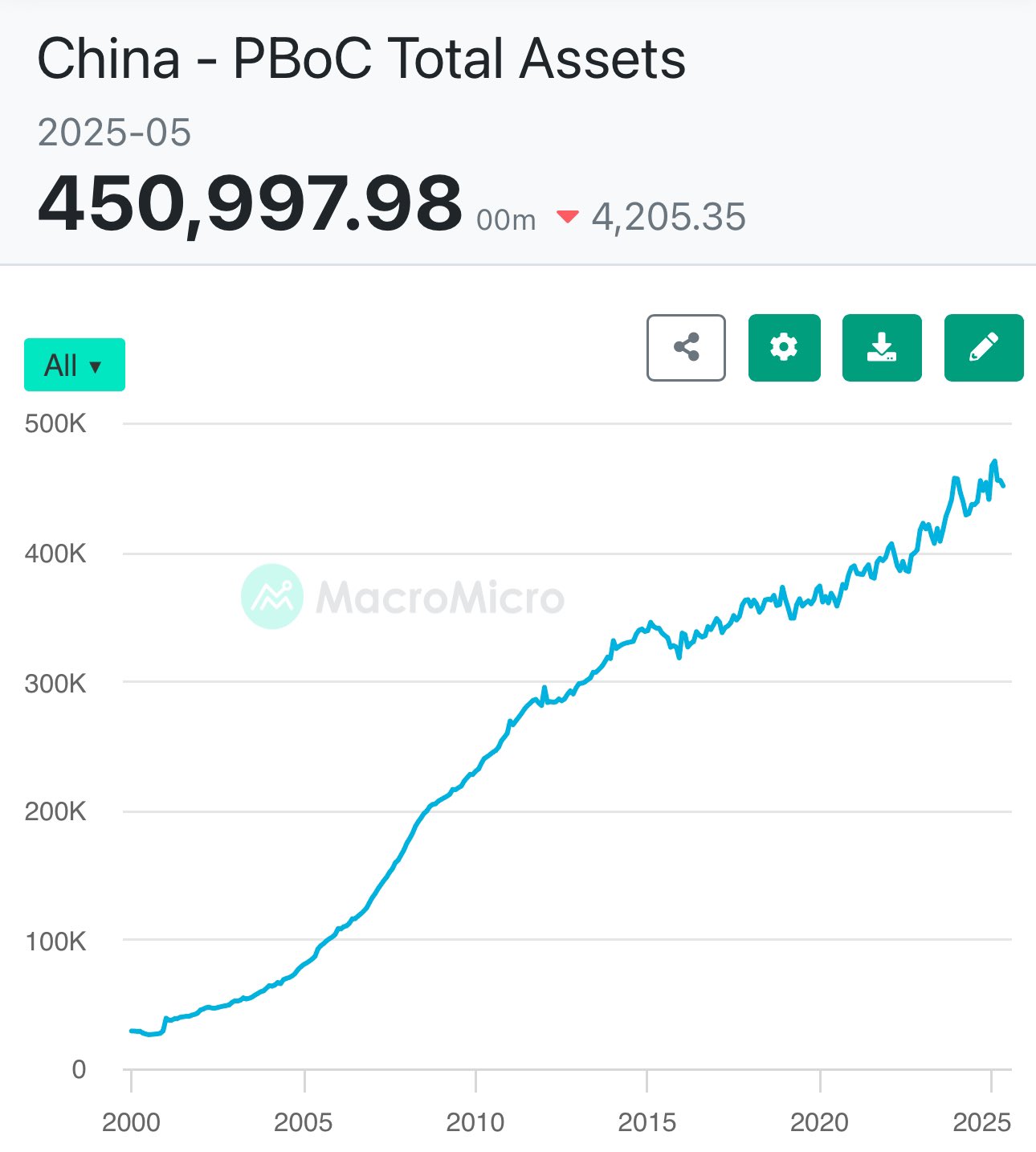

🇨🇳 PBoC provides commercial & policy banks with liquidity via reverse repo open market operations

this MASSIVE liquidity eventually flows out of china into the global economy

so it has a very direct effect on asset prices wherever your are 😄

🇨🇳 china injects liquidity mainly via reverse repurchase agreements

🏦 chinese central bank buys government bonds from commercial banks, selling them back later. this new cash is re-invested yielding a spread

💹 essentially, they allow banks to earn a yield on their bonds

this is why funding repo rates are a very useful indicator

if you're just arriving here - read the previous posts 😄

you can also follow along the quoted posts from below. just click on it ⬇️

smaller busts precede larger busts

whichever is the ultimate resolution of the bubble - repricing will occur

for some assets this will be good, for others - not so much

even in the same asset class different assets perform differently (think manufacturing vs tech stock)

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

this means inflation & gold up

at least short-term: equities up, crypto up

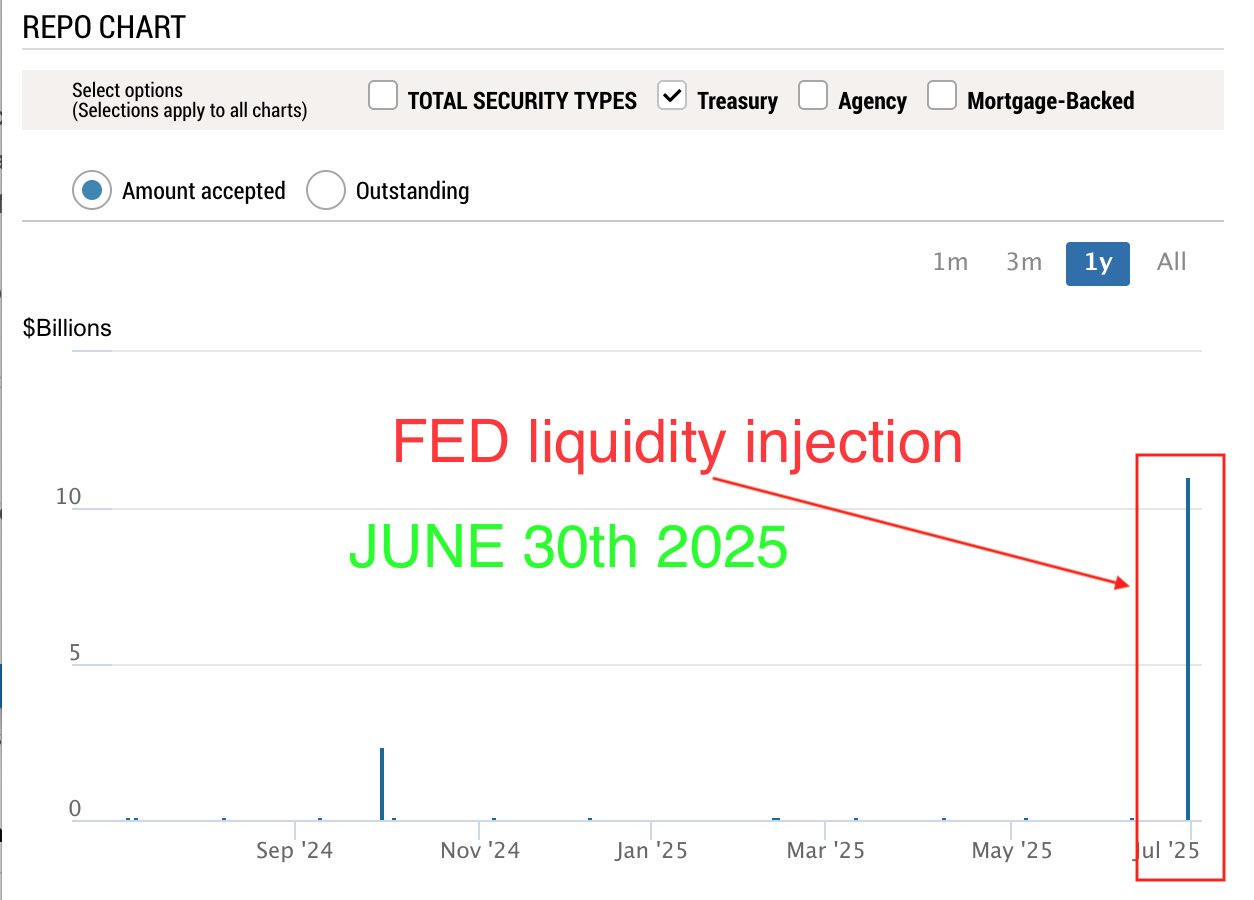

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

repo funding rates are predictors within this global, multi-factor liquidity context

you can use them to understand liquidity flows in the near future

this is also because repo markets are short-term debt instruments - so the signal is also more short-term

repo funding rates are predictors within this global, multi-factor liquidity context

you can use them to understand liquidity flows in the near future

this is also because repo markets are short-term debt instruments - so the signal is also more short-term

regarding liquidity flows - repo markets are just one of the sources

so it's more useful when you combine it with others, such as the central bank policies, how much short-term debt is maturing, and the overall leverage level

regarding liquidity flows - repo markets are just one of the sources

so it's more useful when you combine it with others, such as the central bank policies, how much short-term debt is maturing, and the overall leverage level

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

so the market operations of dealers/market-markers is quite predictable

you just have to look at their business & regulatory model - from there it's almost plain math under regulatory constraints

in a monthly maturity/tenor timescale - the repo funding rate has very direct effects

this makes sense - if your bond is maturing in ≈1 month, every day is significant

so you see more immediate effects from federal reserve's SRF operations / repo funding fee increases

shorter-term US bonds yields react IMMEDIATELY to repo funding rate

notice the huge green candle on June 30th - the same day of FED's SRF $11B volume

June 30th is when the FED SRF volume recorded ≈$11B

this is a 1 month treasury bill ⬇️

persistently high(er) funding repo rates will push the treasury yields up

eventually, the bonds would be sold for cash

again - think of the timescale: funding rates refer to much shorter periods

persistently high(er) funding repo rates will push the treasury yields up

eventually, the bonds would be sold for cash

again - think of the timescale: funding rates refer to much shorter periods

repo funding rates don't affect US treasury yields immediately due to time scale

treasury bond yield expectation is over 10 years, and repo rates are a short-term debt funding mechanism

so the rates shock would need to be prolonged/pronounced to affect treasury rates

repo funding rates don't affect US treasury yields immediately due to time scale

treasury bond yield expectation is over 10 years, and repo rates are a short-term debt funding mechanism

so the rates shock would need to be prolonged/pronounced to affect treasury rates

funding rates on repo markets & bond yields are not the same

different timescales:

1️⃣ repo - short-term / ≈day(s),week(s)

2️⃣ treasury bonds - ≈10 years

so even if a funding rate raises for a few days, the longer-term bond yields may not be affected

funding rates on repo markets & bond yields are not the same

different timescales:

1️⃣ repo - short-term / ≈day(s),week(s)

2️⃣ treasury bonds - ≈10 years

so even if a funding rate raises for a few days, the longer-term bond yields may not be affected

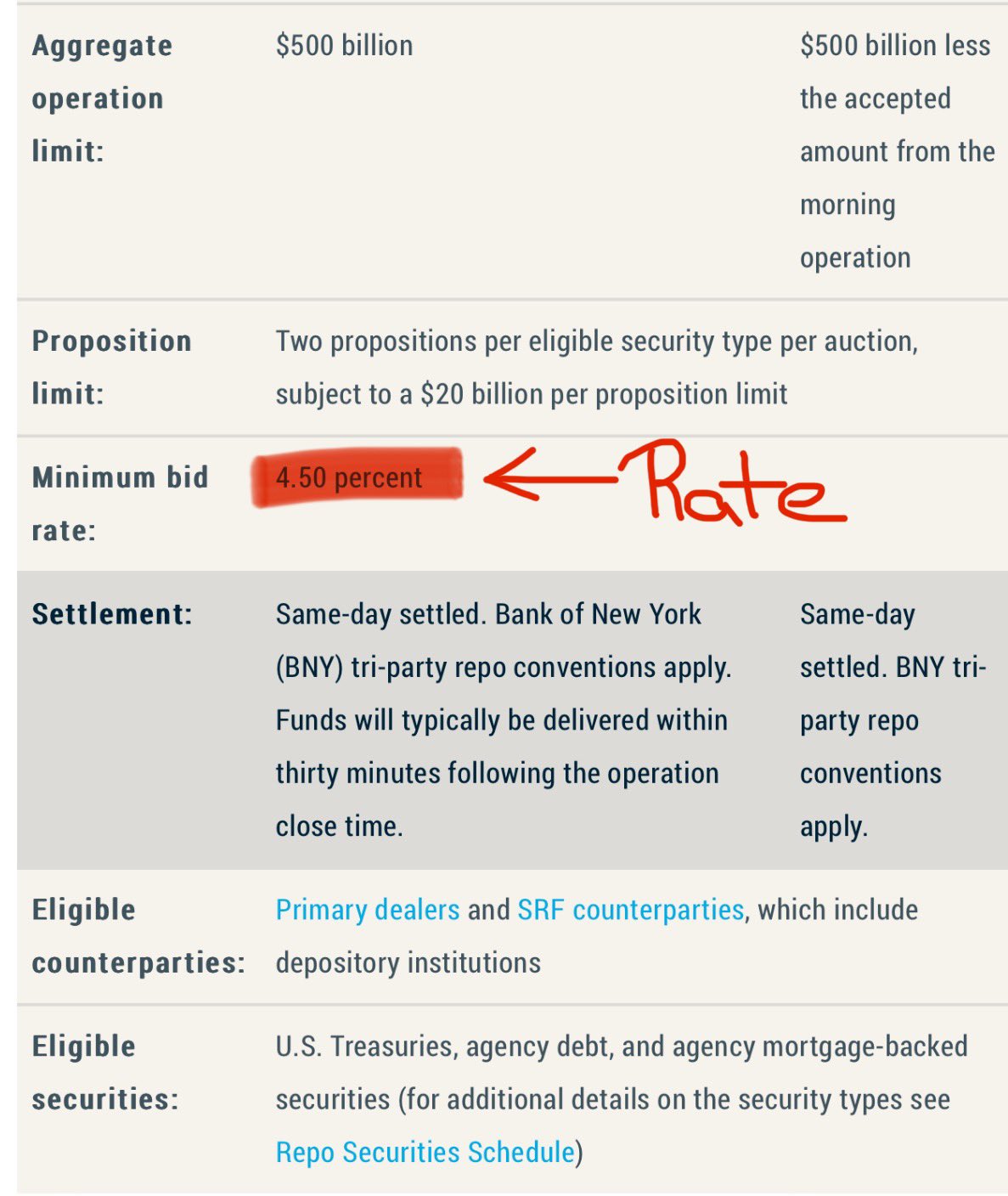

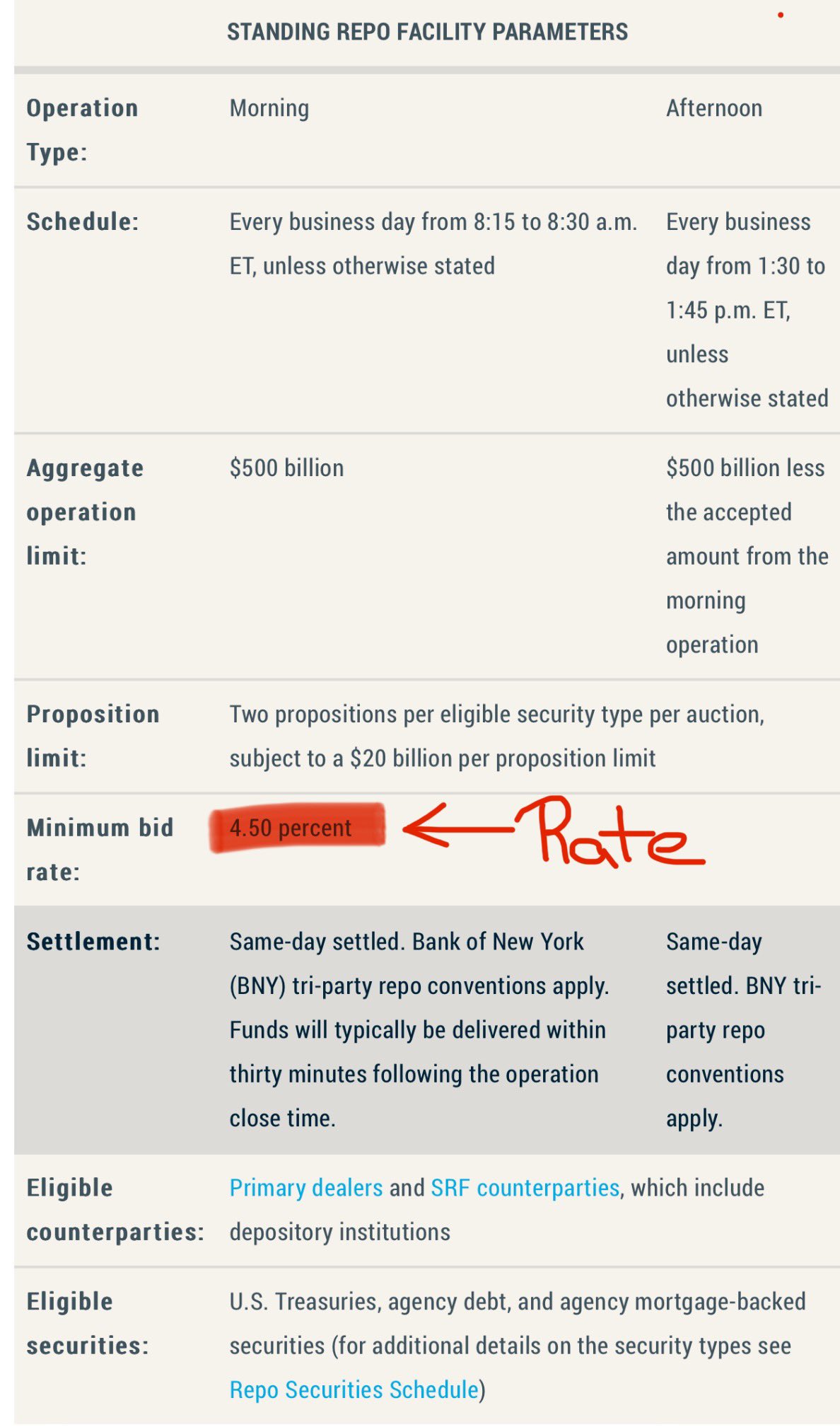

note that FED's SFR doesn't lower the treasury yields per se

it's more correct to say that it puts downward pressure on them, in the form of a $500B buffer

& note that treasuries probably wouldn't be the first in line for liquidation

not only US treasuries are accepted as collateral for SRF

dealers/market makers can use:

1️⃣ US. Treasuries

2️⃣ agency debt

3️⃣ agency mortgage-backed securities

agency debt instruments aren't issued by US Treasury, but by government sponsored enterprises (GSE) & federal agencies

current SRF minimum bid rate is 4.5%

that's the annualized rate that the federal reserve sets requires dor overnight repo loans via Standing Repo Facility

dealers/market makers can borrow cash against US treasuries for 1 day at ≈4.5% annualized directly from the FED

in practice, FED's SRF is used when there is a scarcity of liquidity/cash

the market has US bonds & needs cash, so lenders increase rates

SRF sets a daily rate. if that rate is smaller than in the smaller repo market - the dealers instead borrow USD directly from the FED

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

SRF provides daily $500B liquidity limit for overnight repo operations

a rate is published daily & dealers lend borrow against US bonds

dealers/market makers use SRF when the rate in the open repo market gets too high

SRF = Standing Repo Facility

🚨FED just injected $11B of liquidity

👉 TL;DR: interest rate cuts & QE incoming

$11B is insignificant - but it's an early sign: there is a lack of liquidity/cash

if undressed, will lead to systemic defaults. existing debt needs to be refinanced

the fix/what's next? see TL;DR

the higher use of lower quality collateral has pro-cyclical effects

if the price of collateral falls during economic downturn - you'll get a lot of margin calls & insolvencies. this will further put pressure on short-term funding mechanisms, which already lack HQ collateral

US Treasuries are by far the most popular collateral type in secured short-term funding markets (e.g. the repo market)

outstanding volume of these markets is larger than M2

notice the increase in usage of less safe assets as a collateral

not enough UST for its demand ⬇️