Illya Gerasymchuk

Engineering & Finance

in practice, FED's SRF is used when there is a scarcity of liquidity/cash

the market has US bonds & needs cash, so lenders increase rates

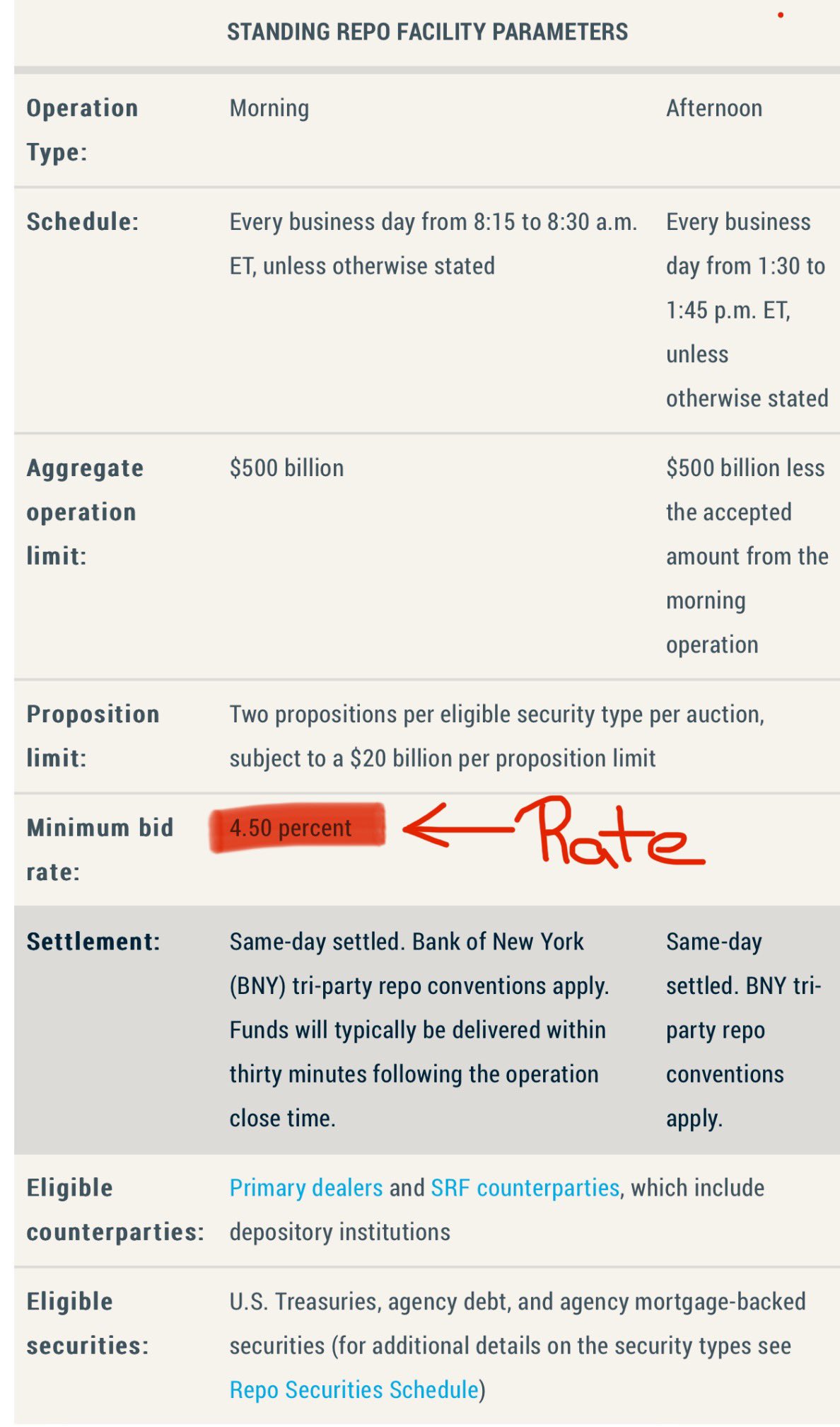

SRF sets a daily rate. if that rate is smaller than in the smaller repo market - the dealers instead borrow USD directly from the FED

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs