Financial plumbing & market structure updates

Short updates on repo markets, collateral chains, clearing and settlement systems, and the core infrastructure that drives global liquidity.

while hybrid intermediation systems don’t strictly need to be technological - in practice they vastly are as most of financial activity happens through computer and information systems

base money issuance and management is a responsibility of the US government - so it's always intermediated, even if by government-controlled systems

base money issuance and management is a responsibility of the US government - so it's always intermediated, even if by government-controlled systems

hybrid intermediation systems include all means of facilitating the issuance, servicing and transactions of USD and USD-denominated securities, including equities, bonds and derivatives

hybrid intermediation systems include all means of facilitating the issuance, servicing and transactions of USD and USD-denominated securities, including equities, bonds and derivatives

balance sheet capacity is heavily dependent on regulations (e.g. Basel III & local)

hybrid intermediation systems facilitate access to the payment and credit channels

SWIFT, FedWire and digital private USD claims like stablecoins & PayPal facilitate USD's movement and usage

balance sheet capacity is heavily dependent on regulations (e.g. Basel III & local)

hybrid intermediation systems facilitate access to the payment and credit channels

SWIFT, FedWire and digital private USD claims like stablecoins & PayPal facilitate USD's movement and usage

liquidity means availability, thus it comes down to being able to:

1️⃣ access USD credit

2️⃣ settle payments in USD

this means balance sheet capacity and hybrid technological intermediation systems in place

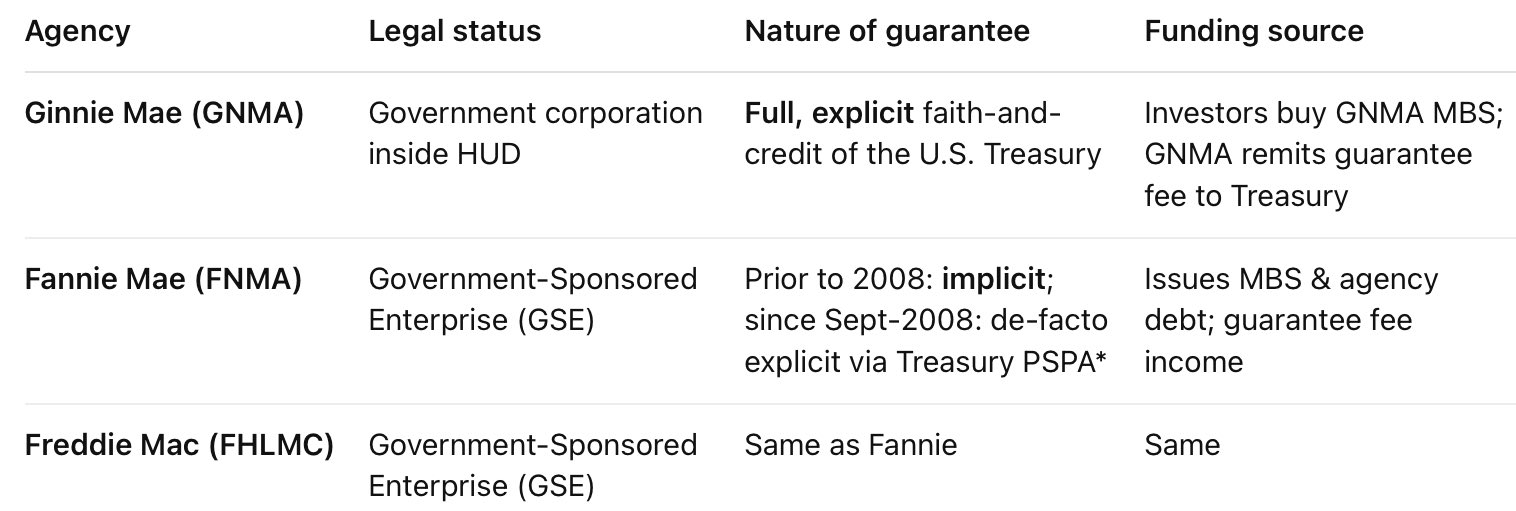

regarding the IPO/privatization of Fannie Mae & Freddie Mac i wrote a thread explaining the role, function and use during QE of those GSE

also their history and how they were used to lower mortgage rates after the 2008 GFC

you can read it it here ⬇️

https://illya.sh/threads/@1754148538-1.html

stablecoin issuers could intermediate the issuance process, so you don't need to get all credit institutions on-chain from the start

non-algorithmic stablecoin issuance already happens off-chain and presumes trust in a third party

this would just be faster. more liquidity

now imagine when credit institutions can tokenize new credit and allow automated stablecoin issuance backed by that credit

in practice it's code in smart contract that wraps one token with another

i created a similar project on an Ethereum hackathon ⬇️

https://github.com/iluxonchik/eth-lisbon-hackathon-23

banks are also subject to regulations when issuing loans

and no - it's not the fractional reserve system

in many sovereigns, like the USA the reserve requirements sit at 0%

there are other regulatory requirements limiting loan issuance

the bank has the legal right to increase the money supply AKA 'print money'

so to give you a $100 loan the bank can just create those $100 and give give them to you

pretty neat arrangement, huh? 😁

banks are credit institutions which means they can create broad money

while a non-credit institution or a regular business can issue loans - they must fund it (e.g. raise money, use excess profits)

they can't just create those $100, thus expanding the monetary supply

so the bank funds the loan by creating $100 and crediting them to your account

those $100 that they credited you did not exist before - the bank created that money on demand

those $100 are not physical cash - they're an entry in a digital ledger (i.e. in a computer system)

so the bank funds the loan by creating $100 and crediting them to your account

those $100 that they credited you did not exist before - the bank created that money on demand

those $100 are not physical cash - they're an entry in a digital ledger (i.e. in a computer system)

a loan for the bank ends up earning more than the lent amount

this is because the borrower repays the principal (loan amount) + interest

deposits are liabilities to the bank - as they are owed to depositors/customers

so the $100 cash loan that the bank issues to you becomes a deposit in that same bank, and thus a liability for the bank

you can move those $100 outside of the bank at any time/on short notice

in the bank’s balance sheet:

⬆️ +$100 assets - the loan they just issued

⬆️ +$100 liabilities - the $100 your account was credited with

your loan is an asset to the bank - and your loan itself funds the $100 deposit that you get in your account

how banks work? bank's business model is very simple:

1️⃣ Take liability

2️⃣ Use liability to buy asset

3️⃣ Pocket the spread/carry

all of the bank's assets are financed by its liabilities

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity

this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it

thus, the yields fell

and this is how the Federal Reserve steers the federal funds rate/interest rates in the market within the target range 🏦✨

follow the quoted posts to read the full thread/article

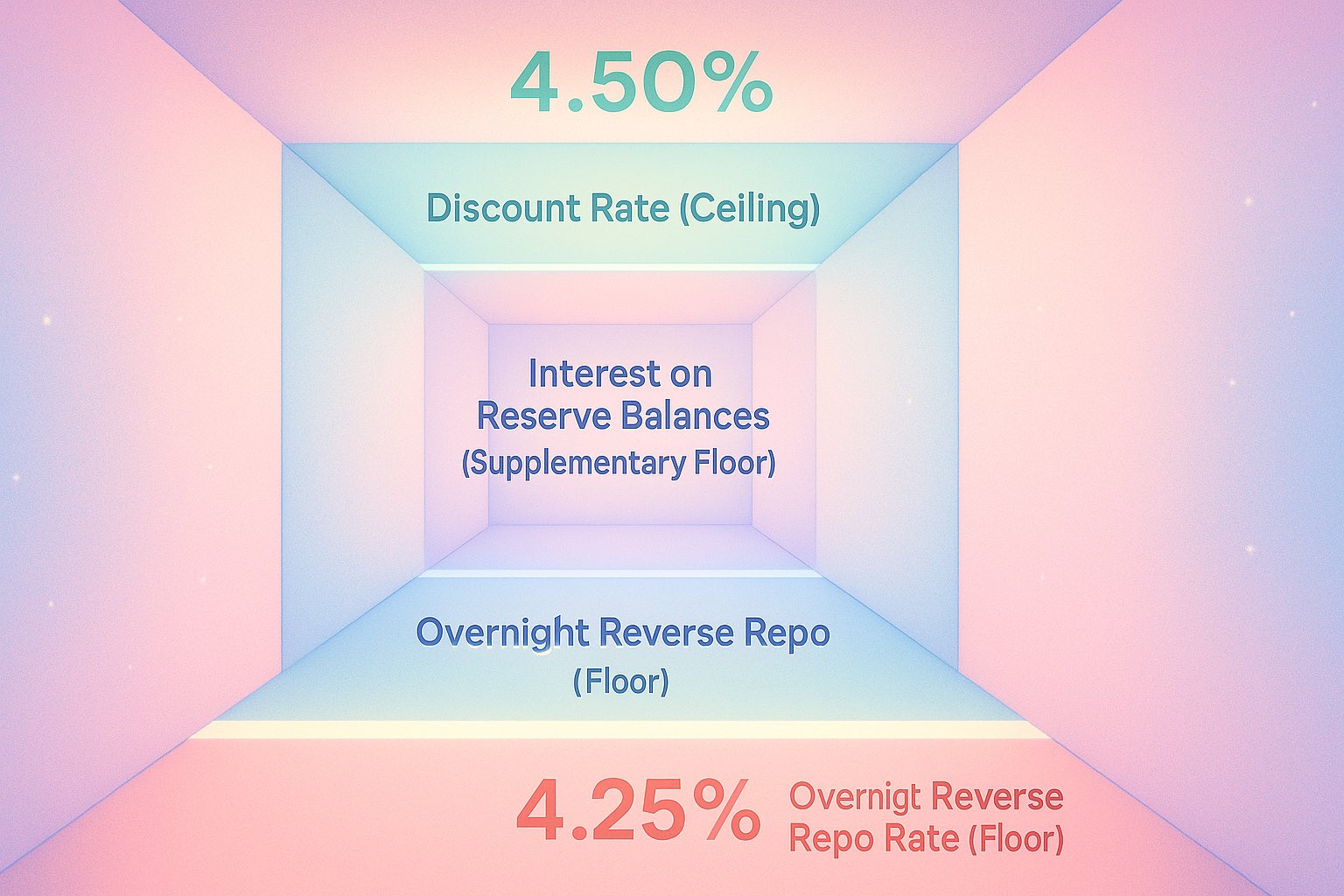

together, ON RRP, IORB, Discount Rate and SRF create a corridor for rates, which stay within the target 4.25%-4.50%

👉 by "firms" i mean select non-bank financial institutions - think dealers, market makers & other wholesale debt institutions

thus, Standing Repo Facility (SRF) further reinforces the upper part of the target interest rate corridor

in other words, it strengthens the cap on short-term interest rates

Standing Repo Facility (SRF) allows banks & other financial institutions to do collateral-backed loans from the FED overnight

the institution provides high quality collateral (e.g. treasury bond) and gets a loan against it - at the set rate

Standing Repo Facility (SRF) allows banks & other financial institutions to do collateral-backed loans from the FED overnight

the institution provides high quality collateral (e.g. treasury bond) and gets a loan against it - at the set rate

it't called discount window for historical reasons

discounting means buying treasuries at a slightly lower price - i.e. at a discount

window comes from the fact that these were sold at counter/teller windows at the bank

the majority of liquidity is actually created in wholesale short-term debt markets

ON RRP addresses exactly that sector, thus setting the lower bound of the target interest rate corridor for the broader financial sector

ON RRP further reinforces the the floor for the market-wide interest rates

since it's accessible to a broader set of financial institutions - not only banks. those now also have little incentive to lend below the ON RRP rate

ON RRP further reinforces the the floor for the market-wide interest rates

since it's accessible to a broader set of financial institutions - not only banks. those now also have little incentive to lend below the ON RRP rate

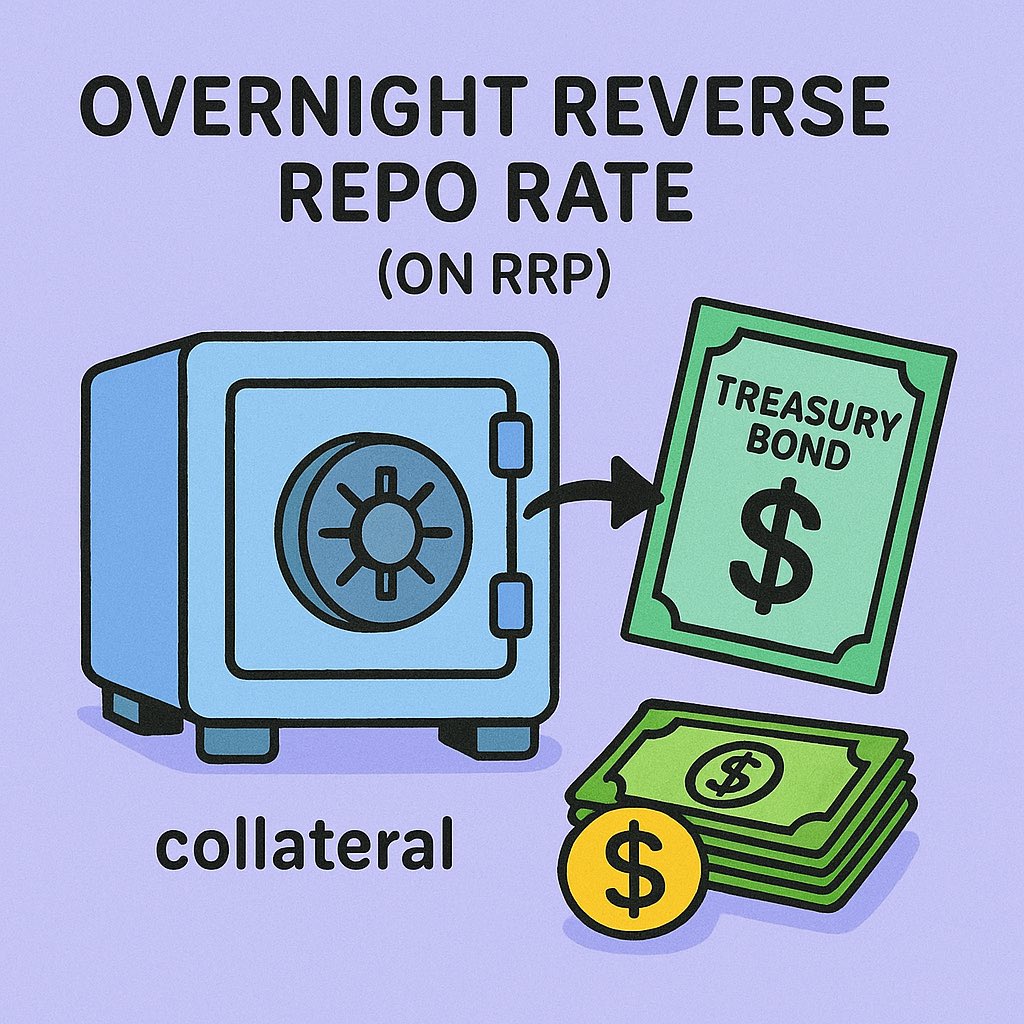

Overnight Reverse Repo Rate (ON RRP) defines the rate at financial institutions can lend money overnight to the FED

in return the FED provides treasury bonds as a collateral

ON RRP is accessible to both banks & non-banks (e.g. money market funds)

since banks can always deposit cash into their reserve account account at the FED and earn the IORB rate they have little incentive to lend at rates below IORB

effectively, this sets the floor (lower bound of the corridor) for interest rates for banks

since banks can always deposit cash into their reserve account account at the FED and earn the IORB rate they have little incentive to lend at rates below IORB

effectively, this sets the floor (lower bound of the corridor) for interest rates for banks

Interest on Reserve Balances (IORB) is the rate FED pays banks on their excess reserves

commercial banks have reserve accounts at the FED. regulations define the minimum amounts - any excess earns the IORB interest rate set by the FED

the 4 key interest rates set by the FED are:

1️⃣ Overnight Reverse Repo Rate (ON RRP)

2️⃣ Interest on Reserve Balances (IORB)

3️⃣ Discount Rate - also known as Lending Rate

4️⃣ Standing Repo Facility (SRF)

we'll cover them in this order below

now let's understand each one of the 4 key rates set by the federal reserve to keep the market rates within the target range

namely, what each one of those rates represents and how together they act as ceiling or floor for the interest rate corridor

now let's understand each one of the 4 key rates set by the federal reserve to keep the market rates within the target range

namely, what each one of those rates represents and how together they act as ceiling or floor for the interest rate corridor

so when banks and other financial institutions need to lend capital - they can do it at a rate within the target range

of course, their balance sheet capacity must allow for that - but that's another topic which I already covered in some detail in my other posts😁

so when banks and other financial institutions need to lend capital - they can do it at a rate within the target range

of course, their balance sheet capacity must allow for that - but that's another topic which I already covered in some detail in my other posts😁

now you should have a clear mental model of how the Federal Reserve sets the interest rates in the market

a target range is defined, and then several different interest rates are set explicitly to steer the real interest rate into that target range

now you should have a clear mental model of how the Federal Reserve sets the interest rates in the market

a target range is defined, and then several different interest rates are set explicitly to steer the real interest rate into that target range

think of these 4 rates as defining a corridor with an upper and a lower bound - currently 4.25% and 4.50%

the average market interest rate will sit somewhere in between

the rates define the interest rate corridor in the following manner:

1️⃣ Overnight Reverse Repo Rate - floor

2️⃣ Interest on Reserve Balances - supplementary floor

3️⃣ Discount Rate - ceiling

4️⃣ Standing Repo Facility - supplementary ceiling

how can the FED even set market-wide rates? 🤔

after all - there is no single rate that the whole market unanimously uses

different types of lending have different rates in the market, as it's a (somewhat) open market