Illya Gerasymchuk

Engineering & Finance

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity

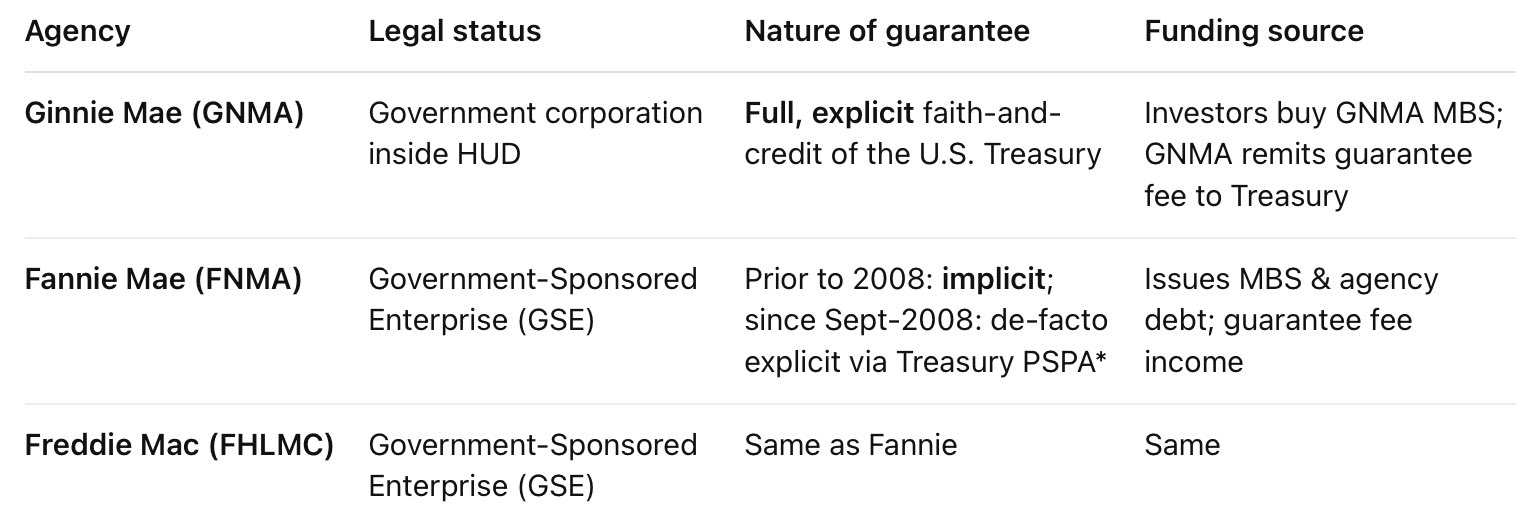

this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it

thus, the yields fell