Financial plumbing & market structure updates

Short updates on repo markets, collateral chains, clearing and settlement systems, and the core infrastructure that drives global liquidity.

this is also why commercial banks purchasing government debt securities, such as Treasury bills may be effectively monetizing that debt

generally speaking:

➖ transaction between central bank accounts = base money reallocated, decreased or increased

➖ transaction between non-central bank accounts = broad money reallocated, decreased or increased

generally speaking:

➖ transaction between central bank accounts = base money reallocated, decreased or increased

➖ transaction between non-central bank accounts = broad money reallocated, decreased or increased

effectively this means that if both parties involved in the transaction have an account at the central bank, they will will use it to settle payments

effectively this means that if both parties involved in the transaction have an account at the central bank, they will will use it to settle payments

reserve accounts at the central bank are important to understand the mechanics of how asset purchase happens. generally speaking, if an institution has an account at the central bank - reserve or other deposit account, they will use it whenever possible to settle payment

reserve accounts at the central bank are important to understand the mechanics of how asset purchase happens. generally speaking, if an institution has an account at the central bank - reserve or other deposit account, they will use it whenever possible to settle payment

also note that it's not just commercial banks that have accounts at the central bank. it varies by jurisdiction, but other entities also have accounts at the central bank

for example, in the US the Treasury has an account at the Fed - the Treasury General Account (TGA)

also note that it's not just commercial banks that have accounts at the central bank. it varies by jurisdiction, but other entities also have accounts at the central bank

for example, in the US the Treasury has an account at the Fed - the Treasury General Account (TGA)

if it's the central bank buying assets from other banks, such as in QE - then the central bank also creates the deposit "out of thin air", thus effectively paying for the assets to the commercial bank with a newly created deposit into their reserve account. base money increases

if it's the central bank buying assets from other banks, such as in QE - then the central bank also creates the deposit "out of thin air", thus effectively paying for the assets to the commercial bank with a newly created deposit into their reserve account. base money increases

when banks buy assets from other banks - new deposits do not get created, as the payment happens by moving funds between the commercial bank's reserve accounts at the central bank

thus, it's base money movements/reallocation, not creation

when banks buy assets from other banks - new deposits do not get created, as the payment happens by moving funds between the commercial bank's reserve accounts at the central bank

thus, it's base money movements/reallocation, not creation

let's say the bank bought a T-bill from you for $1000. for this, they "created $1000" and deposited them into your account. bank’s balance sheet:

➖ Assets: +$1000 (the T-bill)

➖ Liabilities: +$1000 (the deposit/payment to you)

the key here is that you are a NON-bank

the bank doesn't need to have the money to pay you for the T-bill, as that money will be created and deposited into your account

on the bank's sheet side it works: its assets and liabilities increase in the same amount

when a bank buys an asset from a non-bank it creates broad money

if a commercial bank buys a US Treasury bill from you, it will pay you by create a new deposit into your account

so effectively the bank pays you by creating new digital currency and crediting it into your account

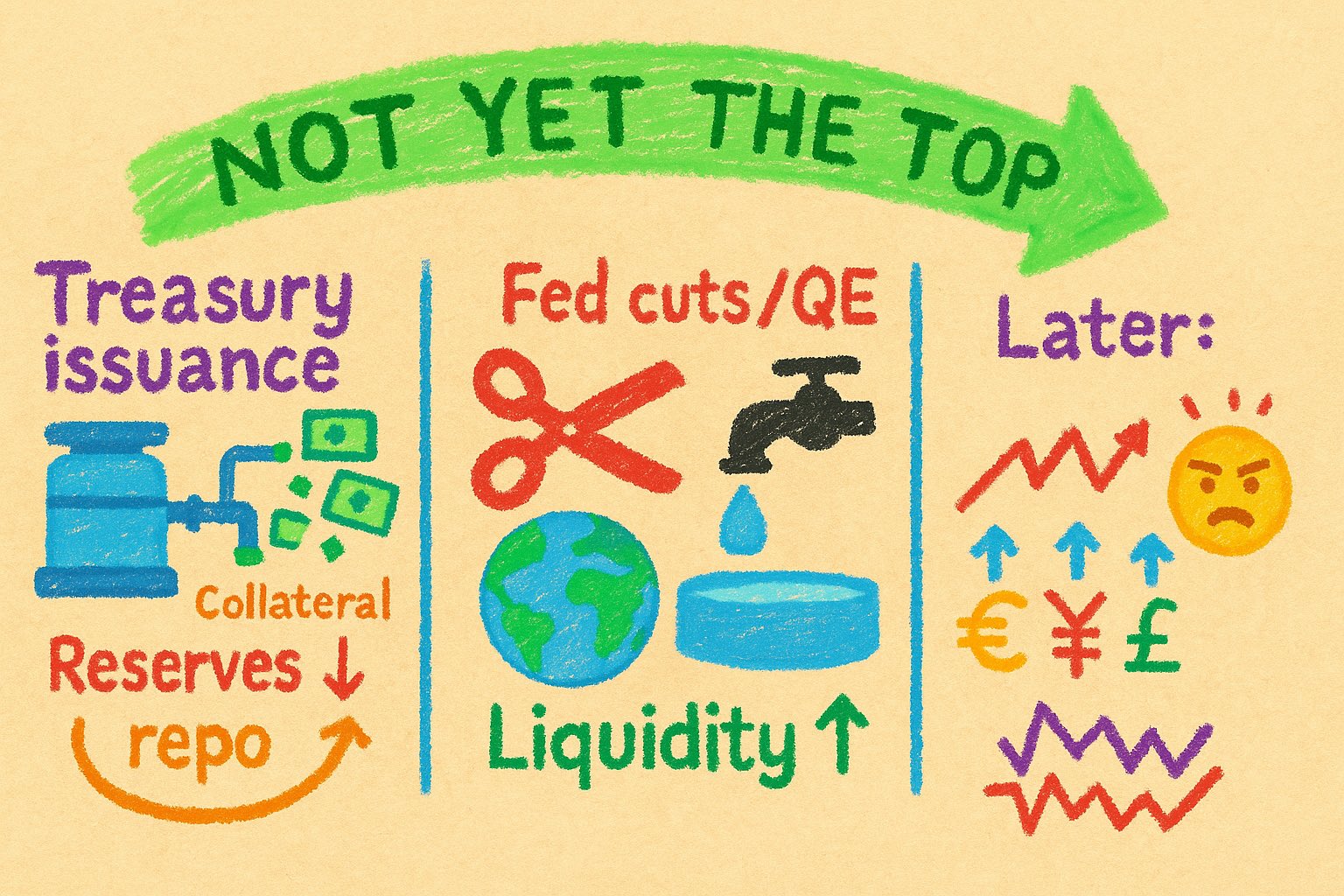

a lot of these US treasury purchases will be financed with short-term rolling debt (e.g. repo)

the newly issued Treasuries themselves will be used as collateral to borrow cash, many times over via rehypothecation

US Treasury debt is likely to be among the assets purchased by those same banks that received QE funds from the central bank. so central bank's QE injection may be used to purchase US Treasury debt at auctions, thus effectively monetizing the government debt 😁

even if it doesn't happen directly at the start - eventually QE also increases broad money, due to reduced balance sheet constraints and an increase in cash reserves, which needs to be invested ASAP. this leads to more lending and asset purchases

initially QE may only increase base money supply - as commercial banks reserve balances get credited by the Central Bank

if the Central Bank purchases assets from non-bank financial institutions, then broad money increases directly as well, as deposits increase

the US Treasury may also issue more debt to increase the supply of safe assets, thus offsetting the compression shock

end result: more safe assets/prime collateral provided to markets. remember that the newly issued treasuries are likely to be rehypothecated several times

the global financial system depends on the abundance of this collateral, otherwise - defaults, margin calls, etc

i wrote a thread/article explaining how US Treasuries are the dominant collateral in short-term wholesale debt markets (e.g. repo). read here: https://illya.sh/threads/@1751726431-1.html

QE also removes safe collateral from the market, mainly US Treasury bills, notes and bonds. this safe collateral is the backbone of wholesale debt markets, where financial institutions, including commercial and central banks finance and re-finance their positions

QE also removes safe collateral from the market, mainly US Treasury bills, notes and bonds. this safe collateral is the backbone of wholesale debt markets, where financial institutions, including commercial and central banks finance and re-finance their positions

however, eventually yield spreads will raise with high velocity. this is the larger financial crisis part of the cycle. there you will also see lower rates and more QE

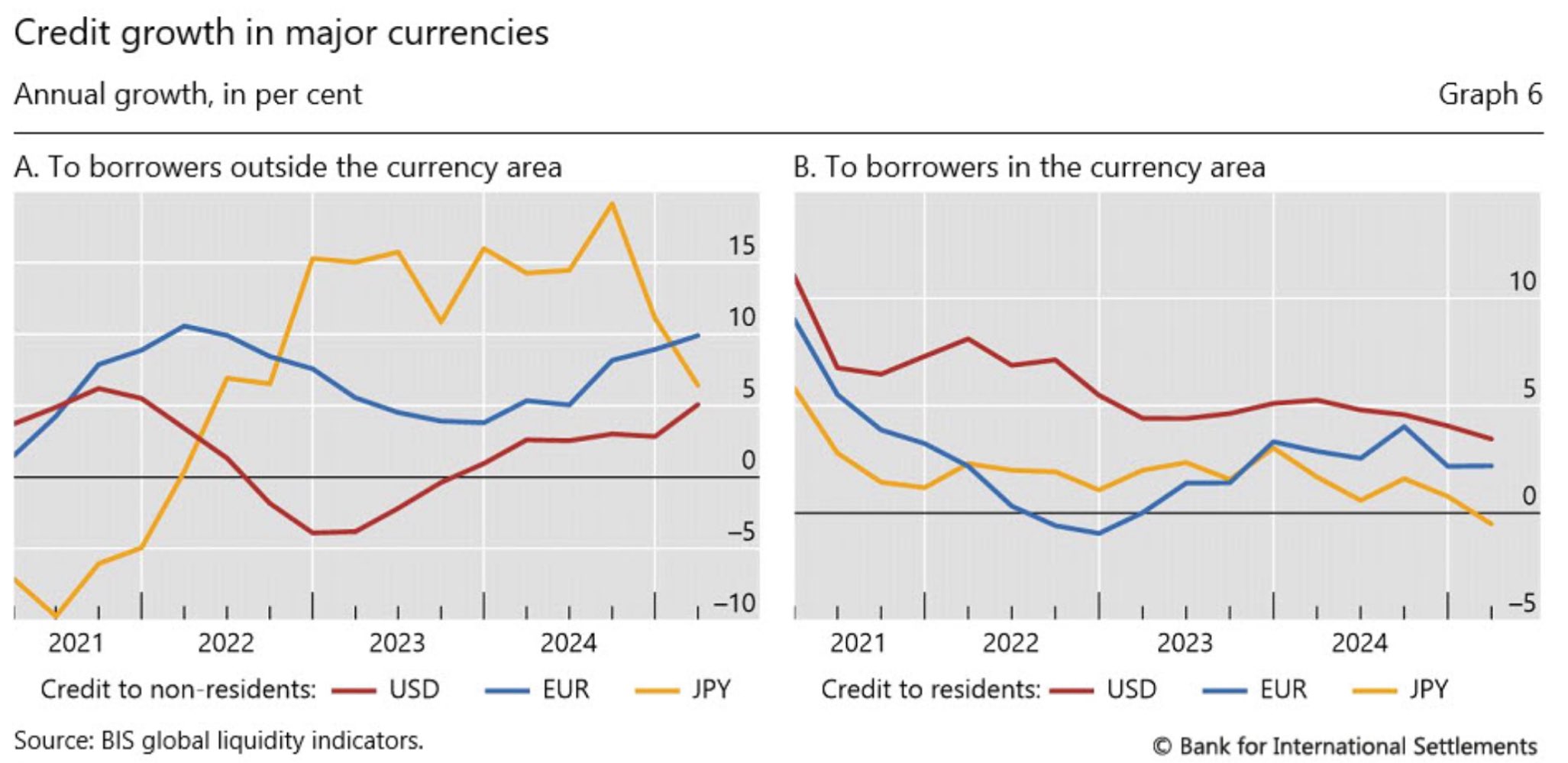

Bank of International Settlements (BIS) has a lot of interesting papers, articles and data on global liquidity and financial system

it's bank-focused, but connected to the broader scope, like the non-bank financial institution (NBFI) credit flows i posted about earlier

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

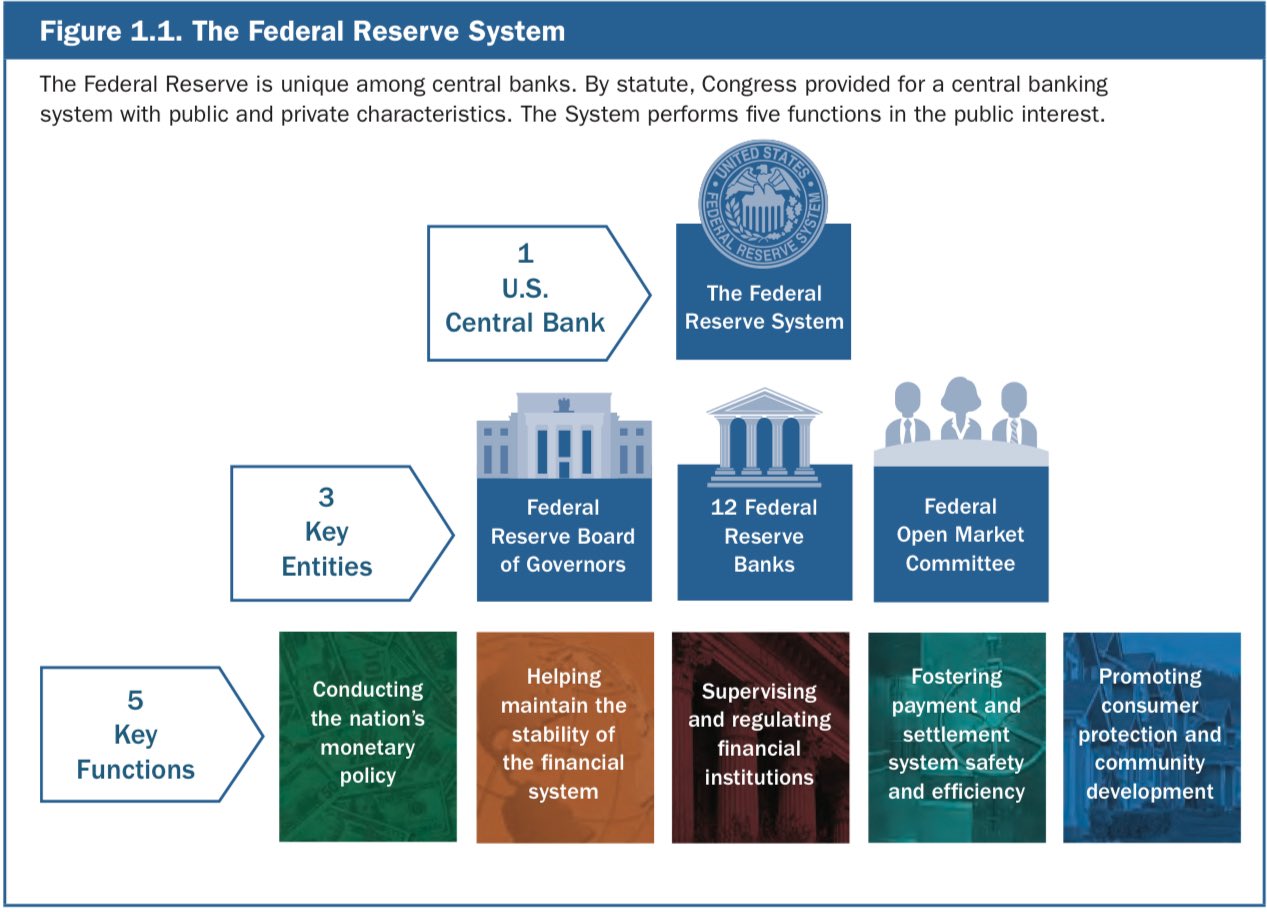

still, in the USA the Fed continues to dominate in importance

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

by "central bank" I'm frequently referring to the broader set of the legal framework behind the macro monetary policy

in most countries central banks plays a key role, but they frequently co-exist in a larger network of institutions

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD

collateral here is the non-USD local currency, such as Yuan

so according to this, since Treasuries yield more than ON RRP the wholesale cash moved from ON RRP into Treasuries

when the US Treasury spends them - they flow right back into broad money

indeed, currently T bills yield from 4.29%, while ON RRP is at 4.25%

interesting take!

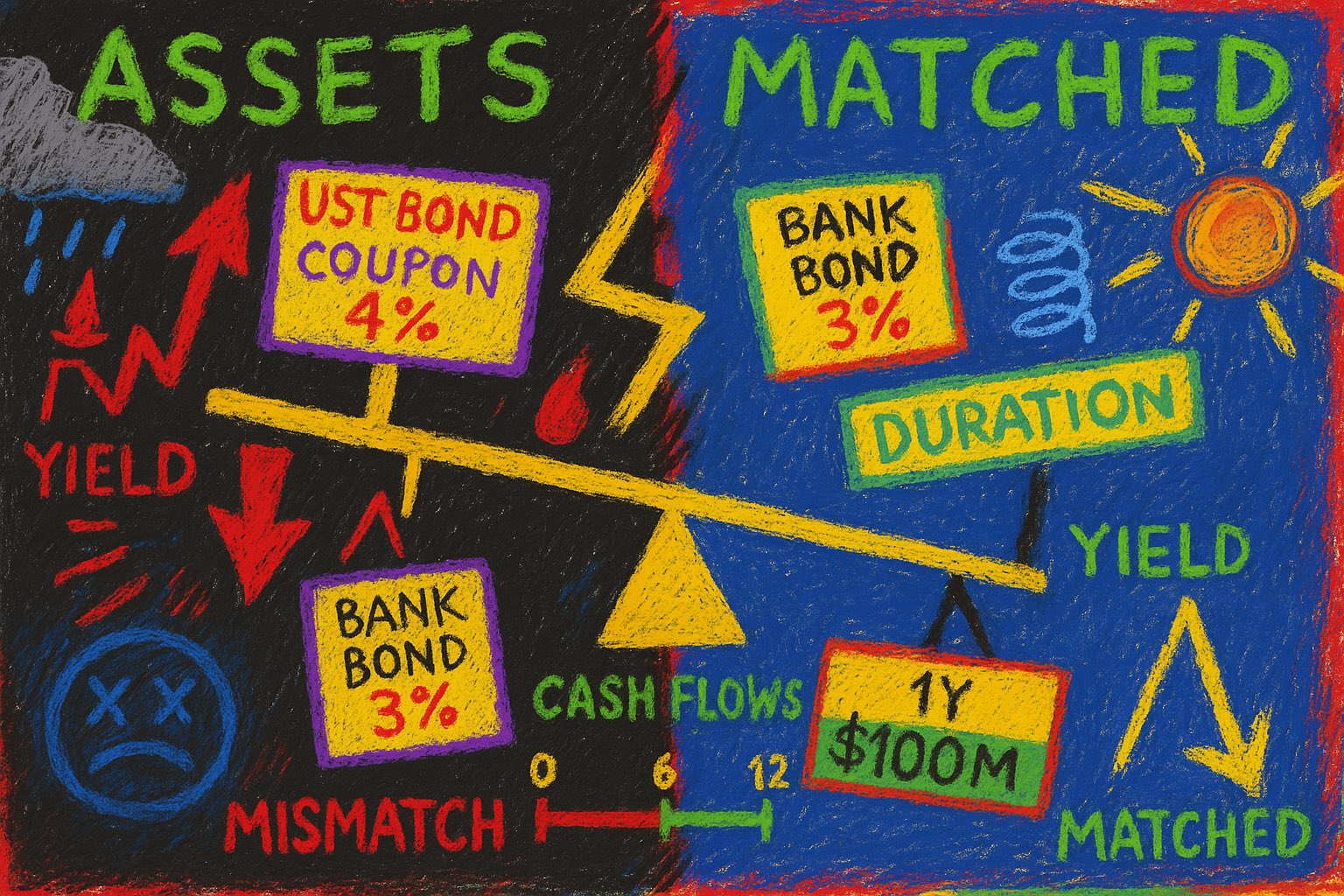

this is why duration matching is key for financial institutions

this is also the reason why it's generally not a good idea for governments to refinance long-term debt with short-term debt

this shortens the duration of both - government liabilities and market's assets

duration matching protects:

➖ liquidity via cashflow modulation, by helping liability cashflows match asset cashflows

➖ solvency via asset and liability value modulation, by reducing asset value loss when yields fall and reducing liability value loss when yields raise

let's develop on this simple bank example

assume a brand-new bank with an empty balance sheet, no revenue, no deposits, no cashflow and no regulations

the bank is about to finance its first asset - a UST bond with a liability - bonds issued by the bank

this newly acquired UST bond was financed with some liability of the bank

let's say the bank itself issued bonds with a smaller coupon than UST’s

thus, the bank used a liability to finance and asset and earns a spread

duration matching protects solvency and liquidity when yields shift

assets are financed by liabilities and equity. financial institutions like banks usually have small equity - so liabilities finance assets

i wrote about how reverse repurchase agreements work and their importance in the global financial system in this thread:

https://illya.sh/threads/@1751561045-2

the US will be able to sustain their debt financing for as long as US government debt and US dollar dominate in demand

for as long as USD is the reserve currency - the US can finance its debt

in other words, as long as there's enough buyers and users - it's all good! 😁

intermediation started with paper records, physical bank counters and now has mostly moved to technological - via computer systems

while hybrid intermediation systems don’t strictly need to be technological - in practice they vastly are as most of financial activity happens through computer and information systems