Financial plumbing & market structure updates

Short updates on repo markets, collateral chains, clearing and settlement systems, and the core infrastructure that drives global liquidity.

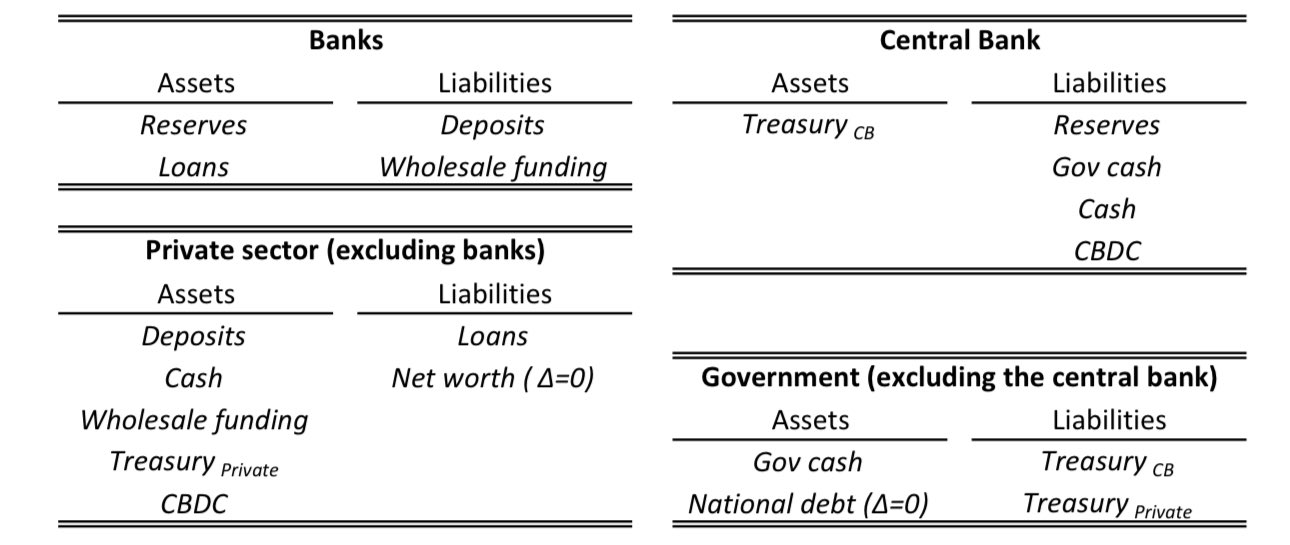

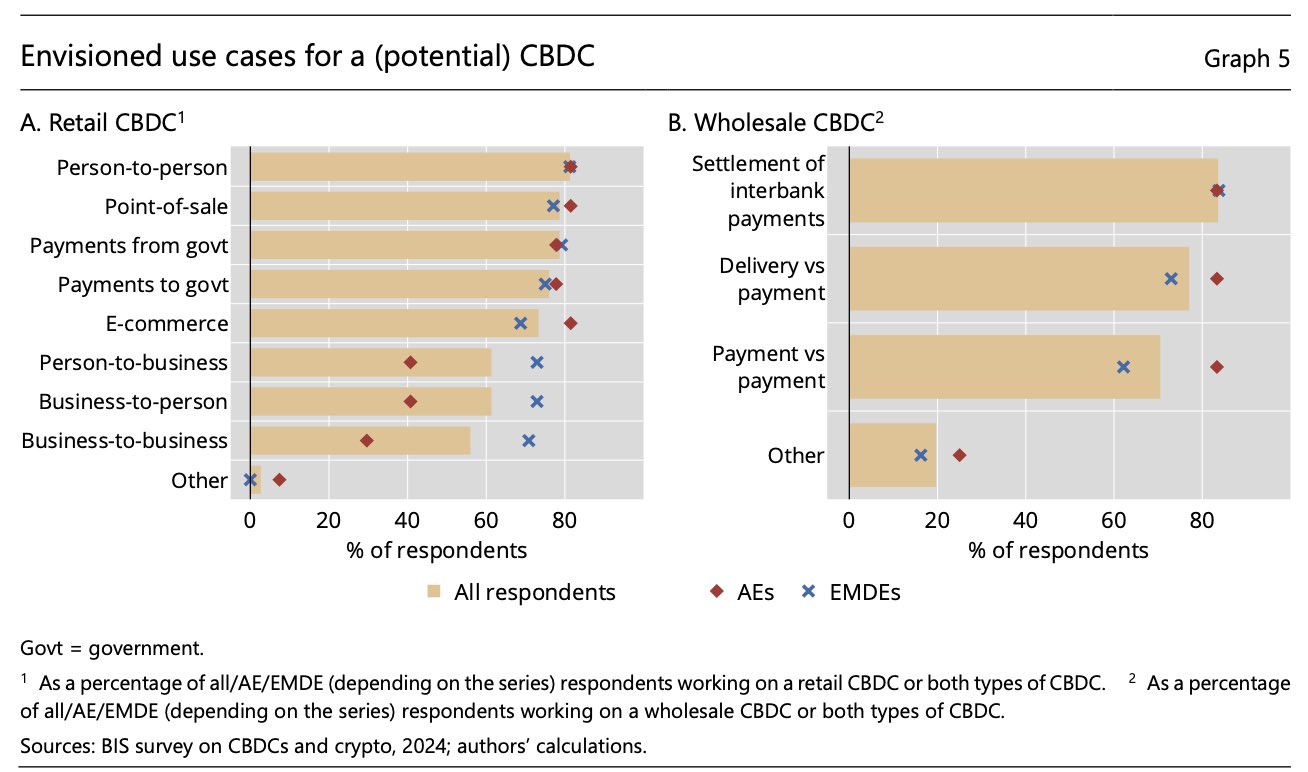

thus, wholesale CBDC is a tokenized/digital version of central bank reserves used by the financial market infrastructure (FMI) and banks

it also lives on the liability side of the central bank

wholesale CBDC will be used by financial institutions only, such as commercial and central banks for interbank and market settlement

wholesale CBDC will only be transacted between select financial institutions - it's not something you'd use as a regular business or consumer

wholesale CBDC will be used by financial institutions only, such as commercial and central banks for interbank and market settlement

wholesale CBDC will only be transacted between select financial institutions - it's not something you'd use as a regular business or consumer

wholesale CBDC vs retail CBDC - what's the difference?

there's two types of central bank digital currencies (CBDC): retail CBDC and wholesale CBDC

➖ retail CBDC = used for ordinary transactions. digital version of the cash

➖ wholesale CBDC = used for interbank/financial institution settlement. tokenized central bank reserves

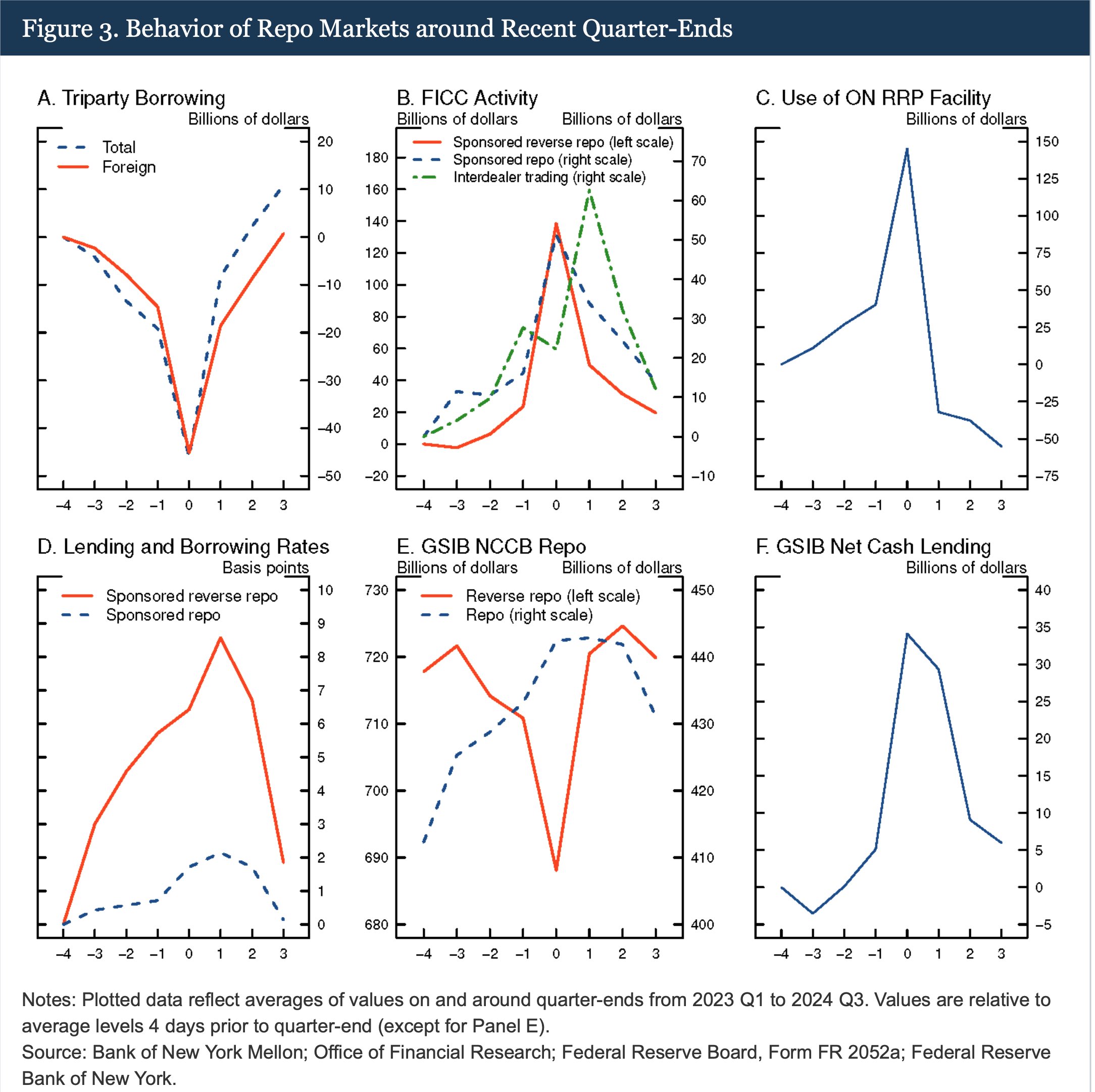

Standing Repo Facility (SRF) is a policy rate set by the Fed, according to the target rate. so unless the target rate is decreased, SRF rate is unlikely to be reduced

this situation is putting pressure on the Fed to decrease interest rates and start QE soon

the funding could also come from Fed’s facilities, like the SRF or OMO

however, current SRF rate is 4.5%, which is above the yield on T-bills, and Fed is still officially in QT, so no large-scale, longer-term liquidity injections via open market operations

moreover, currently the US Treasury is issuing debt and cash at ON RRP is running low. MMF, dealers and banks purchase those T-bills. if they do not have cash in ON RRP, it will be financed by outflows from bank reserve accounts into TGA

repo rates increase and borrowing decreases in quarter-ends

this includes the upcoming month of September. in addition, September 15th the corporate tax limit in the US

this reduces global liquidity, so asset prices tend to fall