Global liquidity indicators & flows

Short-form analysis of TGA, RRP, money aggregates, credit growth and cross-border USD flows that drive risk assets.

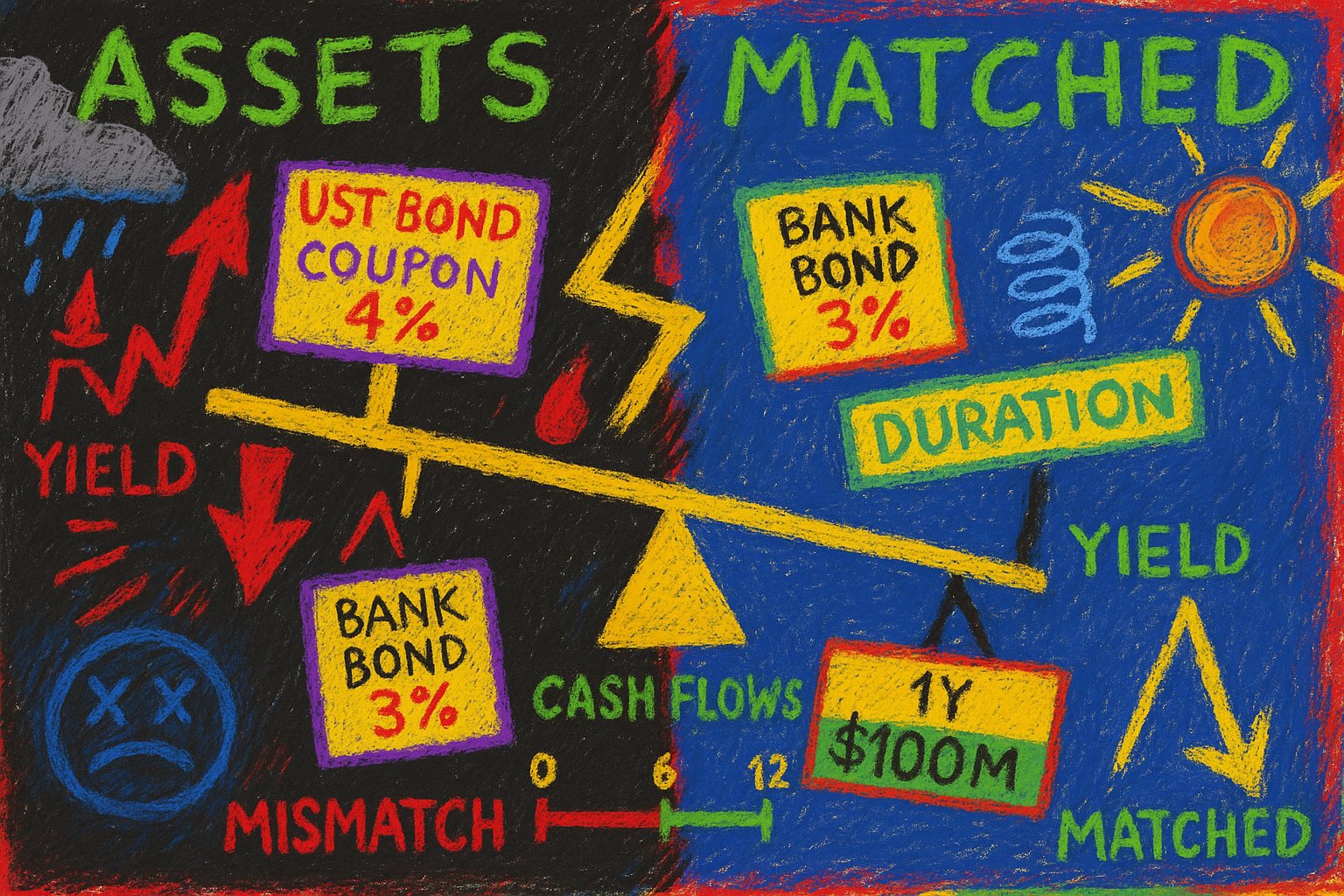

duration matching protects solvency and liquidity when yields shift

assets are financed by liabilities and equity. financial institutions like banks usually have small equity - so liabilities finance assets

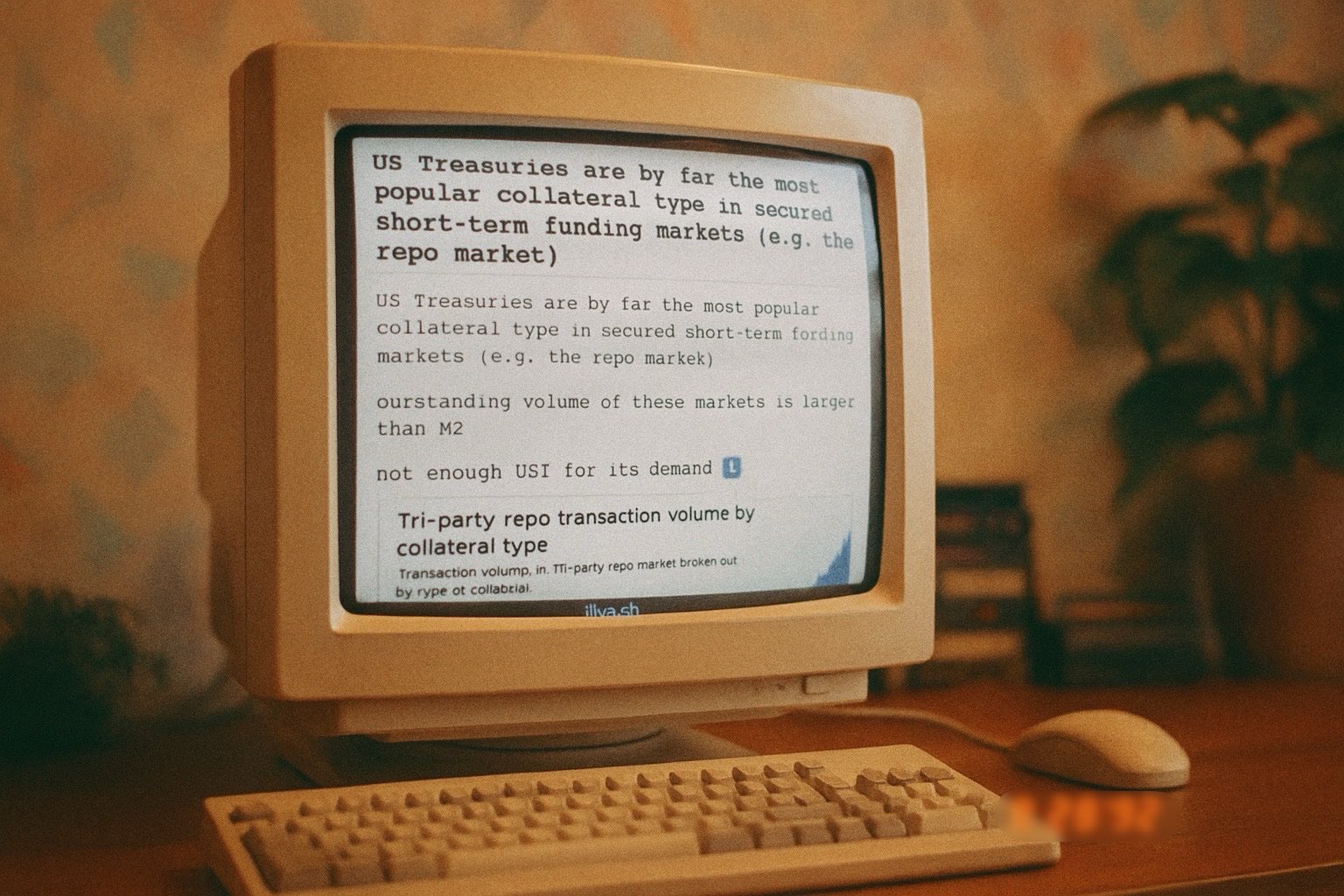

i also wrote a thread explaining the importance of USD-denominated government debt for short-term funding/credit markets

remember that most of credit is issued to refinance existing debt and not for new financing

you can read it here:

https://illya.sh/threads/@1751726431-1

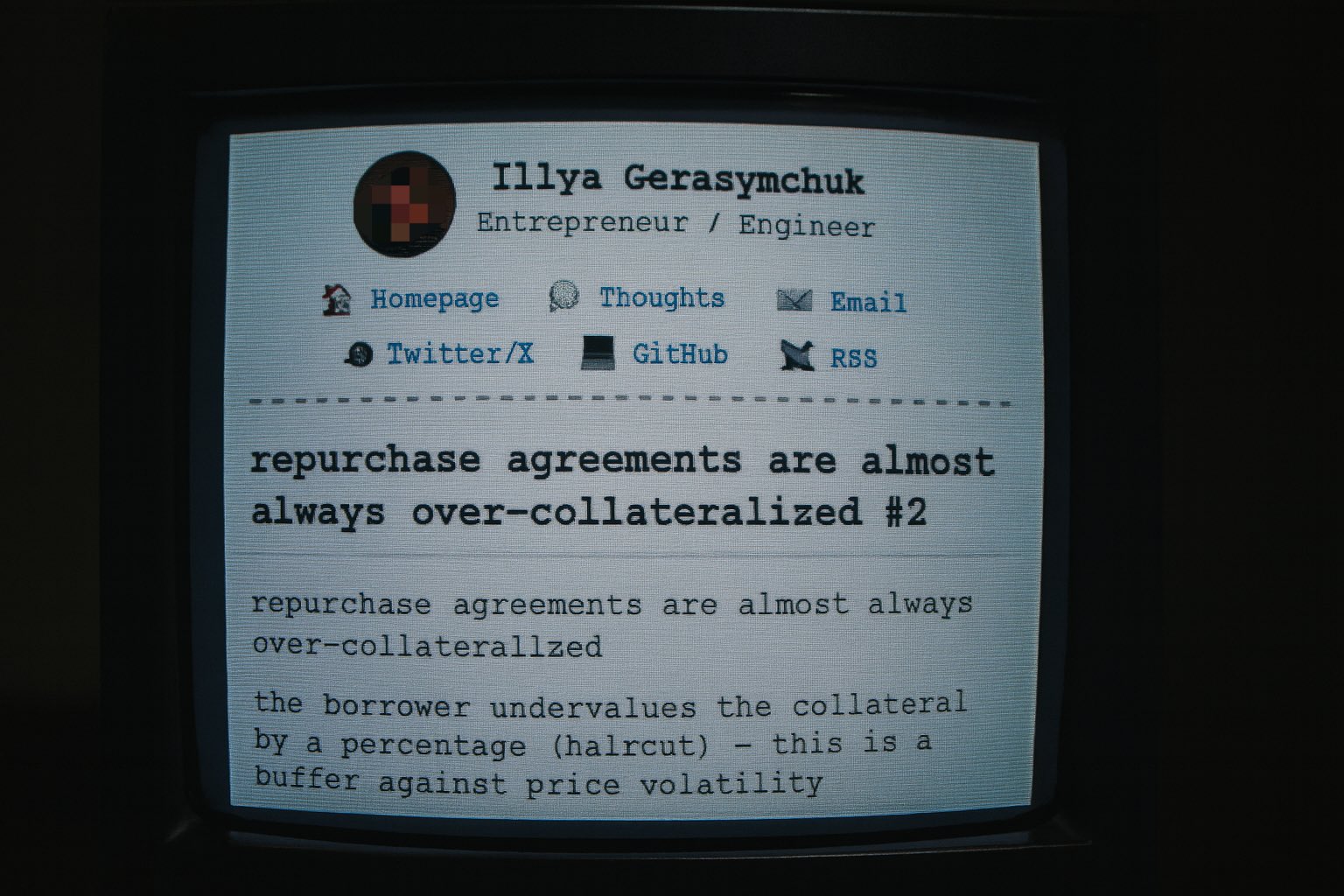

i wrote about how reverse repurchase agreements work and their importance in the global financial system in this thread:

https://illya.sh/threads/@1751561045-2

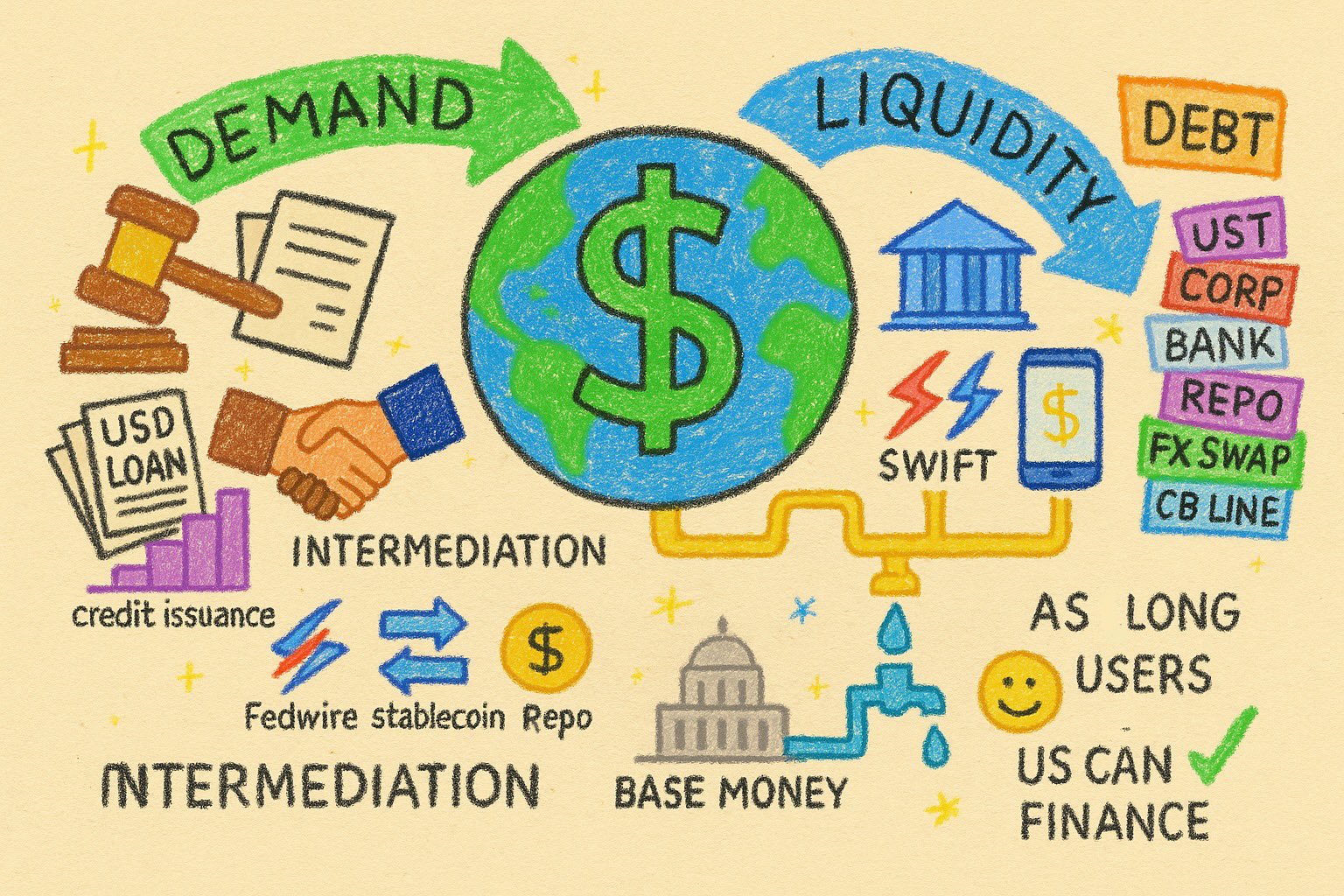

the US will be able to sustain their debt financing for as long as US government debt and US dollar dominate in demand

for as long as USD is the reserve currency - the US can finance its debt

in other words, as long as there's enough buyers and users - it's all good! 😁

debt includes all form, tenor and issuers of USD-denominated debt are included, both public and private

examples: US Treasuries, corporate bonds, commercial bank credit, epos, FX swaps, central-bank lines

base money issuance and management is a responsibility of the US government - so it's always intermediated, even if by government-controlled systems

hybrid intermediation systems include all means of facilitating the issuance, servicing and transactions of USD and USD-denominated securities, including equities, bonds and derivatives

balance sheet capacity is heavily dependent on regulations (e.g. Basel III & local)

hybrid intermediation systems facilitate access to the payment and credit channels

SWIFT, FedWire and digital private USD claims like stablecoins & PayPal facilitate USD's movement and usage

liquidity means availability, thus it comes down to being able to:

1️⃣ access USD credit

2️⃣ settle payments in USD

this means balance sheet capacity and hybrid technological intermediation systems in place

liquidity means availability, thus it comes down to being able to:

1️⃣ access USD credit

2️⃣ settle payments in USD

this means balance sheet capacity and hybrid technological intermediation systems in place

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets

USD is the world's reserve currency, but what does that mean?

for USD to be a reserve currency it must dominate in:

1️⃣ USD-denominated credit issuance (demand)

2️⃣ USD use a means of settlement for payments (liquidity)

this dominance must be at least relative to alternatives

stablecoin issuers would get this new credit, purchase treasury bonds and increase the supply of their stablecoin

a new direct line from newly issued credit into treasuries 😄

stablecoin issuers could intermediate the issuance process, so you don't need to get all credit institutions on-chain from the start

non-algorithmic stablecoin issuance already happens off-chain and presumes trust in a third party

this would just be faster. more liquidity

banks are credit institutions which means they can create broad money

while a non-credit institution or a regular business can issue loans - they must fund it (e.g. raise money, use excess profits)

they can't just create those $100, thus expanding the monetary supply

so the bank funds the loan by creating $100 and crediting them to your account

those $100 that they credited you did not exist before - the bank created that money on demand

those $100 are not physical cash - they're an entry in a digital ledger (i.e. in a computer system)

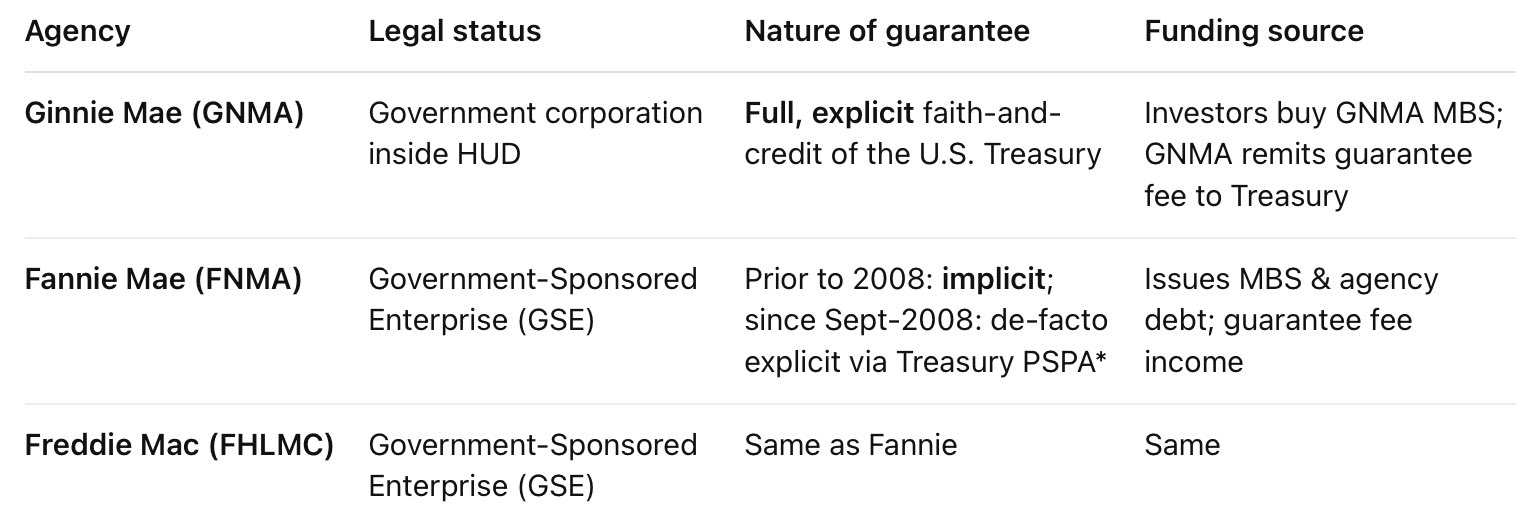

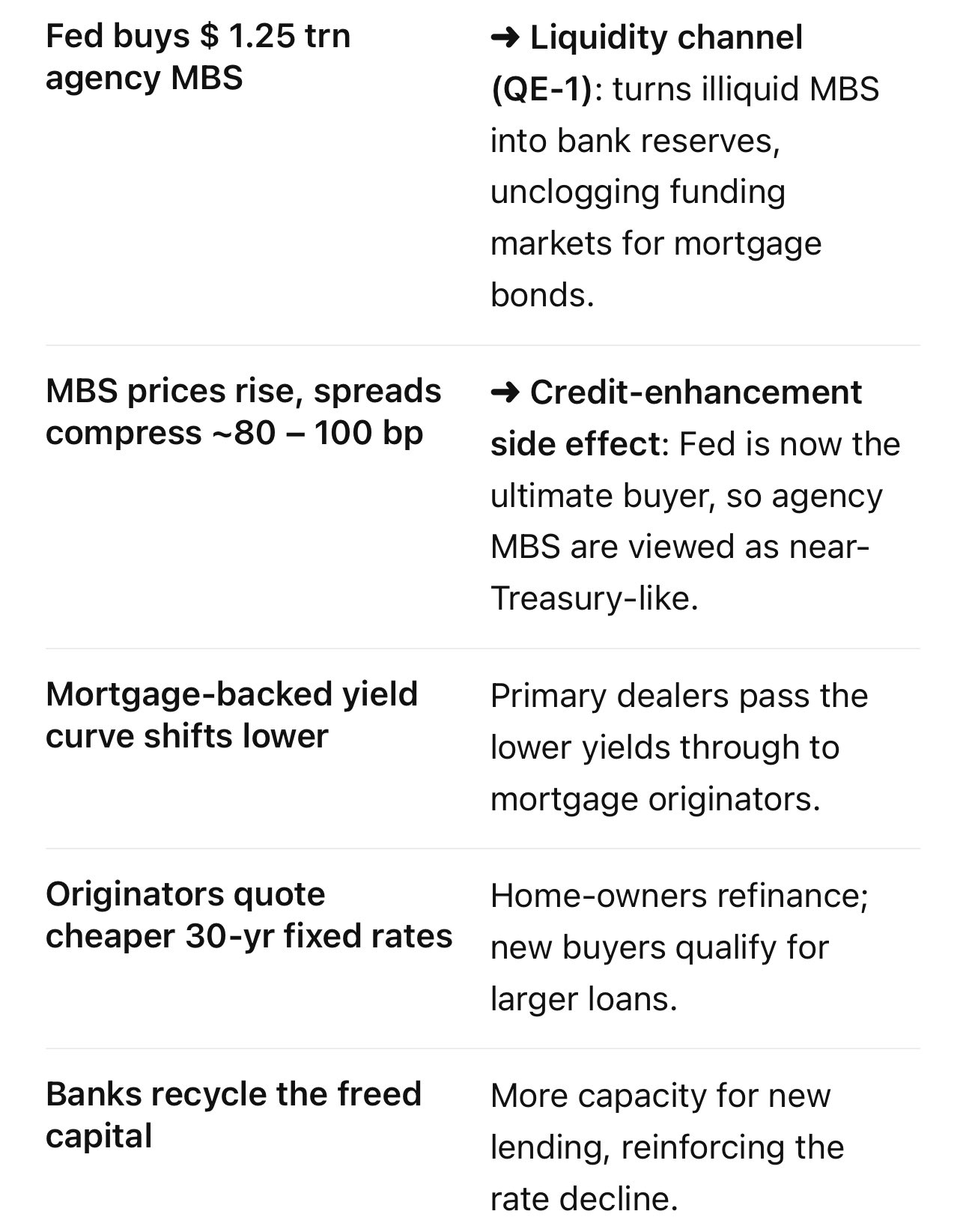

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity

this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it

thus, the yields fell

to lower the mortgage rates the Fed can purchase agency MBS - likely they did in QE 1 2008

buying mortgage backed securities raises their price and provides liquidity for dealers. this directly pushes down the yields

expect some MBS QE to come in the near future

the majority of liquidity is actually created in wholesale short-term debt markets

ON RRP addresses exactly that sector, thus setting the lower bound of the target interest rate corridor for the broader financial sector

ON RRP further reinforces the the floor for the market-wide interest rates

since it's accessible to a broader set of financial institutions - not only banks. those now also have little incentive to lend below the ON RRP rate

regulations may sound boring - but they're crucial to understand money, liquidity and financial system as a whole

they become fun once contextualized - and govern the rules of credit

i'd suggest starting with Basel III - namely liquidity coverage ratio & capital ratio

🚀 and indeed the crypto cap increased even more

now, await for a solid $4 Trillion

it's almost like it's correlated with global liquidity flows - or perhaps I'm just really good at guessing 😳

i wrote a lot about this in the past - so read up for details if inerested!

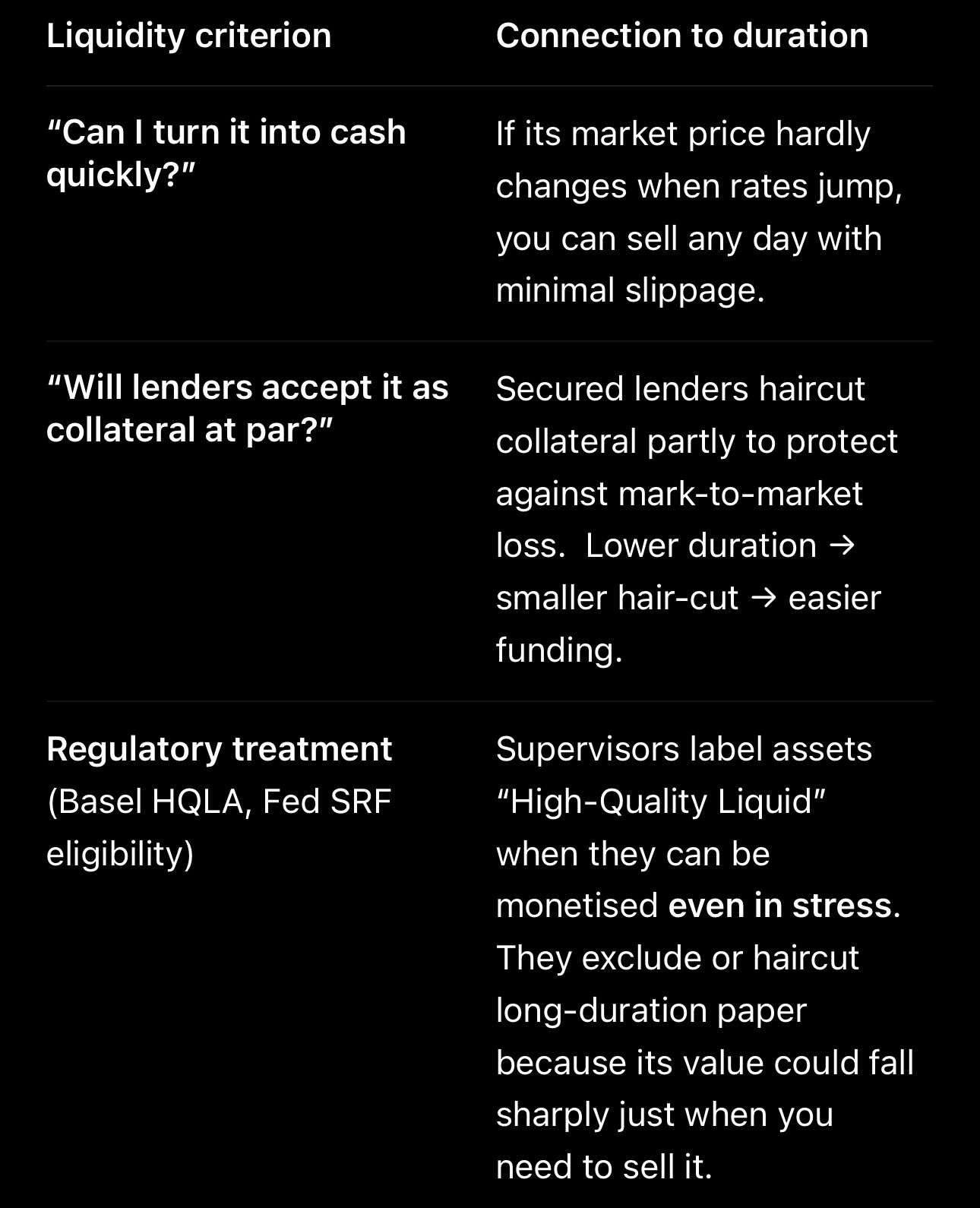

💧a liquid asset is one with low credit and duration risk

but the duration of the assets should be compared to the duration of the liabilities - assets are funded by liabilities + equity

duration of assets & liabilities should be as close as possible to minimize duration risk

not all money (credit) is the same

there's a quality dimension to it as well

credit issued by a central bank is higher quality than the one issued by commercial banks - no credit risk

central bank money is an unambiguous means of settlement for debt - think of legal tender

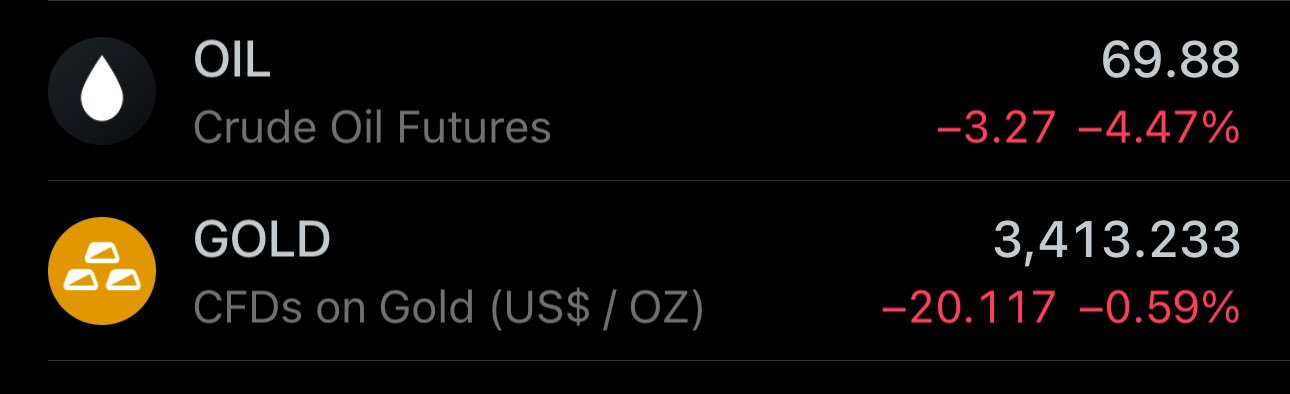

🛢️ crude oil price is heading back up - just like I wrote earlier

significant geopolitical events introduce volatility - but my thesis on increasing oil, gold & other precious metals + commodities has little to do with that

👉 it's about global liquidity flows & bond markets

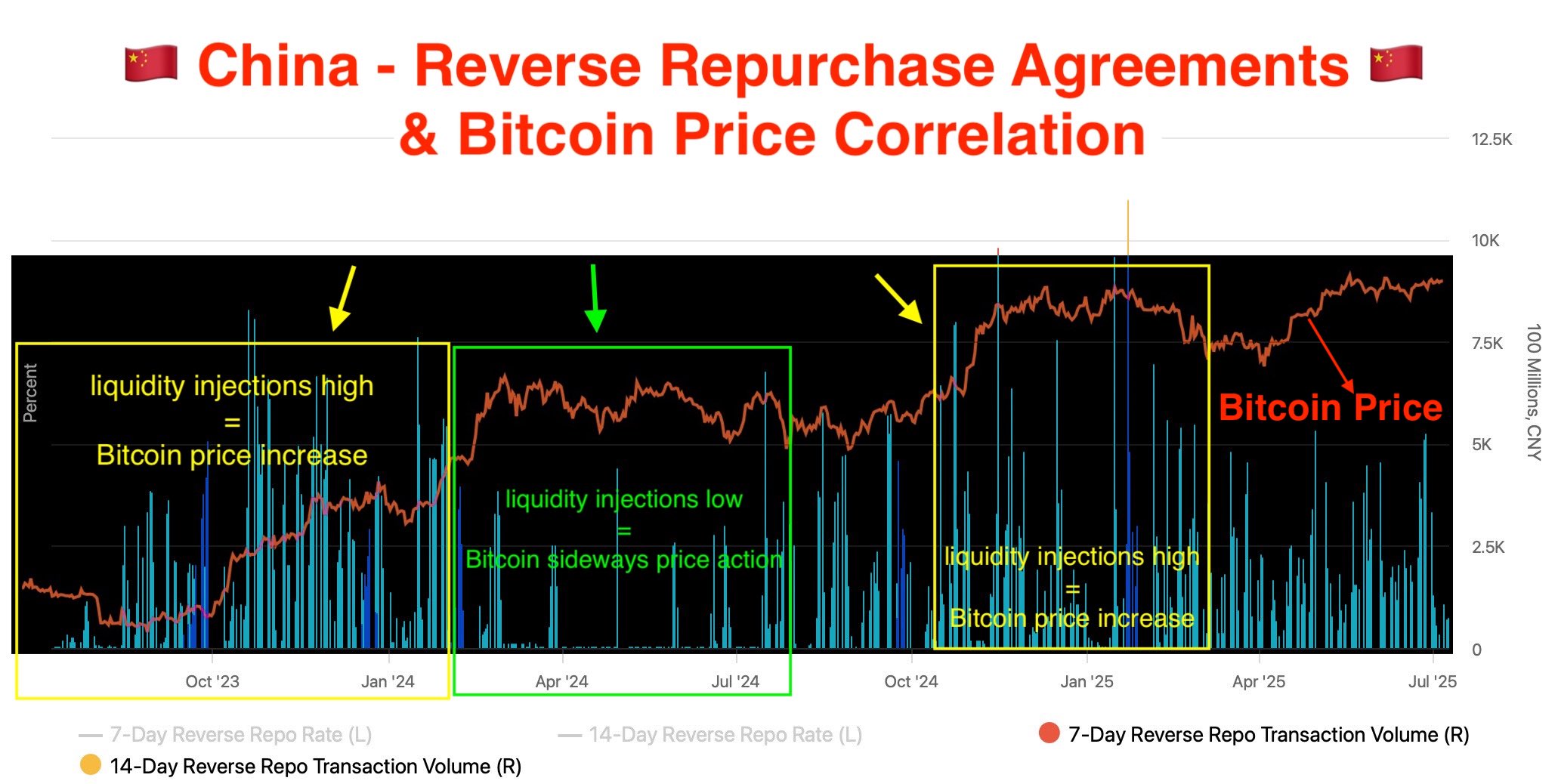

🇨🇳 China's reverse repo liquidity injections predict Bitcoin bullruns

it works like this:

📈 high PBoC injections = increasing bitcoin price

📉 low PBoC injections = sideways or decreasing

so every time China injects Yuan/reminbi, BTC price goes up 😁

🇨🇳 PBoC provides commercial & policy banks with liquidity via reverse repo open market operations

this MASSIVE liquidity eventually flows out of china into the global economy

so it has a very direct effect on asset prices wherever your are 😄

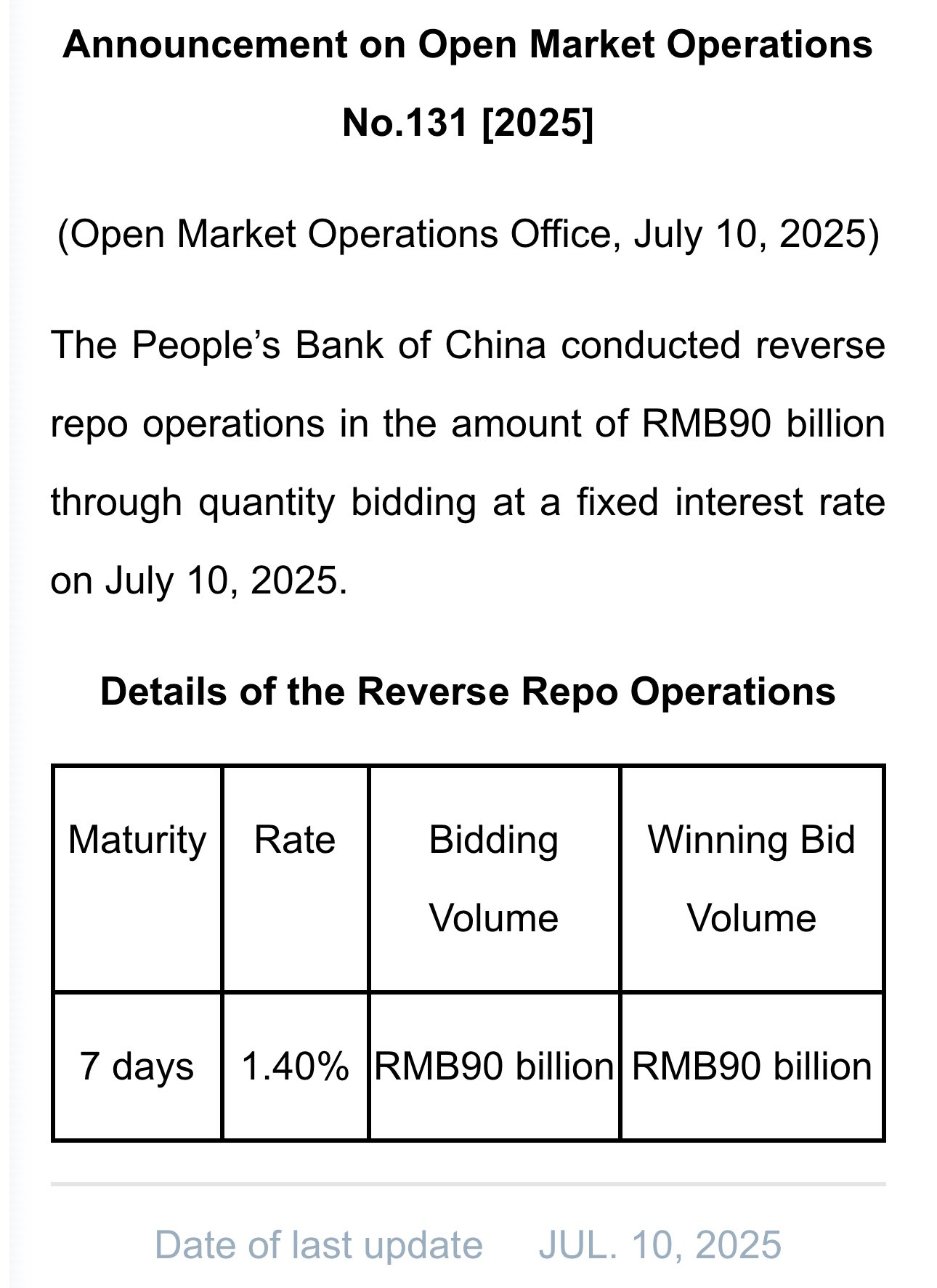

🇨🇳 china injects liquidity mainly via reverse repurchase agreements

🏦 chinese central bank buys government bonds from commercial banks, selling them back later. this new cash is re-invested yielding a spread

💹 essentially, they allow banks to earn a yield on their bonds

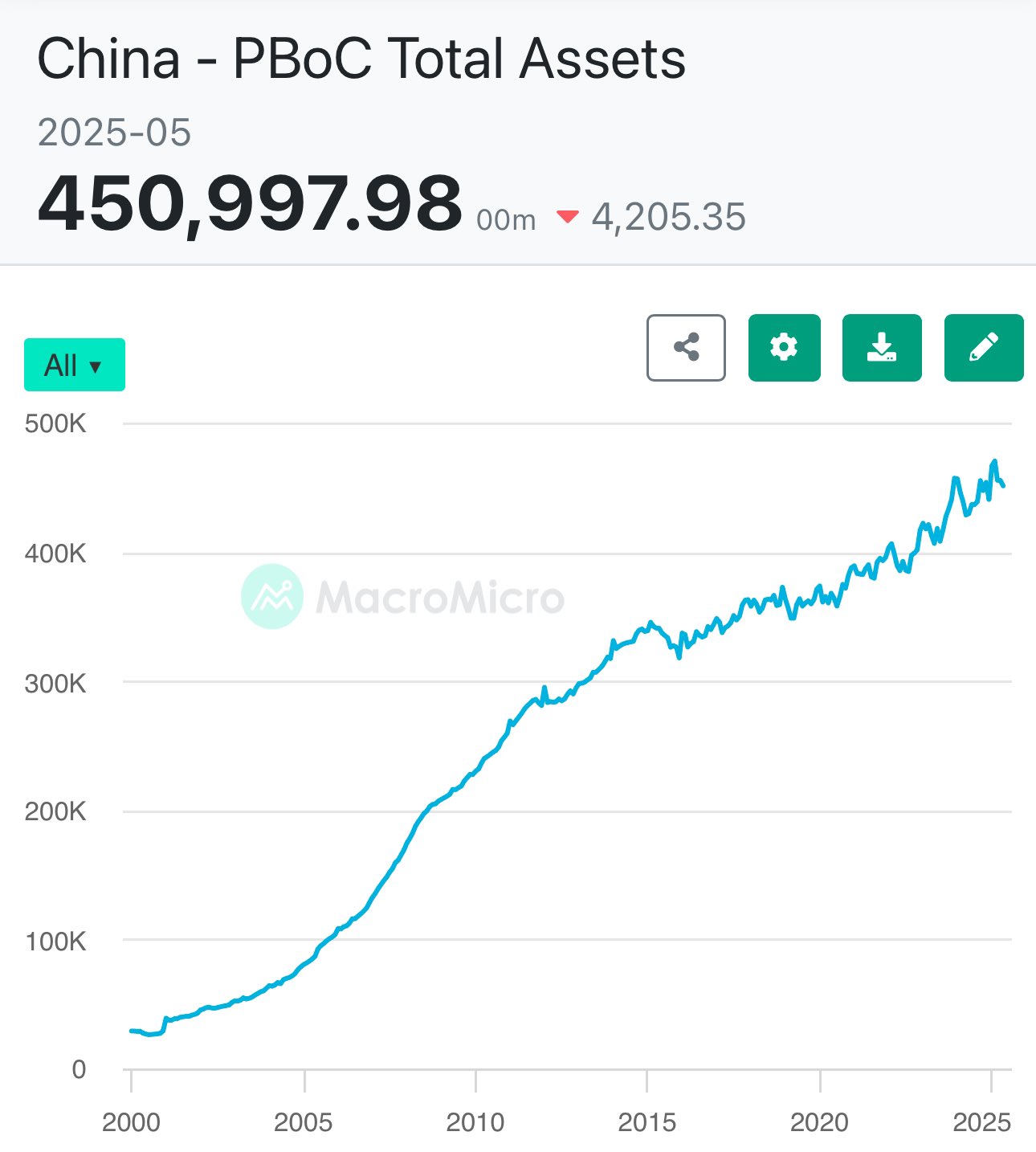

🇺🇸🇨🇳 USA & China are the global liquidity drivers in financial markets

since 2000, each injected ≈$6 trillion of public money into markets. that's ≈40% of global liquidity 🤯

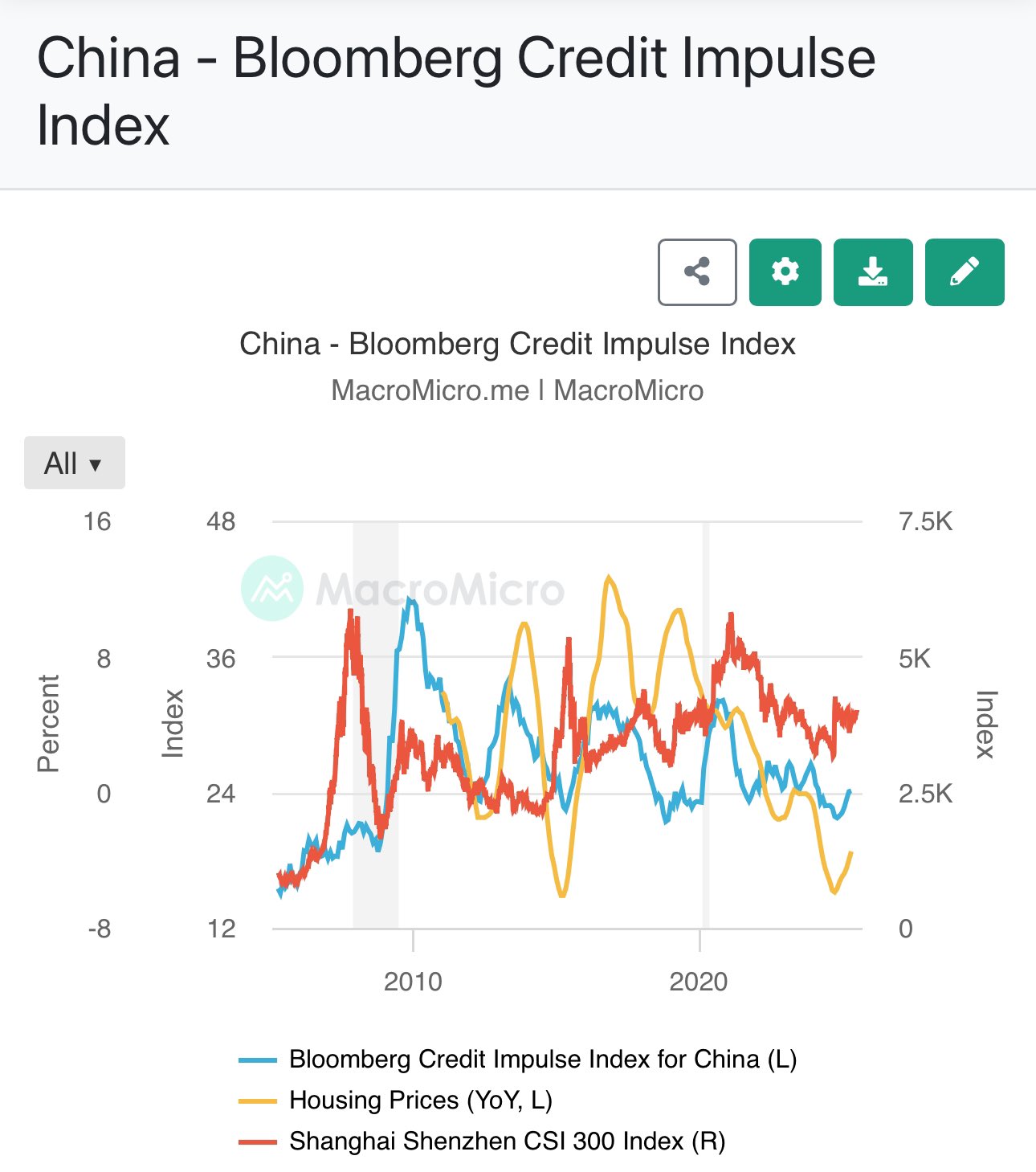

in 2025 - China is leading with injections

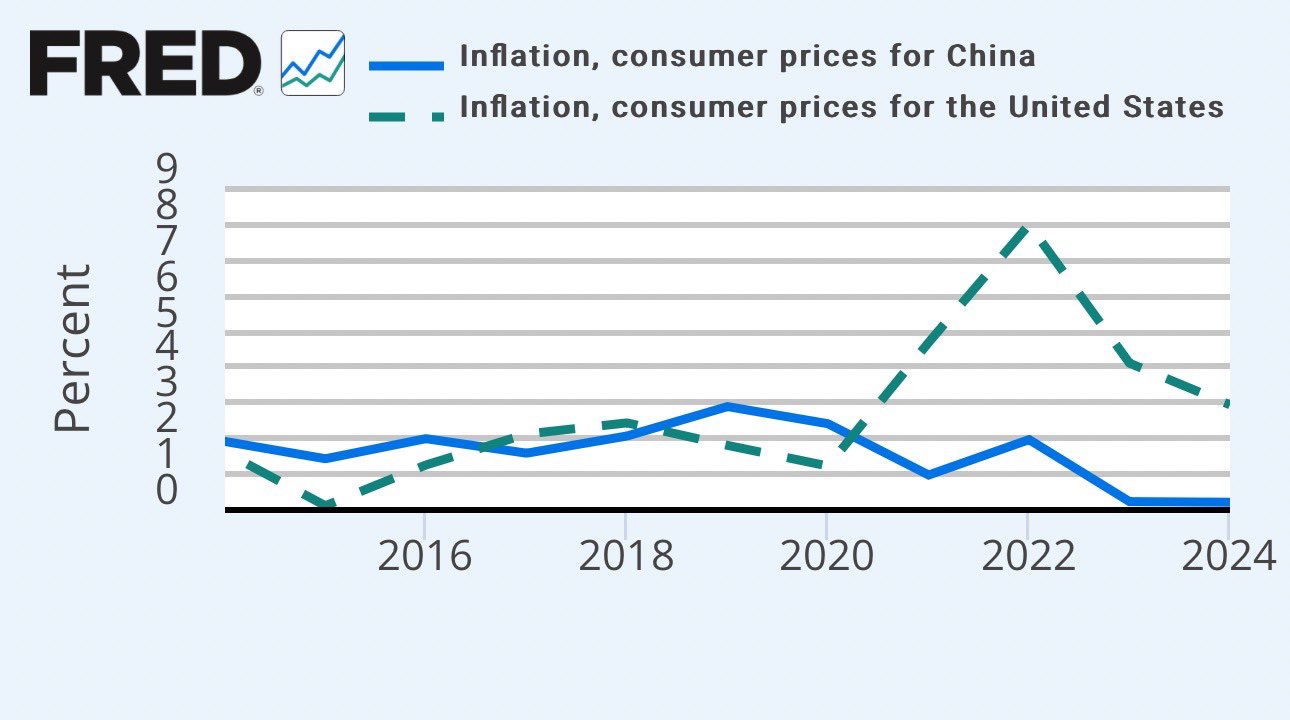

weaker USD + FED rate cuts & QE allow China to print Yuan/renminbi without a capital runoff

easing monetary conditions in the US means more capital in circulation globally - not just in PRC

thus, relative inflation is kept under more control

🇨🇳🇺🇸 china's CPI is below US's ⬇️

🇨🇳 china's central bank uses USD value as a key driver in economic policies

the monetary easing policy is adjusted by PBoC based on the dollar's trend - up or down

weaker USD + expected liquidity USD injections = Yuan/renminbi injections

this will also further fuel the asset bubble & devaluate USD

so it doesn't mean that stock & crypto will go up perpetually - it's a cycle

of course, at some point the debt bubble will pop - but it's unlikely to happen tomorrow 😄

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

this means inflation & gold up

at least short-term: equities up, crypto up