Global liquidity indicators & flows

Short-form analysis of TGA, RRP, money aggregates, credit growth and cross-border USD flows that drive risk assets.

once Fed does QE, reserve account balances increase, thus directly increasing base money

broad money either increases indirectly or directly if the Fed credits a non-bank institution

once Fed cuts interest rates, more borrowing will occur, thus expanding broad money

it will also lower T-bill yields short-term, as the prices are bid up due to a lower risk-free rate

once Fed cuts interest rates, more borrowing will occur, thus expanding broad money

it will also lower T-bill yields short-term, as the prices are bid up due to a lower risk-free rate

a lot of these US treasury purchases will be financed with short-term rolling debt (e.g. repo)

the newly issued Treasuries themselves will be used as collateral to borrow cash, many times over via rehypothecation

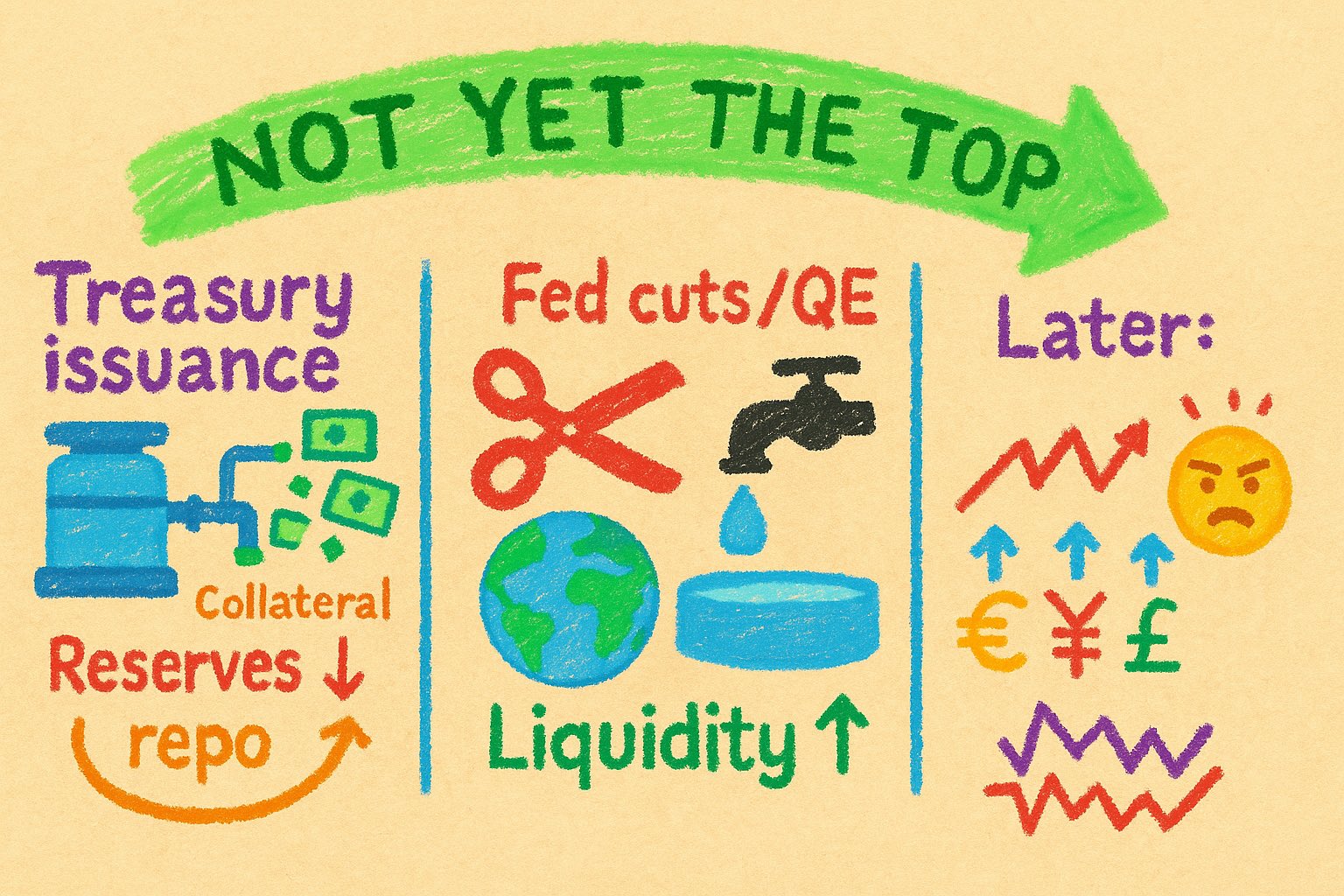

it's NOT yet the top of the cycle for equities, cryptocurrencies and other risk assets. here’s why

1️⃣ US Treasury is issuing more debt

2️⃣ in the next months I expect the Fed to cut rates and/or introduce some form of QE

3️⃣ weaker USD means more cross-border USD credit

even if it doesn't happen directly at the start - eventually QE also increases broad money, due to reduced balance sheet constraints and an increase in cash reserves, which needs to be invested ASAP. this leads to more lending and asset purchases

initially QE may only increase base money supply - as commercial banks reserve balances get credited by the Central Bank

if the Central Bank purchases assets from non-bank financial institutions, then broad money increases directly as well, as deposits increase