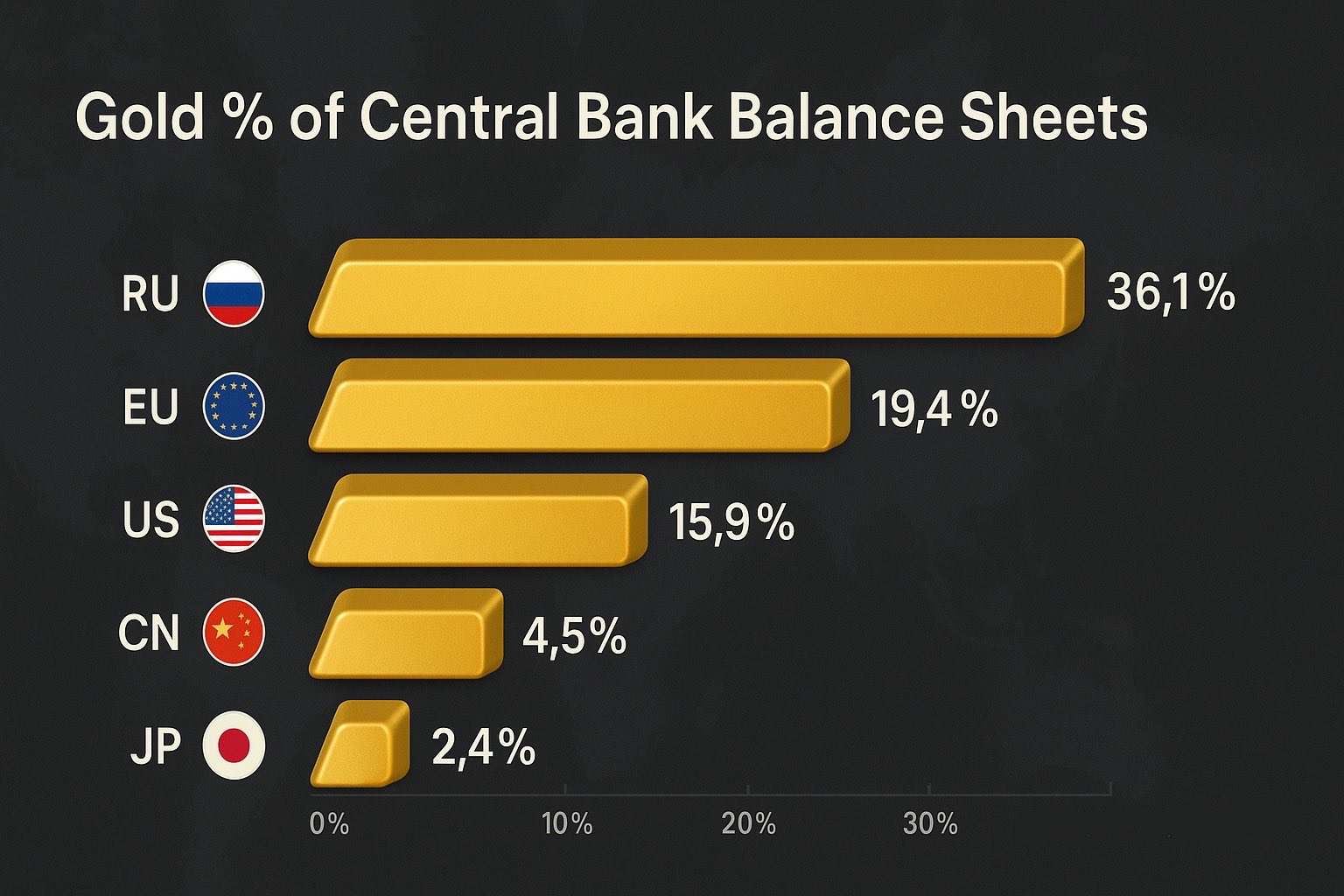

Gold as a percentage of balance sheet size in Central Banks (ranked):

🇯🇵 Japan (MoF + BoJ): ≈2.4%

🇨🇳 China (PBoC): ≈4.5%

🇺🇸 U.S. (Fed gold certificates): ≈15.9%

🇪🇺 European Union (ECB + Eurosystem): ≈19.4%

🇷🇺 Russia (BoR): ≈36.1%

All of the above will expand their balance sheets, but it's mostly China & Russia actively buying more gold.

Conclusions you can take from here:

➖ China's gold holdings are relatively small when compared to their Central Bank's balance sheet size, and given their efforts to promote renminbi as the invoice currency worldwide, you can expect PBoC to continue their gold purchases for the medium-long term. The gold share must at least double to come close to the current reserve currency - the U.S. dollar. All reserve currencies started on a gold and/or silver standard - and the pressure towards this direction won't be different for renminbi/yuan. When the USD became the world reserve currency with the Bretton-Woods agreement - gold certificates accounted for ≈40% of the Fed's balance sheet.

➖ Russia has built up a massive balance sheet capacity for the future. Once the international trade markets with Russia re-open, there will be a plenty of reserves to back-up a massive wave of Ruble credit. Expect Russian capital markets to rally then.

➖ European Union has a healthy relative position. Given that the Euro is currently the closest alternative to the U.S. Dollar - it's a good idea to both, expand gold reserves and promote capital markets. The latter is an explicit goal via the Capital Markets Union (CMU). Given that EU will further expand the balance sheet, it's necessary to increase the gold reserves - repricing won't be enough. Gold will make Euro more attractive, and with it the FX holdings of Euro by sovereigns.