Gold: macro, inflation, miners and price

Ongoing updates on gold price action, central-bank demand, miners and macro drivers in the precious-metals market.

Who's ready for a new gold ATH? 🙋

You don't have to guess - just look at the systemic raising bond yields across all maturities & multiple sovereigns

Btw I've since learned that gold is only ≈10% of total reserves of the Portuguese Central bank - that's low

It's 80% of their international reserves - those are basically regulation-defined ratios that banks must maintain (look into BASEL rules if curious)

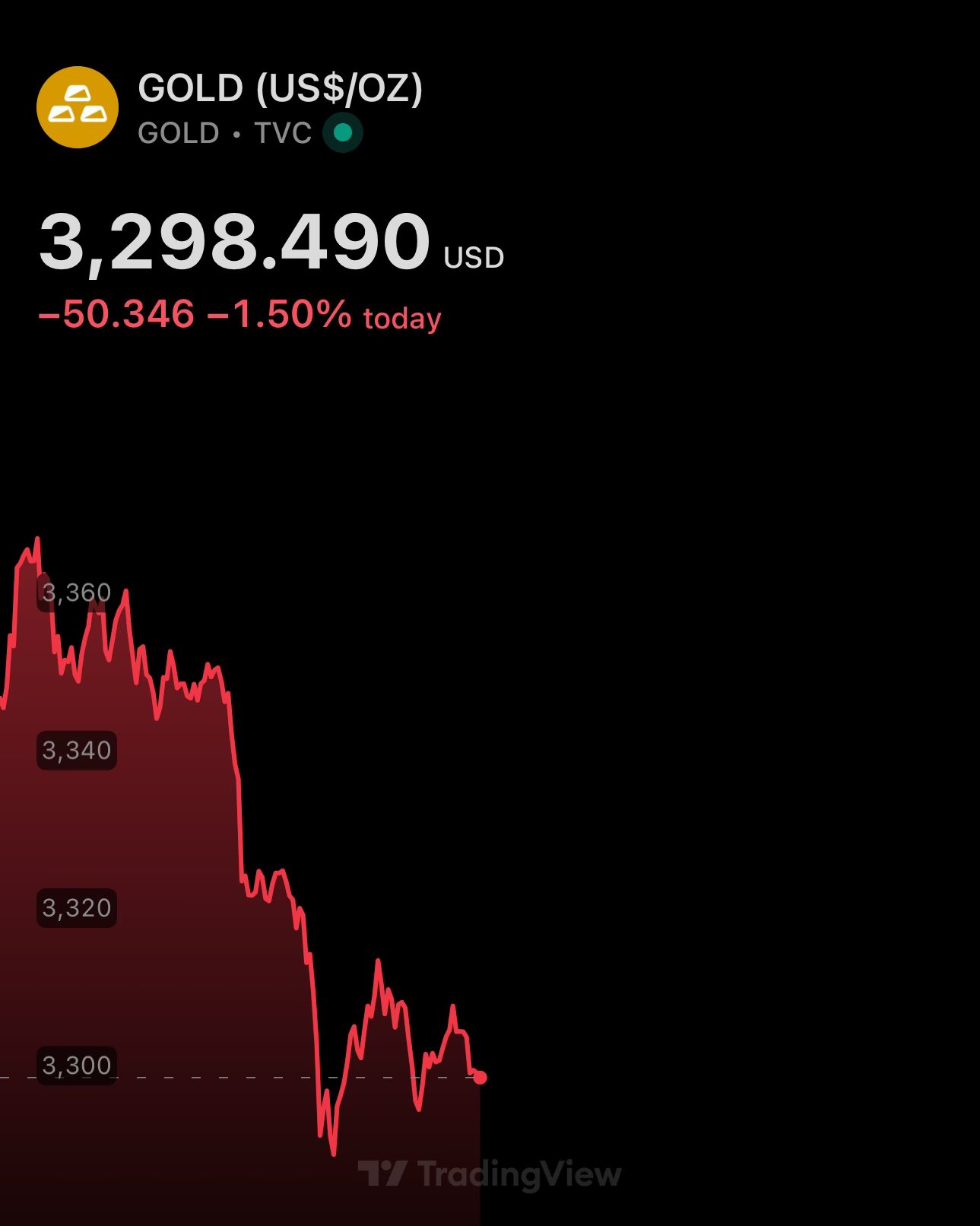

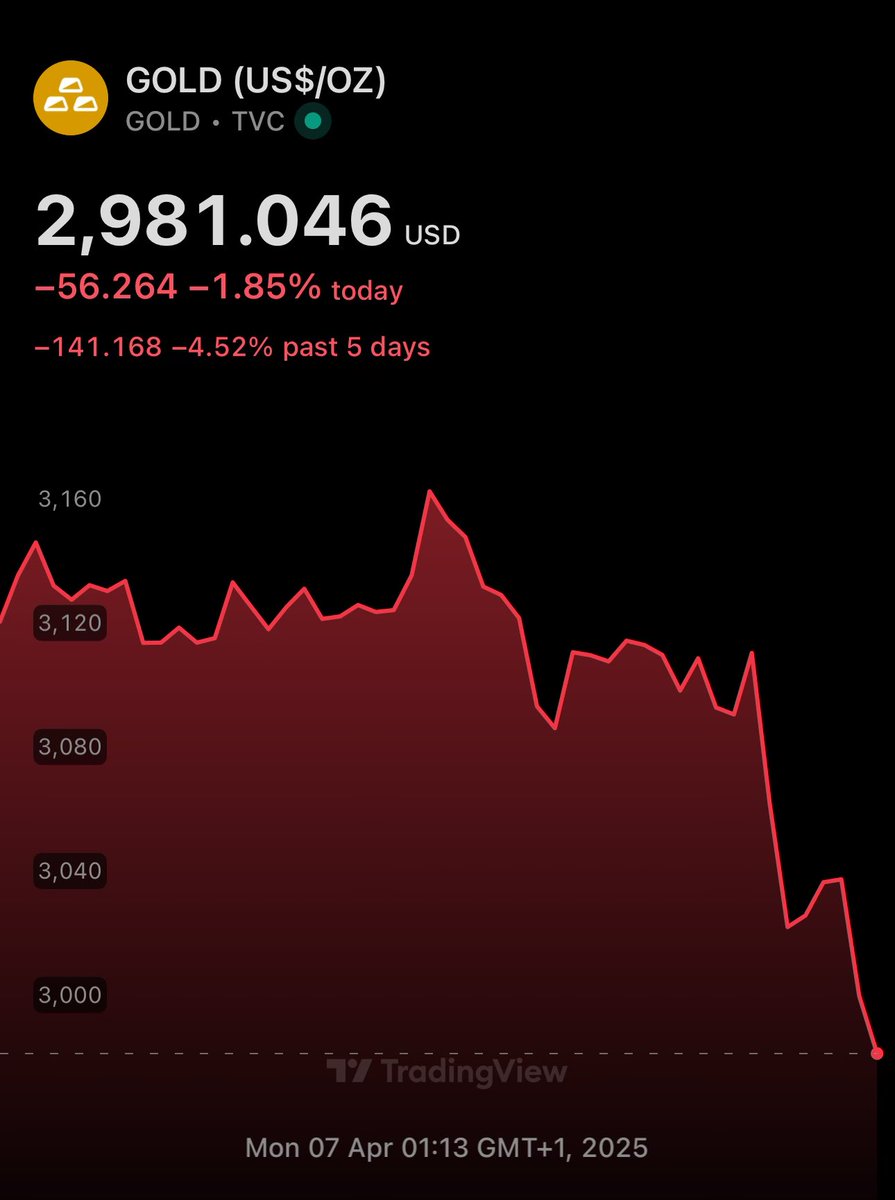

🤯 Of course temporary, but still - Gold down 3% today

Outflows into equities

However, some gold-linked currencies like Ruble are up 2.5%

Volatility is a measure of risk. Gold volatility is an expression of the baseline systemic risk

⚡️You can now create GOLD from lead⚡️

1g gold = two quintillion dollars ($2 × 10¹⁸)

1 gold ring contains x170 billion more gold that LHC produced over 4 years

Oh, and that newly minted Au fragments into other particles almost immediately 😁

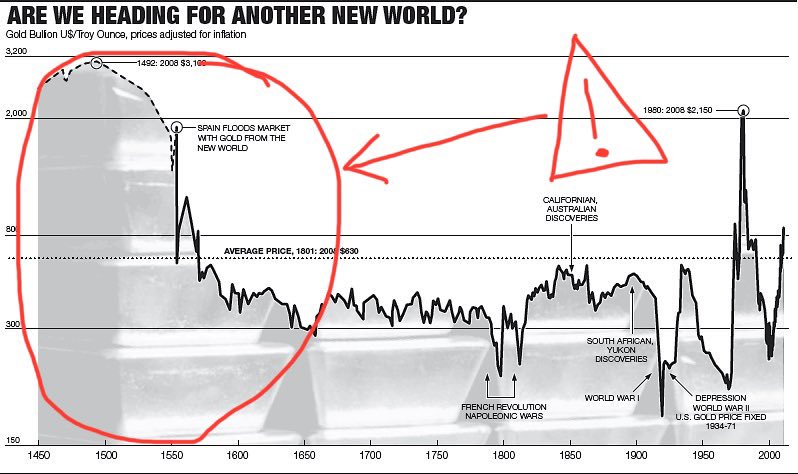

Regarding the 1492 'gold top' & 533 years breakeven - the information is misleading

These price extrapolations made a lot of assumptions & simplifications

Perhaps most importantly, pre-1700's gold prices were fixed by the government - not a trade/free market derived price

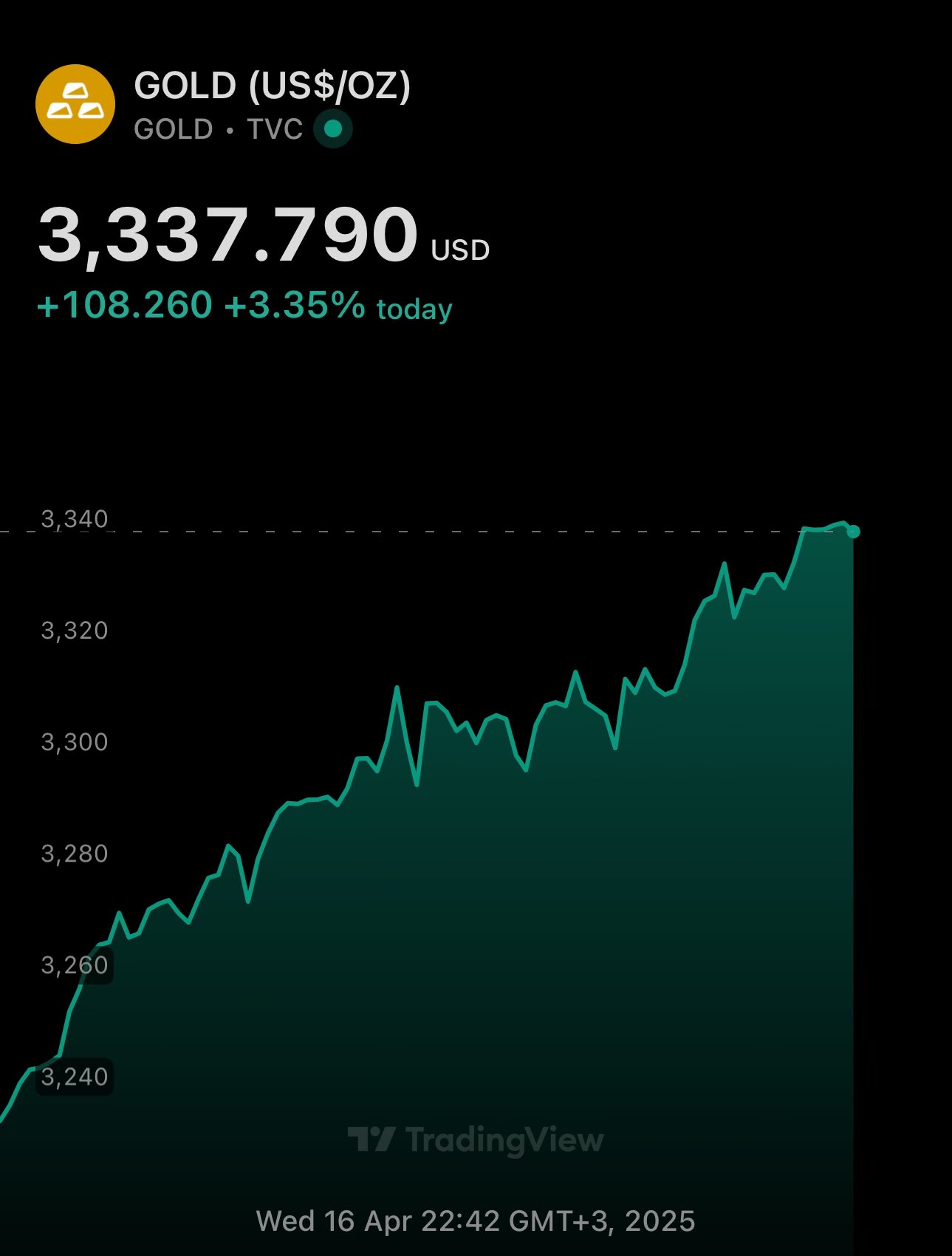

Now that gold is down & below $3.3K, it's a good time to say this:

🎉 New ATH coming very soon 🎉

In the time of political, civil & economic ambiguity - there is only one recourse - Au

Lower interest rates & QE are coming soon - FIAT down, gold up

💾 Save this & check back

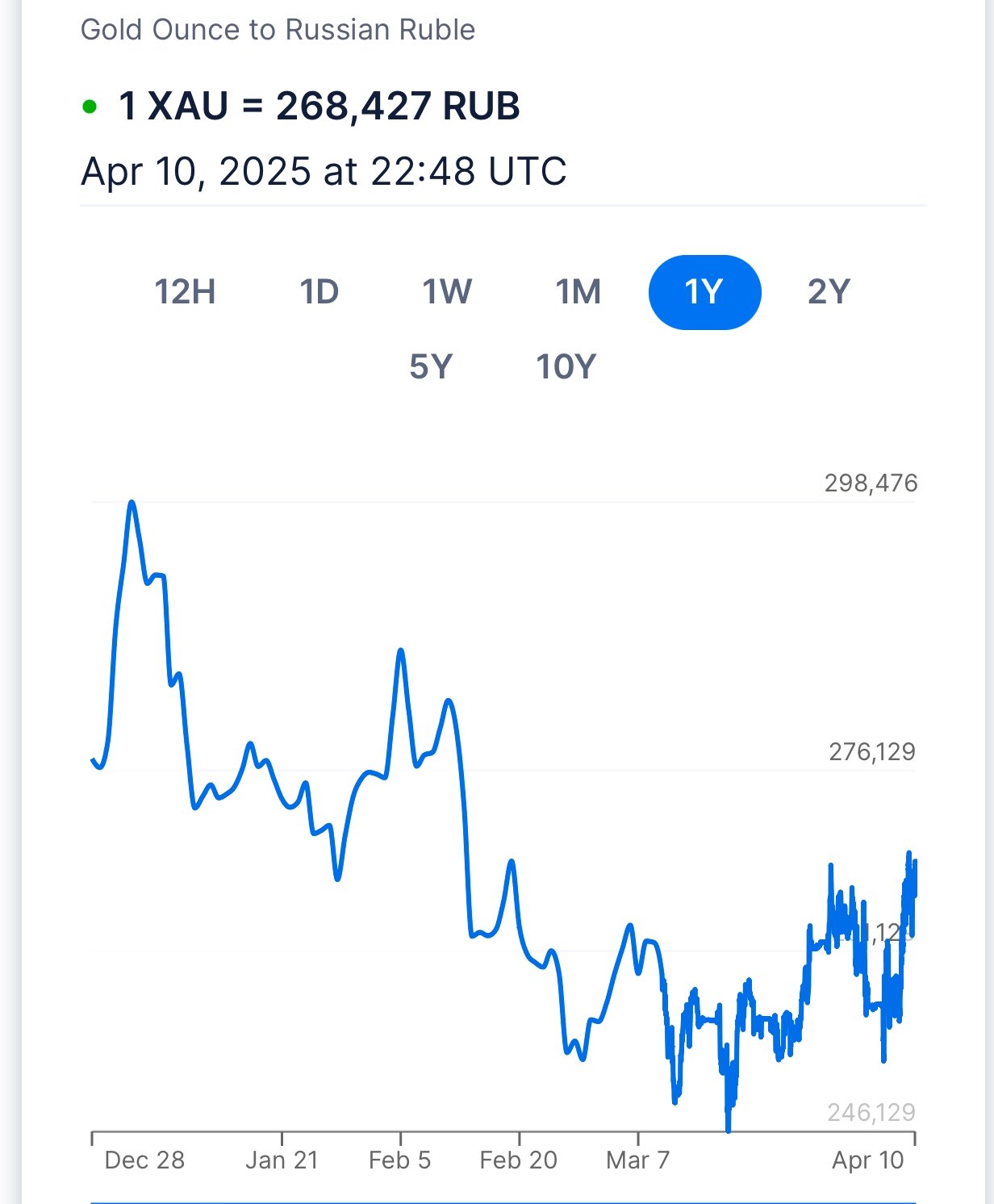

Correlation between Ruble & Gold 🇷🇺🥇:

Gold up ➡️ Ruble up

Gold down ➡️ Ruble down

Gold sideways ➡️ Ruble sideways

Russia could make RUB gold-backed, make RUB convertible to gold on demand & position RUB as a 'trustless'/money-backed currency

Already halfway through there

🇷🇺 Ruble is correlating with gold

This also explains the recent fall in price. Gold went down against USD & so did RUB

Such a retracement after multiple consecutive ATHs is expected

Fundamentals are still on the side of gold

🧠 Remember: gold is 35% of Russia's int'l reserves

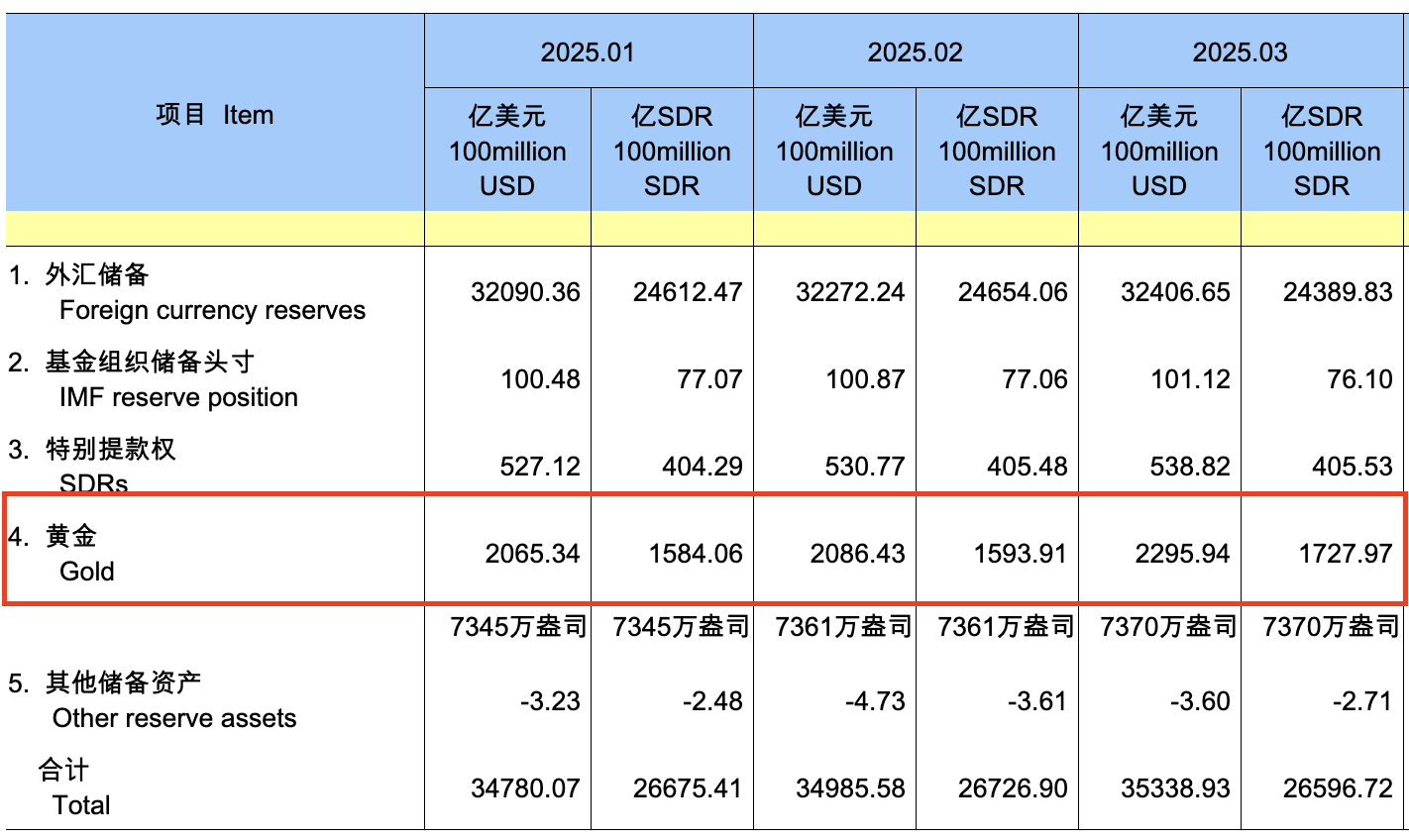

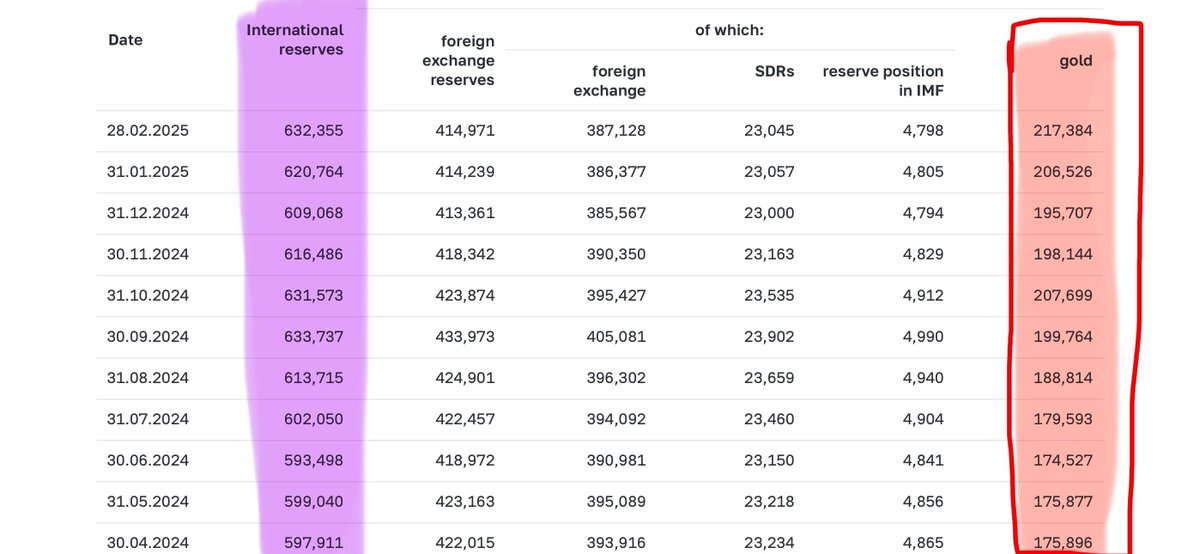

🇨🇳China has been increasing their gold reserves YTD

Gold price keeps going up - major central banks continue to load up

Gold is a hedge against USD. Tariffs are a medium of USD weaponization

👉 Expect US securities sell-off for gold by People's Bank of China

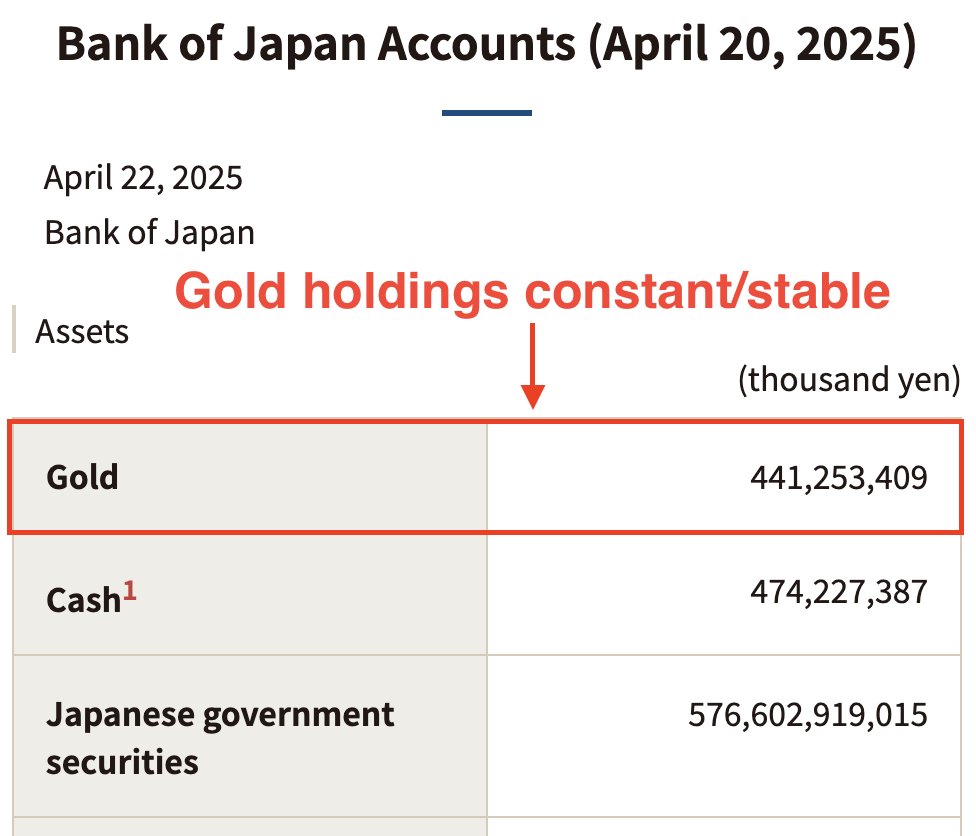

🇯🇵 BOJ's gold holdings have been constant for 10 years

But gold value has skyrocketed - does that mean Japan has been selling gold?

No. Articles 3 & 13 of Accounting Rules of BOJ imply that gold holdings are recorded at book value/purchase value, rather than market/spot price

🚨UPDATE: Gold has now reached $3400

All time highs, followed by more all time highs

Remember: gold is not increasing in value, but rather the underlying currencies are falling in value

Expect this trend to continue

🇷🇺 Ruble correlates with gold, becoming a hedge against USD

USD falls against both, Ruble & gold

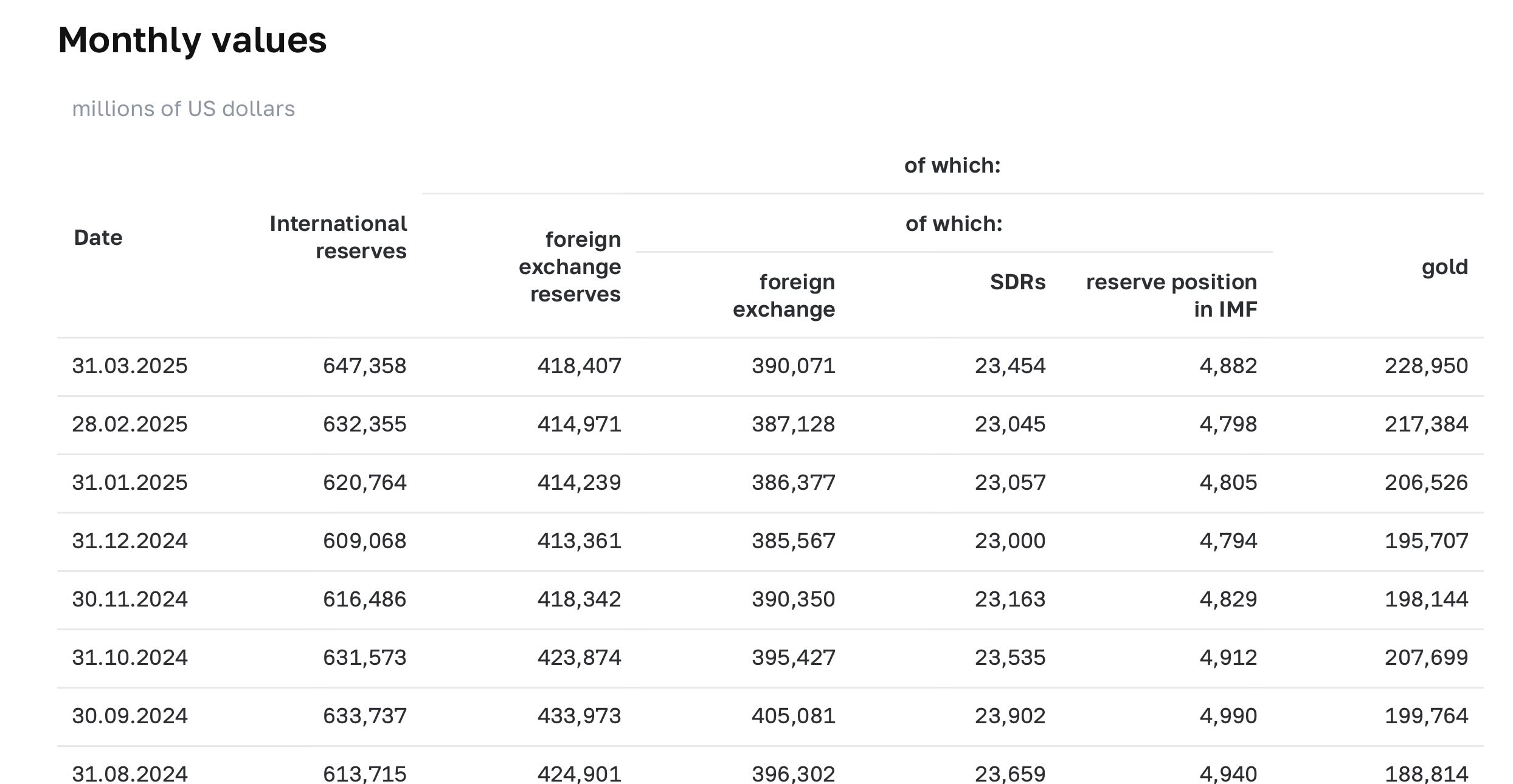

Russian Central Bank has been continuously increasing their gold holdings, which are currently more than 1/2 the size of their foreign currency reserves & 35% of int'l reserves

I've referred to gold being 35% of Russian Central Bank's foreign currency reserves, when I in fact meant international reserves

The core idea is unchanged - this is a technicality. Central Bank of Russia reports:

International Reserves = Foreign Exchange Reserves + Gold

🇵🇹 Portugal's Central Bank is LOADED with gold

👉 Gold reserves are >80% of total assets

Props to @bancodeportugal for a healthy balance sheet ratio

From now on - only gold-sprinkled pastéis de nata!

🚨BREAKING: Gold….

Actually, gold has been reaching new ATHs every other day

Not BREAKING anymore - the new normal 🤷♀️

Heading for $3.4K now

I think now you understand 😁

Gold hitting ATH after ATH 🎉

Very concerning for USD

To clarify - here you're stating with US Dollar and then buying either Ruble or Gold. It's in this scenario that both investments have a similar yield

If you start with EUR, Ruble actually yields more than Gold - 9.3 vs 11% (in the past 3 months)

And Ruble is up on Gold since January 🤯

All while Gold is at ATH & it's extremely difficult to buy ruble or any Russia-issued financial instruments due to sanctions

Loading up foreign reserves with gold & selling US Treasury securities worked ✅

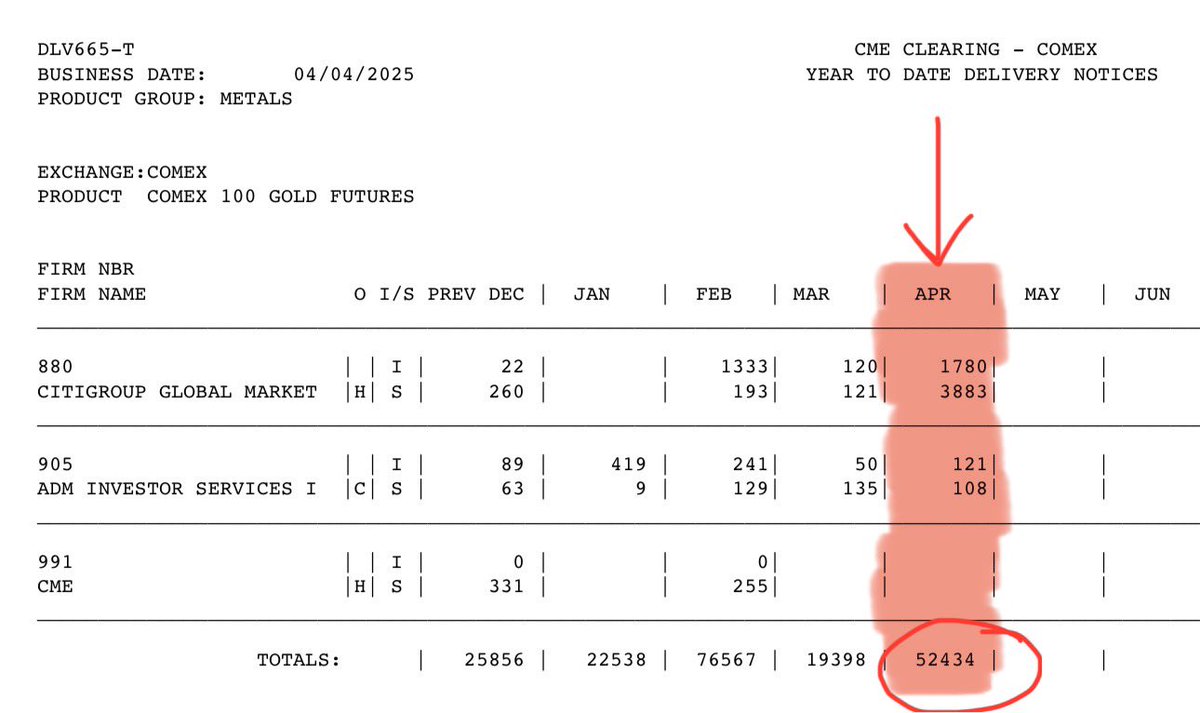

PHYSICAL GOLD RUSH

It's not just Central Banks anymore

In the first 4 days of April 2025, over 52K COMEX 100 Gold Futures contracts have been requested for physical delivery

Only 4 days in & it's already x2 of January interest

Physical gold in high demand

🇪🇺 The best countermeasure that EU can take is swapping US securities for Gold

Gold is inversely correlated with USD. Such a decision can be done today and it will:

1️⃣be a response to the US

2️⃣increase value of EUR

3️⃣minimize consumer impact

Anything else will hurt the economy

Over 10 years the Russian Central Bank has increased gold holdings by x4.5

🇷🇺 Gold is now 35% of all international reserves held by Russia 🤯

🇺🇸 Comparatively, for USA the number is 5%

This is why Russia and Ruble have been so resilient to sanctions

If you only understood how cheap gold is now. To put it in perspective, its current FIAT price only reflects inflation prior to 2011 🤯

Any direct or indirect inflation following that time period has not yet been accounted for

You don't have to trust me. Trust the price action

🚨 $PAXG is trading at an $80 premium over gold

The market sentiment is clear: there is a run from #crypto into #gold

Selling your cryptocurrency for $PAXG is a good hedge against both, #Bitcoin and $USD

You can always buy it back for a profit after