Gold: macro, inflation, miners and price

Ongoing updates on gold price action, central-bank demand, miners and macro drivers in the precious-metals market.

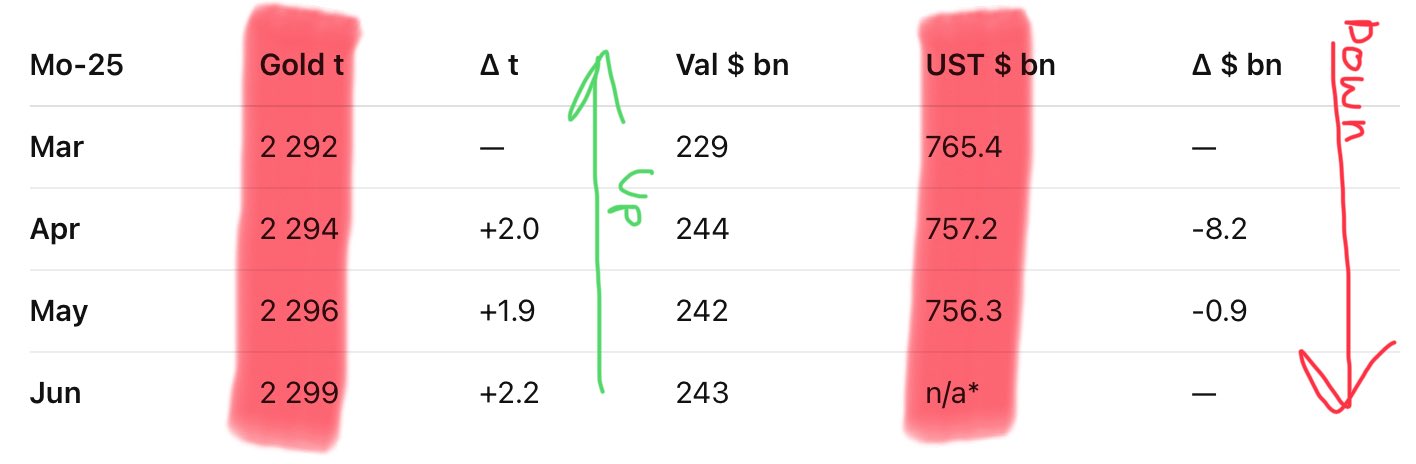

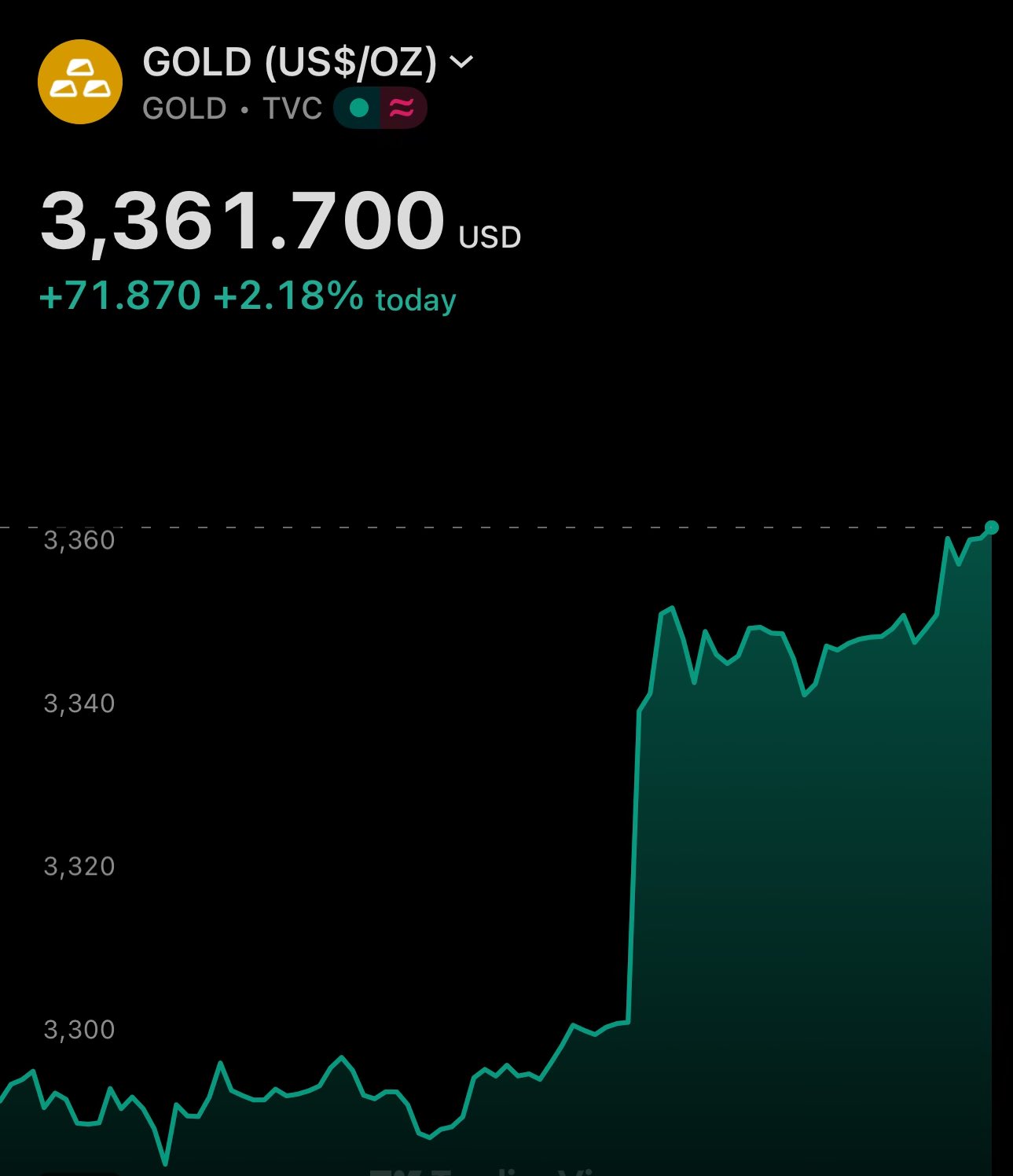

China sold US treasuries and bought gold - just like I wrote over 3 months ago

gold now accounts for ≈6% of PBoC international reserves, while US treasury holdings are ≈40% from their peak in 2013

off-ramp from USD debt to alternative assets continues its progress

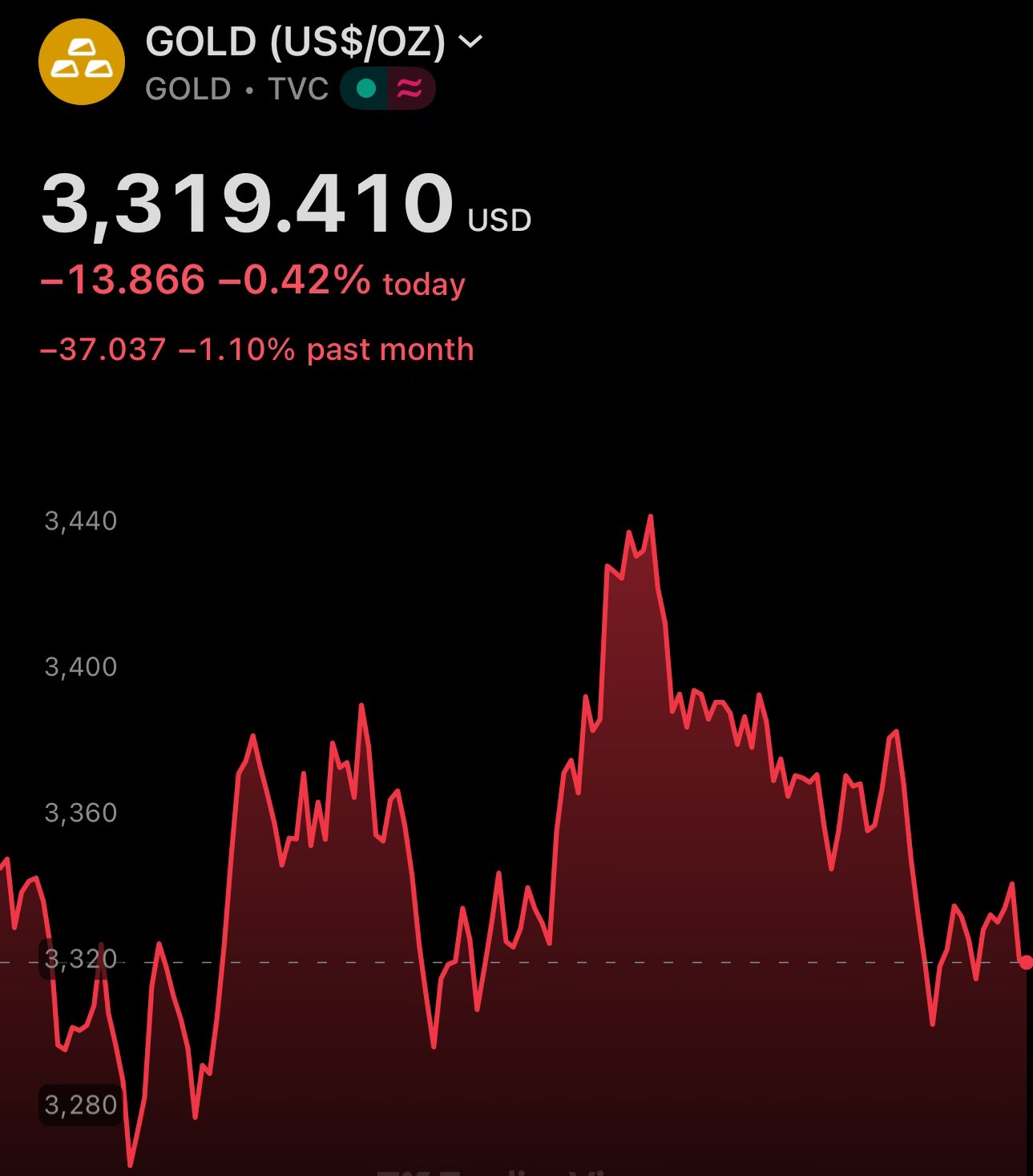

gold hasn't broken the weekly uptrend - note the higher highs

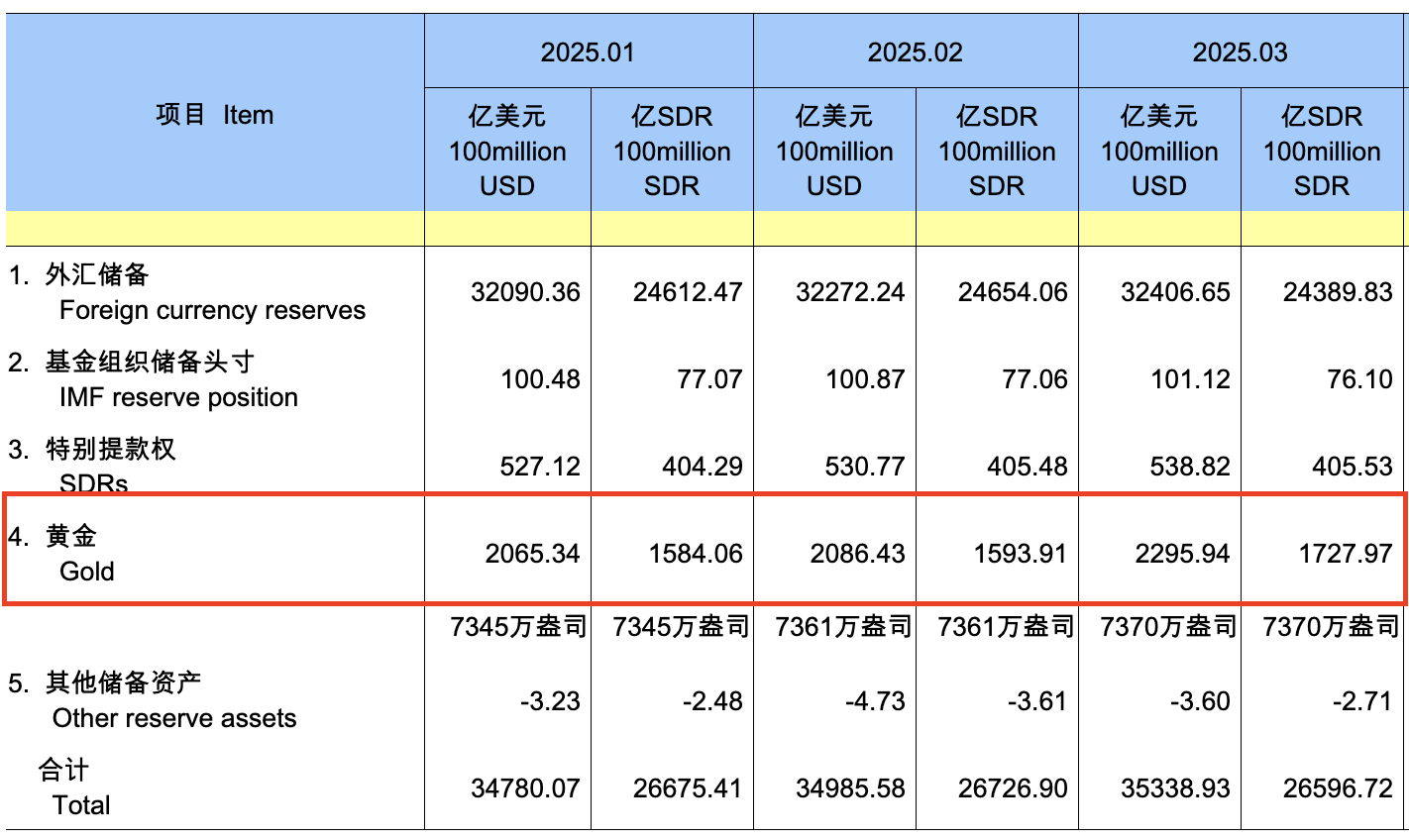

buying pressure today pushed the price up ≈2.5%

TA is an excellent tool to gauge the price action

gold price is back up to its price 2 weeks ago

so it indeed was a good idea to long it at the pullback

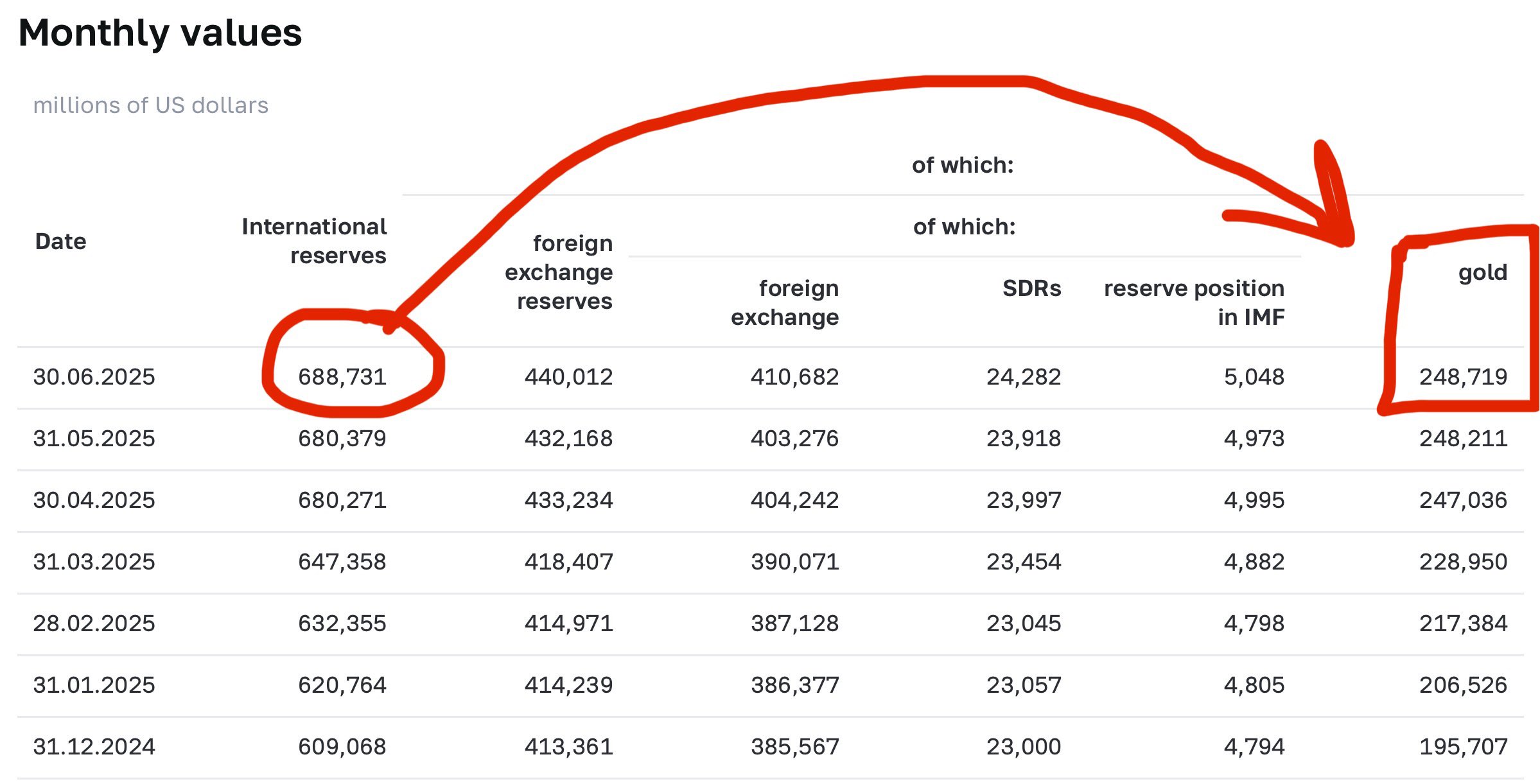

if you've read my previous posts you know that gold is ≈36% of Russia's international reserves

this is taken straight from the Bank of Russia's balance sheet statement

100% of it is stored in Russia, thus no counterparty risk

critical component of Ruble's strength

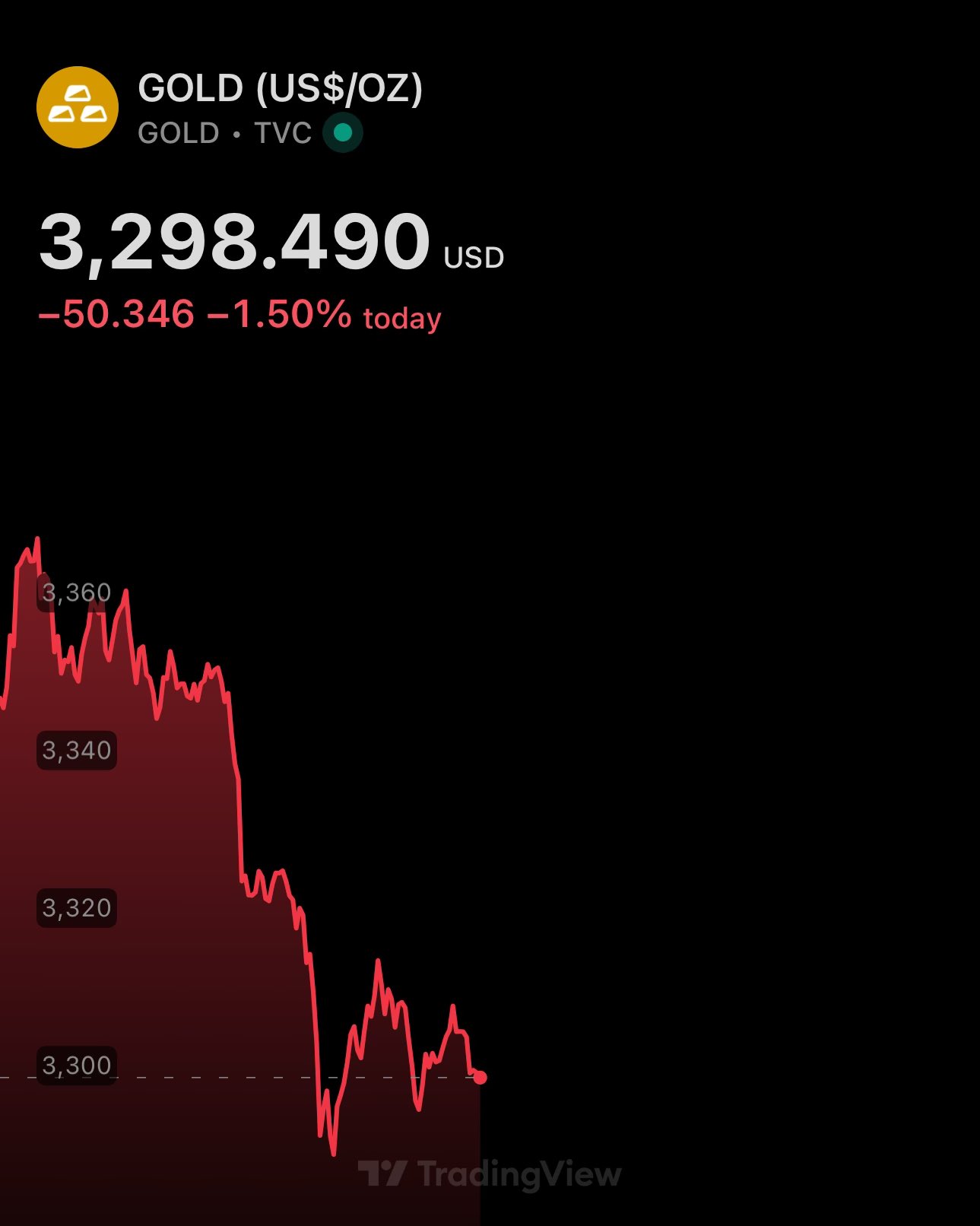

btw the gold depreciation today is due to the appreciation of USD

gold is currently the only asset whose leveraged long position can be hedged by adding more to the long on pullbacks 😄

* one of the only - and ofc technically that's not a hedge - but you can read my previous posts to understand what I mean

substance over matter 😉

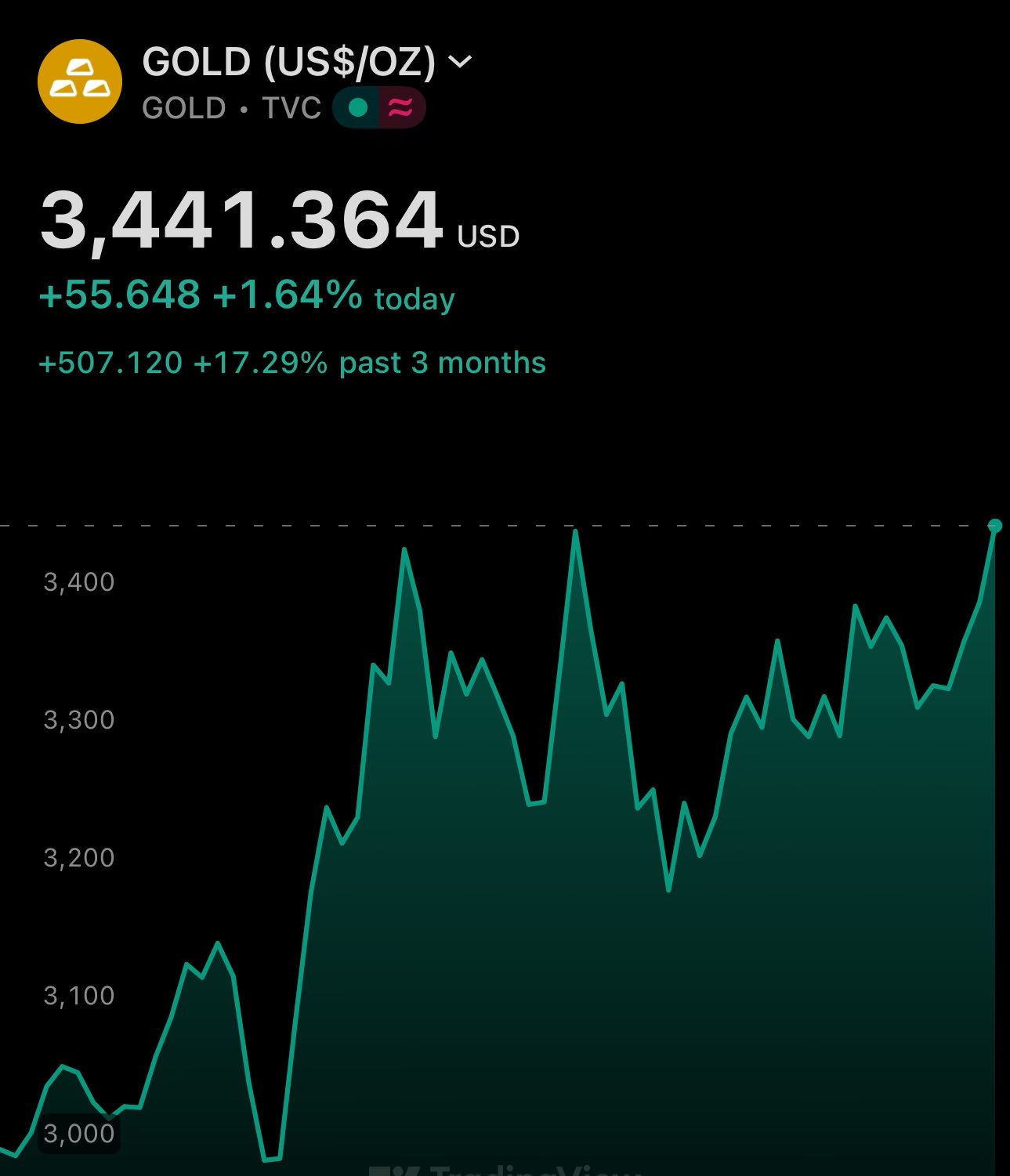

🚀 you can already feel a new ATH for gold

the loading screen is at 96%

[🟩🟩🟩🟩🟩🟩🟩🟩🟩🟩🟩⬛] 96%

and it won't stop there

price action is showing immaculate breakout vibes 🤩⬇️

all of this very bullish for gold & other commodities

it's not just gold & silver - you may have seen the recent appreciation of platinum

those commodities have still have price to catch up on & that has been signaled by their volatility

gold up 40% on the year isn't normal

so today it may not be wise to assume that the FED will hike interest rates into double digits to lower the CPI/inflation

rather - the interest rates are headed down, bc of challenge in refinancing debt

that's what I meant by focusing on historical patterns from this century

(re)monetization of gold is already in progress

central banks have been consistently buying gold for many years

this is especially true for Russia & China

🚨🏦 claims that gold is a Tier 1 asset under Basel III are FALSE:

1. gold is NOT a Tier capital under Basel - it's on the liability, not asset side

2. gold had 0% risk weight since Basel I (no haircut)

3. gold is still NOT considered a high quality liquid asset (HQLA)

central banks will continue to buy gold

you'll be able to confirm that in their upcoming balance sheets reports. pay special attention to China & Russia

enjoy the dip, because smart money is!

and this is how the gold market opened

green candle straight to $3400 🚀

gold futures market opens in 2 mins!!

are you ready?

gold futures market opens in 2 mins!!

are you ready?

gold's behavior during the current 'bullrun' has been consistently to flip previous week's resistance to new support

in the chart - the green vertical lines are weekly levels

gold's current price action suggests it's flipping another resistance for support

Road to $3500 🚀

all eyes on gold futures 👀

COMEX gold futures trading open in 13h

markets are closed now, but blockchain never sleeps

on-chain gold-backed token futures may give you a heads-up - they're up ≈1.3% from yesterday

interesting to see gold moves after open

spoiler: higher price

soooo… new gold ATH next week?

look at gold's price chart with weekly candles - it's unbelievable 🤯

gold is going up like a risky asset - but it in fact is a reflection of risk

now it looks like a breakout from another consolidation phase 📈

always important to remember that gold isn't crypto and volatility is a lot more conservative there 😄

you're talking central banks balance sheet assets - not so much speculative, hedging or portfolio management

yet, $3500 gold is just around the corner

Oil & Gold back on the rise

Just as I wrote earlier today

BTW I soon realized this wasn't an actual ATH for gold yet - but it is coming

The historical chart is showing closing prices, not maximum

So I inadvertently compared current price with closing historical price

Good news - more time for you to accumulate gold before new ATH 😄

💾⏰ Just like with my post about the price of gold a few months ago - feel free to save & set a reminder for this one

The prediction will be correct once again

🤯 Gold may just go straight to $3500 in the next few hours

Look at this 15-minute timeframe momentum ⬇️

🚀📈 NEW Gold ATH is in - $3440 per oz

I've been warning about this for a while

You had a little over a month since my original post to load up

🚀 Are you ready?

New all time high for gold is just around the corner

And there will already be a strong resistance in the ≈$3300 area, due to the recent accumulation

Low(er) interest rates + high(er) CPI will then push it up even further

Gold is having its 'calm before the storm' moment 😄

New all time high is coming very soon to all markets close to you