Monetary policy and central bank updates

Meeting-by-meeting coverage of Fed, ECB, BOJ and other central banks, focusing on rates, balance sheets and forward guidance.

once Fed does QE, reserve account balances increase, thus directly increasing base money

broad money either increases indirectly or directly if the Fed credits a non-bank institution

once Fed cuts interest rates, more borrowing will occur, thus expanding broad money

it will also lower T-bill yields short-term, as the prices are bid up due to a lower risk-free rate

once Fed cuts interest rates, more borrowing will occur, thus expanding broad money

it will also lower T-bill yields short-term, as the prices are bid up due to a lower risk-free rate

a lot of these US treasury purchases will be financed with short-term rolling debt (e.g. repo)

the newly issued Treasuries themselves will be used as collateral to borrow cash, many times over via rehypothecation

US Treasury debt is likely to be among the assets purchased by those same banks that received QE funds from the central bank. so central bank's QE injection may be used to purchase US Treasury debt at auctions, thus effectively monetizing the government debt 😁

even if it doesn't happen directly at the start - eventually QE also increases broad money, due to reduced balance sheet constraints and an increase in cash reserves, which needs to be invested ASAP. this leads to more lending and asset purchases

even if it doesn't happen directly at the start - eventually QE also increases broad money, due to reduced balance sheet constraints and an increase in cash reserves, which needs to be invested ASAP. this leads to more lending and asset purchases

initially QE may only increase base money supply - as commercial banks reserve balances get credited by the Central Bank

if the Central Bank purchases assets from non-bank financial institutions, then broad money increases directly as well, as deposits increase

initially QE may only increase base money supply - as commercial banks reserve balances get credited by the Central Bank

if the Central Bank purchases assets from non-bank financial institutions, then broad money increases directly as well, as deposits increase

the US Treasury may also issue more debt to increase the supply of safe assets, thus offsetting the compression shock

end result: more safe assets/prime collateral provided to markets. remember that the newly issued treasuries are likely to be rehypothecated several times

in the short-term, lower rates and/or QE means easier funding conditions, so more positions will get to be refinanced

the yield spreads may also start an almost vertical uptrend on a monthly timescale - this usually means a financial crisis to some degree

that's probably not happening in the next 3 months though, as you can expect Federal Reserve to decrease interest rates and/or employ QE

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

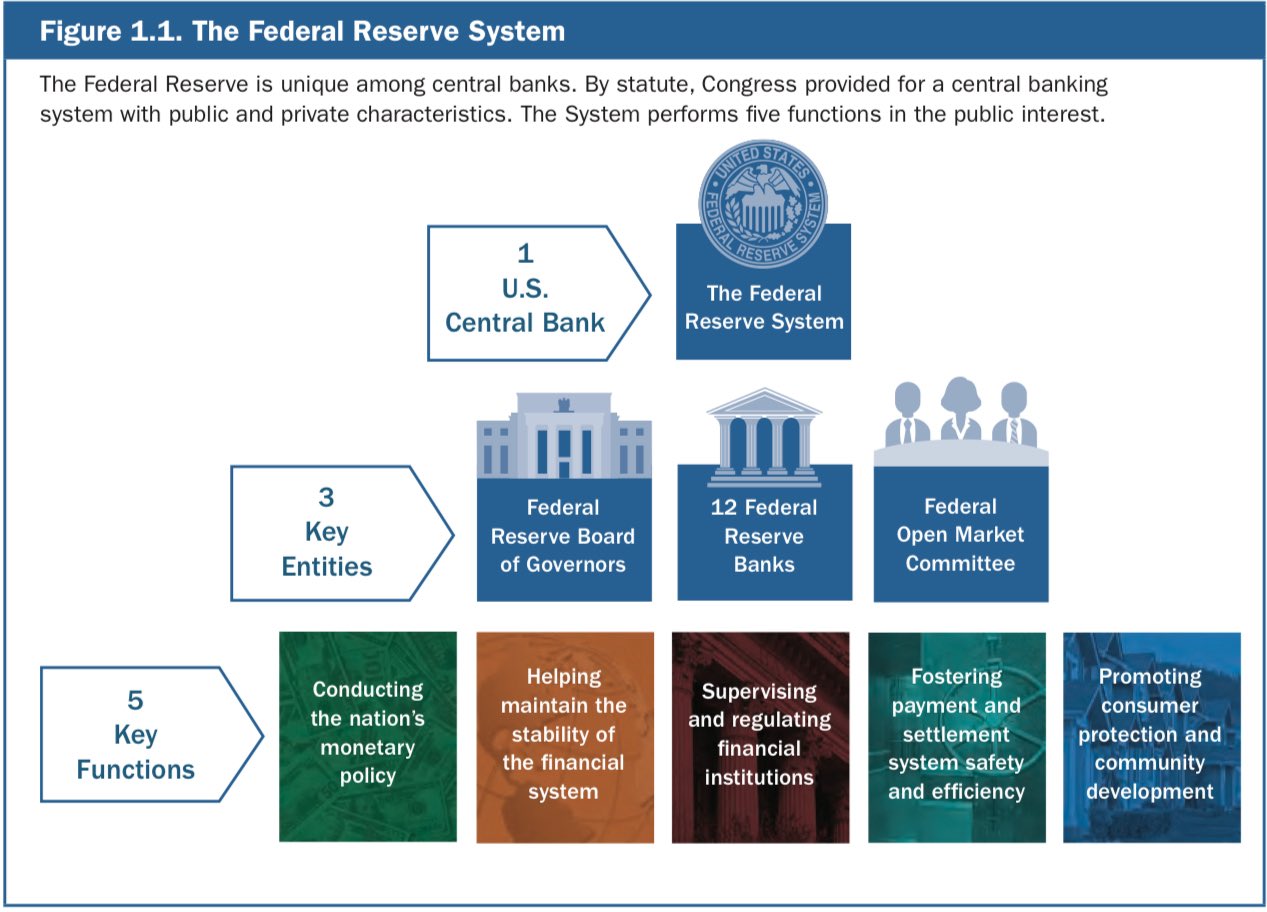

by "central bank" I'm frequently referring to the broader set of the legal framework behind the macro monetary policy

in most countries central banks plays a key role, but they frequently co-exist in a larger network of institutions

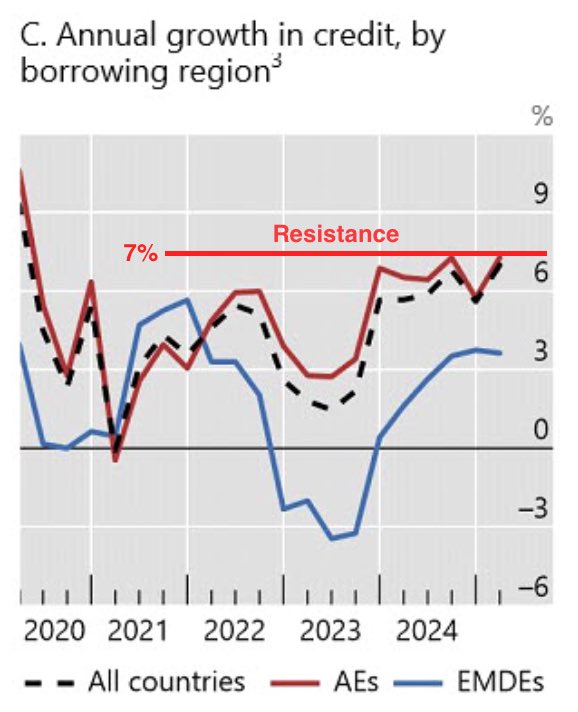

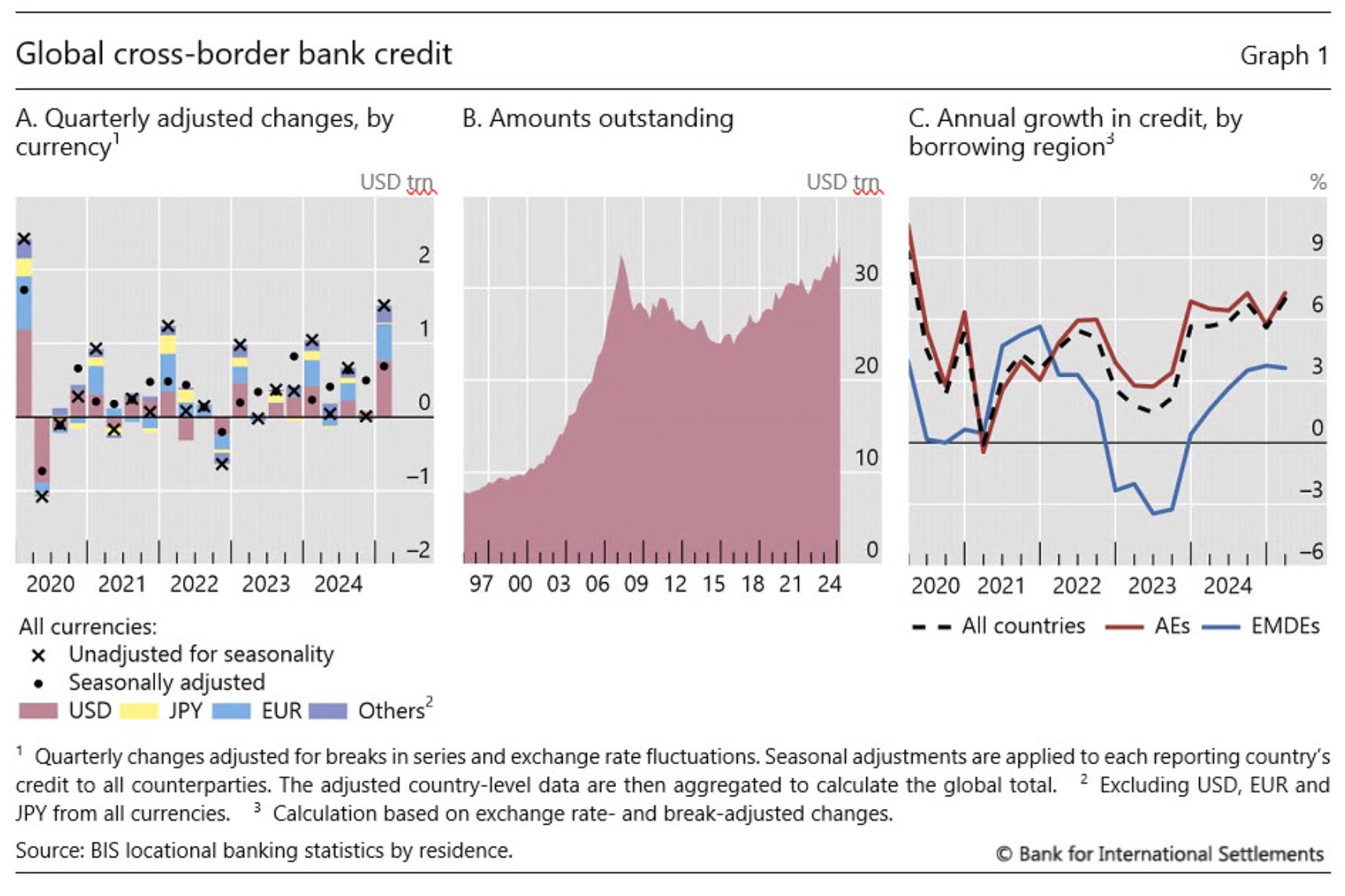

bank credit continues to grow, and it will continue to grow

it will almost certainly break the 7% annual growth resistance

central banks will expand balance sheets and lower interest rates to refinance the existing public and private debt

data source: BIS

regarding the IPO/privatization of Fannie Mae & Freddie Mac i wrote a thread explaining the role, function and use during QE of those GSE

also their history and how they were used to lower mortgage rates after the 2008 GFC

you can read it it here ⬇️

https://illya.sh/threads/@1754148538-1.html

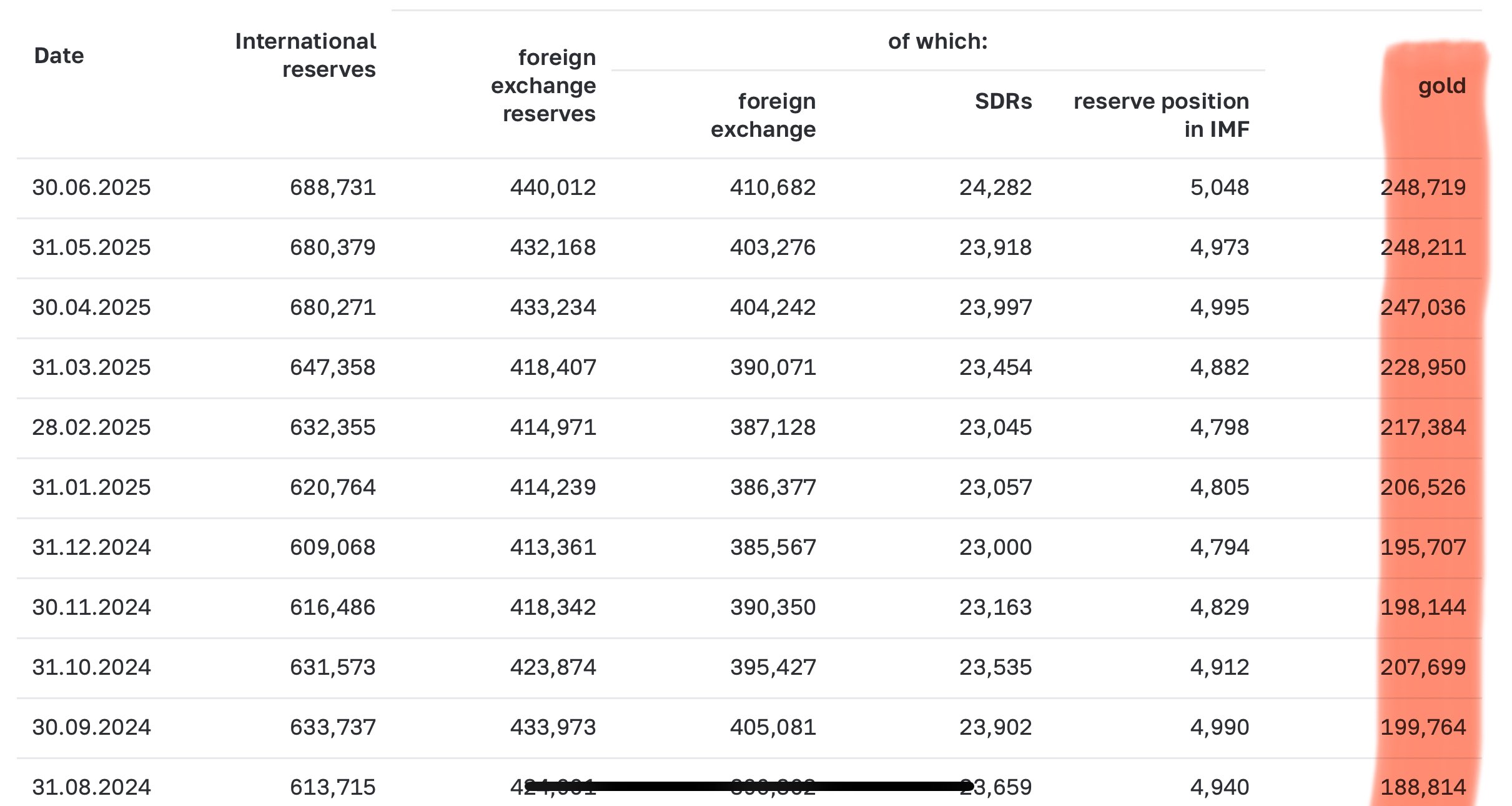

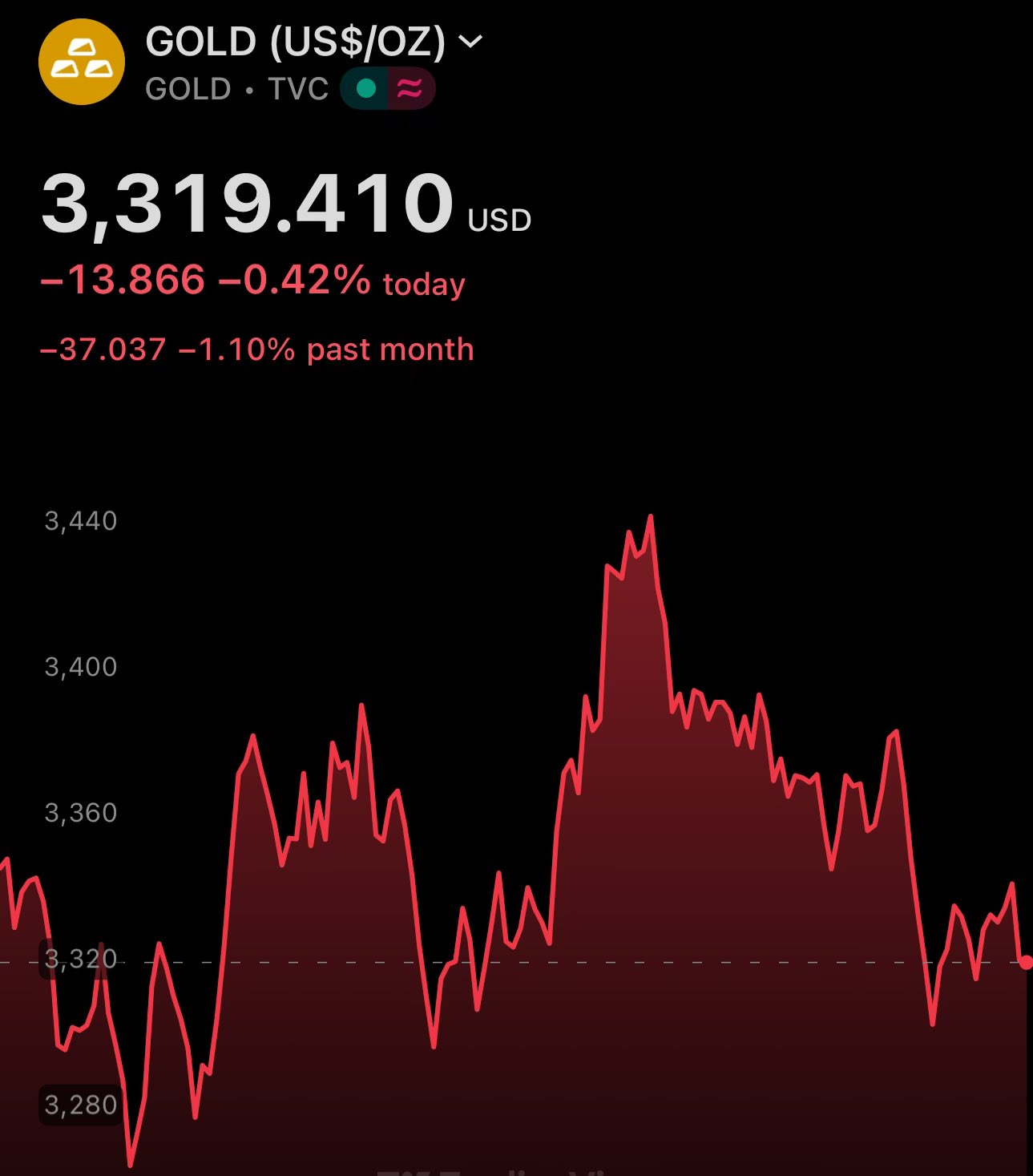

both Russia & China increased their gold holdings since I wrote this 😄

indeed - central banks are continuing to buy the gold dips

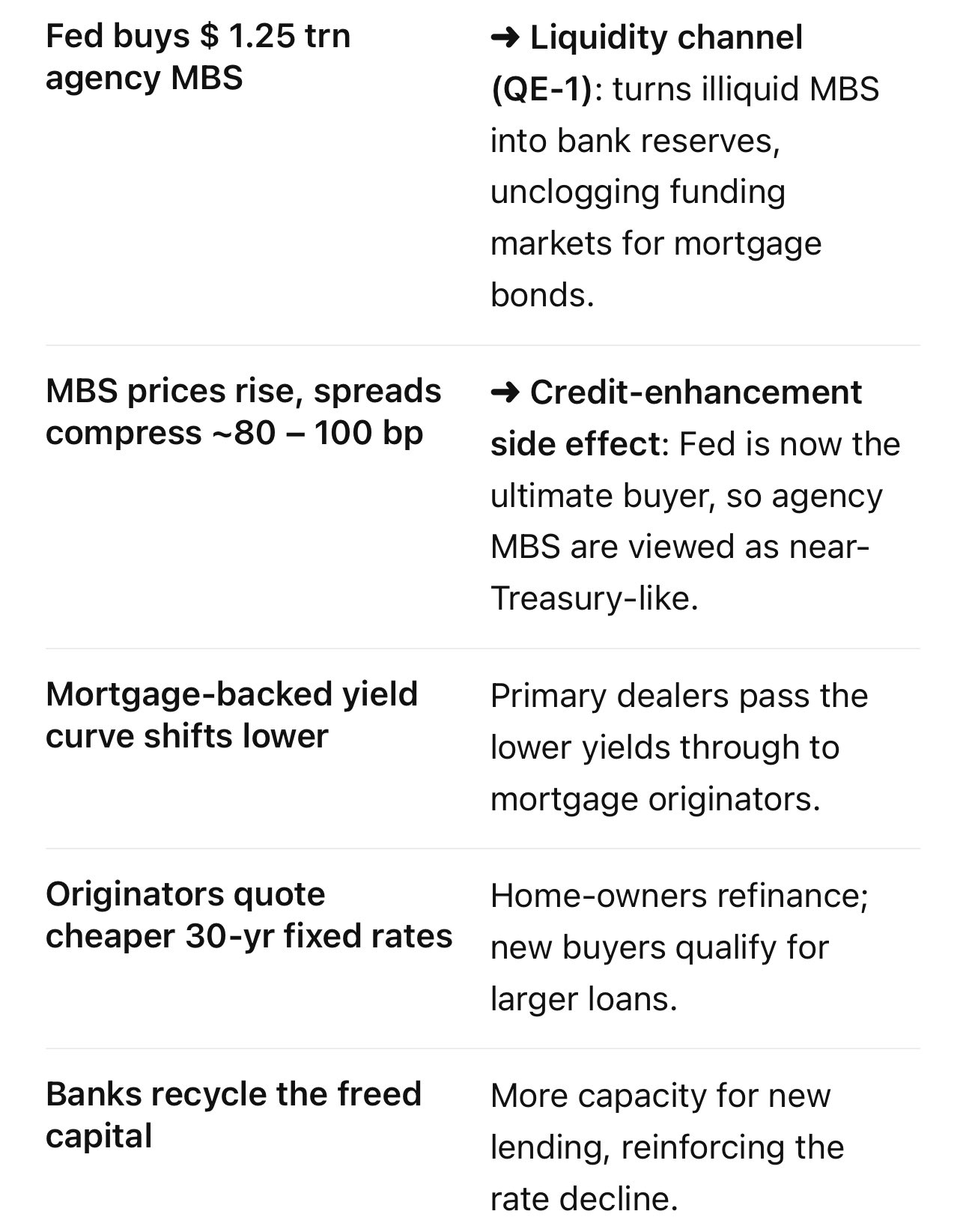

to lower the mortgage rates the Fed can purchase agency MBS - likely they did in QE 1 2008

buying mortgage backed securities raises their price and provides liquidity for dealers. this directly pushes down the yields

expect some MBS QE to come in the near future

and this is how the Federal Reserve steers the federal funds rate/interest rates in the market within the target range 🏦✨

follow the quoted posts to read the full thread/article

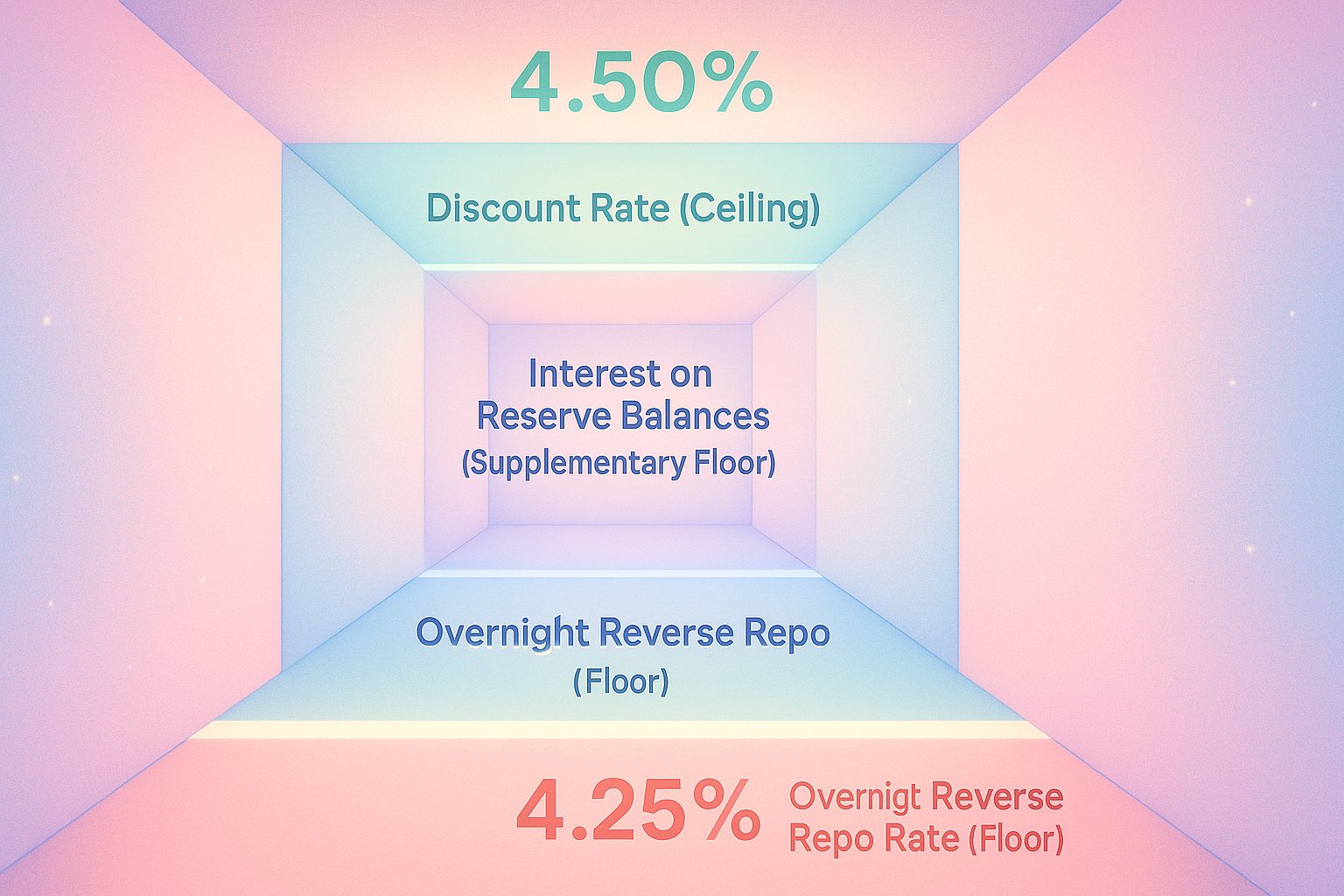

together, ON RRP, IORB, Discount Rate and SRF create a corridor for rates, which stay within the target 4.25%-4.50%

👉 by "firms" i mean select non-bank financial institutions - think dealers, market makers & other wholesale debt institutions

current rates set by FED:

1️⃣ ON RRP - 4.25% (floor) - firms won't lend below

2️⃣ IORB - 4.40% (supplementary floor) - banks won't lend below

3️⃣ Discount Rate - 4.50% (ceiling) - banks won't borrow above

4️⃣ SRF - 4.50% (supplementary ceiling) - banks & firms won't borrow above

so how does the FED currently targets an interest rate range between 4.25%-4.50%?

let's consolidate everything with an example using current, real-world data

so how does the FED currently targets an interest rate range between 4.25%-4.50%?

let's consolidate everything with an example using current, real-world data

SRF has been introduced in 2021, due to occasional spikes of short-term funding rates outside of the corridor

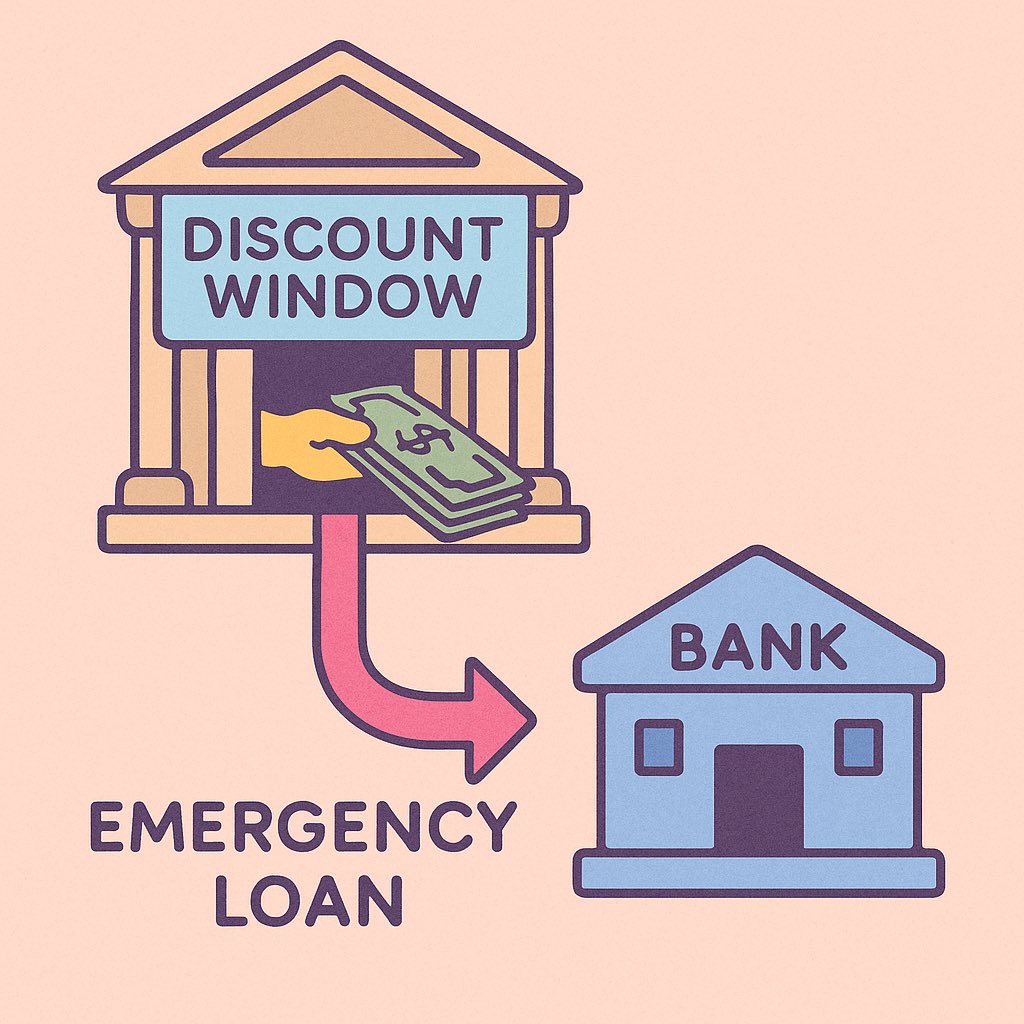

this is because banks avoid using the discount rate - as that is often seen as a sign of financial distress by the broader market

Discount Rate is the rate at which the FED lends directly to banks through its discount window

think of it as an emergency lending facility which the banks can use whenever they need funds

since banks can always get a loan at that rate - it caps the short-term interest rates

the majority of liquidity is actually created in wholesale short-term debt markets

ON RRP addresses exactly that sector, thus setting the lower bound of the target interest rate corridor for the broader financial sector

the 4 key interest rates set by the FED are:

1️⃣ Overnight Reverse Repo Rate (ON RRP)

2️⃣ Interest on Reserve Balances (IORB)

3️⃣ Discount Rate - also known as Lending Rate

4️⃣ Standing Repo Facility (SRF)

we'll cover them in this order below

now let's understand each one of the 4 key rates set by the federal reserve to keep the market rates within the target range

namely, what each one of those rates represents and how together they act as ceiling or floor for the interest rate corridor

now let's understand each one of the 4 key rates set by the federal reserve to keep the market rates within the target range

namely, what each one of those rates represents and how together they act as ceiling or floor for the interest rate corridor

so when banks and other financial institutions need to lend capital - they can do it at a rate within the target range

of course, their balance sheet capacity must allow for that - but that's another topic which I already covered in some detail in my other posts😁

now you should have a clear mental model of how the Federal Reserve sets the interest rates in the market

a target range is defined, and then several different interest rates are set explicitly to steer the real interest rate into that target range

think of these 4 rates as defining a corridor with an upper and a lower bound - currently 4.25% and 4.50%

the average market interest rate will sit somewhere in between

in the Federal Open Market Committee Meetings (FOMC), the Federal Reserve sets a target range - currently 4.25%–4.50%, and then it uses the ON RRP, IORB, discount rate and SRF to steer the average rate in the market

the rates define the interest rate corridor in the following manner:

1️⃣ Overnight Reverse Repo Rate - floor

2️⃣ Interest on Reserve Balances - supplementary floor

3️⃣ Discount Rate - ceiling

4️⃣ Standing Repo Facility - supplementary ceiling

the rates define the interest rate corridor in the following manner:

1️⃣ Overnight Reverse Repo Rate - floor

2️⃣ Interest on Reserve Balances - supplementary floor

3️⃣ Discount Rate - ceiling

4️⃣ Standing Repo Facility - supplementary ceiling

the FED sets a target interest rate range and 4 main explicit interest rates:

1️⃣ Overnight Reverse Repo Rate (ON RRP)

2️⃣ Interest on Reserve Balances (IORB)

3️⃣ Discount Rate - also known as Lending Rate

4️⃣ Standing Repo Facility (SRF)

more on them later (keep reading 😁)

the federal reserve does not set a single interest rate

instead, the FED sets a target interest rate range (the federal funds target range) alongside 4 main explicit interest rates

the federal reserve does not set a single interest rate

instead, the FED sets a target interest rate range (the federal funds target range) alongside 4 main explicit interest rates

how can the FED even set market-wide rates? 🤔

after all - there is no single rate that the whole market unanimously uses

different types of lending have different rates in the market, as it's a (somewhat) open market

how can the FED even set market-wide rates? 🤔

after all - there is no single rate that the whole market unanimously uses

different types of lending have different rates in the market, as it's a (somewhat) open market

How Does the Federal Reserve Set Interest Rates?

some think that they define a single rate - namely the overnight lending rate - i.e. the rate at which the banks lend to each other overnight

but that's not the case ❌