Monetary policy and central bank updates

Meeting-by-meeting coverage of Fed, ECB, BOJ and other central banks, focusing on rates, balance sheets and forward guidance.

i'll be explaining the details of how the Federal Reserve achieves their fed funds target rate in the next posts

i'll be quoting them in sequence - so you can follow the trail of quoted posts and read them like a thread/article

starting with the next post. let's dive in! 🚀

the FED left the interest rates unchanged - at the 4.25%-4.50% target

while they communicated that previously - so it's no surprise - understanding how they achieve that level of short-term rates means understanding the important central bank in the world 🏦

so i'll explain it!

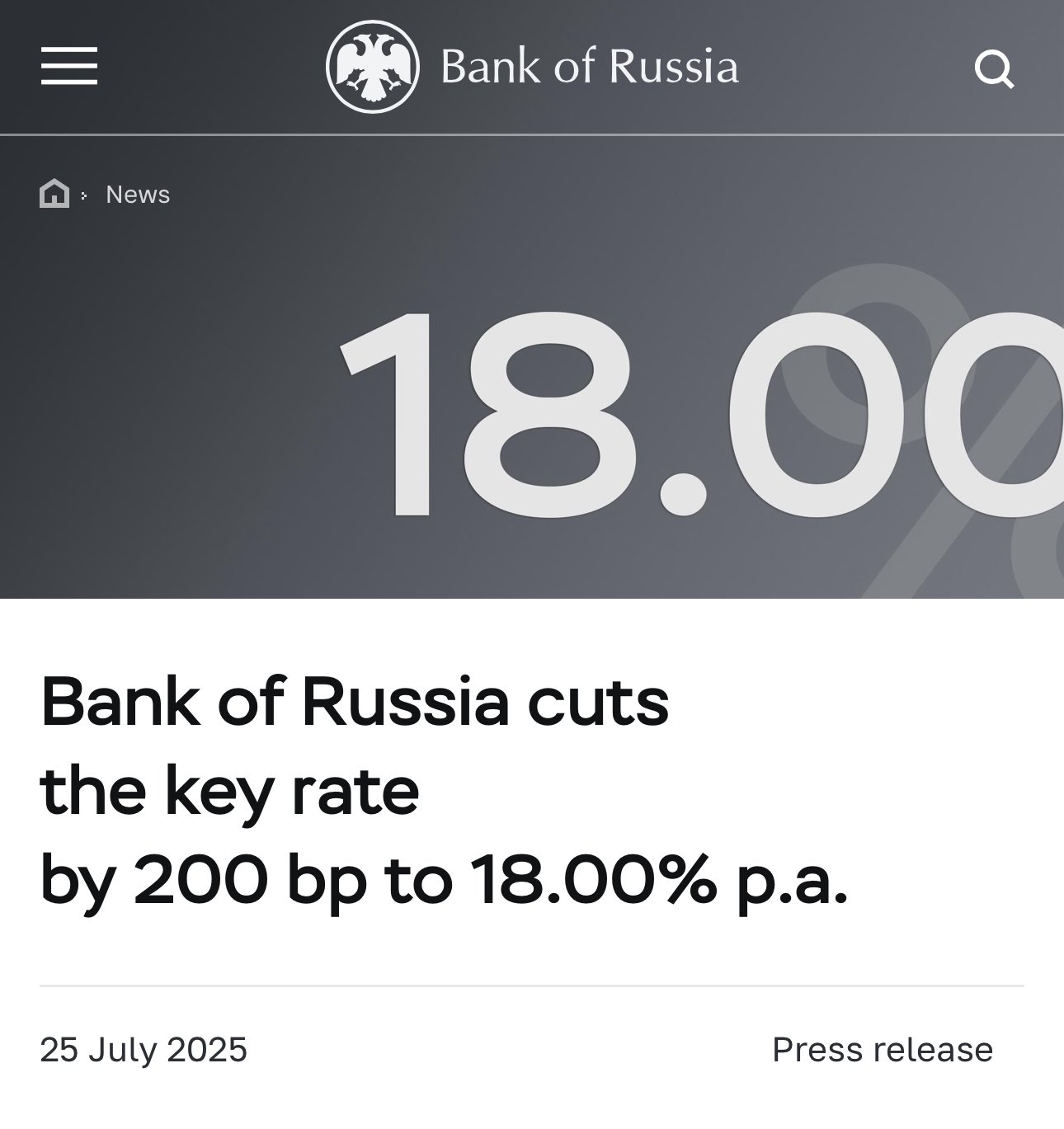

3 days ago the Russian Central Bank cut down the key interest rate by 200bp down to 18%

the only way from here is further down - and if you look at the Russian bond yields that's exactly what they're telling

but honestly you don't need advanced quant to reach this conclusion 😂

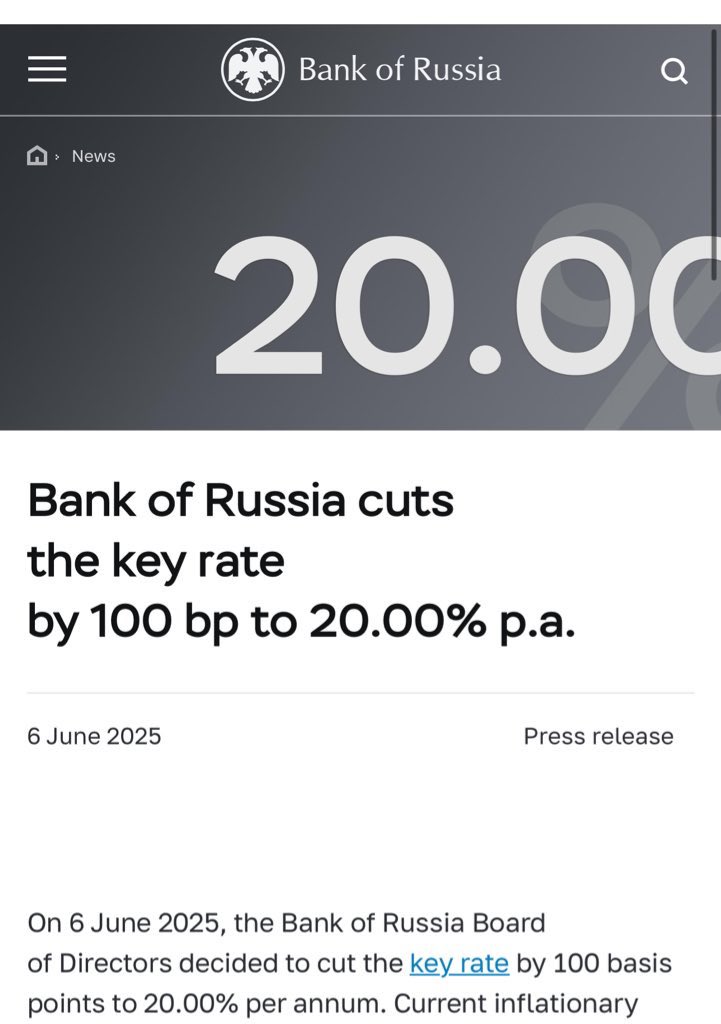

🇷🇺 and indeed Bank of Russia cuts interest rates down to 20%

3 months ago I wrote about how the Russian bond market was pricing in those cuts

a month ago the prediction materialized ✅

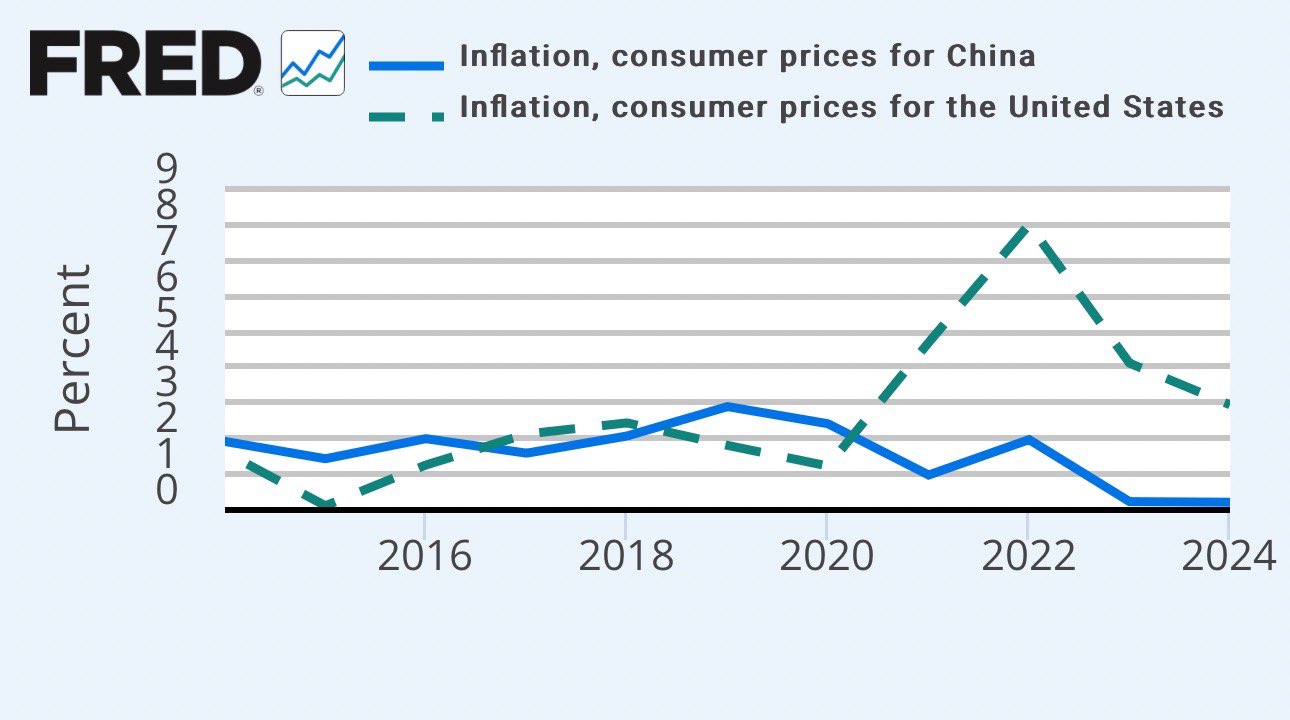

weaker USD + FED rate cuts & QE allow China to print Yuan/renminbi without a capital runoff

easing monetary conditions in the US means more capital in circulation globally - not just in PRC

thus, relative inflation is kept under more control

🇨🇳🇺🇸 china's CPI is below US's ⬇️

🇨🇳 china's central bank uses USD value as a key driver in economic policies

the monetary easing policy is adjusted by PBoC based on the dollar's trend - up or down

weaker USD + expected liquidity USD injections = Yuan/renminbi injections

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

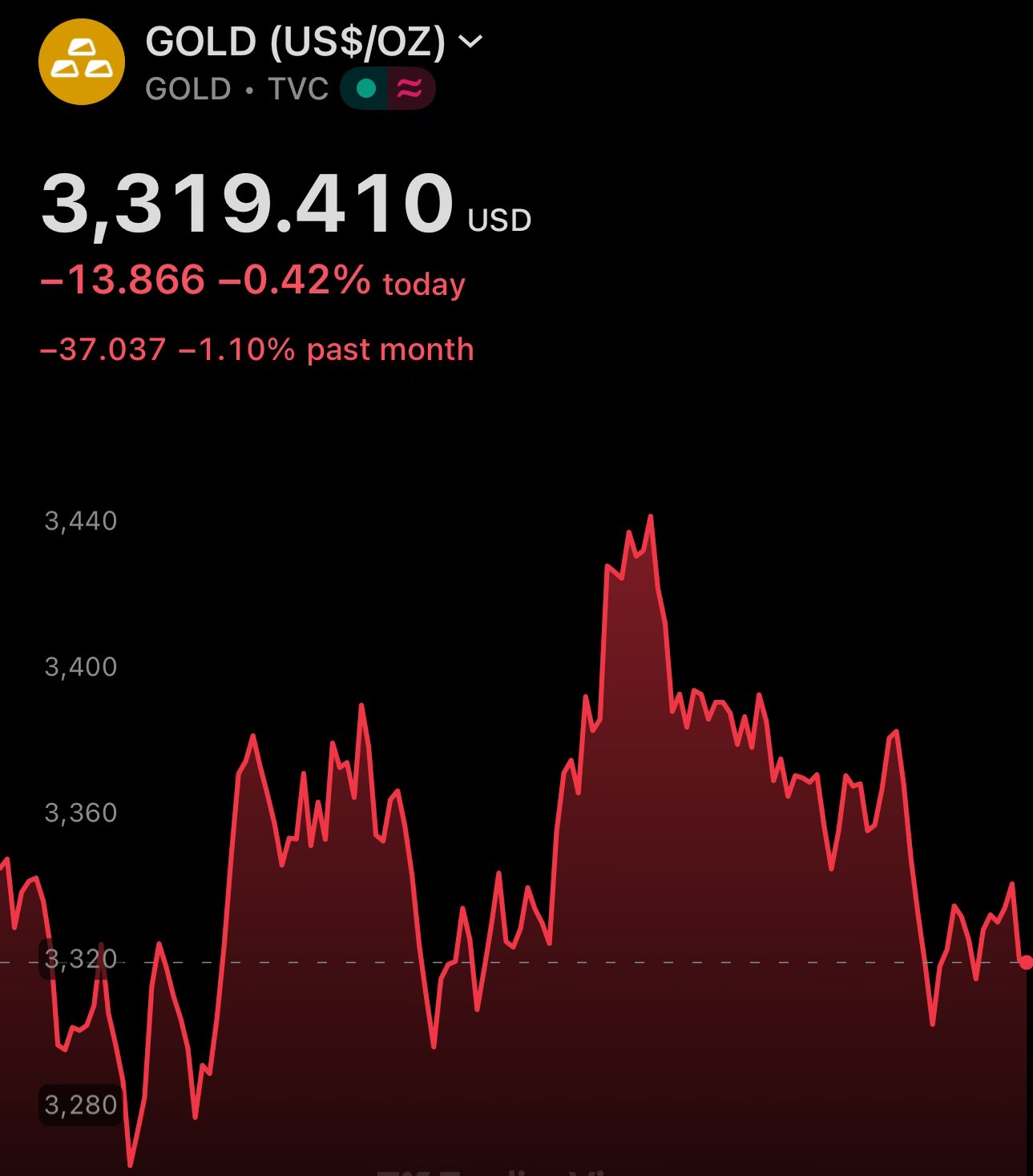

this means inflation & gold up

at least short-term: equities up, crypto up

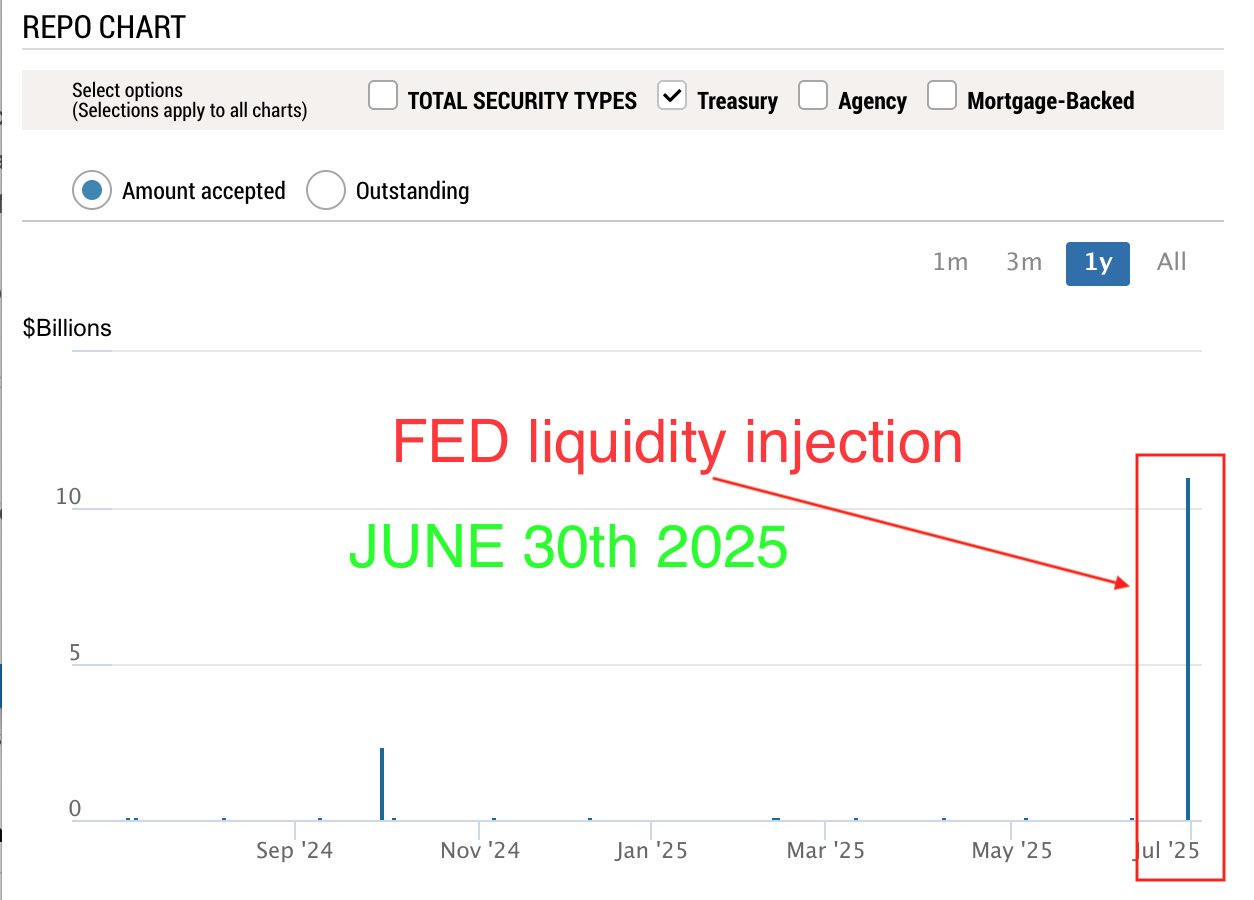

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

🚨FED just injected $11B of liquidity

👉 TL;DR: interest rate cuts & QE incoming

$11B is insignificant - but it's an early sign: there is a lack of liquidity/cash

if undressed, will lead to systemic defaults. existing debt needs to be refinanced

the fix/what's next? see TL;DR

once FED lowers interest rates, it's likely to put downward pressure on yields - assuming term premia doesn't increase by more

in the end, the yields will be higher than in the last 20 years, for the same FED funds rate

QE/liquidity injections will further devalue USD

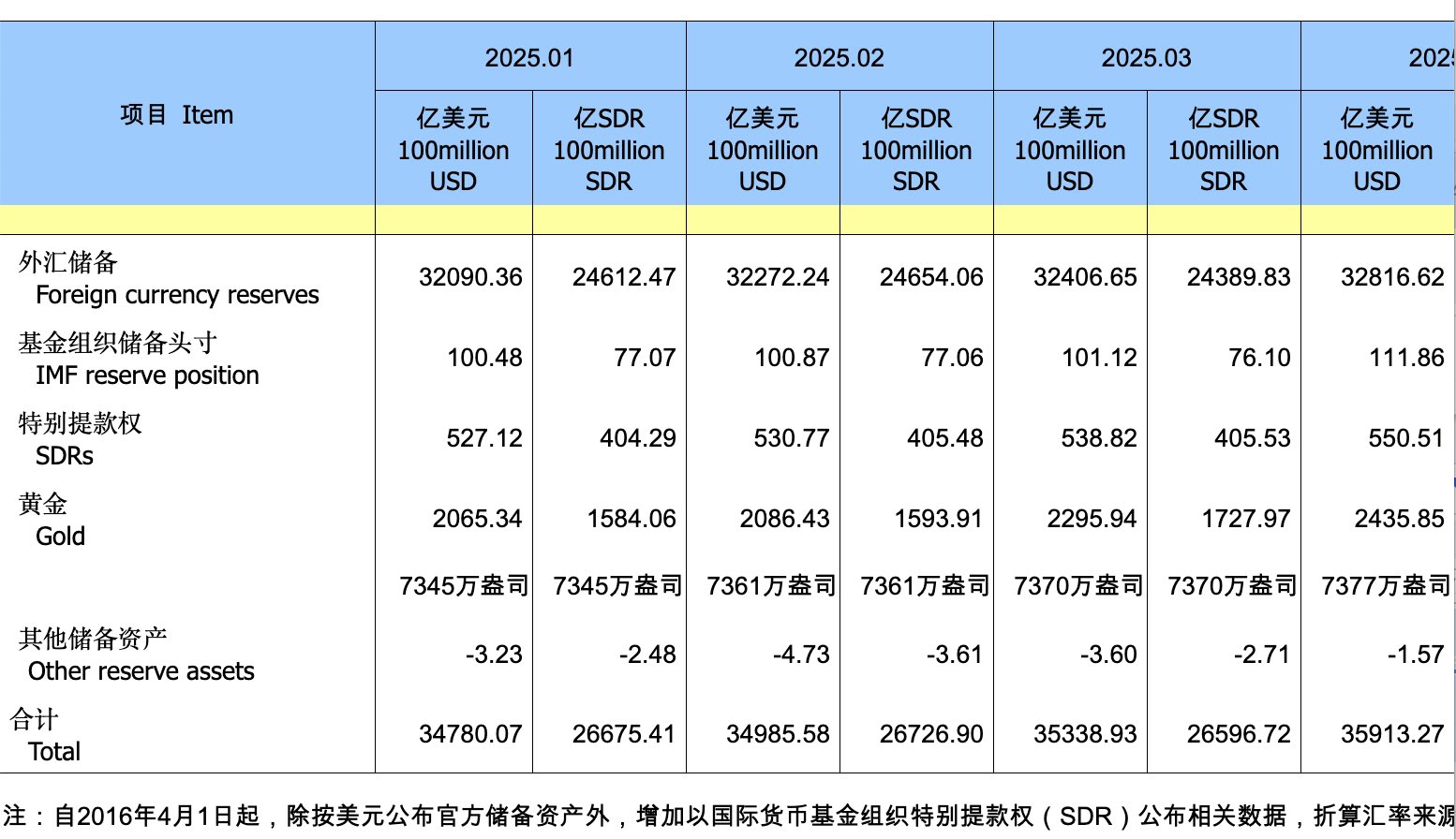

central bank balance sheets are an underrated resource for understanding the global liquidity moves

if you're following my posts - you already know that

rising US bond yields, ruble & gold

falling USD

i've been warning about it for months

90's style data = massive alpha 😂⬇️

central banks will continue to buy gold

you'll be able to confirm that in their upcoming balance sheets reports. pay special attention to China & Russia

enjoy the dip, because smart money is!

🏦 Quantitative Easing (QE) by a Central Bank (CB) increase both - its assets & liabilities

👇

QE = CB buys securities from commercial banks

👆

This involves:

1️⃣ Transfer of securities to CB (asset UP)

2️⃣ Credit the bank's reserve account (liability UP)

Of course - context is always needed

In 2002 Fed Funds Rate was x3 smaller

At that time, rates were higher overall

To find rates as small as in 2002, you'd need to go back to the 1960's 😳

For 15 years now, US had effectively been under QE financing - cheap debt

🏦🫧

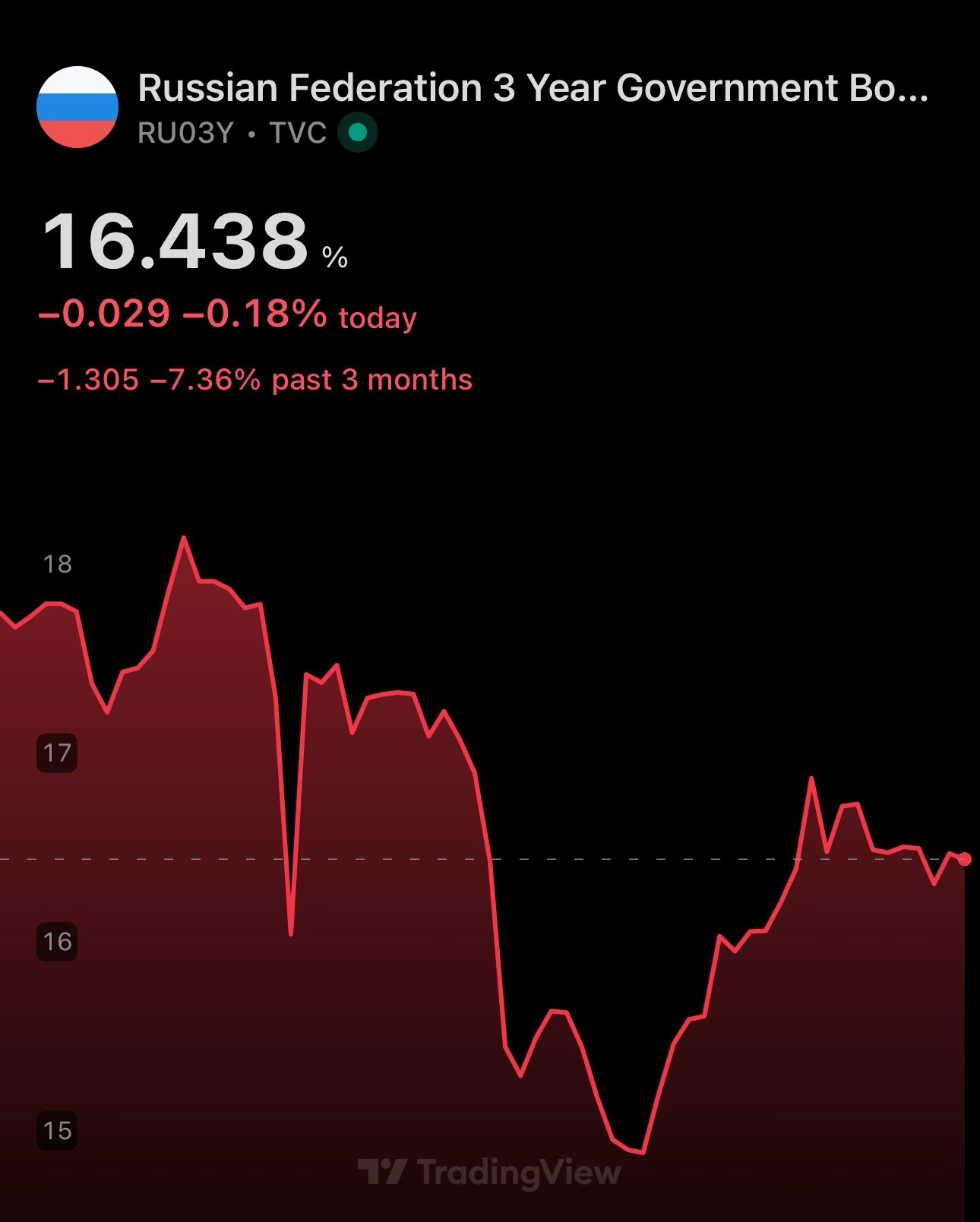

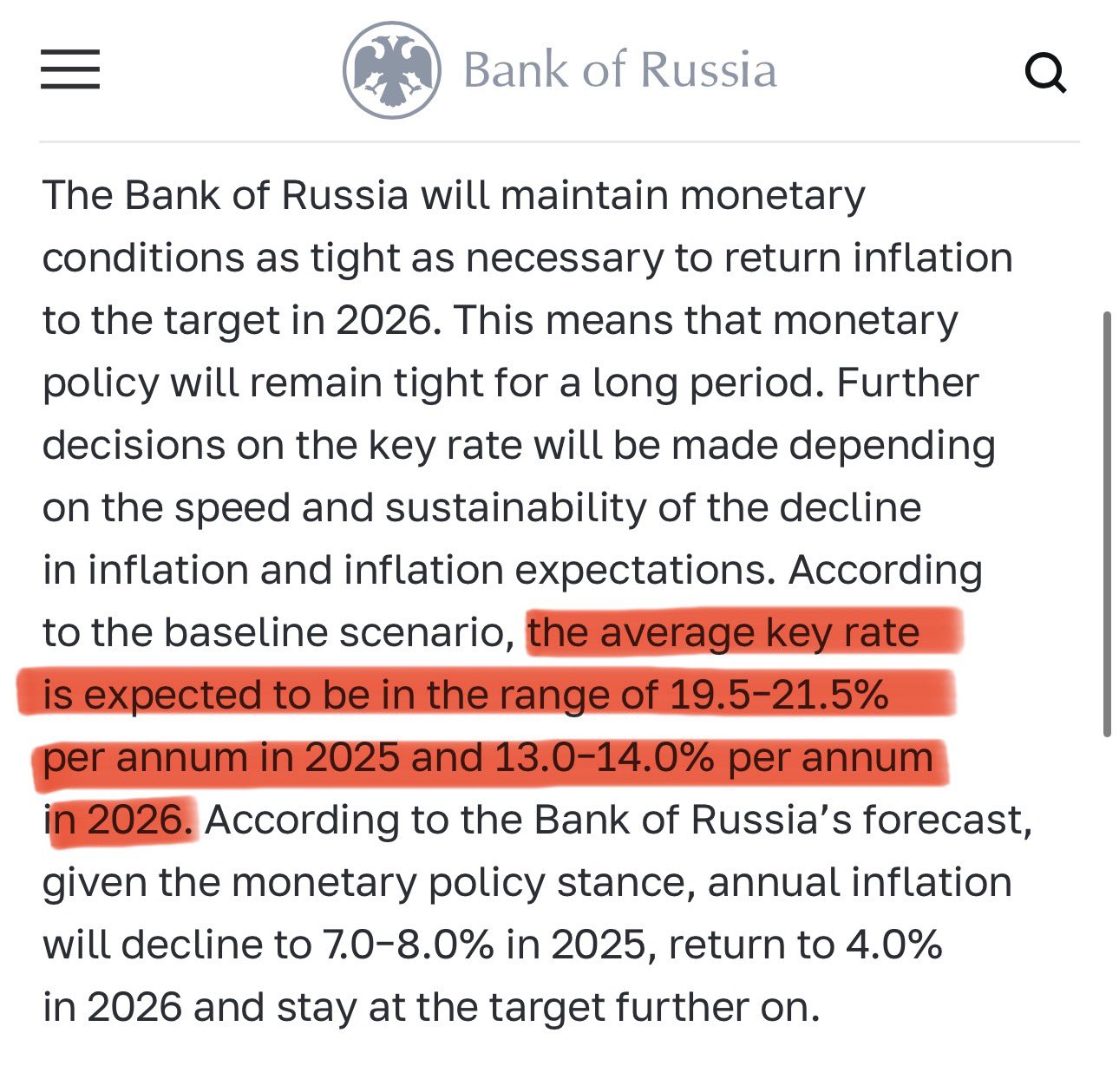

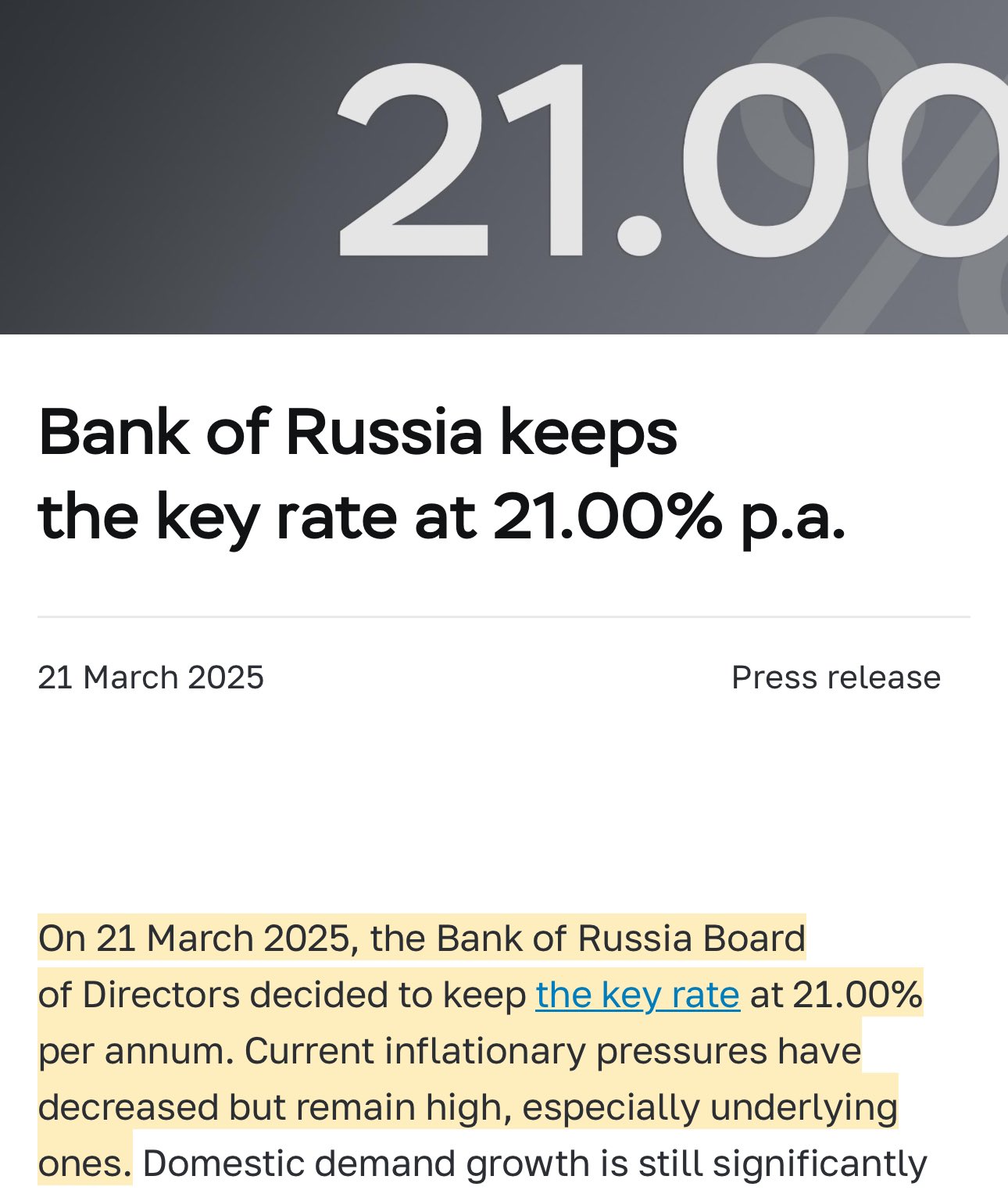

🇷🇺 Russian Central Bank currently has interest rates at 21%

Yet the yield on a 10Y bond is 15.6%

I've previously written that the market is both, pricing in upcoming low(er) rates & paying a premium to stay in Ruble

Today, I found the targets for 2025 & 2026

🇯🇵 Gemini 2.5 Pro Deep Research says Bank of Japan will continue with QT

I say they will switch (back) to QE soon

By QE I mean expansion of balance sheet, combined with low/negative key interest rates

Let's see who's right

🇷🇺 Russian Central Bank key interest rate is at 21%

3Y Russian Federation bonds are at ≈16.5% yield

The market is pricing in upcoming rate cuts

@AskPerplexity and @grok will tell you that Ruble & Russian economy are in a bad state. The reality is different

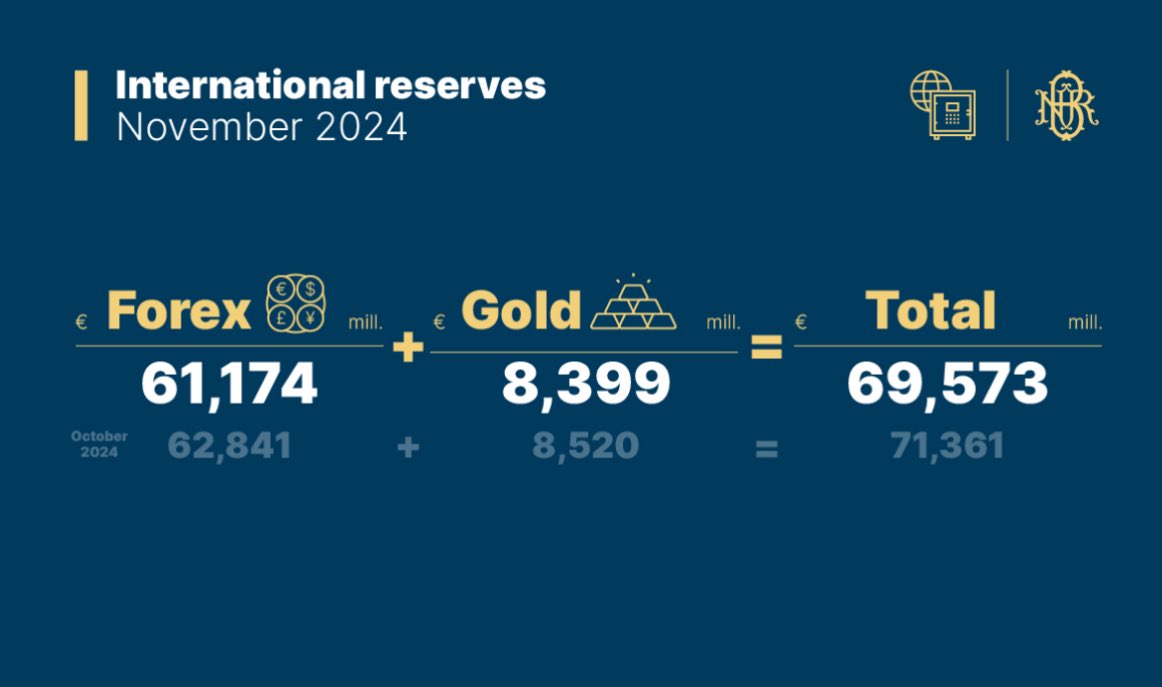

🇷🇴 I like how Romania's Central Bank has this image breaking down their international reserves on their homepage

However, I didn't understand why it links to November 2024 data, when March 2025 data is already available 😁

Gold reserves are ≈12% here

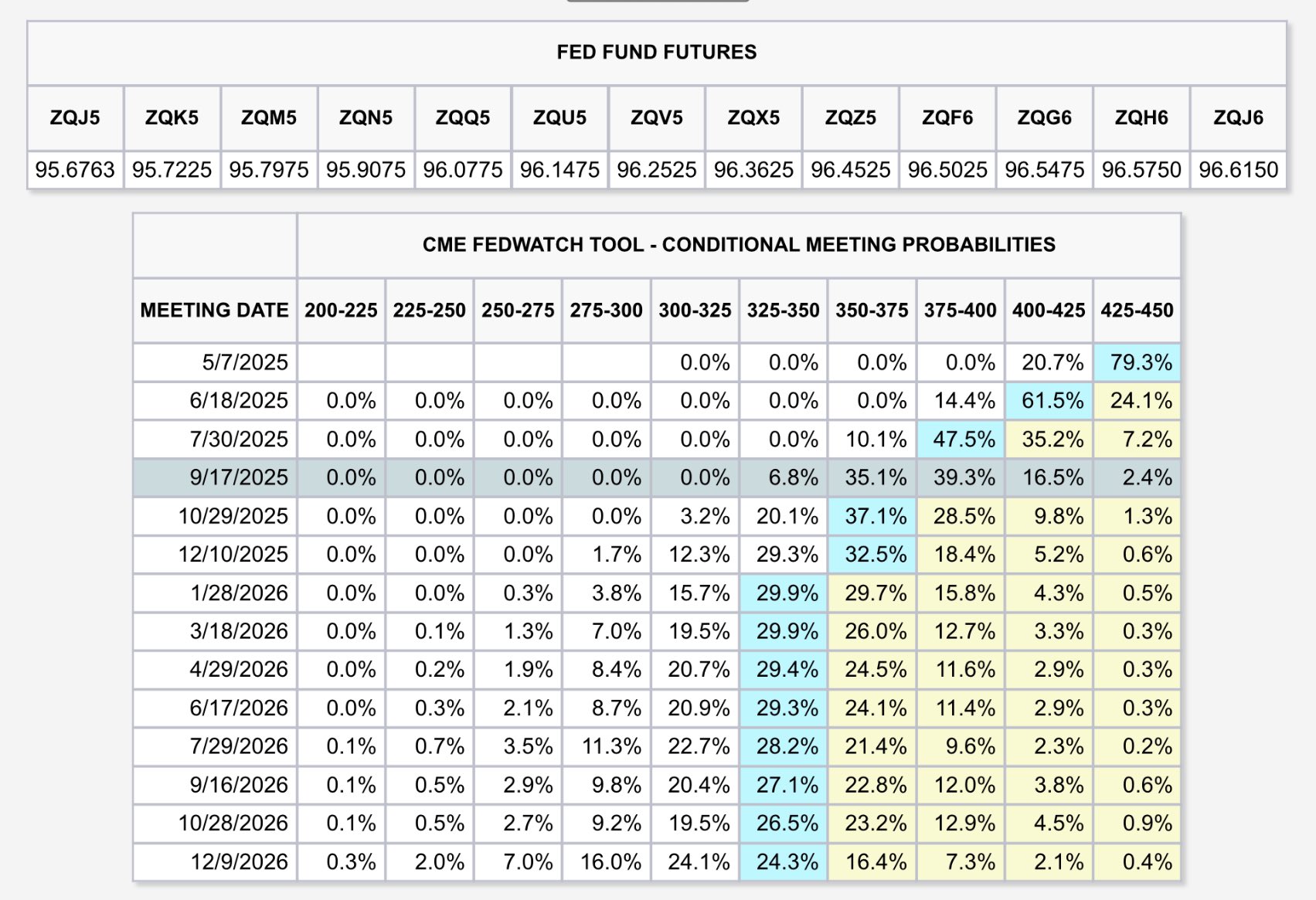

2Y US Bond is a good factor/signal of FED funds rate, but there's an even better one!

CME's 30-day FED Funds futures is a derivative for this exact purpose. The market prices them according to the expectations of upcoming FED Funds Rates

🔗

Another important fact to mention regarding Russia, is that on top of sell-off of US securities & loading up on gold in record numbers, throughout 2025 Central Bank of Russia has kept interest rates at 21% 🤯

Result = massive savings

However, if EU or US did the same - their economies would collapse overnight

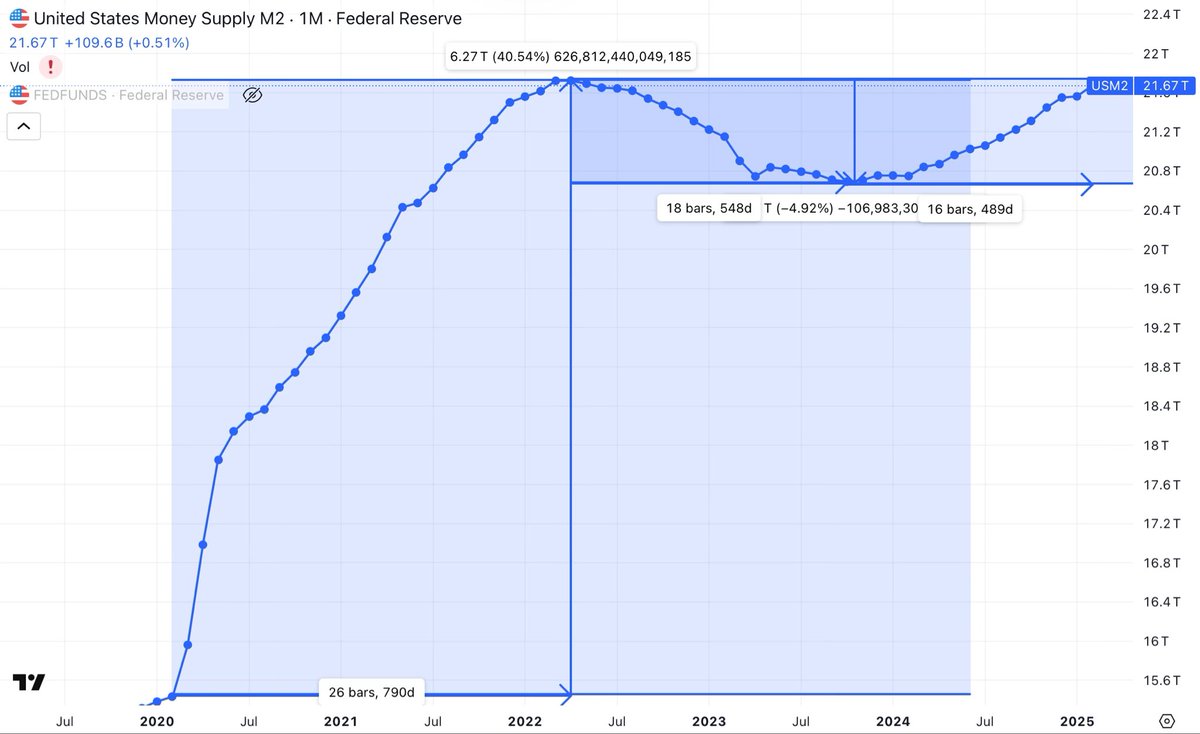

🚨🇺🇸USD M2 Money Supply

⬆️ 790 days to increase M2 by $6.3T

⬇️ 550 days to decrease M2 by $1.1T

⬆️ 500 days to increase M2 by $1.1T

⏯️ QE never stopped, it merely paused

When inflation is blamed on tariffs, keep this in mind

🚨🇺🇸 USD M2 Money Supply is almost back at pre-interest rate increase levels

That QT didn't last after all 🤷♀️

And the first rate cut comes from the European Central Bank (#ECB)

Federal Reserve (#FED) coming up next

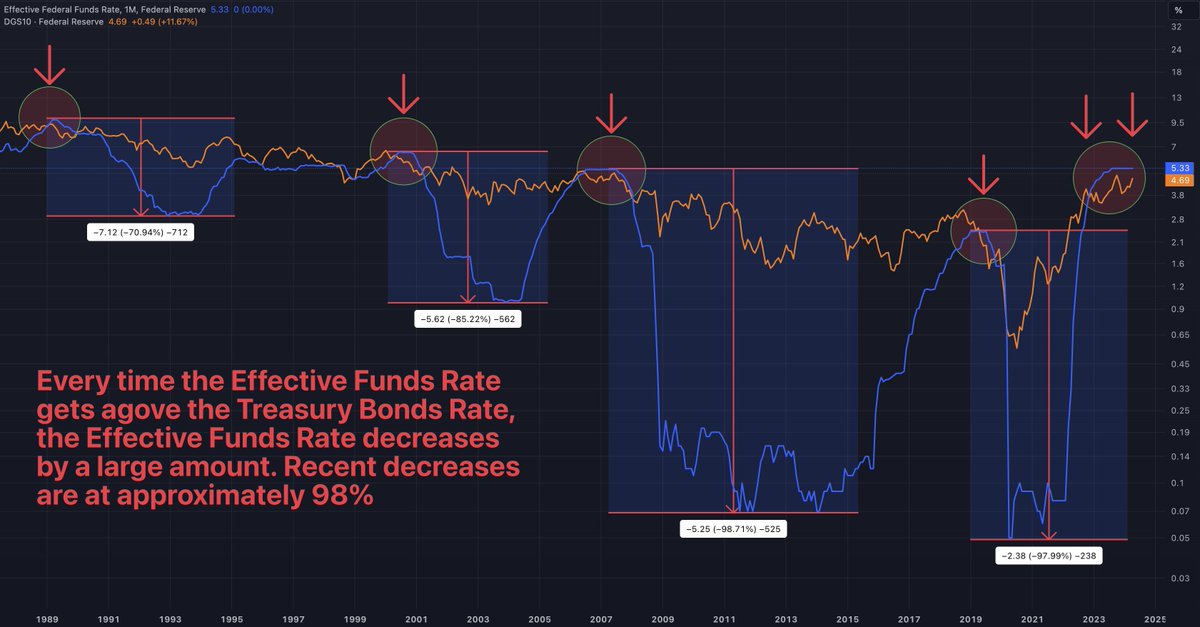

A few days ago I tweeted about how a rate cut is imminent, as suggested by the Treasury Bond rates falling below the overnight exchange rate👇

🔴 Every time the Treasury Bond rate (#DGS10 / #US10Y) raises above the Fed Funds Rate (#FEDFUNDS / #EFFR), the Fed Funds Rate decreases dramatically

Historically, this has always been the case

and this is exactly what's happening now

Expect a rate cut from the #FED very soon

🚨📈 The failure and the bailout of $SVB and $SIVB has shifted the market's sentiment towards the #FED Funds Rate

A rate hike now seems less likely

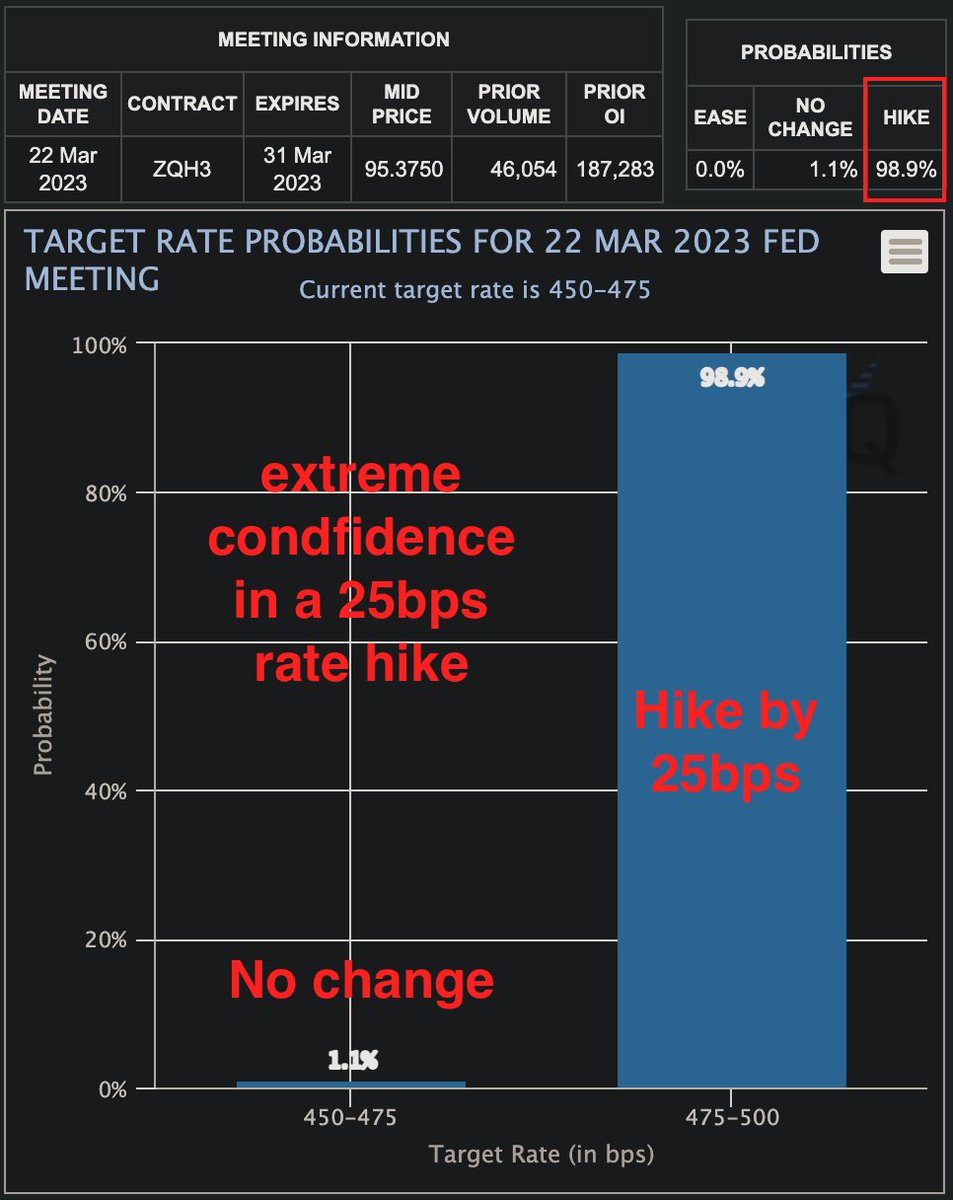

🚨 Despite the Goldman Sachs's statement regarding rate hikes and bank bailouts, currently the market is fully expecting a rate hike by 25bps

Although things may change, specially with the Biden's speech

In either case, QE is not yet back, so no bull market for #Bitcoin