Real estate, mortgages & credit cycle insights

Regular commentary on housing data, mortgage markets, CRE risk and how property interacts with the banking system.

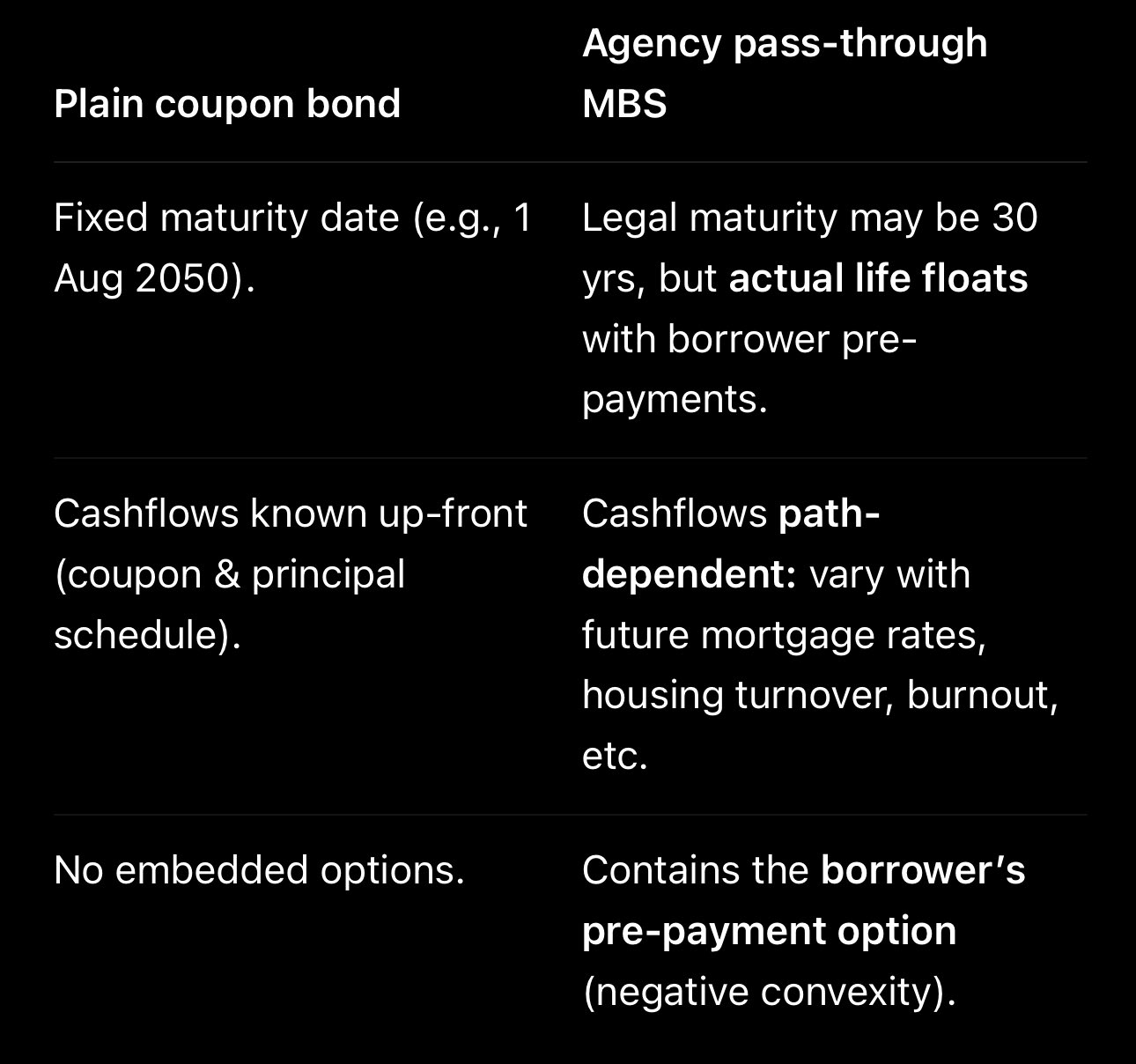

legally mortgage backed securities are bonds since they are tradable debt securities

but they're not a plain bond, due to the option of borrower's early repayment

Macaulay or modified duration used for Treasuries doesn't work - you need effective/option-adjusted duration

the duration formula for MBS assumes for some pre-payments

if those happen at a smaller rate - the duration increases

raising yields means lower incentives to re-finance mortgages which reduces the amount of pre-payments

thus, the duration increases when yields are raising - so even a higher price decrease

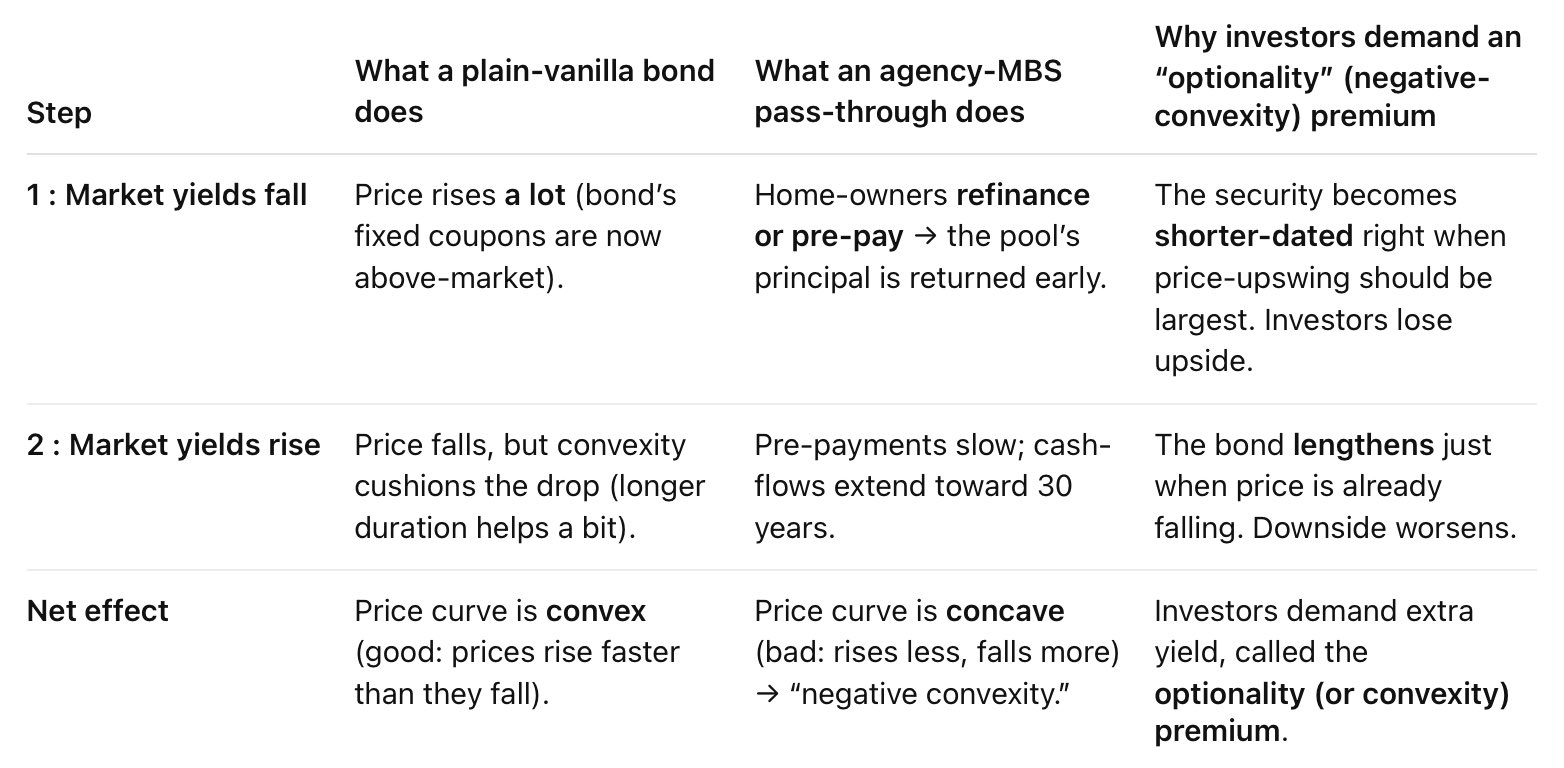

optionality/convexity premium in mortgage backed securities is interesting

when market yields fall the price should rise, but since borrowers take advantage of lower mortgage rates to make early payments - the price does not raise as much, due to lowered duration

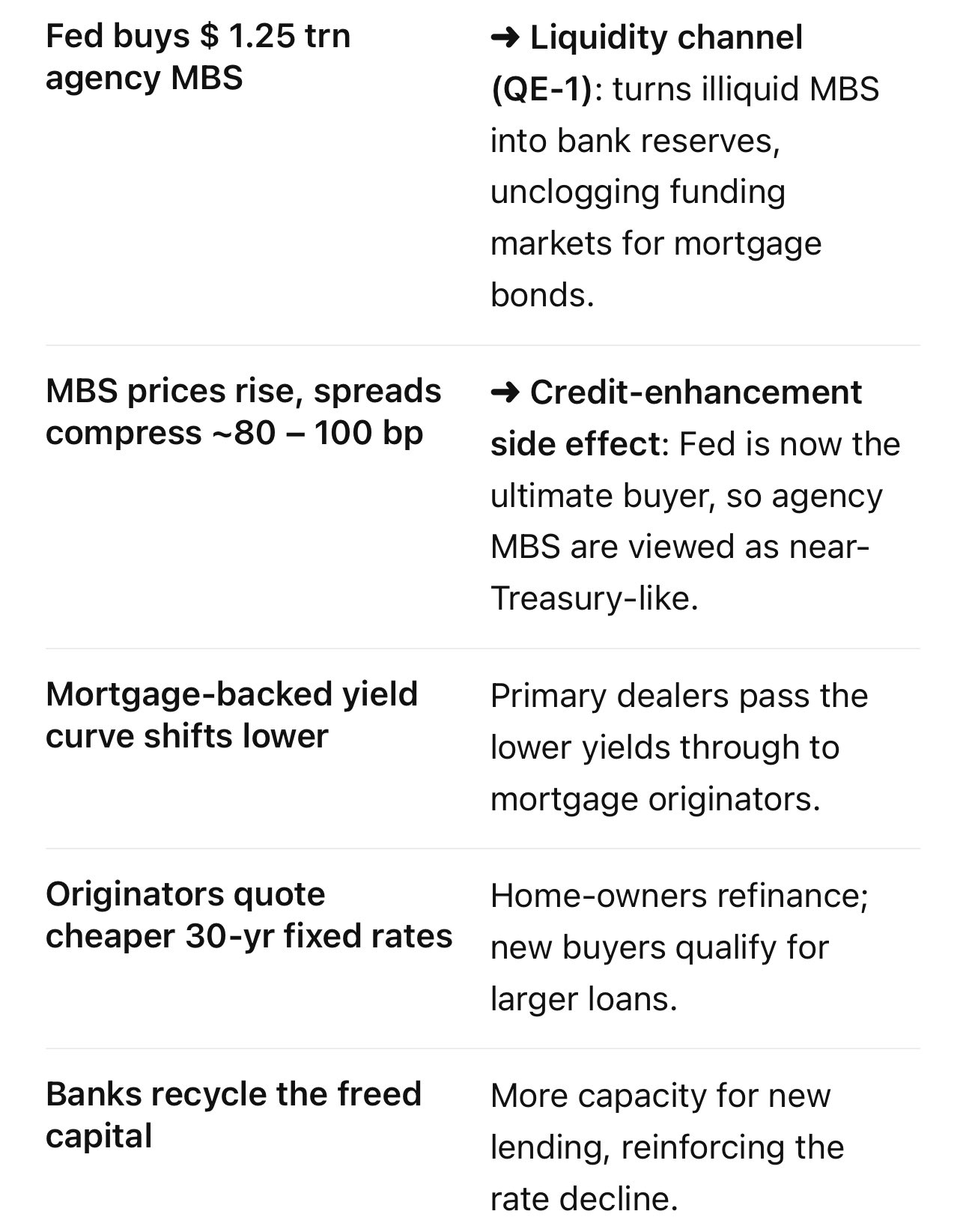

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity

this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it

thus, the yields fell

to lower the mortgage rates the Fed can purchase agency MBS - likely they did in QE 1 2008

buying mortgage backed securities raises their price and provides liquidity for dealers. this directly pushes down the yields

expect some MBS QE to come in the near future

if you can actually take a loan of €10m - just get a bunch of properties in Portugal (I see the flag 🇵🇹😄) and rent them out

you'll be able to comfortably get ≈50 properties - yielding you around €50K MRR

plus all of the equity and appreciation that you're earning