Real estate, mortgages & credit cycle insights

Regular commentary on housing data, mortgage markets, CRE risk and how property interacts with the banking system.

more mobile phones can also be produced - that doesn't mean that price of existing phones will go down

building new houses does not reduce the demand for highly desired areas - physical space is limited

moreover, those new houses will be built with the same credit/funding that will further drive real estate prices up. there is a reason banks eagerly finance at least 75% of the property value

the majority of real estate purchases in Portugal are done with credit. moreover, each property itself can be used as a collateral to get more credit - at least 75% of the property's value. so not only you can purchase the property, earn a yield via rents, but also get a credit/loan for 75% of value of the property

in Portugal, ≈90% of all credit/loans against real estate, go into investing into more real estate. so each collateraized property, can contribute ≈2x of its value as buying pressure for the real estate market as a whole (1x when the property is first purchased, and 0.75x-1x when the property is used as collateral to get a loan against it)

so effectively real estate itself is driving real estate prices up. banks happily finance real estate acquisitions, and lend against real estate collateral. then, most of that credit goes into purchasing more real estate, thus pushing the prices up

so the main drivers behind increasing real estate prices in Portugal are:

the real estate itself, i.e. the property itself

funding rate/cost of credit (highly influenced by ECB policy rates)

low relative transaction volume/market cap, making it easier to move the median

the first two points are generally universal across the globe. i've previously written an article about what makes real estate such a special asset from the point of view of financing. you can read it here: https://illya.sh/threads/@1757632740-1.html

the relatively low total transactional volume, which has increased almost x3 in the past decade - makes it "easier" for buying pressure to push the housing prices up

of course, other factors contribute as well. Portugal is highly demanded area for cultural and geographical reasons - i.e. locals are welcoming and Portugal has a huge coastal area. there is also high inflation, regulatory challenges and supply chain limitations

the bottom line is that real estate purchase and rent prices in Portugal will continue to increase over medium-long term

portugal golden visa real estate investments are less than 3% of total housing transactions

portuguese real estate market volume is ≈30B€/year, golden visa purchases accounted for ≈556M€/year

3% of total volume of the housing market is unlikely to be the primary driver of the national median prices increase

so next time someone tells you that one of the main drivers behind increasing Portuguese real estate prices are golden visa investments - their argument is likely to lack substance

portugal golden visa real estate investments are less than 3% of total housing transactions

portuguese real estate market volume is ≈30B€/year, golden visa purchases accounted for ≈556M€/year

3% of total volume of the housing market is unlikely to be the primary driver of the national median prices increase

so next time someone tells you that one of the main drivers behind increasing Portuguese real estate prices are golden visa investments - their argument is likely to lack substance

real estate/land has been used as a store of value for as long as we have written records - at least 5000 years 😄

even 5K years ago lad had been owned, taxed, transferred, leased and used as collateral

physical space is limited and virtually everybody needs a house/shelter. this has been true for hundreds of thousands of years and it won't become a lie anytime soon

so yes, real estate/land will continue to be used as a store of value

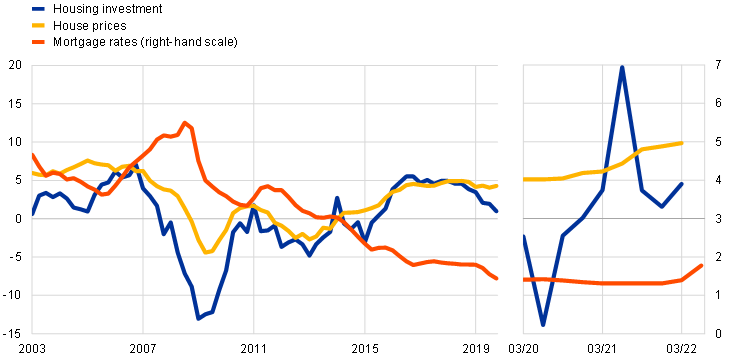

while the mortgage will eventually bubble pop/de-leverage to a significantly lower level, it's unlikely to happen within the next year or two, as many seem to suggest

as I've written here - there are still many tools that can push mortgage rates down shorter-term

so as a takeaway: expect volatility within the mortgage rates in the US

➖ upwards pressure: financial downturns in other sectors, organic de-leveraging

➖ downwards pressure: QE, Fed facilities, government policies

so as a takeaway: expect volatility within the mortgage rates in the US

➖ upwards pressure: financial downturns in other sectors, organic de-leveraging

➖ downwards pressure: QE, Fed facilities, government policies

the US mortgage bubble will likely pop alongside other bubbles, due to a high degree of interdependence and correlation within the financial sector

the mortgage bubble can both, trigger and be triggered by burst of other bubbles

so you'll see a cross-border systemic downturn

the US mortgage bubble will likely pop alongside other bubbles, due to a high degree of interdependence and correlation within the financial sector

the mortgage bubble can both, trigger and be triggered by burst of other bubbles

so you'll see a cross-border systemic downturn

of course, that doesn't resolve the underlying supply/demand imbalance at the risk level implied by the leverage

so the bubble is still there, and eventually it will eventually pop

the same is true for government policies or programs - those are also likely to push mortgage rates lower short-term

at the very least, extended government guarantees synthetically reduce the risk - the US government is a more trusted backer than the issuer of the MBS

mortgage-rates targeted QE, such as the mass purchase of mortgage backed securities (MBS) by the Fed will drive the mortgage yields down short-term, but also further leverage that market sector in the process

mortgage-rates targeted QE, such as the mass purchase of mortgage backed securities (MBS) by the Fed will drive the mortgage yields down short-term, but also further leverage that market sector in the process

so expect a 2008 QE-1 style balance sheet expansion by the Fed targeting mortgage securities via OMO

there will also likely be additional government policies and programs, such as increasing the scope and volume of explicit government guarantees on mortgage securities

so expect a 2008 QE-1 style balance sheet expansion by the Fed targeting mortgage securities via OMO

there will also likely be additional government policies and programs, such as increasing the scope and volume of explicit government guarantees on mortgage securities

in the US, there's been a real estate bubble in the building since 1990's (pun intended). it was about to burst/de-leverage several times, but it was refueled via QE and government guarantees among others, thus delaying it

in the US, there's been a real estate bubble in the building since 1990's (pun intended). it was about to burst/de-leverage several times, but it was refueled via QE and government guarantees among others, thus delaying it

in the longer-term mortgage rates in the US will likely increase, but not because of interest rate cuts

in the longer-term mortgage rates in the US will likely increase, but not because of interest rate cuts

in fact, mortgage rates in the US have been on a downtrend for a while - way before the rate cut

the markets have also gradually priced-in the September for a while, as you could observe in FedFunds futures

current area is also a monthly support, upwards pressure is expected

reducing the cost of capital by 25bps wouldn't affect mortgage that much - as it doesn't eliminate the existing risk in the market (i.e. existing mortgages)

to lower mortgage rates the Fed will likely do a mortgage-targeted QE, like with MBS in 2008 QE1

reducing the cost of capital by 25bps wouldn't affect mortgage that much - as it doesn't eliminate the existing risk in the market (i.e. existing mortgages)

to lower mortgage rates the Fed will likely do a mortgage-targeted QE, like with MBS in 2008 QE1

i've previously written an article about what makes real estate so special in terms of funding/re-funding capacity

banks finance ≈75% LTV on real estate purchases, and you can use existing properties as additional collateral

🧵read it here: https://illya.sh/threads/@1757632740-1.html

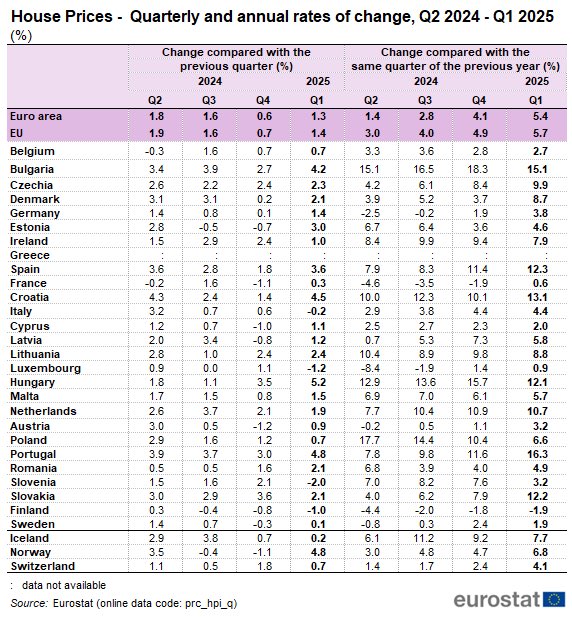

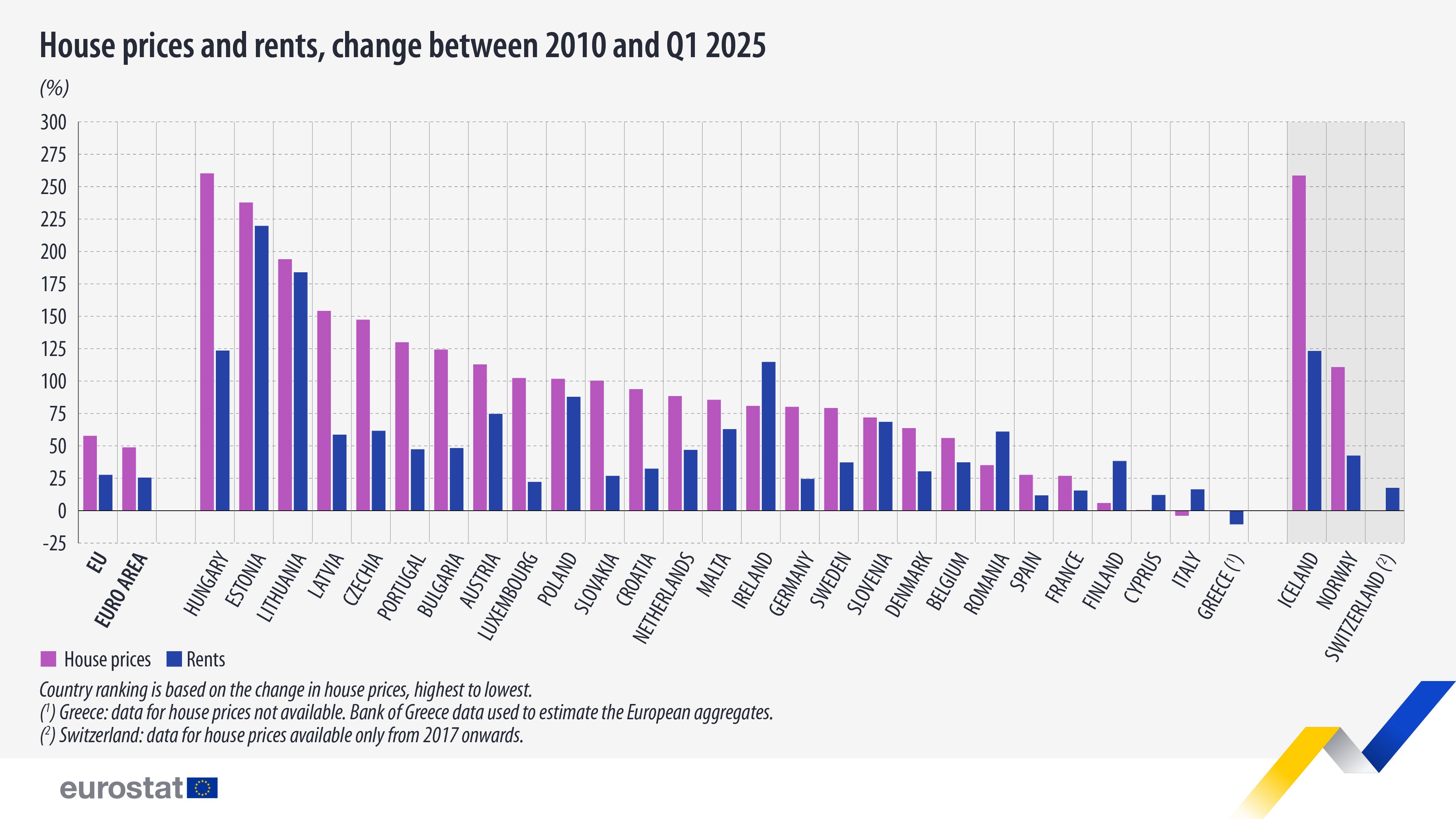

it's not just the Fed, the ECB is also lowering rates into higher inflation

this puts upwards pressure on both, real estate purchase and rent prices

so you can expect both - house prices and rents - to increase throughout the next 2 years

this makes immovable property a good hedge against inflation and economic downturn

price adjusts to value & while the composition of demand may change (e.g. shift towards smaller/cheaper units) - the demand for property will inherently remain high

given that housing is a core necessity for most combined with the willingness of banks to finance against immovable property creates a high persistent demand for real estate

given that housing is a core necessity for most combined with the willingness of banks to finance against immovable property creates a high persistent demand for real estate

as the immovable property appreciates, so do your assets and financing capacity. with a more valuable collateral asset - the bank will give a larger loan

increasing real estate purchase prices push rent prices up as well. so may increased interest rates, since it's harder to buy

as the immovable property appreciates, so do your assets and financing capacity. with a more valuable collateral asset - the bank will give a larger loan

increasing real estate purchase prices push rent prices up as well. so may increased interest rates, since it's harder to buy

so by using real estate as collateral you're just tapping into the existing low interest liquidity/credit line

at the same time the property earns a yield (e.g. via rents) and generally appreciates

so by using real estate as collateral you're just tapping into the existing low interest liquidity/credit line

at the same time the property earns a yield (e.g. via rents) and generally appreciates

this is why a 7 day Treasury bill-backed repo agreement may have 2% haircut and a 0.1% spread, while a 20 year immovable property collateralized loan a 25% haircut and a 2% spread

the T-bill is more liquid, less volatile and the loan term is much shorter

real estate is a great asset because banks lend ≈75% of its value

so if your property is worth $100K, you can borrow $75K against it at a low rate

the immovable property is used as collateral

remember that real estate runs on credit - and in the most basic approach - the bank happily finances 75% of the value of the property. this is true even if you're just starting

as you accumulate collateral/properties it becomes easier and easier, as you can cross-collateralize

EU real estate prices will continue to increase

with investment capital moving away from US to the EU, a significant portion of it will will flow into housing, thus pushing sale and rent prices up

specially true for high-demand areas, like coastal & large cities

the specific QE policies will vary, but it will probably include an MBS-style QE like in QE1 2008. this will lower mortgage rates short-term

I explained why in this thread: https://illya.sh/threads/@1754148538-1.html

the next burst in global liquidity/larger financial crisis will only happen after several more rounds of QE

the next round of QE is close, but hasn’t even started yet and rates were not cut. however, the next big debt refinancing is underway

regarding the IPO/privatization of Fannie Mae & Freddie Mac i wrote a thread explaining the role, function and use during QE of those GSE

also their history and how they were used to lower mortgage rates after the 2008 GFC

you can read it it here ⬇️

https://illya.sh/threads/@1754148538-1.html