MicroStrategy (MSTR) strategy & equity analysis

Updates on MicroStrategy's balance sheet, Bitcoin treasury, leverage, convertible debt and how the stock trades relative to spot BTC.

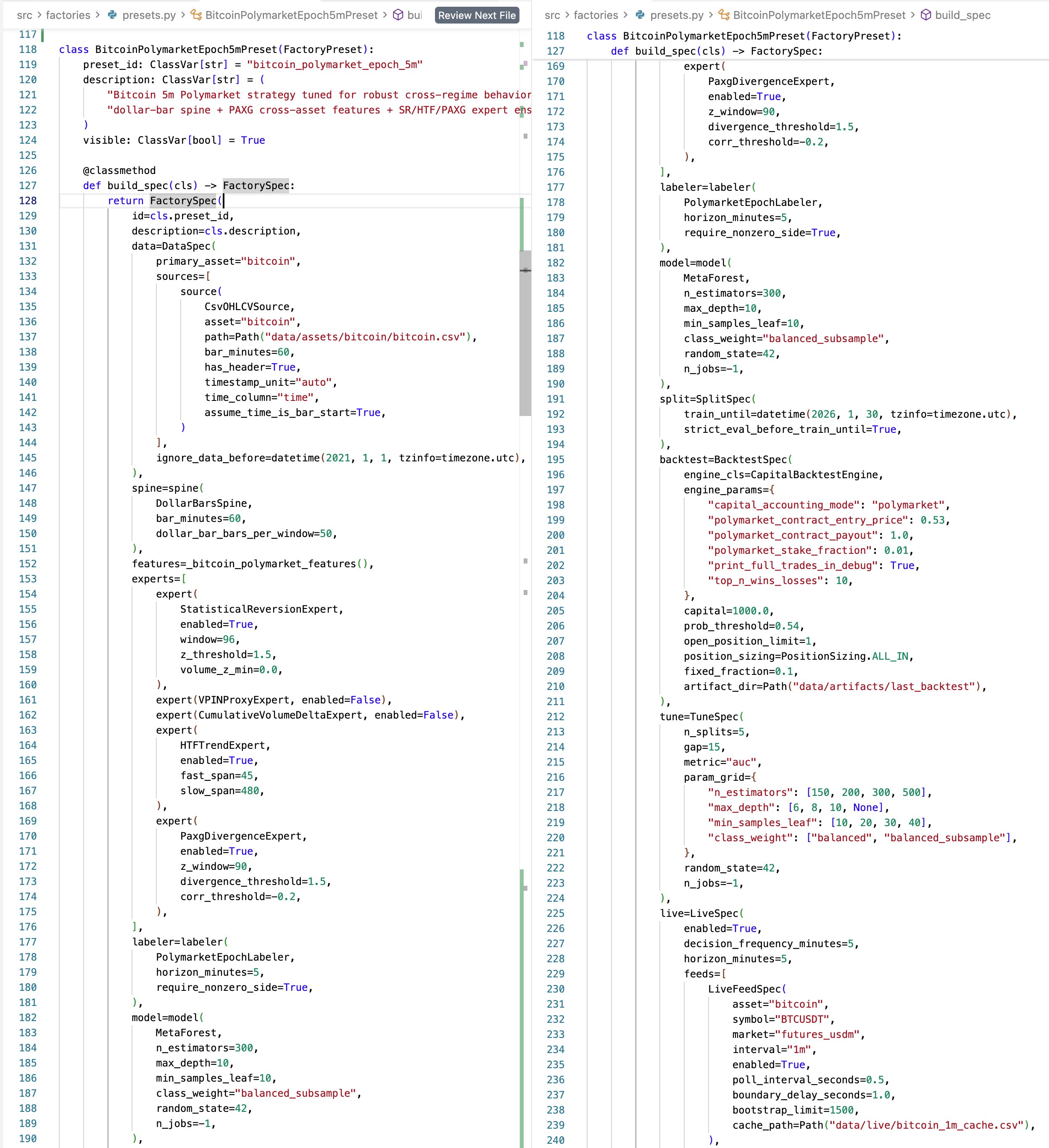

The model factory has been refactored to use a DSL for configuring the pipeline -- so now you can visualize and configure the whole flow from a single place

This also makes it easier for agents to autonomously discover and verify profitable trading strategies, but I'll cover that in more detail in another post 😁

A Primer On Strategy/MSTR Business, Financials, Liquidity and Solvency

There's a lot of misinformation how Strategy/MicroStrategy operates, its business model and what MSTR can and can't do.

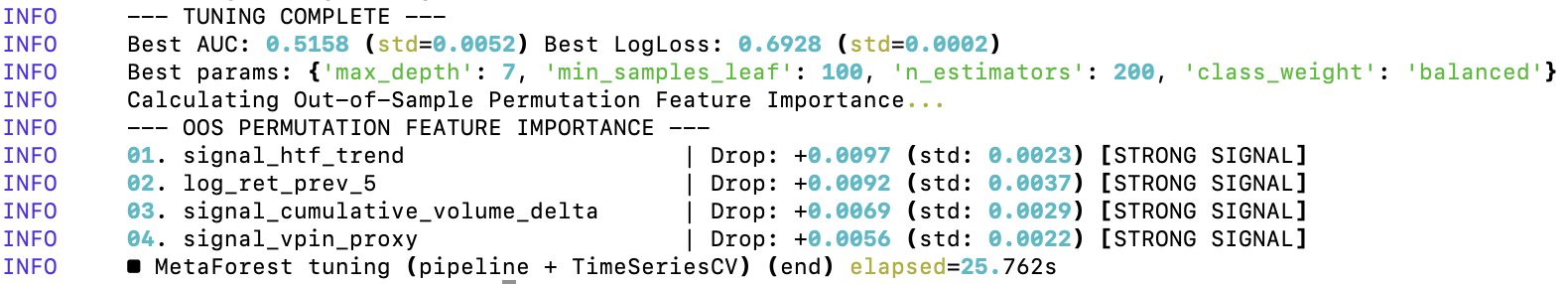

This served as a motivation for me to write 4 short, primer-style articles on MSTR:

1️⃣ MSTR’s business model, describing how the company operates as a "Bitcoin treasury" and what does it mean for its solvency. You can read it here: https://illya.sh/threads/microstrategy-is-dependent-on-refinancing-capacity-not

2️⃣ Why MicroStrategy can’t replay its debt using equity/stock. You can read it here: https://illya.sh/threads/microstrategy-cant-repay-its-debt-in-equity-stock

3️⃣ How Strategy pays for its interest, which currently accounts to ≈$40M/year. You can read it here: https://illya.sh/threads/how-microstrategy-pays-interest-on-its-debt

4️⃣ How Strategy's marketing is misleading regarding MSTR’s risk, liquidity and solvency. You can read it here: https://illya.sh/threads/strategy-invents-financial-metrics-and-everybody-applauds

I suggest reading them in the same order as above, but they're self-isolated. It's a short read, and together they will give you a good understanding on how Strategy operates (its business model), what are its main risks, what MSTR can and cannot do regarding debt repayments, and why you probably shouldn’t trust their marketing campaigns, including the statements made by Michael Saylor on X and various podcasts/videos where he appears.

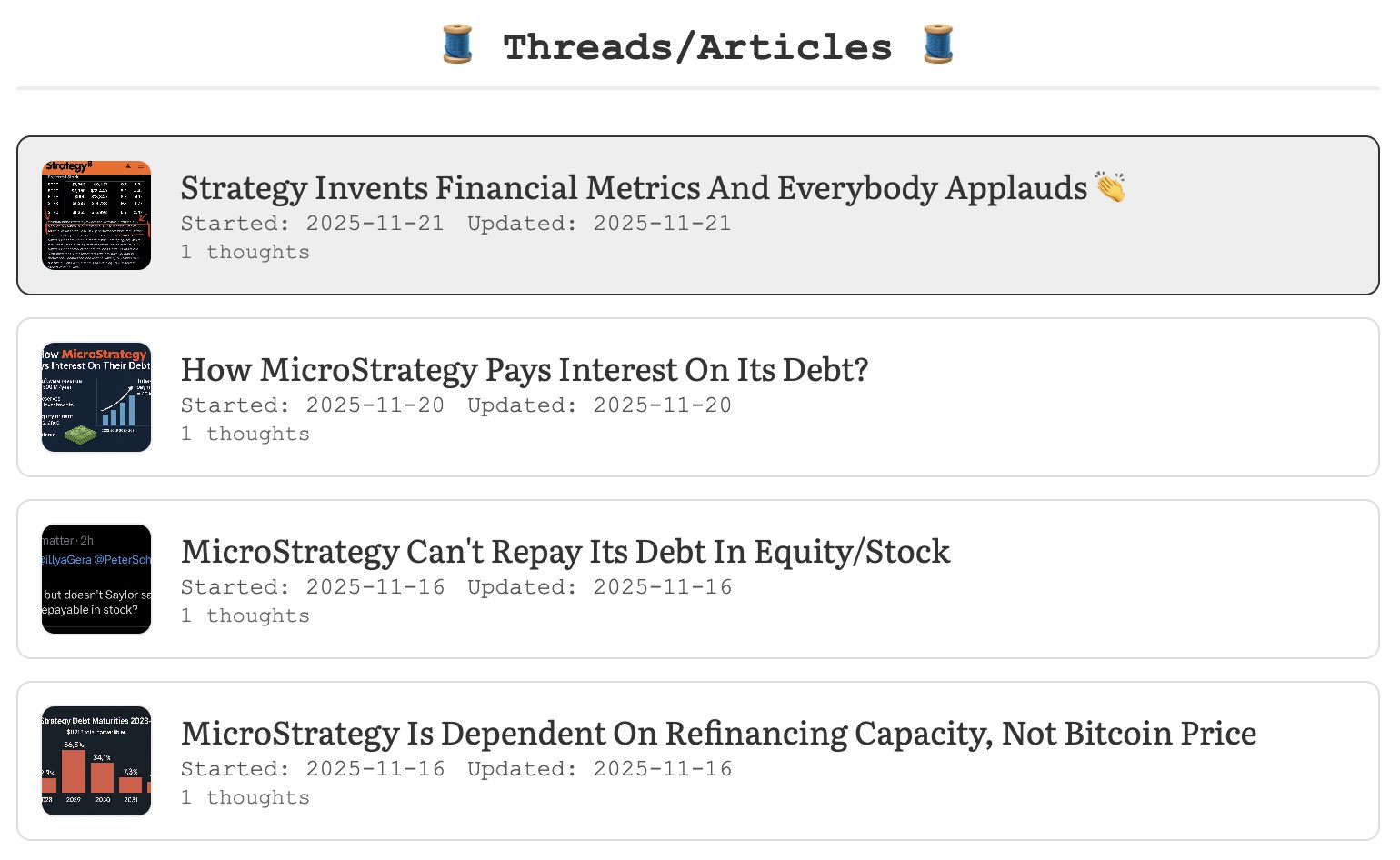

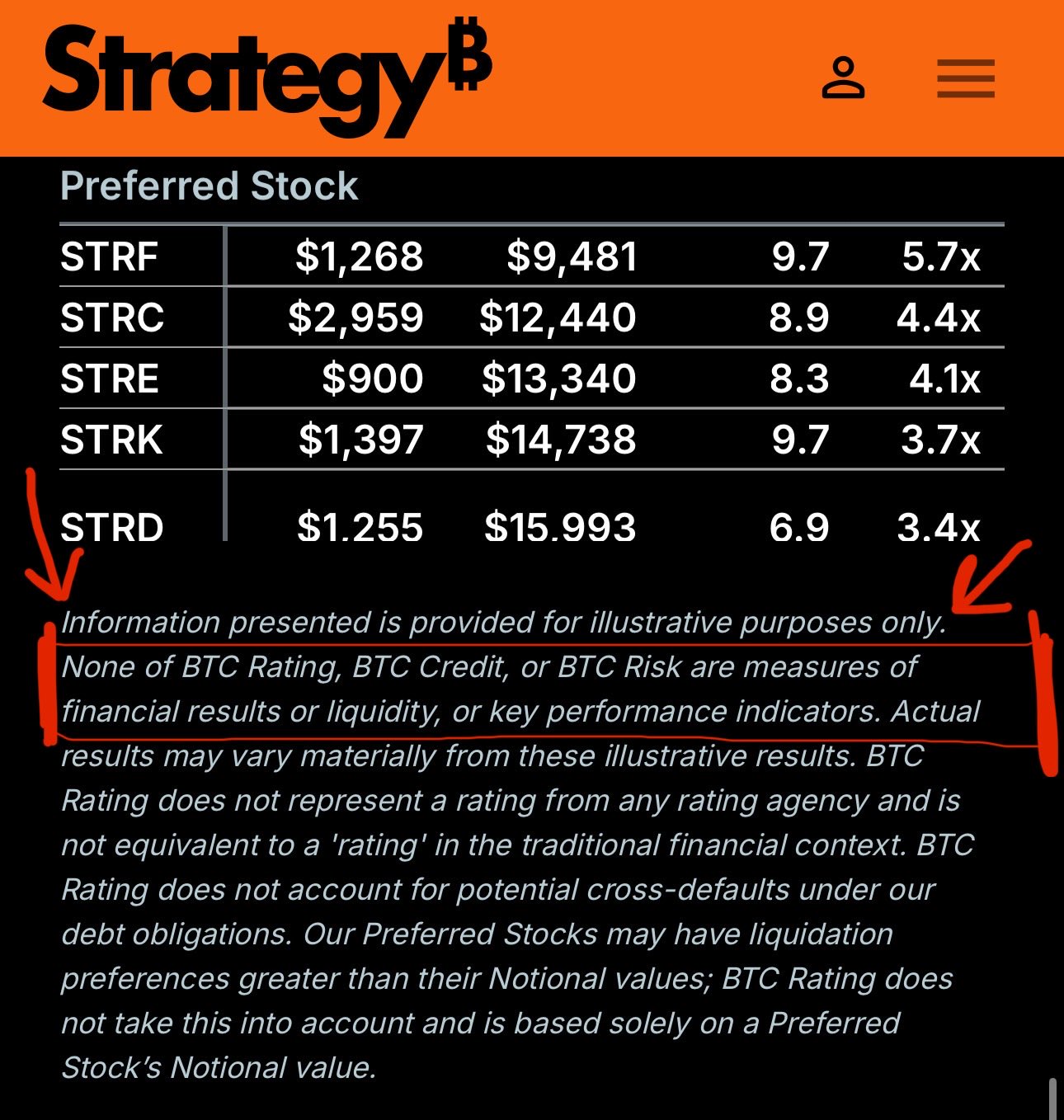

Strategy Invents Financial Metrics And Everybody Applauds 👏

MSTR's own website states that their reports do not reflect the financial reality:

"None of BTC Rating, BTC Credit, or BTC Risk are measures of financial results or liquidity, or key performance indicators."

Strategy's software business also operates at a ≈$60M loss, but on their website and socials they decide to ignore a part of expenses and market it as profit. So they create their own non-standard accounting and credit metrics and advertise those.

Strategy has a consistent pattern of misrepresenting their financials to look more favorable in their public marketing campaigns. A lot of it is in the form of Michael Saylor's videos, podcast appearances and posts on X. A lot seem to think that just because someone says something in a video or a social media post it must be true.

Words can be deceiving, numbers not so much.

How MicroStrategy Pays Interest On Its Debt?

The short answer is that MSTR finances its debt service via a mixture of:

➖ Software business cashflow

➖ Existing reserves & short-term investments

➖ Capital market instruments, such as issuing new equity or debt

➖ Asset liquidation (Bitcoin sales)

MSTR's annual coupon payments sum up to ≈$34.6M/year. Currently, virtually all of MSTR's financial debt is in convertible bonds/senior notes. Those bonds come with small coupons, so relatively small interest payments.

More specifically, here is how MicroStrategy's/Strategy's outstanding outstanding convertible bond maturity, principal, coupon rate and total yearly interest look like:

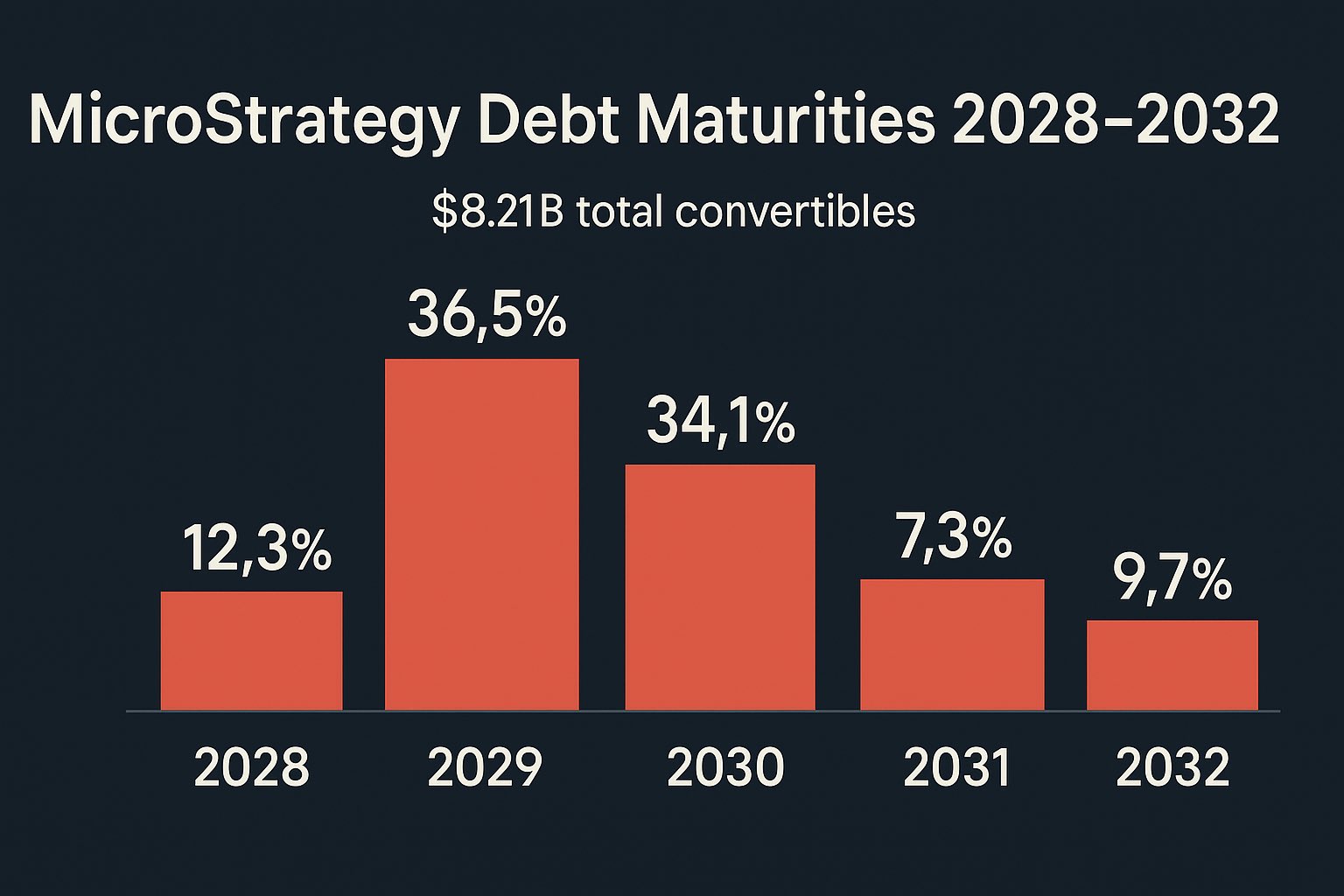

2028 | $1.01B @ 0.625% | $6.3M

2029 | $3.0B @ 0% | $0M

2030A | $0.8B @ 0.625% | $5M

2030B | $2.0B @ 0% | $0M

2031 | $0.604B @ 0.875% | $5.3M

2032 | $0.8B @ 2.25% | $18M

(Format: <year> | <principal> @ <coupon> | <anual interest>)

If you sum up the interest payments you’ll get ≈$34.6M/year in total.

The yearly revenue of MSTR's software services business is almost ≈$500M/year. However, their software portion of the business actually operates at ≈60M/year loss, when using U.S. Generally Accepted Accounting Principles (GAAP).

Strategy advertises their software portion of the business as being in profit, but they "manipulate" those numbers a little. This "manipulation" involves MSTR not counting stock-based compensation as expenses.

So when you hear Strategy advertising profit from their software business - they're not using a legally recognized and standardized measure of profit (in the U.S. it's GAAP). So they take the GAAP software profit and then add some things back at their discretion (i.e. they don't count some expenses), thus turning a negative profit (loss) into a positive one.

This means that while their software business revenue can help them with having liquidity for interest payments - it doesn't cover those costs (since they operate at loss, it actually increases the total cost!).

Thus, Strategy finances their interest rate payments with a mixture of:

➖ Existing reserves & short-term investments

➖ Capital market instruments, such as issuing new equity or debt (main source)

➖ Asset liquidation

The software revenue provides significant cashflow (compared to interest rate costs), so it can help with having cash readily available to make an interest payment (liquidity), but it doesn't effectively cover them, thus requiring financing from other sources.

Strategy (MSTR) pays interest on its debt via a mixture of capital markets, software business cashflow, existing reserves & investments and Bitcoin sales.

MSTR's annual coupon payments are not that high - ≈$40M/year. The convertible bonds that they issue come with small coupons (e.g. 0%, 0.625%, %0.875, 2.25%)

Given MSTR's software business revenue of ≈$500M/year, but it actually operates at a ≈$60M loss after expenses are accounted for.

So effectively, strategy pays interest expenses from the same corporate funds bucket that they rase to purchase Bitcoin in capital markets.

MicroStrategy Can't Repay Its Debt In Equity/Stock

Most of MicroStrategy's debt is in the form of convertible bonds, meaning that by default the principal and the coupons get repaid the cash.

The "convertible" part means the bondholder can choose to convert the bond into shares/equity instead, and then MSTR chooses how settle the conversion of the bond's value in cash, equity or mix.

So MSTR cannot force the debt settlement/repayment in stock/equity - that's simply an option that the bondholders/investors have.

The repayment can always be in cash assuming that MSTR is solvent, as most of the debt is unsecured, meaning that there is no specific collateral pledged against that debt. In case of insolvency, unsecured debt holders are treated as general creditors of the company, and are repaid out of the remaining assets only after secured debt holders are repaid, but before equity holders.

MicroStrategy Is Dependent On Refinancing Capacity, Not Bitcoin Price

MSTR won't have to sell Bitcoin if BTC price goes down, they'll have to sell Bitcoin if they're unable to acquire funding along the maturity of their debt wall.

MicroStrategy is essentially a leveraged trade on Bitcoin, based on the following cycle:

1️⃣ Acquire funding via debt or equity

2️⃣ Buy Bitcoin

3️⃣ Repeat

This cycle works for as long as MSTR is able to obtain funding. Once funding becomes unavailable (i.e. market isn't willing to lend at favorable interest rates), funding must come from asset liquidation (i.e. the sale of Bitcoin).

The availability of funding is mostly dependent on Bitcoin's price. As long as Bitcoin price and trend is favorable around the dates when the debt wall matures - MSTR should be able to continue their leveraged trade. MSTR share price vs Bitcoin NAV is also important. If MSTR trades a premium over Bitcoin's NAV it allows Microstrategy to short their own equity and long Bitcoin.

However, an unfavorable Bitcoin price action environment (e.g. during a bear market) that coincides with debt repayment obligations may trigger the unwinding of this leveraged position, forcing MSTR to sell Bitcoin, thus putting further downwards price pressure on Bitcoin, which lowers Microstrategy's equity even more, which makes lender even less likely to lend. The end result is an even more degraded funding capacity, which at the limit leads to bankruptcy.

Debt starts maturing from 2028 (≈$1B), but the most significant portion of ≈70%/$5.8B matures in 2029-2030. This is where the price of Bitcoin is of great importance for Microstrategy's solvency.

So don't expect Microstrategy to have pressure to sell significant amounts of Bitcoin before at least 2027, even if the Bitcoin price stays low.

Michael Saylor doesn't need to expose MSTR's wallets for a proof of reserves

All you need is Zero Knowledge Proof attesting that MicroStrategy has access to private key(s) holding a total of X BTC

With ZKPs - no Bitcoin addresses are exposed ✨