US dollar, DXY & FX market insights

High-frequency views on DXY, dollar funding, cross-currency basis and how USD trends shape global assets.

Central Bank of Russia Denies Return to USD Payments

Just like I argued yesterday, claims by Bloomberg and other financial media suggesting that Russia is to return to USD settlement were misguided/wrong.

Not only those claims lacked factual basis, but also didn't make sense in terms of a macro picture.

Remember: just because a large-following news source claims something, it doesn't make it true. And do not discount for the existence of coordinated campaigns with ulterior motives. It doesn't have to be necessarily market manipulation -- just the engagement on its own can be a strong motivator.

Fact-Check: Russia Moving Back To USD?

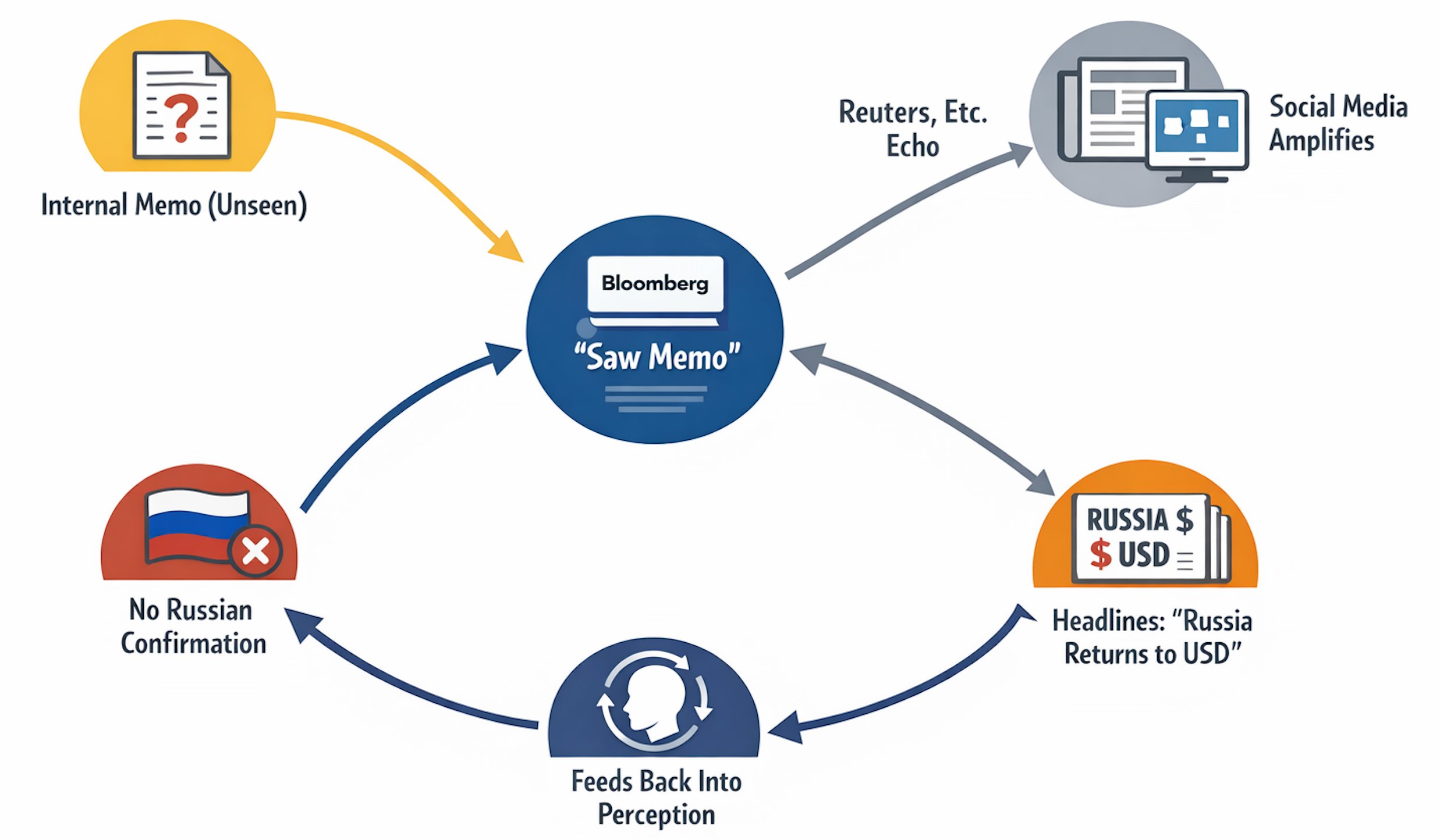

Today, financial news sources are flooded with information claiming that Russia is planning a return to the US dollar, as a part of wider strategic-economic partnership with Trump, but it is true?

Reportedly, Russia’s move back to USD comes packaged with other economic cooperation points, mostly around commodities (fossil fuels in particular). This is what mainstream financial media like Bloomberg, Reuters and accounts with millions followers on X have been spreading viciously today, many of which frame this as the end of BRICS and/or the successful policies of the Trump administration.

What bothered me, is that none of them seem to clearly outline the source, mostly citing it as “Bloomberg reports”. This brings the obvious question: what sources did Bloomberg use in making this report? Well, reports regarding “Russia returning to USD settlement system” arise from an "internal Kremlin memo" that Bloomberg supposedly had access to. No further information is provided regarding the nature of this memo. No Russian state sources confirmed this information. It’s also not clear why Russia would seemingly sidestep their main strategic partner - China with this move (especially for those claiming the end of BRICS). So we are in a situation where Bloomberg claims they’ve seen X, and X gets spread as a fact, based on the claim by Bloomberg.

Major news sources are reposting this memo and framing it as Russias’s return to USD without stepping back to analyze it critically. Why would Russia, which gradually moved away from USD throughout the last 20 years, would suddenly reverse their policy to accept USD as the preferred medium of settlement? Would Russia trade in USD again — of course, I don’t believe they ever refused that.

Eventually, I fully expect Russia to be reintegrated back into international trade, and that includes trading in USD. I’ve written about that many times. What I do not expect is the Central Bank of Russia to dramatically increase USD instruments in their FX reserves. They were already sanctioned once, and that will remain a perpetual risk. Russia has successfully moved away from the U.S. Dollar, by replacing it with gold and renminbi, and they don’t have a serious dependency on US trade. If you think that you will have American companies owning Russian fossil fuel production in the near future you are mistaken.

So my take on this: claims of Russia’s return to USD settlement are overblown. This looks more like a coordinated campaign than something with real substance.

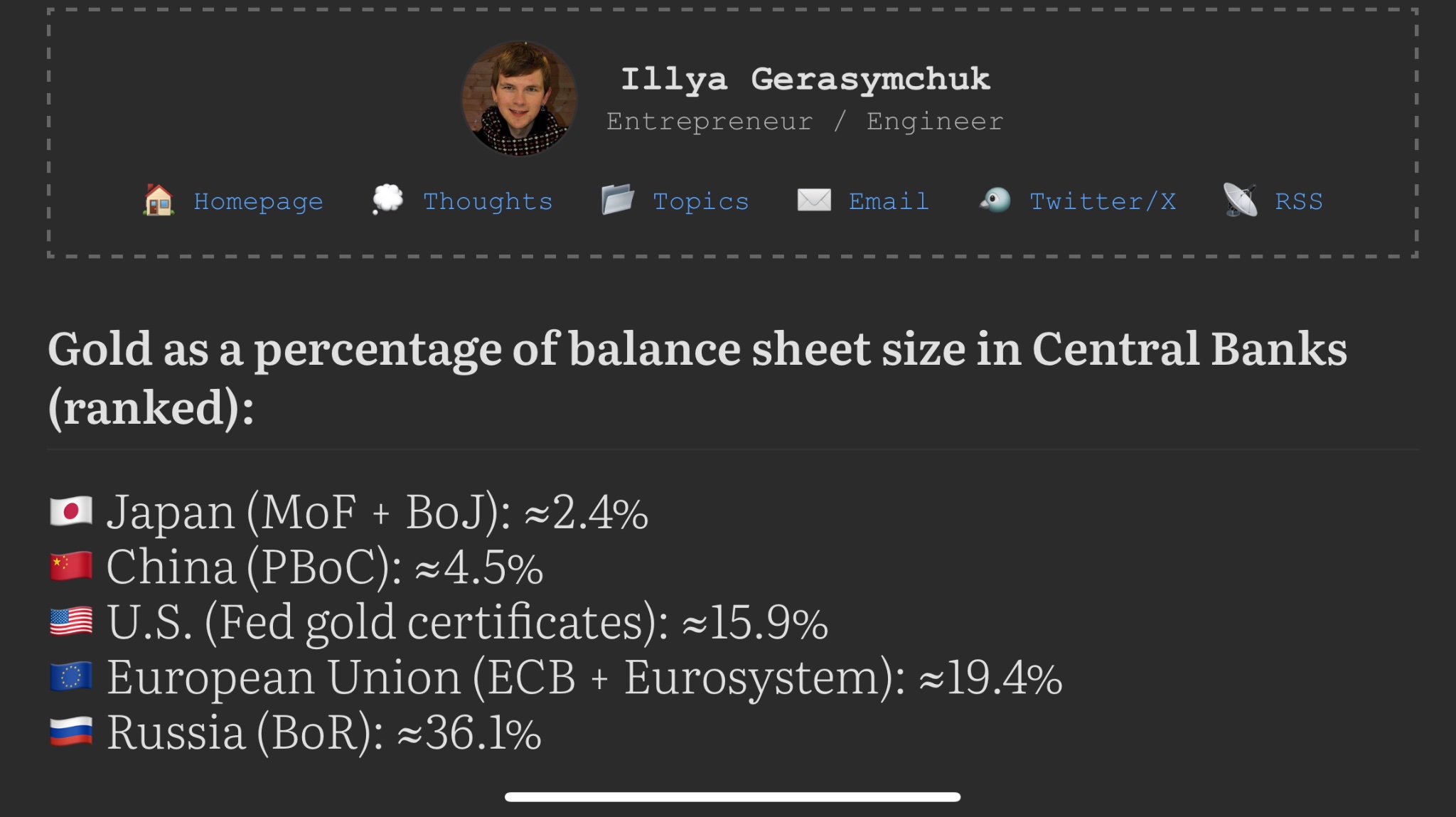

Maybe, just maybe the EU will start swapping their USD-denominated reserves for gold and (at least eventually) renminbi 😉

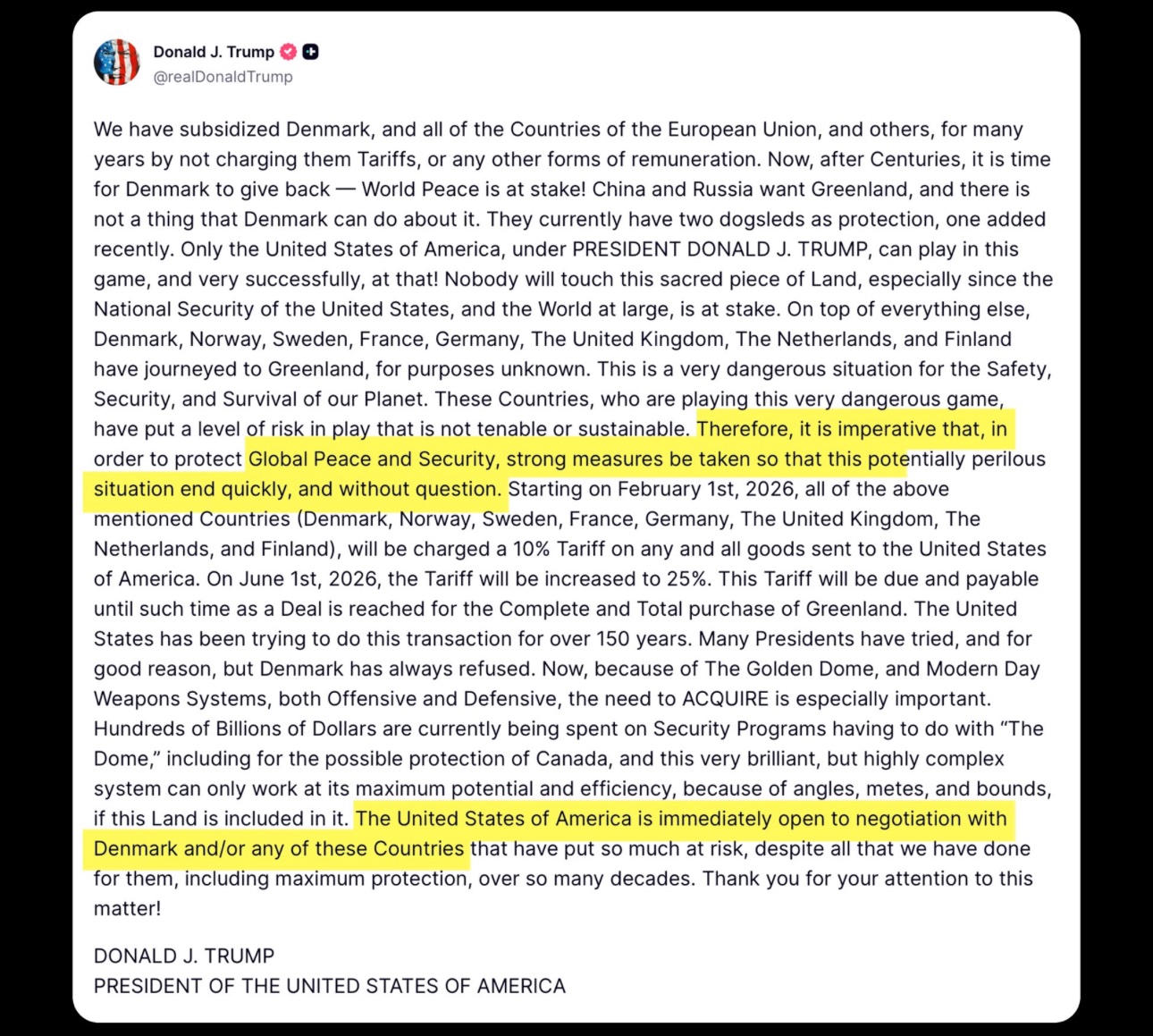

Good For Gold, Bad For USD: US Tariffs on Europe

The tariffs imposed by the U.S. on the European countries are detrimental to USD's position as a reserve currency. A capital outflow out of the U.S. dollar creates positive price pressure on gold via increased demand.

This is true regardless of the U.S. Supreme Court's decision on whether President Trump can lawfully impose unilateral broad tariffs via executive order using the the International Emergency Economic Powers Act (IEEAP).

At the high level, there's two moves for gold here:

➖ If the tariffs are deemed illegal and the collected tariff revenue must to refunded - which would lead to an increase of USD supply accessible to the wider economy. The refund would come either from existing reserves, thus directly increasing broad money or from newly issued debt, which may reduce broad money in the short-term, but the newly issued bonds will eventually be rehypothecated, thus effectively increasing USD credit/effective supply. This is positive price pressure on gold, at the very least due to the increase in liquidity. This is negative price pressure on USD, due to increased supply & public debt of the issuer.

➖If the tariffs are deemed legal, and/or do not need to be refunded, the geopolitical and liquidity risk remains, which materializes in a lower incencitve to own USD. After all, why would you want to hold a currency, whose purchasing power/liqudity may be reduced every other week after the markets close on a Friday? Gold is the natural outflow path from USD, especially at sovereign/central bank level.

If the Eurozone wants to reduce their USD exposure in the next 5 years, what can they do? The European countries may not want to start significantly increasing the share of renminbi in their FX reserves just yet. Additionally, EU could position Euro as an alternative to USD for settlements, as EUR is already the second most used currency for international trade & FX turnover, second only to USD. Gold presents itself as an attractive alternative to USD, even if the focus on increasing its tonnage in the reserves is transitory. At the very least, increasing the share of gold relative to the balance sheet size in the Eurozone, would increase foreign exchange rate value of Euro and/or would provide basis for monetary expansion in the future.

Many forget that the "gold and foreign exchange reserves" are a single asset-side item in central banks balance sheets. "Gold" is explicitly discriminated among all other assets/commodities, while all currencies and their derivatives (e.g. sovereign bonds) are clustered under the generic "FX reserves" name. Across all currencies, renminbi is best positioned to increase its share in reserve assets and international settlement. Unlike renminbi, gold is nobody's liability and has no counterparty risk (assuming no jurisdiction risk, which can be greatly mitigated by storing the gold bullion domestically).

Given this, I expect the European countries to increase their gold holdings, via a combination of swaps from USD-denominated assets for gold and other FX currencies like the Chinese Yen.

Ruble was the best performing major currency of 2025, and it's easy to understand why

What Russia did is replace USD-denominated securities (treasuries, bonds, etc) with gold.

Gold is almost 40% of Russia's Central bank balance sheet, compare it to ≈20% for European Union, ≈16% for U.S. and ≈5% for China. This leaves Russia's central bank with a massive balance sheet capacity for the future and supports the Ruble price.

There's also the National Wealth Fund, which commits to buying gold when Urals oil is sold/traded above a certain price.

This is how The Soviet Union kickstarted Eurodollar markets in the 1950's

Eurodollars are USD deposits held at banks outside the U.S. Originally, they were held mostly in European jurisdictions, thus the "Euro" in the name.

URSS needed U.S. dollars for international trade, but they didn't trust keeping balances directly in New York, as they feared that U.S. would freeze or seize those deposits.

So URSS placed their USD deposits in European banks, often via Soviet-linked banks. Those European banks then re-deposited or lent out those dollars to other banks and institutions.

I've written extensively how the policies of the current U.S. administration are a negative for the USD. Asian countries have been progressively moving away from USD, and this is a sign from Europe in that direction (but don't expect heavy de-dollarization in the near future).

Overall, I view this as a net positive for the sovereignty of EU/Europe as a whole. A more developed financial system infrastructure is crucial for attracting the use of Euro, which is already the 2nd most used currency in the world.

How exactly does Bitcoin break U.S. dollar control, when >90% of Bitcoin's buying volume is USD-derived (including stablecoins)?

i explained how weaker US dollar increases cross-border USD liquidity in this thread: https://illya.sh/threads/@1755216337-1.html

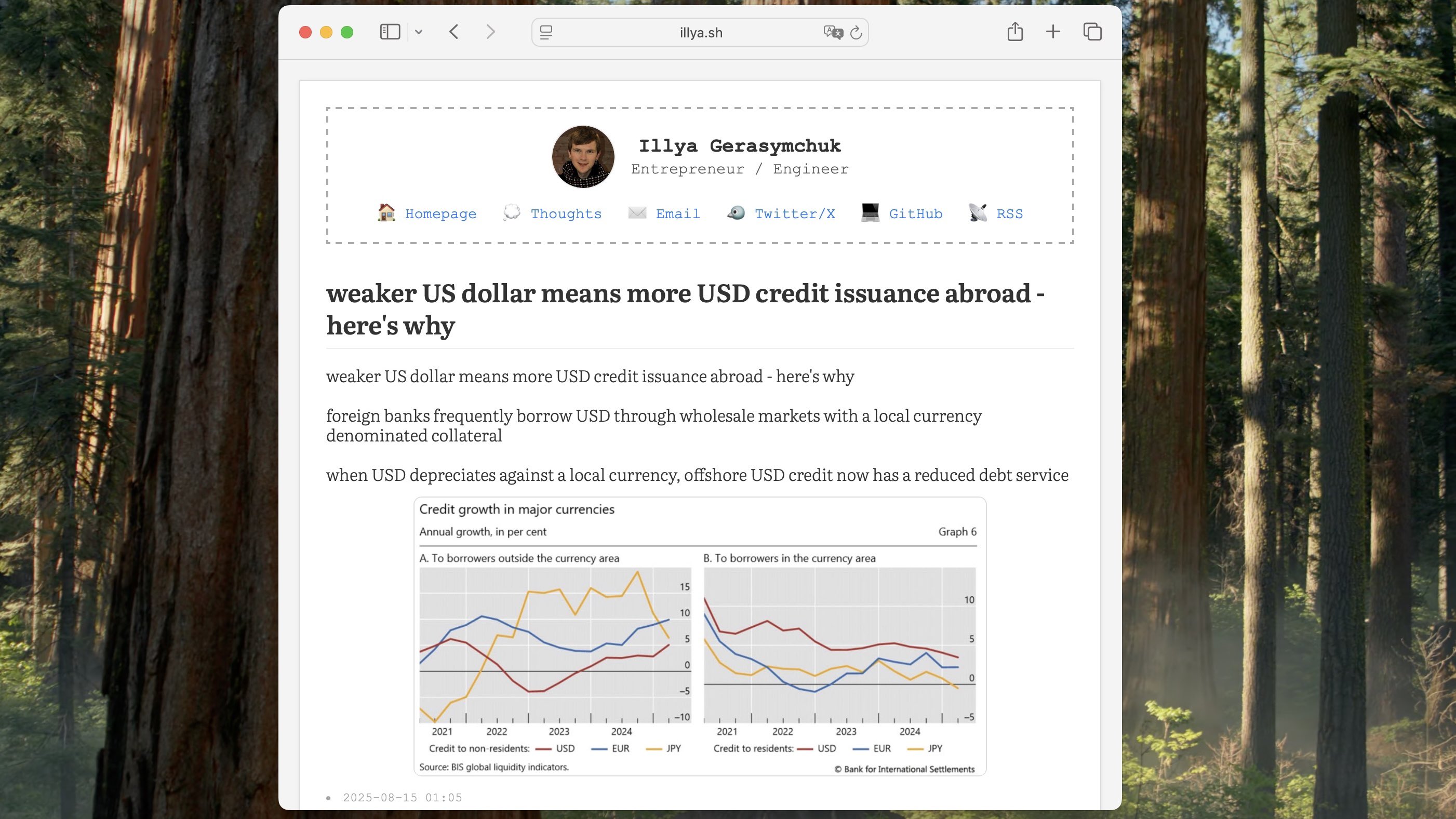

weaker USD, means appreciation of FX currencies and since many cross-border bank loans are collateralized with a local currency - solvency ratios improve, thus increasing balance sheet capacity for more USD credit

this means an increase in broad money

weaker USD, means appreciation of FX currencies and since many cross-border bank loans are collateralized with a local currency - solvency ratios improve, thus increasing balance sheet capacity for more USD credit

this means an increase in broad money

i covered more this aspect of QE in my thread about how to use yield spreads to reason about future Bitcoin price and cycles

you can read it here: https://illya.sh/threads/@1755595543-1.html

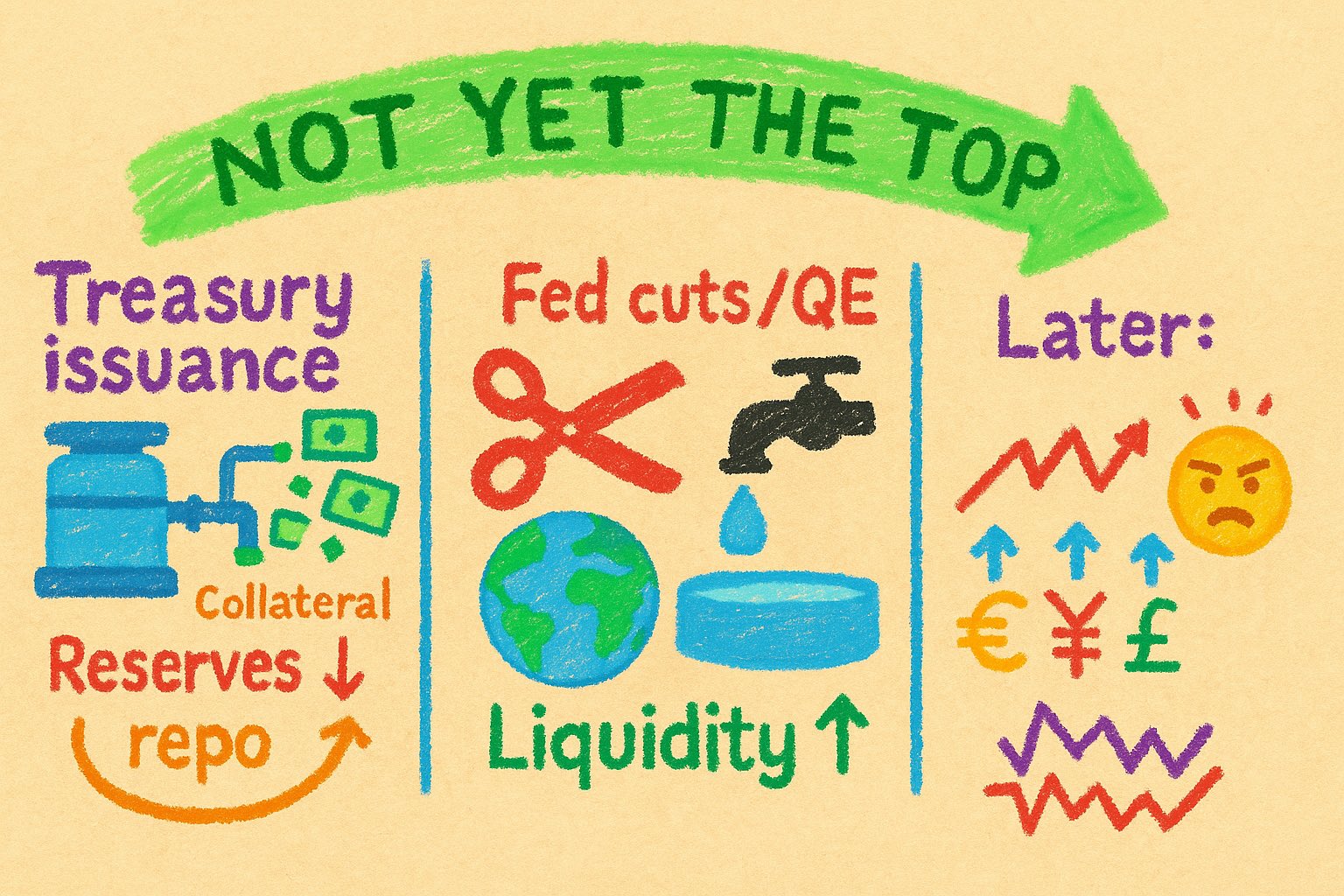

it's NOT yet the top of the cycle for equities, cryptocurrencies and other risk assets. here’s why

1️⃣ US Treasury is issuing more debt

2️⃣ in the next months I expect the Fed to cut rates and/or introduce some form of QE

3️⃣ weaker USD means more cross-border USD credit

i wrote a thread explaining why weaker USD means more credit/loans issued in USD, thus driving up global liquidity

you can read it here: https://illya.sh/threads/@1755216337-1.html

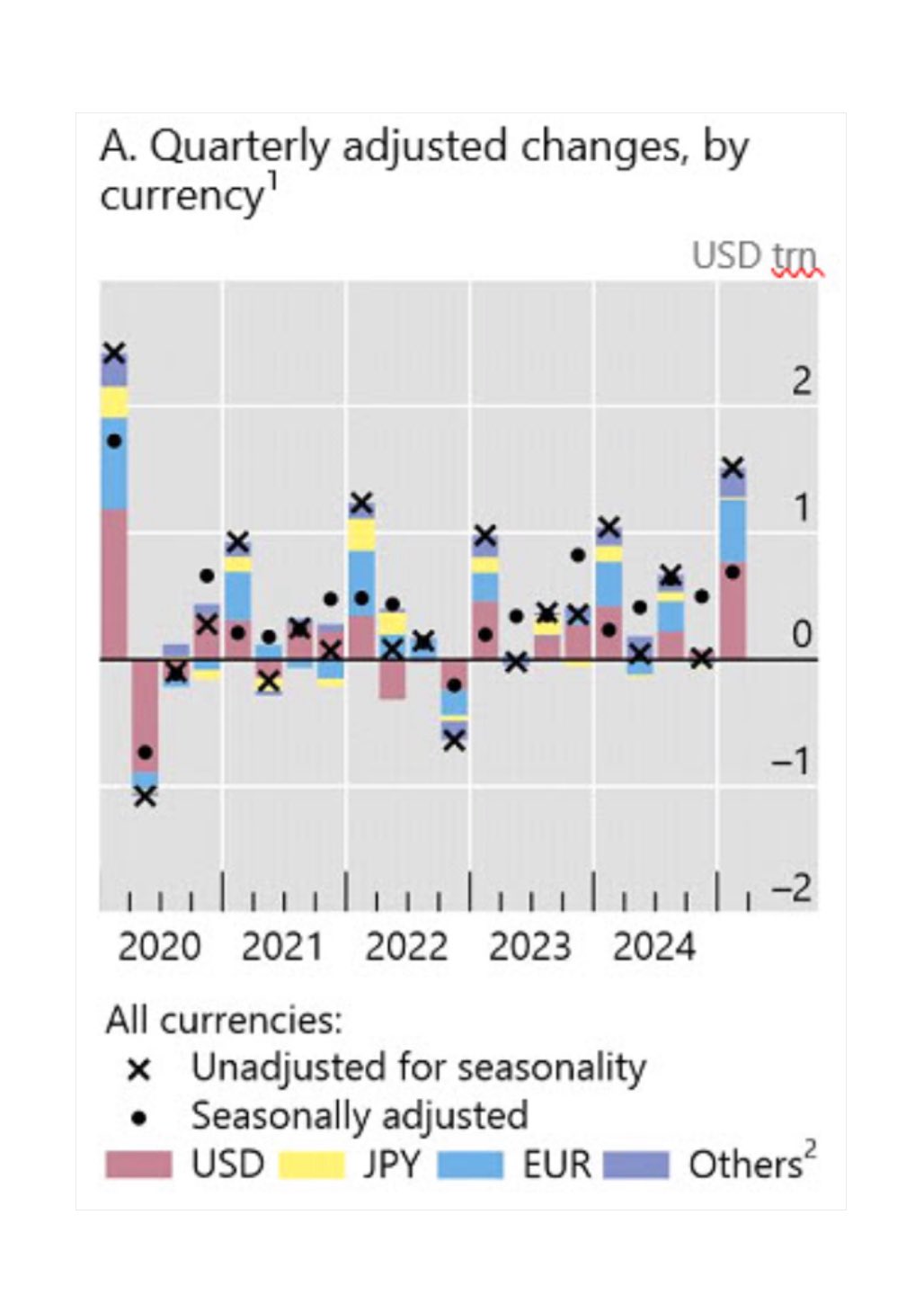

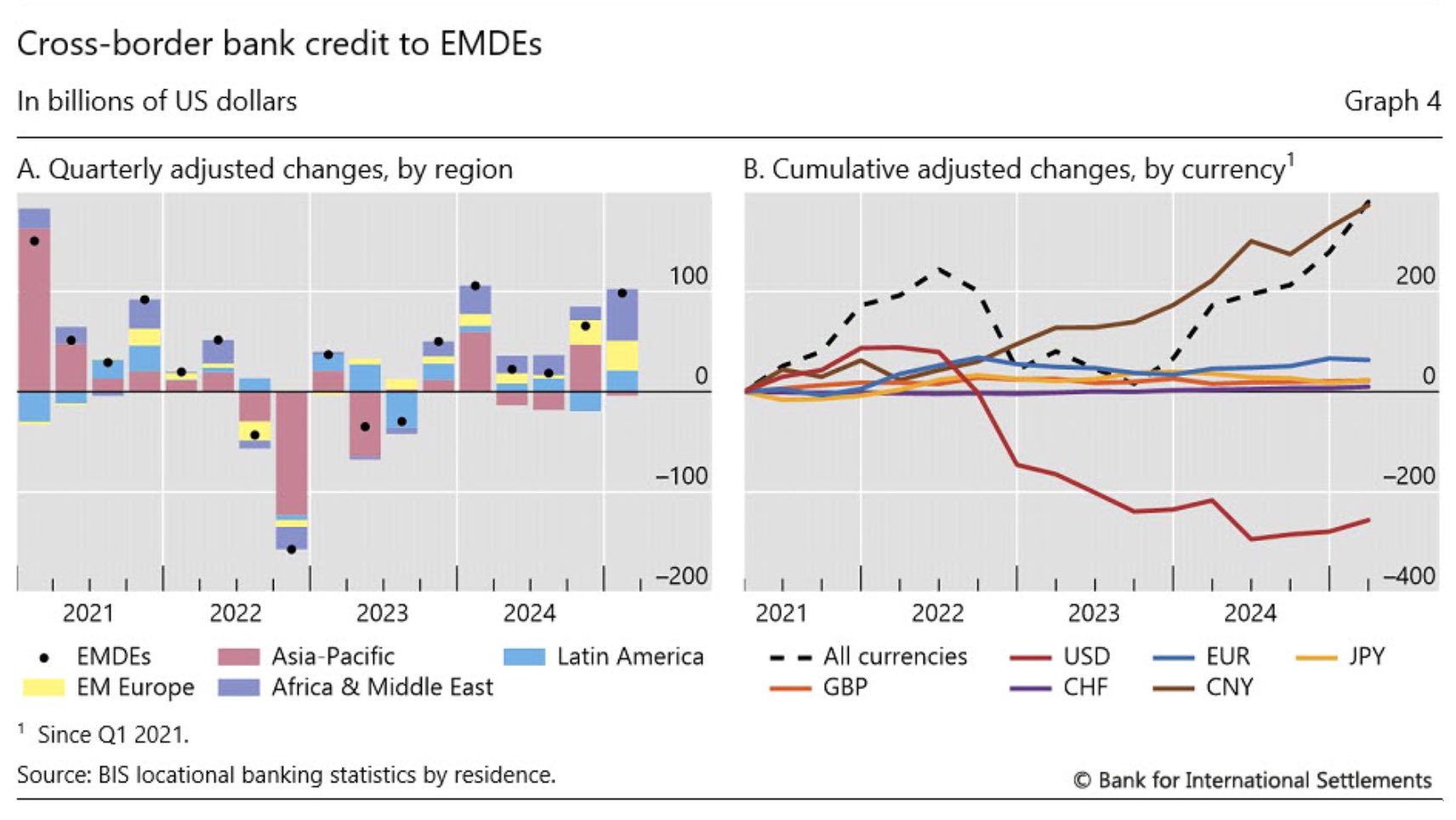

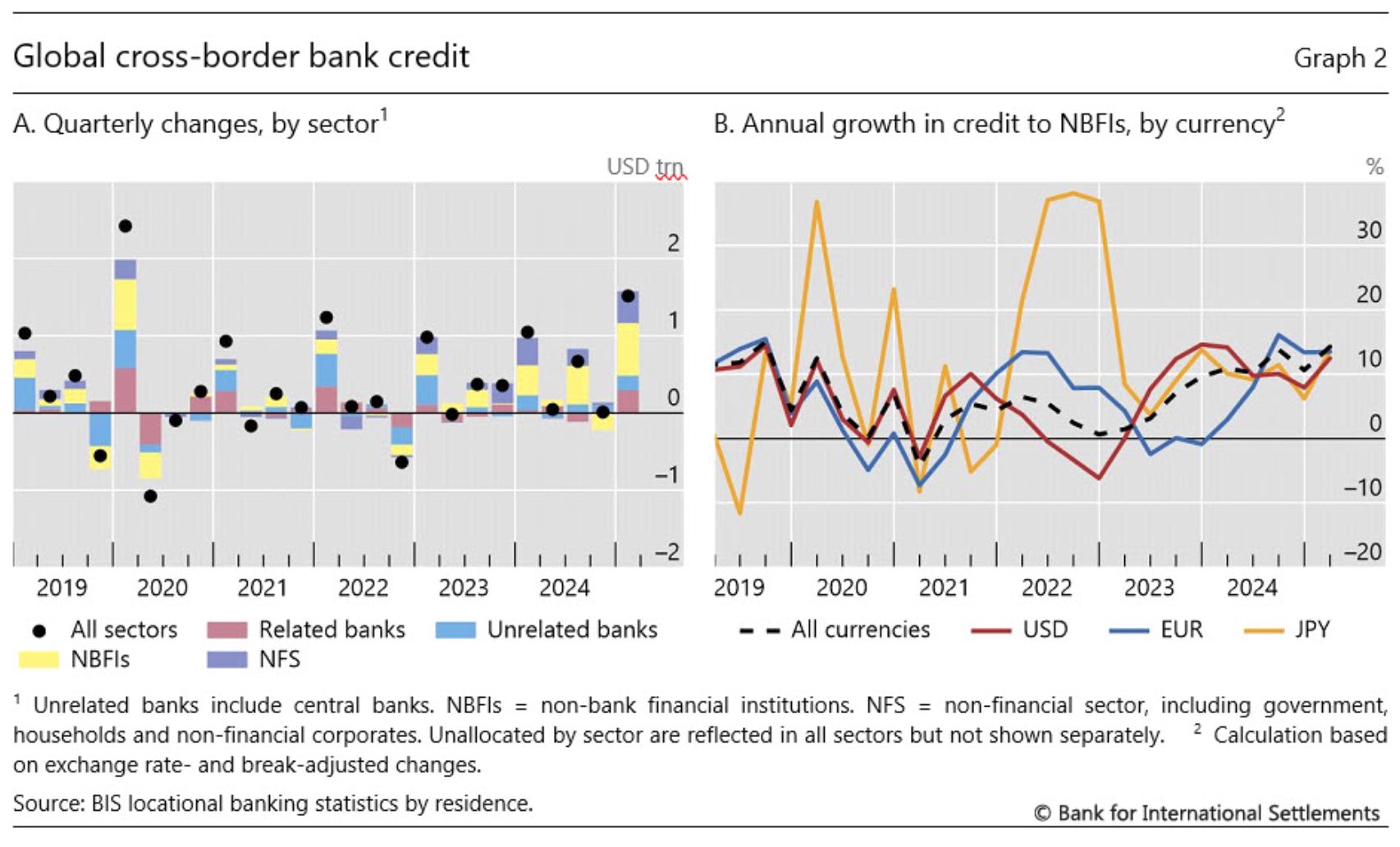

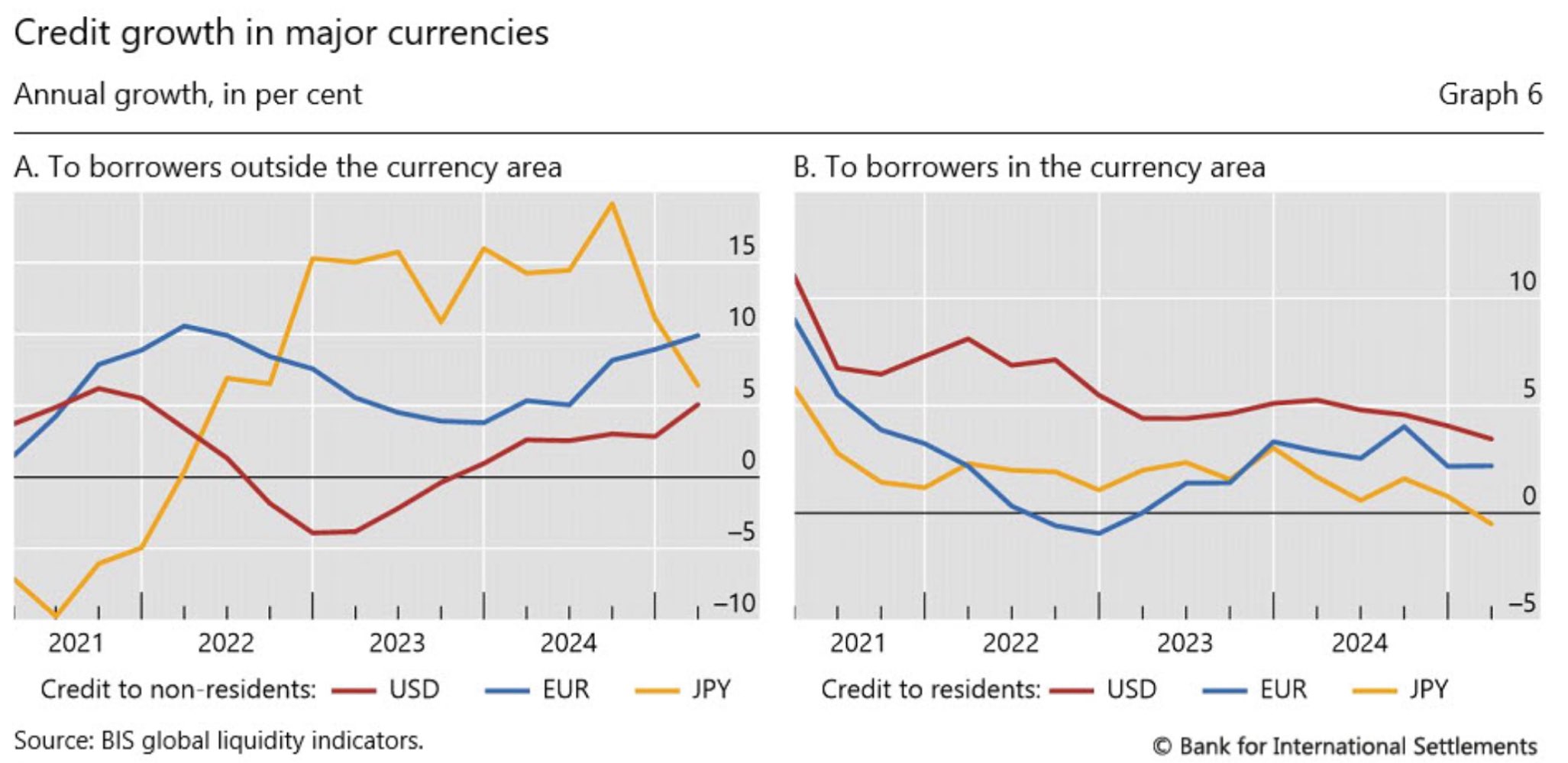

USD cross-border bank credit grew by $800 billion in Q1 2025

expect further increases for Q2 2025, due to the weak US dollar

renminbi has become dominant in credit growth since 2022

a move from US dollar & Euro denominated credit to Chinese Yuan-denominated credit

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

still, in the USA the Fed continues to dominate in importance

so it may not only be central bank setting the rates and affecting liquidity

for example, when US Treasury auctions bonds, they're both, temporarily reducing the effective amount of USD in circulation and providing more high-quanlity collateral

so a weaker US dollar tends to increase global USD liquidity

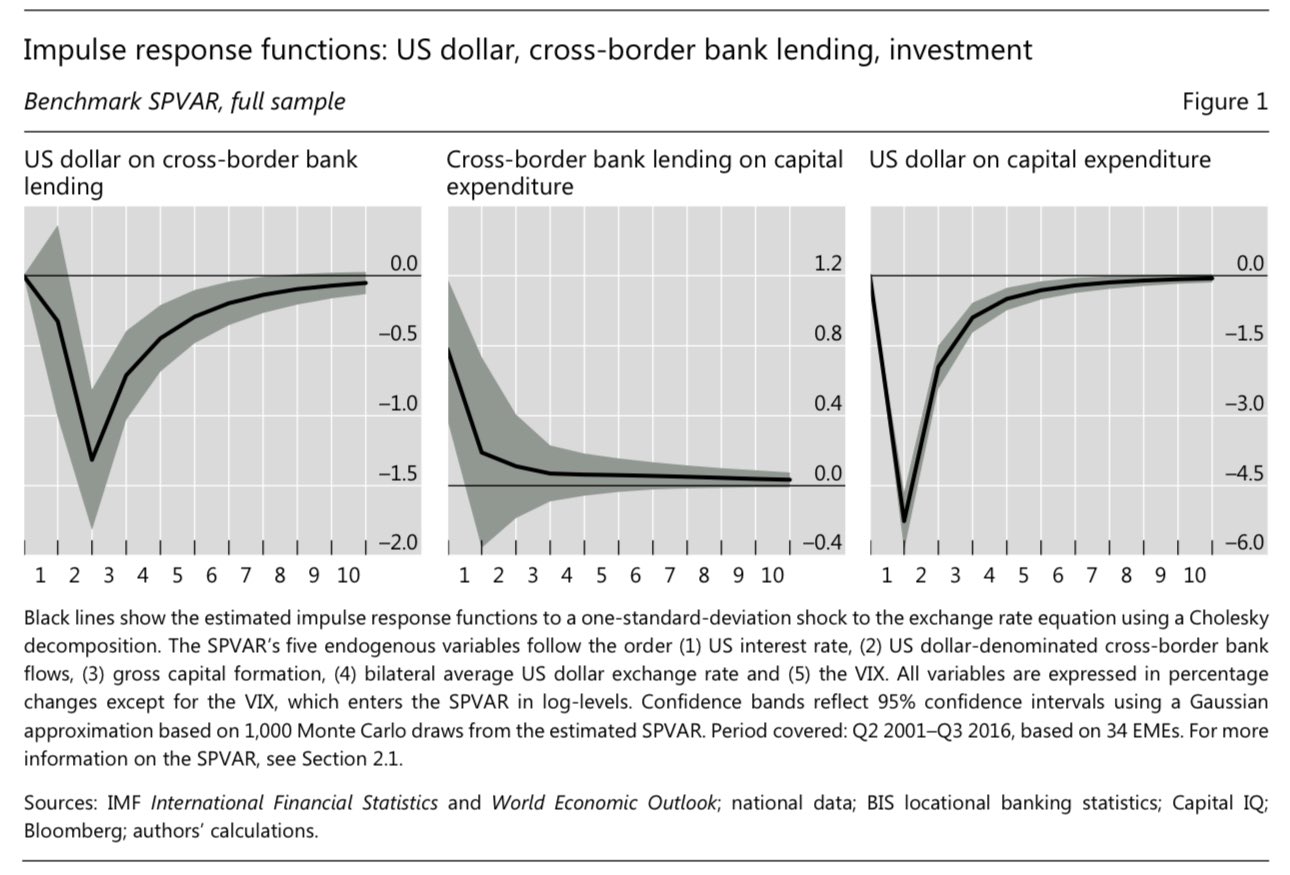

in the SVAR, one standard deviation of US dollar's appreciation leads to a fall in cross-border USD lending. it reaches its bottom after 6 months and then eventually recovers after 2.5 years if no new shocks arrive

bank's leverage ratios improve due to collateral appreciation, thus allowing them to borrow more USD

collateral here is the non-USD local currency, such as Yuan

weaker US dollar means more USD credit issuance abroad - here's why

foreign banks frequently borrow USD through wholesale markets with a local currency denominated collateral

when USD depreciates against a local currency, offshore USD credit now has a reduced debt service

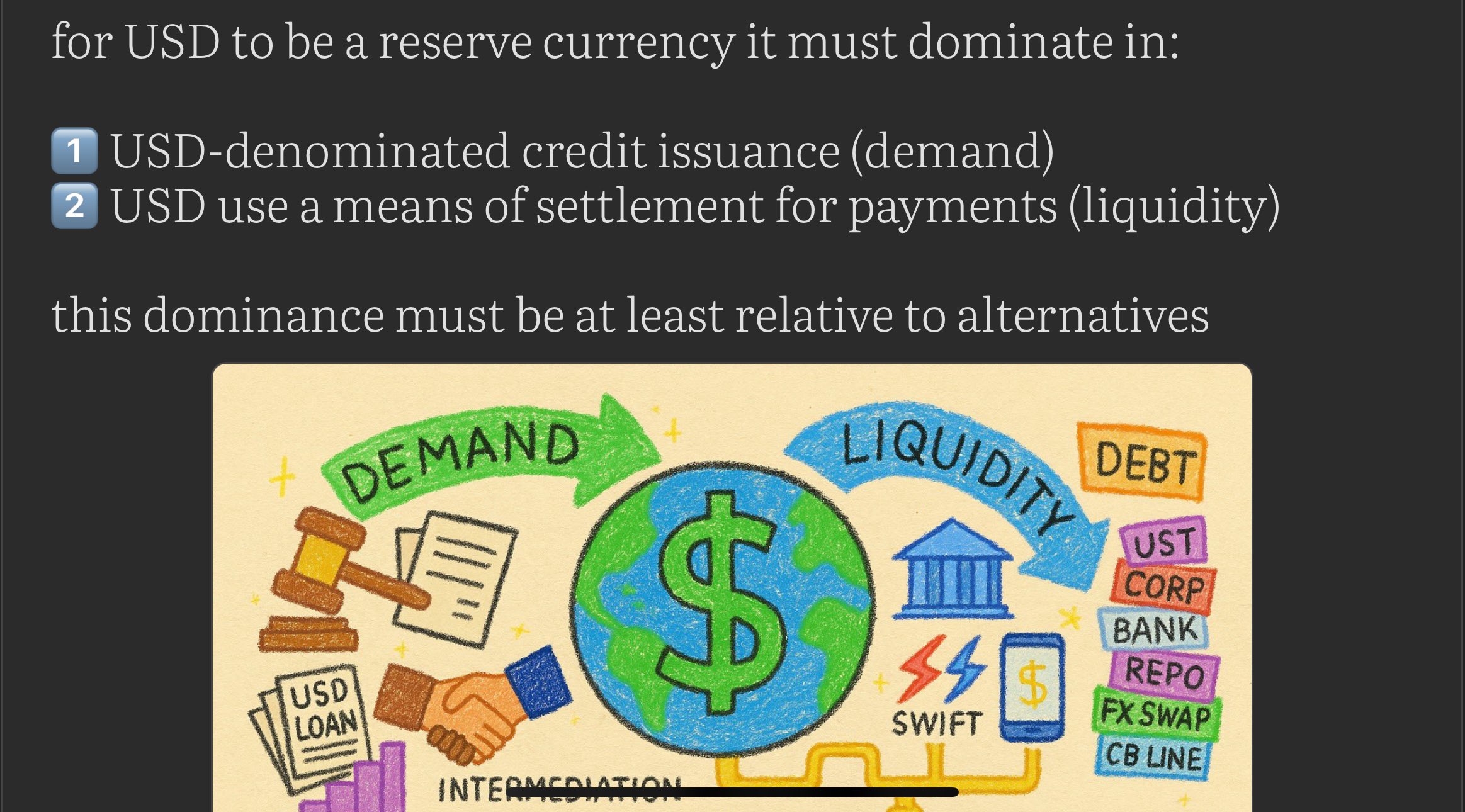

i wrote a thread about what it means for the US dollar to be the reserve currency from the perspective of demand and liquidity

you can read it here:

https://illya.sh/threads/@1754940239-1.html

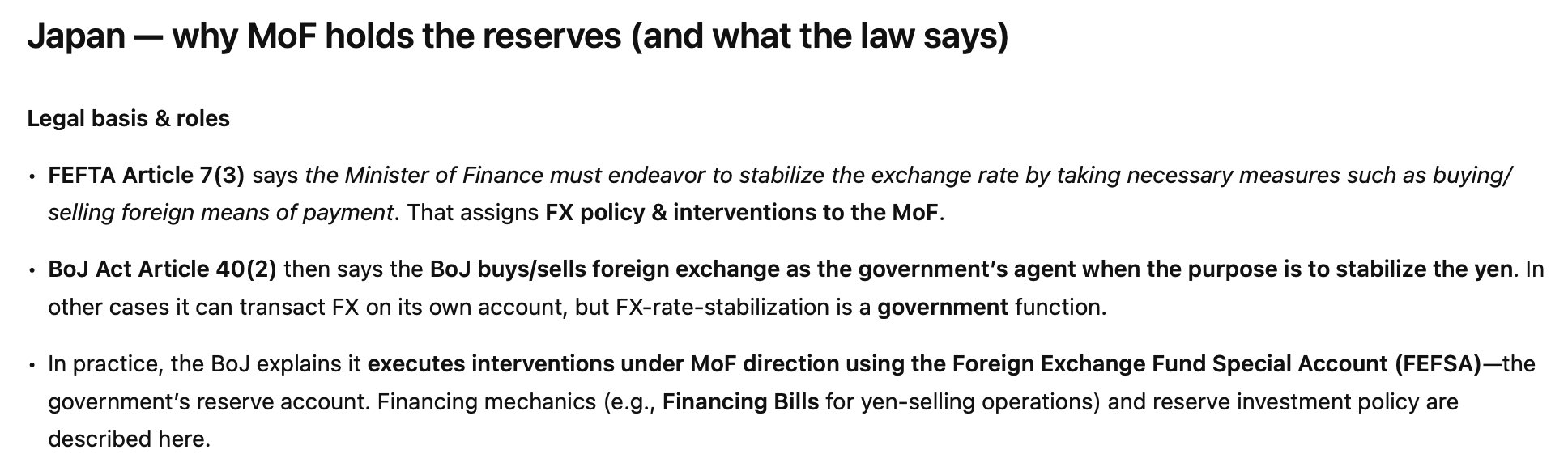

this is nothing unusual though - many governments do this, and it's mostly towards stabilizing the exchange rate with USD

to a large extent this is a result US dollar's reserve currency status and its dominance in use for all sorts of financial transactions

this is nothing unusual though - many governments do this, and it's mostly towards stabilizing the exchange rate with USD

to a large extent this is a result US dollar's reserve currency status and its dominance in use for all sorts of financial transactions

🇯🇵 Yen's exchange rate stabilization is a responsibility of the Minister of Finance (MoF)

MoF is also the holder of Japan's international reserves - not the Bank of Japan

so in Japan the government has significant responsibility for USD/JPY

gold is in the same price range as when the US dollar index was ≈97.7 on July 25th 2025

if DXY hits ≈97.1 - expect gold to retest ≈$3440. this time with a stronger support build up by price action

this could definitely be what pushes gold to a new all time high

i also wrote a thread explaining the importance of USD-denominated government debt for short-term funding/credit markets

remember that most of credit is issued to refinance existing debt and not for new financing

you can read it here:

https://illya.sh/threads/@1751726431-1

i wrote about how reverse repurchase agreements work and their importance in the global financial system in this thread:

https://illya.sh/threads/@1751561045-2

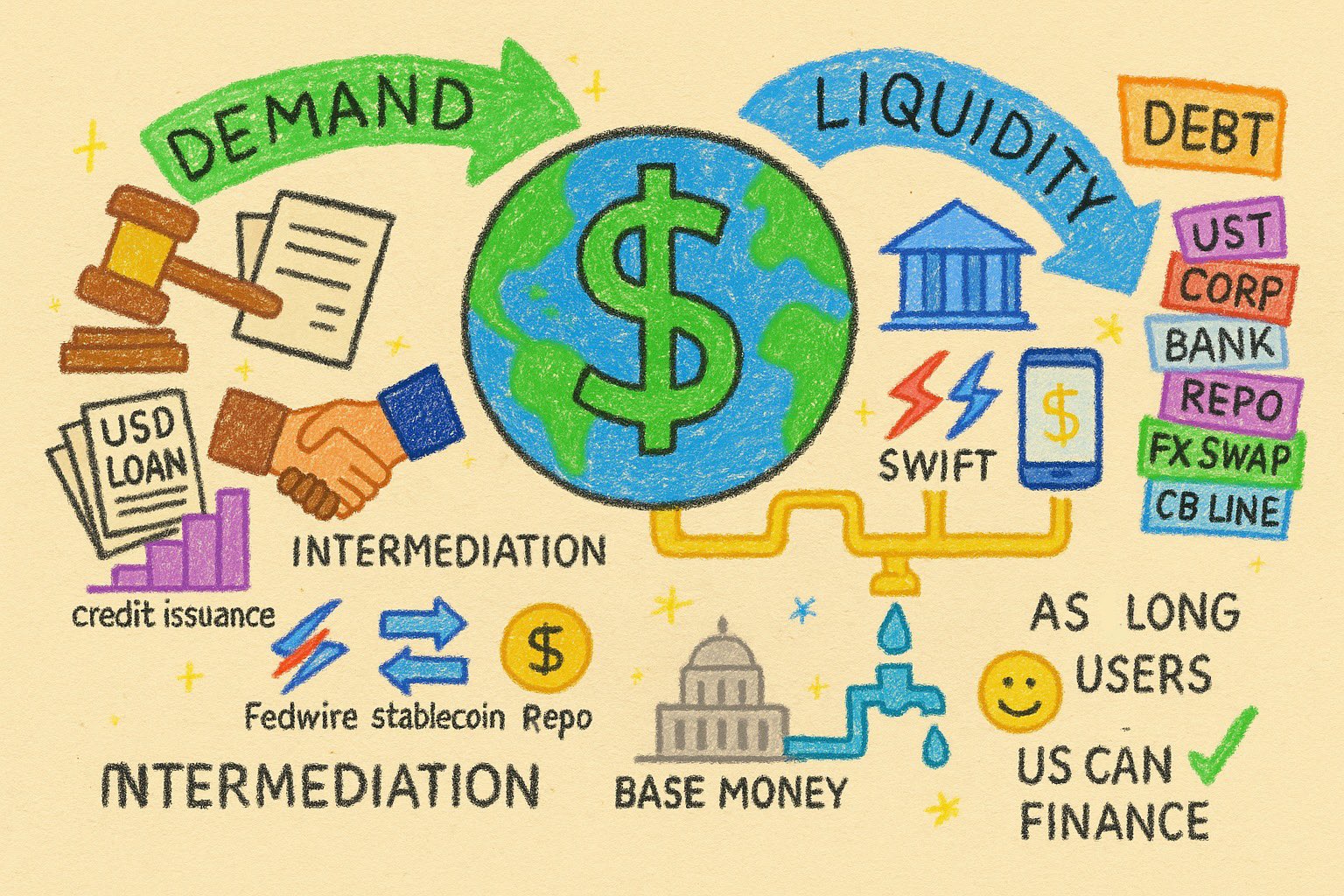

the US will be able to sustain their debt financing for as long as US government debt and US dollar dominate in demand

for as long as USD is the reserve currency - the US can finance its debt

in other words, as long as there's enough buyers and users - it's all good! 😁

debt includes all form, tenor and issuers of USD-denominated debt are included, both public and private

examples: US Treasuries, corporate bonds, commercial bank credit, epos, FX swaps, central-bank lines

liquidity means availability, thus it comes down to being able to:

1️⃣ access USD credit

2️⃣ settle payments in USD

this means balance sheet capacity and hybrid technological intermediation systems in place

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets