US dollar, DXY & FX market insights

High-frequency views on DXY, dollar funding, cross-currency basis and how USD trends shape global assets.

USD is the world's reserve currency, but what does that mean?

for USD to be a reserve currency it must dominate in:

1️⃣ USD-denominated credit issuance (demand)

2️⃣ USD use a means of settlement for payments (liquidity)

this dominance must be at least relative to alternatives

further deprecation of USD against Ruble

now back to July 4th 2025 levels

8 month later after my initial post USD index is down ≈8%

Bad news for #USD 👎

The value of a currency is a direct reflection of the organic demand for it. Sanctions will decrease the demand for US Dollar, via disincentives

Plus, it's the US consumer that will be paying for the tariffs, not the BRICS countries 🤷♀️

5 days ago I wrote that USD/RUB rate will fall. 5 days later it's down ≈2%

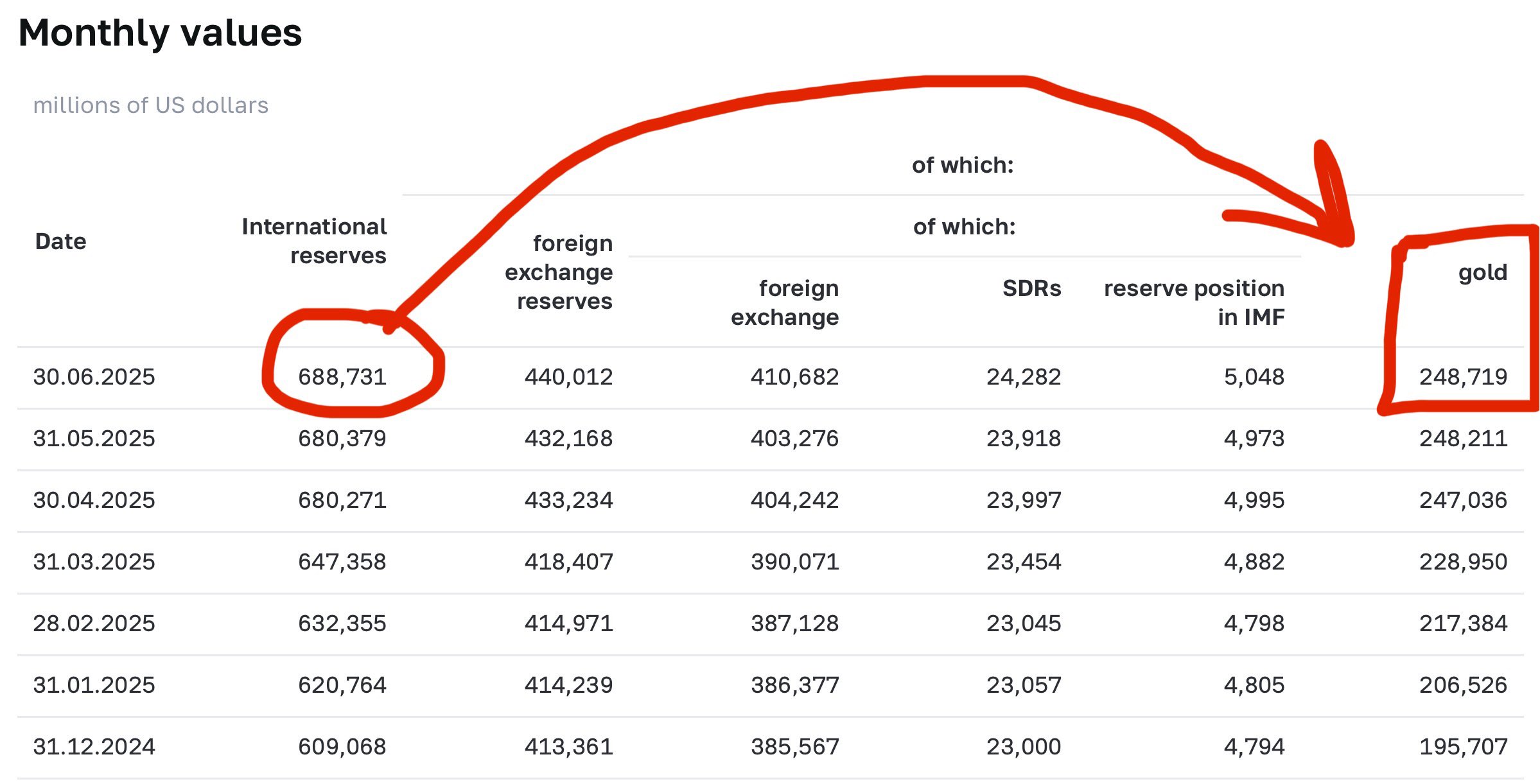

despite oil being down - gold is up

Ruble has hedge from multiple sides

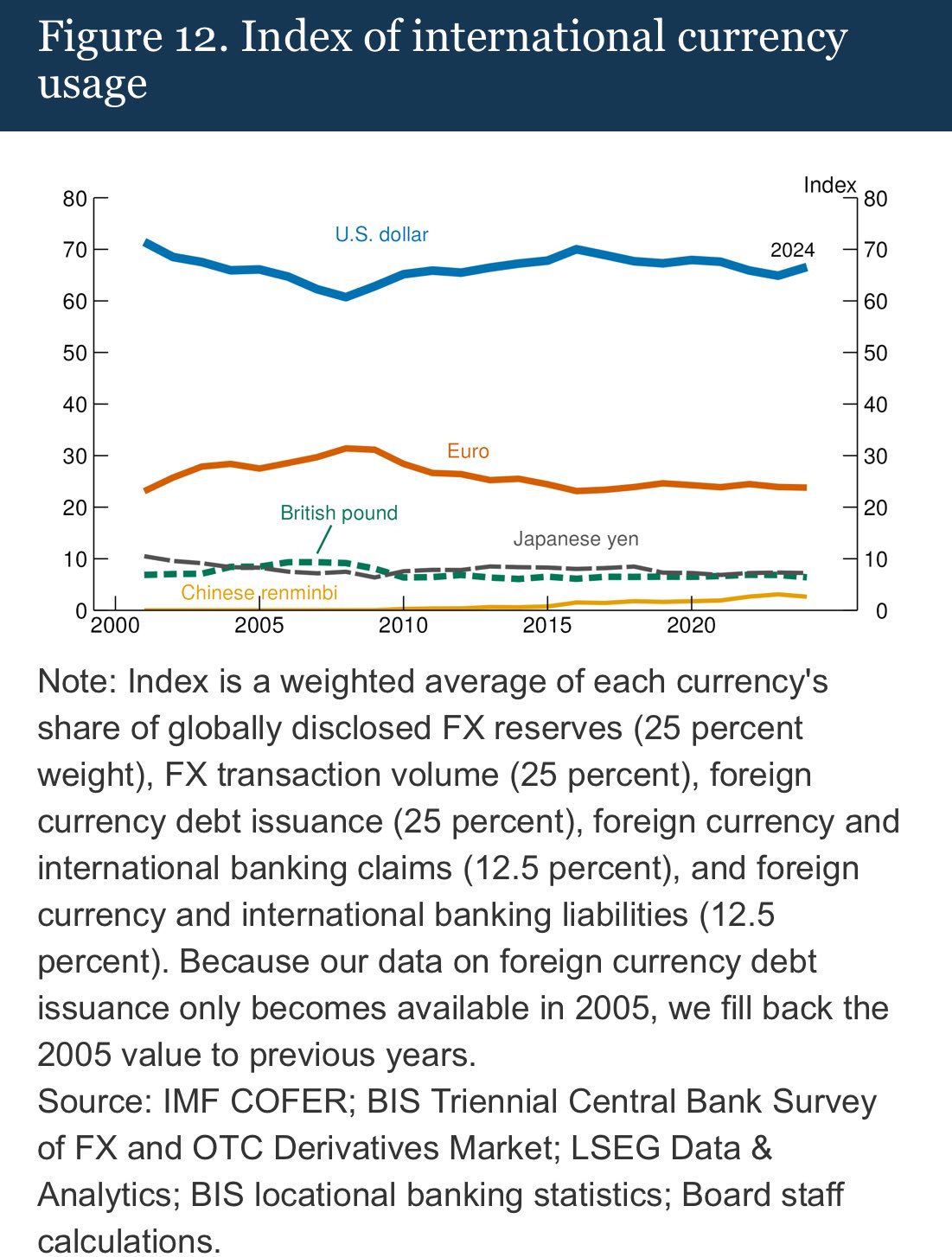

the 70% USD dominance here is as calculated by the Fed across the chosen 5 chosen buckets - with the end result being a weighted composite measure

so don't read this as a literal 70% of all cross-border transactions

🇺🇸 USD dominance is alluring, accounting for ≈70% of currency usage worldwide

even countries that do relatively little trade with US have most of their transactions done in US dollars

ex: 🇮🇳 India invoices 86% of its exports in USD, while only 15% of its exports being to US

🇺🇸🇷🇺 USD/RUB rate already fell to July 24th close, below 80

although it's also important to note that there are several factors at play - USD index is also down today

despite oil down - gold is up. this is about the monetary policy of Russia and their balance sheet structure