US dollar, DXY & FX market insights

High-frequency views on DXY, dollar funding, cross-currency basis and how USD trends shape global assets.

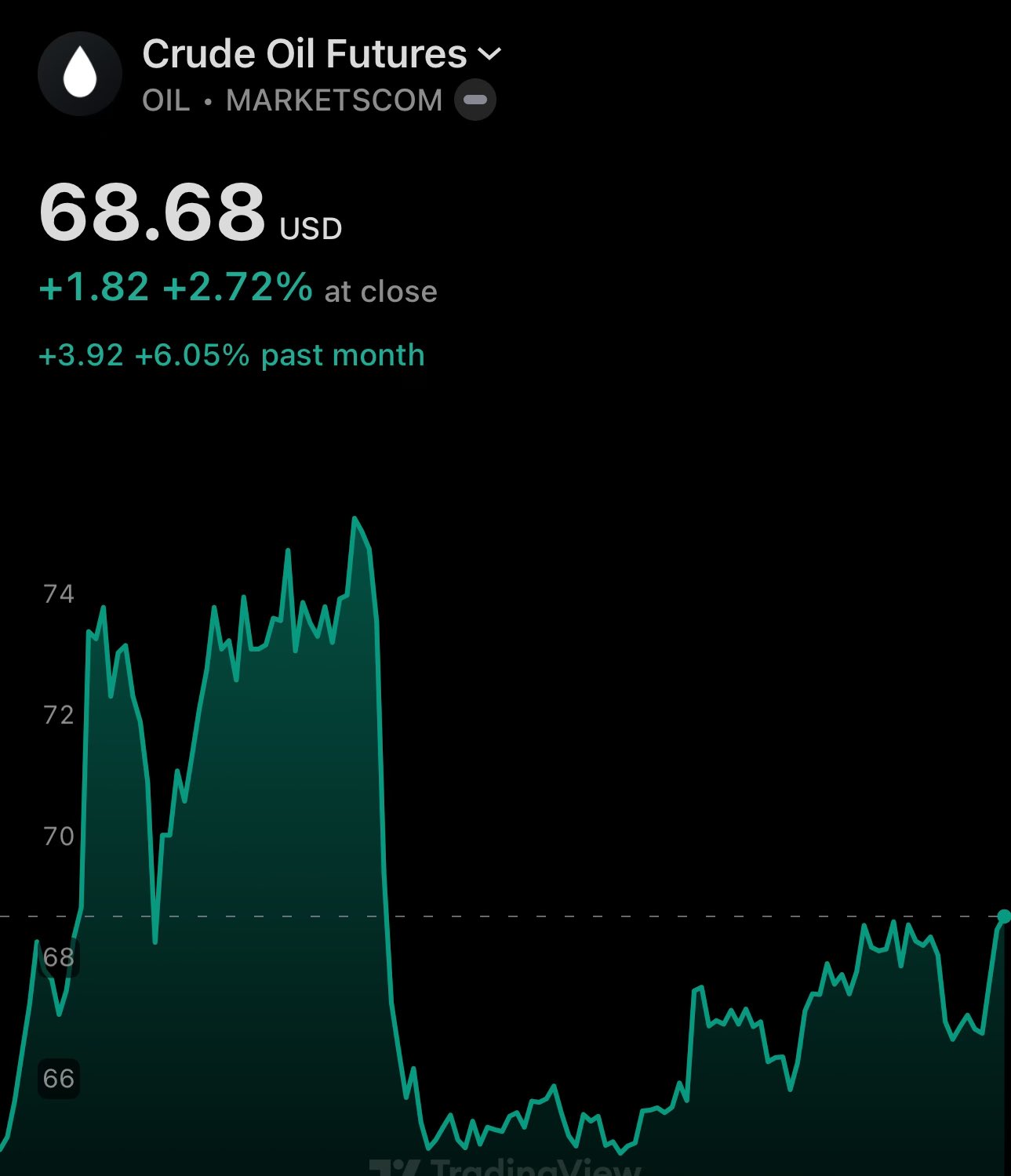

🇷🇺 oil up is GOOD news for Russia & Ruble

every surplus above $60/barrel of Urals oil increases FX reserves in NWF (Yuan or gold) - an interplay between MoF and CBR

exporters pay taxes in Ruble - so higher buying pressure

mark my words:

👉 you'll see USD/RUB exchange rate fall

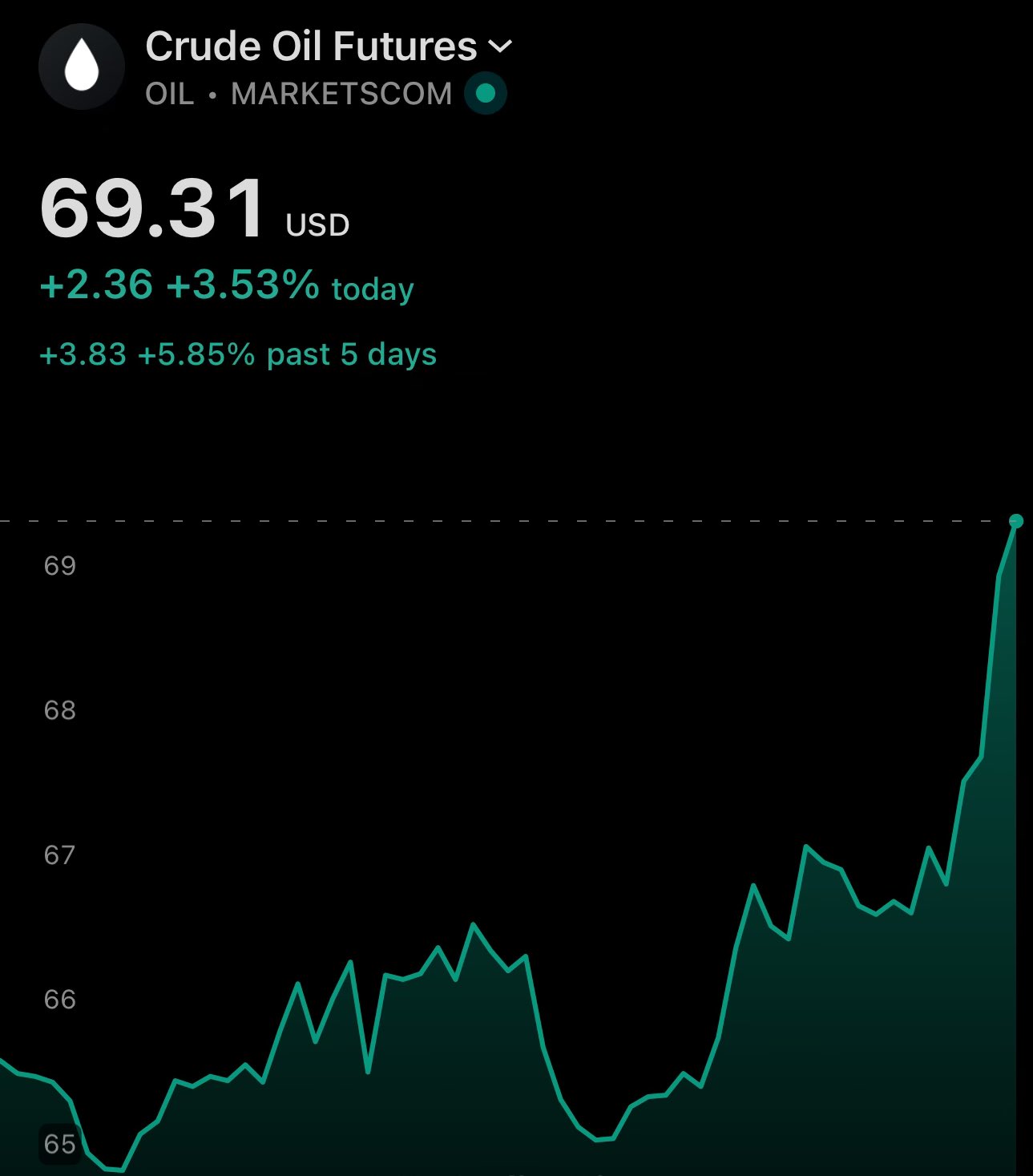

🚨🛢️ crude oil up to almost $70

and this while the US dollar index is also up

over a month and a half ago I told you that it's going to resume the uptrend - and this thesis has been confirmed again and again

wait & watch what comes next - I wrote about that as well 😁

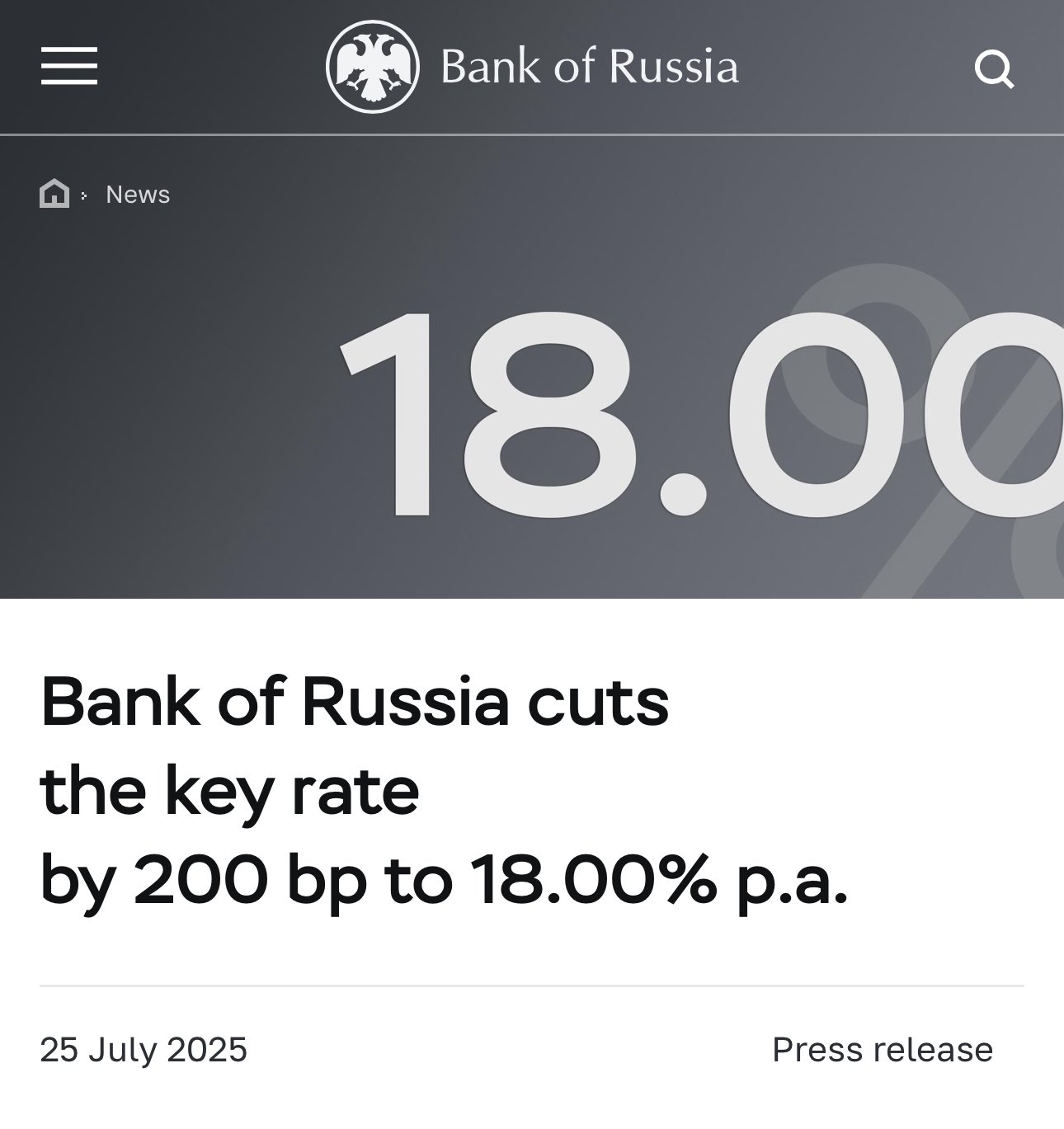

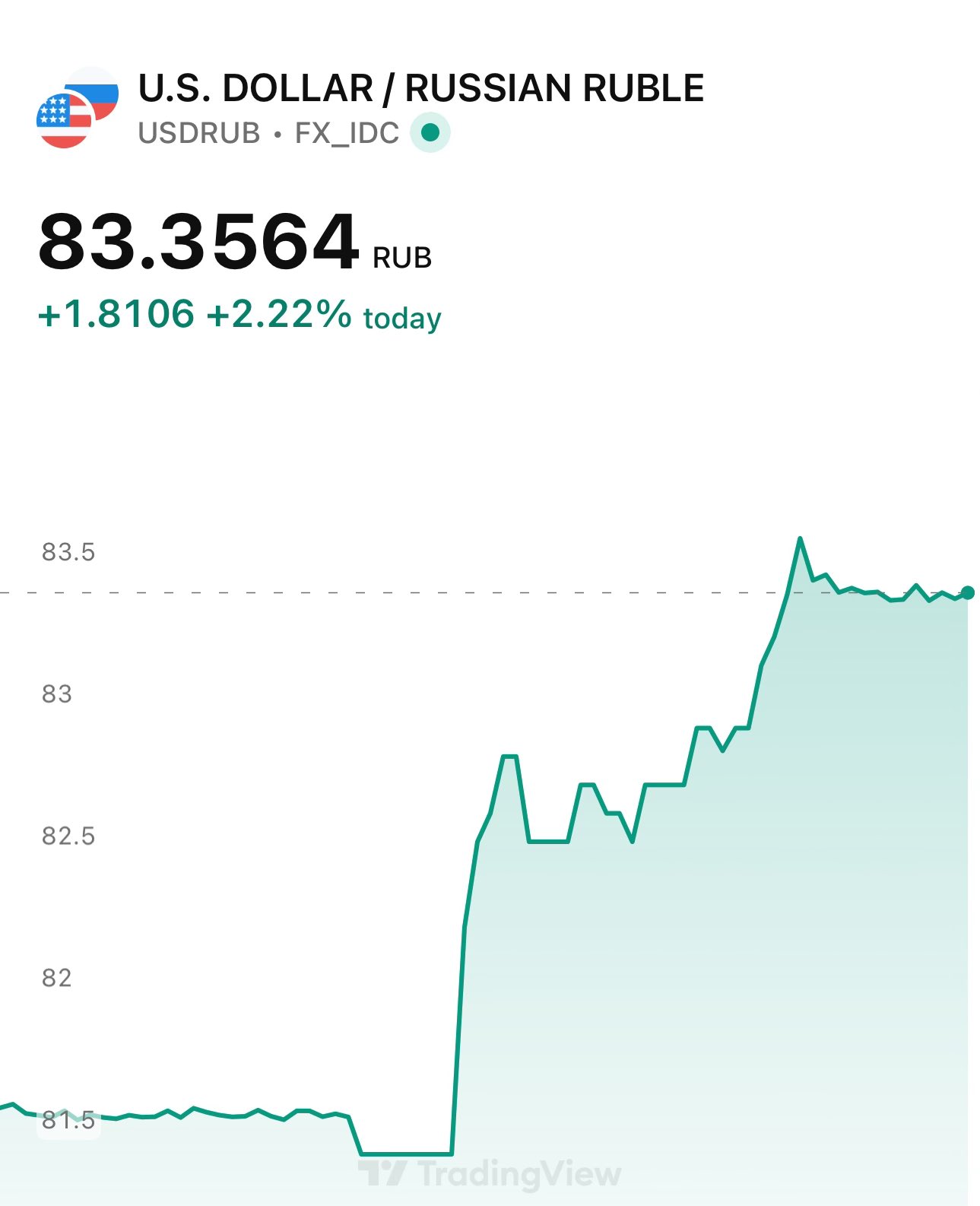

🇷🇺 3 months of Ruble gains against USD erased in 5 days 😄

but also contextualize it with the overall increase in the US Dollar Index over the past 2 days

👋 hello, volatility

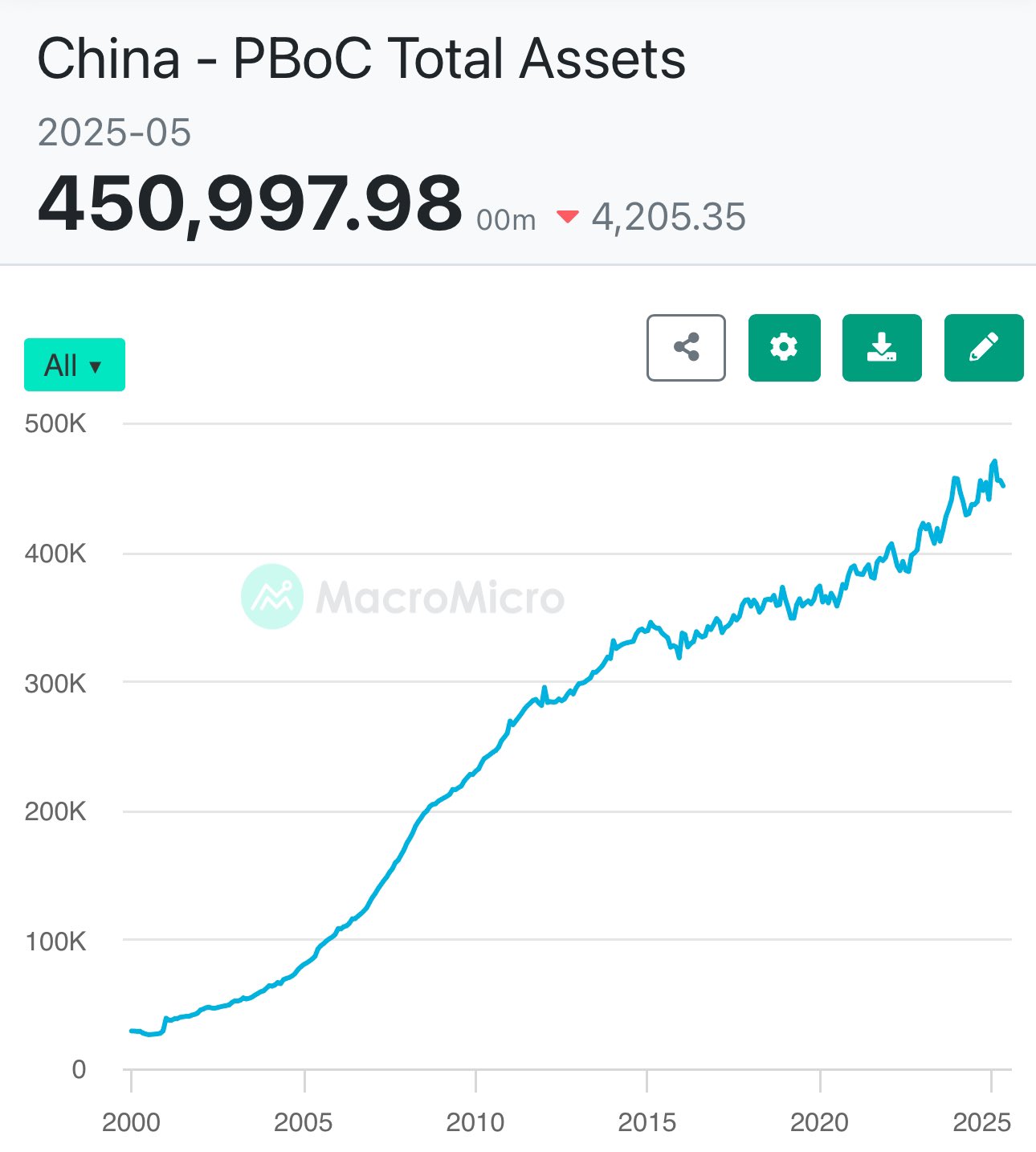

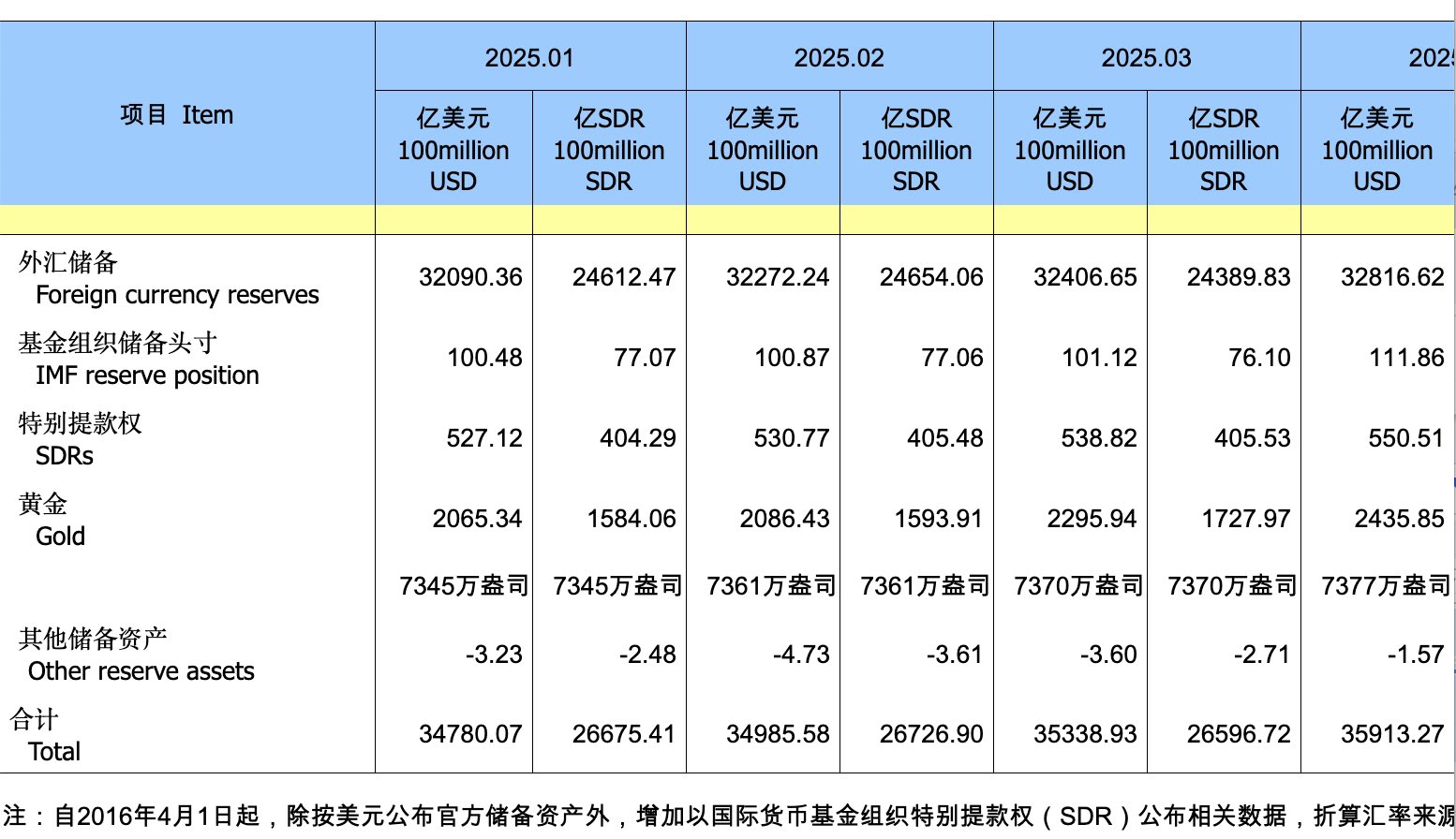

🇺🇸🇨🇳 USA & China are the global liquidity drivers in financial markets

since 2000, each injected ≈$6 trillion of public money into markets. that's ≈40% of global liquidity 🤯

in 2025 - China is leading with injections

weaker USD + FED rate cuts & QE allow China to print Yuan/renminbi without a capital runoff

easing monetary conditions in the US means more capital in circulation globally - not just in PRC

thus, relative inflation is kept under more control

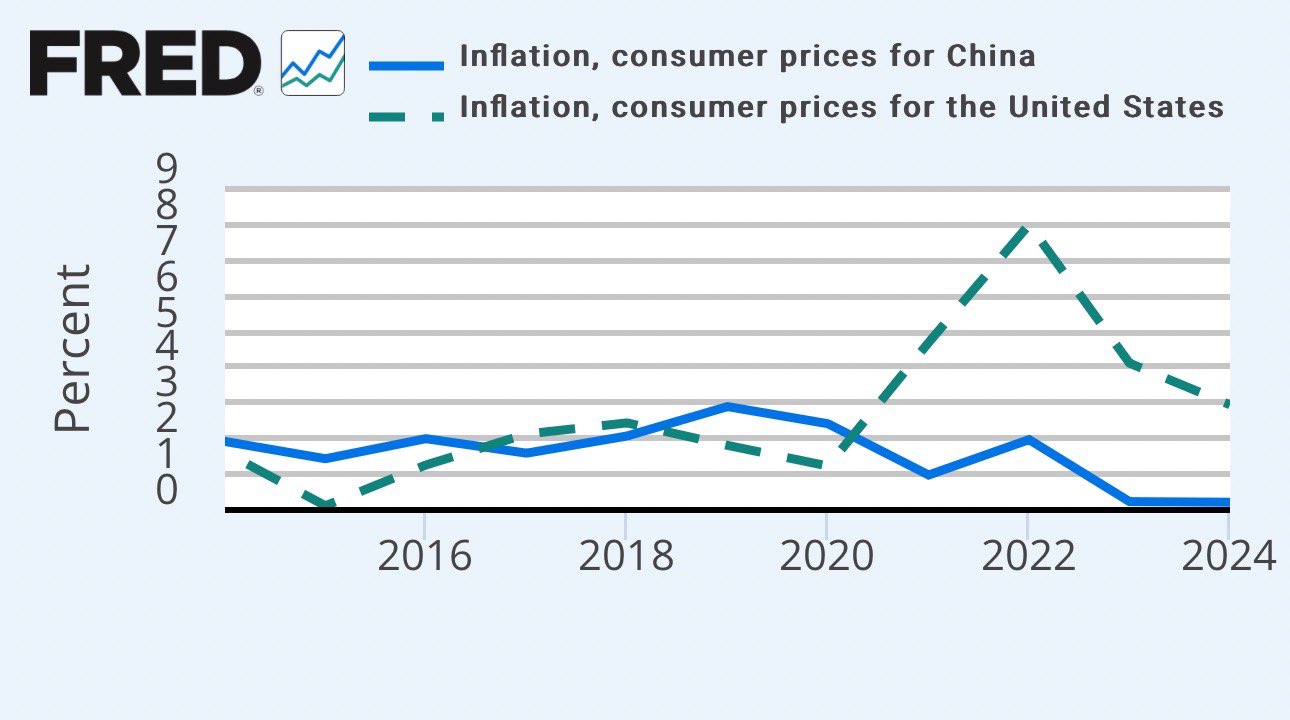

🇨🇳🇺🇸 china's CPI is below US's ⬇️

🇨🇳 china's central bank uses USD value as a key driver in economic policies

the monetary easing policy is adjusted by PBoC based on the dollar's trend - up or down

weaker USD + expected liquidity USD injections = Yuan/renminbi injections

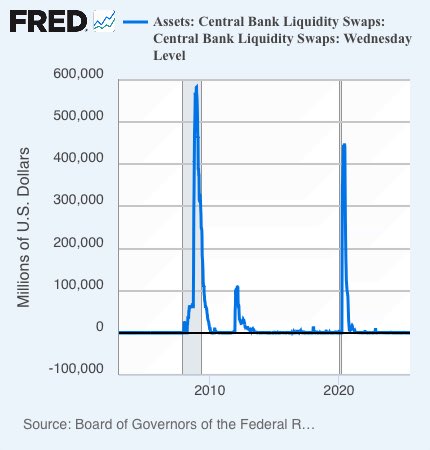

💧FED swap lines = infinite liquidity pool

👉 here's how:

1️⃣ central banks exchange their foreign currency for USD, 7-80 days later, they reverse the exchange at the same rate + fee

2️⃣ central banks then lend these new USD to commercial banks

thus, USD demand is met

central bank balance sheets are an underrated resource for understanding the global liquidity moves

if you're following my posts - you already know that

rising US bond yields, ruble & gold

falling USD

i've been warning about it for months

90's style data = massive alpha 😂⬇️

USD decline prediction was spot-on ✅

2 months later and US dollar index just bounced off from 97

the past 6 months have been a downtrend for $DXY

Falling US Dollar index played out exactly as expected

2 months later and it's down another full point

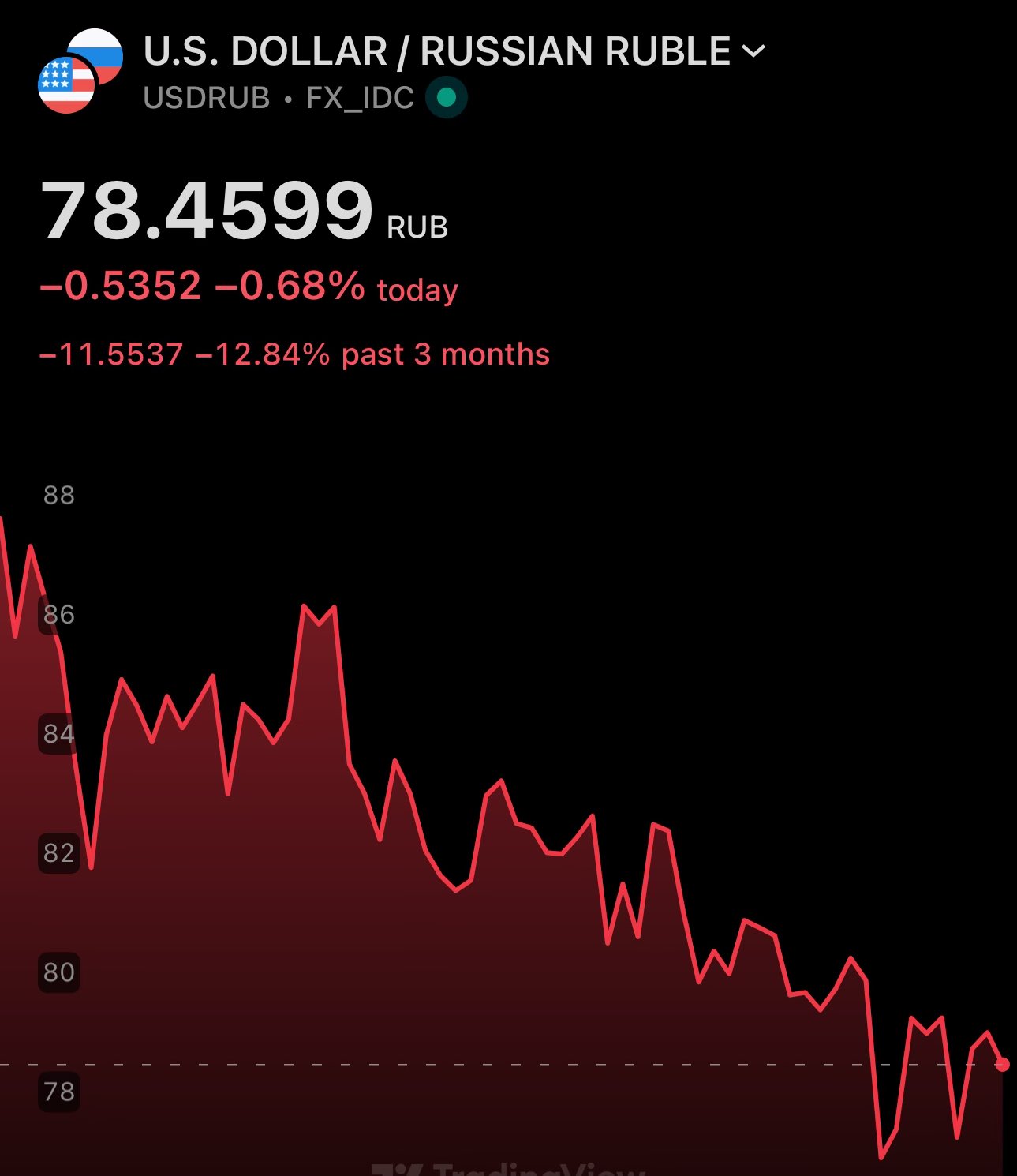

The Ruble thesis remains valid

Up ≈13% on the USD in the past quarter

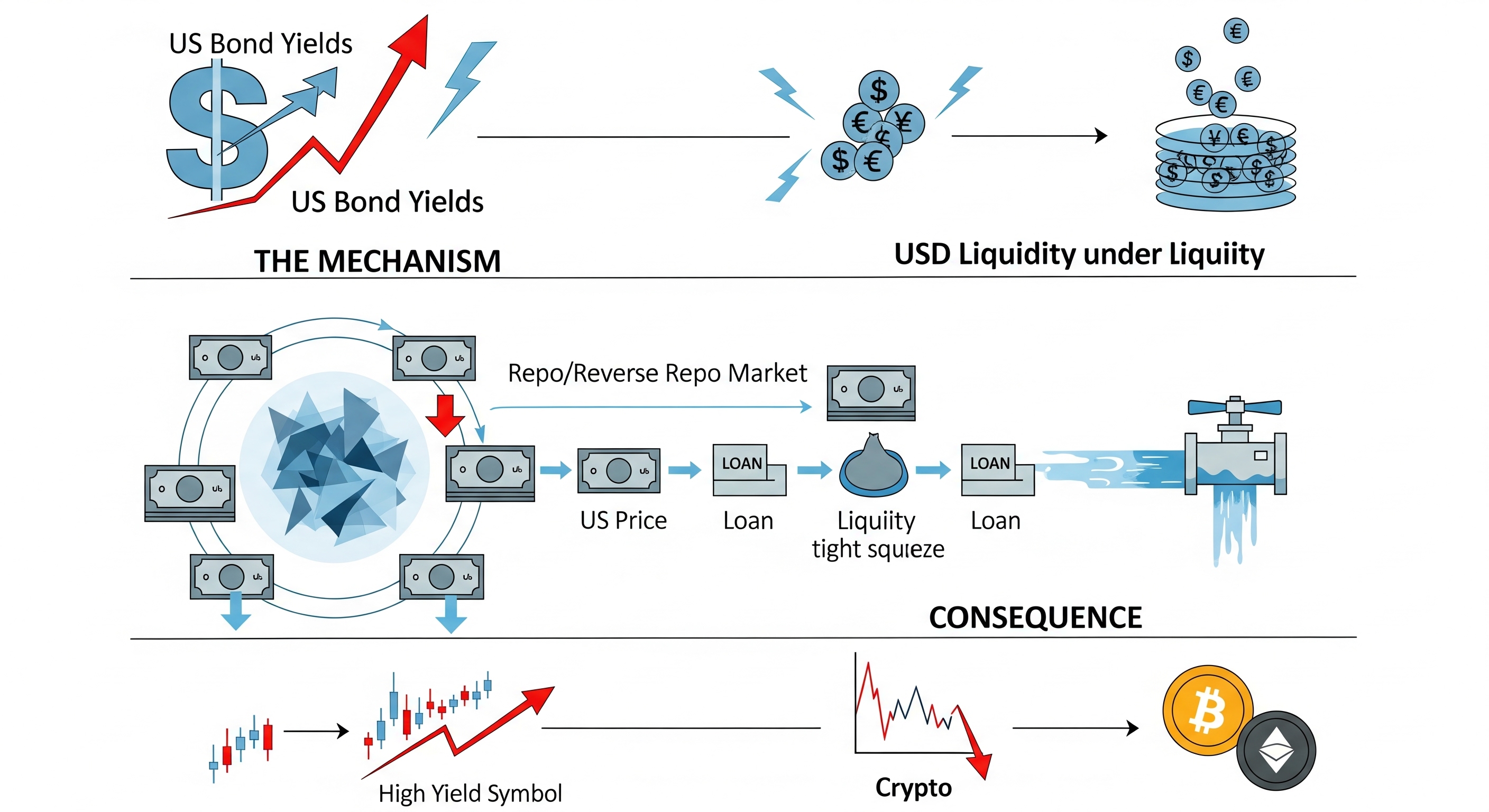

⚡️ US Bond yields directly affect USD liquidity

Here's how 👇

1️⃣ Repo + reverse repo market provides $5 trillion of liquidity

2️⃣ US bonds represent ≈70% of collateral

3️⃣ Lower bond prices means smaller loans, leading to a liquidity squeeze

🇺🇸 US bond yields are at their ≈2006 levels

🏦 Current FED Funds rate is about the same as it was in '06

💰 The US Dollar Index is significantly higher today than in '06

High volatility in the bond market became a norm. Volatility & risk go hand-in-hand

Concerning!

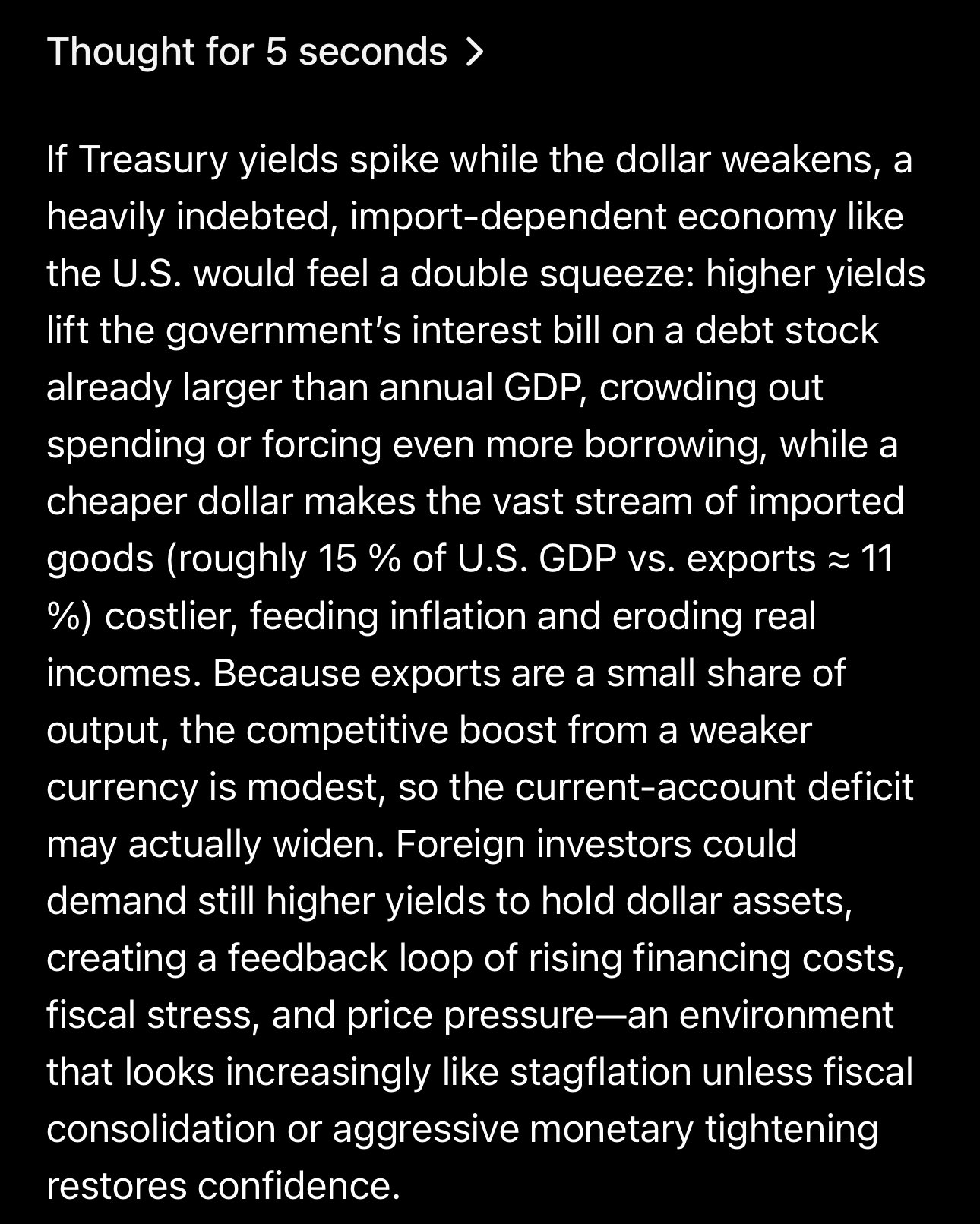

I asked ChatGPT o3 what will happen to the economy of the US, if USD index goes down & Treasury bond yields go up

It correctly pointed out that for a heavily indebted net importer - these are not good news

However, the risk is far beyond than just stagflation ⬇️

🇷🇺 Ruble outflows into USD 🇺🇸

A lot of liquidity moved from RUB back into USD. This is also telling by the rebounded USD index

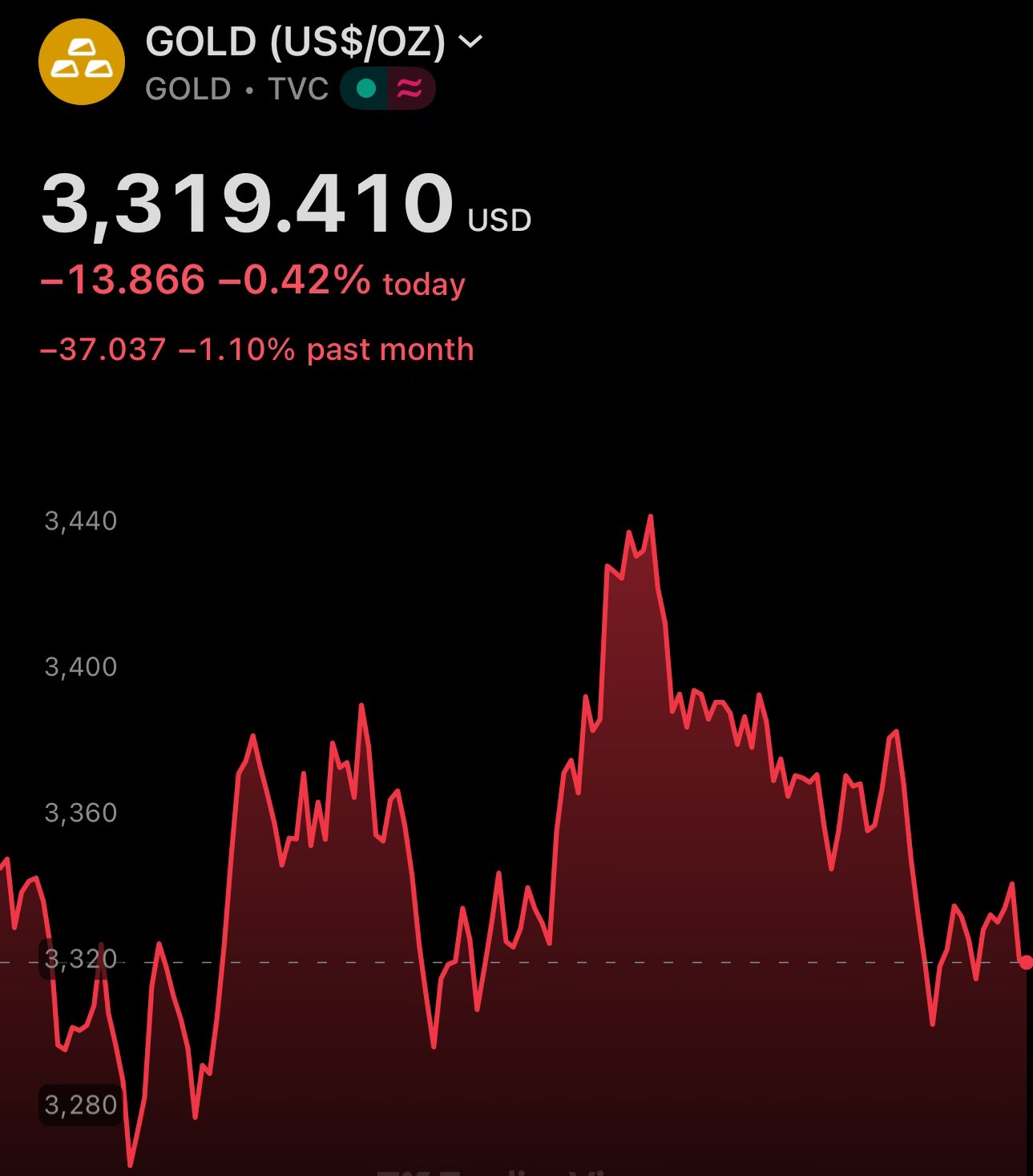

But gold will appreciate further. Russian Central Bank's massive gold reserves will pay off

Upwards retracements for US Dollar Index are normal

$DXY fell to ≈98.3 as I previously predicted

That whole area is a monthly support level, thus a source & trigger for massive amounts of liquidity

It's not only FOREX, but also the world reserve currency

🇺🇸UPDATE: USD Index in fact did NOT enjoy this

#DXY down over 1% today, currently at 98.3

It's almost like aggressively weaponizing the currency erodes the trust in it. Who knew!

🇺🇸 USD index bearish/in a downtrend

5Y timeframe weekly chart shows lower highs & lows

Ever since Trump took office, every $DXY weekly candle has been red

Greatest USD economy in history 🫠

🇷🇺 Ruble correlates with gold, becoming a hedge against USD

USD falls against both, Ruble & gold

Russian Central Bank has been continuously increasing their gold holdings, which are currently more than 1/2 the size of their foreign currency reserves & 35% of int'l reserves

🇺🇸🇷🇺 USD is TANKING against Ruble

… on a daily basis 😳

It's only partially tariffs. This has been a trend even prior to them

Russia loaded up on Gold & sold off their US securities. Trade with US is negligible

Russia self-administered an immunity shot

🇺🇸🇷🇺 USD/RUB dipped under 82 😳

Combine that with $DXY downtrend & a concerning picture for USD emerges

🚨US Dollar Index going to ≈98.3

Current price is a strong monthly level

The next destination is low 98's