1 oz of Gold: Production Cost and Miner Profit

1 oz of Gold: Production Cost and Miner Profit

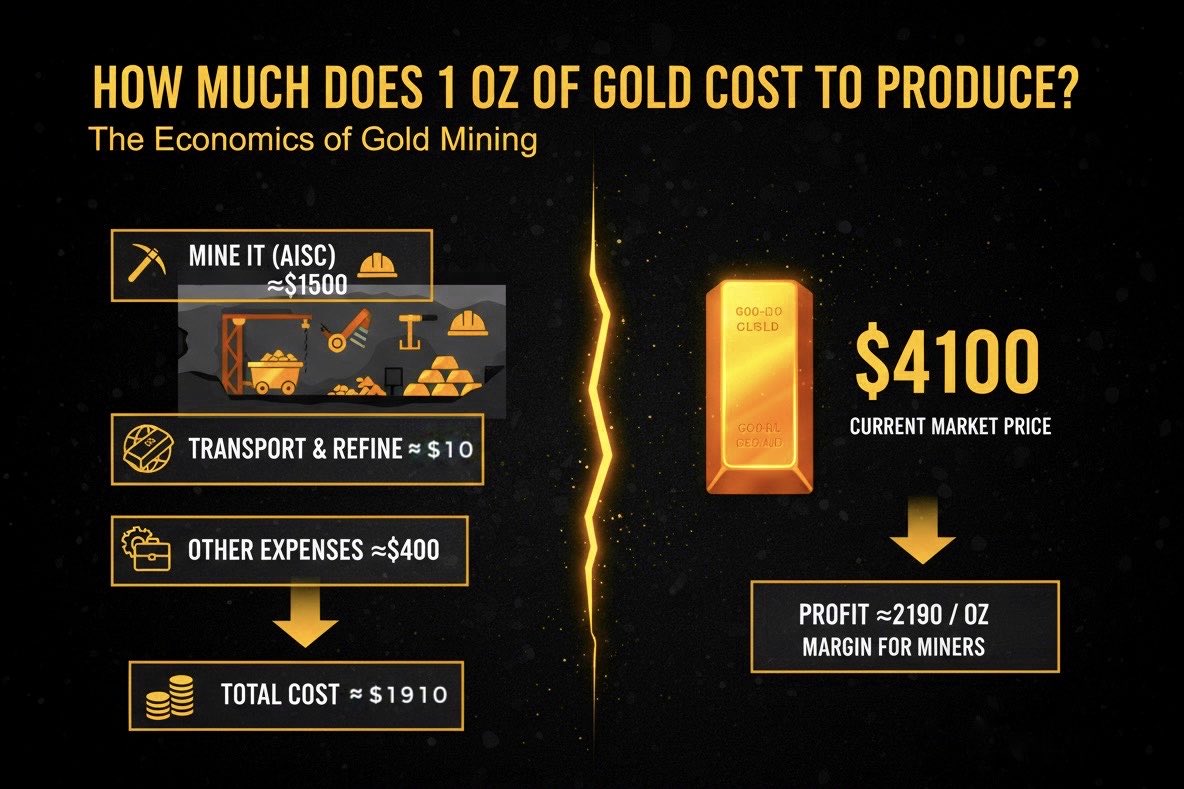

1 oz of gold costs ≈$1500 to mine (AISC), ≈10$ to transport and refine and another ≈$400 in various other expenses.

In total, that sums to about ≈$1910 to get 1 ounce of gold from the ground to bullion gold bar.

Currently, gold trades at ≈$4100/oz (when you're reading this it's probably much higher 😄). This means there is about $4100-$1910=$2190 of margin on each ounce of refined gold. Almost all of this margin on the sale of an ounce of gold is pocketed by gold miners.

Let's compute the profit per ounce of gold from the perspective of a miner. Gold miners generally sell gold to refineries at a fixed haircut over the spot price. This haircut is generally very small, ≈$10 which accounts mainly for refining and treatment costs. So with the numbers above (also see attached image), gold miners are making a profit of $4100-$(1500+400+10)=$2190 (the same number we computed above).

The larger the premium/gap of gold's spot price over its production costs, the larger is the profit for the miners. As the cost of labor and industrial production increases due to global monetary debasement, so will gold production costs. The same monetary debasement, combined with strong demand for gold will push its price further up.

In the next 2-3 years, I expect gold price to increase by a larger proportion than gold mining costs, as gold is under several positive price pressure points (central banks, USD alternatives, monetary debasement, etc). Thus, the margin over mining costs should remain high, leading to a sustained high profit per ounce of gold for miners.

This is why gold mining stocks are currently a great investment. The same is true for other miners, such as silver.