⬇️ My Thoughts ⬇️

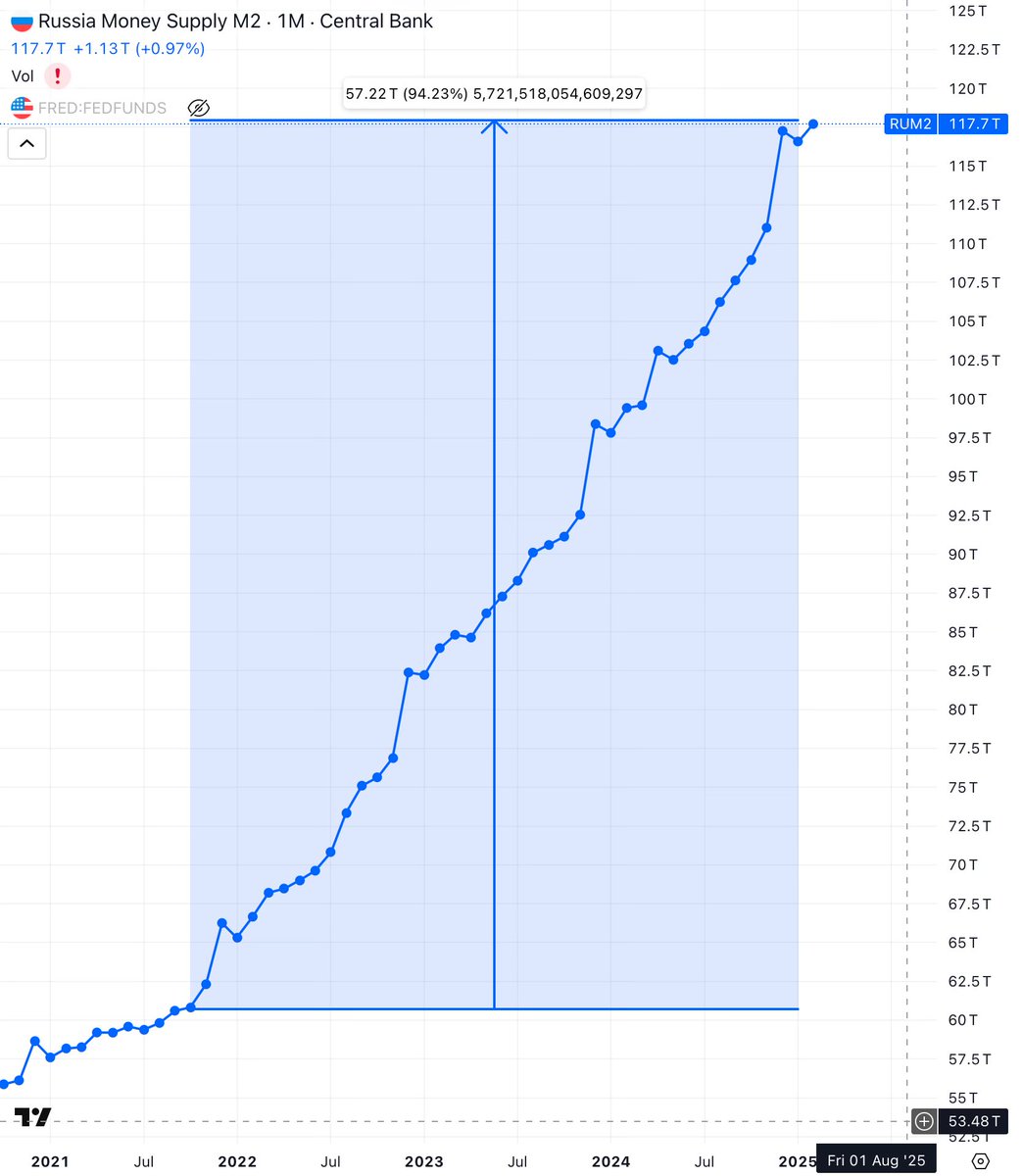

If you think 🇺🇸USD M2 is bad, look at 🇷🇺Russia's

In 3 years, Ruble DOUBLED in supply. Up by a 100%

How come despite this, Ruble maintained its value in FOREX?

The answer is GOLD, more specifically its expansion in the balance sheet of Central Bank of Russia

It works 🤷♀️

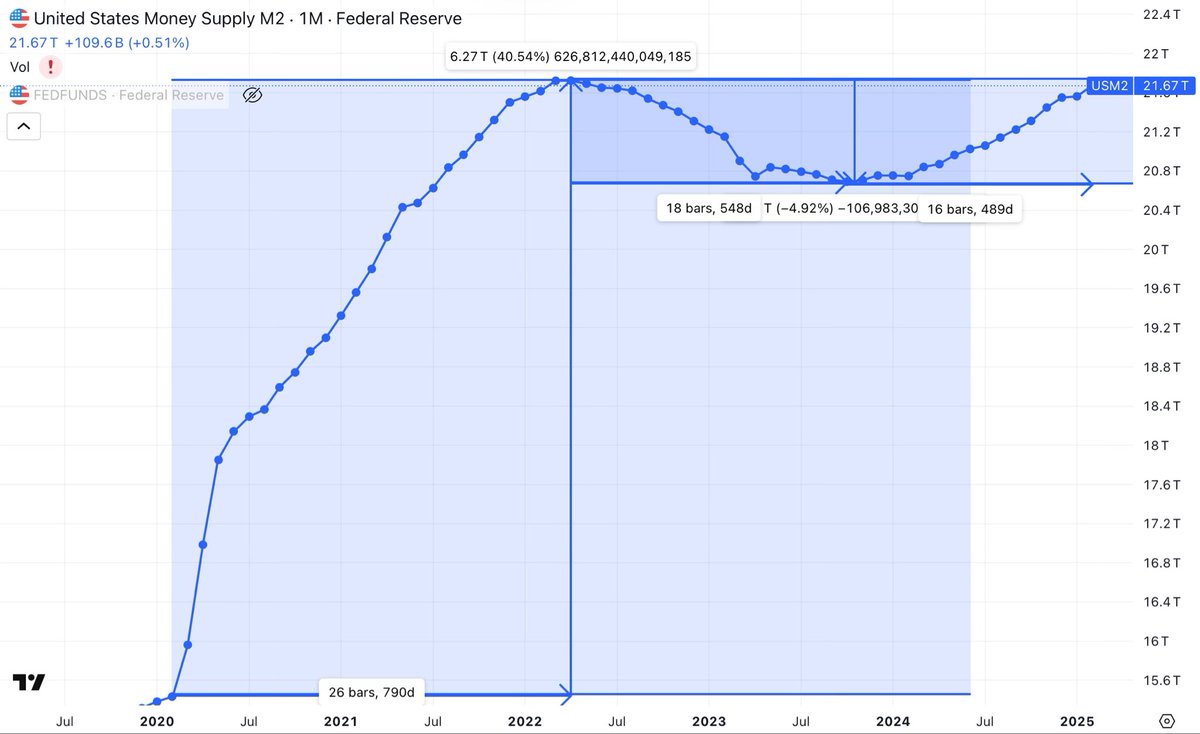

🚨🇺🇸USD M2 Money Supply

⬆️ 790 days to increase M2 by $6.3T

⬇️ 550 days to decrease M2 by $1.1T

⬆️ 500 days to increase M2 by $1.1T

⏯️ QE never stopped, it merely paused

When inflation is blamed on tariffs, keep this in mind

🚨🇺🇸 USD M2 Money Supply is almost back at pre-interest rate increase levels

That QT didn't last after all 🤷♀️

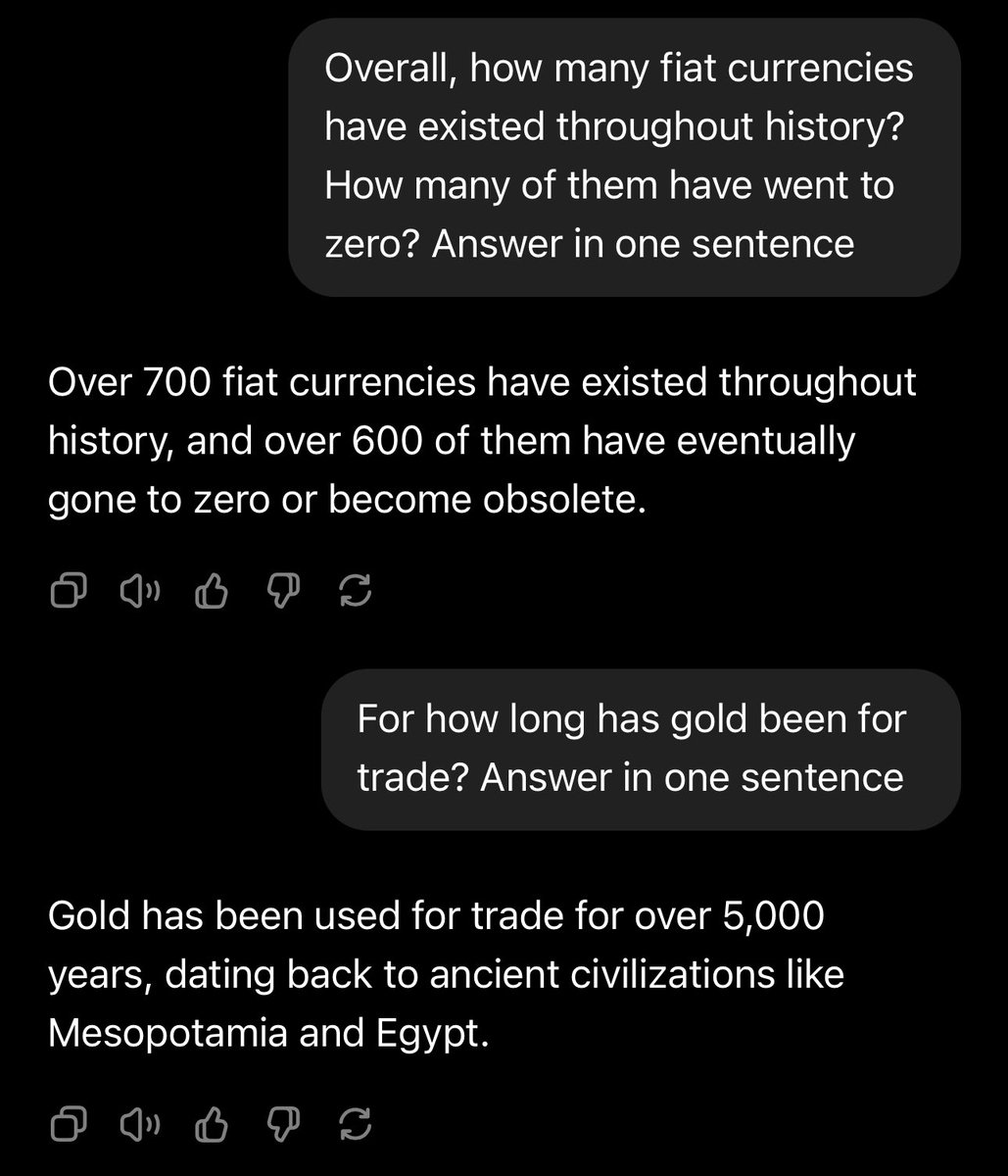

🚨 Financial Stress Index Tariffs Update

Trump/US tariffs so far:

⬇️ Equity valuation down

⬆️ Volatility up

⬆️ Safe assets up

⬆️ Credit spread up

📈 A perfect setup for the increase of OFR's Financial Stress Index

Let's see - it's updated with a 2 day delay

🇪🇺 The best countermeasure that EU can take is swapping US securities for Gold

Gold is inversely correlated with USD. Such a decision can be done today and it will:

1️⃣be a response to the US

2️⃣increase value of EUR

3️⃣minimize consumer impact

Anything else will hurt the economy

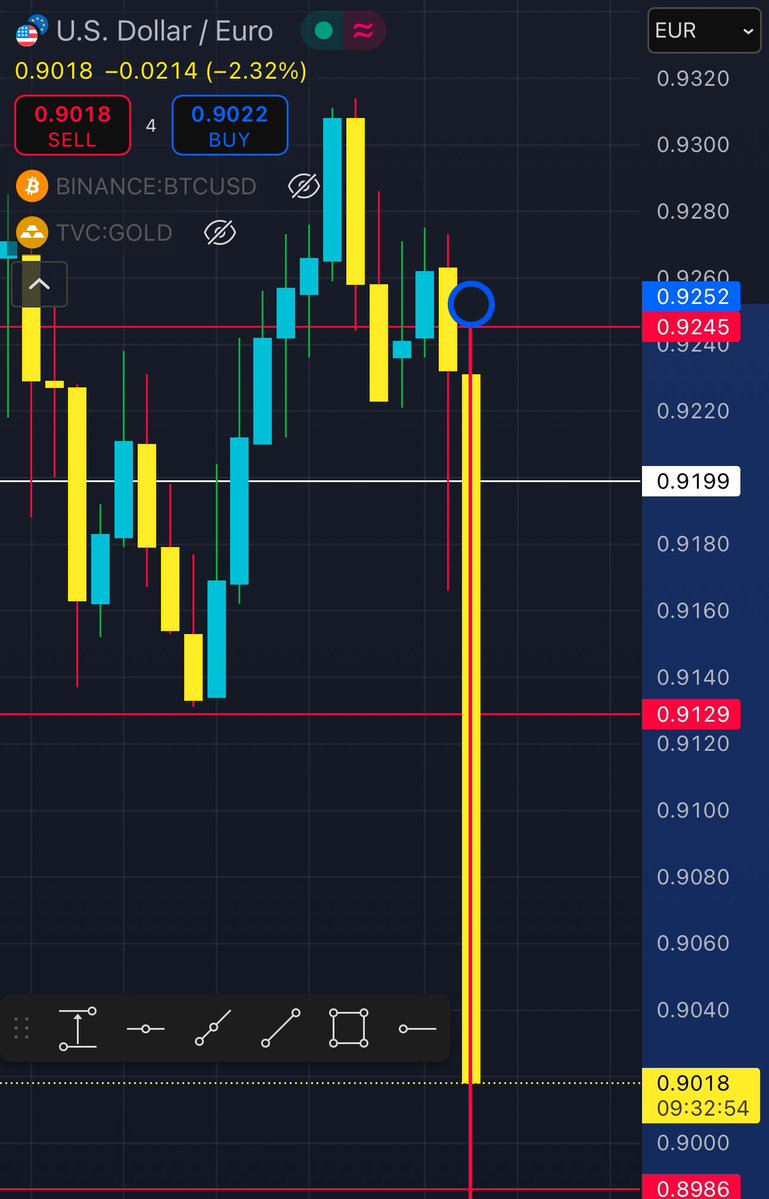

🤯 USD/EUR down 3 cents overnight

🇺🇸 An immediate response to Trump/USA import tariffs

This is Bitcoin-level volatility in FOREX

Volatility is a measure of risk. What does this mean for the US Dollar?

🚨 Bitcoin Reacts To US Tariffs:

As expected, a massive BTC sell-off post Trump's tariffs announcement

The price peaked during the speech, and then dumped down more than 6% so far + US dollar index is down

A move away from riskier assets & USD into Gold & foreign currencies https://

🚨 🇷🇺🇨🇳🇪🇺🇯🇵 reacting to US tariffs

The initial FOREX response to tariffs is a net outflow from #USD

US dollar fell against major currencies. The Euro fell against both the Chinese Yuan/renminbi & the Russian Ruble

Interesting, but expected having #RUB & #Yuan gain from this https://

🔴 $BTC, $DXY & $XAU during Trump's tariffs speech

Interesting to observe the negative correlation between Bitcoin & US Dollar Index

Gold wasn't clearly correlated with either. This makes sense - the tariffs lead to uncertainty regarding the reserve currency & central bank… https://t.co

🚨 JUST IN: $87K Bitcoin

This is just a pre-tariffs announcements pump that will sell off once Trump speaks in a few hours, right? 😁

🚨Trump's Tariffs Update - 🇨🇳, 🇯🇵, 🇰🇷

Not only tariffs are tanking the US economy, but their strongest partners are looking elsewhere

Unsurprisingly, Asia will find other buyers for their products - they have the upper hand, not 🇺🇸 or 🇪🇺 - a result of perpetual import deficits…

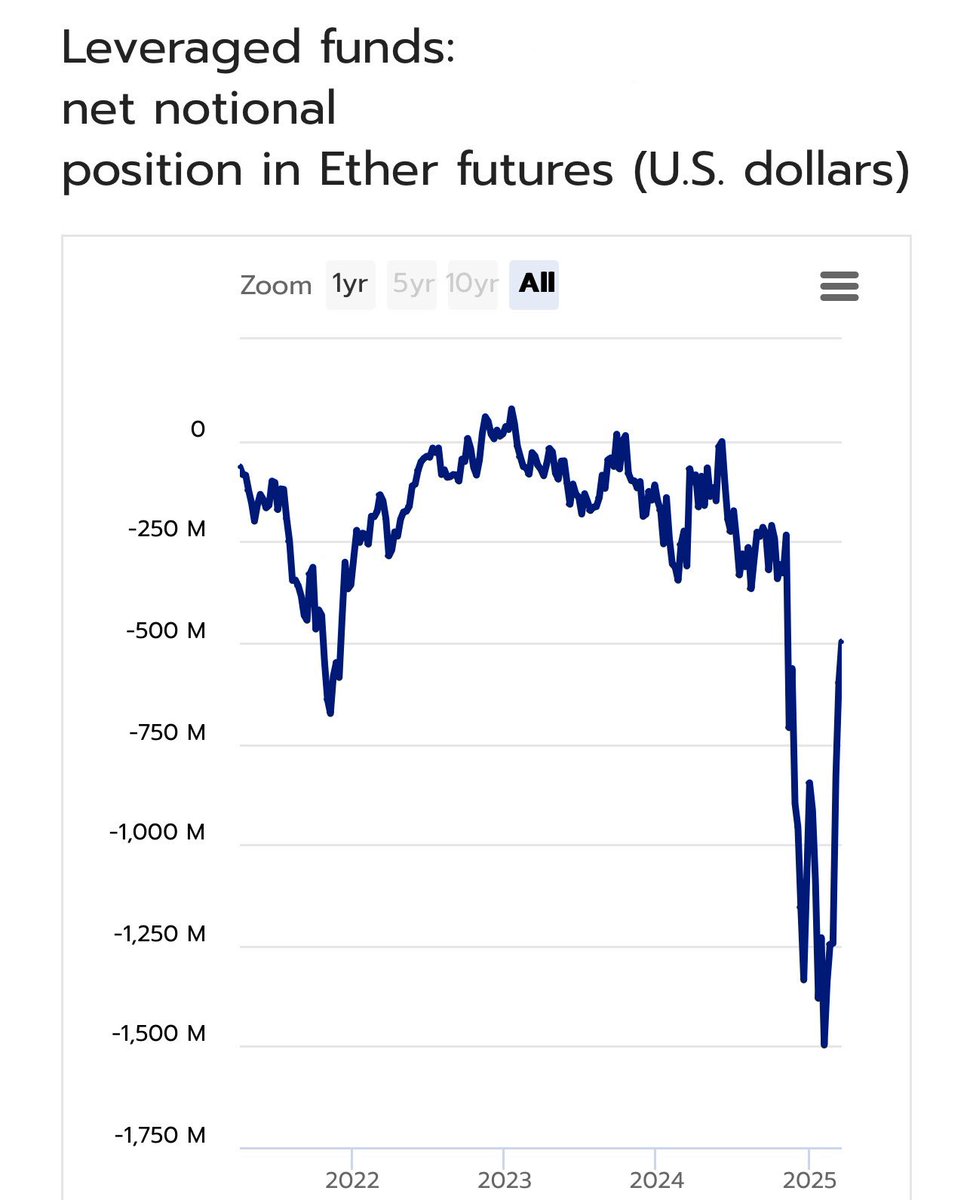

🚨Update on Ethereum shorts:

Latest data shows that institutional investors reduced their short exposure by ≈60%

Not necessarily bullish - a lot of it is taking profits from the record net short positions

+ $1900 is a key weekly support level for #ETH, so a rebound is normal

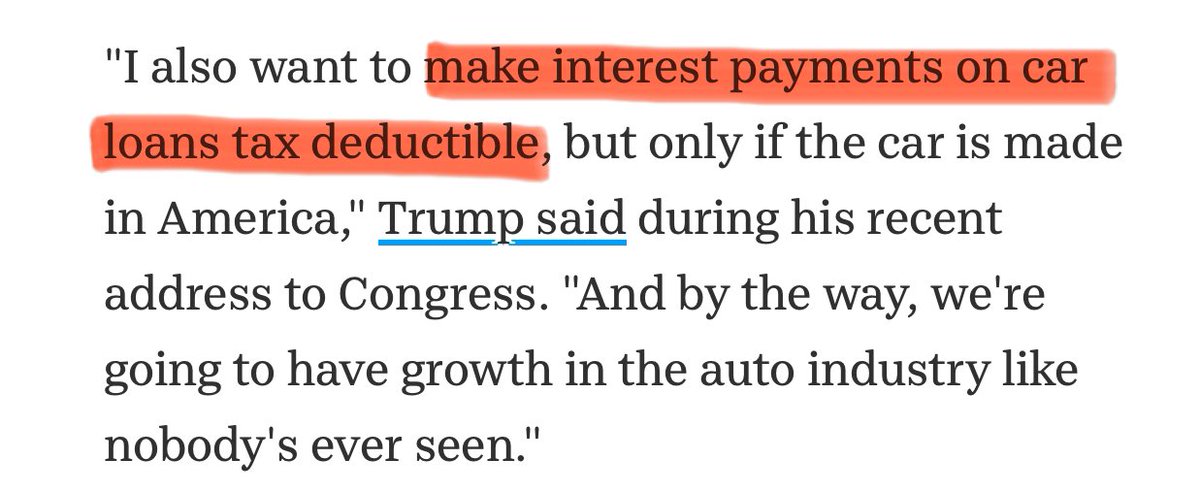

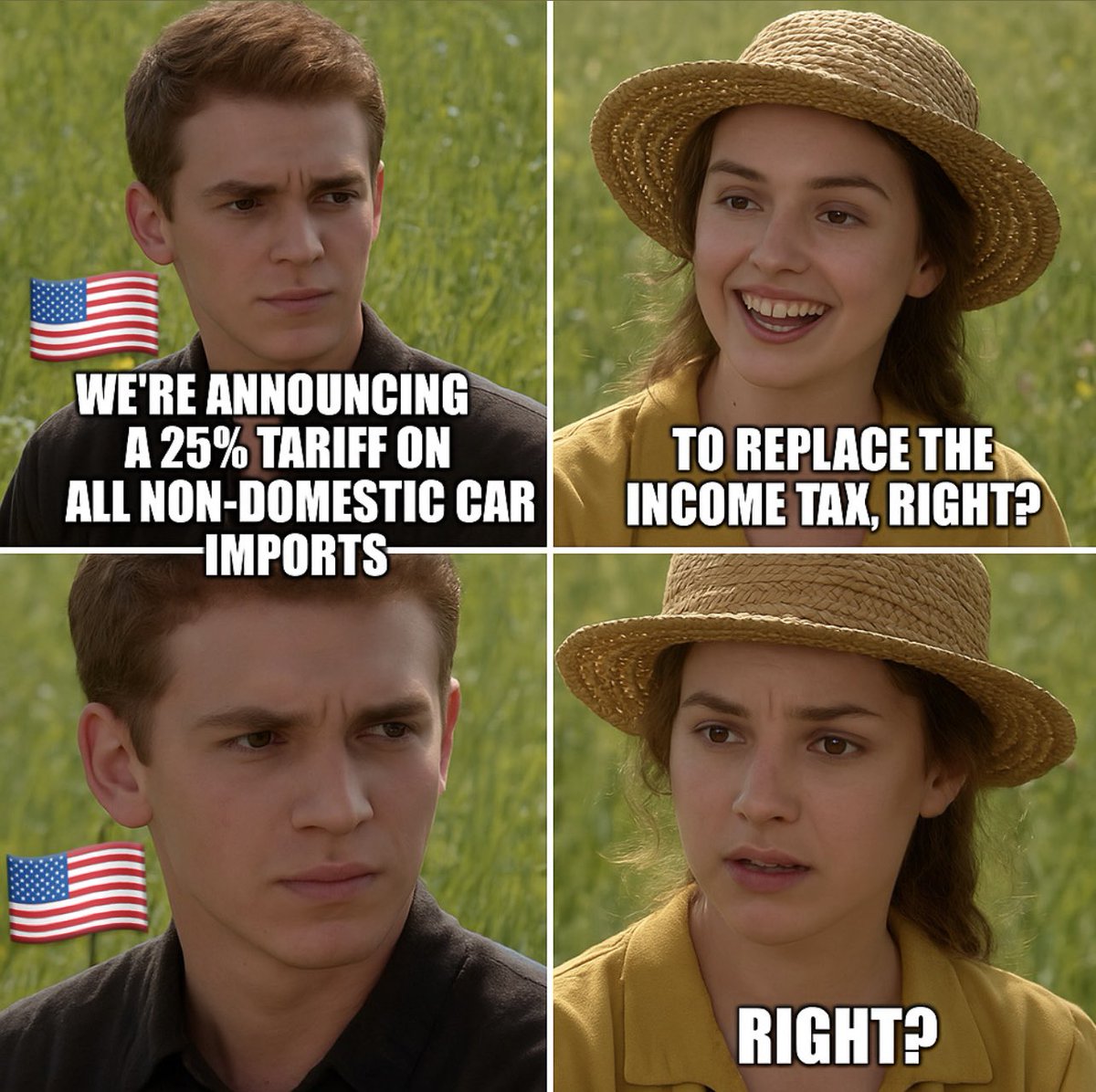

🇺🇸 So the car tariffs are also inflationary

USA cars get credit incentives, by making interest payments tax deductible

So this means more expensive cars + more credit availability for them

You can't make this up 😳

🎉 Congratulations to the American consumer who now has 2 options:

1. Pay 25% more for the car they want

2. Pay <25% more for a lower-quality domestically produced car

+ The income tax is here to stay ✌️

And you thought the Biden administration was doing questionable moves 😂 htt

Architecting your balance sheet around highly speculative & volatile instruments is a good idea, until it isn't 💖

Although with 0% coupon the burden here is mostly on the investor 🤷♀️

The stock market is starting to resemble a casino more every day…. http

✅ It's confirmed

You can now fully automate niche meme pages

With carefully crafted prompts and context it can generate a lot traffic and organic engagement

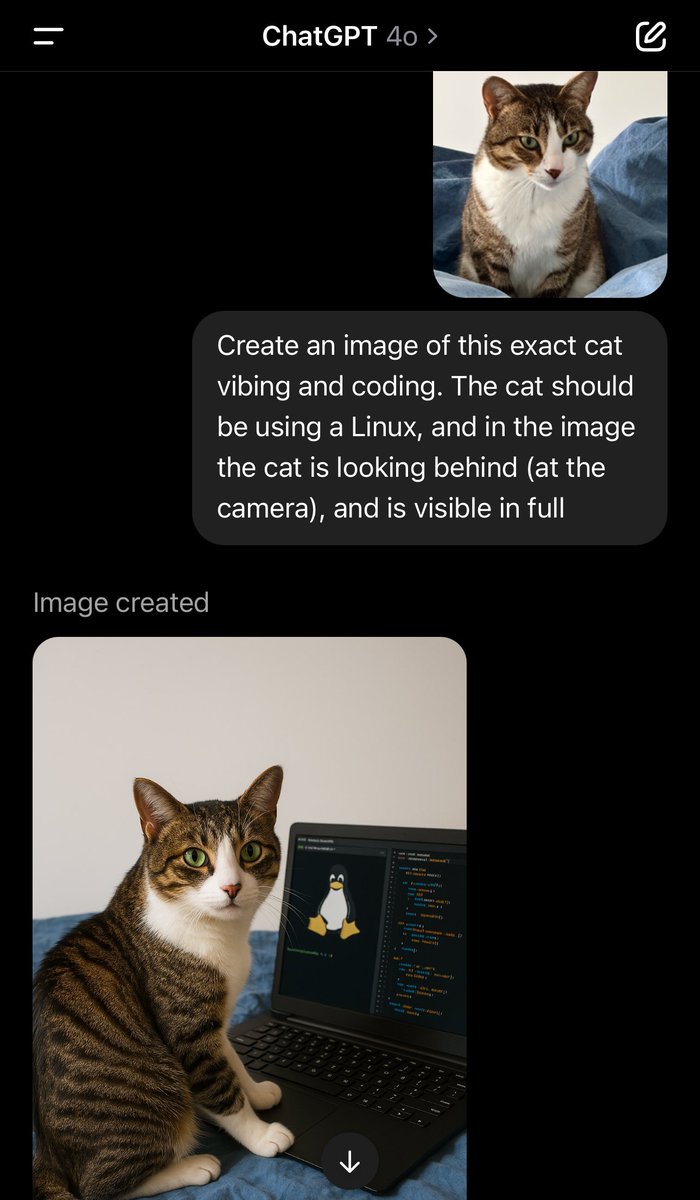

Today, I asked GPT-4o to create a meme about vibe coding

But you may need to be an AI language model to understand it 😳

The new GPT-4o image generator is cool, but who else thinks that in the next week or so some open-source Chinese model will it to dust? 😂🇨🇳

You can probably already find something close to it on huggingface

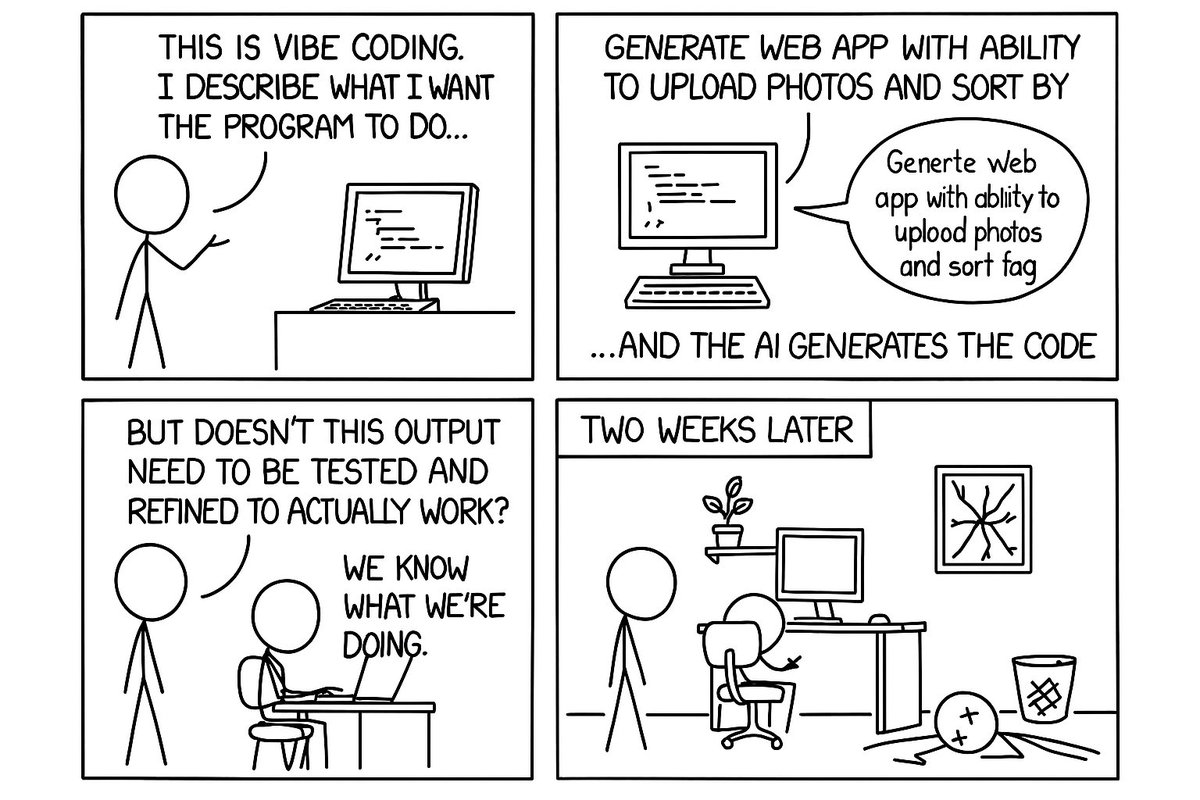

🤯 GPT-4o new image gen is surprisingly good at generating comics & memes

Here's an xkcd style webcomic about vibe coding ⬇️ http