⬇️ My Thoughts ⬇️

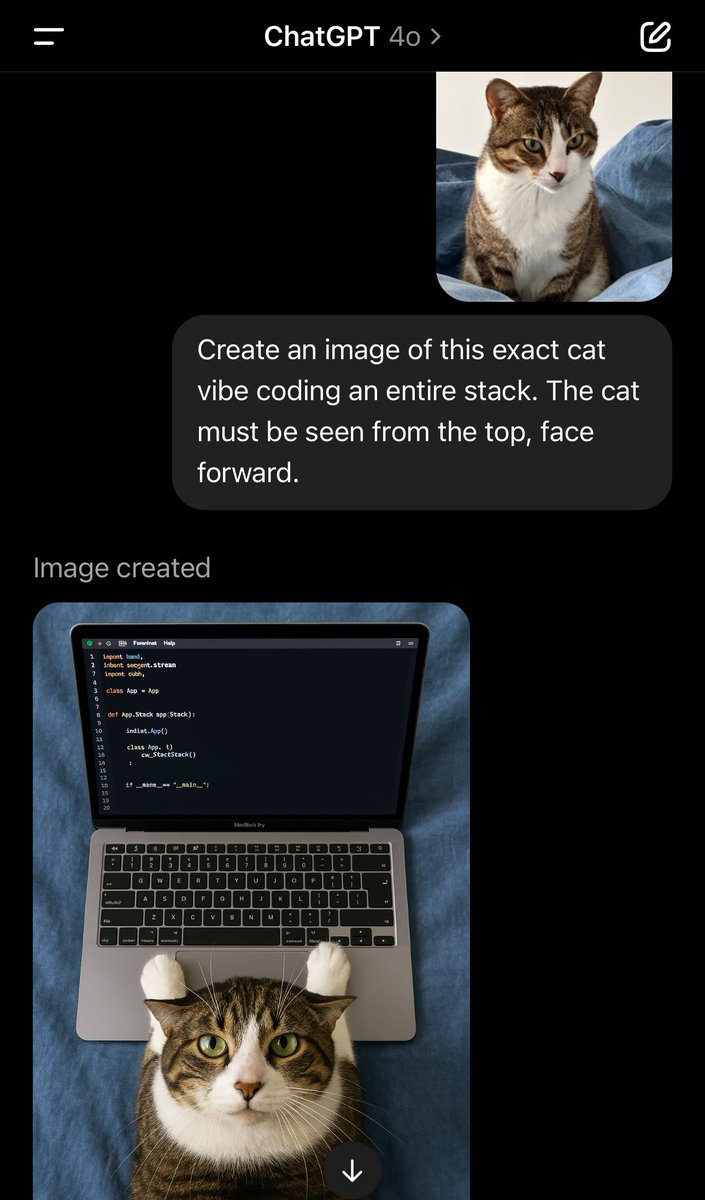

The new GPT 4o is also quite good as an image editor

It's able to fairly accurately replicate & alter subjects

But maybe they should increase their training set on the anatomy of cats 😂

(expand the image) http

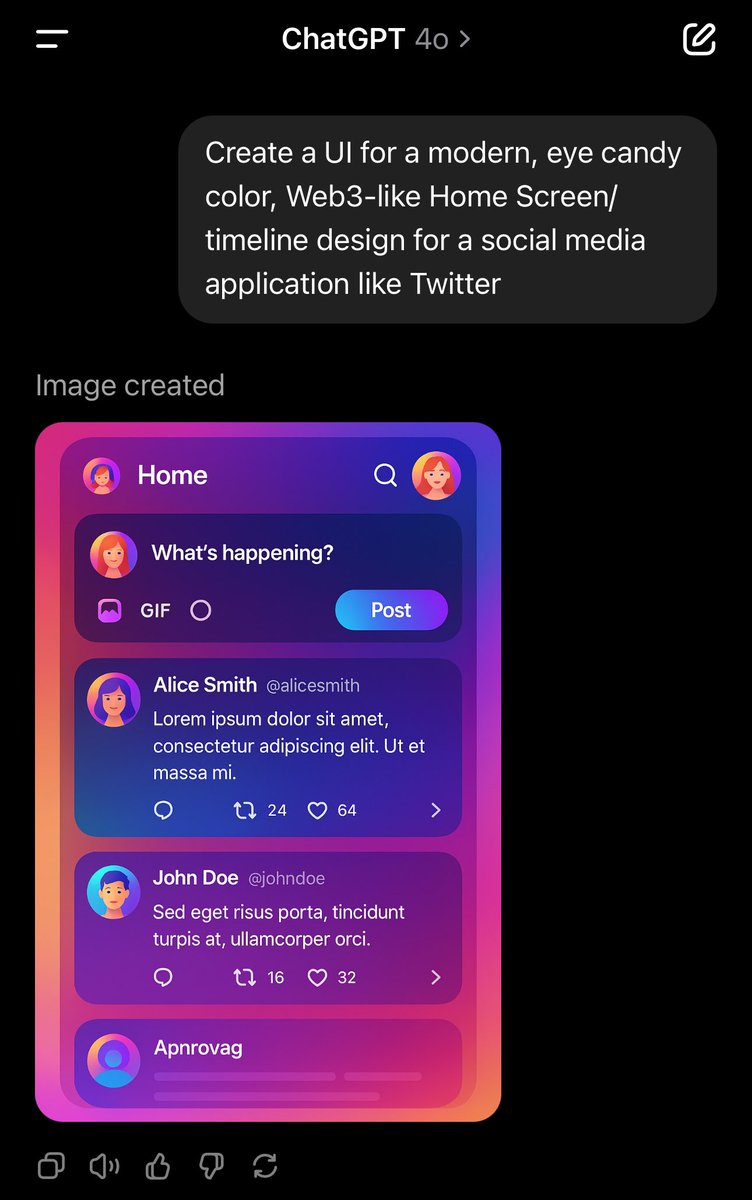

The new GPT 4o image generator is impressive!

You can ask ChatGPT to generate a UI design, and then pass it to Cursor/Claude/V0 for implementation

Character accuracy makes a big difference

Microcontrollers fostered IoT - Internet of Things

Vibe coding is fostering IoV - Internet of Vulnerabilities

But IoT is already IoV 😁

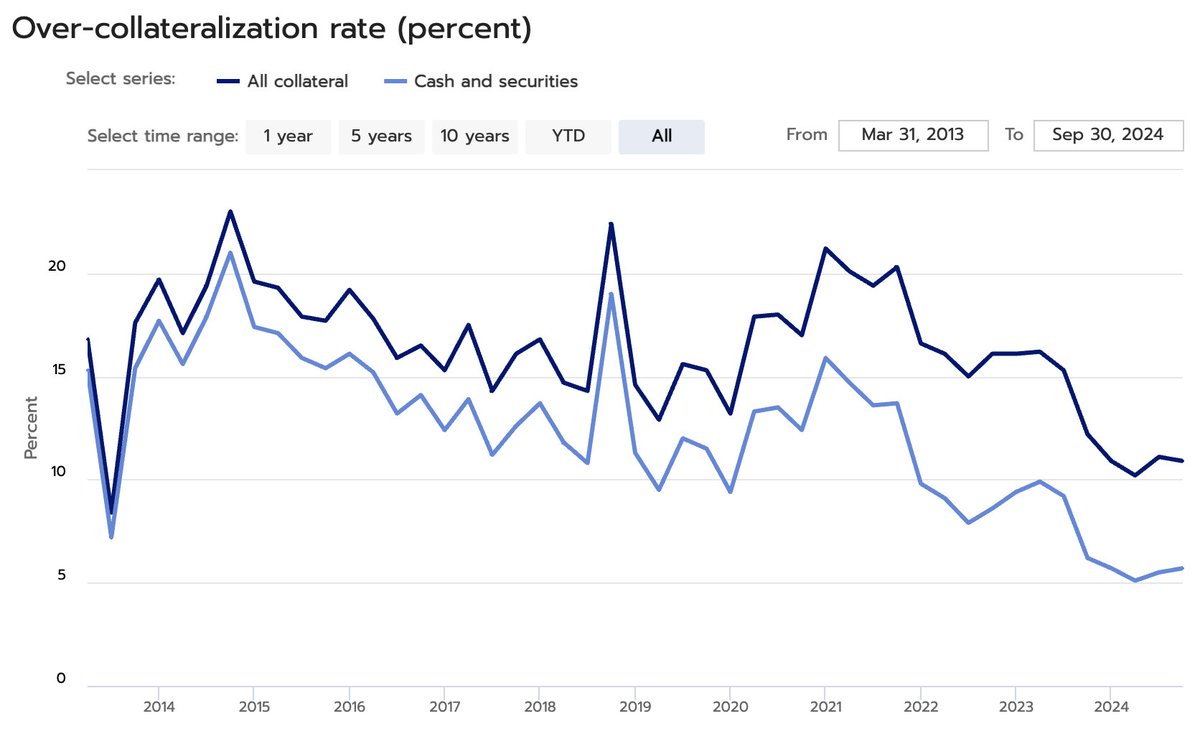

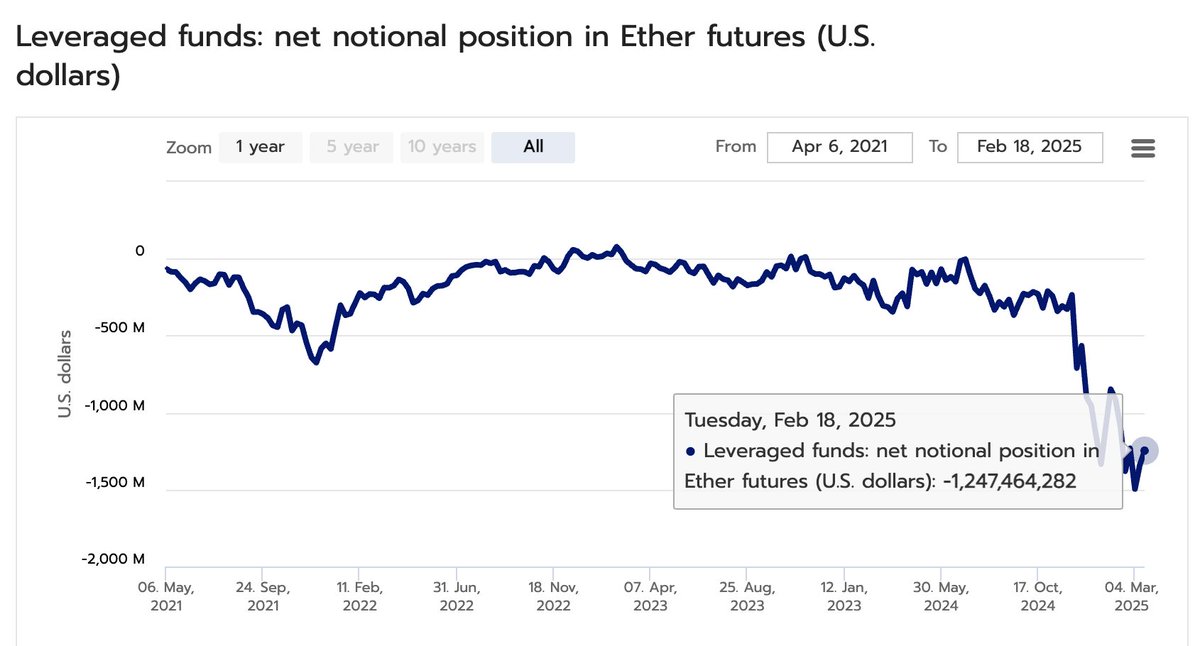

🫧 Debt bubble about to pop

Borrowing is increasing & collateralization is decreasing

These are symptoms of a highly leveraged economy

Lowest (over)collateralization rate in 10 years. Surely a lot of that is caused by the huge amount of cheap credit issued during COVID, which… http

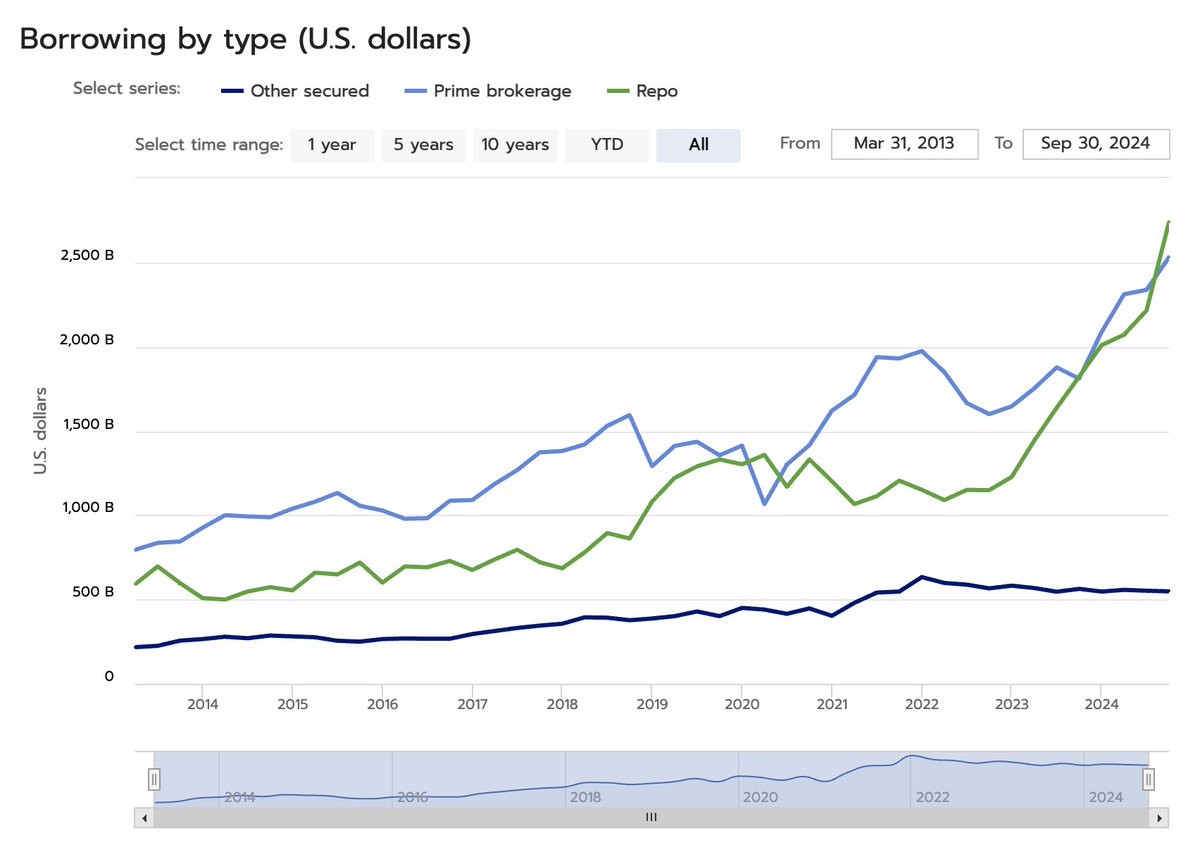

📈 Institutional investors have increased their reverse purchase agreements exposure ever since the central bank interest rates spiked

Repos are shorter-term loans, meaning they present a shorter commitment, thus less risk

Another message is clear: institutions are expecting…

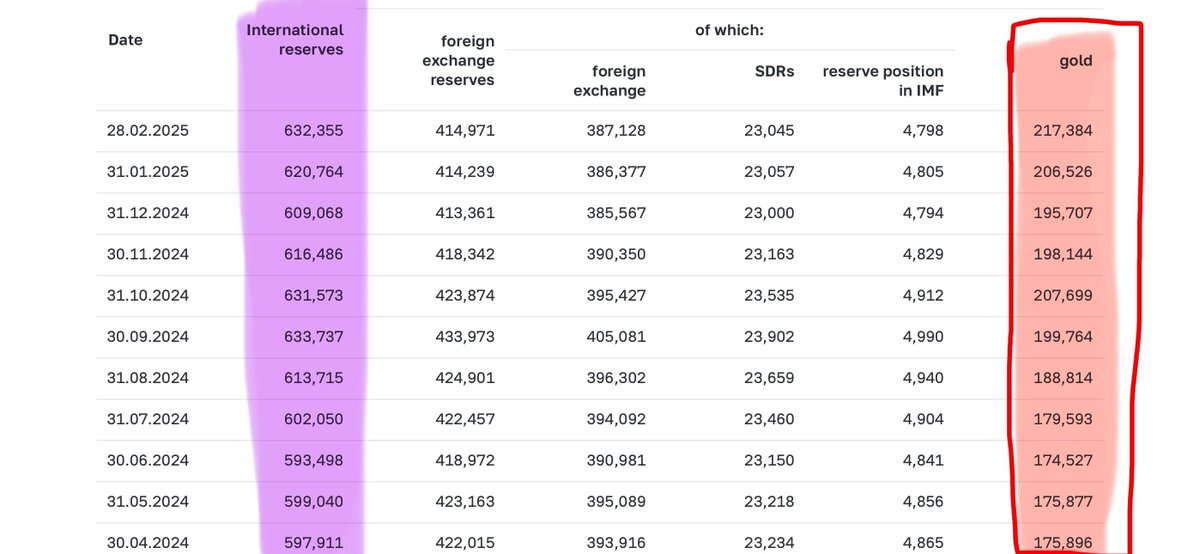

Over 10 years the Russian Central Bank has increased gold holdings by x4.5

🇷🇺 Gold is now 35% of all international reserves held by Russia 🤯

🇺🇸 Comparatively, for USA the number is 5%

This is why Russia and Ruble have been so resilient to sanctions

Just found GUN, already prototyping

It enables a decentralized, reactive, real-time, shared graph layer allowing you to build dApps right in the browser

Every visitor/user of your web app becomes a peer in the network of your application. The peers can communicate events &…

Oh btw, this was also about option pricing

These bonds acted as synthetic call options, which were priced below the market value of calls on $MSTR at the time

Yeah crypto & stocks is fun, but have you tried orange juice futures? 😂

Almost 50% down since December 🤨 http

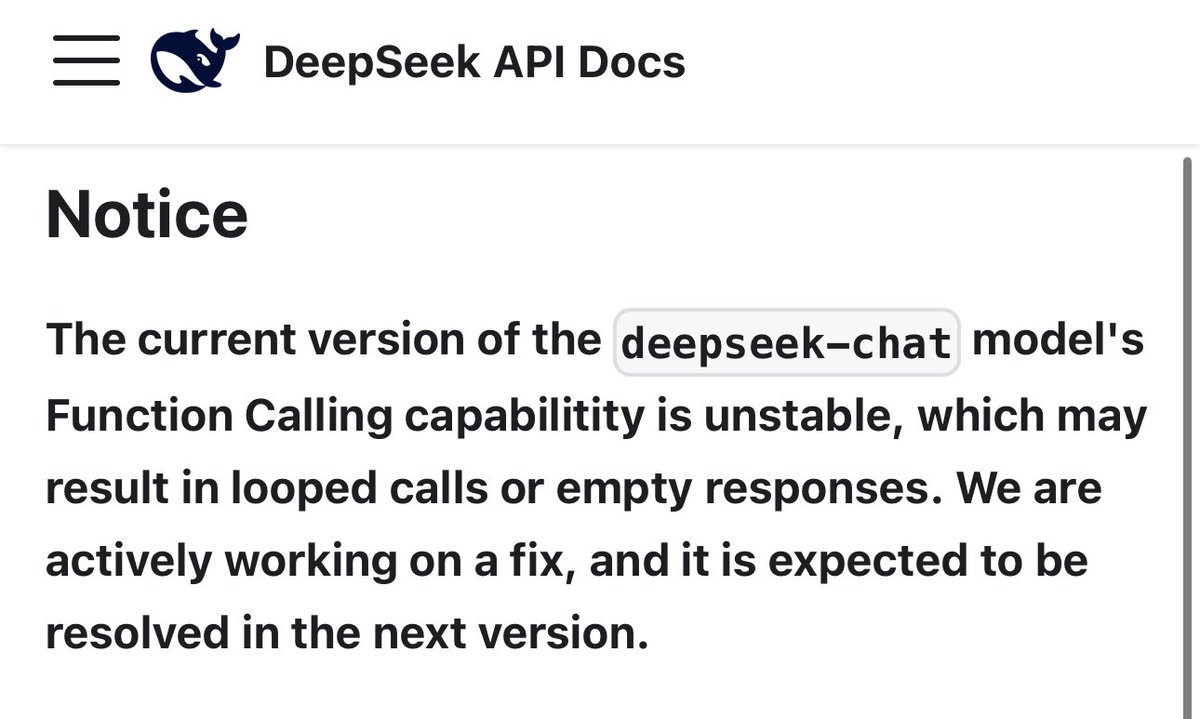

I'm working on an Agent and was debugging why the responses from the LLM come as null/empty

Turns out function calling is currently broken on DeepSeek ☹️

🤯 Think about all of those US market outflows due to DeepSeek, Qwen & Co.

$NVDA's & other AI-related stock crash wasn't just about cheaper AI-compute. The outflow also represents funds that may be potentially invested in the Chinese market

This point is often omitted 🤫 https://

Running LLM models locally really makes you appreciate the 'unlimited' bandwidth, which is a standard offering in most EU countries

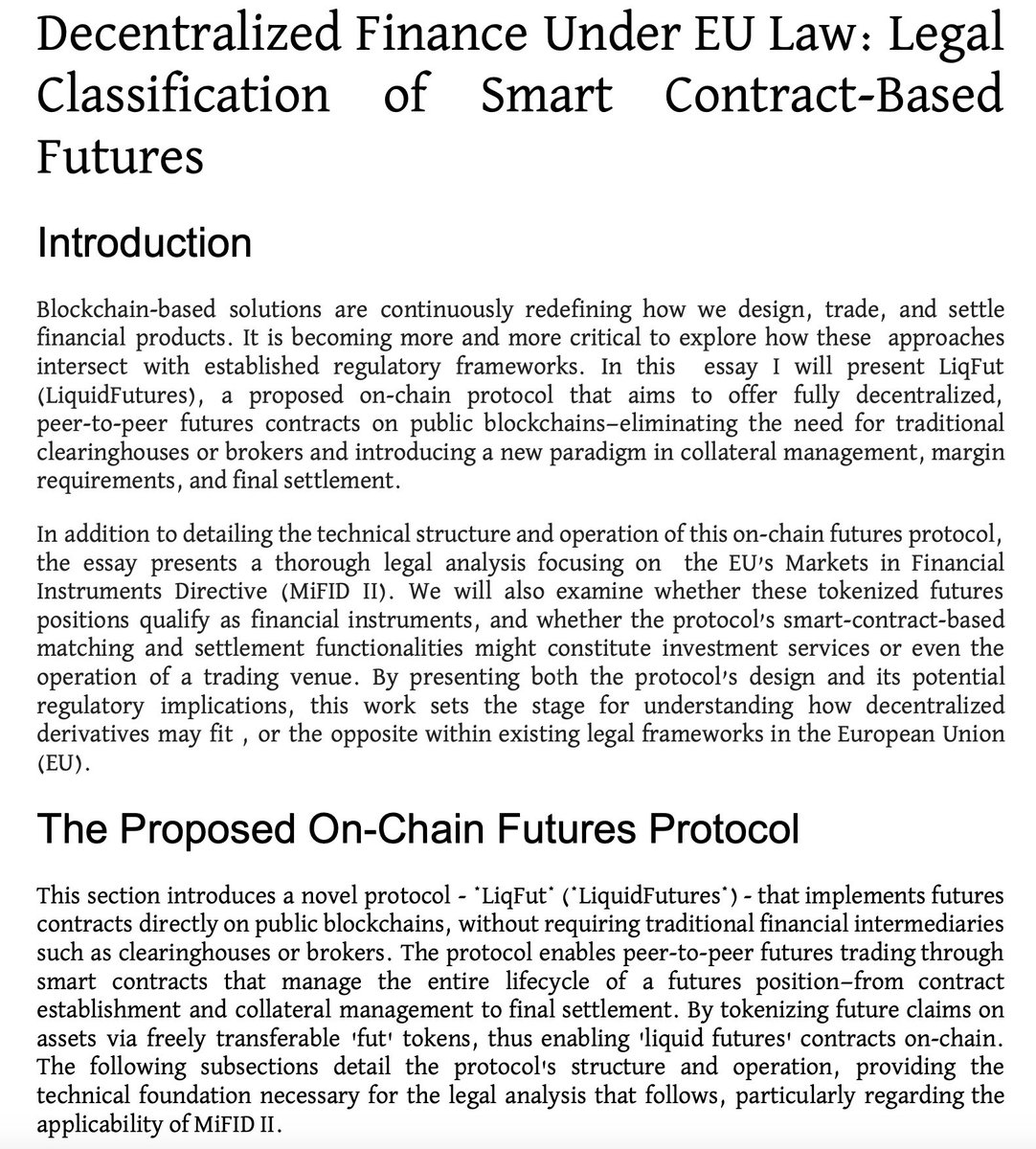

Are you building DeFi in the EU? Here's what you need to know ⬇️

At the time of conceptualizing this 'liquid futures protocol' I didn't even know where to start with regard to its legal compliance

A few days ago I finalized a paper exploring how one can legally launch on-chain…

🇪🇺 The future of Web3 & DeFi in the EU 🇪🇺

Legal compliance is fundamental for wide adoption of Web3 & DeFi. While security audits of DeFi protocols are a common practice, the same is not true for regulatory compliance audits

All investment services in the EU, including those… https://

🚨JUST IN: Quantum Computer Hacked #Bitcoin

Satoshi Nakamoto has been suspiciously quiet since the news broke out 🤫

According to experts on social media, the recent advancements in quantum computing have just made Bitcoin obsolete. Of course, neither the market, nor…

Bad news for #USD 👎

The value of a currency is a direct reflection of the organic demand for it. Sanctions will decrease the demand for US Dollar, via disincentives

Plus, it's the US consumer that will be paying for the tariffs, not the BRICS countries 🤷♀️

👉 Sold at par

👉 0% coupon

👉 Unsecured debt

👉 Option to convert to equity at $672/share

For the loan of the principal you're getting an option to buy $MSTR stock at $672 in 2029 - 60% higher than the current share price of ≈ $420

Why not just buy $BTC directly? 🤷♀️

Very interesting alternative USD market

Usual flow:

🇺🇸 buys oil from 🇸🇦, 🇸🇦 reinvest excess back into UST

New flow:

🇸🇦 reinvests excess into 🇨🇳-issued USD bonds

Result:

USD flows to 🇨🇳, instead of 🇺🇸, as the USD-denominated debt (bonds) are issued directly by 🇨🇳

Part of Bitcoin's value derives from the total electricity cost of maintaining a decentralized, trustless, immutable ledger of transactions for >15 years

20% of GDP is spent on financial services. Blockchains remove intermediaries & improve efficiency

It's apples to oranges 🤷♀️ https:/

🚀🎧 Podcast covering #BRICS Currency on the blockchain is out!

🔗🔈:

🤖 Smart contracts & #DeFi are an ideal match for #BRICSPay showcased at #BRICS2024 summit. Podcast & article exply why

🎤 AI Audio created with NotebookLM https://

🇯🇵🎧 Added an audio version of the article

It's an AI-generated podcast of the article using NotebookLM audio overview with custom sources & instructions

🔗 http

🇯🇵🧠 For a deeper dive into Japan's deposit insurance system, read or listen my article at https://illya.sh/blog/posts/deposit-guarantee-scheme-japan-dia-dicj/

It covers Japan's deposit insurance's:

• Legal framework

• Historical cases

• Risk analysis

• EU comparison

Got questions? Ask me! 👇

🎌 While Japan has been successful in resolving hundreds of financial institution failures, the debt-heavy approach can only be only effective if the value created by credit is larger than the principal

Otherwise, there's another bubble building up 🫧

🇯🇵⚠️ Current risks:

• Heavy reliance on debt

• Large US Dollar & Securities exposure

• Currency devaluation, leading to inflation

These could trigger a 90s-style crisis 2.0 📉