⬇️ My Thoughts ⬇️

Regarding the bond market collapse ⬇️

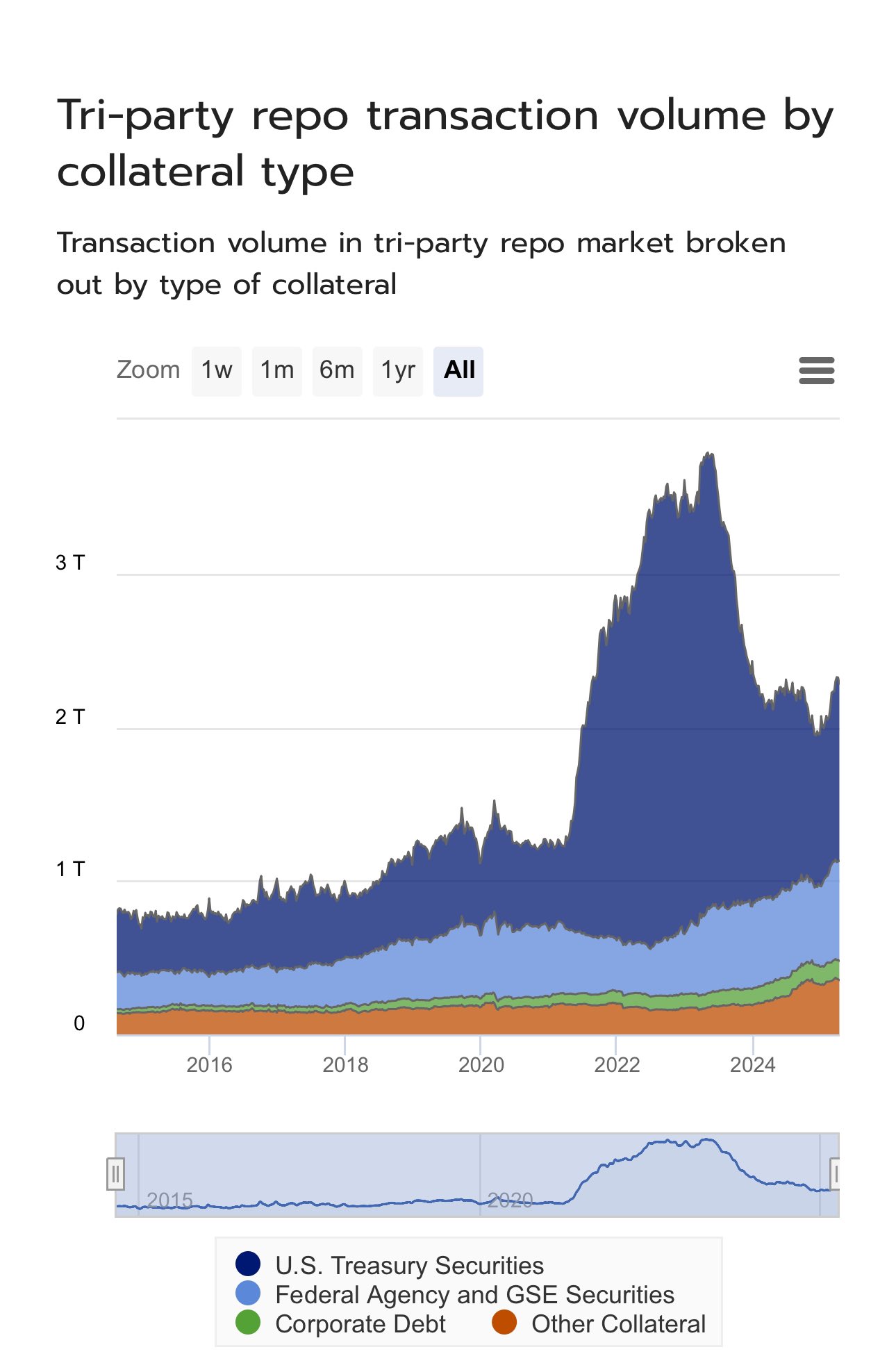

US Treasury Securities are the main collateral used in repurchase agreements. Given that these are short-term, the yield spike is unlikely to lead to defaults

However, the fall in bond prices will reduce credit, adding to liquidity crunch

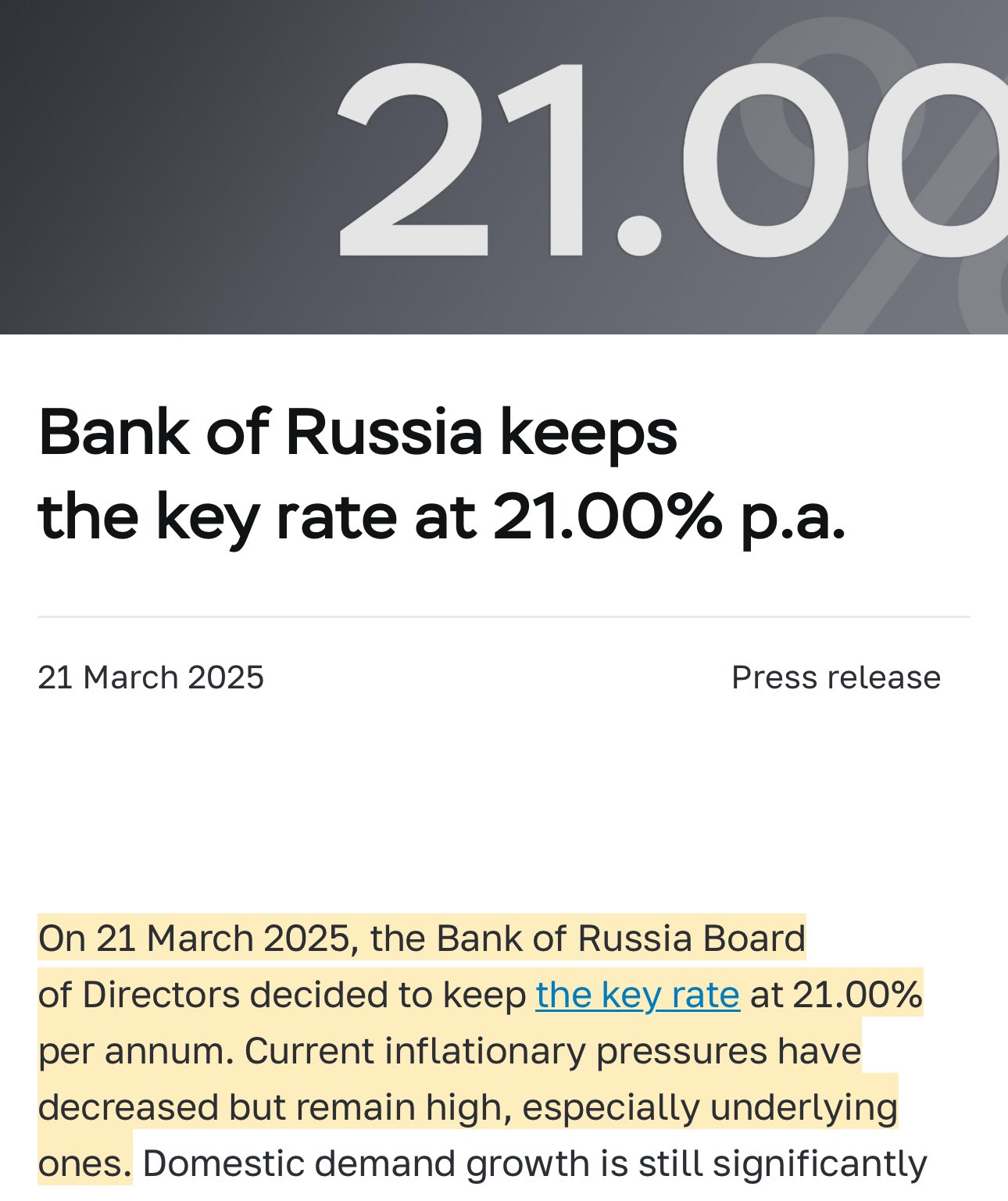

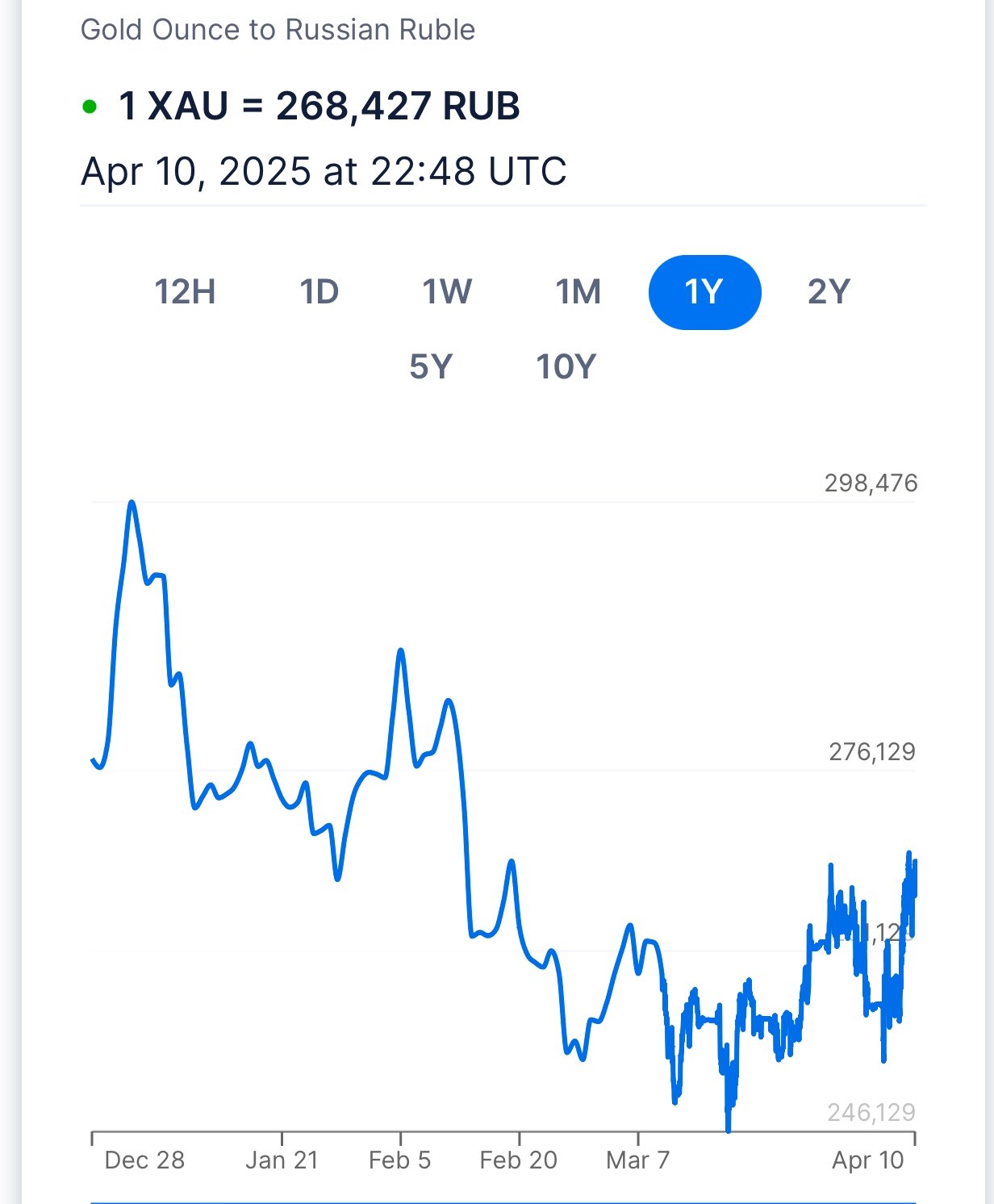

Another important fact to mention regarding Russia, is that on top of sell-off of US securities & loading up on gold in record numbers, throughout 2025 Central Bank of Russia has kept interest rates at 21% 🤯

Result = massive savings

However, if EU or US did the same - their economies would collapse overnight

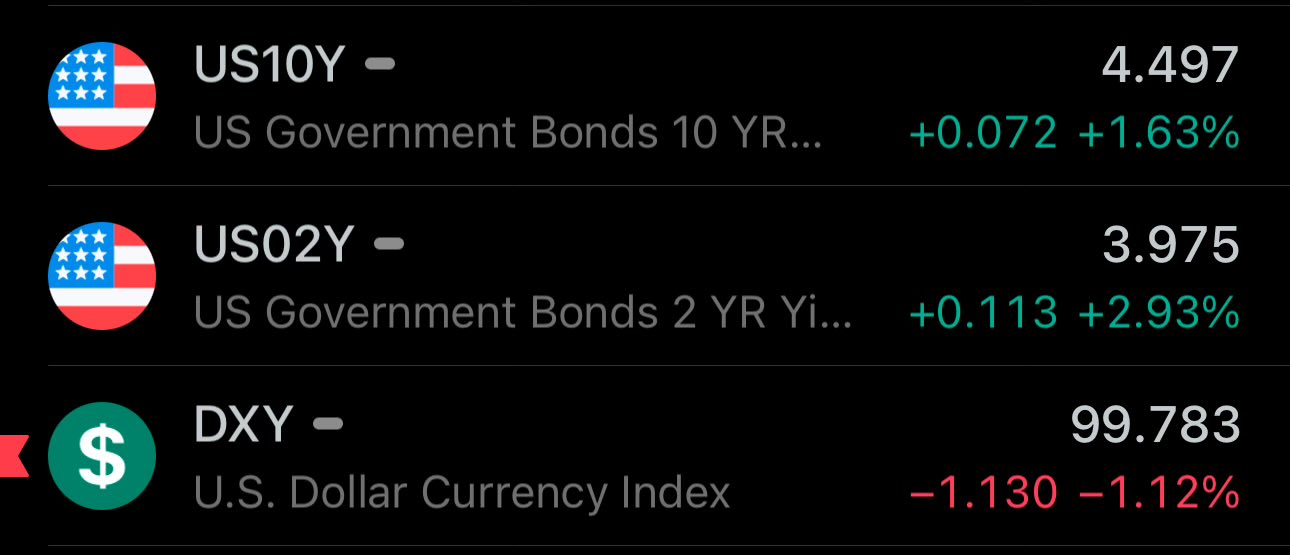

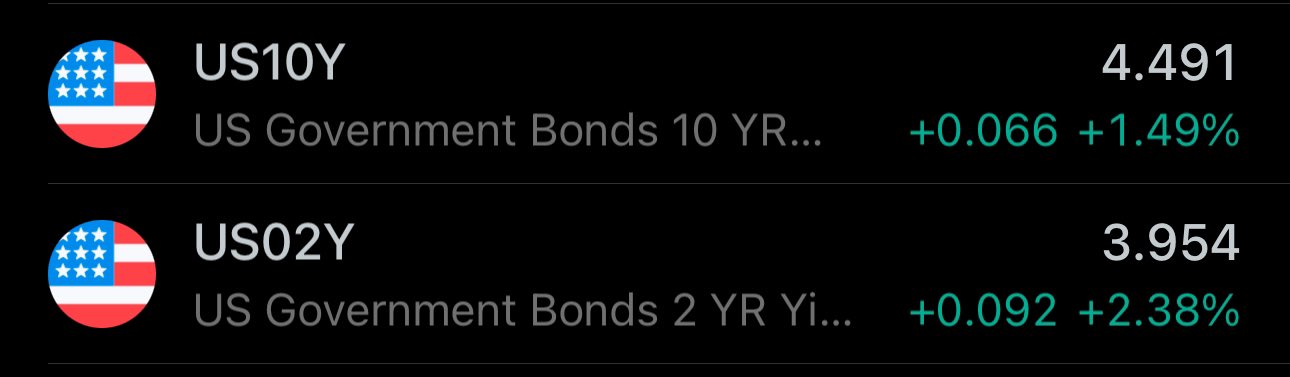

Lower USD Index = USD Devaluation = Higher premium for USD loans = Lower bond prices = Higher bond yields

It's all connected

🇺🇸 US Treasury bond yields are acting as a risky asset

Over 2% daily moves is something you see in crypto 👀

And I don't believe the FED will be raising rates - so it's a market-driven US debt premium increase

Lower rates incoming, but sovereign premium will still increase

I think now you understand 😁

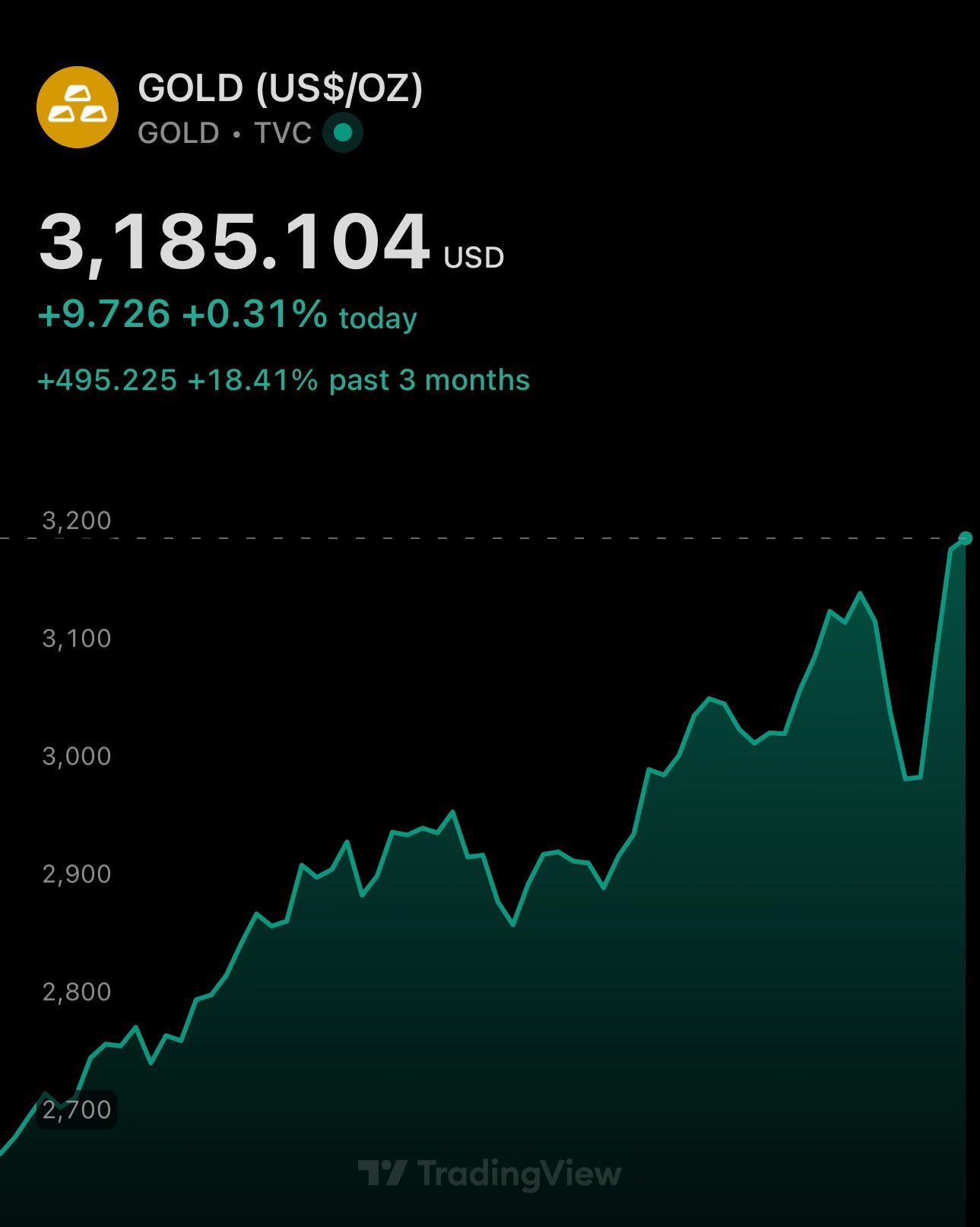

Gold hitting ATH after ATH 🎉

Very concerning for USD

Just launched

I'll use for short-form posts. Think Twitter/X, but self-hosted under my domain

It's an MVP and for now contains a subset of X posts. Later I'll make it real-timish and cross-post some of my content from here

Coded using Gemini 2.5 Pro

To clarify - here you're stating with US Dollar and then buying either Ruble or Gold. It's in this scenario that both investments have a similar yield

If you start with EUR, Ruble actually yields more than Gold - 9.3 vs 11% (in the past 3 months)

And Ruble is up on Gold since January 🤯

All while Gold is at ATH & it's extremely difficult to buy ruble or any Russia-issued financial instruments due to sanctions

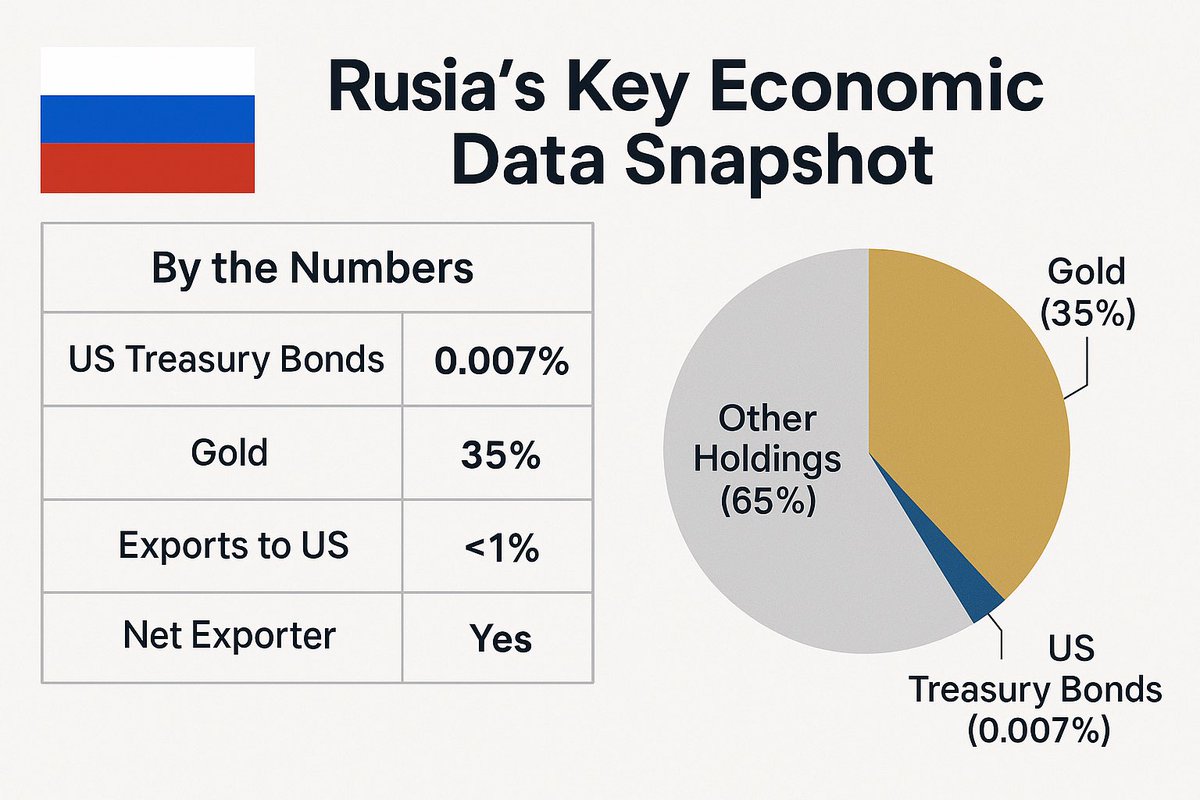

Loading up foreign reserves with gold & selling US Treasury securities worked ✅

It gets crazier 🤯

In the past 3 months, amids the tariff madness - at the time of rush into safe assets - Ruble & Gold head-to-head

You could've either bought gold or Ruble & gained 18% in both cases

And buying ruble isn't easy due to sanctions. Imagine when it opens up

Ruble is a gold success story ✨

Sanctions, tariffs, raising M2 - it doesn't care

Central Bank Of Russia sold off their US bonds & loaded up on gold

⬇️ US bond prices are down

⬆️ Gold is up

⬆️ Ruble is up against USD

Expect this playbook to be repeated by others

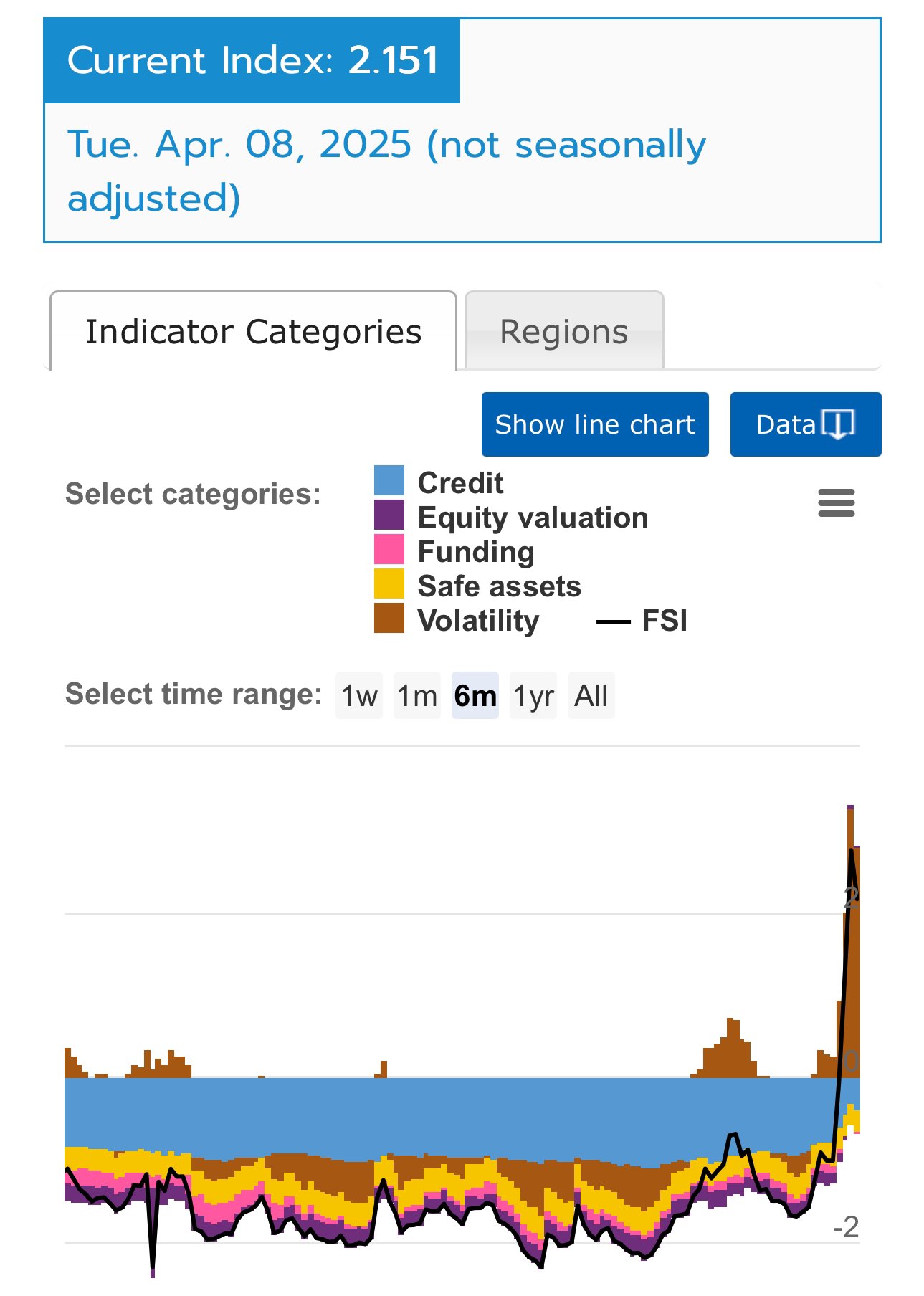

🚨Financial Stress Index Keeps Going Up

It has now reached COVID-levels

Combine they with the bond sell off, the falling dollar index & you get a worrying picture

The stock market will rebounce/inflate, but that will increase the premium for debt refinancing over time

Regulated equities market, which is supposed to be low-risk became as volatile as crypto

Just look at NASDAQ, S&P500 & Co

Every time I open TradingView it's a +-5%

Maybe more regulations will solve this? 😁

🇷🇺 Russia is immune to US tariffs

Russia's international reserves are as follows:

- 0.007% US Treasury bonds

- 35% Gold

Russia exports <1% to the US. Russia is a net exporter

This makes them protected from US sovereign risk (USD devaluation) & trade risk

🇪🇺🇺🇸US tariffs present a unique opportunity for EU's capital markets

Billions of $ are flowing out of US markets. Let that liquidity be parked in the EU. All that's needed is inviting conditions

It can start with a small, less-regulated market subsection to allow seamless foreign funds flow

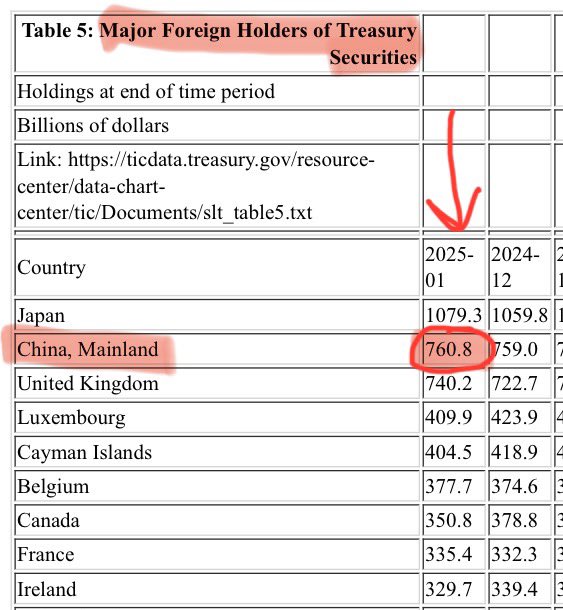

Of course, this also gives China leverage - if The People Bank's of China (China's Central Bank) dumps their US Securities in the market, it will skyrocket bond yields, by reducing their prices

Who will lend to the US then, and at what premium? And at 125% debt to GDP 😬

China is the 2nd largest holder of US Treasury bonds - a staggering 23% of their foreign exchange reserves

This makes China extremely exposed to US systemic risk. Which is why tariffs will hit them double hard - at exports and at renminbi/Yuan due to falling #DXY

Not saying they can't sustain it though

For net BTC/ETH futures positions by hedge funds, you can check:

Sure, if you:

Put tariffs

Lower interest rates

Remove tariffs

the maket will skyrocket

But that also means increased:

Asset bubble

Inflation

Public debt/deficit

Tariff income won't offset it

Monitor the hedge fund's shorts on risky assets, and when the

One of the core ideas behind the tariffs is to solve US's the trade deficit by incentivizing other countries to import from the US - I'm deriving this from the 'tariff' formula

So by importing more from US - you get lower/no tariffs

That won't work. Over the medium term the

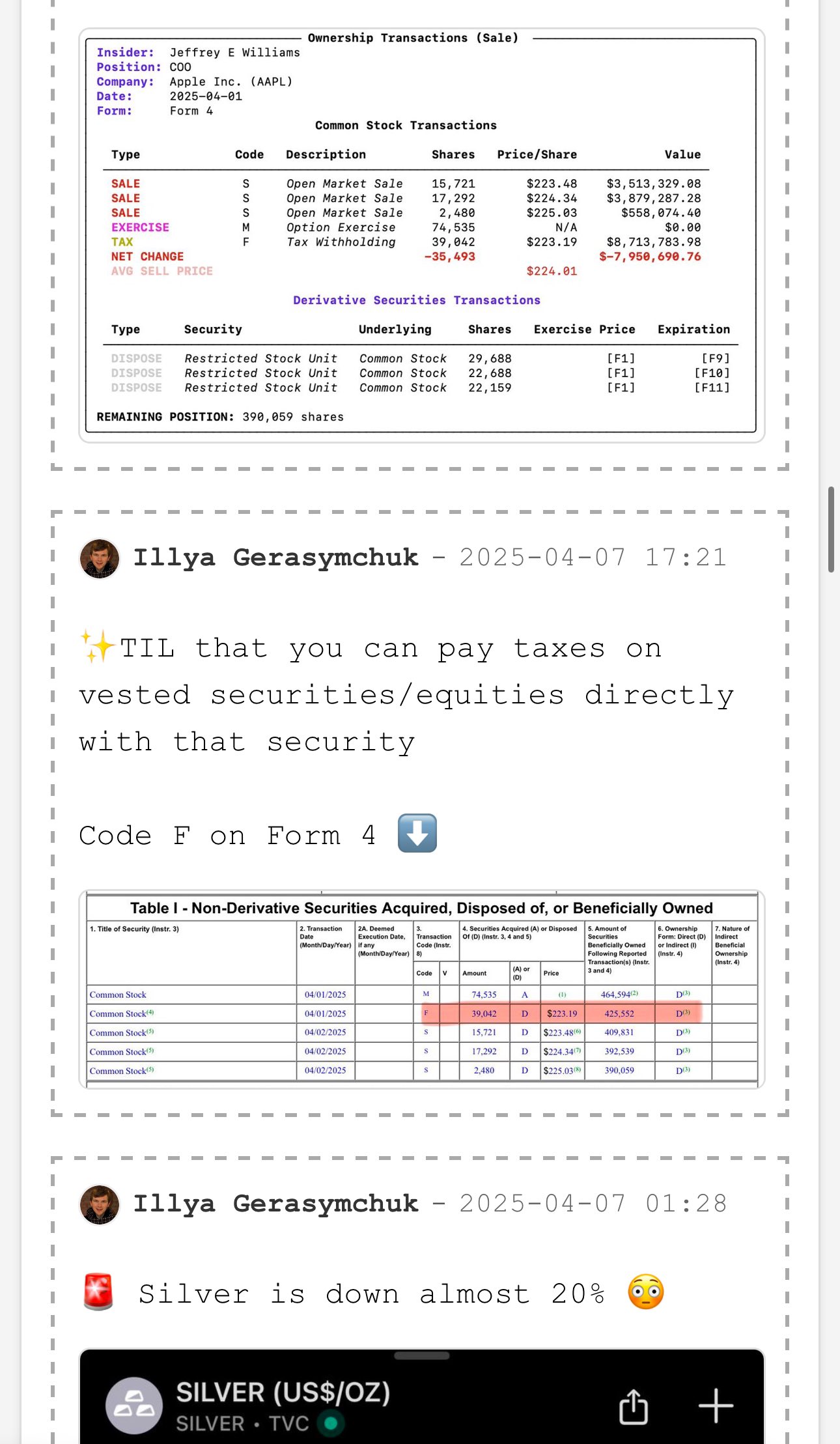

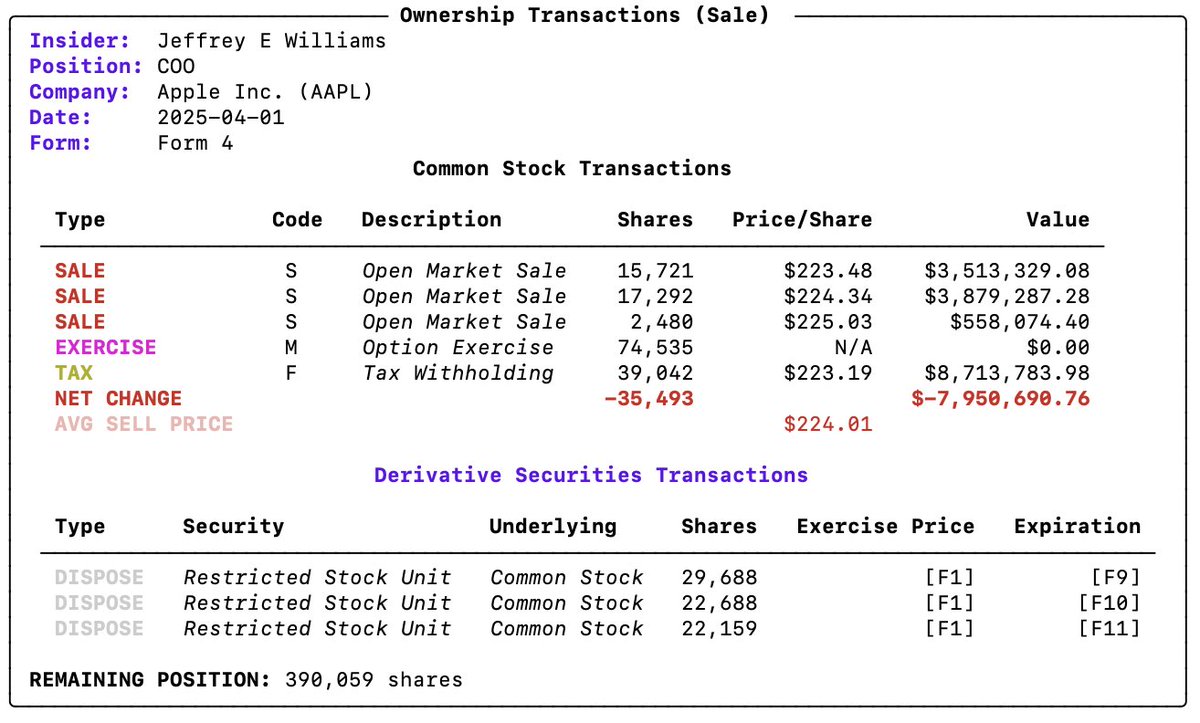

Do not browse insider trading SEC filings on EDGAR directly

There's a Python library called edgartools - much better, cleaner & you can directly extract the data

Now go find alpha factors that you can use next time worldwide tariffs are set