⬇️ My Thoughts ⬇️

🇷🇺 Ruble correlates with gold, becoming a hedge against USD

USD falls against both, Ruble & gold

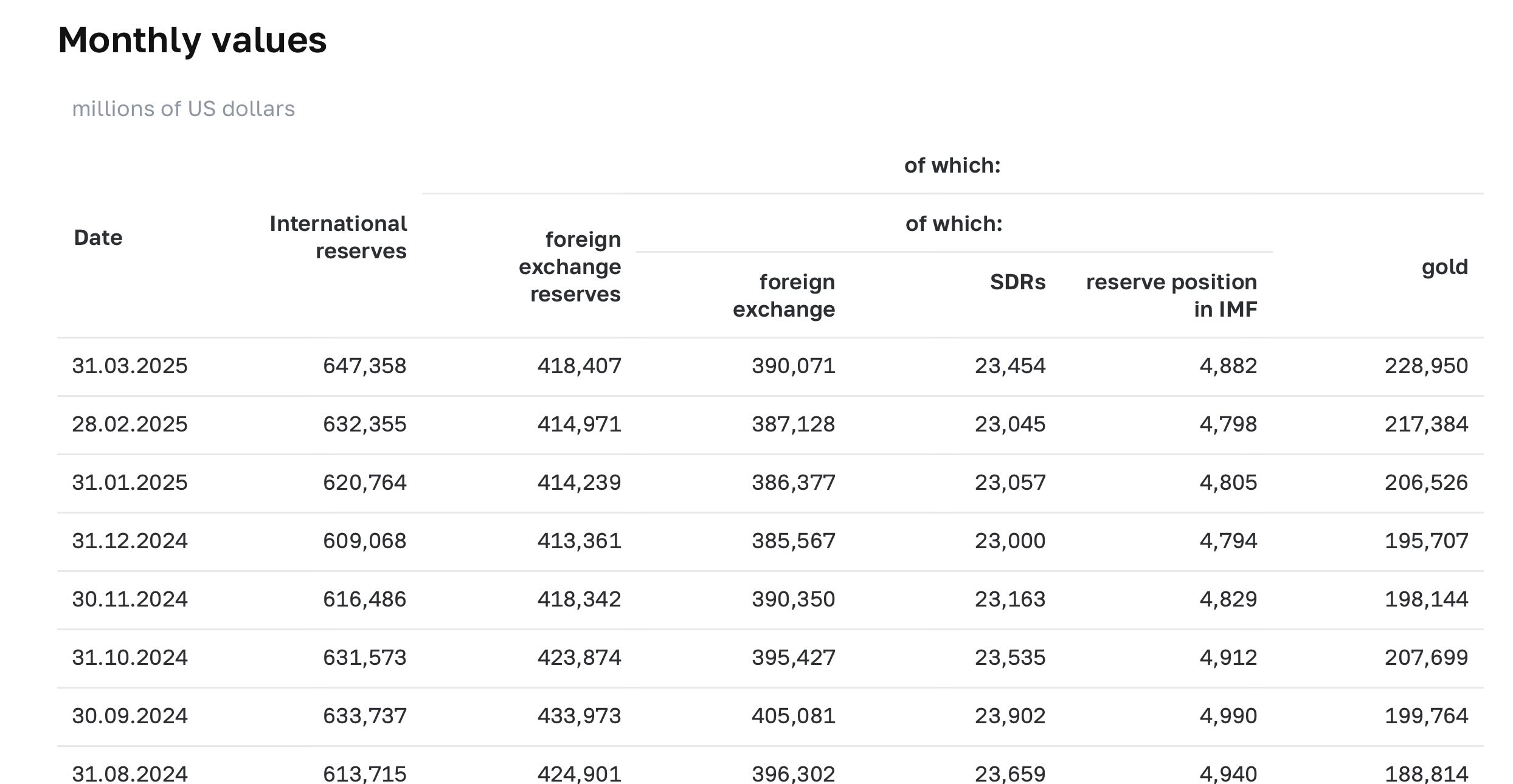

Russian Central Bank has been continuously increasing their gold holdings, which are currently more than 1/2 the size of their foreign currency reserves & 35% of int'l reserves

I've referred to gold being 35% of Russian Central Bank's foreign currency reserves, when I in fact meant international reserves

The core idea is unchanged - this is a technicality. Central Bank of Russia reports:

International Reserves = Foreign Exchange Reserves + Gold

🇺🇸🇷🇺 USD is TANKING against Ruble

… on a daily basis 😳

It's only partially tariffs. This has been a trend even prior to them

Russia loaded up on Gold & sold off their US securities. Trade with US is negligible

Russia self-administered an immunity shot

🇵🇹 Portugal's Central Bank is LOADED with gold

👉 Gold reserves are >80% of total assets

Props to @bancodeportugal for a healthy balance sheet ratio

From now on - only gold-sprinkled pastéis de nata!

🇺🇸🇷🇺 USD/RUB dipped under 82 😳

Combine that with $DXY downtrend & a concerning picture for USD emerges

🚨US Dollar Index going to ≈98.3

Current price is a strong monthly level

The next destination is low 98's

Grok summarized US tariffs effect very well

As well as what will happen to the US economy, and by extension, US Dollar - the most important currency in the world

🚨68-82 is the next range for USD/RUB

A lot of liquidity in that area & expect selling pressure. But there is also selling pressure on the USD

RUB is already up 30% YTD, so expect some pullbacks in the white box region

🚨 Ruble falls below 82 against USD

I've been writing for a long time about Ruble & the Russian economy, but it's still crazy to watch it play out live

REMEMBER: Russia is still under heavy sanctions, and it's virtually impossible to purchase RUB. Once they're dropped: 📈

Nice catch!

Indeed, the adjusted March deficit is higher. It also means the adjusted February's deficit is lower

By 'adjusted' I mean had the payments not been shifted due to March 1st falling on a Saturday

Pushed updates to https://illya.sh/thoughts/

The images now lazy load & fixed several issues on desktop

Also updated/synced the content

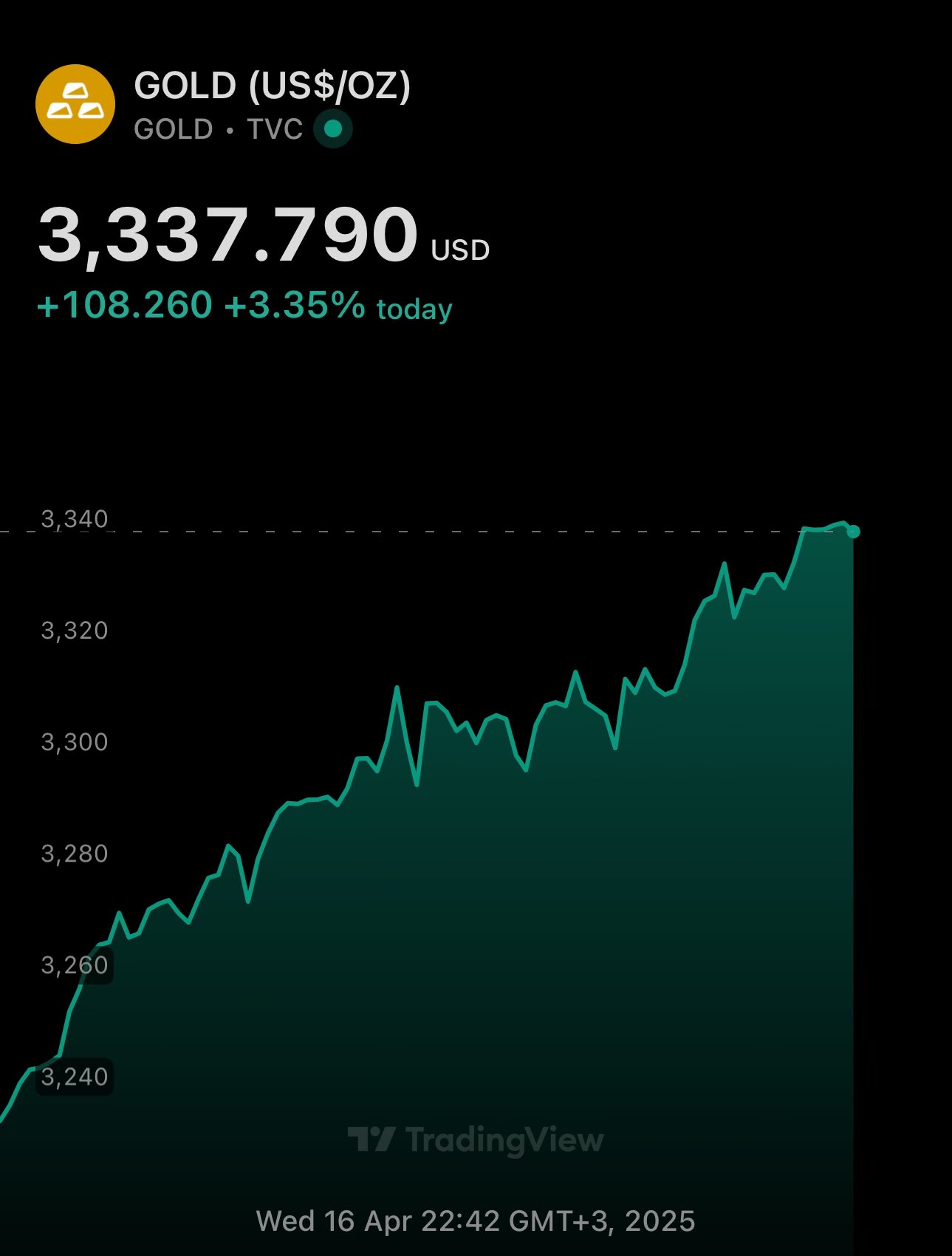

🚨BREAKING: Gold….

Actually, gold has been reaching new ATHs every other day

Not BREAKING anymore - the new normal 🤷♀️

Heading for $3.4K now

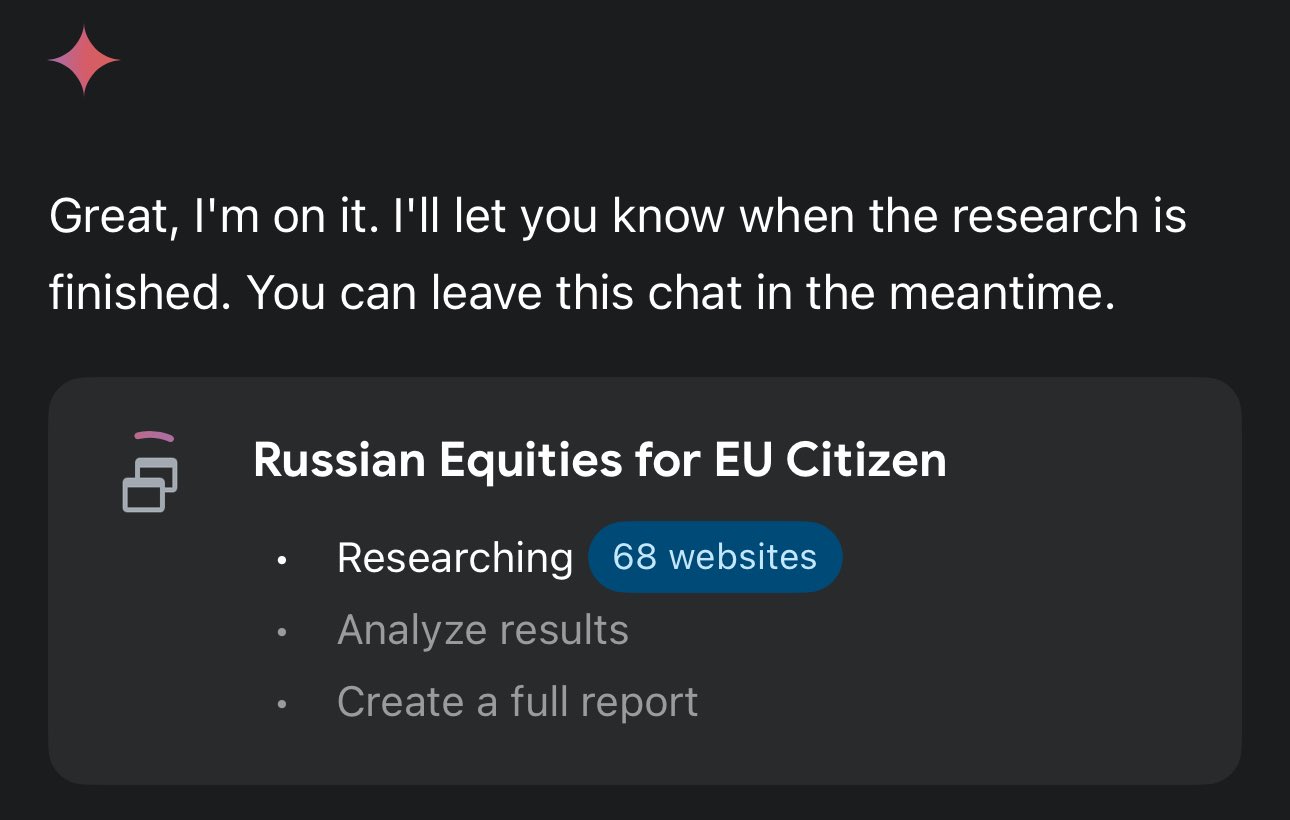

🇪🇺🇷🇺 So how can you buy Russian securities in the EU?

Since 2022 it's unfeasible. IBKR & KIT Finance suspended trading

Deep researching with LLMs now, but it hasn't been very fruitful so far 🤔

Once the sanctions are lifted you'll see the prices explode

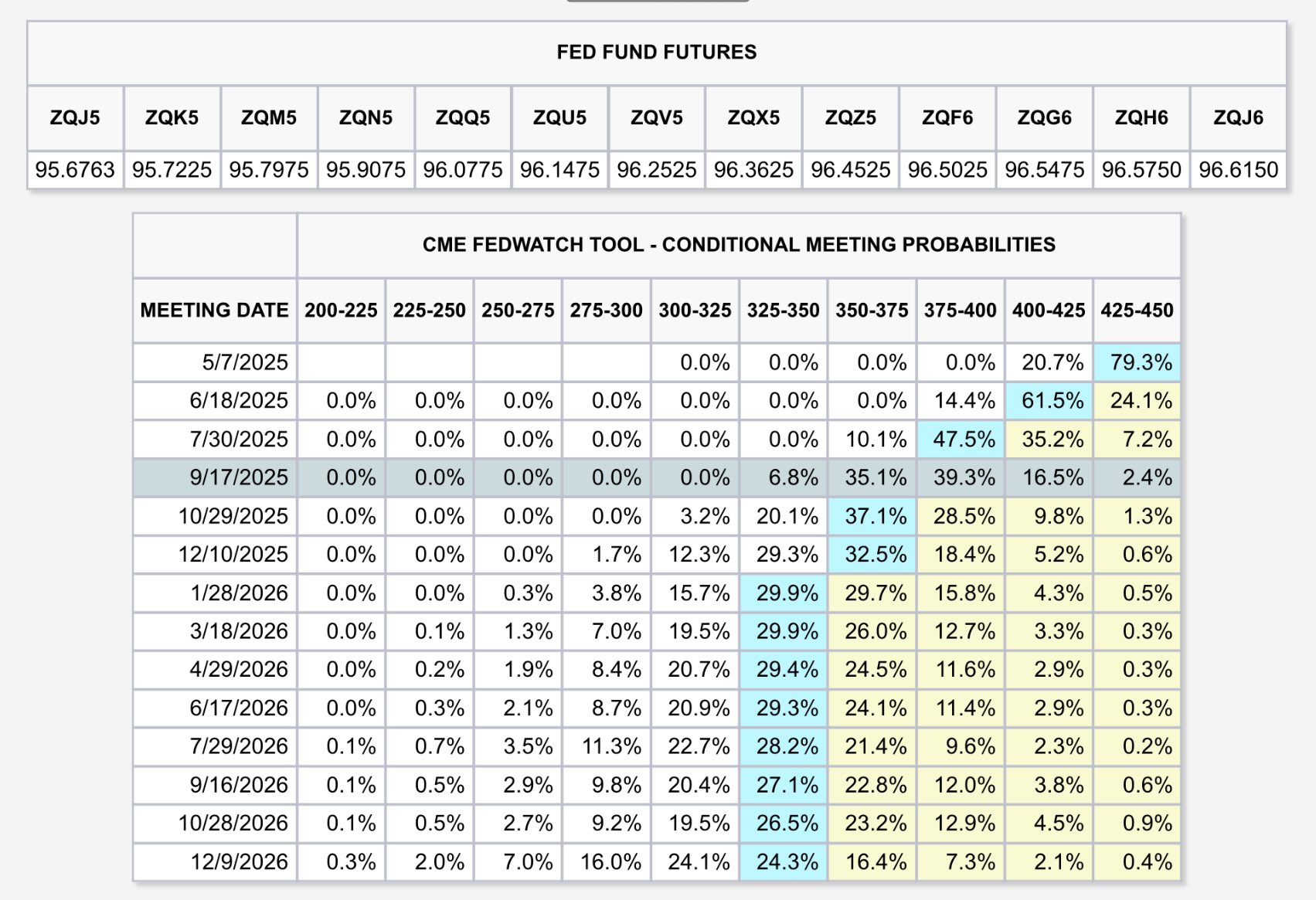

2Y US Bond is a good factor/signal of FED funds rate, but there's an even better one!

CME's 30-day FED Funds futures is a derivative for this exact purpose. The market prices them according to the expectations of upcoming FED Funds Rates

🔗

This is definitely good news short-term for the USD!

Today, short-term funding got 1.25% cheaper for the US government, and once the FED lowers the interest rates, the yields will fall more. Now ofc this will lead to inflation & devaluation of USD, but that's a a different story

Look at that liquidity moving from short-term Chinese bonds(CN01Y), to short-term US bonds(US02Y) 👀

The market liked the removal of tariffs, however, you can't undo the massive volatility over the past 2 weeks

Moreover, US Dollar index is still below 100

🚨 Ruble is up 30% on USD 2025 YTD

82-68 is a strong support - including pre-Ukraine war liquidity

A small pullback is very likely to happen, but in the medium-long term it's heading towards the 68

Once sanctions are dropped by US & EU - RUB will skyrocket

ChatGPT states that a higher interest rate means bad currency & economy

Lower interest rates on the other hand - a flourishing economy

What GPT-o1 failed to mention is that higher interest rates promote savings - a non-inflationary demand

Keynesian economics in its training 🤷♀️

🚨US 10 Year Bond yield spikes above 4.5% at open

I previously posted about the move of liquidity towards the Chinese bonds

The USD is facing an increased perceived risk, which in addition to the public debt puts questions on its role as the reserve currency

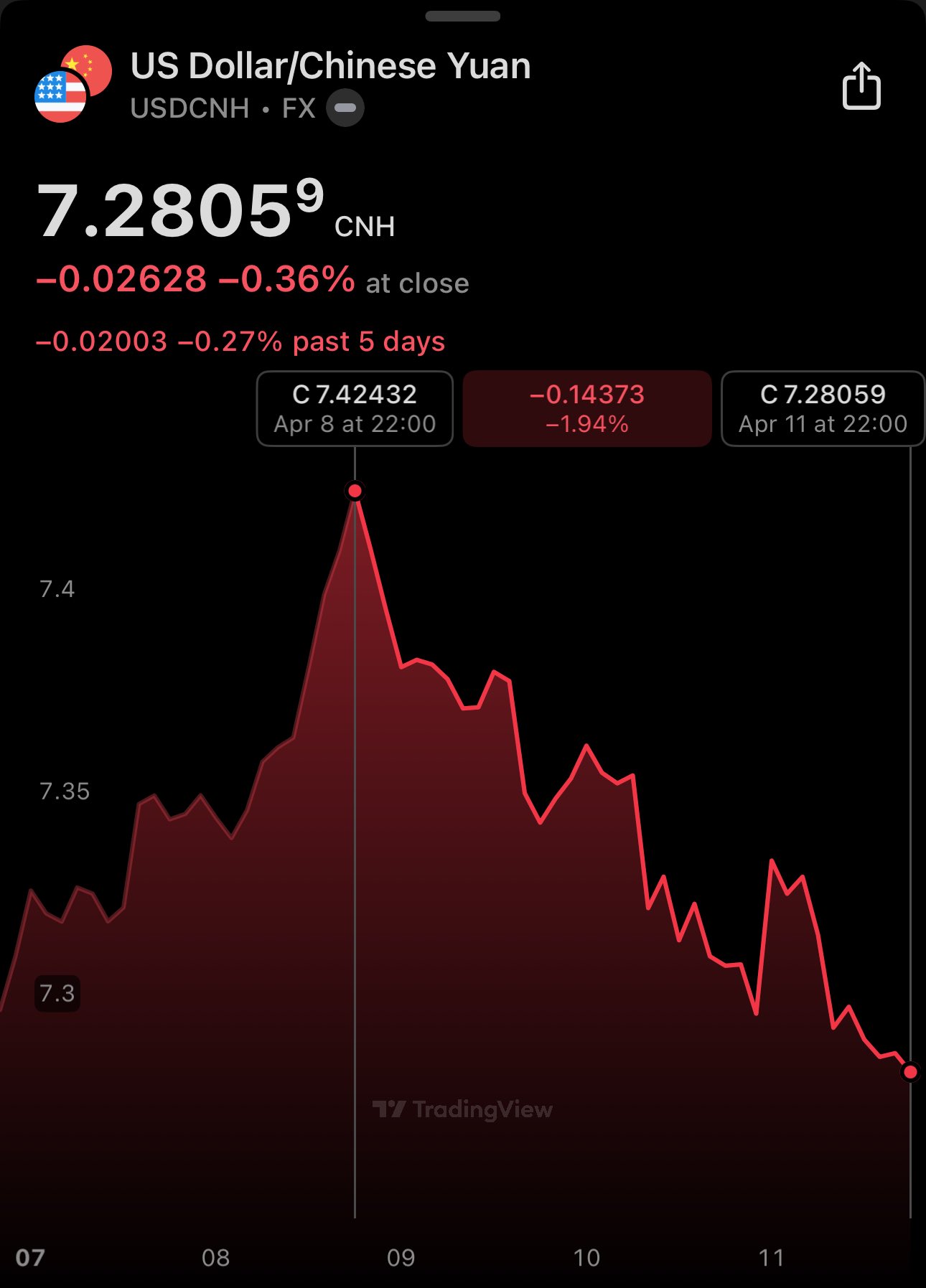

Yuan downside party really didn't last 😳

It went up just as fast as it went down

Yuan up + falling yields on Chinese bonds builds a positive outlook for renminbi

The hinted US securities liquidation/purchase pause by Chinese banks also contributed to this

All expected 🤷♀️

🚨 Chinese 1 year bond prices are up ≈6%

Two extremes:

🇺🇸Massive selling pressure on US Treasury securities

🇨🇳Massibe buying pressure on MoF Chinese securities

USD-denominated debt is being swapped for Yuan-denominated debt

Tariffs mainly hurt the US (unsurprisingly)

1. It will NOT happen

2. What 😂

Imagine swapping a part of the peg of the US Dollar - the world reserve currency - from gold to a highly volatile asset

The US Bond market would crash at record numbers. Same for US Dollar index

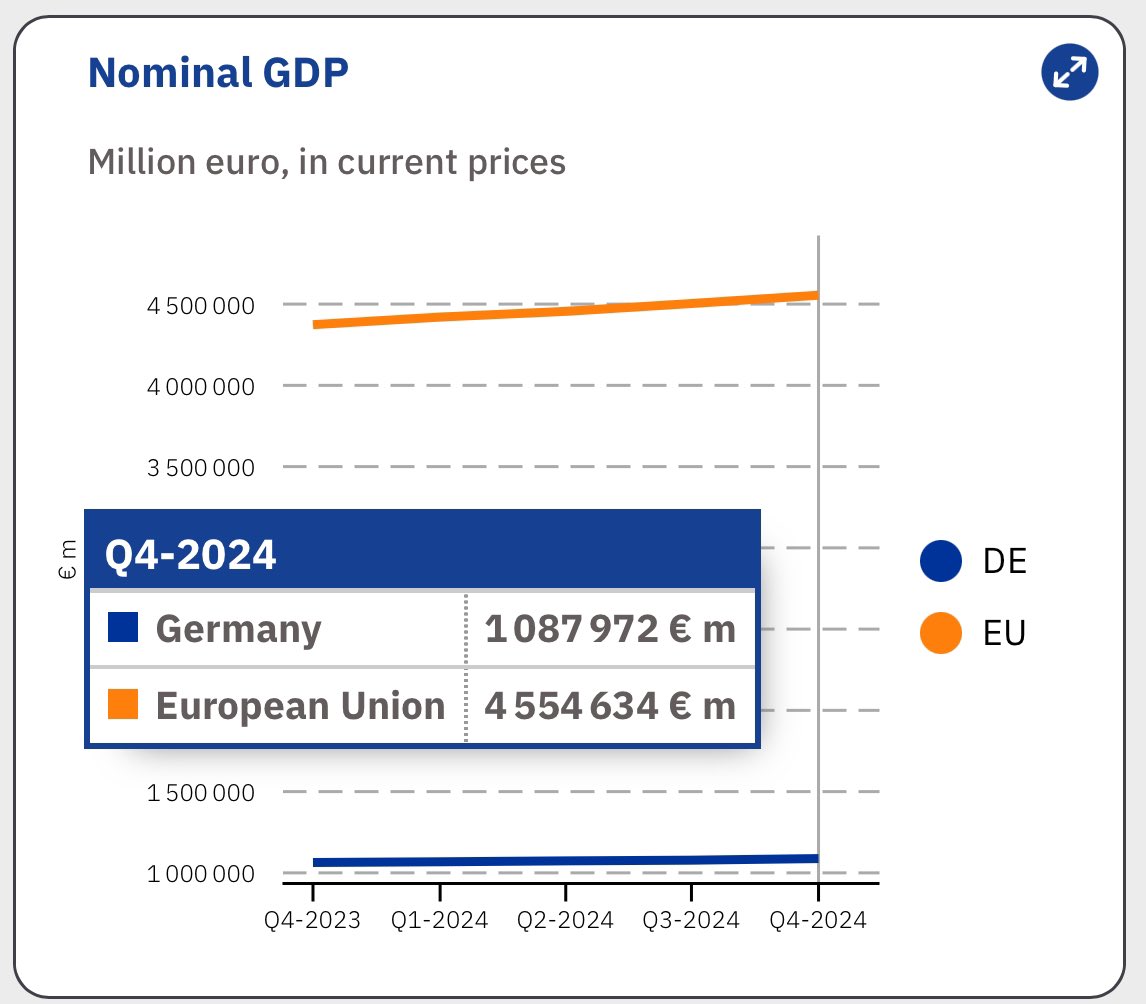

🇩🇪 Germany's GDP is 1/4 of EU's GDP

There are 27 countries in the European Union. 26 of them combined represent 3/4 of EU's GDP

Germany, France & Italy represent 52% of EU's GDP

You have to be very specific when talking about EU economy 🇪🇺