⬇️ My Thoughts ⬇️

🇺🇸🇨🇳Here's why trade war with China will hurt the US

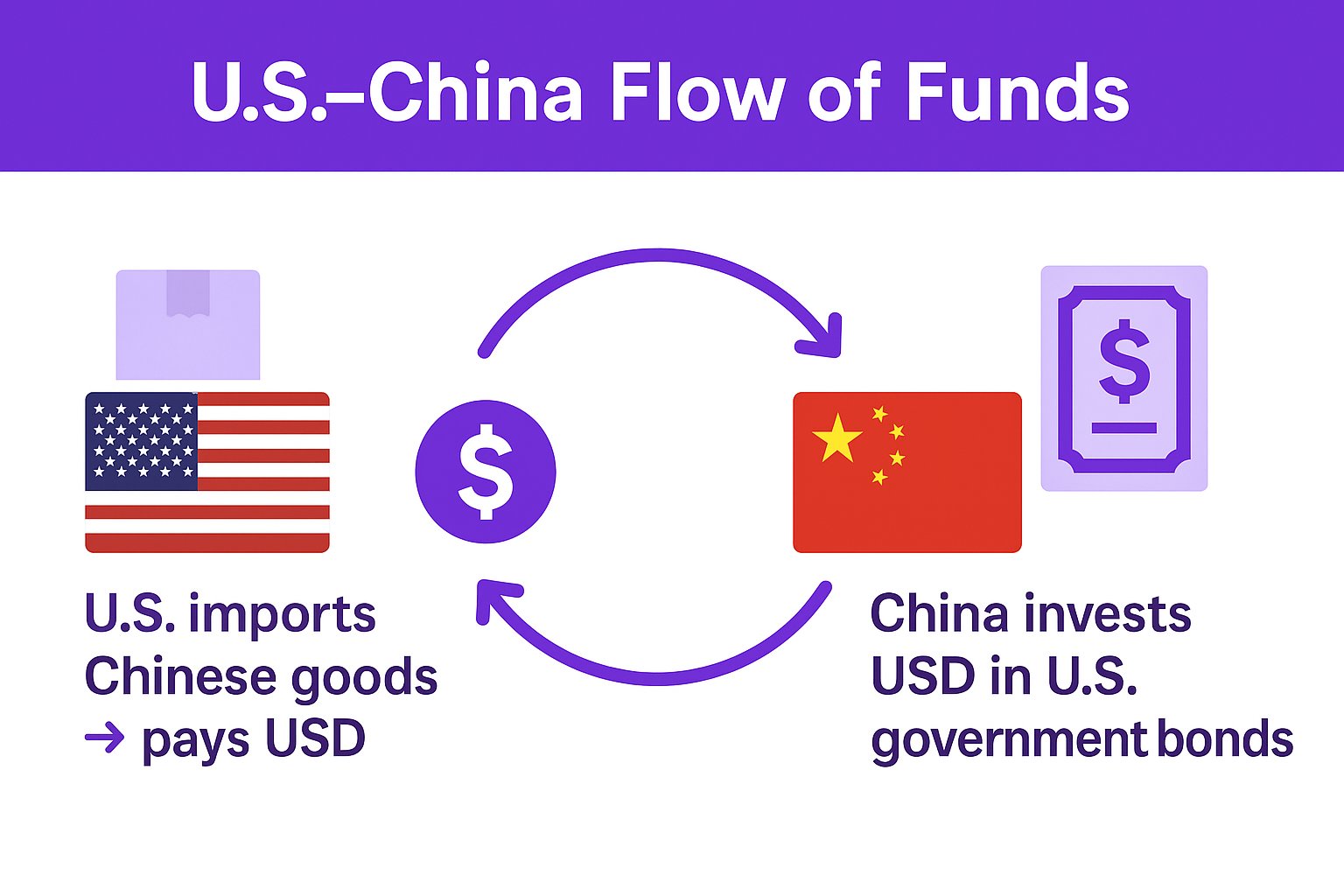

The economic relationship between US & China is:

1️⃣US pays USD for Chinese goods

2️⃣China re-invests USD back into US bonds

Thus, the same USD comes back to US!

Tariffs = less imports = less US bond investment = higher yield

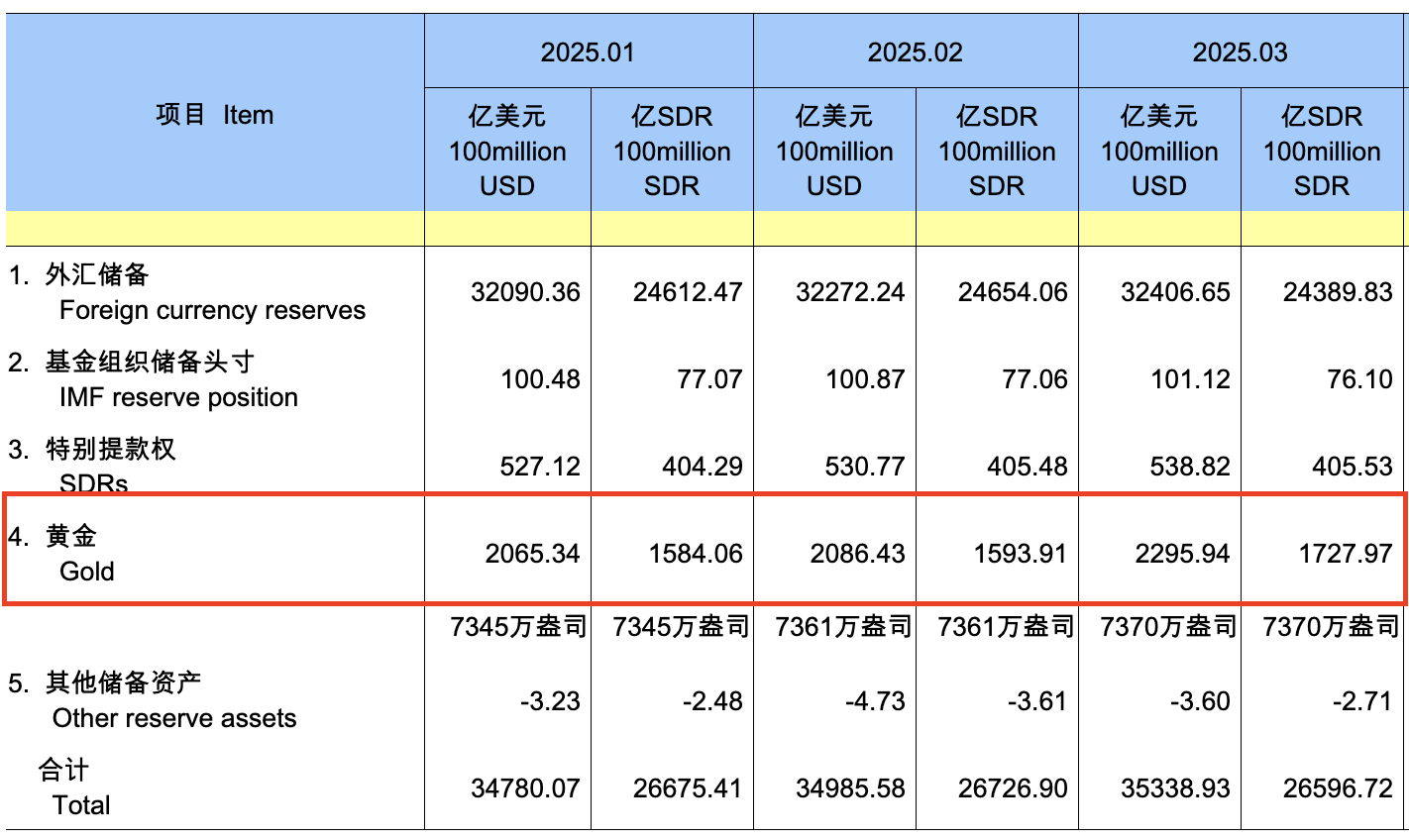

🇨🇳China has been increasing their gold reserves YTD

Gold price keeps going up - major central banks continue to load up

Gold is a hedge against USD. Tariffs are a medium of USD weaponization

👉 Expect US securities sell-off for gold by People's Bank of China

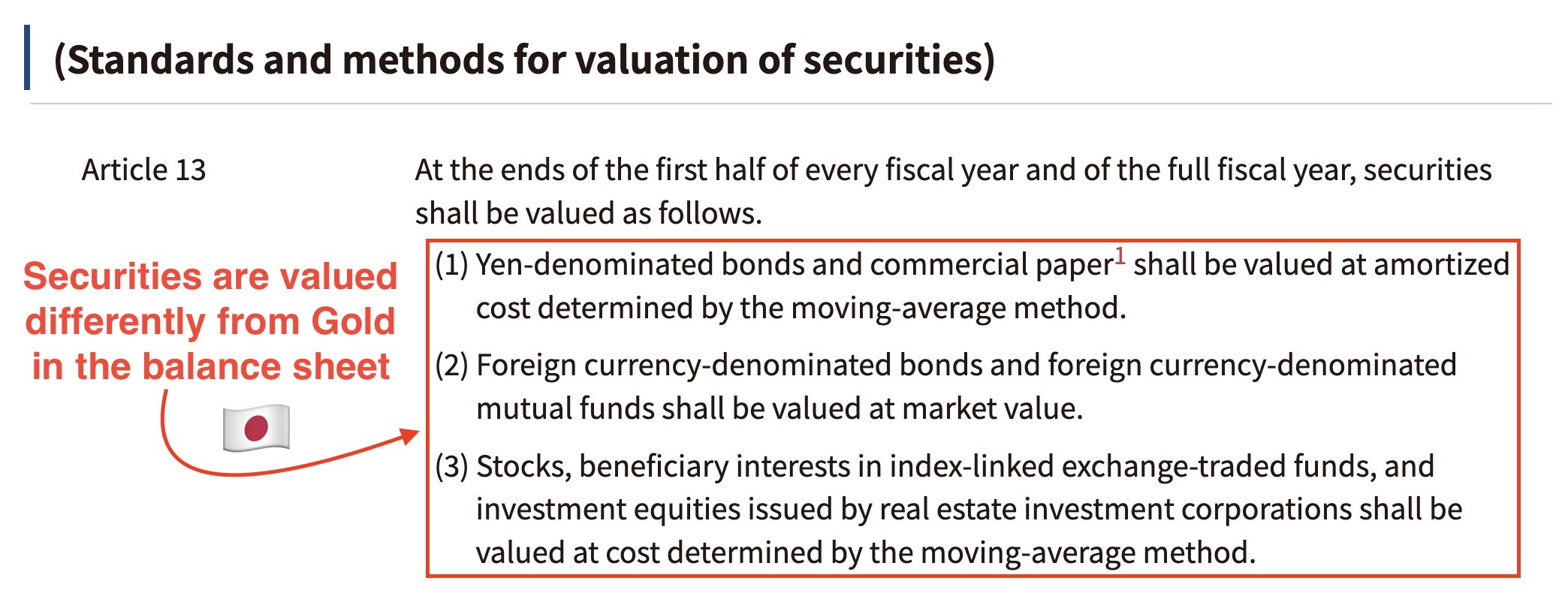

🇯🇵Article 13 of Accounting Rules of the BOJ defines special valuation rules for securities:

1️⃣ Yen bonds at amortized cost

2️⃣ Foreign currency bonds at market value

3️⃣ Stocks, ETFs, J-REITs at MA cost

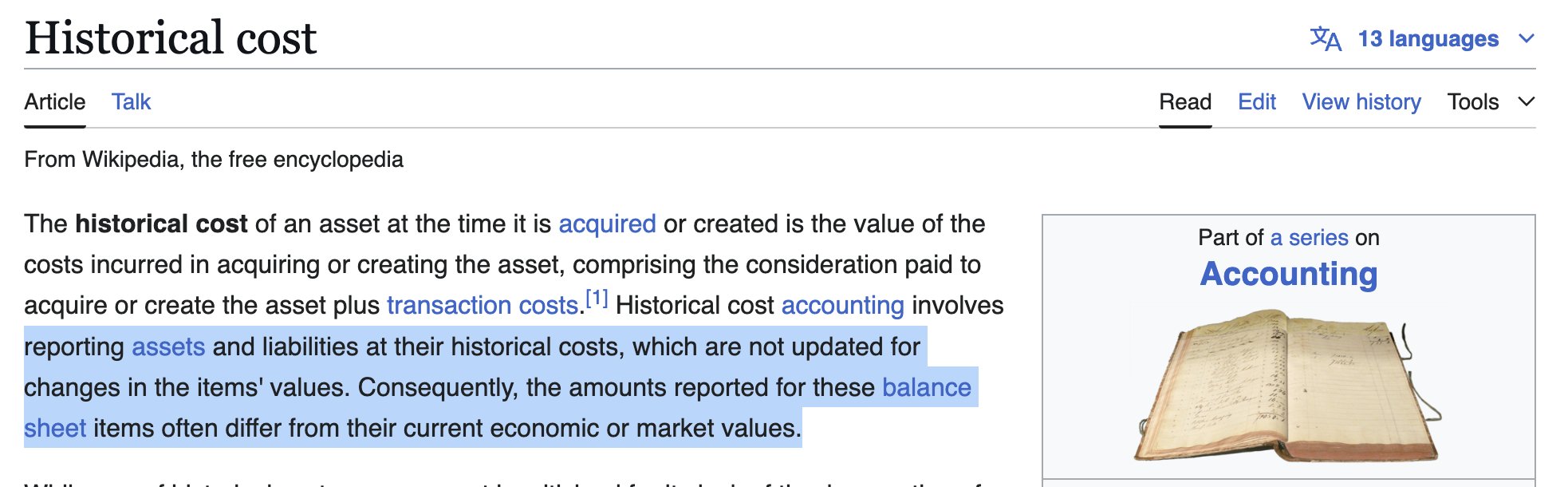

Since gold is not a security, it falls under Article 3 - book value

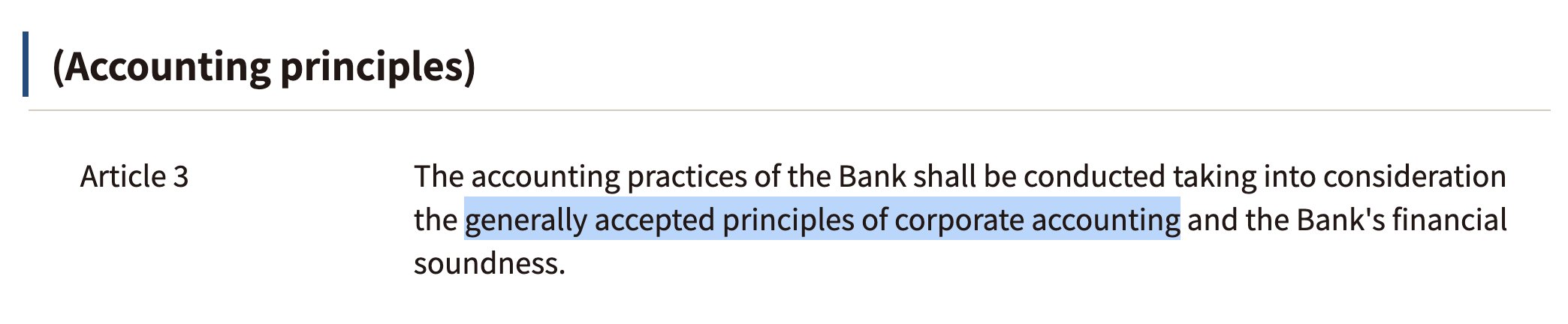

Generally accepted principles of corporate accounting are:

- Historical cost - asset value is recorded at book/acquisition value

- Prudence/Conservatism - decrease the asset value in the balance sheet if it has fallen in value. Unrealized gains are ignored

🇯🇵BOJ abides by them

🇯🇵Article 3 of Accounting Rules of the Bank of Japan states that "generally accepted principles of corporate accounting" shall be used for BOJ's accounting

This defines the framework of how assets and liabilities are values in the central bank's balance sheet

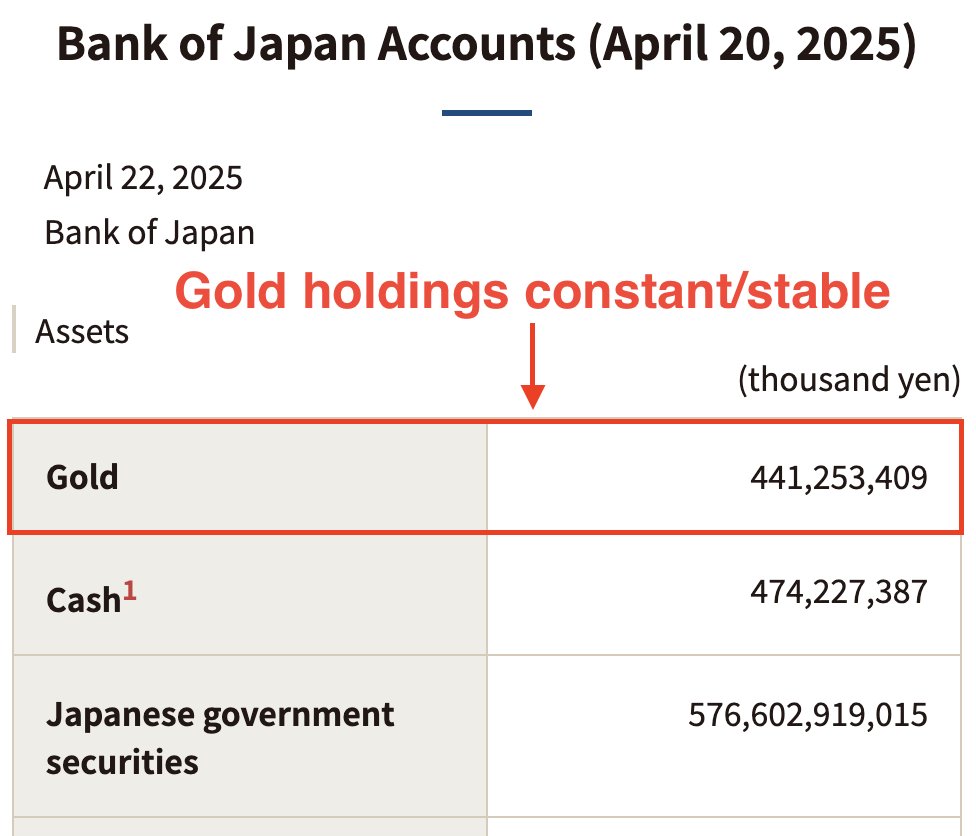

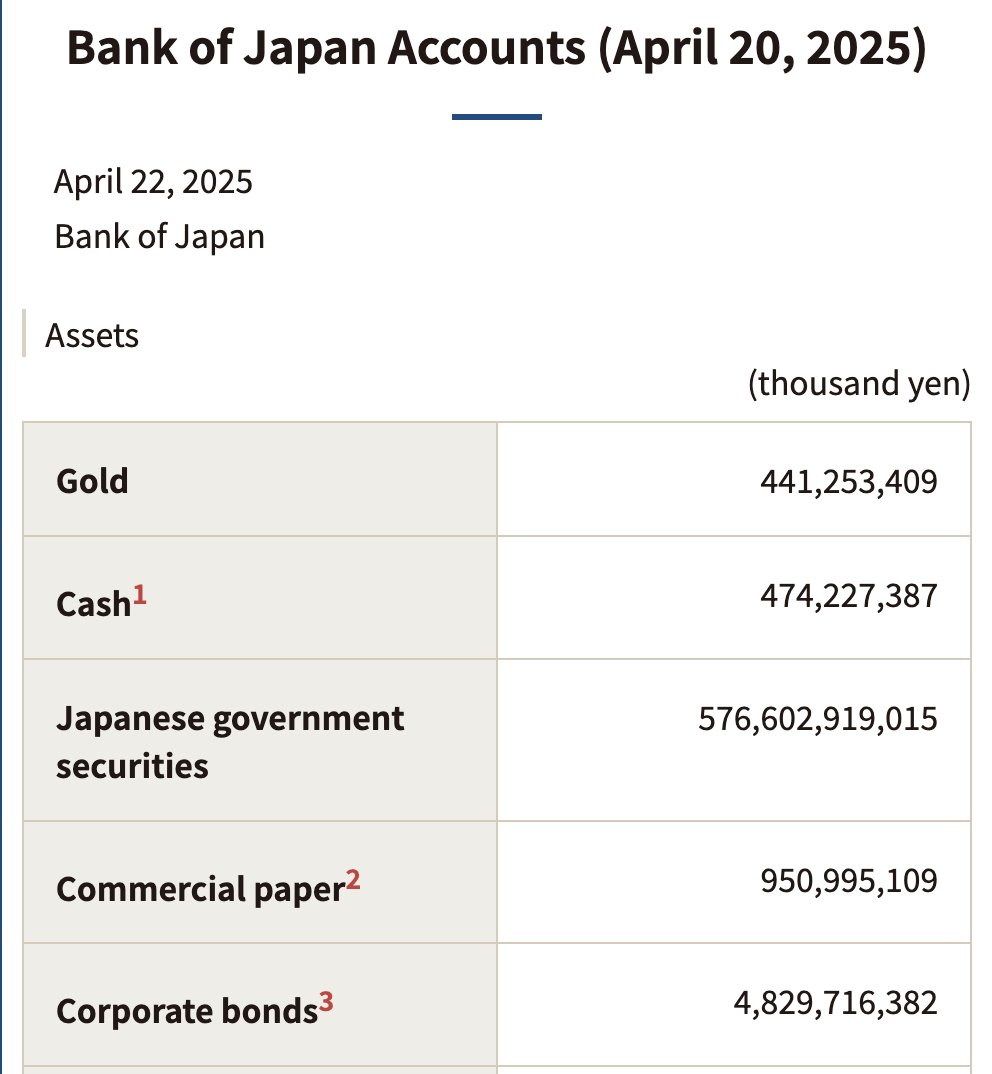

🇯🇵 BOJ's gold holdings have been constant for 10 years

But gold value has skyrocketed - does that mean Japan has been selling gold?

No. Articles 3 & 13 of Accounting Rules of BOJ imply that gold holdings are recorded at book value/purchase value, rather than market/spot price

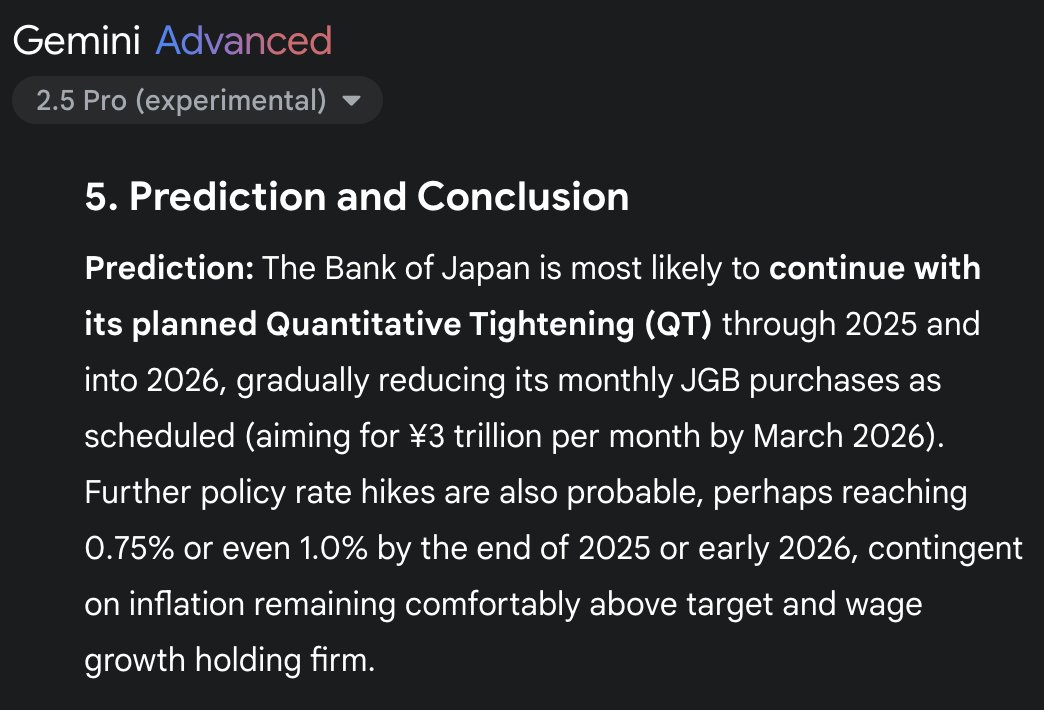

🇯🇵 Gemini 2.5 Pro Deep Research says Bank of Japan will continue with QT

I say they will switch (back) to QE soon

By QE I mean expansion of balance sheet, combined with low/negative key interest rates

Let's see who's right

🇯🇵Bank of Japan just released their 10 day account/balance sheet statements

💰2025 YTD:

- Gold holdings stable

- Foreign currencies down

- Cash up

- JGB down

- Total assets down

Signs of QT, but it won't last. Soon, the balance sheet will expand again. High exposure to USD.

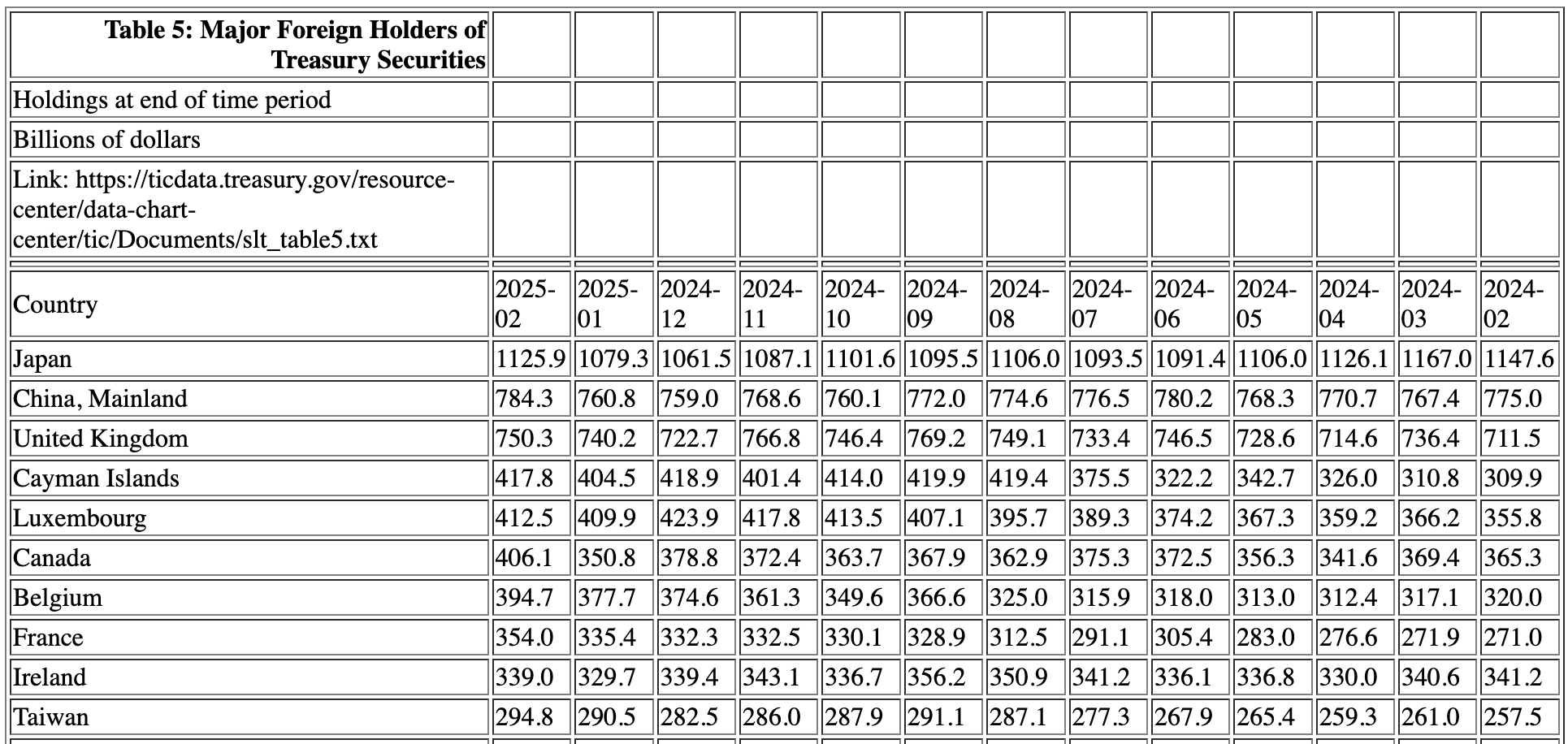

A moment of appreciation for how the US Treasury reports the major sovereign holders of securities in this plain HTML table

Clear, lightweight and works on every device

There's also a plain text version, but it's not as neatly formatted

🚨 Short-term USD risk is up

Premium/yield is a measure a risk

Imagine you're purchasing a stock of a company. The CEO of that company makes hostile comments towards its financial division

Does the required return to cover the risk of that company increase or decrease?

🚀 Updated https://illya.sh/thoughts/

- Dark/Light mode automatic + toggleable (click on profile image)

- More compact design

- Large image preview (on click) fixed on mobile

My latest X posts are now also live

🚀 Pushed an update to my homepage at https://illya.sh/

Added a link to https://illya.sh/thoughts/ to which I have been exporting a lot of my tweets

Making 'My Thoughts' button exactly like I wanted took a few iterations and custom contexting with Gemini 2.5 Pro

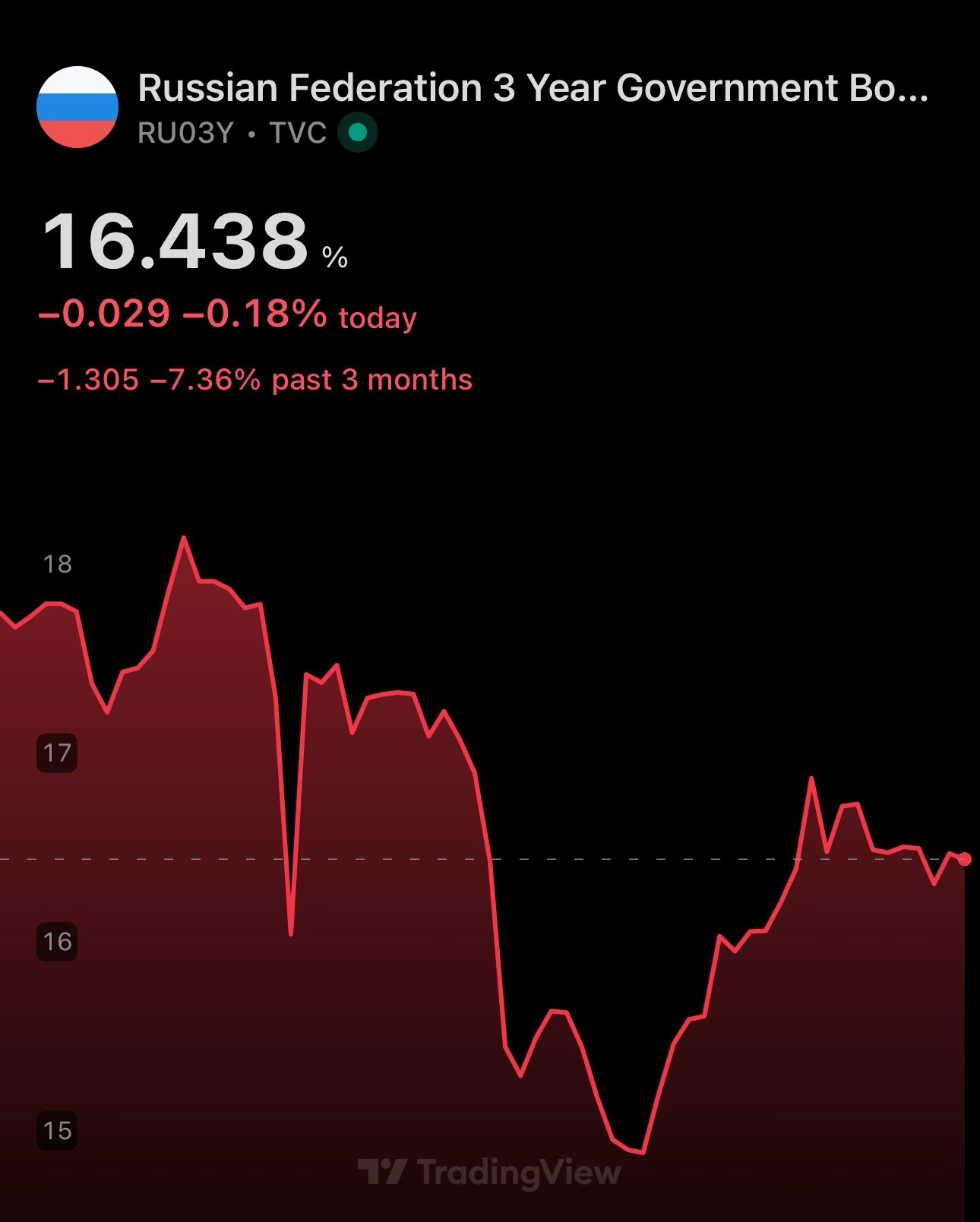

🇷🇺 Russian Central Bank key interest rate is at 21%

3Y Russian Federation bonds are at ≈16.5% yield

The market is pricing in upcoming rate cuts

@AskPerplexity and @grok will tell you that Ruble & Russian economy are in a bad state. The reality is different

🚨UPDATE: Gold has now reached $3400

All time highs, followed by more all time highs

Remember: gold is not increasing in value, but rather the underlying currencies are falling in value

Expect this trend to continue

🇺🇸UPDATE: USD Index in fact did NOT enjoy this

#DXY down over 1% today, currently at 98.3

It's almost like aggressively weaponizing the currency erodes the trust in it. Who knew!

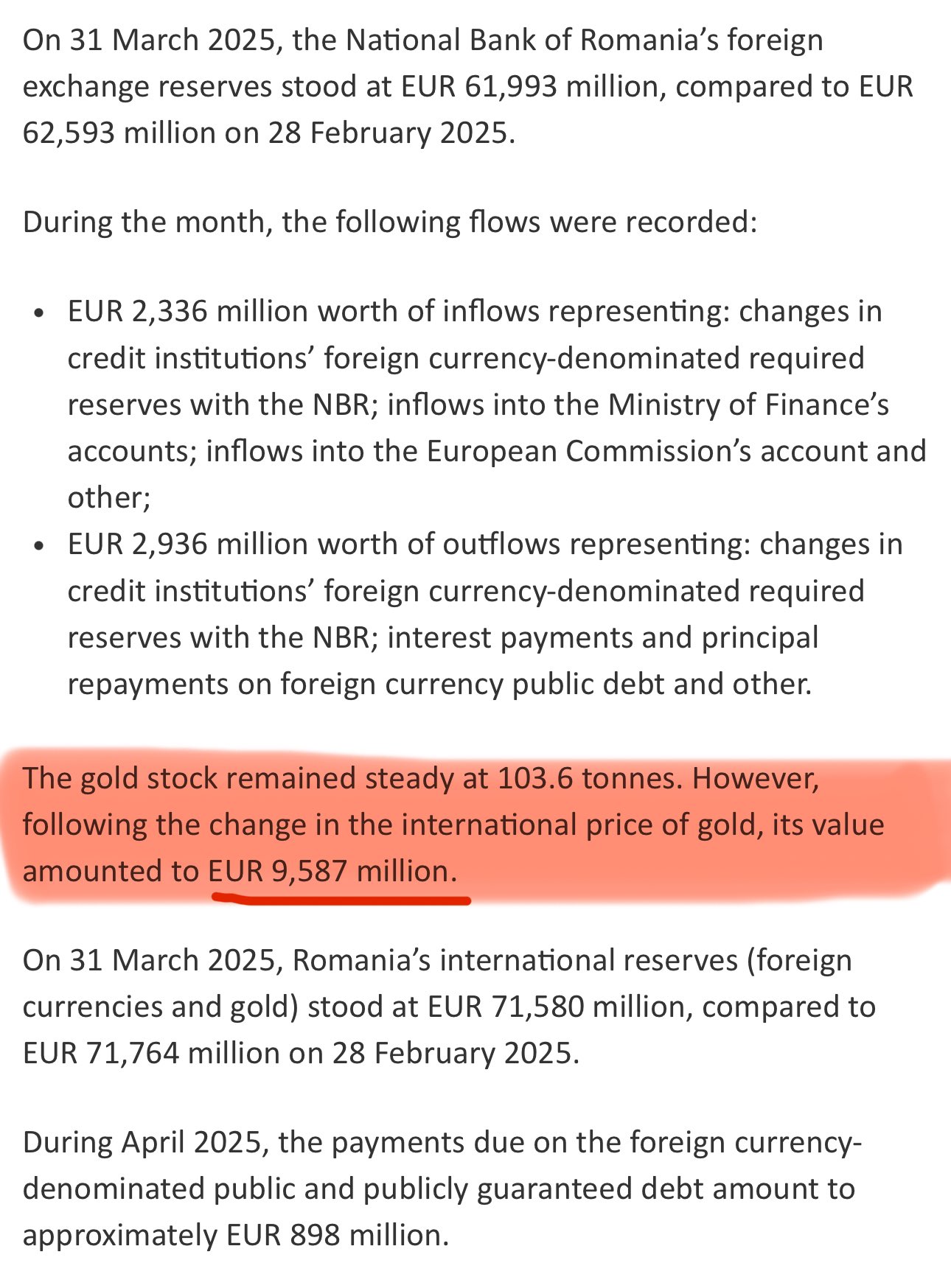

🇷🇴 National Bank of Romania's gold reserves are ≈13% of their international reserves as of March 2025

I like how they added the paragraph in red 😁

Gold reserves unchanged - value raising. Get used to this trend

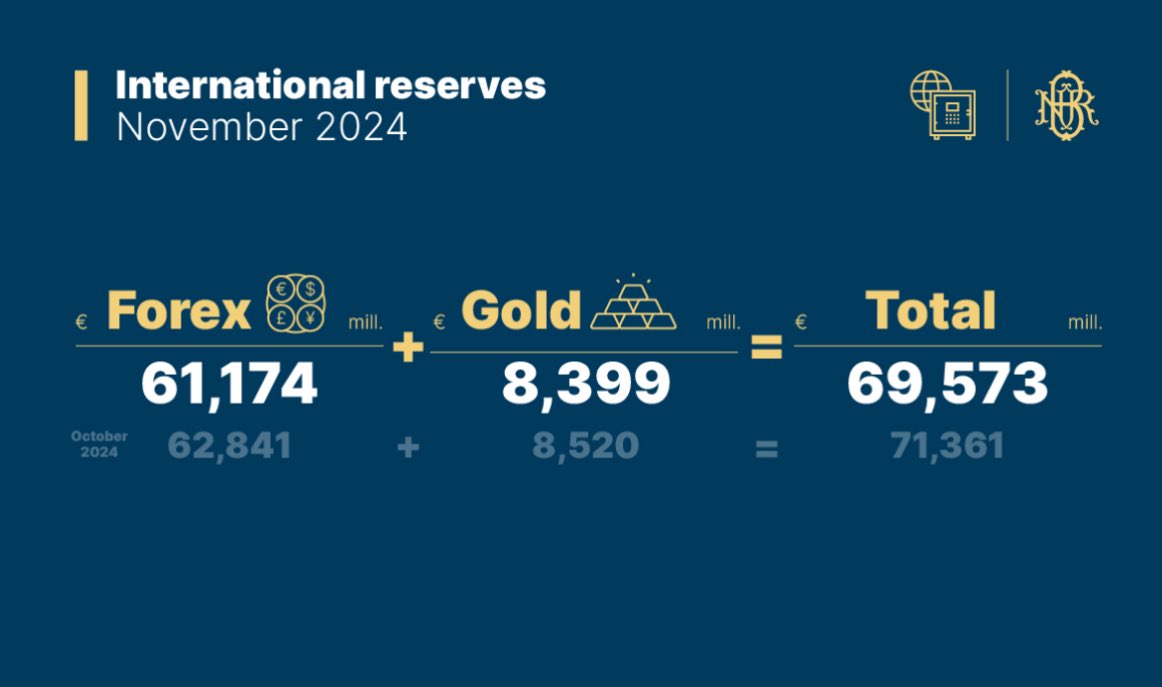

🇷🇴 I like how Romania's Central Bank has this image breaking down their international reserves on their homepage

However, I didn't understand why it links to November 2024 data, when March 2025 data is already available 😁

Gold reserves are ≈12% here

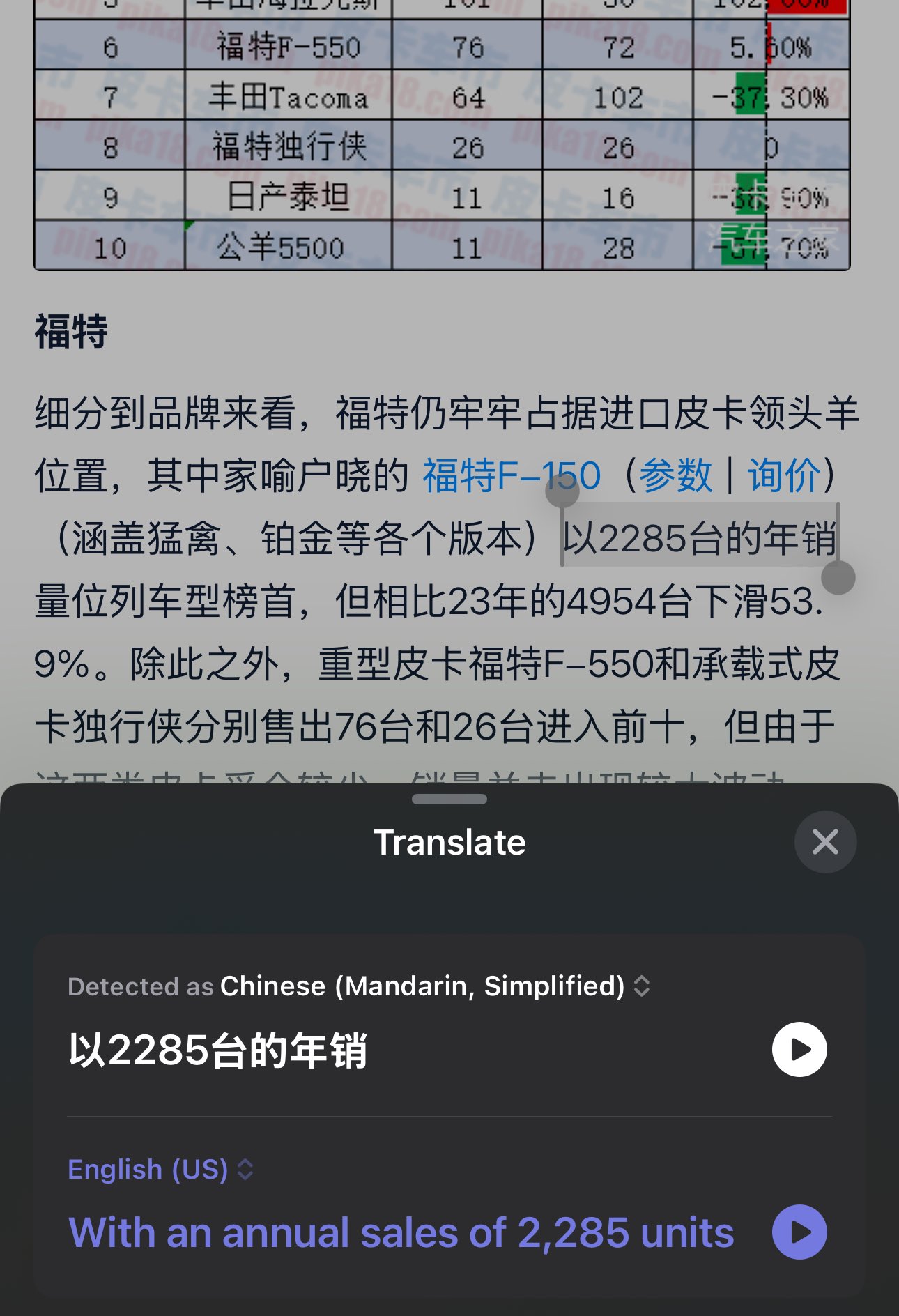

Ford F-150 sold 2285 units in China 🇨🇳

Great Wall Cannon (长城炮) - 80K

Unlike the US or most of the world - China has effective factories & supply chains - offering them a myriad of domestic alternatives

China doesn't need Ford. Ford needs China due to imported parts

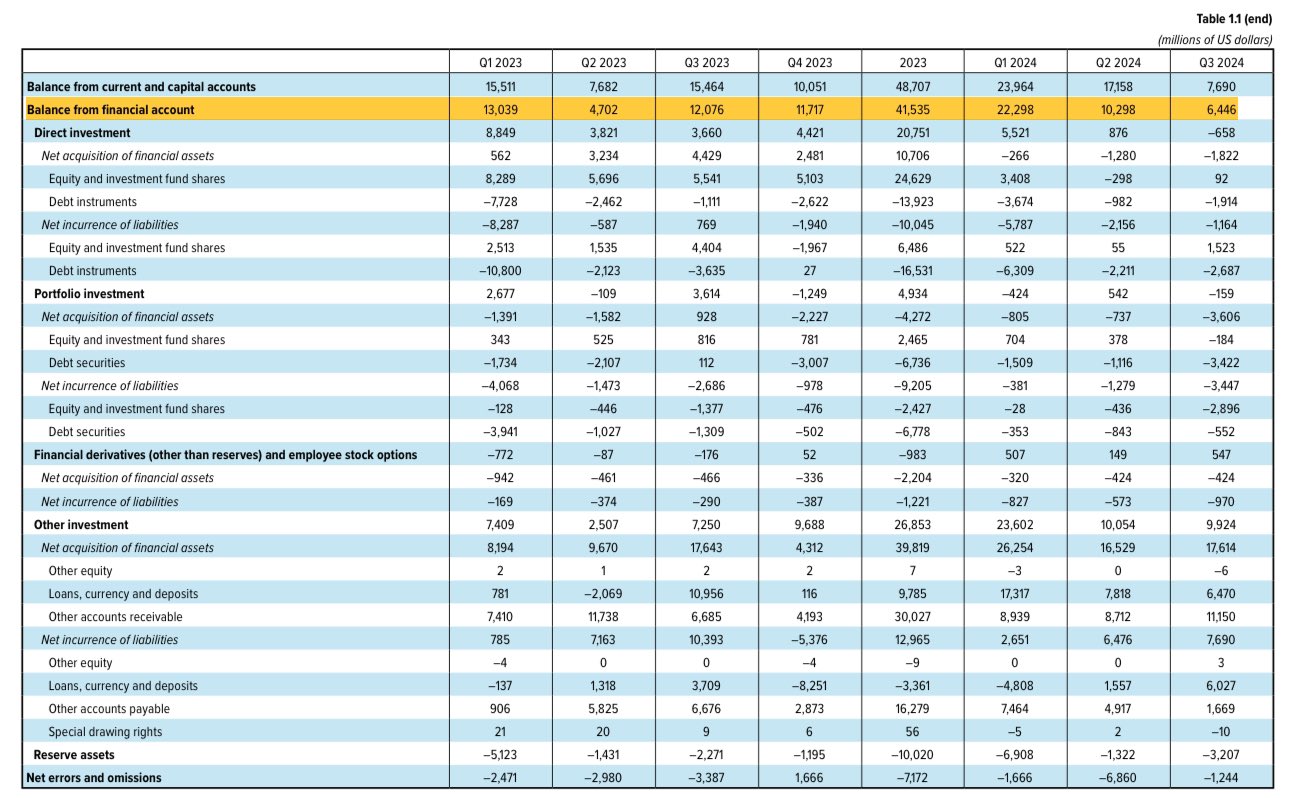

🇷🇺 Russian residents are net creditors to the world

In Balance of Payments, financial account tracks transactions involving financial assets and liabilities

Positive value = more capital leaving country than entering

Sanctions make it almost impossible to invest in Russia

🇺🇸 USD index bearish/in a downtrend

5Y timeframe weekly chart shows lower highs & lows

Ever since Trump took office, every $DXY weekly candle has been red

Greatest USD economy in history 🫠

🇷🇺 Russian government gets a lot of revenue from natural resource exports, such as oil and gas

This means the government has a lot of Rubles to deposit at the Central Bank

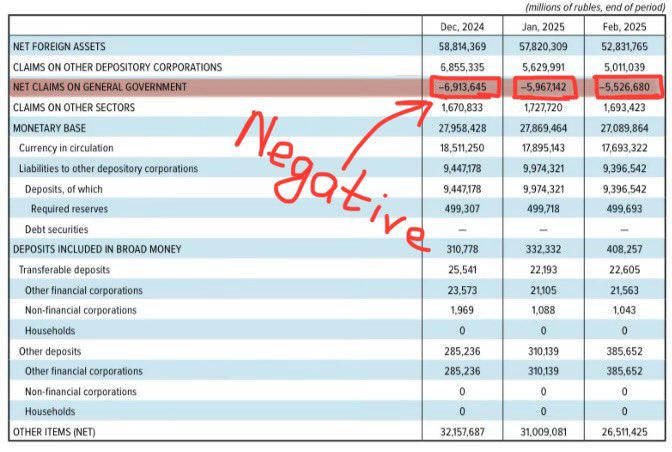

👉A big help towards the CBR maintaining negative net claims on the government

Result = strong Ruble 📈

🇷🇺 Another reason for a strong Ruble is the consistent negative net claims on general government on the balance sheet of Russian Central Bank

Russian government deposited more in the central bank than borrowed from it - meaning NO monetary financing of budget deficit