⬇️ My Thoughts ⬇️

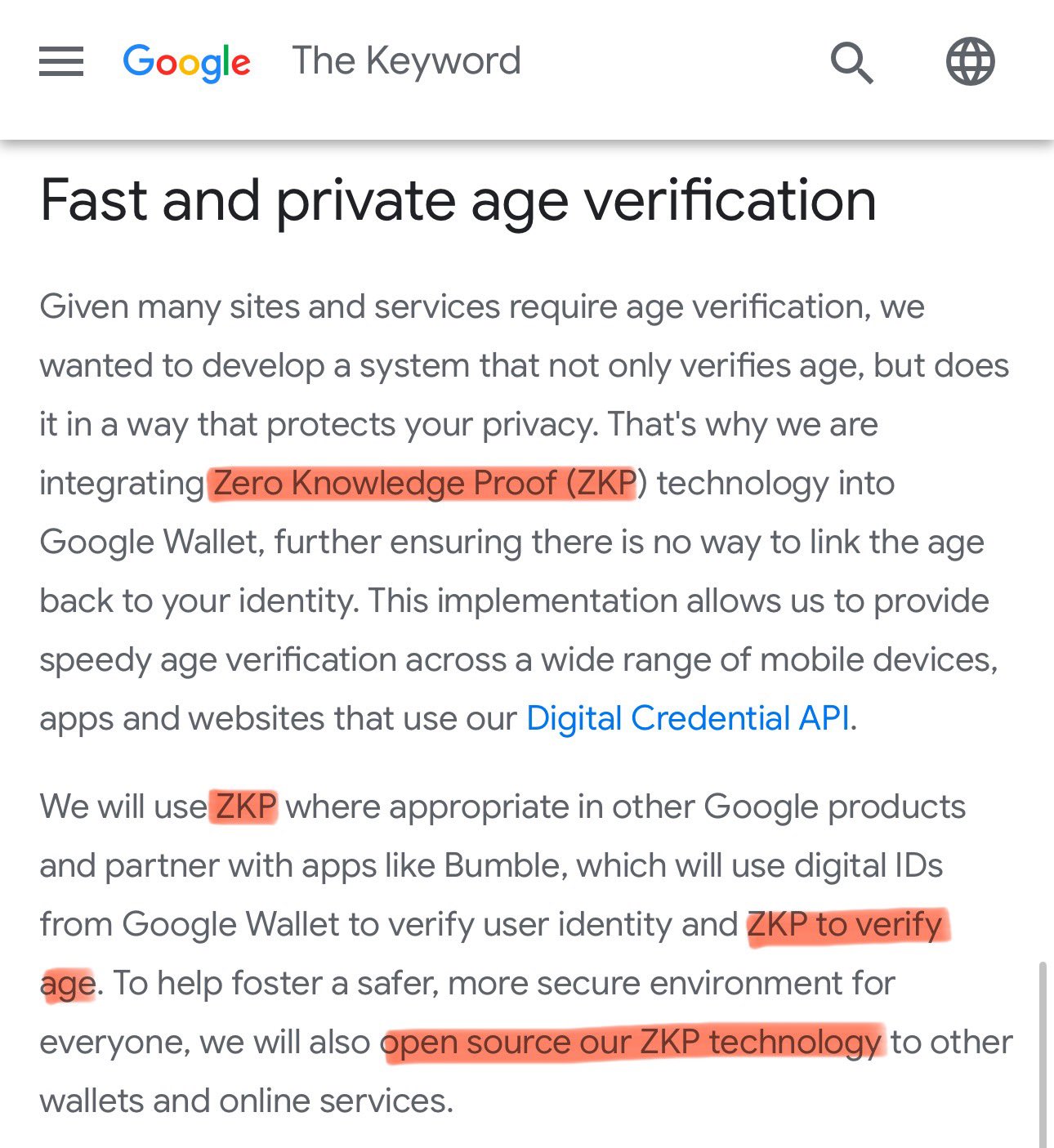

Google + Zero Knowledge Proofs = ❤️🔐

ZKPs will allow you to prove your age to other apps via Google Wallet - e.g. a proof that you are >18

AFAIK you'll upload your ID, Google BE verifies & signs it

Integrate with @MinaProtocol schemes & Android goes on the 22KB blockchain 😳

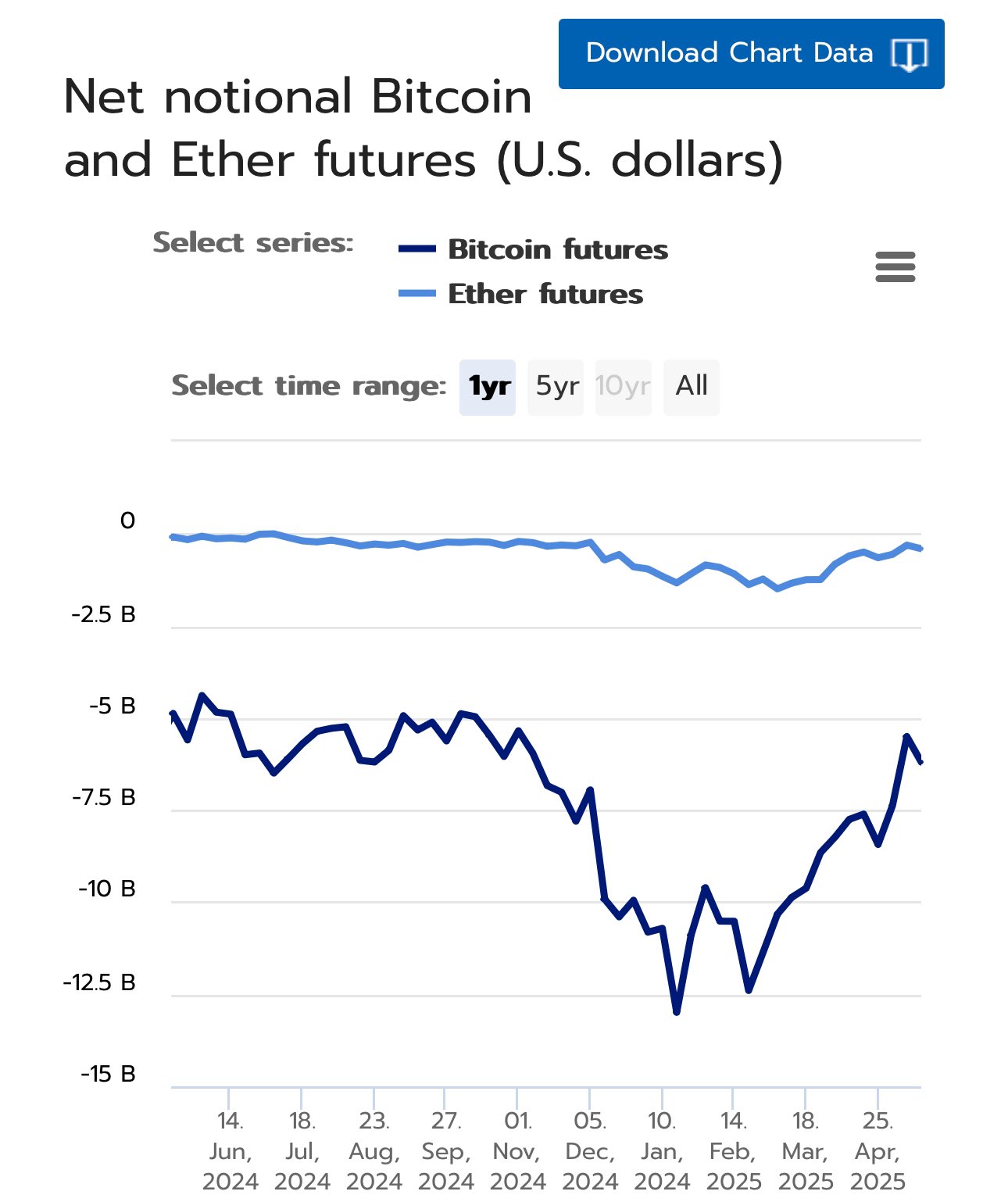

⚠️It's important not to interpret the net notional futures positions simply as short - bearish, long - bullish

There are several reasons why futures may be short & the sentiment is still bullish - e.g. basis trade, funding fee (for perpetual futures). Same for long/bearish

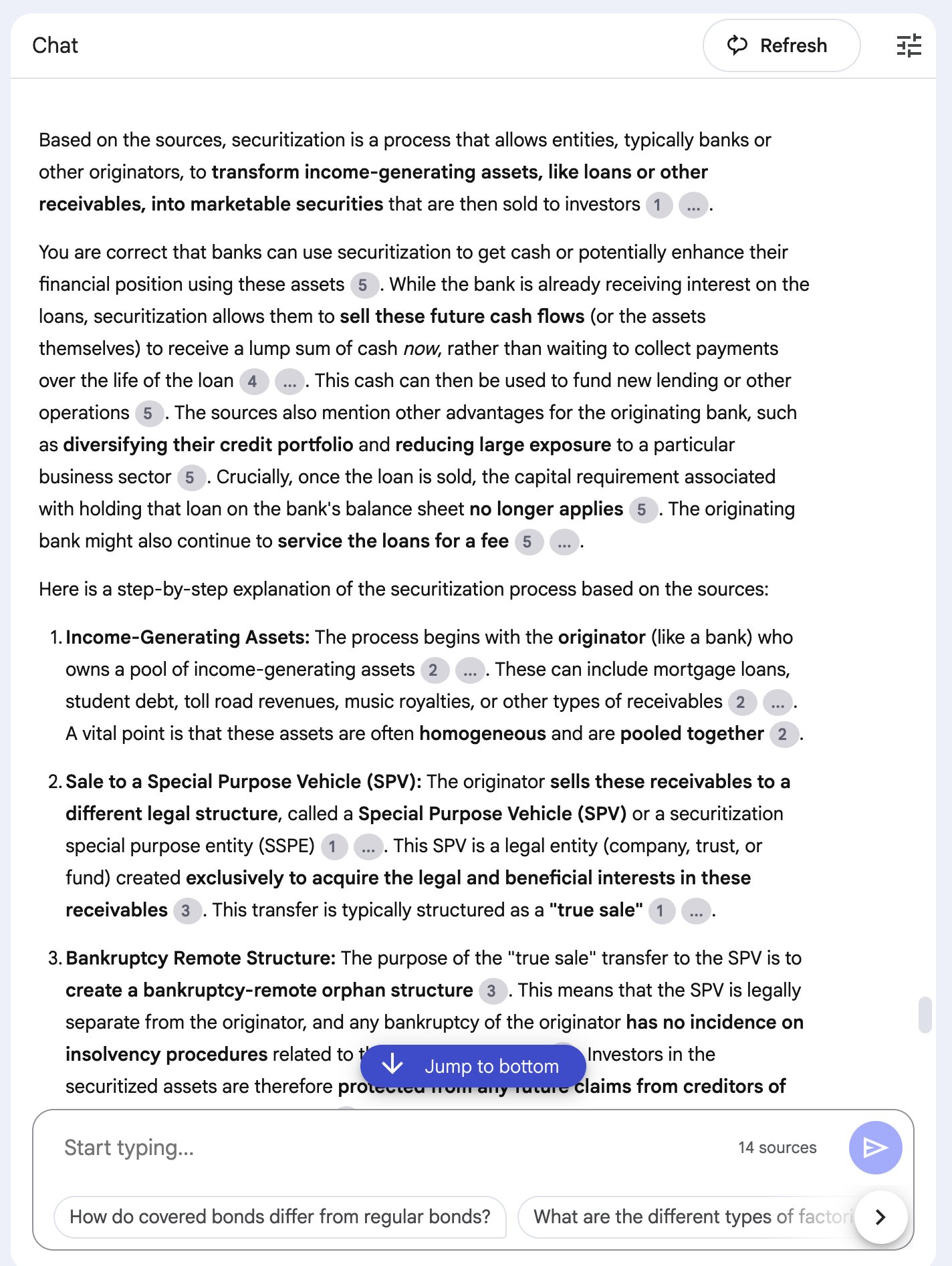

I've said this before, but I'm still amazed daily by how much LLMs have augmented the learning process

A much more efficient way of information retrieval.

Don't overthink the prompts - type or dictate your question, however unclear it is - neural networks will figure it out 🧠

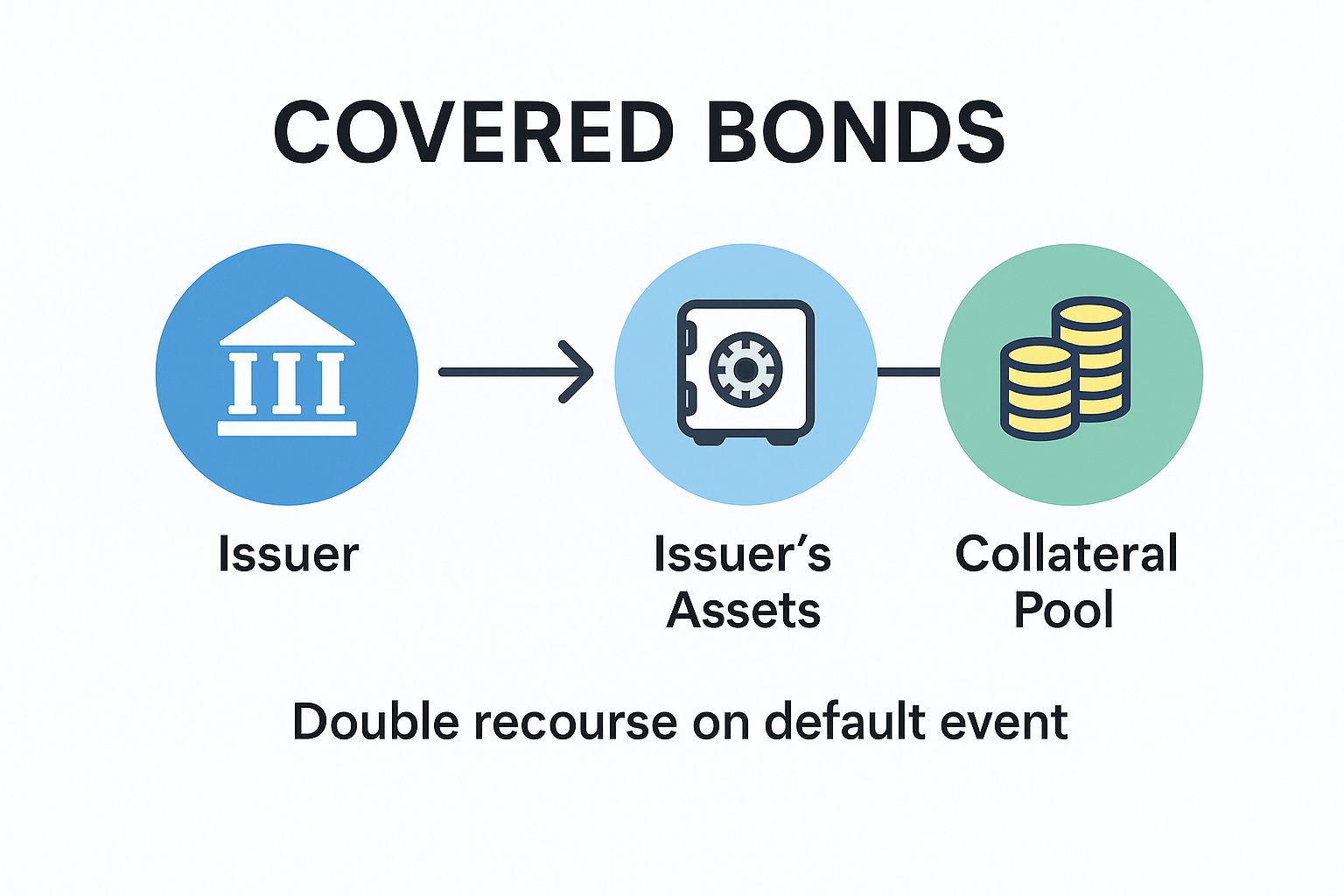

Covered bonds are issued by a financial institution (e.g. bank) & include a claim on both issuer's assets & an additional collateral in the form of a pool of assets

Investor has double recourse on issuer's default event:

1️⃣ Issuer's assets

2️⃣ Collateral pool

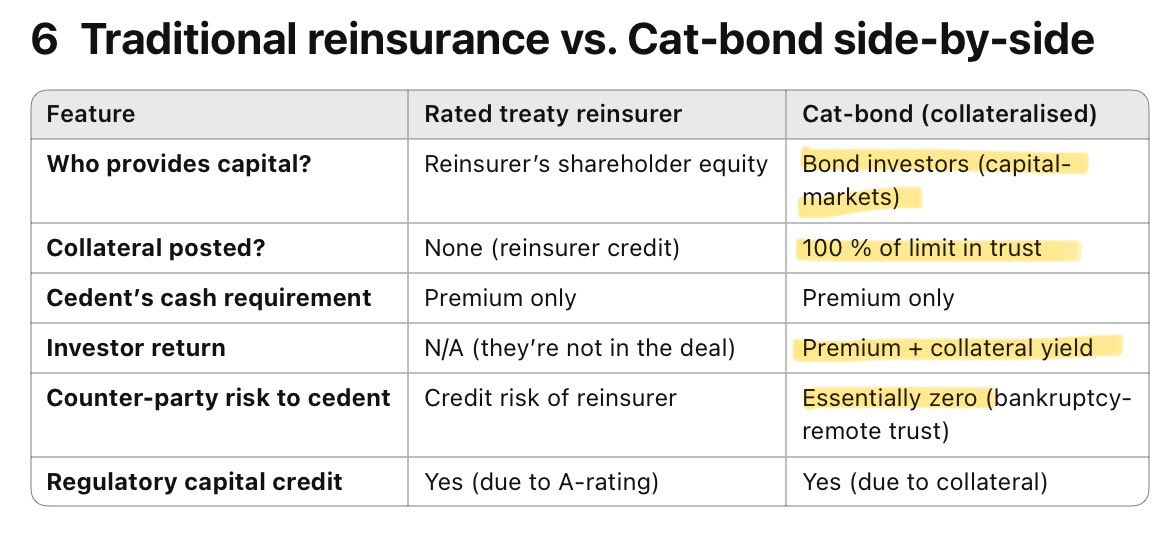

Catastrophe bonds (cat bonds) work by having an investor pool deposit 100% of collateral and earn ≈risk free rate + premium paid by the insured

If the covered event occurs, investors lose a proportionate part of their principal, as the insured gets repaid from the collateral

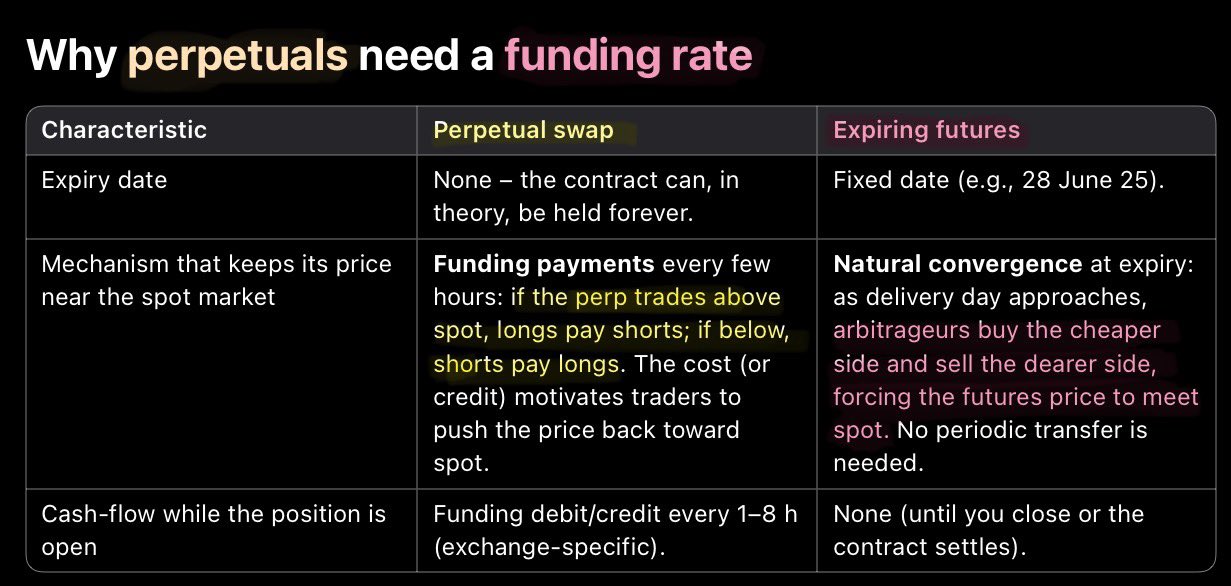

Basis/carry yield in expiring futures ≈ funding rate in perpetual futures

Both converge futures price with spot via an arbitrage incentive - long undervalued, short overvalued

Profits are realized once at expiry for basis, and periodically for funding rate (e.g. every 8h)

⏰ Reminder to do a deep dive into funding rates, if you still haven't

You can earn a yield on futures though delta neutral positions

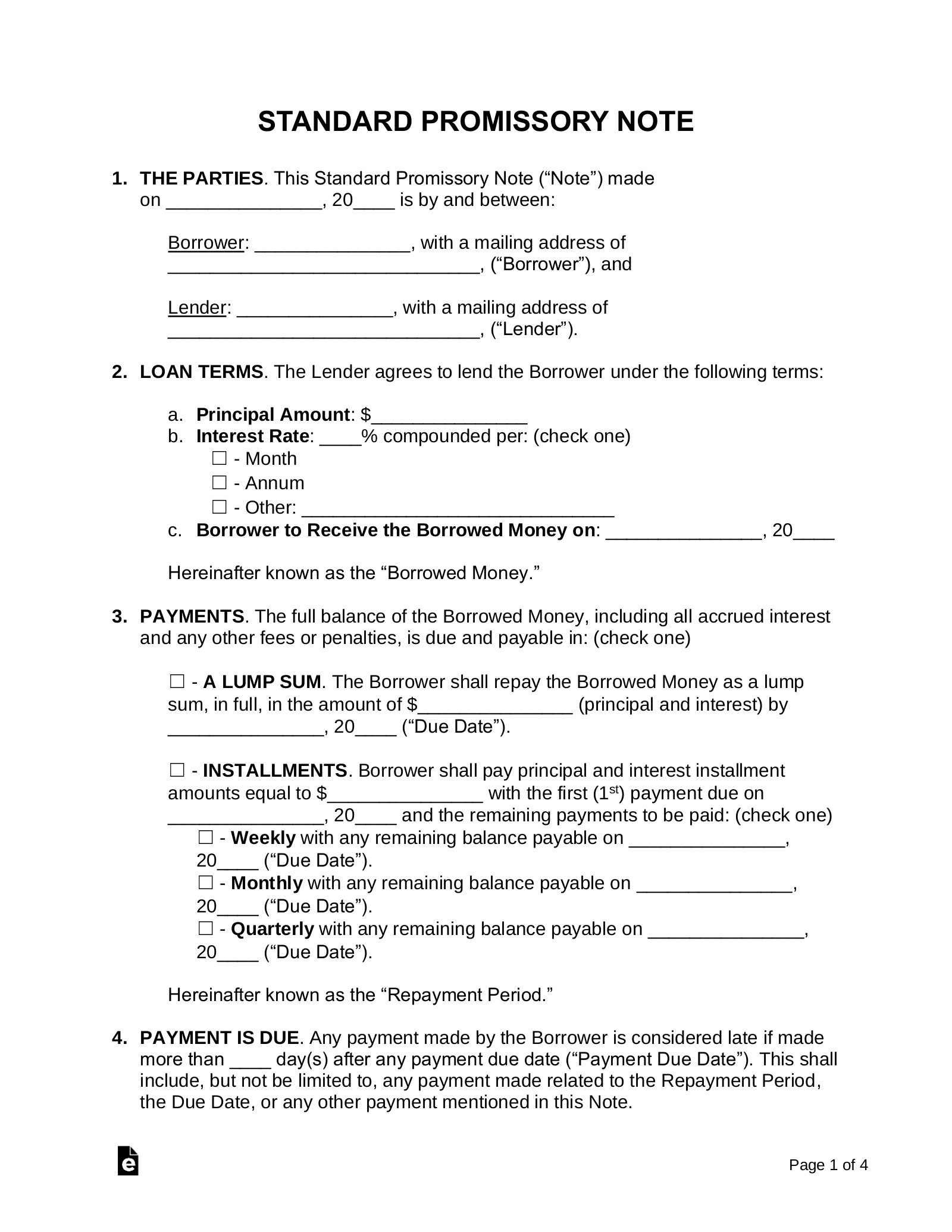

Promissory notes are very simple legal documents, generally 1 page

Unlike bonds, it has no coverants, no trustee & no collateral

Financial markets are defined by legal documents with math formulas/values

Promissory notes are very simple legal documents. It looks like this ⬇️

Commercial paper is unsecured short-term debt issued by large, creditworthy companies

In practice, it's a short-term promissory note - so something a company would use for short-term financing, perhaps for meeting working capital needs

🚨 ETH & BTC shorts update:

Short positions on Bitcoin & Ethereum are gradually reducing

Institutional net position on cryptocurrencies is still short, but only a half from the start of the year

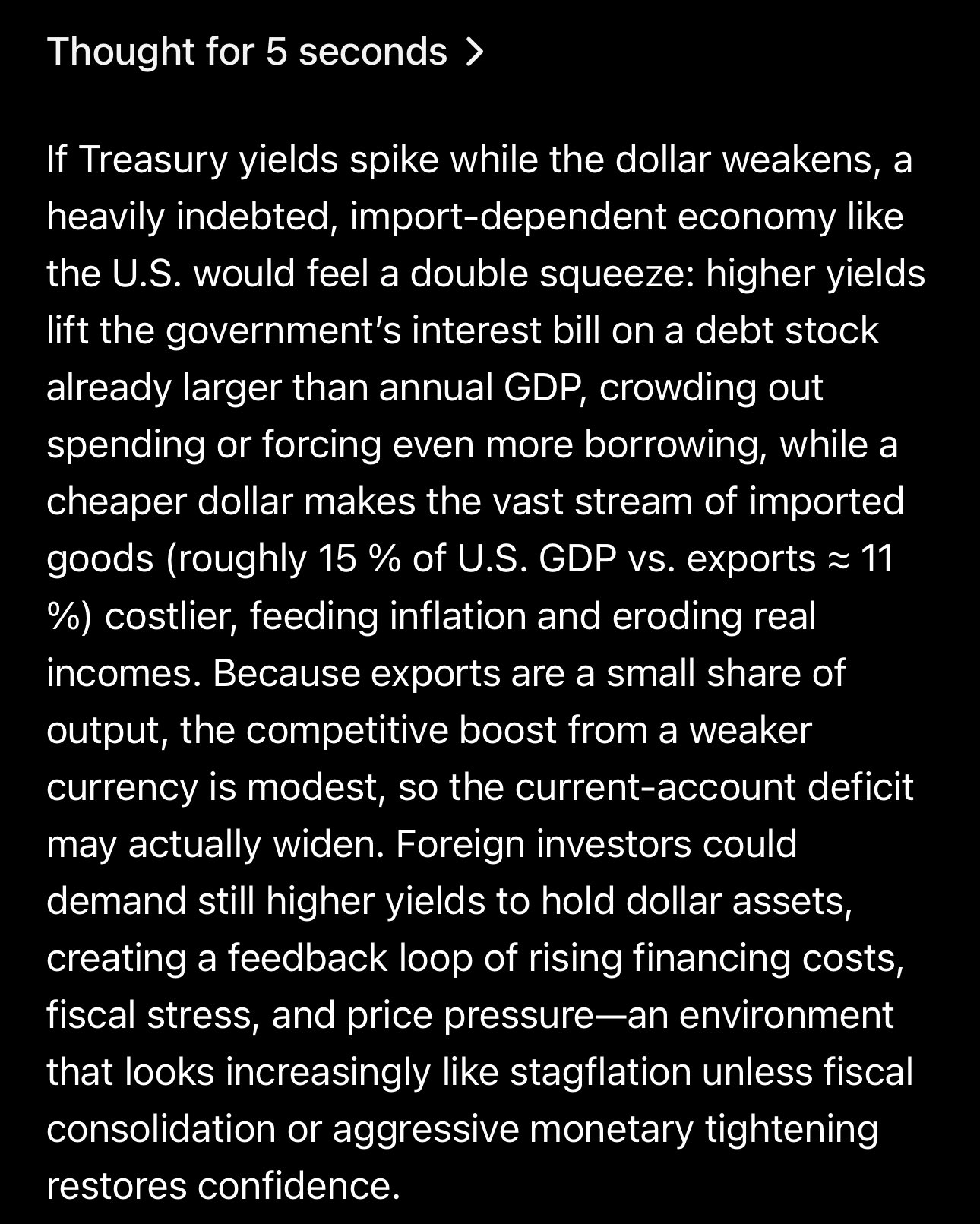

I asked ChatGPT o3 what will happen to the economy of the US, if USD index goes down & Treasury bond yields go up

It correctly pointed out that for a heavily indebted net importer - these are not good news

However, the risk is far beyond than just stagflation ⬇️

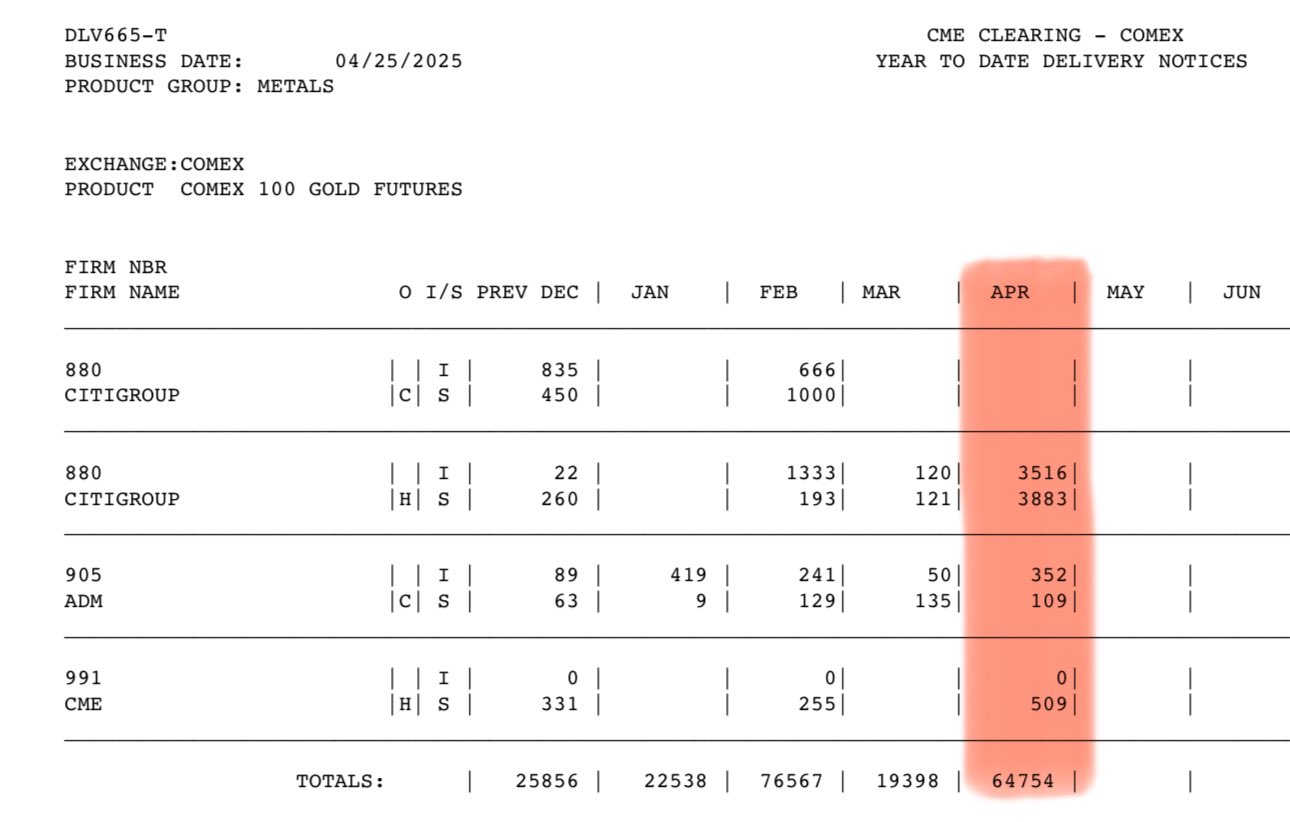

CME publishes daily data on physical settlement on gold futures

The problem is that it's PDFs with numbers

Some interesting alpha factors can be extracted from this 💡

Maybe making a website to visualize, interpret & combine that data would be useful 👀

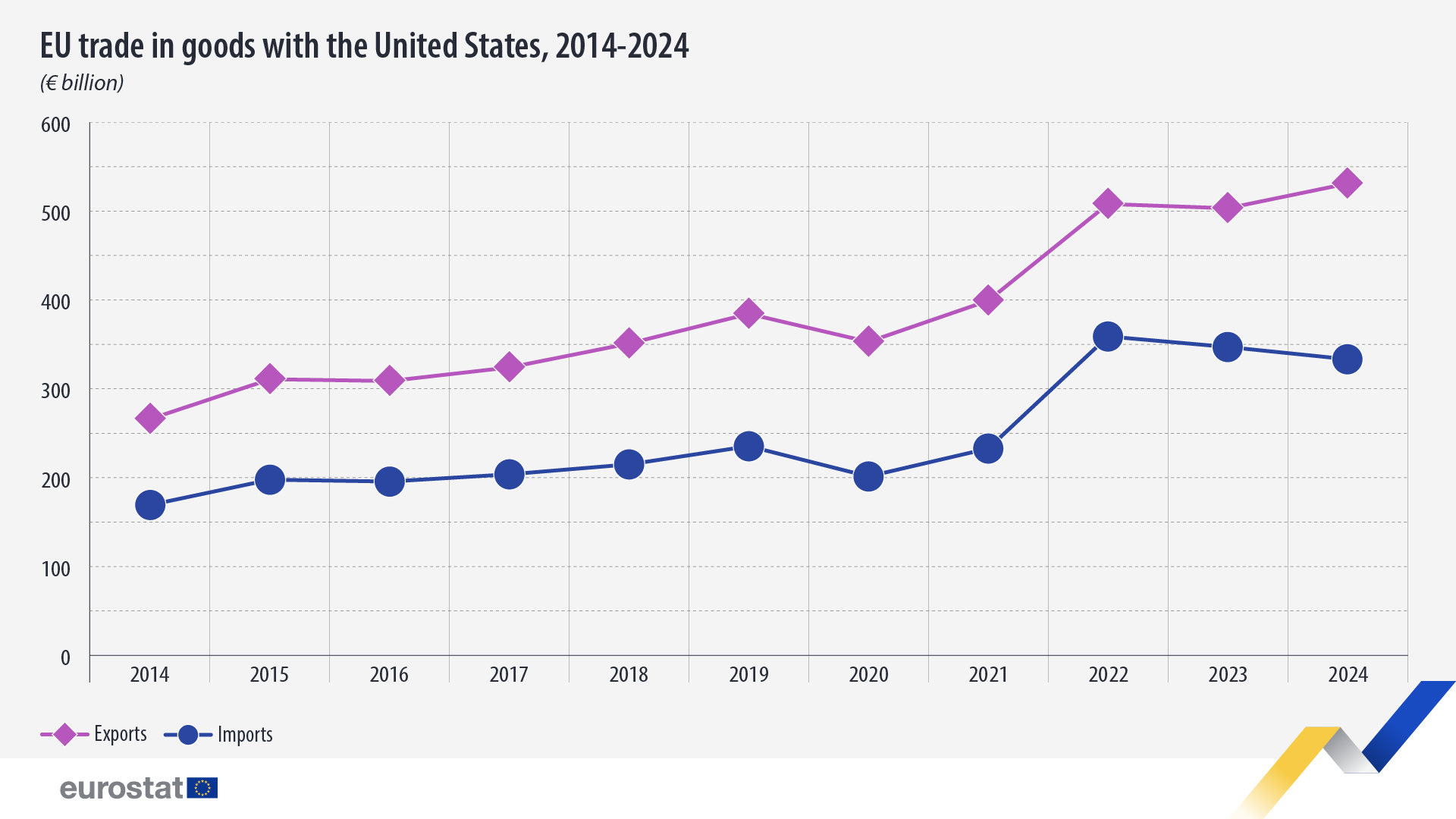

Many boast about US's higher GDP than EU without looking at the bigger picture

US/EU balance:

🇺🇸 is a net importer from the 🇪🇺

World:

🇪🇺: Net exporter

🇺🇸: Net importer

Debt to GDP:

🇪🇺: 81%

🇺🇸: 123%

Exports as % of GDP:

🇪🇺: 52%

🇺🇸 : 11%

👉 You must always contextualize GDP 👈

🚨GDP is a useless metric…

…unless you combine it with additional context

If $1 billion is credited into an economy, a significant portion of that will make it into GDP, thus increasing it. That debt may be low quality/default

You need Debt to GDP, exports to GDP, etc

Rest of April was relatively uneventful 😴

≈50% of all gold physical delivery notices were filed on March 28th

I've learned that these are typical proportions for 1st notice day

Last intent/notice day is on April 29th

📆 YTD April is the 2nd largest month in terms of volume

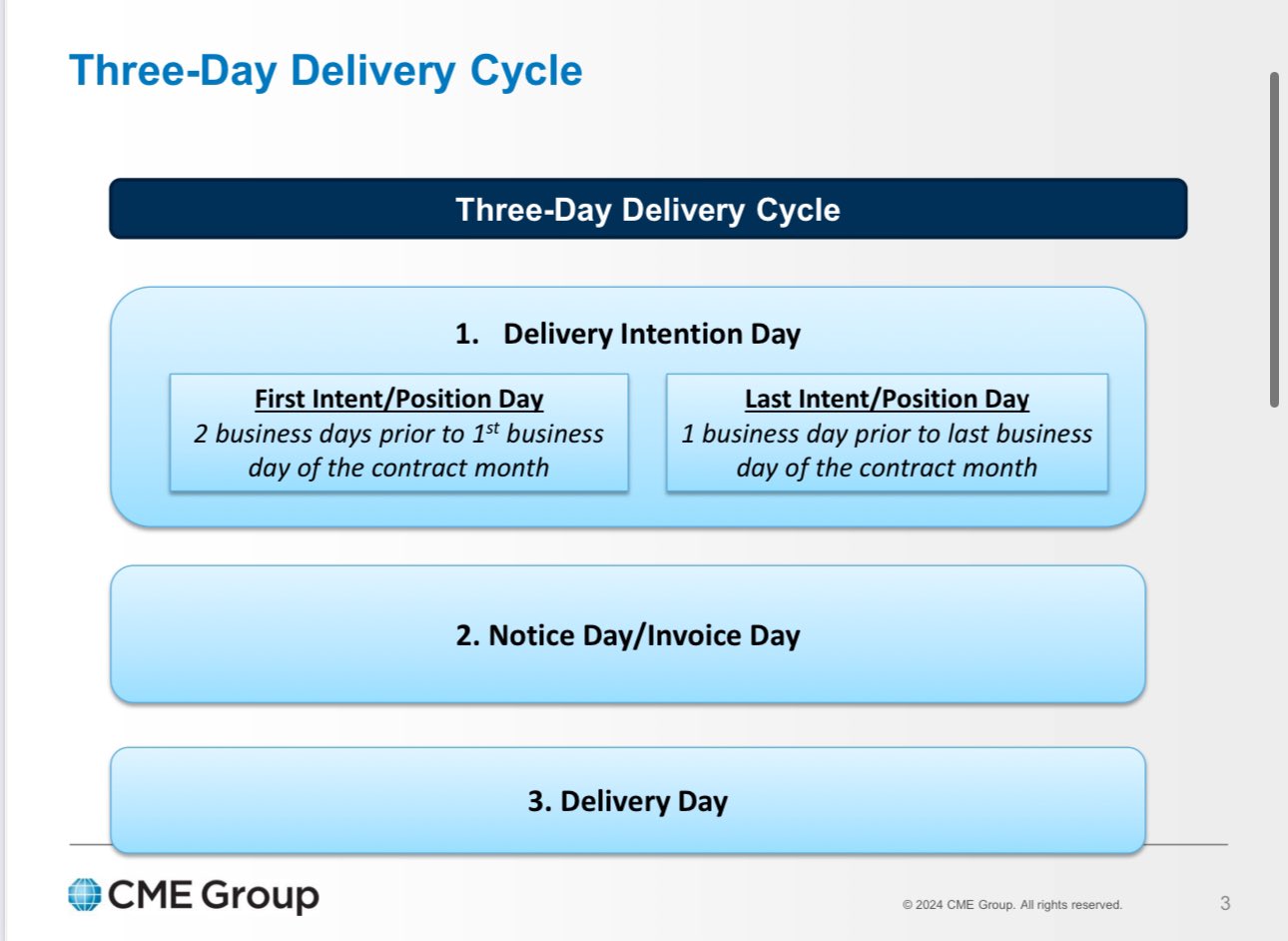

⚠️ Regarding CME COMEX 100 Gold Futures:

👉 Notice period begins 2 business days before the first day of the contract month

📅 So these are YTD values are starting from March 28th, not April 1st (DLV665-T)

The core idea remains the same - this is just a technicality of TradFi

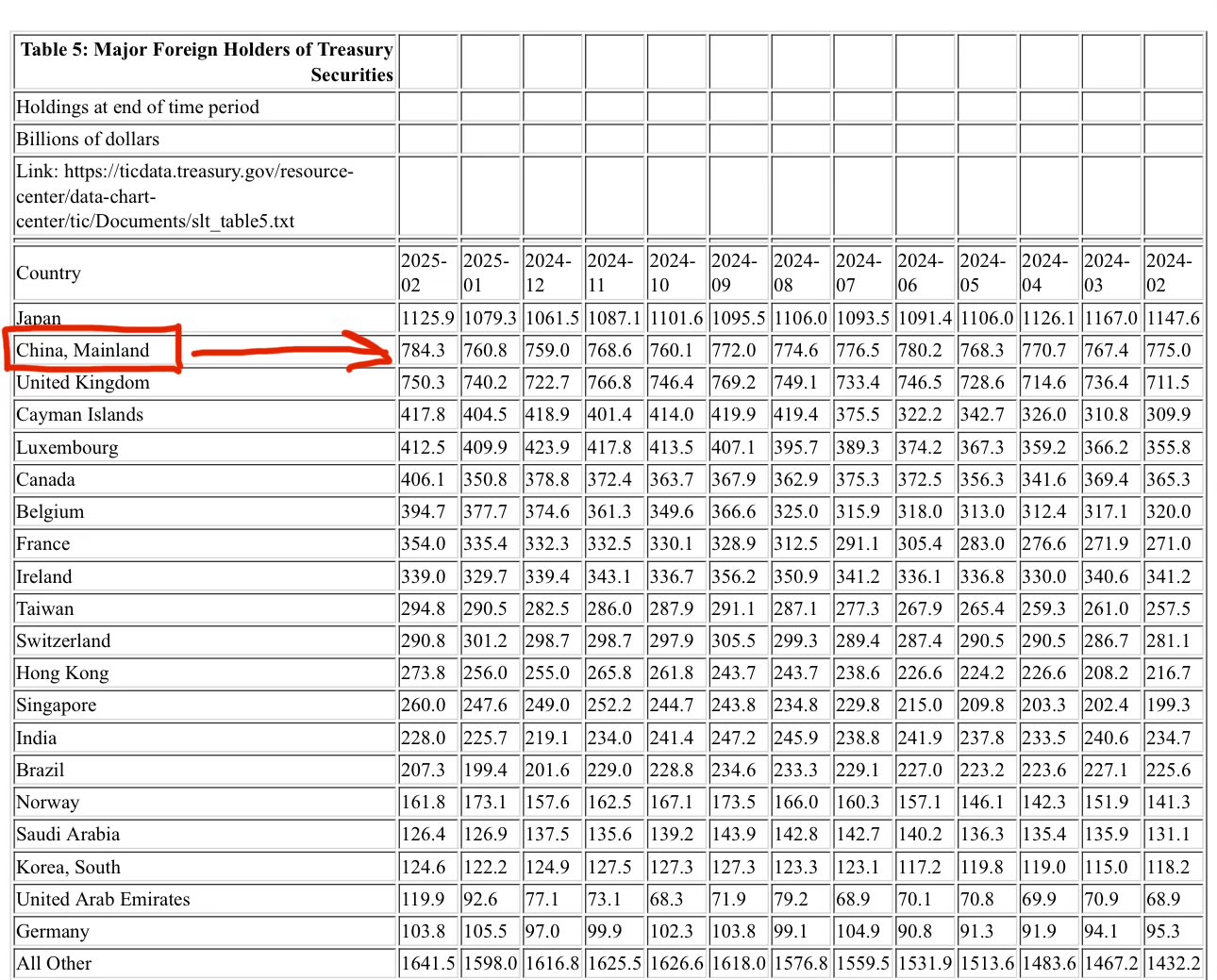

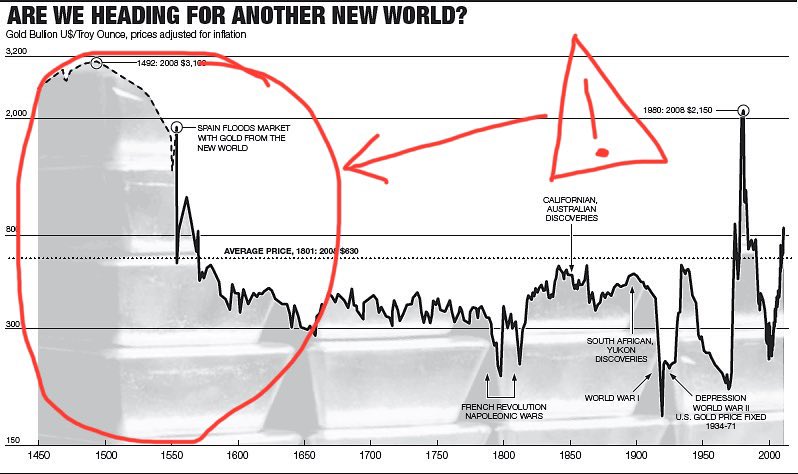

Regarding the 1492 'gold top' & 533 years breakeven - the information is misleading

These price extrapolations made a lot of assumptions & simplifications

Perhaps most importantly, pre-1700's gold prices were fixed by the government - not a trade/free market derived price

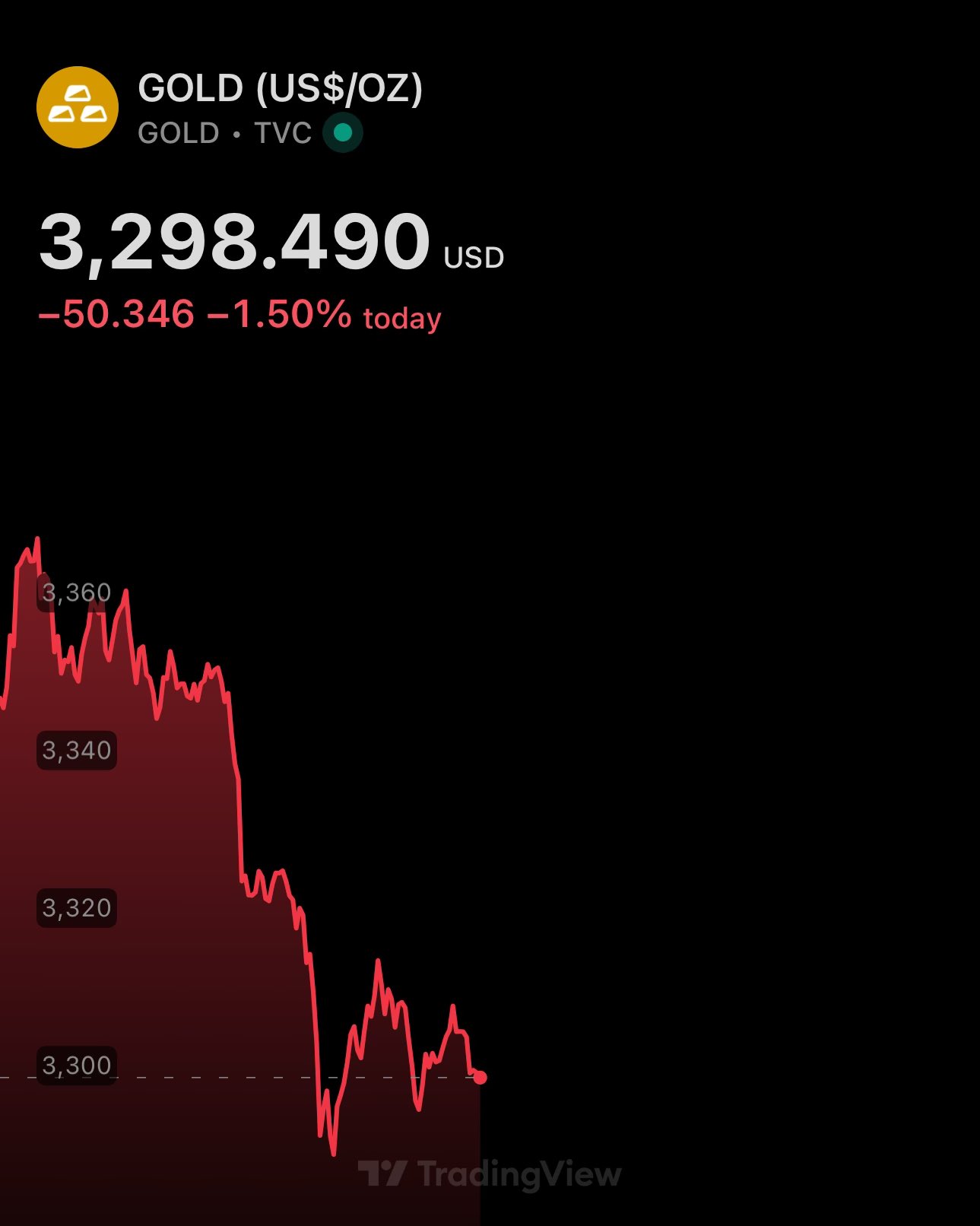

Now that gold is down & below $3.3K, it's a good time to say this:

🎉 New ATH coming very soon 🎉

In the time of political, civil & economic ambiguity - there is only one recourse - Au

Lower interest rates & QE are coming soon - FIAT down, gold up

💾 Save this & check back

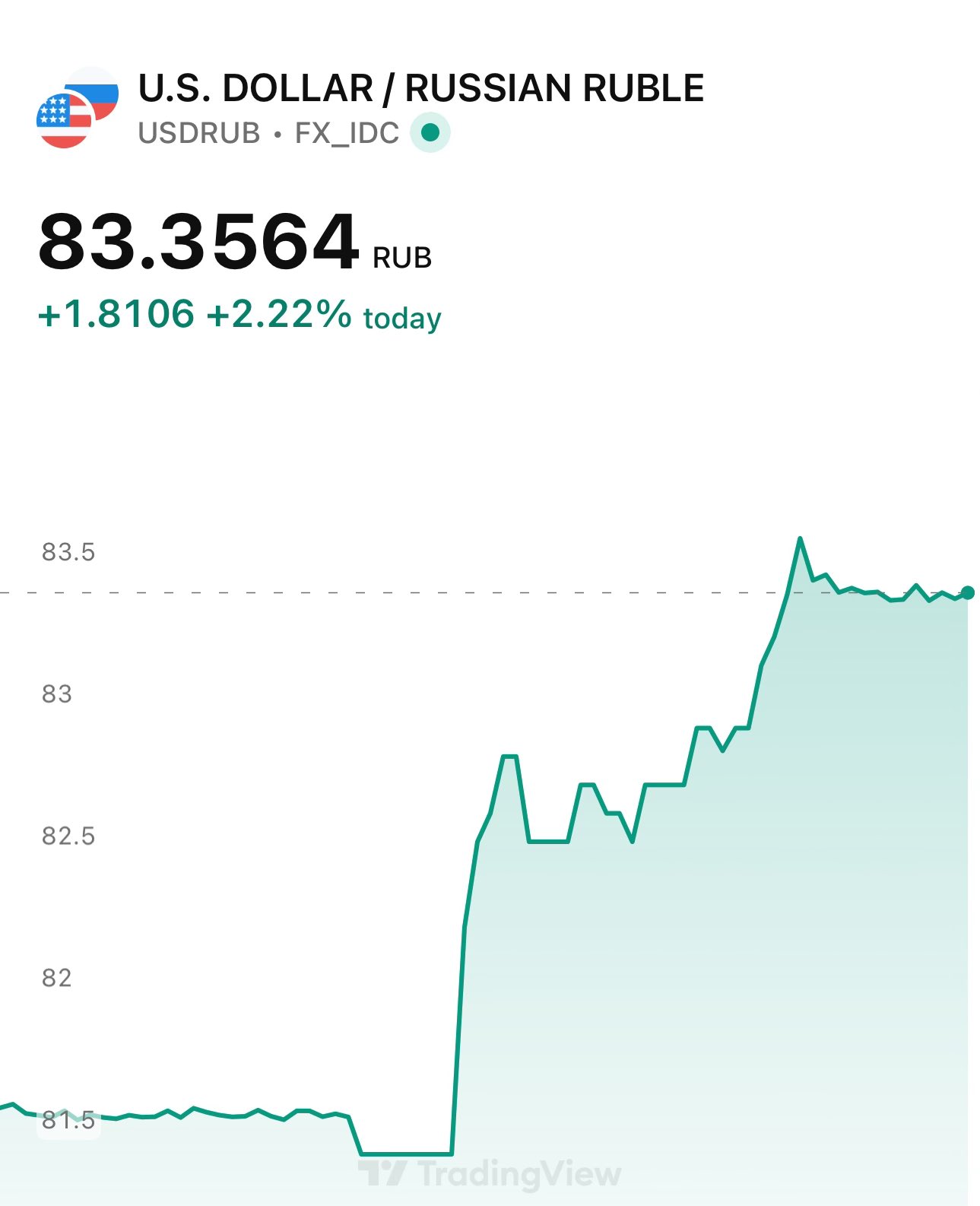

Correlation between Ruble & Gold 🇷🇺🥇:

Gold up ➡️ Ruble up

Gold down ➡️ Ruble down

Gold sideways ➡️ Ruble sideways

Russia could make RUB gold-backed, make RUB convertible to gold on demand & position RUB as a 'trustless'/money-backed currency

Already halfway through there

🇷🇺 Ruble is correlating with gold

This also explains the recent fall in price. Gold went down against USD & so did RUB

Such a retracement after multiple consecutive ATHs is expected

Fundamentals are still on the side of gold

🧠 Remember: gold is 35% of Russia's int'l reserves

🇷🇺 Ruble outflows into USD 🇺🇸

A lot of liquidity moved from RUB back into USD. This is also telling by the rebounded USD index

But gold will appreciate further. Russian Central Bank's massive gold reserves will pay off

Upwards retracements for US Dollar Index are normal

$DXY fell to ≈98.3 as I previously predicted

That whole area is a monthly support level, thus a source & trigger for massive amounts of liquidity

It's not only FOREX, but also the world reserve currency