⬇️ My Thoughts ⬇️

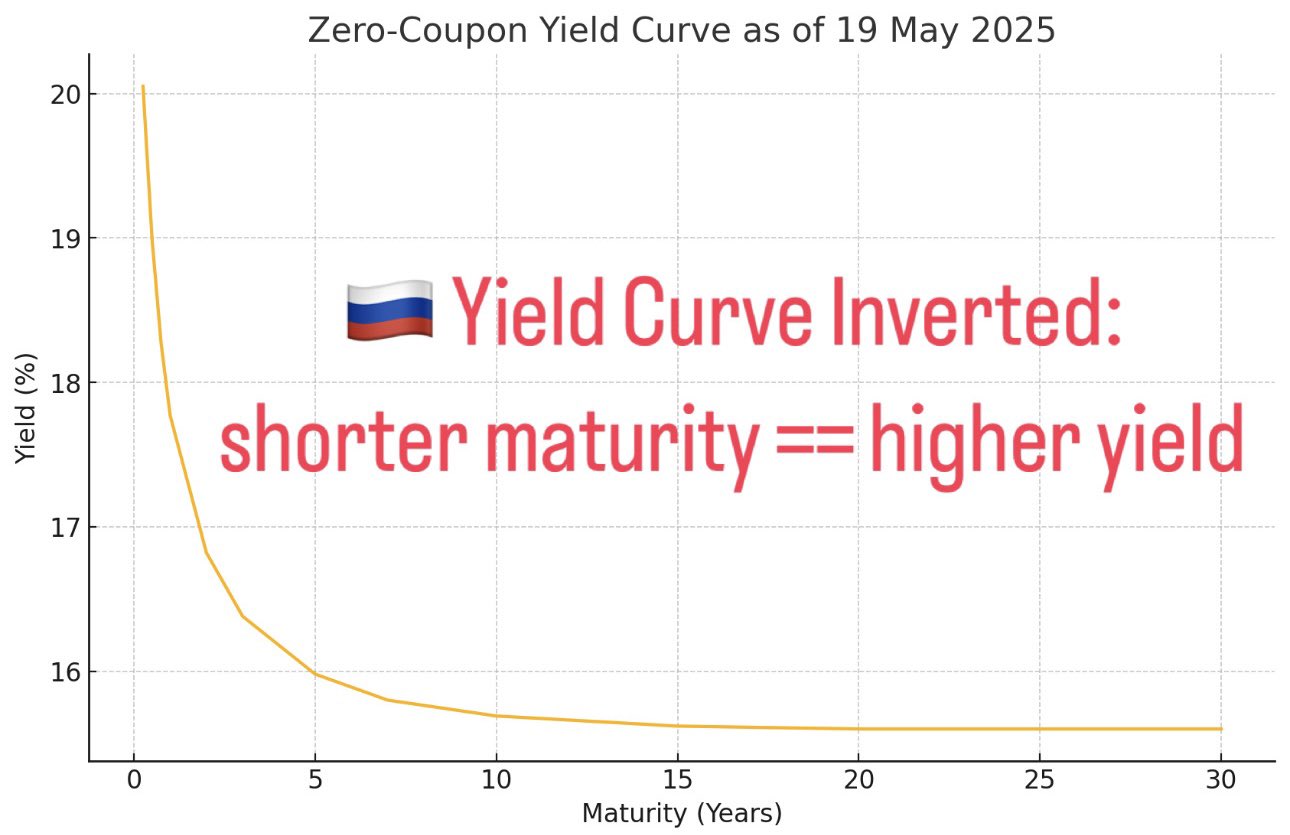

🇷🇺 Russian Bond Yield Curve Is Inverted

An inverted yield curve is usually a bad sign (e.g. recession)

However, 🇷🇺's fundamentals are healthy

Why inverted? 🇷🇺 Central Bank's 21% key interest rate, or rather the expectation of it going down, is what's pushing this shape

Here's why bond yields skyrocketing worldwide ⬇️

Countries own a lot of US debt (bonds)

Moody's downgraded the US credit rating

Now, countries are at a higher risk of default, because the US debt they own is now less valuable = higher chance of country's default

(simplified)

Btw I've since learned that gold is only ≈10% of total reserves of the Portuguese Central bank - that's low

It's 80% of their international reserves - those are basically regulation-defined ratios that banks must maintain (look into BASEL rules if curious)

It's very okay to leverage, as long as you are sufficiently hedging the risk. In practice this means that you are explicitly quantifying & accepting a certain percentage of risk in exchange for a certain return/alpha

Ever since I wrote this about Japan's easing monetary policy - the yields on 🇯🇵 30 year bonds are up more than x2

Japan heavily relies on debt. Today, Japan has to pay 123% more for that debt than they did 2 years ago

Solutions:

1️⃣ Default

2️⃣ Inflate Yen

Hello inflation 👋

Regarding global skyrocketing bond yields - it depends where you're looking 😄

Sovereign bond yields up: 🇺🇸🇯🇵🇬🇧🇪🇺

Sovereign bond yields down: 🇷🇺🇨🇳

I've been posting numerous explanations for of this - all very expected

30Y US bond yield just crossed 5% 😳

Scraping the ≈5.22% from 2023

👉(Soon) highest yield in >17 years!

Last time yields were consistently this high was 2007. But a lot of QE policies came in force after the 2007-2011 crisis, so rates were naturally higher back then

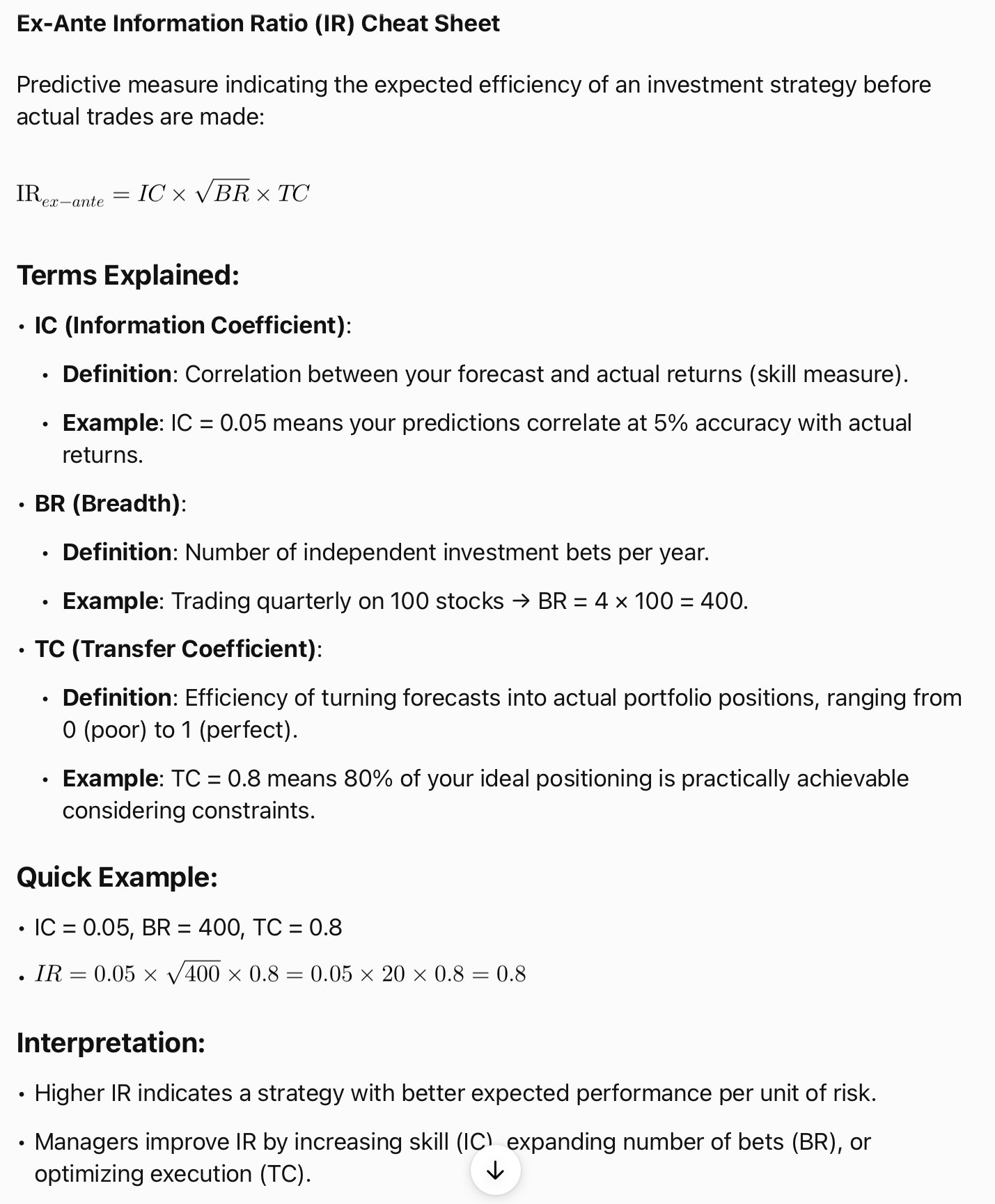

There is also ex-ante Information Ratio, i.e. the expected future IR, based on:

1️⃣ How accurate your forecasts are (IC)

2️⃣ Num independent investments (BR)

3️⃣ How effectively your strategy can be executed(TC)

👉 Allows you to model risk-adjusted prediction of investment returns

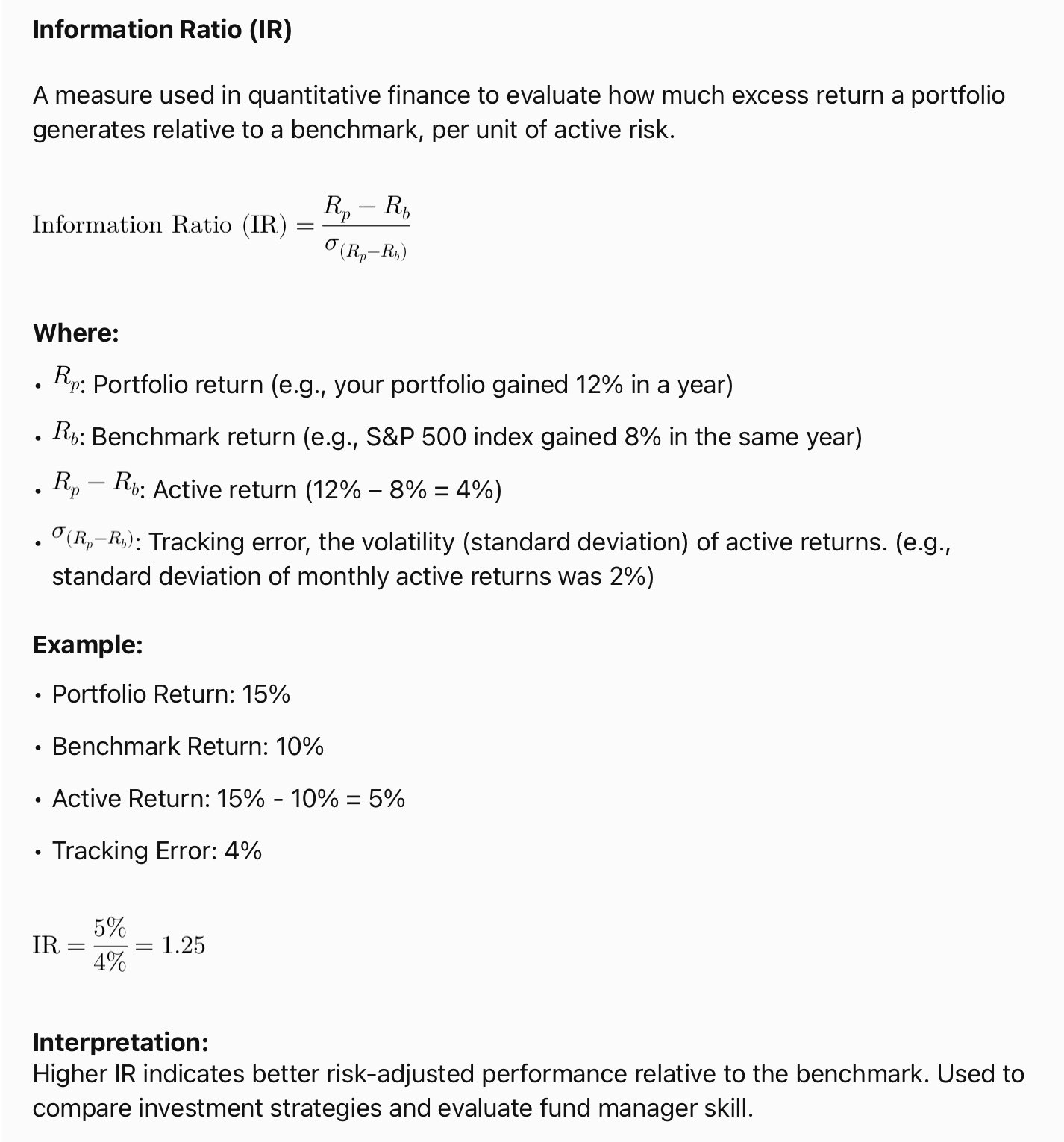

Information Ratio is a risk-adjusted measure of how good your portfolio performs against the market average/benchmark

📈 Risk=how much your portfolio return deviates from benchmark

💡IR=1: for every 1% of risk there is 1% return

👉Look for IR>1

🔑 metric in quantitative finance

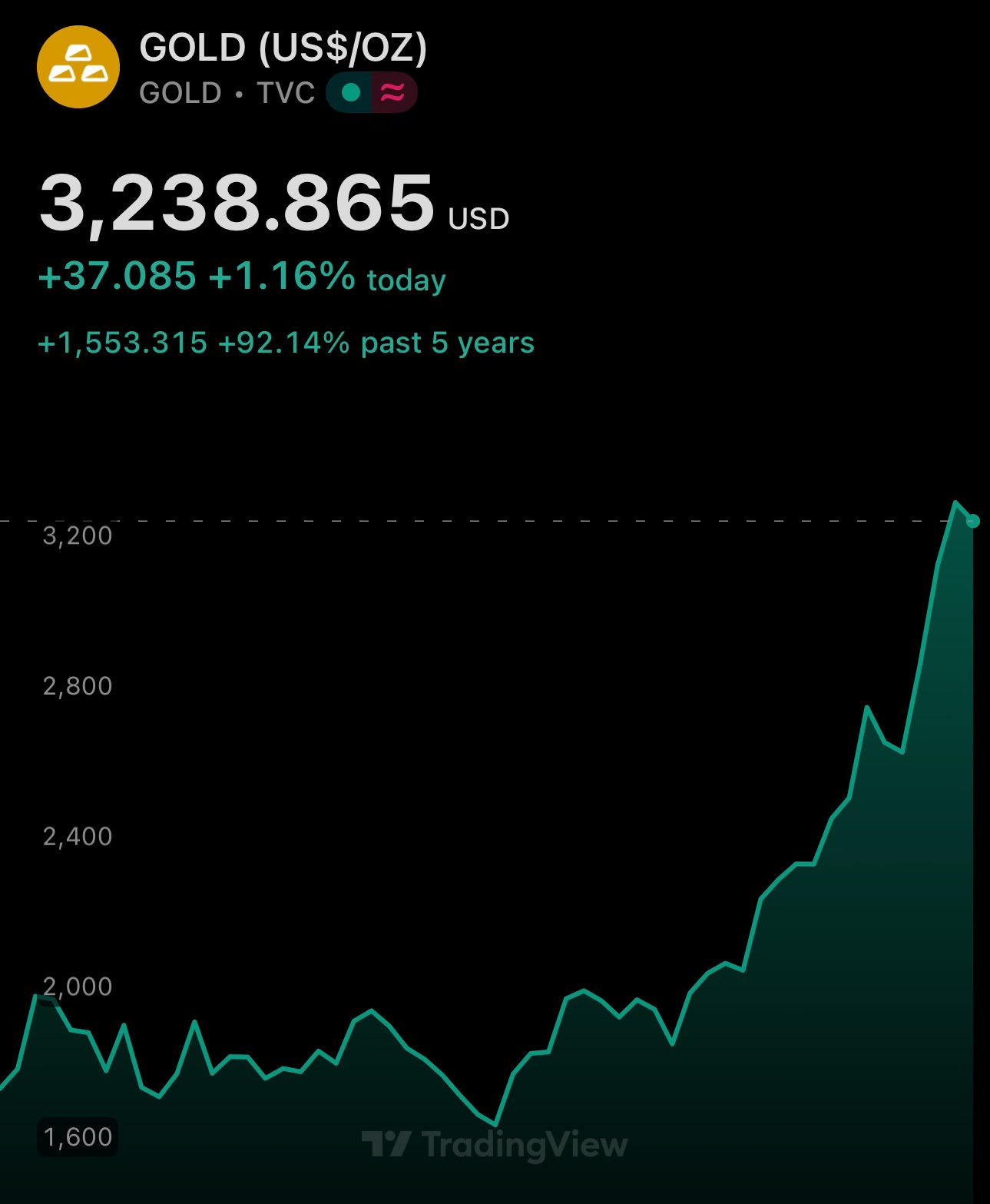

🤯 Of course temporary, but still - Gold down 3% today

Outflows into equities

However, some gold-linked currencies like Ruble are up 2.5%

Volatility is a measure of risk. Gold volatility is an expression of the baseline systemic risk

It's a mystery why US bond yields are skyrocketing

Higher yield = higher risk, BUT the US has been doing nothing, but irradiating confidence, respect & cooperation 🤯

🇷🇺 Russian Central Bank currently has interest rates at 21%

Yet the yield on a 10Y bond is 15.6%

I've previously written that the market is both, pricing in upcoming low(er) rates & paying a premium to stay in Ruble

Today, I found the targets for 2025 & 2026

🇷🇺 Budget deficit financing through the National Reserve Fund instead of bond issuance is one of the reasons why Ruble and the Russian bond yields have been doing so good

🇺🇸 $DXY is up - but not against $RUB 🇷🇺

Fundamentals speak louder than words

🇺🇸🇨🇳This makes no sense:

1️⃣ USA gets themselves into a net importer, 130% debt to GDP & higher refinancing costs

2️⃣ 🇺🇸 became so dependent on China, that 🇺🇸 economy can't survive with the tariffs

3️⃣ Now, the (not so good) student is lecturing the teacher?

Why would 🇨🇳 listen?

🇺🇸 2Y bond up 3% percent to a 4% yield 😳

10Y yield also up & approaching 4.5%

At least USD index is back above 100 for now

⚡️You can now create GOLD from lead⚡️

1g gold = two quintillion dollars ($2 × 10¹⁸)

1 gold ring contains x170 billion more gold that LHC produced over 4 years

Oh, and that newly minted Au fragments into other particles almost immediately 😁

🇷🇺 Russia announced that they will cover their 2025 budget deficit not through the issuance of debt via government bonds, but via the National Reserve Fund - funded by natural resource surpluses

👉 Good news for the Ruble, of course

👉 Bond yields went down - 10Y is down ≈-3%

How does the Russian government get the oil & gas revenue?

👉 Heavy taxation 👈

So no matter if you're public or private - you pay for per extracted unit of natural resource

This income is directly tied to the budget & NWF - which is then debited or credited, base on target

🇷🇺 TIL Russia has a National Wealth Fund

Excess oil & gas profits are credited to NWF

NWF funds are used to finance government deficit, instead of relying on debt issuance of Ruble (government bonds). Inflation-free deficit financing

🇪🇺 We need this in the EU for Euro

Note: the actual raising of the flag happened on April 30th, but May 9th is the day of celebration of Red Army's WW II victory

It's celebrated today throughout slavic & ex-Soviet countries

⭐️ May 9th 1945: The Red Army, lead by Zhukov, raises the Soviet flag over Reichstag

Nazi Germany has been defeated

≈73 million Soviets were killed or injured for the world's freedom. Today, we celebrate their lives

С Днём Победы! 🥳

🇷🇺🇺🇦🇧🇾🇺🇿🇰🇿🇬🇪🇦🇿🇱🇹🇲🇩🇱🇻🇰🇬🇹🇯🇦🇲🇹🇲🇪🇪

🇪🇺👩⚖️ EU Securitisation TL;DR

Securitisation of subprime loans was a key factor in 2007-11 financial crisis

EU Regulation 2017/2402 aims to address that by detailing how risk should be managed mathematically & how to distribute it among the parties in securitisation operations